Deck 2: Basic Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/77

العب

ملء الشاشة (f)

Deck 2: Basic Financial Statements

1

The answers to these questions appear on page 85.Note: In order to review as many chapter concepts as possible, some self-test questions include more than one correct answer.n these cases, you should indicate all of the correct answers.

A set of financial statements:

a.s intended to assist users in evaluating the financial position, profitability, and future prospects of an entity.

b.s intended to substitute for filing income tax returns to the Internal Revenue Service in determining the amount of income taxes owed by a business organization.

c.ncludes notes disclosing information necessary for the proper interpretation of the statements.

d.s intended to assist investors and creditors in making decisions involving the allocation of economic resources.

A set of financial statements:

a.s intended to assist users in evaluating the financial position, profitability, and future prospects of an entity.

b.s intended to substitute for filing income tax returns to the Internal Revenue Service in determining the amount of income taxes owed by a business organization.

c.ncludes notes disclosing information necessary for the proper interpretation of the statements.

d.s intended to assist investors and creditors in making decisions involving the allocation of economic resources.

Financial statements: The statement which indicates the real picture of the organization. The performance of the entity during the year is represented in the statement of income. The financial worth after working for a year is shown on the balance sheet. The cash inflows and outflows during the period are presented in the statement of cash flows.

Main Solution:

First, analyze the situation with the help of above explanation of related concept(s) and then reach to a conclusion in the following manner:

Analysis:

As per the above discussed features of financial statements, following can be deduced:

a. A set of financial statements facilitates perspicuous view of the present financial position of the entity and determines whether the entity achieved its financial objectives and if yes, then to what extent. It also provides accurate information about the profitability of the entity and premise of its future possible activities.

Hence, it can be said with full certainty that ' point a' given in question describes one of the features of a set of financial statements.

b. A set of financial statements facilitates a base for preparation of income tax return and computation of income tax payable but it can never be treated as replacement of income tax return filing in finalizing the income tax payable by the entity.

Hence, it can be said with firm conviction that ' point b' given in question does not describes one of the features of a set of financial statements.

c. A set of financial statements comprises of balance sheet, income statement, cash flows statement and information provided through notes to accounts and further supplementary presentations imparting essential details to accurately decipher the financial statements.

Hence, it can be said without any doubt that ' point c' given in question describes one of the features of a set of financial statements.

d. A set of financial statements serves one of its purposes by facilitating necessary details to its external users (such as investors, creditors, etc.) that helps them in measuring out their economic resources in different segments and timely making crucial economic decisions.

Hence, it can be said with full conviction that 'point d' given in question describes one of the features of a set of financial statements.

Conclusion:

On the basis of the above analysis, it can be concluded without a trace of doubt that indicates the correct answer and describe features of a set of financial statements appropriately.

indicates the correct answer and describe features of a set of financial statements appropriately.

Main Solution:

First, analyze the situation with the help of above explanation of related concept(s) and then reach to a conclusion in the following manner:

Analysis:

As per the above discussed features of financial statements, following can be deduced:

a. A set of financial statements facilitates perspicuous view of the present financial position of the entity and determines whether the entity achieved its financial objectives and if yes, then to what extent. It also provides accurate information about the profitability of the entity and premise of its future possible activities.

Hence, it can be said with full certainty that ' point a' given in question describes one of the features of a set of financial statements.

b. A set of financial statements facilitates a base for preparation of income tax return and computation of income tax payable but it can never be treated as replacement of income tax return filing in finalizing the income tax payable by the entity.

Hence, it can be said with firm conviction that ' point b' given in question does not describes one of the features of a set of financial statements.

c. A set of financial statements comprises of balance sheet, income statement, cash flows statement and information provided through notes to accounts and further supplementary presentations imparting essential details to accurately decipher the financial statements.

Hence, it can be said without any doubt that ' point c' given in question describes one of the features of a set of financial statements.

d. A set of financial statements serves one of its purposes by facilitating necessary details to its external users (such as investors, creditors, etc.) that helps them in measuring out their economic resources in different segments and timely making crucial economic decisions.

Hence, it can be said with full conviction that 'point d' given in question describes one of the features of a set of financial statements.

Conclusion:

On the basis of the above analysis, it can be concluded without a trace of doubt that

indicates the correct answer and describe features of a set of financial statements appropriately.

indicates the correct answer and describe features of a set of financial statements appropriately. 2

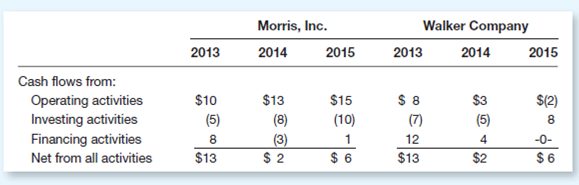

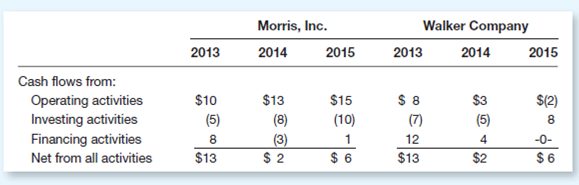

John Marshall is employed as a bank loan officer for First State Bank.e is comparing two companies that have applied for loans, and he wants your help in evaluating those companies.he two companies-Morris, Inc., and Walker Company-are approximately the same size and had approximately the same cash balance at the beginning of 2013.ecause the total cash flows for the three-year period are virtually the same, John is inclined to evaluate the two companies as equal in terms of their desirability as loan candidates.

Abbreviated information (in thousands of dollars) from Morris, Inc., and Walker Company is as follows:

Instructions

a.o you agree with John's preliminary assessment that the two companies are approximately equal in terms of their strength as loan candidates Why or why not

b.hat might account for the fact that Walker Company's cash flow from financing activities is zero in 2015

c.enerally, what would you advise John with regard to using statements of cash flows in evaluating loan candidates

Abbreviated information (in thousands of dollars) from Morris, Inc., and Walker Company is as follows:

Instructions

a.o you agree with John's preliminary assessment that the two companies are approximately equal in terms of their strength as loan candidates Why or why not

b.hat might account for the fact that Walker Company's cash flow from financing activities is zero in 2015

c.enerally, what would you advise John with regard to using statements of cash flows in evaluating loan candidates

Financial reporting means reporting financial facts and data of the company for a fixed point of time. It includes Balance sheet, income statements, cash flow statements, notes to accounts and press releases.

Statement of financial position is also called balance sheet, consisting asset, liabilities, and capital structure details.

Cash flow statement is a financial reporting statement, it is used to record changes in cash and cash equivalents due to changes in balance sheet accounts and various income and expenses. Cash flow statement is divided into three types of activities, operating activity, investing activity, and financing activity.

There are two methods of making a cash flow statement, direct method and indirect method. The major difference in both the methods is in the computation of operating activity, other than this the rest of the activities are calculated in similar way.

(a)John assessment is focused more on the overall results rather than the overall thorough evaluation. Morris Inc. is having more cash flows from the operating activities which mean that the company is focussing on increasing the efficiency of their processes in the shop floors and are focussing on getting the right product which will help them in long run.

(b)This may be due to the unavailability of the financing sources in 2015. Also, this means that the earlier investments were done by the owner itself.

There might also be a case that the cash inflow and cash outflows in 2015 are offset by each other.

(c)The recommendations will be as follows:

• Consideration should be given to every relevant detail of financial statements, not just the final figures or bottom line.

• Focus on the sources of the cash and how they are being used by the company.

• Negative values in the cash flow statement for the investment and the financing activities are not always bad for the company.

Statement of financial position is also called balance sheet, consisting asset, liabilities, and capital structure details.

Cash flow statement is a financial reporting statement, it is used to record changes in cash and cash equivalents due to changes in balance sheet accounts and various income and expenses. Cash flow statement is divided into three types of activities, operating activity, investing activity, and financing activity.

There are two methods of making a cash flow statement, direct method and indirect method. The major difference in both the methods is in the computation of operating activity, other than this the rest of the activities are calculated in similar way.

(a)John assessment is focused more on the overall results rather than the overall thorough evaluation. Morris Inc. is having more cash flows from the operating activities which mean that the company is focussing on increasing the efficiency of their processes in the shop floors and are focussing on getting the right product which will help them in long run.

(b)This may be due to the unavailability of the financing sources in 2015. Also, this means that the earlier investments were done by the owner itself.

There might also be a case that the cash inflow and cash outflows in 2015 are offset by each other.

(c)The recommendations will be as follows:

• Consideration should be given to every relevant detail of financial statements, not just the final figures or bottom line.

• Focus on the sources of the cash and how they are being used by the company.

• Negative values in the cash flow statement for the investment and the financing activities are not always bad for the company.

3

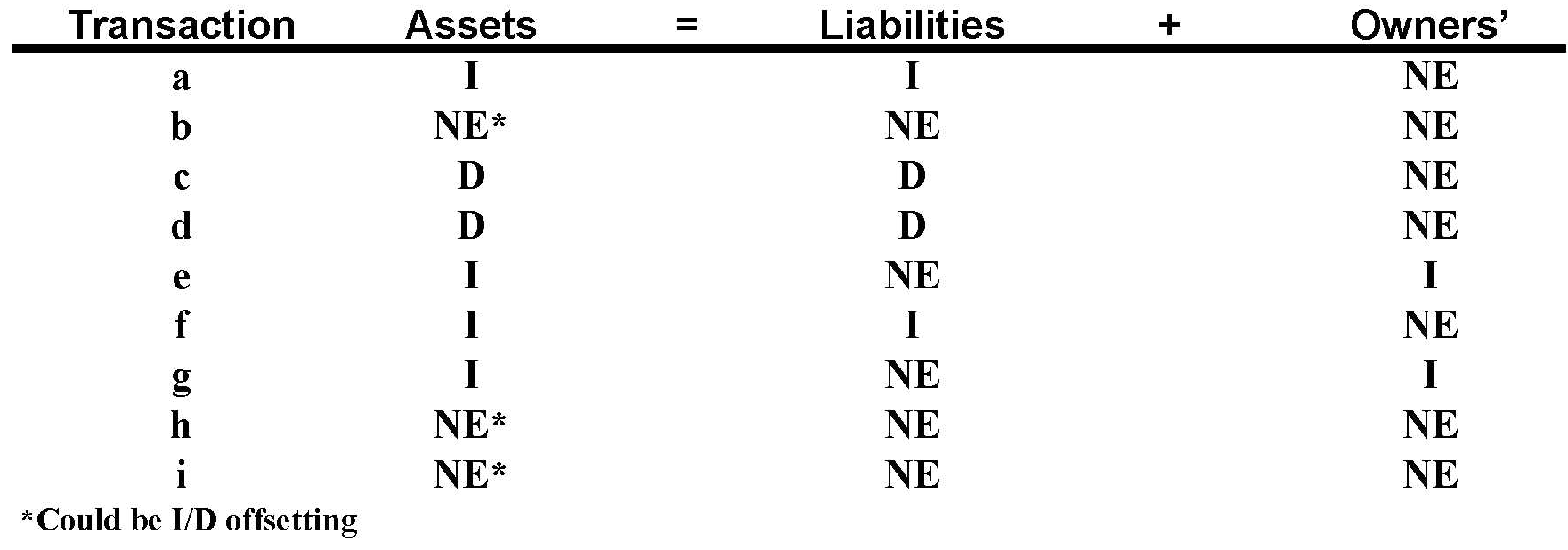

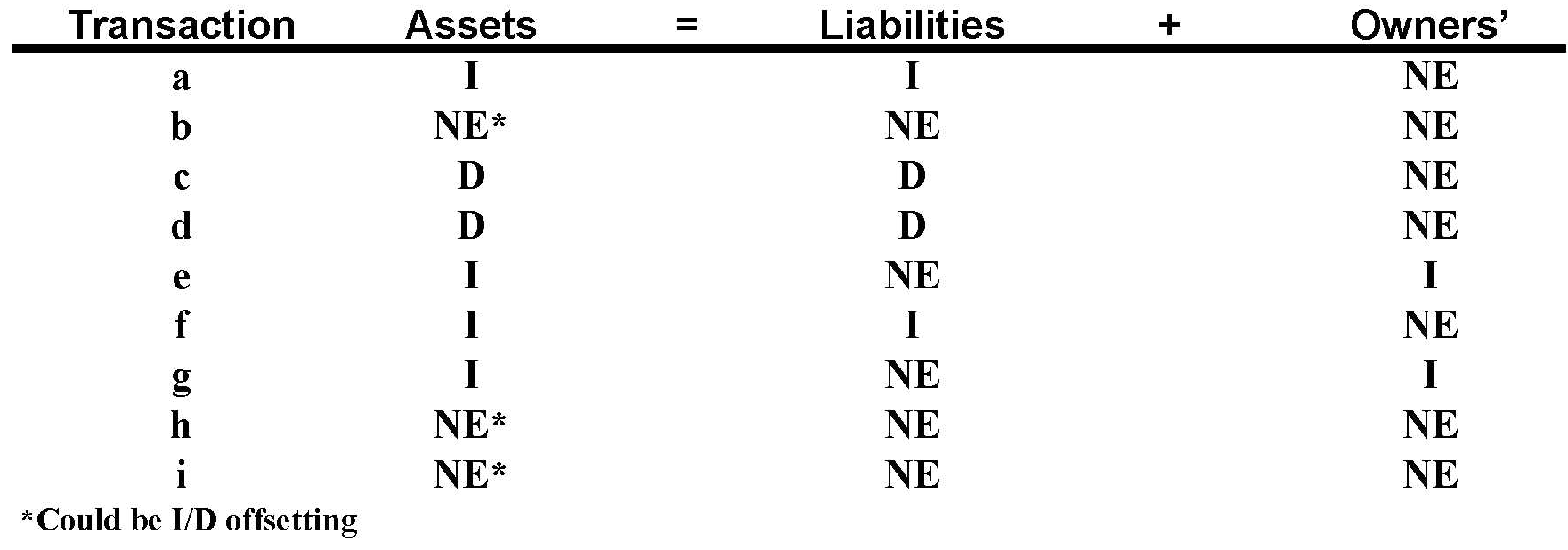

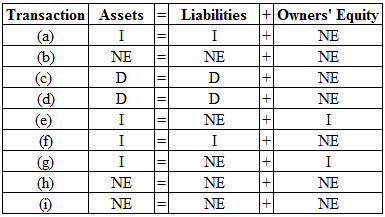

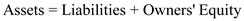

The Accounting Equation

A number of business transactions carried out by Smalling Manufacturing Company are as follows:

a. Borrowed money from a bank.

b. Sold land for cash at a price equal to its cost.

c.Paid a liability.

d.Returned for credit some of the office equipment previously purchased on credit but not yet paid for.Treat this the opposite of a transaction in which you purchased office equipment on credit.)

e.Sold land for cash at a price in excess of cost.Hint: The difference between cost and sales price represents a gain that will be in the company's income statement.)

f.Purchased a computer on credit.

g.The owner invested cash in the business.

h. Purchased office equipment for cash.

i.Collected an account receivable.

Indicate the effects of each of these transactions on the total amounts of the company's assets, liabilities, and owners' equity.rganize your answer in tabular form, using the following column headings and the code letters I for increase, D for decrease, and NE for no effect.he answer for transaction a is provided as an example:

A number of business transactions carried out by Smalling Manufacturing Company are as follows:

a. Borrowed money from a bank.

b. Sold land for cash at a price equal to its cost.

c.Paid a liability.

d.Returned for credit some of the office equipment previously purchased on credit but not yet paid for.Treat this the opposite of a transaction in which you purchased office equipment on credit.)

e.Sold land for cash at a price in excess of cost.Hint: The difference between cost and sales price represents a gain that will be in the company's income statement.)

f.Purchased a computer on credit.

g.The owner invested cash in the business.

h. Purchased office equipment for cash.

i.Collected an account receivable.

Indicate the effects of each of these transactions on the total amounts of the company's assets, liabilities, and owners' equity.rganize your answer in tabular form, using the following column headings and the code letters I for increase, D for decrease, and NE for no effect.he answer for transaction a is provided as an example:

Transaction Analysis:

Transaction analysis is the process of the documents such as invoice or bill in order to determine the effect on the accounting equation and accounts involved.Accounting equation implies that each economic event has dual effect on the equation because resource always must equal claims. Indicate effect of each transaction on assets, liabilities and owners' equity:

Indicate effect of each transaction on assets, liabilities and owners' equity:  Transaction (a):

Transaction (a):

Money borrowed from bank increases cash and liability to pay. Increase in cash increases assets. Hence, this transaction results in increase of assets, liabilities and nil effect on owners' equity.

Transaction (b):

When land is sold for cash equal to its cost, cash increases and value of land decreases. Increase in cash increases assets and decrease in land decreases assets. Both increase and decrease of assets will offset and show nil effect.

Transaction (c):

Payment of liability decreases cash and decreases liability. Decrease in cash decreases assets. Hence, liability paid decreased assets and liabilities.

Transaction (d):

Return of office equipment previously purchased on credit decreases liability and decreases assets.

Transaction (e):

When land is sold for cash in excess of cost, cash increases more than value of land and value of land decreases. Increase in cash increases assets and decrease in land decreases assets. Increase in cash is more than decrease in land which results in net effect of increase in assets. Gain on sale of land increases net income resulting in increase of owners' equity.

Transaction (f):

Purchase of computer on credit increases assets and liability to pay resulting in increase of assets and liabilities.

Transaction (g):

Investing cash in business increases cash and capital resulting in increase of assets and owners' equity.

Transaction (h):

Purchase of office equipment for cash increases assets and decreases cash for payment made. Increase of assets and decrease of assets offset each other resulting in nil effect.

Transaction (i):

Cash collected from accounts receivable increases cash and decreases accounts receivable. Increase in cash increases assets and decrease in accounts receivable decreases assets. Hence, increase in assets and decrease in assets offset each other resulting in nil effect.

Transaction analysis is the process of the documents such as invoice or bill in order to determine the effect on the accounting equation and accounts involved.Accounting equation implies that each economic event has dual effect on the equation because resource always must equal claims.

Indicate effect of each transaction on assets, liabilities and owners' equity:

Indicate effect of each transaction on assets, liabilities and owners' equity:  Transaction (a):

Transaction (a): Money borrowed from bank increases cash and liability to pay. Increase in cash increases assets. Hence, this transaction results in increase of assets, liabilities and nil effect on owners' equity.

Transaction (b):

When land is sold for cash equal to its cost, cash increases and value of land decreases. Increase in cash increases assets and decrease in land decreases assets. Both increase and decrease of assets will offset and show nil effect.

Transaction (c):

Payment of liability decreases cash and decreases liability. Decrease in cash decreases assets. Hence, liability paid decreased assets and liabilities.

Transaction (d):

Return of office equipment previously purchased on credit decreases liability and decreases assets.

Transaction (e):

When land is sold for cash in excess of cost, cash increases more than value of land and value of land decreases. Increase in cash increases assets and decrease in land decreases assets. Increase in cash is more than decrease in land which results in net effect of increase in assets. Gain on sale of land increases net income resulting in increase of owners' equity.

Transaction (f):

Purchase of computer on credit increases assets and liability to pay resulting in increase of assets and liabilities.

Transaction (g):

Investing cash in business increases cash and capital resulting in increase of assets and owners' equity.

Transaction (h):

Purchase of office equipment for cash increases assets and decreases cash for payment made. Increase of assets and decrease of assets offset each other resulting in nil effect.

Transaction (i):

Cash collected from accounts receivable increases cash and decreases accounts receivable. Increase in cash increases assets and decrease in accounts receivable decreases assets. Hence, increase in assets and decrease in assets offset each other resulting in nil effect.

4

The answers to these questions appear on page 85.Note: In order to review as many chapter concepts as possible, some self-test questions include more than one correct answer.n these cases, you should indicate all of the correct answers.

Which of the following statements relating to the role of professional judgment in the financial reporting process is (are) true

a.ifferent accountants may evaluate similar situations differently.

b.he determination of which items should be disclosed in notes to financial statements requires professional judgment.

c.nce a complete list of generally accepted accounting principles is prepared, judgment by accountants will no longer enter into the financial reporting process.

d.he possibility exists that professional judgment later may prove to have been incorrect.

Which of the following statements relating to the role of professional judgment in the financial reporting process is (are) true

a.ifferent accountants may evaluate similar situations differently.

b.he determination of which items should be disclosed in notes to financial statements requires professional judgment.

c.nce a complete list of generally accepted accounting principles is prepared, judgment by accountants will no longer enter into the financial reporting process.

d.he possibility exists that professional judgment later may prove to have been incorrect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

5

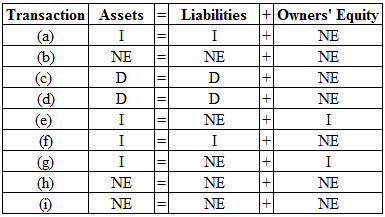

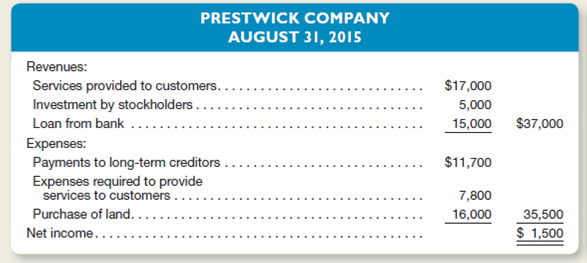

An inexperienced accountant for Prestwick Company prepared the following income statement for the month of August 2015:

Prepare a revised income statement in accordance with generally accepted accounting principles.

Prepare a revised income statement in accordance with generally accepted accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

6

Foster, Inc., purchased a truck by paying $5,000 and borrowing the remaining $30,000 required to complete the transaction.riefly state how this transaction affects the company's basic accounting equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

7

Why is the statement of financial position, or balance sheet, a logical place to begin a discussion of financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

8

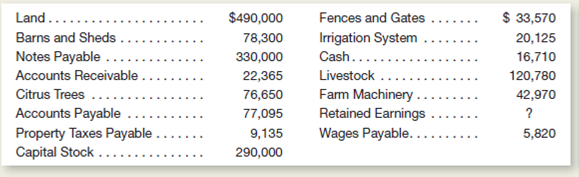

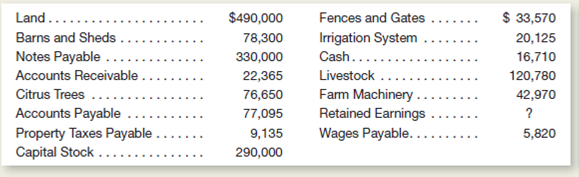

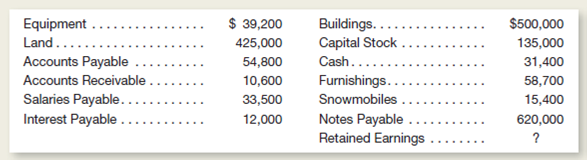

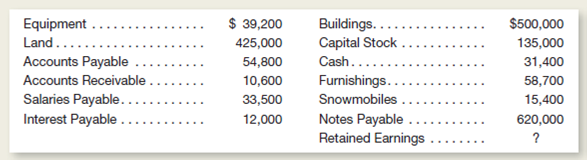

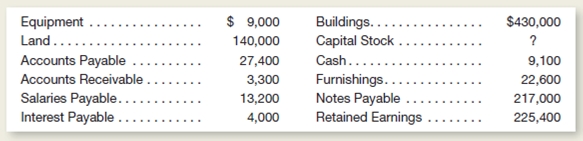

The following list of balance sheet items are in random order for Alexander Farms, Inc., at September 30, 2015:

Instructions

a.repare a balance sheet by using these items and computing the amount for Retained Earnings.se a sequence of assets similar to that illustrated in Exhibit 2-10.After "Barns and Sheds," you may list the remaining assets in any order.) Include a proper heading for your balance sheet.

b.ssume that on September 30, immediately after this balance sheet was prepared, a tornado completely destroyed one of the barns.his barn had a cost of $14,000 and was not insured against this type of disaster.xplain what changes would be required in your September 30 balance sheet to reflect the loss of this barn.

Instructions

a.repare a balance sheet by using these items and computing the amount for Retained Earnings.se a sequence of assets similar to that illustrated in Exhibit 2-10.After "Barns and Sheds," you may list the remaining assets in any order.) Include a proper heading for your balance sheet.

b.ssume that on September 30, immediately after this balance sheet was prepared, a tornado completely destroyed one of the barns.his barn had a cost of $14,000 and was not insured against this type of disaster.xplain what changes would be required in your September 30 balance sheet to reflect the loss of this barn.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

9

Alternative Forms of Equity

Repeat Brief Exercise 2.8, except assume that rather than being a sole proprietorship or a partnership, Solway Company is organized as a corporation with capital stock of $40,000.ow would the $50,000 of owners' equity be presented in the company's balance sheet

Repeat Brief Exercise 2.8, except assume that rather than being a sole proprietorship or a partnership, Solway Company is organized as a corporation with capital stock of $40,000.ow would the $50,000 of owners' equity be presented in the company's balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

10

What are the characteristics of a strong income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

11

Using Financial Statements

Obtain from the library the annual report of a well-known company (or a company specified by your instructor).

Instructions

From the balance sheet, income statement, statement of cash flows, and notes to the financial statements, answer the following:

a.What are the largest assets included in the company's balance sheet Why would a company of this type (size and industry) have a large investment in this particular type of asset

b.In a review of the company's statement of cash flows:

1.What are the primary sources and uses of cash from investing activities

2.Did investing activities cause the company's cash to increase or decrease

3.What are the primary sources and uses of cash from financing activities

4.Did financing activities cause the company's cash to increase or decrease

c. In a review of the company's income statement, did the company have a net income or a net loss for the most recent year What percentage of total revenues was that net income or net loss

d.Select three items in the notes accompanying the financial statements and explain briefly the importance of these items to people making decisions about investing in, or extending credit to, this company.

e.Assume that you are a lender and this company has asked to borrow an amount of cash equal to 10 percent of its total assets, to be repaid in 90 days.ould you consider this company to be a good credit risk Explain.

Obtain from the library the annual report of a well-known company (or a company specified by your instructor).

Instructions

From the balance sheet, income statement, statement of cash flows, and notes to the financial statements, answer the following:

a.What are the largest assets included in the company's balance sheet Why would a company of this type (size and industry) have a large investment in this particular type of asset

b.In a review of the company's statement of cash flows:

1.What are the primary sources and uses of cash from investing activities

2.Did investing activities cause the company's cash to increase or decrease

3.What are the primary sources and uses of cash from financing activities

4.Did financing activities cause the company's cash to increase or decrease

c. In a review of the company's income statement, did the company have a net income or a net loss for the most recent year What percentage of total revenues was that net income or net loss

d.Select three items in the notes accompanying the financial statements and explain briefly the importance of these items to people making decisions about investing in, or extending credit to, this company.

e.Assume that you are a lender and this company has asked to borrow an amount of cash equal to 10 percent of its total assets, to be repaid in 90 days.ould you consider this company to be a good credit risk Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

12

The following cases relate to the valuation of assets.onsider each case independently.

a.orld-Wide Travel Agency has office supplies costing $1,400 on hand at the balance sheet date.hese supplies were purchased from a supplier that does not give cash refunds.orld-Wide's management believes that the company could sell these supplies for no more than $500 if it were to advertise them for sale.owever, the company expects to use these supplies and to purchase more when they are gone.n its balance sheet, the supplies were presented at $500.

b.erez Corporation purchased land in 1957 for $40,000.n 2015, it purchased a similar parcel of land for $300,000.n its 2015 balance sheet, the company presented these two parcels of land at a combined amount of $340,000.

c.t December 30, 2015, Felix, Inc., purchased a computer system from a mail-order supplier for $14,000.he retail value of the system-according to the mail-order supplier-was $20,000.n January 7, however, the system was stolen during a burglary.n its December 31, 2015, balance sheet, Felix showed this computer system at $14,000 and made no reference to its retail value or to the burglary.he December balance sheet was issued in February 2016.n each case, indicate the appropriate balance sheet amount of the asset under generally accepted accounting principles.f the amount assigned by the company is incorrect, briefly explain the accounting principles that have been violated.f the amount is correct, identify the accounting principles that justify this amount.

a.orld-Wide Travel Agency has office supplies costing $1,400 on hand at the balance sheet date.hese supplies were purchased from a supplier that does not give cash refunds.orld-Wide's management believes that the company could sell these supplies for no more than $500 if it were to advertise them for sale.owever, the company expects to use these supplies and to purchase more when they are gone.n its balance sheet, the supplies were presented at $500.

b.erez Corporation purchased land in 1957 for $40,000.n 2015, it purchased a similar parcel of land for $300,000.n its 2015 balance sheet, the company presented these two parcels of land at a combined amount of $340,000.

c.t December 30, 2015, Felix, Inc., purchased a computer system from a mail-order supplier for $14,000.he retail value of the system-according to the mail-order supplier-was $20,000.n January 7, however, the system was stolen during a burglary.n its December 31, 2015, balance sheet, Felix showed this computer system at $14,000 and made no reference to its retail value or to the burglary.he December balance sheet was issued in February 2016.n each case, indicate the appropriate balance sheet amount of the asset under generally accepted accounting principles.f the amount assigned by the company is incorrect, briefly explain the accounting principles that have been violated.f the amount is correct, identify the accounting principles that justify this amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

13

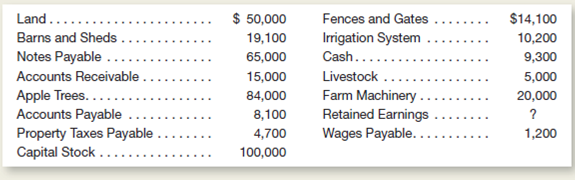

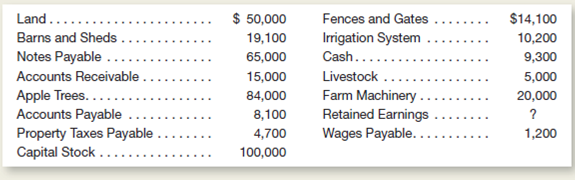

Shown below in random order is a list of balance sheet items for Maple Valley Farms at September 30, 2015:

Instructions

a.repare a balance sheet by using these items and computing the amount for Retained Earnings.se a sequence of assets similar to that illustrated in Chapter 2 of the text.nclude a proper heading for your balance sheet.

b.ssume that on September 30, immediately after this balance sheet was prepared, a tornado completely destroyed one of the barns.his barn had a cost of $4,500 and was not insured against this type of disaster.xplain what changes would be required in your September 30 balance sheet to reflect the loss of this barn.

Instructions

a.repare a balance sheet by using these items and computing the amount for Retained Earnings.se a sequence of assets similar to that illustrated in Chapter 2 of the text.nclude a proper heading for your balance sheet.

b.ssume that on September 30, immediately after this balance sheet was prepared, a tornado completely destroyed one of the barns.his barn had a cost of $4,500 and was not insured against this type of disaster.xplain what changes would be required in your September 30 balance sheet to reflect the loss of this barn.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is meant by the terms positive cash flows and negative cash flows How do they relate to revenues and expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

15

On the basis of the information for Prestwick Company in Exercise 2.13, prepare a statement of cash flows in a form consistent with generally accepted accounting principles.ou may assume all transactions were in cash and that the beginning cash balance was $7,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

16

Why is a knowledge of accounting terms and concepts useful to persons other than professional accountants

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

17

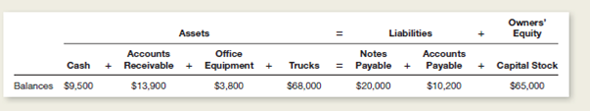

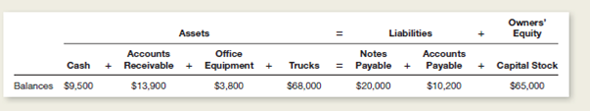

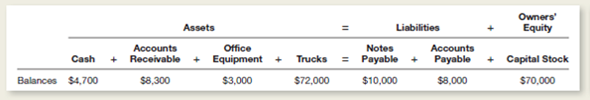

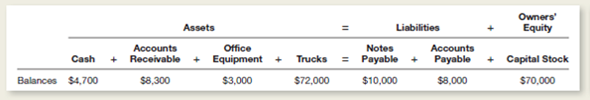

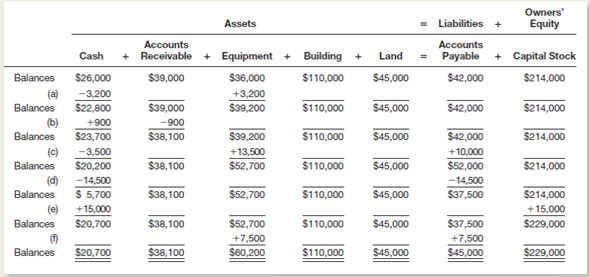

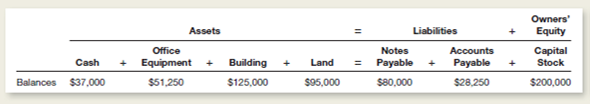

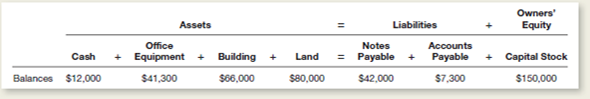

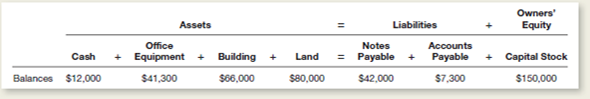

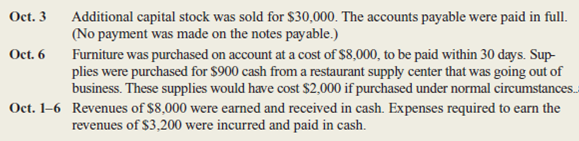

The items making up the balance sheet of Phillips Truck Rental at December 31 are listed below in tabular form similar to the illustration of the accounting equation in Exhibit 2-11.

During a short period after December 31, Phillips Truck Rental had the following transactions:

1.ought office equipment at a cost of $2,700.aid cash.

2.ollected $4,000 of accounts receivable.

3.aid $3,200 of accounts payable.

4.orrowed $10,000 from a bank.igned a note payable for that amount.

5.urchased two trucks for $30,500.aid $15,000 cash and signed a note payable for the balance.

6.old additional stock to investors for $85,000.

Instructions

a.ist the December 31 balances of assets, liabilities, and owners' equity in tabular form as shown above.

b.ecord the effects of each of the six transactions in the preceding tabular arrangement.how the totals for all columns after each transaction.

During a short period after December 31, Phillips Truck Rental had the following transactions:

1.ought office equipment at a cost of $2,700.aid cash.

2.ollected $4,000 of accounts receivable.

3.aid $3,200 of accounts payable.

4.orrowed $10,000 from a bank.igned a note payable for that amount.

5.urchased two trucks for $30,500.aid $15,000 cash and signed a note payable for the balance.

6.old additional stock to investors for $85,000.

Instructions

a.ist the December 31 balances of assets, liabilities, and owners' equity in tabular form as shown above.

b.ecord the effects of each of the six transactions in the preceding tabular arrangement.how the totals for all columns after each transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

18

The answers to these questions appear on page 85.Note: In order to review as many chapter concepts as possible, some self-test questions include more than one correct answer.n these cases, you should indicate all of the correct answers.

Which of the following would you expect to find in a correctly prepared income statement

a.ash balance at the end of the period.

b.evenues earned during the period.

c.ontributions by the owner during the period.

d.xpenses incurred during the period to earn revenues.

Which of the following would you expect to find in a correctly prepared income statement

a.ash balance at the end of the period.

b.evenues earned during the period.

c.ontributions by the owner during the period.

d.xpenses incurred during the period to earn revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

19

Factors Contributing to Solvency

Explain whether each of the following balance sheet items increases, reduces, or has no direct effect on a company's ability to pay its obligations as they come due.xplain your reasoning.

a.Cash.

b.Accounts Payable.

c.Accounts Receivable.

d.Capital Stock.

Explain whether each of the following balance sheet items increases, reduces, or has no direct effect on a company's ability to pay its obligations as they come due.xplain your reasoning.

a.Cash.

b.Accounts Payable.

c.Accounts Receivable.

d.Capital Stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

20

What are the characteristics of a strong statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

21

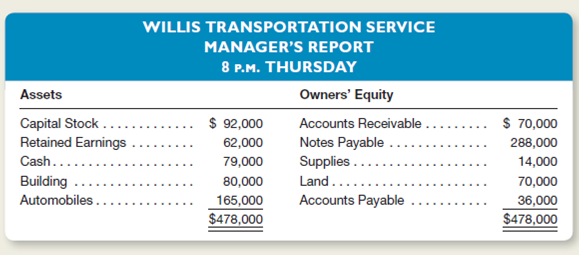

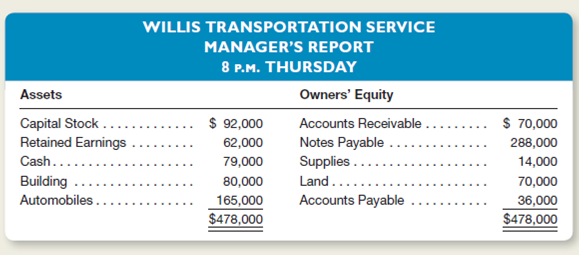

The night manager of Willis Transportation Service, who had no accounting background, prepared the following balance sheet for the company at February 28, 2015.he dollar amounts were taken directly from the company's accounting records and are correct.owever, the balance sheet contains a number of errors in its headings, format, and the classification of assets, liabilities, and owners' equity.

Prepare a corrected balance sheet.nclude a proper heading.

Prepare a corrected balance sheet.nclude a proper heading.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

22

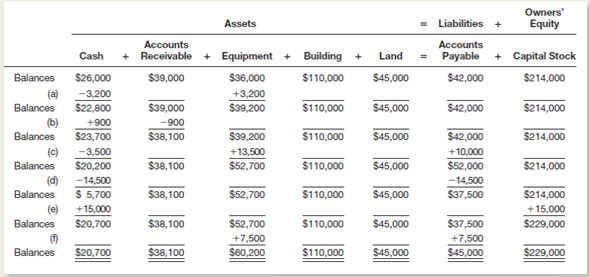

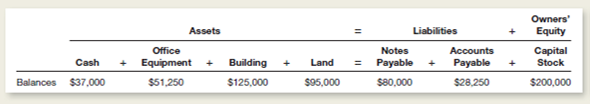

The items making up the balance sheet of Maxx Trucking at December 31 are listed below in tabular form similar to the illustration of the accounting equation in Chapter 2 of the text.

During a short period after December 31, Maxx Trucking had the following transactions:

1.ought office equipment at a cost of $2,600.aid cash.

2.ollected $2,500 of accounts receivable.

3.aid $2,000 of accounts payable.

4.orrowed $5,000 from a bank.igned a note payable for that amount.

5.urchased three trucks for $60,000.aid $5,000 cash and signed a note payable for the balance.

6.old additional stock to investors for $25,000.

Instructions

a.ist the December 31 balances of assets, liabilities, and owners' equity in tabular form as shown above.

b.ecord the effects of each of the six transactions in the tabular arrangement illustrated above.how the totals for all columns after each transaction.

During a short period after December 31, Maxx Trucking had the following transactions:

1.ought office equipment at a cost of $2,600.aid cash.

2.ollected $2,500 of accounts receivable.

3.aid $2,000 of accounts payable.

4.orrowed $5,000 from a bank.igned a note payable for that amount.

5.urchased three trucks for $60,000.aid $5,000 cash and signed a note payable for the balance.

6.old additional stock to investors for $25,000.

Instructions

a.ist the December 31 balances of assets, liabilities, and owners' equity in tabular form as shown above.

b.ecord the effects of each of the six transactions in the tabular arrangement illustrated above.how the totals for all columns after each transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

23

Wilkes Company had the following transactions during the current year:

• Earned revenues of $100,000 and incurred expenses of $56,000, all in cash.

• Purchased a truck for $25,000.

• Sold land for $10,000.

• Borrowed $15,000 from a local bank.

What was the total change in cash during the year

• Earned revenues of $100,000 and incurred expenses of $56,000, all in cash.

• Purchased a truck for $25,000.

• Sold land for $10,000.

• Borrowed $15,000 from a local bank.

What was the total change in cash during the year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

24

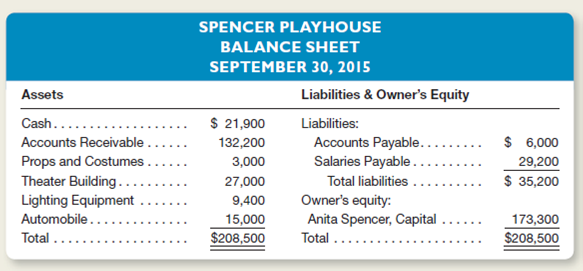

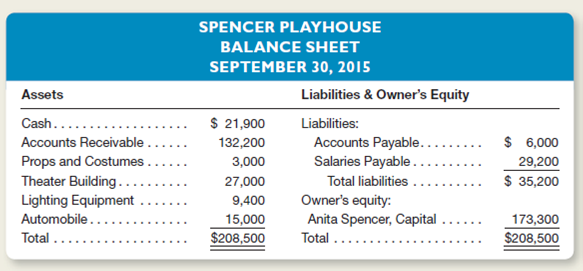

Anita Spencer is the founder and manager of Spencer Playhouse.he business needs to obtain a bank loan to finance the production of its next play.s part of the loan application, Anita Spencer was asked to prepare a balance sheet for the business.he prepared the following balance sheet, which is arranged correctly but which contains several errors with respect to such concepts as the business entity and the valuation of assets, liabilities, and owner's equity.

In discussions with Anita Spencer and by reviewing the accounting records of Spencer Playhouse, you determine the following facts:

1.he amount of cash, $21,900, includes $15,000 in the company's bank account, $1,900 on hand in the company's safe, and $5,000 in Anita Spencer's personal savings account.

2.he accounts receivable, listed as $132,200, include $7,200 owed to the business by Artistic Tours.he remaining $125,000 is Anita Spencer's estimate of future ticket sales from September 30 through the end of the year (December 31).

3.nita Spencer explains to you that the props and costumes were purchased several days ago for $18,000.he business paid $3,000 of this amount in cash and issued a note payable to Actors' Supply Co.or the remainder of the purchase price ($15,000).s this note is not due until January of next year, it was not included among the company's liabilities.

4.pencer Playhouse rents the theater building from Kievits International at a rate of $3,000 a month.he $27,000 shown in the balance sheet represents the rent paid through September 30 of the current year.ievits International acquired the building seven years ago at a cost of $135,000.

5.he lighting equipment was purchased on September 26 at a cost of $9,400, but the stage manager says that it isn't worth a dime.

6.he automobile is Anita Spencer's classic 1978 Jaguar, which she purchased two years ago for $9,000.he recently saw a similar car advertised for sale at $15,000.he does not use the car in the business, but it has a personalized license plate that reads "PLAHOUS."

7.he accounts payable include business debts of $3,900 and the $2,100 balance of Anita Spencer's personal Visa card.

8.alaries payable include $25,000 offered to Mario Dane to play the lead role in a new play opening next December and $4,200 still owed to stagehands for work done through September 30.

9.hen Anita Spencer founded Spencer Playhouse several years ago, she invested $20,000 in the business.owever, Live Theatre, Inc., recently offered to buy her business for $173,300.herefore, she listed this amount as her equity in the above balance sheet.

Instructions

a.repare a corrected balance sheet for Spencer Playhouse at September 30, 2015.

b.or each of the nine numbered items above, explain your reasoning in deciding whether or not to include the items in the balance sheet and in determining the proper dollar valuation.

In discussions with Anita Spencer and by reviewing the accounting records of Spencer Playhouse, you determine the following facts:

1.he amount of cash, $21,900, includes $15,000 in the company's bank account, $1,900 on hand in the company's safe, and $5,000 in Anita Spencer's personal savings account.

2.he accounts receivable, listed as $132,200, include $7,200 owed to the business by Artistic Tours.he remaining $125,000 is Anita Spencer's estimate of future ticket sales from September 30 through the end of the year (December 31).

3.nita Spencer explains to you that the props and costumes were purchased several days ago for $18,000.he business paid $3,000 of this amount in cash and issued a note payable to Actors' Supply Co.or the remainder of the purchase price ($15,000).s this note is not due until January of next year, it was not included among the company's liabilities.

4.pencer Playhouse rents the theater building from Kievits International at a rate of $3,000 a month.he $27,000 shown in the balance sheet represents the rent paid through September 30 of the current year.ievits International acquired the building seven years ago at a cost of $135,000.

5.he lighting equipment was purchased on September 26 at a cost of $9,400, but the stage manager says that it isn't worth a dime.

6.he automobile is Anita Spencer's classic 1978 Jaguar, which she purchased two years ago for $9,000.he recently saw a similar car advertised for sale at $15,000.he does not use the car in the business, but it has a personalized license plate that reads "PLAHOUS."

7.he accounts payable include business debts of $3,900 and the $2,100 balance of Anita Spencer's personal Visa card.

8.alaries payable include $25,000 offered to Mario Dane to play the lead role in a new play opening next December and $4,200 still owed to stagehands for work done through September 30.

9.hen Anita Spencer founded Spencer Playhouse several years ago, she invested $20,000 in the business.owever, Live Theatre, Inc., recently offered to buy her business for $173,300.herefore, she listed this amount as her equity in the above balance sheet.

Instructions

a.repare a corrected balance sheet for Spencer Playhouse at September 30, 2015.

b.or each of the nine numbered items above, explain your reasoning in deciding whether or not to include the items in the balance sheet and in determining the proper dollar valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

25

Window Dressing Financial Statements

Prepare a two-column analysis that illustrates steps management might take to improve the appearance of its company's financial statements.n the left column, briefly identify three steps that might be taken.n the right column, briefly describe for each step the impact on the balance sheet, income statement, and statement of cash flows.f there is no impact on one or more of these financial statements, indicate that.

Prepare a two-column analysis that illustrates steps management might take to improve the appearance of its company's financial statements.n the left column, briefly identify three steps that might be taken.n the right column, briefly describe for each step the impact on the balance sheet, income statement, and statement of cash flows.f there is no impact on one or more of these financial statements, indicate that.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

26

The following six transactions of Memphis Moving Company, a corporation, are summarized in equation form, with each of the six transactions identified by a letter.or each of the transactions (a) through (f) write a separate statement explaining the nature of the transaction.or example, the explanation of transaction (a) could be as follows: Purchased equipment for cash at a cost of $3,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

27

The answers to these questions appear on page 85.Note: In order to review as many chapter concepts as possible, some self-test questions include more than one correct answer.n these cases, you should indicate all of the correct answers.

A transaction caused a $15,000 decrease in both total assets and total liabilities.his transaction could have been:

a.urchase of a delivery truck for $15,000 cash.

b.n asset with a cost of $15,000 destroyed by fire.

c.epayment of a $15,000 bank loan.

d.ollection of a $15,000 account receivable.

A transaction caused a $15,000 decrease in both total assets and total liabilities.his transaction could have been:

a.urchase of a delivery truck for $15,000 cash.

b.n asset with a cost of $15,000 destroyed by fire.

c.epayment of a $15,000 bank loan.

d.ollection of a $15,000 account receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

28

Gathering Financial Information

This assignment introduces you to EDGAR, the Securities and Exchange Commission's database of financial information about publicly owned companies;.he SEC maintains EDGAR to increase the efficiency of financial reporting in the American economy and also to give the public free and.asy access to information about publicly owned companies.

Instructions

Access EDGAR at the following Internet address: www.sec.gov.o to "Filings Forms."

Click "Search for Company Filings" and then "Companies and Other Filers." Then type Cisco Systems into the search box and click on "Find Companies." Locate the most recent10Q (quarterly) report.

a.What is the business address of Cisco Systems

b.Locate the balance sheet in Form 10Q and determine whether the amount of the company's cash (and cash equivalents) increased or decreased in the most recent quarter.

c.Locate the income statement (called the "statement of operations").hat was the company's net income for the most recent quarter Is that amount higher or lower than in the previous quarter

d.Analyze the statement of cash flows.ow much cash was provided by operations to date for the current year

e.While you ere in EDGAR, pick another company that interests you and learn more about it by studying that company's information.e prepared to tell the class which company you selected and explain what you learned.

Internet sites are time and date sensitive.t is the purpose of these exercises to have you explore the Internet.ou may need to use the Yahoo! search engine http://www.vahoo.com (or another favorite search engine) to find a company's current Web address.

This assignment introduces you to EDGAR, the Securities and Exchange Commission's database of financial information about publicly owned companies;.he SEC maintains EDGAR to increase the efficiency of financial reporting in the American economy and also to give the public free and.asy access to information about publicly owned companies.

Instructions

Access EDGAR at the following Internet address: www.sec.gov.o to "Filings Forms."

Click "Search for Company Filings" and then "Companies and Other Filers." Then type Cisco Systems into the search box and click on "Find Companies." Locate the most recent10Q (quarterly) report.

a.What is the business address of Cisco Systems

b.Locate the balance sheet in Form 10Q and determine whether the amount of the company's cash (and cash equivalents) increased or decreased in the most recent quarter.

c.Locate the income statement (called the "statement of operations").hat was the company's net income for the most recent quarter Is that amount higher or lower than in the previous quarter

d.Analyze the statement of cash flows.ow much cash was provided by operations to date for the current year

e.While you ere in EDGAR, pick another company that interests you and learn more about it by studying that company's information.e prepared to tell the class which company you selected and explain what you learned.

Internet sites are time and date sensitive.t is the purpose of these exercises to have you explore the Internet.ou may need to use the Yahoo! search engine http://www.vahoo.com (or another favorite search engine) to find a company's current Web address.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

29

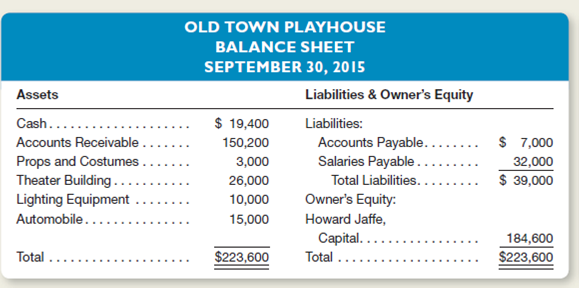

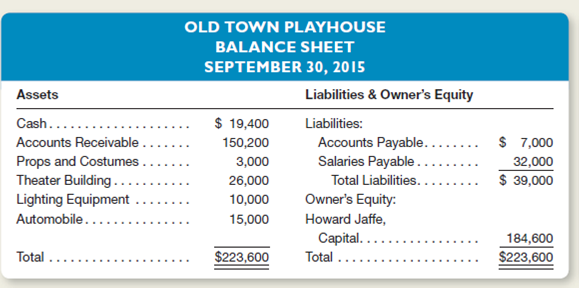

Howard Jaffe is the founder and manager of Old Town Playhouse.he business wishes to obtain a bank loan to finance the production of its next play.s part of the loan application, Jaffe was asked to prepare a balance sheet for the business.e prepared the following balance sheet, which is arranged correctly but which contains several errors with respect to such concepts as the business entity and the valuation of assets, liabilities, and owner's equity.

In discussions with Jaffe and by reviewing the accounting records of Old Town Playhouse, you discover the following facts:

1.he amount of cash, $19,400, includes $16,000 in the company's bank account, $2,400 on hand in the company's safe, and $1,000 in Jaffe's personal savings account.

2.he accounts receivable, listed as $150,200, include $10,000 owed to the business by Dell, Inc.he remaining $140,200 is Jaffe's estimate of future ticket sales from September 30 through the end of the year (December 31).

3.affe explains to you that the props and costumes were purchased several days ago for $18,000.he business paid $3,000 of this amount in cash and issued a note payable to Ham's Supply Co.or the remainder of the purchase price ($15,000).s this note is not due until January of next year, it was not included among the company's liabilities.

4.ld Town Playhouse rents the theater building from Time International.he $26,000 shown in the balance sheet represents the rent paid through September 30 of the current year.ime International acquired the building seven years ago at a cost of $180,000.

5.he lighting equipment was purchased on September 26 at a cost of $10,000, but the stage manager says that it isn't worth a dime.

6.he automobile is Jaffe's classic 1935 Ford, which he purchased two years ago for $12,000.e recently saw a similar car advertised for sale at $15,000.e does not use the car in the business, but it has a personalized license plate that reads "OTPLAY."

7.he accounts payable include business debts of $6,000 and the $1,000 balance of Jaffe's personal Visa card.

8.alaries payable include $30,000 offered to Robin Needelman to play the lead role in a new play opening next December and $2,000 still owed to stagehands for work done through September 30.

9.hen Jaffe founded Old Town Playhouse several years ago, he invested $20,000 in the business.owever, New Theatre, Inc., recently offered to buy his business for $184,600.herefore, he listed this amount as his equity in the above balance sheet.

Instructions

a.repare a corrected balance sheet for Old Town Playhouse at September 30, 2015.

b.or each of the nine numbered items above, explain your reasoning for deciding whether or not to include the items in the balance sheet and in determining the proper dollar valuation.

In discussions with Jaffe and by reviewing the accounting records of Old Town Playhouse, you discover the following facts:

1.he amount of cash, $19,400, includes $16,000 in the company's bank account, $2,400 on hand in the company's safe, and $1,000 in Jaffe's personal savings account.

2.he accounts receivable, listed as $150,200, include $10,000 owed to the business by Dell, Inc.he remaining $140,200 is Jaffe's estimate of future ticket sales from September 30 through the end of the year (December 31).

3.affe explains to you that the props and costumes were purchased several days ago for $18,000.he business paid $3,000 of this amount in cash and issued a note payable to Ham's Supply Co.or the remainder of the purchase price ($15,000).s this note is not due until January of next year, it was not included among the company's liabilities.

4.ld Town Playhouse rents the theater building from Time International.he $26,000 shown in the balance sheet represents the rent paid through September 30 of the current year.ime International acquired the building seven years ago at a cost of $180,000.

5.he lighting equipment was purchased on September 26 at a cost of $10,000, but the stage manager says that it isn't worth a dime.

6.he automobile is Jaffe's classic 1935 Ford, which he purchased two years ago for $12,000.e recently saw a similar car advertised for sale at $15,000.e does not use the car in the business, but it has a personalized license plate that reads "OTPLAY."

7.he accounts payable include business debts of $6,000 and the $1,000 balance of Jaffe's personal Visa card.

8.alaries payable include $30,000 offered to Robin Needelman to play the lead role in a new play opening next December and $2,000 still owed to stagehands for work done through September 30.

9.hen Jaffe founded Old Town Playhouse several years ago, he invested $20,000 in the business.owever, New Theatre, Inc., recently offered to buy his business for $184,600.herefore, he listed this amount as his equity in the above balance sheet.

Instructions

a.repare a corrected balance sheet for Old Town Playhouse at September 30, 2015.

b.or each of the nine numbered items above, explain your reasoning for deciding whether or not to include the items in the balance sheet and in determining the proper dollar valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

30

Locate the balance sheet, income statement, and statement of cash flows of Home Depot, Inc. in Appendix A of your text.eview those statements and then respond to the following for the year ended February 3, 2013 (fiscal year 2012).

a.id the company have a net income or net loss for the year How much

b.hat were the cash balances at the beginning and end of the year What were the most important causes of the cash decrease during the year (Treat "cash equivalents" as if they were cash.)

c.hat are the two largest assets and two largest liabilities included in the company's balance sheet at the end of the year

a.id the company have a net income or net loss for the year How much

b.hat were the cash balances at the beginning and end of the year What were the most important causes of the cash decrease during the year (Treat "cash equivalents" as if they were cash.)

c.hat are the two largest assets and two largest liabilities included in the company's balance sheet at the end of the year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

31

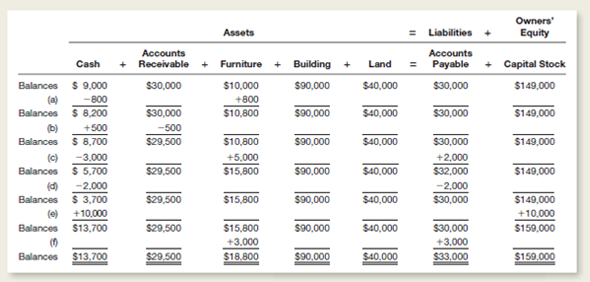

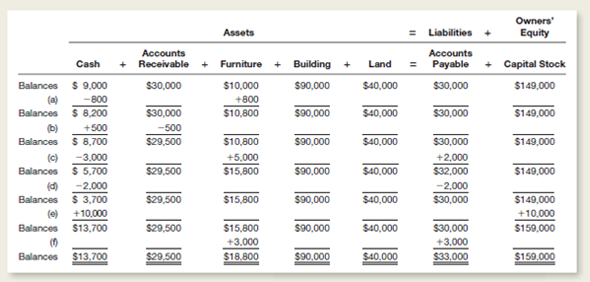

Six transactions of Prosperity Company, a corporation, are summarized below in equation form, with each of the six transactions identified by a letter.or each of the transactions (a) through (f) write a separate statement explaining the nature of the transaction.or example, the explanation of transaction (a) could be as follows: Purchased furniture for cash at a cost of $800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

32

Wiley Company had total revenues of $300,000 for a recent month.uring the month the company incurred operating expenses of $205,000 and purchased land for $55,000.ompute the amount of Wiley's net income for the month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

33

Can a business transaction cause one asset to increase without affecting any other asset, liability; or owners' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

34

Ben Washington, sole owner of Washington Mattress Company, has an ownership interest in the company of $50,000 at January 1, 2015.uring that year, he invests an additional $20,000 in the company and the company reports a net income of $25,000.etermine the balance of owner's equity that will appear in the statement of financial position at the end of the year, and explain how the amount of net income articulates with that figure in the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

35

McKesson Corporation 's annual report for the year ended March 31, 2012, includes income statements for three years: ending on March 31, 2010, 2011, and 2012.et income for these three years is as follows (all in millions): $1,263 (2010), $1,202 (2011), and $1,403 (2012).urther analysis of the same income statements reveals that revenues were the following amounts for these same years (all in millions): $108,702 (2010), $112,084 (2011), and $122,734 (2012).tate each year's net income as a percentage of revenues and comment briefly on the trend you see over the three-year period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

36

The answers to these questions appear on page 85.Note: In order to review as many chapter concepts as possible, some self-test questions include more than one correct answer.n these cases, you should indicate all of the correct answers.

Which of the following statements is (are) not consistent with generally accepted accounting principles relating to asset valuation

a.ost assets are originally recorded in accounting records at their cost to the business entity.

b.ubtracting total liabilities from total assets indicates what the owners' equity in the business is worth under current market conditions.

c.ccountants assume that assets such as office supplies, land, and buildings will be used in business operations rather than sold at current market prices.

d.ccountants prefer to base the valuation of assets on objective, verifiable evidence rather than upon appraisals or personal opinions.

Which of the following statements is (are) not consistent with generally accepted accounting principles relating to asset valuation

a.ost assets are originally recorded in accounting records at their cost to the business entity.

b.ubtracting total liabilities from total assets indicates what the owners' equity in the business is worth under current market conditions.

c.ccountants assume that assets such as office supplies, land, and buildings will be used in business operations rather than sold at current market prices.

d.ccountants prefer to base the valuation of assets on objective, verifiable evidence rather than upon appraisals or personal opinions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

37

The date is November 18, 2015.ou are the chief executive officer of Omega Software-a publicly owned company that is currently in financial difficulty.mega needs new large bank loans if it is to survive.

You have been negotiating with several banks, but each has asked to see your 2015 financial statements, which will be dated December 31.hese statements will, of course, be audited.ou are now meeting with other corporate officers to discuss the situation, and the following suggestions have been made:

1.We are planning to buy WordMaster Software Co.or $8 million cash in December.he owners of WordMaster are in no hurry; if we delay this acquisition until January, we'll have $8 million more cash at year-end.hat should make us look a lot more solvent."

2.At year-end, we'll owe accounts payable of about $18 million.f we were to show this liability in our balance sheet at half that amount-say, $9 million-no one would know the difference.e could report the other $9 million as stockholders' equity and our financial position would appear much stronger."

3.We owe Delta Programming $5 million, due in 90 days. know some people at Delta.f we were to sign a note and pay them 10 percent interest, they'd let us postpone this debt for a year or more."

4.We own land that cost us $2 million but today is worth at least $6 million.et's show it at $6 million in our balance sheet, and that will increase our total assets and our stockholders' equity by $4 million."

Instructions

Separately evaluate each of these four proposals to improve Omega Software's financial statements.our evaluations should consider ethical and legal issues as well as accounting issues.

You have been negotiating with several banks, but each has asked to see your 2015 financial statements, which will be dated December 31.hese statements will, of course, be audited.ou are now meeting with other corporate officers to discuss the situation, and the following suggestions have been made:

1.We are planning to buy WordMaster Software Co.or $8 million cash in December.he owners of WordMaster are in no hurry; if we delay this acquisition until January, we'll have $8 million more cash at year-end.hat should make us look a lot more solvent."

2.At year-end, we'll owe accounts payable of about $18 million.f we were to show this liability in our balance sheet at half that amount-say, $9 million-no one would know the difference.e could report the other $9 million as stockholders' equity and our financial position would appear much stronger."

3.We owe Delta Programming $5 million, due in 90 days. know some people at Delta.f we were to sign a note and pay them 10 percent interest, they'd let us postpone this debt for a year or more."

4.We own land that cost us $2 million but today is worth at least $6 million.et's show it at $6 million in our balance sheet, and that will increase our total assets and our stockholders' equity by $4 million."

Instructions

Separately evaluate each of these four proposals to improve Omega Software's financial statements.our evaluations should consider ethical and legal issues as well as accounting issues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

38

Effects of Business Transactions

For each of the following categories, state concisely a transaction that will have the required effect on the elements of the accounting equation.

a.Increase an asset and increase a liability.

b.Decrease an asset and decrease a liability.

c.Increase one asset and decrease another asset.

d.Increase an asset and increase owners' equity.

e.Increase one asset, decrease another asset, and increase a liability.

For each of the following categories, state concisely a transaction that will have the required effect on the elements of the accounting equation.

a.Increase an asset and increase a liability.

b.Decrease an asset and decrease a liability.

c.Increase one asset and decrease another asset.

d.Increase an asset and increase owners' equity.

e.Increase one asset, decrease another asset, and increase a liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

39

What are the three categories commonly found in a statement of cash flows, and what is included in each category

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

40

Bosh Company's assets total $155,000 and its liabilities total $85,000.hat is the amount of Bosh's retained earnings if its capital stock amounts to $50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is the basic accounting equation Briefly define the three primary elements in the equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

42

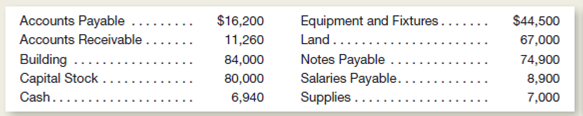

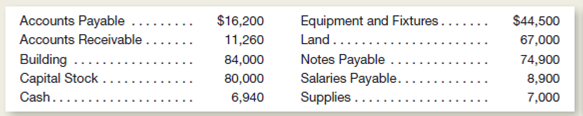

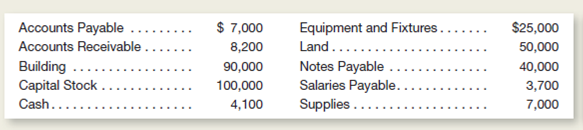

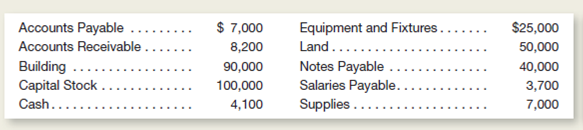

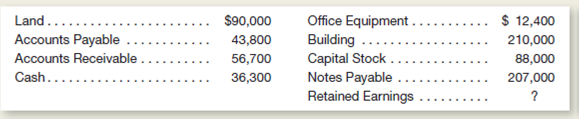

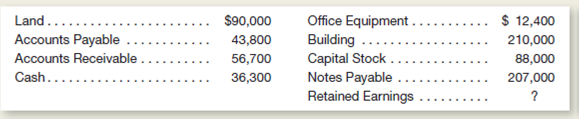

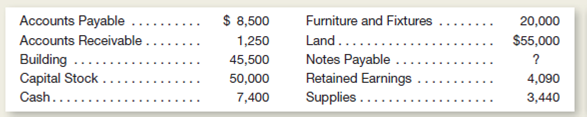

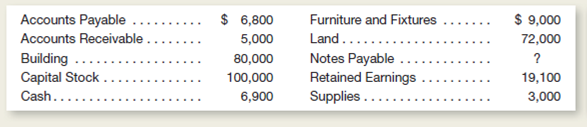

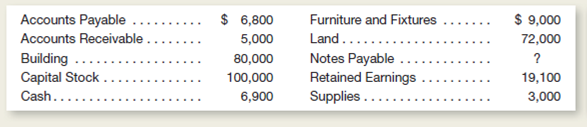

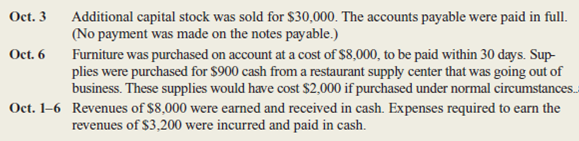

The balance sheet items for Franklin Bakery (arranged in alphabetical order) were as follows at August 1, 2015.You are to compute the missing figure for Retained Earnings.)

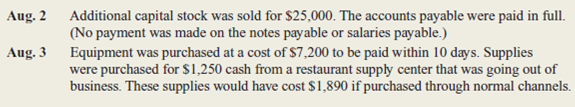

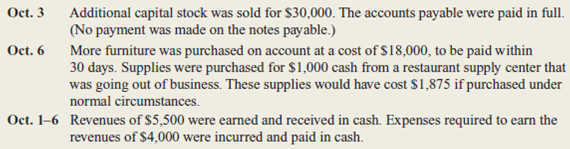

During the next two days, the following transactions occurred:

Instructions

a.repare a balance sheet at August 1, 2015.

b.repare a balance sheet at August 3, 2015, and a statement of cash flows for August 1-3.lassify the payment of accounts payable and the purchase of supplies as operating activities.

c.ssume the notes payable do not come due for several years.s Franklin Bakery in a stronger financial position on August 1 or on August 3 Explain briefly.

During the next two days, the following transactions occurred:

Instructions

a.repare a balance sheet at August 1, 2015.

b.repare a balance sheet at August 3, 2015, and a statement of cash flows for August 1-3.lassify the payment of accounts payable and the purchase of supplies as operating activities.

c.ssume the notes payable do not come due for several years.s Franklin Bakery in a stronger financial position on August 1 or on August 3 Explain briefly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

43

Professional Judgment

Professional judgment plays a major role in the practice of accounting.

a.In general terms, explain why judgment enters into the accounting process.

b.Identify at least three situations in which accountants must rely on their professional judgment, rather than on official rules.

Professional judgment plays a major role in the practice of accounting.

a.In general terms, explain why judgment enters into the accounting process.

b.Identify at least three situations in which accountants must rely on their professional judgment, rather than on official rules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

44

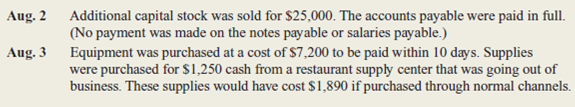

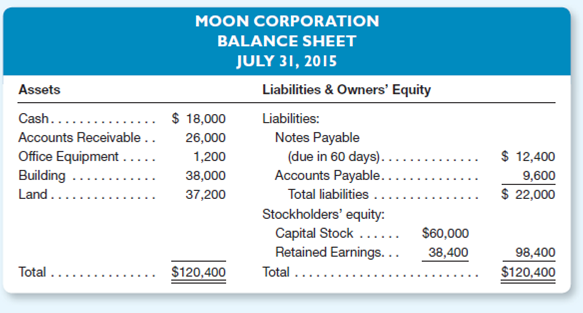

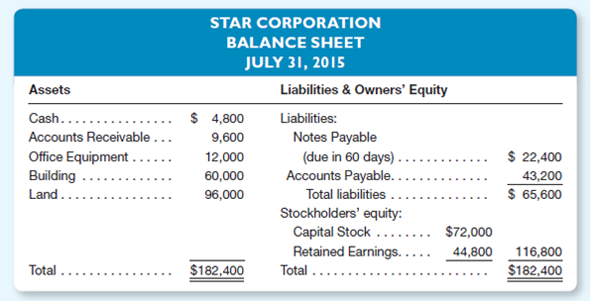

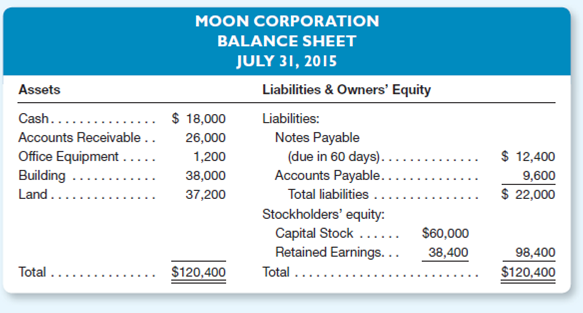

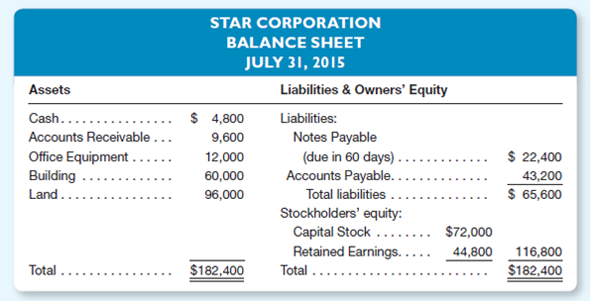

Moon Corporation and Star Corporation are in the same line of business and both were recently organized, so it may be assumed that the recorded costs for assets are close to current market values.he balance sheets for the two companies are as follows at July 31, 2015:

Instructions

a.ssume that you are a banker and that each company has applied to you for a 90-day loan of $12,000.hich would you consider to be the more favorable prospect Explain your answer fully.

b.ssume that you are an investor considering purchasing all the capital stock of one or both of the companies.or which business would you be willing to pay the higher price Do you see any indication of a financial crisis that you might face shortly after buying either company Explain your answer fully.For either decision, additional information would be useful, but you are to reach your decision on the basis of the information available.)

Instructions

a.ssume that you are a banker and that each company has applied to you for a 90-day loan of $12,000.hich would you consider to be the more favorable prospect Explain your answer fully.

b.ssume that you are an investor considering purchasing all the capital stock of one or both of the companies.or which business would you be willing to pay the higher price Do you see any indication of a financial crisis that you might face shortly after buying either company Explain your answer fully.For either decision, additional information would be useful, but you are to reach your decision on the basis of the information available.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

45

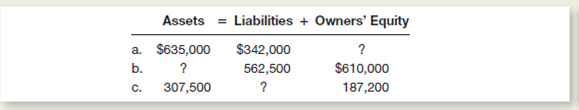

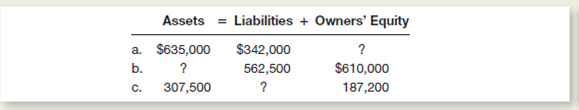

Compute the missing amounts in the following table:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

46

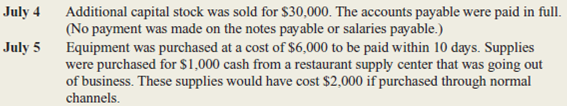

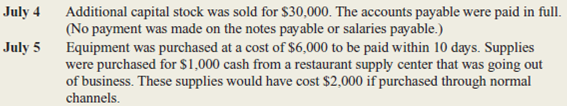

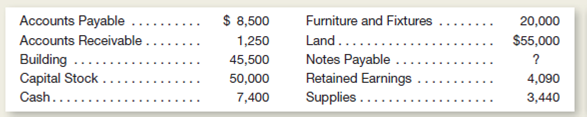

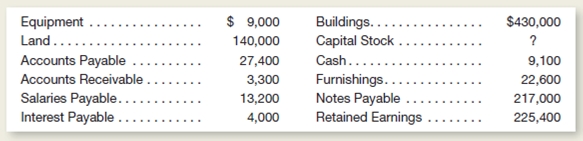

The balance sheet items for Collier Butcher Shop (arranged in alphabetical order) were as follows at July 1, 2015.You are to compute the missing figure for Retained Earnings.)

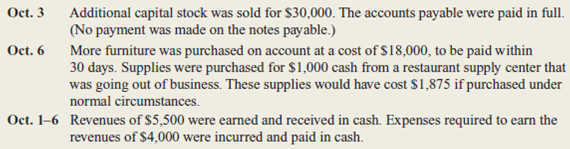

During the next few days, the following transactions occurred:

Instructions

a.repare a balance sheet at July 1, 2015.

b.repare a balance sheet at July 5, 2015, and a statement of cash flows for July 1-5.lassify the payment of accounts payable and the purchase of supplies as operating activities.

c.ssume the notes payable do not come due for several years.s Collier Butcher Shop in a stronger financial position on July 1 or on July 5 Explain briefly.

During the next few days, the following transactions occurred:

Instructions

a.repare a balance sheet at July 1, 2015.

b.repare a balance sheet at July 5, 2015, and a statement of cash flows for July 1-5.lassify the payment of accounts payable and the purchase of supplies as operating activities.

c.ssume the notes payable do not come due for several years.s Collier Butcher Shop in a stronger financial position on July 1 or on July 5 Explain briefly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

47

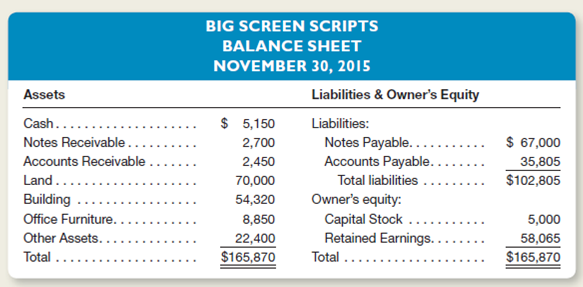

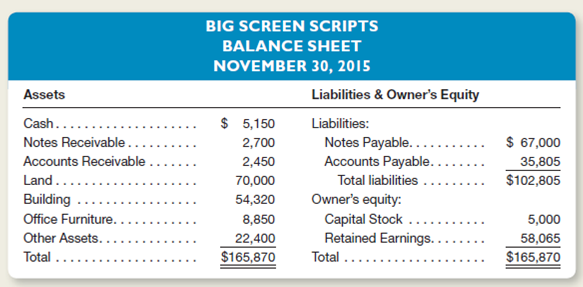

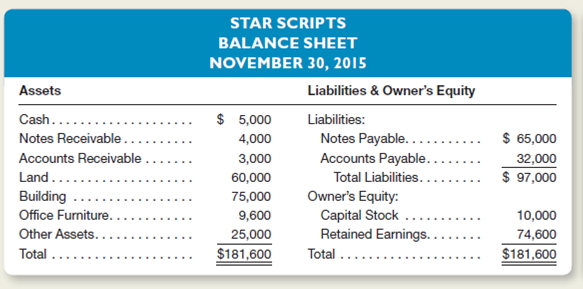

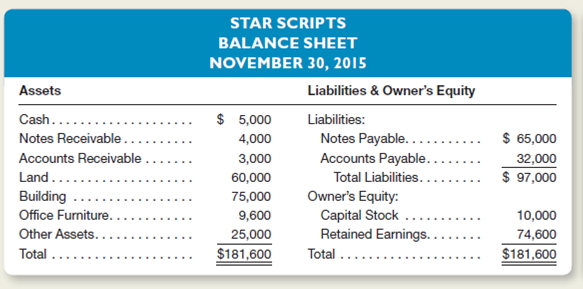

Big Screen Scripts is a service-type enterprise in the entertainment field, and its manager, William Pippin, has only a limited knowledge of accounting.ippin prepared the following balance sheet, which, although arranged satisfactorily, contains certain errors with respect to such concepts as the business entity and asset valuation.ippin owns all of the corporation's outstanding stock.

In discussion with Pippin and by inspection of the accounting records, you discover the following facts:

1.he amount of cash, $5,150, includes $3,400 in the company's bank account, $540 on hand in the company's safe, and $1,210 in Pippin's personal savings account.

2.ne of the notes receivable in the amount of $500 is an IOU that Pippin received in a poker game several years ago.he IOU is signed by "B.K.," whom Pippin met at the game but has not heard from since.

3.ffice furniture includes $2,900 for a Persian rug for the office purchased on November 20.he total cost of the rug was $9,400.he business paid $2,900 in cash and issued a note payable to Zoltan Carpet for the balance due ($6,500).s no payment on the note is due until January, this debt is not included in the liabilities above.

4.lso included in the amount for office furniture is a computer that cost $2,525 but is not on hand because Pippin donated it to a local charity.

5.he "Other Assets" of $22,400 represent the total amount of income taxes Pippin has paid the federal government over a period of years.ippin believes the income tax law to be unconstitutional, and a friend who attends law school has promised to help Pippin recover the taxes paid as soon as he passes the bar exam.

6.he asset "Land" was acquired at a cost of $39,000 but was increased to a valuation of $70,000 when one of Pippin's friends offered to pay that much for it if Pippin would move the building off the lot.

7.he accounts payable include business debts of $32,700 and the $3,105 balance owed on Pippin's personal MasterCard.

Instructions

a.repare a corrected balance sheet at November 30, 2015.

b.or each of the seven numbered items above, use a separate numbered paragraph to explain whether the treatment followed by Pippin is in accordance with generally accepted accounting principles.

In discussion with Pippin and by inspection of the accounting records, you discover the following facts:

1.he amount of cash, $5,150, includes $3,400 in the company's bank account, $540 on hand in the company's safe, and $1,210 in Pippin's personal savings account.

2.ne of the notes receivable in the amount of $500 is an IOU that Pippin received in a poker game several years ago.he IOU is signed by "B.K.," whom Pippin met at the game but has not heard from since.

3.ffice furniture includes $2,900 for a Persian rug for the office purchased on November 20.he total cost of the rug was $9,400.he business paid $2,900 in cash and issued a note payable to Zoltan Carpet for the balance due ($6,500).s no payment on the note is due until January, this debt is not included in the liabilities above.

4.lso included in the amount for office furniture is a computer that cost $2,525 but is not on hand because Pippin donated it to a local charity.

5.he "Other Assets" of $22,400 represent the total amount of income taxes Pippin has paid the federal government over a period of years.ippin believes the income tax law to be unconstitutional, and a friend who attends law school has promised to help Pippin recover the taxes paid as soon as he passes the bar exam.

6.he asset "Land" was acquired at a cost of $39,000 but was increased to a valuation of $70,000 when one of Pippin's friends offered to pay that much for it if Pippin would move the building off the lot.

7.he accounts payable include business debts of $32,700 and the $3,105 balance owed on Pippin's personal MasterCard.

Instructions

a.repare a corrected balance sheet at November 30, 2015.

b.or each of the seven numbered items above, use a separate numbered paragraph to explain whether the treatment followed by Pippin is in accordance with generally accepted accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

48

Walters Company purchased a piece of machinery on credit for $20,000.riefly state the way this transaction affects the company's basic accounting equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

49

In general terms, what are revenues and expenses How are they related in the determination of an enterprise's net income or net loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

50

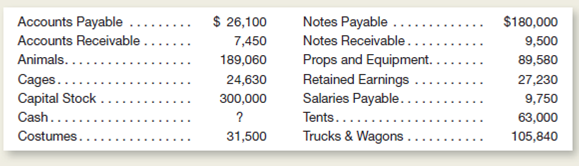

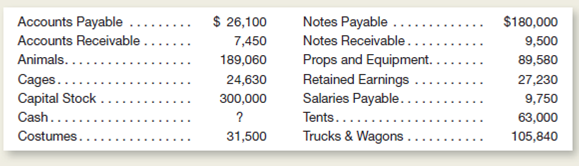

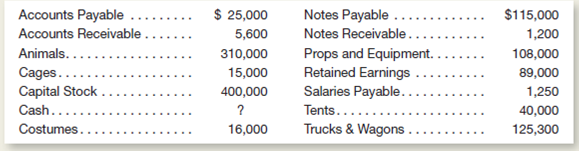

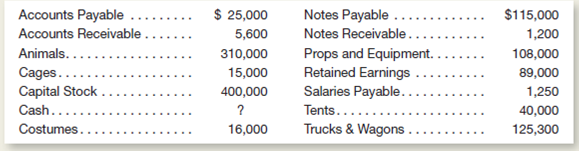

HERE COME THE CLOWNS! is the name of a traveling circus.he ledger accounts of the business at June 30, 2015, are listed here in alphabetical order:

Instructions

a.repare a balance sheet by using these items and computing the amount of Cash at June 30, 2015.rganize your balance sheet similar to the one illustrated in Exhibit 2-10.nclude a proper balance sheet heading.

b.ssume that late in the evening of June 30, after your balance sheet had been prepared, a fire destroyed one of the tents, which had cost $14,300.he tent was not insured.xplain what changes would be required in your June 30 balance sheet to reflect the loss of this asset.

Instructions

a.repare a balance sheet by using these items and computing the amount of Cash at June 30, 2015.rganize your balance sheet similar to the one illustrated in Exhibit 2-10.nclude a proper balance sheet heading.

b.ssume that late in the evening of June 30, after your balance sheet had been prepared, a fire destroyed one of the tents, which had cost $14,300.he tent was not insured.xplain what changes would be required in your June 30 balance sheet to reflect the loss of this asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

51

The answers to these questions appear on page 85.Note: In order to review as many chapter concepts as possible, some self-test questions include more than one correct answer.n these cases, you should indicate all of the correct answers.

What information would you find in a statement of cash flows that you would not be able to get from the other two primary financial statements

a.ash provided by or used in financing activities.

b.ash balance at the end of the period.

c.otal liabilities due to creditors at the end of the period.

d.et income.

What information would you find in a statement of cash flows that you would not be able to get from the other two primary financial statements