Deck 13: Binomial Trees

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/20

العب

ملء الشاشة (f)

Deck 13: Binomial Trees

1

When moving from valuing an option on a non-dividend paying stock to an option on a currency which of the following is true?

A)The risk-free rate is replaced by the excess of the domestic risk-free rate over the foreign risk-free rate in all calculations

B)The formula for u changes

C)The risk-free rate is replaced by the excess of the domestic risk-free rate over the foreign risk-free rate for discounting

D)The risk-free rate is replaced by the excess of the domestic risk-free rate over the foreign risk-free rate when p is calculated

A)The risk-free rate is replaced by the excess of the domestic risk-free rate over the foreign risk-free rate in all calculations

B)The formula for u changes

C)The risk-free rate is replaced by the excess of the domestic risk-free rate over the foreign risk-free rate for discounting

D)The risk-free rate is replaced by the excess of the domestic risk-free rate over the foreign risk-free rate when p is calculated

D

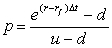

The formula for u does not change.The discount rate does not change.The formula for p becomes showing that D is correct.

showing that D is correct.

The formula for u does not change.The discount rate does not change.The formula for p becomes

showing that D is correct.

showing that D is correct. 2

The current price of a non-dividend-paying stock is $30.Over the next six months it is expected to rise to $36 or fall to $26.Assume the risk-free rate is zero.What is the risk-neutral probability of that the stock price will be $36?

A)0.6

B)0.5

C)0.4

D)0.3

A)0.6

B)0.5

C)0.4

D)0.3

C

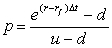

The formula for the risk-neutral probability of an up movement is

In this case u=36/30 or 1.2 and d=26/30 =0.8667.Also r=0 and T=0.5.The formula gives

p=(1-0.8667/(1.2-0.8667)=0.4.

The formula for the risk-neutral probability of an up movement is

In this case u=36/30 or 1.2 and d=26/30 =0.8667.Also r=0 and T=0.5.The formula gives

p=(1-0.8667/(1.2-0.8667)=0.4.

3

The current price of a non-dividend-paying stock is $40.Over the next year it is expected to rise to $42 or fall to $37.An investor buys put options with a strike price of $41.What is the value of each option? The risk-free interest rate is 2% per annum with continuous compounding.

A)$3.93

B)$2.93

C)$1.93

D)$0.93

A)$3.93

B)$2.93

C)$1.93

D)$0.93

D

The formula for the risk-neutral probability of an up movement is In this case r=0.02,T= 1,u=42/40=1.05 and d=37/40=0.925 so that p=0.76 and the value of the option is (0.76×0+0.24×4)e??.?²×¹=0.93

In this case r=0.02,T= 1,u=42/40=1.05 and d=37/40=0.925 so that p=0.76 and the value of the option is (0.76×0+0.24×4)e??.?²×¹=0.93

The formula for the risk-neutral probability of an up movement is

In this case r=0.02,T= 1,u=42/40=1.05 and d=37/40=0.925 so that p=0.76 and the value of the option is (0.76×0+0.24×4)e??.?²×¹=0.93

In this case r=0.02,T= 1,u=42/40=1.05 and d=37/40=0.925 so that p=0.76 and the value of the option is (0.76×0+0.24×4)e??.?²×¹=0.93 4

The current price of a non-dividend paying stock is $50.Use a two-step tree to value an American put option on the stock with a strike price of $48 that expires in 12 months.Each step is 6 months,the risk free rate is 5% per annum,and the volatility is 20%.Which of the following is the option price?

A)$1.95

B)$2.00

C)$2.05

D)$2.10

A)$1.95

B)$2.00

C)$2.05

D)$2.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

5

The current price of a non-dividend paying stock is $30.Use a two-step tree to value a European call option on the stock with a strike price of $32 that expires in 6 months.Each step is 3 months,the risk free rate is 8% per annum with continuous compounding.What is the option price when u = 1.1 and d = 0.9.

A)$1.29

B)$1.49

C)$1.69

D)$1.89

A)$1.29

B)$1.49

C)$1.69

D)$1.89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

6

The current price of a non-dividend-paying stock is $30.Over the next six months it is expected to rise to $36 or fall to $26.Assume the risk-free rate is zero.An investor sells call options with a strike price of $32.What is the value of each call option?

A)$1.6

B)$2.0

C)$2.4

D)$3.0

A)$1.6

B)$2.0

C)$2.4

D)$3.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

7

The current price of a non-dividend paying stock is $30.Use a two-step tree to value a European put option on the stock with a strike price of $32 that expires in 6 months with u = 1.1 and d = 0.9.Each step is 3 months,the risk free rate is 8%.

A)$2.24

B)$2.44

C)$2.64

D)$2.84

A)$2.24

B)$2.44

C)$2.64

D)$2.84

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

8

The current price of a non-dividend-paying stock is $30.Over the next six months it is expected to rise to $36 or fall to $26.Assume the risk-free rate is zero.An investor sells call options with a strike price of $32.Which of the following hedges the position?

A)Buy 0.6 shares for each call option sold

B)Buy 0.4 shares for each call option sold

C)Short 0.6 shares for each call option sold

D)Short 0.6 shares for each call option sold

A)Buy 0.6 shares for each call option sold

B)Buy 0.4 shares for each call option sold

C)Short 0.6 shares for each call option sold

D)Short 0.6 shares for each call option sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following describes delta?

A)The ratio of the option price to the stock price

B)The ratio of the stock price to the option price

C)The ratio of a change in the option price to the corresponding change in the stock price

D)The ratio of a change in the stock price to the corresponding change in the option price

A)The ratio of the option price to the stock price

B)The ratio of the stock price to the option price

C)The ratio of a change in the option price to the corresponding change in the stock price

D)The ratio of a change in the stock price to the corresponding change in the option price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

10

In a binomial tree created to value an option on a stock,the expected return on stock is

A)Zero

B)The return required by the market

C)The risk-free rate

D)It is impossible to know without more information

A)Zero

B)The return required by the market

C)The risk-free rate

D)It is impossible to know without more information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is true for a call option on a stock worth $50

A)As a stock's expected return increases the price of the option increases

B)As a stock's expected return increases the price of the option decreases

C)As a stock's expected return increases the price of the option might increase or decrease

D)As a stock's expected return increases the price of the option on the stock stays the same

A)As a stock's expected return increases the price of the option increases

B)As a stock's expected return increases the price of the option decreases

C)As a stock's expected return increases the price of the option might increase or decrease

D)As a stock's expected return increases the price of the option on the stock stays the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

12

If the volatility of a non-dividend-paying stock is 20% per annum and a risk-free rate is 5% per annum,which of the following is closest to the Cox,Ross,Rubinstein parameter p for a tree with a three-month time step?

A)0.50

B)0.54

C)0.58

D)0.62

A)0.50

B)0.54

C)0.58

D)0.62

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

13

A stock is expected to return 10% when the risk-free rate is 4%.What is the correct discount rate to use for the expected payoff on an option in the real world?

A)4%

B)10%

C)More than 10%

D)It could be more or less than 10%

A)4%

B)10%

C)More than 10%

D)It could be more or less than 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

14

A tree is constructed to value an option on an index which is currently worth 100 and has a volatility of 25%.The index provides a dividend yield of 2%.Another tree is constructed to value an option on a non-dividend-paying stock which is currently worth 100 and has a volatility of 25%.Which of the following are true?

A)The parameters p and u are the same for both trees

B)The parameter p is the same for both trees but u is not

C)The parameter u is the same for both trees but p is not

D)None of the above

A)The parameters p and u are the same for both trees

B)The parameter p is the same for both trees but u is not

C)The parameter u is the same for both trees but p is not

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following are NOT true

A)Risk-neutral valuation and no-arbitrage arguments give the same option prices

B)Risk-neutral valuation involves assuming that the expected return is the risk-free rate and then discounting expected payoffs at the risk-free rate

C)A hedge set up to value an option does not need to be changed

D)All of the above

A)Risk-neutral valuation and no-arbitrage arguments give the same option prices

B)Risk-neutral valuation involves assuming that the expected return is the risk-free rate and then discounting expected payoffs at the risk-free rate

C)A hedge set up to value an option does not need to be changed

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

16

The current price of a non-dividend-paying stock is $40.Over the next year it is expected to rise to $42 or fall to $37.An investor buys put options with a strike price of $41.Which of the following is necessary to hedge the position?

A)Buy 0.2 shares for each option purchased

B)Sell 0.2 shares for each option purchased

C)Buy 0.8 shares for each option purchased

D)Sell 0.8 shares for each option purchased

A)Buy 0.2 shares for each option purchased

B)Sell 0.2 shares for each option purchased

C)Buy 0.8 shares for each option purchased

D)Sell 0.8 shares for each option purchased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the volatility of a non-dividend paying stock is 20% per annum and a risk-free rate is 5% per annum,which of the following is closest to the Cox,Ross,Rubinstein parameter u for a tree with a three-month time step?

A)1.05

B)1.07

C)1.09

D)1.11

A)1.05

B)1.07

C)1.09

D)1.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

18

In a binomial tree created to value an option on a stock,what is the expected return on the option?

A)Zero

B)The return required by the market

C)The risk-free rate

D)It is impossible to know without more information

A)Zero

B)The return required by the market

C)The risk-free rate

D)It is impossible to know without more information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is NOT true in a risk-neutral world?

A)The expected return on a call option is independent of its strike price

B)Investors expect higher returns to compensate for higher risk

C)The expected return on a stock is the risk-free rate

D)The discount rate used for the expected payoff on an option is the risk-free rate

A)The expected return on a call option is independent of its strike price

B)Investors expect higher returns to compensate for higher risk

C)The expected return on a stock is the risk-free rate

D)The discount rate used for the expected payoff on an option is the risk-free rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following describes how American options can be valued using a binomial tree?

A)Check whether early exercise is optimal at all nodes where the option is in-the-money

B)Check whether early exercise is optimal at the final nodes

C)Check whether early exercise is optimal at the penultimate nodes and the final nodes

D)None of the above

A)Check whether early exercise is optimal at all nodes where the option is in-the-money

B)Check whether early exercise is optimal at the final nodes

C)Check whether early exercise is optimal at the penultimate nodes and the final nodes

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck