Deck 19: The Greek Letters

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/20

العب

ملء الشاشة (f)

Deck 19: The Greek Letters

1

Vega tends to be high for which of the following

A)At-the money options

B)Out-of-the money options

C)In-the-money options

D)Options with a short time to maturity

A)At-the money options

B)Out-of-the money options

C)In-the-money options

D)Options with a short time to maturity

A

2

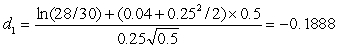

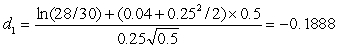

A call option on a non-dividend-paying stock has a strike price of $30 and a time to maturity of six months.The risk-free rate is 4% and the volatility is 25%.The stock price is $28.What is the delta of the option?

A)N(-0.1342)

B)N(-0.1888)

C)N(-0.2034)

D)N(-0.2241)

A)N(-0.1342)

B)N(-0.1888)

C)N(-0.2034)

D)N(-0.2241)

B

The delta is N(d?)where

In this case

The delta is N(d?)where

In this case

3

Which of the following is true for a long position in an option

A)Both gamma and vega are negative

B)Gamma is negative and vega is positive

C)Gamma is positive and vega is negative

D)Both gamma and vega are positive

A)Both gamma and vega are negative

B)Gamma is negative and vega is positive

C)Gamma is positive and vega is negative

D)Both gamma and vega are positive

D

Gamma and vega are both positive for a long position in an option.It does not matter whether the option is a call or a put.

Gamma and vega are both positive for a long position in an option.It does not matter whether the option is a call or a put.

4

Which of the following is true for a call option on a non-dividend-paying stock when the stock's price equals the strike price?

A)It has a delta of 0.5

B)It has a delta less than 0.5

C)It has a delta greater than 0.5

D)Delta can be greater than or less than 0.5

A)It has a delta of 0.5

B)It has a delta less than 0.5

C)It has a delta greater than 0.5

D)Delta can be greater than or less than 0.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is NOT a letter in the Greek alphabet?

A)delta

B)rho

C)vega

D)gamma

A)delta

B)rho

C)vega

D)gamma

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

6

A trader uses a stop-loss strategy to hedge a short position in a three-month call option with a strike price of 0.7000 on an exchange rate.The current exchange rate is 0.6950 and value of the option is 0.1.The trader covers the option when the exchange rate reaches 0.7005 and uncovers (i.e.,assumes a naked position)if the exchange rate falls to 0.6995.Which of the following is NOT true?

A)The exchange rate trading might cost nothing so that the trader gains 0.1 for each option sold

B)The exchange rate trading might cost considerably more than 0.1 for each option sold so that the trader loses money

C)The present value of the gain or loss from the exchange rate trading should be about 0.1 on average for each option sold

D)The hedge works reasonably well

A)The exchange rate trading might cost nothing so that the trader gains 0.1 for each option sold

B)The exchange rate trading might cost considerably more than 0.1 for each option sold so that the trader loses money

C)The present value of the gain or loss from the exchange rate trading should be about 0.1 on average for each option sold

D)The hedge works reasonably well

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

7

The risk-free rate is 5% and the dividend yield on an index is 2%.Which of the following is the delta with respect to the index for a one-year futures on the index?

A)0.98

B)1.05

C)1.03

D)1.02

A)0.98

B)1.05

C)1.03

D)1.02

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

8

What does gamma measure?

A)The rate of change of delta with the asset price

B)The rate of change of the portfolio value with the passage of time

C)The sensitivity of a portfolio value to interest rate changes

D)None of the above

A)The rate of change of delta with the asset price

B)The rate of change of the portfolio value with the passage of time

C)The sensitivity of a portfolio value to interest rate changes

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

9

A portfolio of derivatives on a stock has a delta of 2400 and a gamma of -10.An option on the stock with a delta of 0.5 and a gamma of 0.04 can be traded.What position in the option is necessary to make the portfolio gamma neutral?

A)Long position in 250 options

B)Short position in 250 options

C)Long position in 20 options

D)Short position in 20 options

A)Long position in 250 options

B)Short position in 250 options

C)Long position in 20 options

D)Short position in 20 options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

10

Gamma tends to be high for which of the following

A)At-the money options

B)Out-of-the money options

C)In-the-money options

D)Options with a long time to maturity

A)At-the money options

B)Out-of-the money options

C)In-the-money options

D)Options with a long time to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

11

What does vega measure?

A)The rate of change of delta with the asset price

B)The rate of change of the portfolio value with the passage of time

C)The sensitivity of a portfolio value to interest rate changes

D)None of the above

A)The rate of change of delta with the asset price

B)The rate of change of the portfolio value with the passage of time

C)The sensitivity of a portfolio value to interest rate changes

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following could NOT be a delta-neutral portfolio?

A)A long position in call options plus a short position in the underlying stock

B)A short position in call options plus a short position in the underlying stock

C)A long position in put options and a long position in the underlying stock

D)A long position in a put option and a long position in a call option

A)A long position in call options plus a short position in the underlying stock

B)A short position in call options plus a short position in the underlying stock

C)A long position in put options and a long position in the underlying stock

D)A long position in a put option and a long position in a call option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is true?

A)The delta of a European put equals minus the delta of a European call

B)The delta of a European put equals the delta of a European call

C)The gamma of a European put equals minus the gamma of a European call

D)The gamma of a European put equals the gamma of a European call

A)The delta of a European put equals minus the delta of a European call

B)The delta of a European put equals the delta of a European call

C)The gamma of a European put equals minus the gamma of a European call

D)The gamma of a European put equals the gamma of a European call

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

14

A call option on a stock has a delta of 0.3.A trader has sold 1,000 options.What position should the trader take to hedge the position?

A)Sell 300 shares

B)Buy 300 shares

C)Sell 700 shares

D)Buy 700 shares

A)Sell 300 shares

B)Buy 300 shares

C)Sell 700 shares

D)Buy 700 shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

15

The gamma of a delta-neutral portfolio is 500.What is the impact of a jump of $3 in the price of the underlying asset?

A)A gain of $2,250

B)A loss of $2,250

C)A gain of $750

D)A loss of $750

A)A gain of $2,250

B)A loss of $2,250

C)A gain of $750

D)A loss of $750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

16

The delta of a call option on a non-dividend-paying stock is 0.4.What is the delta of the corresponding put option?

A)-0.4

B)0.4

C)-0.6

D)0.6

A)-0.4

B)0.4

C)-0.6

D)0.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

17

What does rho measure?

A)The rate of change of delta with the asset price

B)The rate of change of the portfolio value with the passage of time

C)The sensitivity of a portfolio value to interest rate changes

D)None of the above

A)The rate of change of delta with the asset price

B)The rate of change of the portfolio value with the passage of time

C)The sensitivity of a portfolio value to interest rate changes

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is NOT true about gamma?

A)A highly positive or highly negative value of gamma indicates that a portfolio needs frequent rebalancing to stay delta neutral

B)The magnitude of gamma is a measure of the curvature of the portfolio value as a function of the underlying asset price

C)A big positive value for gamma indicates that a big movement in the asset price in either direction will lead to a loss

D)A long position in either a call or a put has a positive gamma

A)A highly positive or highly negative value of gamma indicates that a portfolio needs frequent rebalancing to stay delta neutral

B)The magnitude of gamma is a measure of the curvature of the portfolio value as a function of the underlying asset price

C)A big positive value for gamma indicates that a big movement in the asset price in either direction will lead to a loss

D)A long position in either a call or a put has a positive gamma

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

19

Maintaining a delta-neutral portfolio is an example of which of the following

A)Stop-loss strategy

B)Dynamic hedging

C)Hedge and forget strategy

D)Static hedging

A)Stop-loss strategy

B)Dynamic hedging

C)Hedge and forget strategy

D)Static hedging

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

20

What does theta measure?

A)The rate of change of delta with the asset price

B)The rate of change of the portfolio value with the passage of time

C)The sensitivity of a portfolio value to interest rate changes

D)None of the above

A)The rate of change of delta with the asset price

B)The rate of change of the portfolio value with the passage of time

C)The sensitivity of a portfolio value to interest rate changes

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck