Deck 9: Other Income, Other Deductions, and Other Issues

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/130

العب

ملء الشاشة (f)

Deck 9: Other Income, Other Deductions, and Other Issues

1

As evidenced by the ability to deduct these items in the calculation of Taxable Income, the government does not intend to tax social assistance payments or worker's compensation payments. Given this, why are these amounts included in Net Income For Tax Purposes?

They are included in Net Income For Tax Purposes because that figure is used in a variety of eligibility tests. For example, to get the full tax credit for an infirm dependant over 17, the dependant's income must be less than a threshold amount. Since the policy is to reduce this credit in proportion to the dependant's income in excess of that amount, it is important that all types of income be included in the Net Income For Tax Purposes calculation. To accomplish this goal, social assistance and workers' compensation payments are included in the calculation of Net Income For Tax Purposes and then deducted in the calculation of Taxable Income.

2

What is the objective of providing a disability supports deduction. Cite two examples of costs that can be deducted using this provision.

The objective of providing the disability supports deduction is to assist individuals with the extra costs that a disabled person incurs when trying to attend school or work. Examples of such costs that are cited in the text are as follows:

• sign-language interpretation services, a teletypewriter or similar device;

• a Braille printer;

• an optical scanner, an electronic speech synthesizer;

• note-taking services, voice recognition software, tutoring services; and

• talking textbooks.

• sign-language interpretation services, a teletypewriter or similar device;

• a Braille printer;

• an optical scanner, an electronic speech synthesizer;

• note-taking services, voice recognition software, tutoring services; and

• talking textbooks.

3

What are the major tax advantages of Tax Free Savings Accounts (TFSAs)?

There are several major advantages to the use of TFSAs:

• Earnings in the plan accumulate on a tax free basis.

• Withdrawals from the plan are not subject to tax.

• Amounts earned in the plan are not subject to the income attribution rules.

• Reductions in contribution room related to withdrawals are replaced in the following taxation year.

• Earnings in the plan accumulate on a tax free basis.

• Withdrawals from the plan are not subject to tax.

• Amounts earned in the plan are not subject to the income attribution rules.

• Reductions in contribution room related to withdrawals are replaced in the following taxation year.

4

John Withers is receiving an annuity payment of $500 per month. How will this payment be taxed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

5

What are the conditions that must be met for spousal support payments to be deductible to the payor and taxable to the recipient?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

6

What are the tax advantages and other benefits associated with making contributions to a Registered Education Savings Plan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

7

For purposes of deducting child care costs, how is an "eligible child" defined?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is a retiring allowance? What are the tax consequences associated with receiving a retiring allowance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is a death benefit? Indicate any special tax features that are associated with the receipt of a death benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

10

List the situations in which an individual can deduct moving expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

11

Briefly describe the treatment of amounts received as scholarships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

12

Briefly describe the general rules applicable to the treatment of an individual's capital property at death.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

13

Can an employer compensate an individual for a loss on a home that was sold because the employee was required to move, without creating a taxable benefit for the employee? Explain your conclusion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the Canada Learning Bonds program? Briefly describe the program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

15

An individual wishes to transfer several properties to related parties, some of whom are in higher tax brackets, some of whom are in lower tax brackets. What advice would you give this individual with respect to the consideration that he should take back in return for the property transferred?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

16

What are the normal tax consequences, at the time of transfer, for an individual who is transferring property to a spouse or common-law partner? In these circumstances, at what value will the transfer be deemed to take place? Is there an election that can be used to alter these results? If so, briefly describe the election.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

17

How is the balance in a Tax Free Savings Account (TFSA)dealt with when the beneficiary of the plan dies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

18

ITA 69 deals with non-arm's length transfers of capital property at values that are different from the fair market value of the property. Why would an individual wish to transfer a property to an adult child at a value that is below its fair market value? Briefly explain your conclusion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

19

When there is a non-arm's length transfer of a depreciable property that has a fair market value in excess of its capital cost, the capital cost to the transferee for UCC and recapture purposes will be equal to the transferor's capital cost, plus one-half of the difference between the fair market value and the transferor's capital cost. What is the reason for this rule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

20

Splitting pension income with a spouse may not be a desirable tax planning strategy. Explain this statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

21

Earnings on amounts contributed to an RESP accumulate on a tax free basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

22

For 2020, contributions to a Tax Free Savings Account (TFSA)are limited to a maximum of $6,000 for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

23

The contributions that can be made to an RESP for one beneficiary are limited to $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

24

An individual is considering making a gift of a portfolio of publicly traded stocks. On the basis of tax considerations, provide advice to this individual as to whether he should give the stocks to his 12 year old daughter or, alternatively, to his spouse. Assume that, if the transfer is to his spouse, the taxpayer does not elect out of ITA 73(1).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

25

Chris Shaffer is being transferred by his employer from Prince George, British Columbia to Red Deer, Alberta. The $5,000 in real estate fees paid to sell their Prince George house is a deductible moving cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

26

Chris Shaffer is being transferred by his employer from Prince George, British Columbia to Red Deer, Alberta. His airfare from Prince George to Red Deer is a deductible moving cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

27

Jim and Shirley Noonan decide to separate after ten years of marriage. They have no children. To keep the separation amiable, they decide not to involve lawyers or the courts at this stage. They have a written separation agreement in which Shirley agrees to pay Jim $500 per month until he remarries. The payments will be taxed in Jim's hands and will be deductible from Shirley's income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

28

Chris Shaffer is being transferred by his employer from Prince George, British Columbia to Red Deer, Alberta. His wife spent $750 for gas, meals, and lodging while driving their car from Prince George to Red Deer. The $750 is a deductible moving cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

29

For purposes of deducting child care costs, an "eligible child" must be under 16 at some time during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

30

Sarah and David Johnston paid $5,500 during the year for child care for their three children, aged 3, 5, and 7. Her annual salary was $8,000 and his annual salary was $30,000. Sarah can deduct the $5,500 paid from her income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

31

One of your clients is a successful businessman with both a spouse and a minor child that have no income of their own. He would like to transfer some of his income into their hands for tax purposes. However, he is concerned about the income attribution rules. Provide him with three tax tips for dealing with these rules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

32

Chris Shaffer is being transferred by his employer from Prince George, British Columbia to Red Deer, Alberta. The Shaffers paid $1,000 in legal fees to sell their Prince George home and $800 in legal fees to buy their new home in Red Deer. The total $1,800 in legal fees is a deductible moving cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

33

When a transfer is made to a spouse or common-law partner, the income attribution rules may be applicable. Briefly describe the conditions under which the income attribution rules would be applicable on such transfers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

34

Chris Shaffer is being transferred by his employer from Prince George, British Columbia to Red Deer, Alberta. Before moving into their new home, the Shaffers had to pay $2,000 to repair faulty wiring. The $2,000 is a deductible moving cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

35

While the general rules for dealing with an individual's capital property at death require a deemed disposition and the recognition of fair market values, there are rollovers available that can eliminate or reduce the income that would be recognized on such deemed dispositions. Briefly describe these rollovers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

36

The tax treatment of payments received under an annuity contract will depend on whether the annuity was purchased with after tax funds or, alternatively, from funds that are in an RRSP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

37

The entire amount of a retiring allowance received must be included in income, even if some part of the allowance is transferred to an RRSP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

38

Chris Shaffer is being transferred by his employer from Prince George, British Columbia to Red Deer, Alberta. All moving expenses can only be deducted from income earned in Red Deer in the year of the move. There are no carry forward provisions for moving costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

39

If the lower income spouse was in prison for the entire year, the higher income spouse would be able to deduct child care costs during this period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

40

The widow of Peter Toscan received a death benefit from his employer of $25,000. She must include the $25,000 in income in the year of receipt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following sources of income would NOT result in any increase in Taxable Income for the taxpayer who receives it?

A)Amounts that are withdrawn from an individual's RRSP.

B)A research grant received by a student in a university program.

C)Workers' compensation payments.

D)Spousal support payments.

A)Amounts that are withdrawn from an individual's RRSP.

B)A research grant received by a student in a university program.

C)Workers' compensation payments.

D)Spousal support payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

42

When an individual dies, there is a deemed disposition of all of his capital property at fair market value, without regard to his relationship to the beneficiary of his estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

43

Adhira has Taxable Income of $110,000 before any consideration of a CPP deduction (26 percent federal income tax bracket). She is a self-employed hairdresser. How much will her federal tax payable decrease as a result of the $5,796 contribution to CPP that she must make in 2020?

A)$410

B)$1,207

C)$869

D)$1,507

A)$410

B)$1,207

C)$869

D)$1,507

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

44

At her death on August 1 of the current year, Nancy Mori owned stocks with an adjusted cost base of $11,000 and a fair market value of $20,000, and a term deposit of $30,000. She also owned a building that had a cost of $98,750, a fair market value of $110,000, and a UCC of $70,000. She bequeaths all of her assets to her daughter, Christine. Nancy's Taxable Income at death arising from the dispositions totals $10,125.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

45

Martha Stuart has a depreciable asset with a UCC of $50,000, a capital cost of $80,000, and a fair market value of $100,000. If she gifts this property to her spouse without making any election, she will have a capital gain of $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

46

Stan Aiken changed employers during 2020 and, as a result of the change, moved 150 kilometers, from Windsor to London. His new employer was located in London and reimbursed 50 percent of Stan's eligible moving expenses. On his 2020 personal tax return, Stan can:

A)claim 0 percent of his moving expenses.

B)claim 50 percent of his moving expenses against his income from employment.

C)claim 50 percent of his moving expenses against his income from his new employer.

D)claim 100 percent of his moving expenses against his income from employment.

A)claim 0 percent of his moving expenses.

B)claim 50 percent of his moving expenses against his income from employment.

C)claim 50 percent of his moving expenses against his income from his new employer.

D)claim 100 percent of his moving expenses against his income from employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

47

At her death on August 1 of the current year, Nancy Mori owned stocks with an adjusted cost base of $11,000 and a fair market value of $20,000, and a term deposit of $30,000. She also owned a building that had a cost of $98,750, a fair market value of $110,000, and a UCC of $70,000. She bequeaths all of her assets to her daughter, Christine, who sells the building before the end of the current year for $125,000. Christine's Taxable Income arising from the sale is $7,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

48

A rollover is a term that is used to describe any transfer of assets between parties that are not dealing at arm's length.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

49

During 2020, Jan Harding accepted a job transfer from British Columbia to Ontario. She will begin her new position on December 1. Her new salary will be $102,000 per annum or $8,500 per month. Upon arriving, Jan spent 25 days staying in a hotel due to an unfortunate delay in moving into her new residence. Jan incurred expenses related to the move of $13,402. Included in this total was $1,125 for meals and $2,125 for hotel stays while waiting for her new residence to be ready. How much can she claim on her 2020 tax return for moving expenses?

A)$ 8,500.

B)$12,102.

C)$12,952.

D)$13,402.

A)$ 8,500.

B)$12,102.

C)$12,952.

D)$13,402.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

50

The term arm's length can apply to transactions involving trusts, corporations, and individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

51

Brian Lawson gives equity securities to his 15 year old son. If the securities are sold, in the following year, for more than their fair market value at the time of the gift, the resulting capital gain will be taxed in the hands of Mr. Lawson.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

52

Johan Deroi has securities with an adjusted cost base of $1,000 and a fair market value of $1,500. If he sells these securities to his brother for $2,000, he will have a capital gain of $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

53

While earnings on assets held in a Tax Free Savings Account (TFSA)will not be taxed while the assets are in the plan, the accumulated income will be subject to tax when it is withdrawn from the plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

54

Dwayne Brooks is self employed and, because of the high level of his income, is required to make a 2020 CPP contribution of $5,796 [(2)($2,898)]. How will this affect his 2020 Net Income For Tax Purposes and his 2020 Taxable Income?

A)Both his Net Income For Tax Purposes and his Taxable Income will be reduced by $5,796.

B)Both his Net Income For Tax Purposes and his Taxable Income will be reduced by $3,064.

C)Neither his Net Income For Tax Purposes nor his Taxable Income will be affected.

D)Both his Net Income For Tax Purposes and his Taxable Income will be reduced by $869.

A)Both his Net Income For Tax Purposes and his Taxable Income will be reduced by $5,796.

B)Both his Net Income For Tax Purposes and his Taxable Income will be reduced by $3,064.

C)Neither his Net Income For Tax Purposes nor his Taxable Income will be affected.

D)Both his Net Income For Tax Purposes and his Taxable Income will be reduced by $869.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

55

A father gives $10,000 in securities to his 19 year old daughter who is living at home. Any dividends declared on the securities will be attributed to the father.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following statements related to the costs of an eligible relocation is correct?

A)If the employer provides an allowance for these moving costs that is less than the actual moving costs, it is not included in income.

B)All legal and other costs associated with acquiring a residence in the new work location are deductible.

C)The costs of visiting the new work location in order to find a new residence are deductible.

D)The costs of selling a residence where the taxpayer lived prior to the relocation is always deductible.

A)If the employer provides an allowance for these moving costs that is less than the actual moving costs, it is not included in income.

B)All legal and other costs associated with acquiring a residence in the new work location are deductible.

C)The costs of visiting the new work location in order to find a new residence are deductible.

D)The costs of selling a residence where the taxpayer lived prior to the relocation is always deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following statements with respect to Subdivision d income inclusions is correct?

A)100 percent of any death benefit received by a spouse must be included in income.

B)100 percent of any scholarships received must be included in income.

C)100 percent of any retiring allowance received must be included in income.

D)Social assistance payments received are not included in income.

A)100 percent of any death benefit received by a spouse must be included in income.

B)100 percent of any scholarships received must be included in income.

C)100 percent of any retiring allowance received must be included in income.

D)Social assistance payments received are not included in income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

58

At her death on August 1 of the current year, Nancy Mori owned stocks with an adjusted cost base of $11,000 and a fair market value of $20,000, and a term deposit of $30,000. She also owned a building that had a cost of $98,750, a fair market value of $110,000, and a UCC of $70,000. She bequeaths all of her assets to a spousal trust. Her Taxable Income at death arising from the dispositions is nil.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following statements with respect to other inclusions in income is NOT correct?

A)The $10,000 exclusion from income of a death benefit must be claimed by a spouse.

B)Social assistance payments will increase the recipient's Net Income For Tax Purposes but not their Taxable Income.

C)The minimum withdrawal amount from a RRIF must be included in income, even if it is not withdrawn from the plan.

D)Research grants are included in income net of unreimbursed expenses related to carrying on the research work.

A)The $10,000 exclusion from income of a death benefit must be claimed by a spouse.

B)Social assistance payments will increase the recipient's Net Income For Tax Purposes but not their Taxable Income.

C)The minimum withdrawal amount from a RRIF must be included in income, even if it is not withdrawn from the plan.

D)Research grants are included in income net of unreimbursed expenses related to carrying on the research work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

60

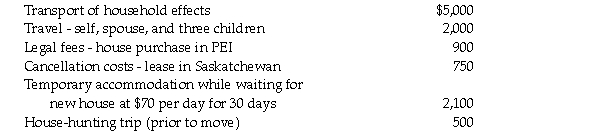

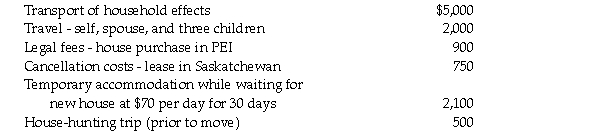

In 2020, Mr. Kumar moved from Saskatchewan to Prince Edward Island to start a new business. In his 2020 fiscal year, the business generated income in excess of $50,000. Mr. Kumar incurred the following costs of moving:  Which one of the following amounts represents the maximum amount that Mr. Kumar may deduct for moving expenses in his 2020 personal income tax return?

Which one of the following amounts represents the maximum amount that Mr. Kumar may deduct for moving expenses in his 2020 personal income tax return?

A)$ 8,800.

B)$ 9,700.

C)$10,200.

D)$11,250.

Which one of the following amounts represents the maximum amount that Mr. Kumar may deduct for moving expenses in his 2020 personal income tax return?

Which one of the following amounts represents the maximum amount that Mr. Kumar may deduct for moving expenses in his 2020 personal income tax return?A)$ 8,800.

B)$ 9,700.

C)$10,200.

D)$11,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

61

There are a number of benefits and tax advantages associated with Registered Education Savings Plans (RESPs). Which of the following is NOT a benefit or advantage?

A)Contributions to the plans are deductible.

B)Earnings on assets within the plan are not subject to tax.

C)The government makes contributions in the form of Canada Education Savings Grants and Canada Learning Bonds.

D)Distributions from the plan may be received by some recipients without incurring any additional taxation.

A)Contributions to the plans are deductible.

B)Earnings on assets within the plan are not subject to tax.

C)The government makes contributions in the form of Canada Education Savings Grants and Canada Learning Bonds.

D)Distributions from the plan may be received by some recipients without incurring any additional taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

62

With respect to Tax Free Savings Accounts (TFSAs), which of the following statements is NOT correct?

A)Contributions to the accounts are not deductible.

B)Contributions to the accounts can be returned tax free at any time.

C)Earnings on assets in the accounts accumulate tax free.

D)Withdrawals of accumulated account earnings will be subject to tax.

A)Contributions to the accounts are not deductible.

B)Contributions to the accounts can be returned tax free at any time.

C)Earnings on assets in the accounts accumulate tax free.

D)Withdrawals of accumulated account earnings will be subject to tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

63

Mr. Dayani purchases an annuity with funds from his savings account on January 1, 2020. The annuity has a 5 year term, and cost him $25,000. Payments are made annually on December 31 in the amount of $5,772. The annuity provides an effective yield of 5%. How much of the annuity payment is taxable in 2020?

A)Nil

B)$772.

C)$1,250.

D)$5,000.

A)Nil

B)$772.

C)$1,250.

D)$5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

64

Charam and Baka each have income of over $200,000. During the year, they paid a nanny $20,000 to care for their three children. Divya, age 5, has no income. Elina, age 10 is disabled and eligible for the disability tax credit. Hinda is 12 and has income of $25,000 which he earns from a TV acting job. What is the maximum deduction for child care costs for this family?

A)$18,000

B)$19,000

C)$24,000

D)$22,000

A)$18,000

B)$19,000

C)$24,000

D)$22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following statements with respect to the disability supports deduction is correct?

A)To qualify for this deduction, the individual must be performing duties as an employee.

B)The total amount of the deduction is limited to $15,000 per taxation year.

C)Some amounts can be claimed both as a disability supports deduction and as an inclusion in the base for the medical expense tax credit.

D)This deduction is available to individuals who do not qualify for the disability tax credit.

A)To qualify for this deduction, the individual must be performing duties as an employee.

B)The total amount of the deduction is limited to $15,000 per taxation year.

C)Some amounts can be claimed both as a disability supports deduction and as an inclusion in the base for the medical expense tax credit.

D)This deduction is available to individuals who do not qualify for the disability tax credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

66

Aaron, aged 65 and Abbie, aged 63 are married. Aaron received OAS of $4,000 and pension income of $65,000 from a plan that was sponsored by his former employer. If Aaron shares the maximum amount of pension income with Abbie, what will his Net Income For Tax Purposes be?

A)$32,500.

B)$34,500.

C)$36,500.

D)$69,000.

A)$32,500.

B)$34,500.

C)$36,500.

D)$69,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

67

Arnold Ingram has $5,000 in funds that he does not currently need. He has a young son who he expects will pursue university education when he is older. Arnold is trying to decide whether the unneeded funds should be invested in a TFSA or an RESP. With respect to this decision, which of the following statements is NOT correct?

A)His current Tax Payable will not be affected by the choice between the two types of registered plans.

B)Withdrawals from either plan will be received tax free.

C)If he chooses the RESP, the plan will receive additional funds from the government in the form of Canada Education Savings Grants.

D)Contributions from either type of registered plan can be removed on a tax free basis.

A)His current Tax Payable will not be affected by the choice between the two types of registered plans.

B)Withdrawals from either plan will be received tax free.

C)If he chooses the RESP, the plan will receive additional funds from the government in the form of Canada Education Savings Grants.

D)Contributions from either type of registered plan can be removed on a tax free basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

68

With respect to the tax rules for Registered Education Savings Plans (RESPs), which of the following statements is NOT correct?

A)The total contributions to one individual's plan cannot exceed $50,000.

B)Earnings paid out of the plan are subject to tax in the hands of the recipient.

C)The annual contributions made by any one individual cannot exceed $4,000.

D)Distributions can be made to a beneficiary of a plan when they commence full-time studies at a qualifying educational institution.

A)The total contributions to one individual's plan cannot exceed $50,000.

B)Earnings paid out of the plan are subject to tax in the hands of the recipient.

C)The annual contributions made by any one individual cannot exceed $4,000.

D)Distributions can be made to a beneficiary of a plan when they commence full-time studies at a qualifying educational institution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

69

John and Alexandria are married and they have two children, aged 2 and 5. They pay Alexandria's 22 year old sister $150 per week to take care of their children for 48 weeks each year. John works full time and earns a salary of $90,000 per year. Alexandria works part time, earning a salary of $28,000 per year. She also goes to college part time during the fall semester, for a total of 17 weeks, or 4 months, each year. Which of the following is correct with respect to John and Alexandria's ability to claim a deduction for child care expenses?

A)Neither John nor Alexandria can claim child care expenses because they paid a relative to take care of their children.

B)Alexandria must claim all of the child care expenses because she is the supporting person with the lower Net Income.

C)John can claim child care expenses of $1,600 and Alexandria can claim the remaining $5,600.

D)John can claim child care expenses of $7,200.

A)Neither John nor Alexandria can claim child care expenses because they paid a relative to take care of their children.

B)Alexandria must claim all of the child care expenses because she is the supporting person with the lower Net Income.

C)John can claim child care expenses of $1,600 and Alexandria can claim the remaining $5,600.

D)John can claim child care expenses of $7,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following statements with respect to pension income splitting is NOT correct?

A)Neither OAS payments nor CPP payments are eligible for the pension income splitting provisions.

B)If an individual and his spouse are in different tax brackets, pension income splitting will always reduce their combined federal Tax Payable.

C)These provisions allow a taxpayer to allocate up to 50 percent of his qualifying pension income to a spouse.

D)Lump sum withdrawals from RRSPs are not eligible for pension income splitting.

A)Neither OAS payments nor CPP payments are eligible for the pension income splitting provisions.

B)If an individual and his spouse are in different tax brackets, pension income splitting will always reduce their combined federal Tax Payable.

C)These provisions allow a taxpayer to allocate up to 50 percent of his qualifying pension income to a spouse.

D)Lump sum withdrawals from RRSPs are not eligible for pension income splitting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements with respect to child care costs is NOT correct?

A)In calculating earned income for child care cost purposes, net business income is included, but net business losses are not.

B)Amounts paid to a person under the age of 18 are never deductible.

C)The higher income spouse can deduct child care costs if the lower income spouse is a person confined to a prison or similar institution throughout a period of not less than 2 weeks in the year.

D)There is no requirement that amounts be spent on specific children.

A)In calculating earned income for child care cost purposes, net business income is included, but net business losses are not.

B)Amounts paid to a person under the age of 18 are never deductible.

C)The higher income spouse can deduct child care costs if the lower income spouse is a person confined to a prison or similar institution throughout a period of not less than 2 weeks in the year.

D)There is no requirement that amounts be spent on specific children.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

72

With respect to spousal and child support, which of the following statements is NOT correct?

A)Any amounts that are not specifically identified in the agreement as spousal support will be considered child support.

B)An amount qualifies as a support payment only if it is payable or receivable on a periodic basis.

C)The recipient of child support payments will not be able to claim the tax credit for an eligible dependant.

D)Deductible support payments reduce the taxpayer's Earned Income for RRSP purposes.

A)Any amounts that are not specifically identified in the agreement as spousal support will be considered child support.

B)An amount qualifies as a support payment only if it is payable or receivable on a periodic basis.

C)The recipient of child support payments will not be able to claim the tax credit for an eligible dependant.

D)Deductible support payments reduce the taxpayer's Earned Income for RRSP purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following statements about annuity payments received is correct?

A)Net Income For Tax Purposes is increased by the amount of any annuity payment received.

B)If the taxpayer uses funds from his savings account to purchase an annuity, the taxable amount of any payment is reduced by the capital element that is included in the payment.

C)To qualify as an annuity, the payments cannot extend beyond the life of the annuitant.

D)If the annuity was purchased inside an RRSP, none of the payments will be subject to tax.

A)Net Income For Tax Purposes is increased by the amount of any annuity payment received.

B)If the taxpayer uses funds from his savings account to purchase an annuity, the taxable amount of any payment is reduced by the capital element that is included in the payment.

C)To qualify as an annuity, the payments cannot extend beyond the life of the annuitant.

D)If the annuity was purchased inside an RRSP, none of the payments will be subject to tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

74

Maxine used to work and live in Alberta, but has accepted a new job in Ontario. The new job has a starting salary of $105,600 per year, or $8,800 per month. She moved there with her family in October, so she could start her new job on November 1. While she had rented her accommodations in Alberta, she bought a new house in Ontario. She incurred the following expenses as a result of the move: • canceling the lease on her rental apartment, $1,200.

• hiring movers to pack and move her household effects, $12,000.

• legal fees on the house purchase, $1,400.

• land transfer tax on the house purchase, $3,000.

• cost of disconnecting utilities in Alberta, $100.

• cost of connecting utilities in Ontario, $200.

• gas, food, and lodging while traveling from Alberta to Ontario, $2,800.

How much can she claim for moving expenses for the year of the move?

A)$16,000.

B)$16,300.

C)$17,700.

D)$20,700.

• hiring movers to pack and move her household effects, $12,000.

• legal fees on the house purchase, $1,400.

• land transfer tax on the house purchase, $3,000.

• cost of disconnecting utilities in Alberta, $100.

• cost of connecting utilities in Ontario, $200.

• gas, food, and lodging while traveling from Alberta to Ontario, $2,800.

How much can she claim for moving expenses for the year of the move?

A)$16,000.

B)$16,300.

C)$17,700.

D)$20,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

75

Jack and his wife, Sally, separated during 2004. The written separation agreement requires Jack to make payments for the maintenance of Sally and their child. Payments were set at $250 per month for Sally and $150 per month for their child. During 2020 Jack's payments totaled $4,000. How much of the 2020 payments can Jack deduct on his 2020 personal tax return?

A)$4,000.

B)$3,000.

C)$1,800.

D)$2,200.

A)$4,000.

B)$3,000.

C)$1,800.

D)$2,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following statements is NOT correct with respect to the Disability Supports Deduction?

A)The deduction is limited to individuals who qualify for the disability tax credit.

B)The deduction is available to disabled individuals who are carrying on research.

C)The deduction is available to disabled individuals who are attending a designated educational institution.

D)Many of the items that can be claimed under the disability supports deduction could also be claimed as medical expenses.

A)The deduction is limited to individuals who qualify for the disability tax credit.

B)The deduction is available to disabled individuals who are carrying on research.

C)The deduction is available to disabled individuals who are attending a designated educational institution.

D)Many of the items that can be claimed under the disability supports deduction could also be claimed as medical expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

77

Ms. Eli has $10,000 in pre-tax income that she does not need in the current year, but will require in two years to purchase a condo. She is considering whether she should use this money to contribute to a Tax Free Savings Account (TFSA)or a Registered Retirement Savings Plan (RRSP). She expects her marginal tax rate to increase in two years. She expects her invested funds will earn the same rate of return in either account. Which of the following statements is correct with respect to her investment decision?

A)Whether she invests in the RRSP or the TFSA, the effect on her Net Income For Tax Purposes will be the same.

B)Ms. Eli should invest in the RRSP.

C)Ms. Eli should invest in the TFSA.

D)Ms. Eli should not invest in the either the RRSP or the TFSA since she will need the money in two years.

A)Whether she invests in the RRSP or the TFSA, the effect on her Net Income For Tax Purposes will be the same.

B)Ms. Eli should invest in the RRSP.

C)Ms. Eli should invest in the TFSA.

D)Ms. Eli should not invest in the either the RRSP or the TFSA since she will need the money in two years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

78

Katrina has cerebral palsy, but does not qualify for the disability tax credit. During 2020, she earned $75,000 in income working at a facility for disabled children. In order to work, Katrina required full time attendant care that cost $25,000. Of this total, $10,000 was paid for by her employer, and $5,000 by her benefit plan. In addition, Katrina purchased equipment to increase her mobility at work costing $12,000. What is Katrina's maximum claim for the disability supports deduction?

A)$10,000

B)$12,000

C)$22,000

D)$32,000

A)$10,000

B)$12,000

C)$22,000

D)$32,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

79

Elijah, aged 62 and Dara, aged 68 are married. Elijah collects CPP of $7,200 and has a $35,000 withdrawal from his RRSP. If Elijah shares the maximum amount of pension income with Dara, what will his Net Income For Tax Purposes be?

A)$17,500.

B)$21,100.

C)$24,700.

D)$42,200.

A)$17,500.

B)$21,100.

C)$24,700.

D)$42,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is NOT a requirement for spousal support payments to be deductible?

A)The payments must be made on a periodic basis.

B)The payments must be made for a period of time that the spouses, or former spouses, are living apart.

C)The payments must be made pursuant to a separation agreement.

D)None of the above.

A)The payments must be made on a periodic basis.

B)The payments must be made for a period of time that the spouses, or former spouses, are living apart.

C)The payments must be made pursuant to a separation agreement.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 130 في هذه المجموعة.

فتح الحزمة

k this deck