Deck 25: International Finance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/60

العب

ملء الشاشة (f)

Deck 25: International Finance

1

If the U.S. dollar depreciates relative to the Japanese yen, what will happen to the price

of an automobile produced by the Ford Motor Company in Detroit, Michigan as far as

the American consumer is concerned?

of an automobile produced by the Ford Motor Company in Detroit, Michigan as far as

the American consumer is concerned?

Nothing. The prices of domestic products do not change for the domestic consumer regardless of whether the home currency appreciates or depreciates.

2

The spot exchange rate today is $1.4714 per  The 12-month forward exchange rate is $1.4256 per €. If the

The 12-month forward exchange rate is $1.4256 per €. If the  1-year Treasury rate is 4%, what does this imply the 1-year European Central

1-year Treasury rate is 4%, what does this imply the 1-year European Central

Bank interest rate must be? Round your answer to the nearest tenth of a percent.

A)7.6%

B)7.3%

C)0.8%

D)1.0%

The 12-month forward exchange rate is $1.4256 per €. If the

The 12-month forward exchange rate is $1.4256 per €. If the  1-year Treasury rate is 4%, what does this imply the 1-year European Central

1-year Treasury rate is 4%, what does this imply the 1-year European CentralBank interest rate must be? Round your answer to the nearest tenth of a percent.

A)7.6%

B)7.3%

C)0.8%

D)1.0%

7.3%

3

The current exchange rate between the Swiss franc and the U.S. dollar is $0.9107/S.F. If a pair of jeans costs $50.00 in the U.S. and purchasing power parity holds, what would you expect

This same pair of jeans to sell for in Switzerland?

A)S.F. 54.90

B)S.F. 49.09

C)S.F. 45.54

D)This cannot be answered without knowing the inflation rates for each country.

This same pair of jeans to sell for in Switzerland?

A)S.F. 54.90

B)S.F. 49.09

C)S.F. 45.54

D)This cannot be answered without knowing the inflation rates for each country.

S.F. 54.90

4

Which of the following statements about the differences between interest rate parity (IRP)and purchasing power parity (PPP)is true?

A)Purchasing power parity tends to hold well in the long term while interest rate parity tends to hold well only over short time periods.

B)Interest rate parity assumes that the average international inflation rate is zero; purchasing power parity makes no such assumption.

C)Interest rate parity is the relationship between interest rates and the prices of goods across countries whereas purchasing power parity is the relation between currencies and the

Prices of goods.

D)Interest rate parity tends to hold well in the real world while purchasing power parity holds only over a very long term.

A)Purchasing power parity tends to hold well in the long term while interest rate parity tends to hold well only over short time periods.

B)Interest rate parity assumes that the average international inflation rate is zero; purchasing power parity makes no such assumption.

C)Interest rate parity is the relationship between interest rates and the prices of goods across countries whereas purchasing power parity is the relation between currencies and the

Prices of goods.

D)Interest rate parity tends to hold well in the real world while purchasing power parity holds only over a very long term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

5

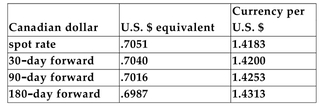

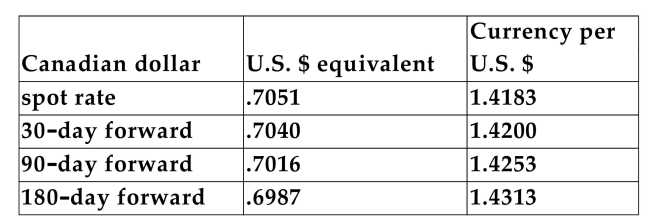

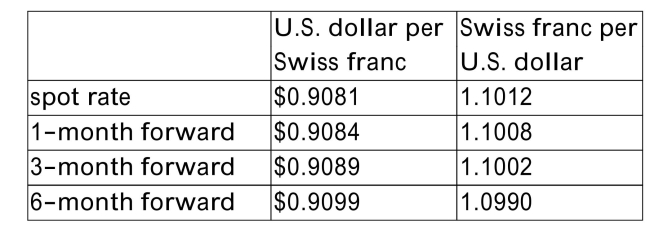

The following exchange rates existed between the U.S. dollar and the Canadian dollar at a given point in time:

Refer to the information above. Based on this information, it appears the markets were expecting

A)the U.S. dollar to appreciate relative to the Canadian dollar.

B)the U.S. dollar to depreciate relative to the Canadian dollar.

C)the Canadian dollar to depreciate relative to the U.S. dollar.

D)Both A and C are correct responses.

Refer to the information above. Based on this information, it appears the markets were expecting

A)the U.S. dollar to appreciate relative to the Canadian dollar.

B)the U.S. dollar to depreciate relative to the Canadian dollar.

C)the Canadian dollar to depreciate relative to the U.S. dollar.

D)Both A and C are correct responses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the current exchange rate is 0.6205 Swiss francs per euro, the Swiss franc will have depreciated relative to the euro if the exchange rate next week is

A)0.5592 Swiss francs per euro.

B)1.6116 euros per Swiss franc.

C)0.6514 Swiss francs per euro.

D)either A or B.

A)0.5592 Swiss francs per euro.

B)1.6116 euros per Swiss franc.

C)0.6514 Swiss francs per euro.

D)either A or B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

7

The 1-year Treasury rate is 2.7%, and the inflation rate in the U.S. is 2%. If purchasing power parity holds and the 1-year Japanese central bank rate is 0.8%, what is the implied inflation

Rate in Japan? Round your answer to the nearest tenth of a percent.

A)0.1%

B)5.6%

C)1.5%

D)1.1%

Rate in Japan? Round your answer to the nearest tenth of a percent.

A)0.1%

B)5.6%

C)1.5%

D)1.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

8

You are the manager of a U.S. firm that is undertaking a project in Hong Kong that will cost 10,000 Hong Kong dollars (HKD). The current exchange rate is 7.8068 HKD/U.S. $. If the

Project generates cash flows of 12,000 HKD at the end of a year and the exchange rate at that

Point in time is 7.9192 HKD/U.S. $, what is its HKD rate of return? Round your answer to the

Nearest tenth of a percent.

A)1.4%

B)14.0%

C)21.7%

D)none of the above

Project generates cash flows of 12,000 HKD at the end of a year and the exchange rate at that

Point in time is 7.9192 HKD/U.S. $, what is its HKD rate of return? Round your answer to the

Nearest tenth of a percent.

A)1.4%

B)14.0%

C)21.7%

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

9

The spot exchange rate today is $1.4544 per  If the 1-year Treasury rate is 3.5% and the 1-year European Central Bank rate is 5%, what would you expect the 12-month forward

If the 1-year Treasury rate is 3.5% and the 1-year European Central Bank rate is 5%, what would you expect the 12-month forward

Exchange rate to be?

A)1.4755

B)1.4336

C)1.5806

D)1.5001

If the 1-year Treasury rate is 3.5% and the 1-year European Central Bank rate is 5%, what would you expect the 12-month forward

If the 1-year Treasury rate is 3.5% and the 1-year European Central Bank rate is 5%, what would you expect the 12-month forwardExchange rate to be?

A)1.4755

B)1.4336

C)1.5806

D)1.5001

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

10

One difference between a futures contract and a forward contract is that

A)the price at which the currency will be delivered is specified in the forward contract, but a range of prices is stipulated in the futures contract.

B)forward contracts are marked to market daily.

C)futures contracts trade on exchanges while forward contracts trade in the over-the-counter market.

D)the futures contract has more counterparty risk than the forward contract.

A)the price at which the currency will be delivered is specified in the forward contract, but a range of prices is stipulated in the futures contract.

B)forward contracts are marked to market daily.

C)futures contracts trade on exchanges while forward contracts trade in the over-the-counter market.

D)the futures contract has more counterparty risk than the forward contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

11

The 1-year Treasury rate is 2.25% and the British central bank rate is 3.22%. If the spot exchange rate is  what does covered interest rate parity imply that the 1-year

what does covered interest rate parity imply that the 1-year

Forward currency exchange rate should be?

A)

B)

C)

D)

what does covered interest rate parity imply that the 1-year

what does covered interest rate parity imply that the 1-yearForward currency exchange rate should be?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

12

The current spot rate is ¥109.5450 per U.S. dollar , and the 1-year forward rate is  1 per dollar. If the 1-year Treasury rate is 2.25%, what do you expect the 1-year Japanese central

1 per dollar. If the 1-year Treasury rate is 2.25%, what do you expect the 1-year Japanese central

Bank rate to be? Round your answer to the nearest tenth of a percent.

A)9.8%

B)1.8%

C)0.4%

D)1.0%

1 per dollar. If the 1-year Treasury rate is 2.25%, what do you expect the 1-year Japanese central

1 per dollar. If the 1-year Treasury rate is 2.25%, what do you expect the 1-year Japanese centralBank rate to be? Round your answer to the nearest tenth of a percent.

A)9.8%

B)1.8%

C)0.4%

D)1.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

13

The 1-year Brazilian central bank rate is 12.25% and the 1-year Treasury rate is 2.25%.

If the current exchange rate is 1.63 Brazilian real per U.S. dollar, what does interest rate

parity imply the 1-year forward rate must be?

If the current exchange rate is 1.63 Brazilian real per U.S. dollar, what does interest rate

parity imply the 1-year forward rate must be?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

14

If the current exchange rate is $1.4658 per euro, the dollar will have appreciated relative to the euro if the exchange rate next week is

A)$1.4241 per euro.

B)0.6570 euros per $.

C)0.7022 euros per $.

D)either A or C.

A)$1.4241 per euro.

B)0.6570 euros per $.

C)0.7022 euros per $.

D)either A or C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

15

U.S. corporations account for how much of the world's corporate bond issues?

A)25%

B)75%

C)50%

D)90%

A)25%

B)75%

C)50%

D)90%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements about purchasing power parity (PPP)is true?

A)If PPP always holds, then the differences in interest rates across countries can be explained by differences in inflation rates.

B)PPP states that the current forward rate must be an unbiased predictor of the expected future spot rate.

C)PPP implies that expected inflation rates should be the same across countries.

D)PPP implies that nominal interest rates should be the same across countries.

A)If PPP always holds, then the differences in interest rates across countries can be explained by differences in inflation rates.

B)PPP states that the current forward rate must be an unbiased predictor of the expected future spot rate.

C)PPP implies that expected inflation rates should be the same across countries.

D)PPP implies that nominal interest rates should be the same across countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

17

The inflation rate in Switzerland is 0.6% while the inflation rate in Brazil is 8.3%. If purchasing power parity holds, what should happen to the exchange rate of the Swiss franc relative to the

Brazilian real?

A)The Swiss franc should appreciate by 7.6% relative to the Brazilian real.

B)The Swiss franc should depreciate by 7.7% relative to the Brazilian real.

C)The Swiss franc should appreciate by 7.2% relative to the Brazilian real.

D)The Swiss franc should depreciate by 7.1% relative to the Brazilian real.

Brazilian real?

A)The Swiss franc should appreciate by 7.6% relative to the Brazilian real.

B)The Swiss franc should depreciate by 7.7% relative to the Brazilian real.

C)The Swiss franc should appreciate by 7.2% relative to the Brazilian real.

D)The Swiss franc should depreciate by 7.1% relative to the Brazilian real.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

18

The theory that states that the current forward rate is an unbiased predictor of the expected future spot rate is called

A)the international Fisher effect.

B)purchasing power parity.

C)covered interest rate parity.

D)uncovered interest rate parity.

A)the international Fisher effect.

B)purchasing power parity.

C)covered interest rate parity.

D)uncovered interest rate parity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

19

The theory that states that expected real rates of return should be equal across countries is called

A)the Fisher effect.

B)uncovered interest rate parity.

C)covered interest rate parity.

D)purchasing power parity.

A)the Fisher effect.

B)uncovered interest rate parity.

C)covered interest rate parity.

D)purchasing power parity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

20

If purchasing power parity holds, then which of the following statements must be true?

A)The currencies of countries with lower average inflation rates should appreciate relative to the currencies of other countries.

B)A country that has a lower exchange rate relative to other currencies must also have a lower rate of inflation.

C)The currencies of countries with higher average inflation rates should appreciate relative to the currencies of other countries.

D)A country that has a higher exchange rate relative to other currencies must also have a higher rate of inflation.

A)The currencies of countries with lower average inflation rates should appreciate relative to the currencies of other countries.

B)A country that has a lower exchange rate relative to other currencies must also have a lower rate of inflation.

C)The currencies of countries with higher average inflation rates should appreciate relative to the currencies of other countries.

D)A country that has a higher exchange rate relative to other currencies must also have a higher rate of inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

21

Assume the 1-year Treasury rate is 3% and that the Brazilian central bank rate is 12%. The 12-month forward exchange rate is 1.75 Brazilian real per dollar, and the spot exchange rate is

1.63 real per dollar. If an American firm's Brazilian subsidiary has a project that will return 10

Million Brazilian real for certain at the end of a year, what is this project's present value?

Round your answer to the nearest ten thousand dollars.

A)$16.99 million

B)$15.63 million

C)$5.55 million

D)$5.10 million

1.63 real per dollar. If an American firm's Brazilian subsidiary has a project that will return 10

Million Brazilian real for certain at the end of a year, what is this project's present value?

Round your answer to the nearest ten thousand dollars.

A)$16.99 million

B)$15.63 million

C)$5.55 million

D)$5.10 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

22

Assume a U.S. company has a project in Switzerland that is expected to return 1 million Swiss francs in one year. If the Swiss franc appreciates relative to the dollar, then

A)the return in Swiss francs will be lower than if the exchange rate had remained constant.

B)the return in U.S. dollars will be lower than if the exchange rate had remained constant.

C)the return in Swiss francs will be greater than if the exchange rate had remained constant.

D)the return in U.S. dollars will be greater than if the exchange rate had remained constant.

A)the return in Swiss francs will be lower than if the exchange rate had remained constant.

B)the return in U.S. dollars will be lower than if the exchange rate had remained constant.

C)the return in Swiss francs will be greater than if the exchange rate had remained constant.

D)the return in U.S. dollars will be greater than if the exchange rate had remained constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

23

An American investor invested in the Swiss company, Nestle, when it was selling for 48.62 Swiss francs. The exchange rate was $0.9088 per Swiss franc. At the end of a year, Nestle paid

A dividend of 1.22 Swiss francs and was selling for 50.13 Swiss francs. The exchange rate at

That time was $1.0349 per Swiss franc. What was the American investor's rate of return on this

Investment? Round your answer to the nearest tenth of a percent.

A)17.4%

B)13.9%

C)20.3%

D)none of the above

A dividend of 1.22 Swiss francs and was selling for 50.13 Swiss francs. The exchange rate at

That time was $1.0349 per Swiss franc. What was the American investor's rate of return on this

Investment? Round your answer to the nearest tenth of a percent.

A)17.4%

B)13.9%

C)20.3%

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

24

Assume the 1-year Treasury rate is 2.25%, and the 1-year British central bank rate is

5.0%. The 6-month

forward exchange rate is $1.8005 per and the spot exchange rate is $1.8295 per

and the spot exchange rate is $1.8295 per  If

If

an American firm's British subsidiary has a project that will retu million for

million for

certain at the end of 6 months, what is this project's present value in dollars?

5.0%. The 6-month

forward exchange rate is $1.8005 per

and the spot exchange rate is $1.8295 per

and the spot exchange rate is $1.8295 per  If

Ifan American firm's British subsidiary has a project that will retu

million for

million forcertain at the end of 6 months, what is this project's present value in dollars?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is not a component of the U.S. beta of a foreign project?

A)the beta of the foreign market's index with respect to the U.S. market index

B)the foreign project's beta relative to a global market index

C)the foreign project's beta relative to the foreign country's market index

D)the beta of the foreign currency's exchange rate with respect to the U.S. market index

A)the beta of the foreign market's index with respect to the U.S. market index

B)the foreign project's beta relative to a global market index

C)the foreign project's beta relative to the foreign country's market index

D)the beta of the foreign currency's exchange rate with respect to the U.S. market index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

26

Assume the 1-year Treasury rate is 2.25%, and the Japanese central bank rate is 0.40%. The 12-month forward exchange rate is $0.0093 per  , and the spot exchange rate is $0.0091 per

, and the spot exchange rate is $0.0091 per

Yen. If an American firm's Japanese subsidiary has a project that will re ion for

ion for

Certain at the end of a year, what is this project's present value? Round your answer to the

Nearest ten thousand dollars.

A)$4.63 million

B)$4.50 million

C)$4.45 million

D)$4.55 million

, and the spot exchange rate is $0.0091 per

, and the spot exchange rate is $0.0091 perYen. If an American firm's Japanese subsidiary has a project that will re

ion for

ion forCertain at the end of a year, what is this project's present value? Round your answer to the

Nearest ten thousand dollars.

A)$4.63 million

B)$4.50 million

C)$4.45 million

D)$4.55 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

27

A large part of the historical returns that a U.S. investor could have earned by investing in foreign stocks during the 1970 - 2005 period was due to

A)the higher betas of the foreign stocks.

B)the diversification that the foreign stocks provided to the U.S. investor's portfolio.

C)the lower tax rates on foreign dividends.

D)the depreciation of the U.S. dollar relative to other currencies.

A)the higher betas of the foreign stocks.

B)the diversification that the foreign stocks provided to the U.S. investor's portfolio.

C)the lower tax rates on foreign dividends.

D)the depreciation of the U.S. dollar relative to other currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

28

Assume that your Singapore subsidiary has a beta with respect to the Singapore market of 1.2 and that the Singapore central bank rate is 1.0%. The expected return on the Singapore market

Index is 13%. The corresponding Treasury rate is 2.25%, and the expected return on the S&P

500 Index is 10%. If the Singapore stock market is almost perfectly positively correlated with

The U.S. stock market and if exchange rate movements are uncorrelated with stock market

Movements, what is the expected return of your subsidiary in the U.S.? Round your answer to

The nearest tenth of a percent.

A)14.4%

B)11.6%

C)15.4%

D)13.2%

Index is 13%. The corresponding Treasury rate is 2.25%, and the expected return on the S&P

500 Index is 10%. If the Singapore stock market is almost perfectly positively correlated with

The U.S. stock market and if exchange rate movements are uncorrelated with stock market

Movements, what is the expected return of your subsidiary in the U.S.? Round your answer to

The nearest tenth of a percent.

A)14.4%

B)11.6%

C)15.4%

D)13.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

29

If a Japanese investor and a German investor both use euros to invest in the stock of a French firm and the value of the euro appreciates relative to the value of the yen, then

A)both investors will have earned the same total return on the investment after adjusting for the differential inflation rates.

B)the Japanese investor will have earned a higher total return on the investment.

C)both investors will have earned the same total return on the investment.

D)the German investor will have earned a higher total return on the investment.

A)both investors will have earned the same total return on the investment after adjusting for the differential inflation rates.

B)the Japanese investor will have earned a higher total return on the investment.

C)both investors will have earned the same total return on the investment.

D)the German investor will have earned a higher total return on the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements is true?

A)Empirical evidence suggests that currency movements and stock market returns are uncorrelated.

B)If a foreign stock market has a high beta with respect to the 0 Index, then the beta of a foreign project with respect to the U.S. market will be the same as its beta with respect to

0 Index, then the beta of a foreign project with respect to the U.S. market will be the same as its beta with respect to

The foreign stock market.

C)Empirical evidence suggests that currency movements and stock market returns are almost perfectly positively correlated.

D)If a foreign stock market is uncorrelated with the U.S. stock market, then the beta of a foreign project with respect to the U.S. market will be the same as its beta with respect to

The foreign stock market.

A)Empirical evidence suggests that currency movements and stock market returns are uncorrelated.

B)If a foreign stock market has a high beta with respect to the

0 Index, then the beta of a foreign project with respect to the U.S. market will be the same as its beta with respect to

0 Index, then the beta of a foreign project with respect to the U.S. market will be the same as its beta with respect toThe foreign stock market.

C)Empirical evidence suggests that currency movements and stock market returns are almost perfectly positively correlated.

D)If a foreign stock market is uncorrelated with the U.S. stock market, then the beta of a foreign project with respect to the U.S. market will be the same as its beta with respect to

The foreign stock market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following statements regarding a U.S. investor's investment in foreign stocks today is true?

A)Investing in foreign equities is still very difficult for the U.S. investor, which wipes out the benefits of diversification that may be had.

B)Although investment in foreign equities is relatively easy for U.S. investors and some diversification benefits remain, many U.S. investors choose not to invest in foreign

Markets.

C)Because international mutual funds and ETFs have made foreign investment as easy as investing domestically, there is no longer any diversification benefit to be had from

Investing in foreign equities.

D)Because dividends earned on foreign stock investments are taxed at a higher rate than dividends on domestic stocks, the after-tax returns on the foreign investments do not

Compensate investors for the risk involved.

A)Investing in foreign equities is still very difficult for the U.S. investor, which wipes out the benefits of diversification that may be had.

B)Although investment in foreign equities is relatively easy for U.S. investors and some diversification benefits remain, many U.S. investors choose not to invest in foreign

Markets.

C)Because international mutual funds and ETFs have made foreign investment as easy as investing domestically, there is no longer any diversification benefit to be had from

Investing in foreign equities.

D)Because dividends earned on foreign stock investments are taxed at a higher rate than dividends on domestic stocks, the after-tax returns on the foreign investments do not

Compensate investors for the risk involved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

32

What effect will the appreciation of the U.S. dollar relative to the euro have on the

returns earned by a U.S. firm with an investment in Germany, all else equal?

returns earned by a U.S. firm with an investment in Germany, all else equal?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements is true regarding the risk and return a U.S. investor would have experienced if she had invested in foreign stocks during the period from 1986 to 2005?

A)Although foreign stocks would have increased her portfolio returns, the risk would have increased significantly as well.

B)Foreign stocks did not perform as well as U.S. stocks during this period when the relative risk is considered.

C)The beta of her overall portfolio would have increased had she invested in foreign stocks in addition to investing in U.S. stocks.

D)An investment in a majority of the countries would have outperformed what she should have expected to earn on a risk-adjusted basis, using the CAPM as the benchmark.

A)Although foreign stocks would have increased her portfolio returns, the risk would have increased significantly as well.

B)Foreign stocks did not perform as well as U.S. stocks during this period when the relative risk is considered.

C)The beta of her overall portfolio would have increased had she invested in foreign stocks in addition to investing in U.S. stocks.

D)An investment in a majority of the countries would have outperformed what she should have expected to earn on a risk-adjusted basis, using the CAPM as the benchmark.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements about determining the appropriate cost of capital for a foreign subsidiary of a U.S. corporation (owned by U.S. investors)is true?

A)It is both simpler and more appropriate to use the cost of capital of the U.S.-based operations to evaluate projects to be undertaken by a foreign subsidiary.

B)A U.S. corporation should consider how its foreign operations covary with the U.S. stock market when calculating the cost of capital for a foreign subsidiary.

C)A U.S. corporation should consider how its foreign subsidary's cash flows covary with the exchange rate for the currency of the country in which that subsidiary is located when

Calculating the cost of capital for a foreign subsidiary.

D)In calculating a foreign subsidiary's cost of capital, a U.S. corporation needs to determine how its projects covary with the global market.

A)It is both simpler and more appropriate to use the cost of capital of the U.S.-based operations to evaluate projects to be undertaken by a foreign subsidiary.

B)A U.S. corporation should consider how its foreign operations covary with the U.S. stock market when calculating the cost of capital for a foreign subsidiary.

C)A U.S. corporation should consider how its foreign subsidary's cash flows covary with the exchange rate for the currency of the country in which that subsidiary is located when

Calculating the cost of capital for a foreign subsidiary.

D)In calculating a foreign subsidiary's cost of capital, a U.S. corporation needs to determine how its projects covary with the global market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

35

An American investor invested in British Airways when it was selling for £  The exchange rate at that time was $1.8385 pe

The exchange rate at that time was $1.8385 pe  At the end of the year, British Airways paid

At the end of the year, British Airways paid  in dividends and was sel

in dividends and was sel  hange rate at that point was $2.0906 per

hange rate at that point was $2.0906 per  What was this investor's total return? Round your answer to the nearest tenth of a percent.

What was this investor's total return? Round your answer to the nearest tenth of a percent.

A)-12.0%

B)+4.3%

C)-9.4%

D)+3.0%

The exchange rate at that time was $1.8385 pe

The exchange rate at that time was $1.8385 pe  At the end of the year, British Airways paid

At the end of the year, British Airways paid  in dividends and was sel

in dividends and was sel  hange rate at that point was $2.0906 per

hange rate at that point was $2.0906 per  What was this investor's total return? Round your answer to the nearest tenth of a percent.

What was this investor's total return? Round your answer to the nearest tenth of a percent.A)-12.0%

B)+4.3%

C)-9.4%

D)+3.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

36

According to the empirical data, the world stock market enjoyed average price increases of how much during the period from 1970 to 2005?

A)16%

B)5%

C)11%

D)8%

A)16%

B)5%

C)11%

D)8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

37

A U.S. firm has invested in a project in Switzerland that has a beta of 0.9 relative to the

Swiss stock market. Assume that the beta of the Swiss market relative to the U.S.

market is 0.65 and that the market beta of the $/Swiss franc exchange rate movements

is 0.0. What would you expect the beta of the Swiss project relative to the U.S. market

to be?

Swiss stock market. Assume that the beta of the Swiss market relative to the U.S.

market is 0.65 and that the market beta of the $/Swiss franc exchange rate movements

is 0.0. What would you expect the beta of the Swiss project relative to the U.S. market

to be?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

38

A U.S. firm invested $800,000 in a project in India when the exchange rate was 43.8789

rupees per dollar. At the end of a year, the project produced a cash flow of 50 million

rupees, and the exchange rate was 40.5669 rupees per dollar. What was the rate of

return on the currency? What was the rate of return on the project? What was the total

rate of return earned by the U.S. firm?

rupees per dollar. At the end of a year, the project produced a cash flow of 50 million

rupees, and the exchange rate was 40.5669 rupees per dollar. What was the rate of

return on the currency? What was the rate of return on the project? What was the total

rate of return earned by the U.S. firm?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

39

If a British investor and an American investor both use British pound sterling to invest in the stock of a British firm, and the value of the dollar depreciates relative to the value of the pound

Sterling, then

A)both investors will have earned the same total return on the investment.

B)both investors will have earned the same total return on the investment after adjusting for the differential inflation rates.

C)the American investor will have earned a higher total return on the investment.

D)the British investor will have earned a higher total return on the investment.

Sterling, then

A)both investors will have earned the same total return on the investment.

B)both investors will have earned the same total return on the investment after adjusting for the differential inflation rates.

C)the American investor will have earned a higher total return on the investment.

D)the British investor will have earned a higher total return on the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

40

A U.S. firm invested $1 million in a project in Brazil when the exchange rate was 1.63 Brazilian real per U.S. dollar. At the end of the year, the project returned 1.8 million Brazilian real, and

The exchange rate was 1.55 real per dollar. What was the U.S. firm's total return on this

Investment? Round your answer to the nearest tenth of a percent.

A)10.4%

B)16.1%

C)17.9%

D)none of the above

The exchange rate was 1.55 real per dollar. What was the U.S. firm's total return on this

Investment? Round your answer to the nearest tenth of a percent.

A)10.4%

B)16.1%

C)17.9%

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

41

The agency that was established to encourage smooth functioning of money flows and to aid in stabilizing currencies is the

A)International Monetary Fund.

B)World Trade Organization.

C)World Bank.

D)Organization for Economic Cooperation and Development.

A)International Monetary Fund.

B)World Trade Organization.

C)World Bank.

D)Organization for Economic Cooperation and Development.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

42

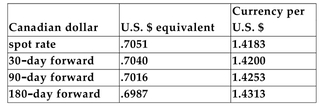

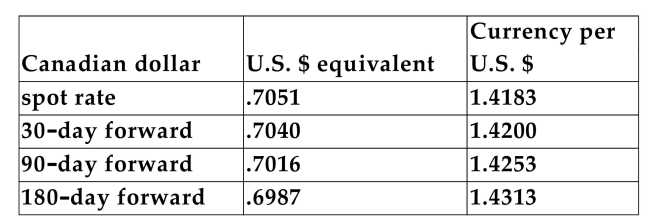

The following exchange rates existed between the U.S. dollar and the Canadian dollar at a given point in time:

If an American firm expects to receive payment in Canadian dollars 90 days from now and is concerned that the spot exchange rate in 90 days will be less than U.S. $0.7016, it should

A)agree to buy Canadian dollars forward at the exc

B)agree to deliver Canadian dollars 90 days from now in exchange for by selling the Canadian dollars forward.

by selling the Canadian dollars forward.

C)agree to buy 1.4253 U.S. dollars 90 days from now in exchange for 0.7016 Canadian dollars.

D)agree to deliver 1.4253 U.S. dollars 90 days from now in exchange for 0.7016 Canadian dollars.

If an American firm expects to receive payment in Canadian dollars 90 days from now and is concerned that the spot exchange rate in 90 days will be less than U.S. $0.7016, it should

A)agree to buy Canadian dollars forward at the exc

B)agree to deliver Canadian dollars 90 days from now in exchange for

by selling the Canadian dollars forward.

by selling the Canadian dollars forward.C)agree to buy 1.4253 U.S. dollars 90 days from now in exchange for 0.7016 Canadian dollars.

D)agree to deliver 1.4253 U.S. dollars 90 days from now in exchange for 0.7016 Canadian dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

43

Assume you are a manager of a corporation in Canada that has only investors from the U.S. You are considering investing in a Brazilian operation. To determine the beta of your project,

You should

A)determine how the Brazilian project covaries with the Canadian stock market.

B)determine how the Brazilian project covaries with the U.S. stock market.

C)determine how the Brazilian project covaries with the Brazilian stock market.

D)determine how the Canadian stock market varies with the U.S. stock market.

You should

A)determine how the Brazilian project covaries with the Canadian stock market.

B)determine how the Brazilian project covaries with the U.S. stock market.

C)determine how the Brazilian project covaries with the Brazilian stock market.

D)determine how the Canadian stock market varies with the U.S. stock market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

44

If a British firm issues a bond that is denominated in Japanese yen and is sold in Japan, it is called a

A)Samurai bond.

B)Eurobond.

C)Yankee bond.

D)Bulldog bond.

A)Samurai bond.

B)Eurobond.

C)Yankee bond.

D)Bulldog bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

45

If you are the manager of a U.S. corporation that is considering listing only on the Hong Kong exchange and Hong Kong investors are allowed to invest only in the Hong Kong stock market,

But all their consumption is in Japan, then how should you calculate your cost of capital?

A)Use U.S. interest rates and the S&P 500 index.

B)Use Hong Kong interest rates and a Hong Kong market index.

C)Use Hong Kong interest rates and a Japanese market index.

D)Use Japanese interest rates and a Japanese market index.

But all their consumption is in Japan, then how should you calculate your cost of capital?

A)Use U.S. interest rates and the S&P 500 index.

B)Use Hong Kong interest rates and a Hong Kong market index.

C)Use Hong Kong interest rates and a Japanese market index.

D)Use Japanese interest rates and a Japanese market index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

46

A Eurobond is

A)a general term for any bond that is denominated in euros.

B)a bond issued by the European central bank and denominated in euros.

C)a bond that is issued by a foreign firm and denominated in a currency foreign to the country in which the bond is sold.

D)a bond that is issued by a non-EU nation but is denominated in euros and is sold in the EU.

A)a general term for any bond that is denominated in euros.

B)a bond issued by the European central bank and denominated in euros.

C)a bond that is issued by a foreign firm and denominated in a currency foreign to the country in which the bond is sold.

D)a bond that is issued by a non-EU nation but is denominated in euros and is sold in the EU.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

47

If a Canadian firm is expecting to receive a payment in British pounds in 30 days, how

can the firm use foreign financing to hedge against the depreciation of the pound?

Explain how the process would work.

can the firm use foreign financing to hedge against the depreciation of the pound?

Explain how the process would work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

48

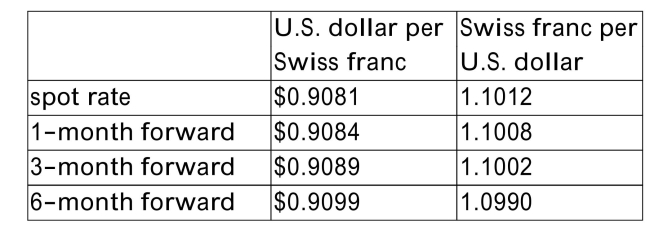

Your U.S. firm will need to make a payment of 200,000 Swiss francs in 6 months and

would like to hedge its exchange rate risk. The following data has been collected on

the Swiss franc/U.S. $ exchange rates: Explain what your firm should do to hedge the risk completely. Be specific. What will

Explain what your firm should do to hedge the risk completely. Be specific. What will

be the dollar cash outflow to your firm in 6 months if it executes this hedge? What

would it be if the actual future spot rate were 1.0890 Swiss francs/$ in 6 months, and

your firm had not executed this hedge?

would like to hedge its exchange rate risk. The following data has been collected on

the Swiss franc/U.S. $ exchange rates:

Explain what your firm should do to hedge the risk completely. Be specific. What will

Explain what your firm should do to hedge the risk completely. Be specific. What willbe the dollar cash outflow to your firm in 6 months if it executes this hedge? What

would it be if the actual future spot rate were 1.0890 Swiss francs/$ in 6 months, and

your firm had not executed this hedge?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

49

A German firm is expecting to receive a payment denominated in Australian dollars sixty days from now. If the firm is concerned about the value of the Australian dollar and wants to hedge

Against the possibility that the Australian dollar will depreciate relative to the euro prior to its

Receiving the payment, how should it execute the hedge?

A)It should sell Australian dollars forward.

B)It should sell euros forward.

C)It should buy Australian dollars forward.

D)It could execute the hedge by doing either A or C.

Against the possibility that the Australian dollar will depreciate relative to the euro prior to its

Receiving the payment, how should it execute the hedge?

A)It should sell Australian dollars forward.

B)It should sell euros forward.

C)It should buy Australian dollars forward.

D)It could execute the hedge by doing either A or C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

50

Currency hedging can increase firm value

A)by increasing profits through superior trades undertaken by the corporation's traders.

B)by making managerial performance easier to evaluate.

C)by reducing the volatility of the cash flows.

D)by A and C only.

A)by increasing profits through superior trades undertaken by the corporation's traders.

B)by making managerial performance easier to evaluate.

C)by reducing the volatility of the cash flows.

D)by A and C only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

51

If you are the manager of a Danish corporation that is considering listing only on the Singapore exchange and Singapore investors invest only in the Singapore stock market, but all their

Consumption is in Britain, you should focus on maximizing your returns in

A)Singapore dollars.

B)British pounds.

C)U.S. dollars

D)Danish krone.

Consumption is in Britain, you should focus on maximizing your returns in

A)Singapore dollars.

B)British pounds.

C)U.S. dollars

D)Danish krone.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

52

Empirical evidence suggests that

A)The returns of Real Estate Investment Trusts covary more with the returns on the underlying real estate they hold than with th x.

x.

B)closed-end mutual funds that trade on the NYSE and invest in the stocks of foreign corporations provide exceptional diversification opportunities for the American investor.

C)investing in U.S. firms with foreign subsidiaries offers exceptional diversification opportunities for the American investor.

D)none of the above.

A)The returns of Real Estate Investment Trusts covary more with the returns on the underlying real estate they hold than with th

x.

x.B)closed-end mutual funds that trade on the NYSE and invest in the stocks of foreign corporations provide exceptional diversification opportunities for the American investor.

C)investing in U.S. firms with foreign subsidiaries offers exceptional diversification opportunities for the American investor.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

53

The United Nations non-profit agency that both extends loans and coordinates third-party private loans is the

A)Organization for Economic Cooperation and Development.

B)World Trade Organization.

C)World Bank.

D)International Monetary Fund.

A)Organization for Economic Cooperation and Development.

B)World Trade Organization.

C)World Bank.

D)International Monetary Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

54

A bond that is denominated in U.S. dollars and sold in the U.S., but that is issued by a Japanese firm is called a

A)Eurobond.

B)Yankee bond.

C)Samurai bond.

D)matador bond.

A)Eurobond.

B)Yankee bond.

C)Samurai bond.

D)matador bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following statements regarding hedging with currency forwards is true?

A)Currency forwards can be used to eliminate the volatility of earnings from foreign operations.

B)Currency forward contracts serve to reduce the cash flow volatility associated with a project.

C)If possible, it is to a firm's benefit to hedge their exchange rate risk exposure completely.

D)Both A and B are true statements.

A)Currency forwards can be used to eliminate the volatility of earnings from foreign operations.

B)Currency forward contracts serve to reduce the cash flow volatility associated with a project.

C)If possible, it is to a firm's benefit to hedge their exchange rate risk exposure completely.

D)Both A and B are true statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is not a method that a firm can use to hedge its foreign currency risk?

A)buying or selling currency forward contracts

B)borrowing money in the currency of the country in which the project will be generating revenues

C)investing in risk-free bonds denominated in the currency of the country in which the firm's manufacturing facilities are located

D)moving production facilities to the country in which the final products will be sold

A)buying or selling currency forward contracts

B)borrowing money in the currency of the country in which the project will be generating revenues

C)investing in risk-free bonds denominated in the currency of the country in which the firm's manufacturing facilities are located

D)moving production facilities to the country in which the final products will be sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following would be negatively affected by the depreciation of the dollar relative to the Japanese yen?

A)a Swiss firm that exports finished goods to Japan

B)a Japanese auto manufacturer with facilities in the U.S.

C)a U.S. manufacturing firm that relies on Japan for some of its components

D)a Japanese student attending a university in the U.S.

A)a Swiss firm that exports finished goods to Japan

B)a Japanese auto manufacturer with facilities in the U.S.

C)a U.S. manufacturing firm that relies on Japan for some of its components

D)a Japanese student attending a university in the U.S.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

58

Briefly describe the purpose of the following four international institutions: The

International Monetary Fund, the World Bank, the World Trade Organization, and the

Organization for Economic Co-operation and Development.

International Monetary Fund, the World Bank, the World Trade Organization, and the

Organization for Economic Co-operation and Development.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

59

An American company imports steins from Germany. The steins will be delivered in 6 months, at which time payment will be due. The CFO wants to hedge against currency

Fluctuations. To do so, she should

A)enter a forward contract to buy euros in 6 months.

B)enter a forward contract to deliver U.S. dollars in 6 months.

C)enter a forward contract to buy U.S. dollars in 6 months.

D)enter a forward contract to deliver euros in 6 months.

Fluctuations. To do so, she should

A)enter a forward contract to buy euros in 6 months.

B)enter a forward contract to deliver U.S. dollars in 6 months.

C)enter a forward contract to buy U.S. dollars in 6 months.

D)enter a forward contract to deliver euros in 6 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

60

Does the empirical evidence support the assumption that investing in U.S. firms that

have operations in foreign countries and/or in U.S. closed-end funds that invest in

foreign stocks are effective methods by which a U.S. investor can diversify his

portfolio?

have operations in foreign countries and/or in U.S. closed-end funds that invest in

foreign stocks are effective methods by which a U.S. investor can diversify his

portfolio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck