Deck 20: Pro Forma Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/73

العب

ملء الشاشة (f)

Deck 20: Pro Forma Financial Statements

1

Which of the following income statement accounts is most likely to vary directly with sales?

A)interest expense

B)cost of goods sold

C)taxes

D)depreciation

A)interest expense

B)cost of goods sold

C)taxes

D)depreciation

cost of goods sold

2

The detailed projection period

A)should be long enough so that the discount factor is high enough to make any error in the length of the horizon period negligible.

B)should end before the point at which you expect the present value of your growth opportunities to no longer relevant.

C)should be no longer than 5 years since it is next to impossible to make accurate cash flow forecasts beyond that point.

D)Both B and C are true statements.

A)should be long enough so that the discount factor is high enough to make any error in the length of the horizon period negligible.

B)should end before the point at which you expect the present value of your growth opportunities to no longer relevant.

C)should be no longer than 5 years since it is next to impossible to make accurate cash flow forecasts beyond that point.

D)Both B and C are true statements.

should be long enough so that the discount factor is high enough to make any error in the length of the horizon period negligible.

3

The most important item to forecast in a detailed financial pro forma is

A)interest expense.

B)long-term debt.

C)plant, property, and equipment.

D)sales.

A)interest expense.

B)long-term debt.

C)plant, property, and equipment.

D)sales.

sales.

4

An advantage to using earnings growth rather than cash flow growth to estimate the present value of the future cash flow stream is that

A)cash flows to be lumpier than net income.

B)historical cash flows could have more easily been manipulated by management.

C)there are fewer factors that determine earnings, so there are fewer opportunities for estimation errors.

D)net income is less risky than cash flows.

A)cash flows to be lumpier than net income.

B)historical cash flows could have more easily been manipulated by management.

C)there are fewer factors that determine earnings, so there are fewer opportunities for estimation errors.

D)net income is less risky than cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements is (are)true?

A)It is always better to use cash-flow-based forecasts.

B)For publicly traded corporations, earnings-based forecasts of terminal values are superior to cash-flow-based forecasts, on average.

C)It is always better to use earnings-based forecasts.

D)Both B and C are true statements.

A)It is always better to use cash-flow-based forecasts.

B)For publicly traded corporations, earnings-based forecasts of terminal values are superior to cash-flow-based forecasts, on average.

C)It is always better to use earnings-based forecasts.

D)Both B and C are true statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

6

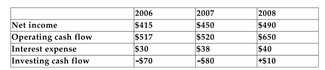

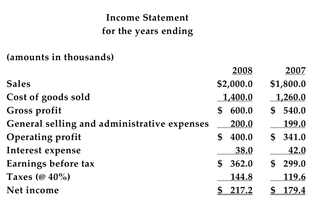

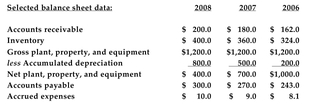

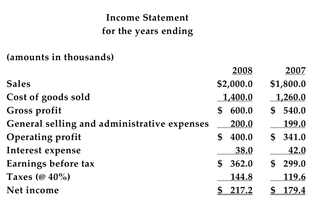

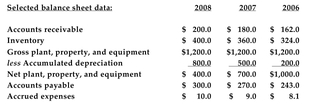

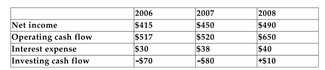

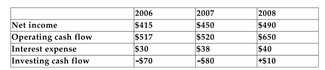

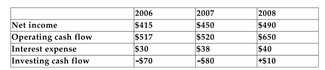

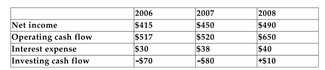

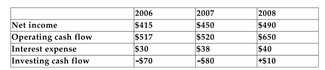

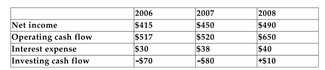

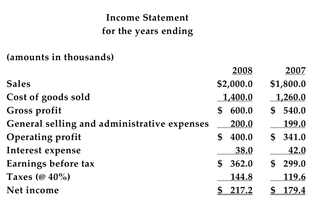

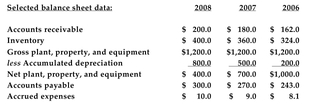

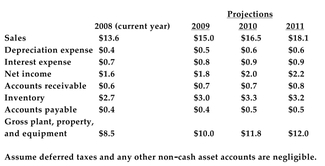

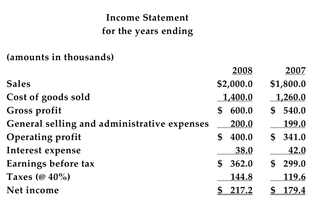

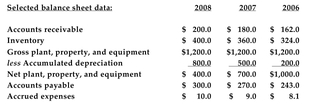

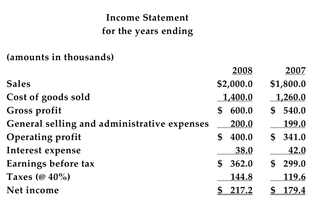

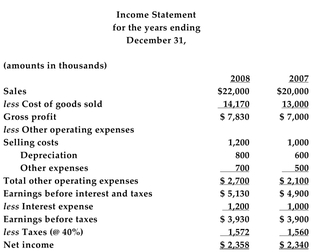

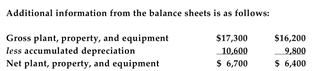

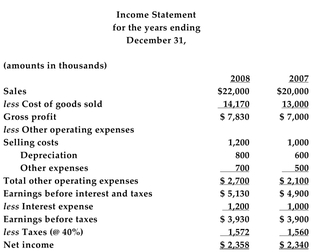

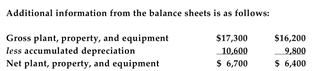

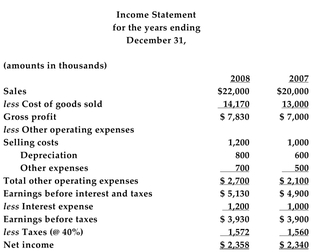

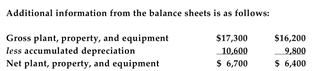

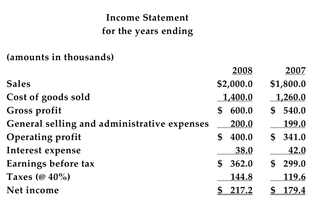

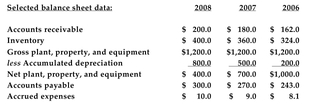

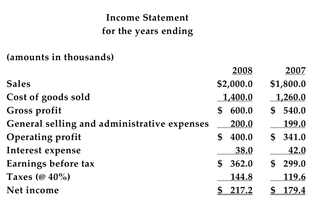

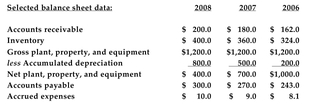

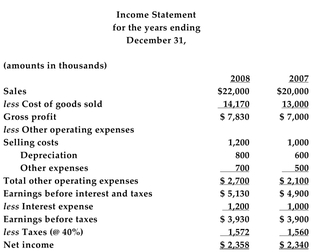

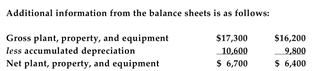

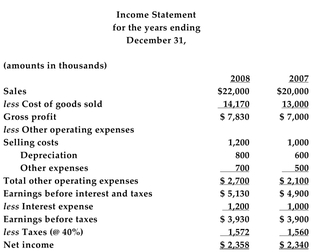

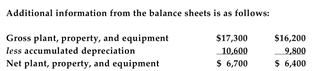

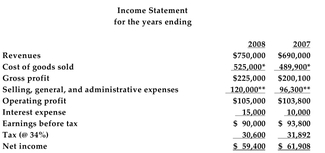

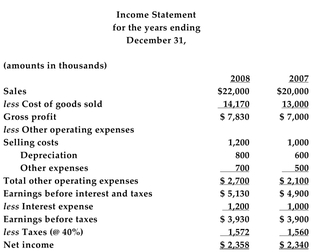

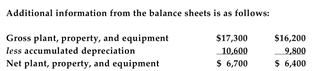

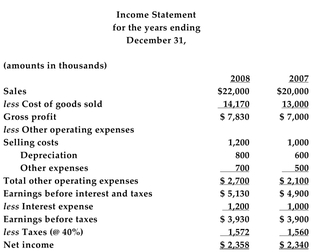

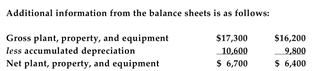

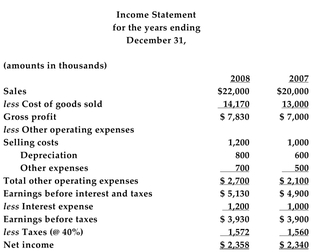

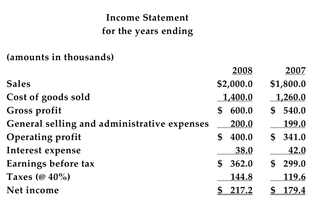

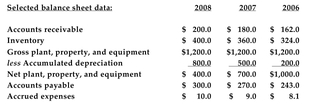

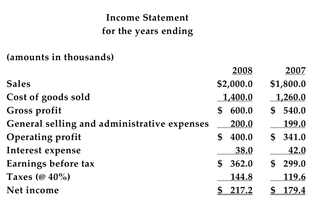

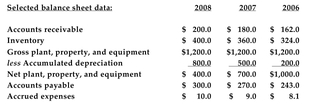

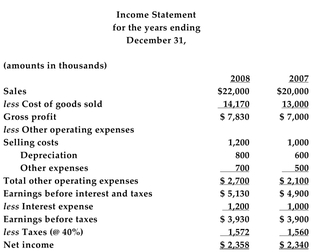

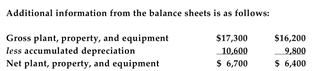

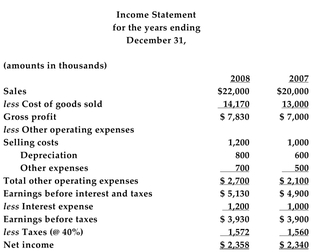

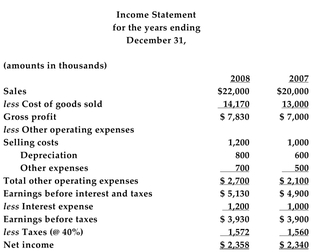

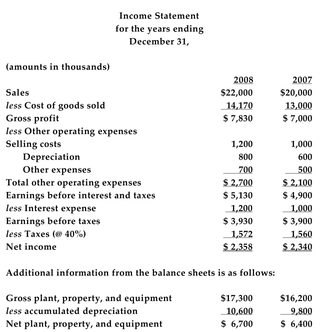

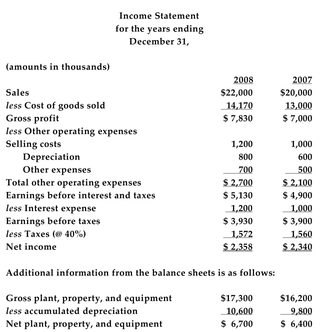

The following information has been collected from the most recent three years of financial statements for the Dougherty Corporation: (All numbers are in thousands.)

Refer to the information above. What was the average annual growth rate of Dougherty's earnings from 2006 to 2008? Round your answer to the nearest tenth of a percent.

A)8.7%

B)18.1%

C)8.9%

D)none of the above

Refer to the information above. What was the average annual growth rate of Dougherty's earnings from 2006 to 2008? Round your answer to the nearest tenth of a percent.

A)8.7%

B)18.1%

C)8.9%

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

7

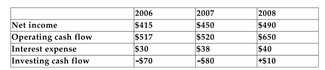

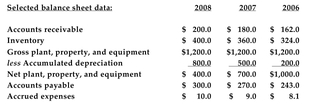

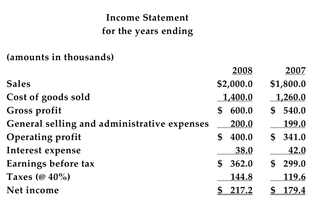

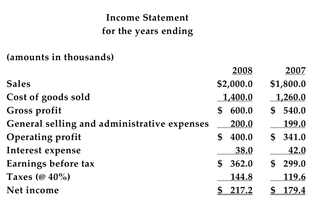

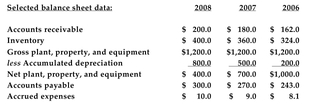

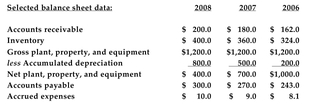

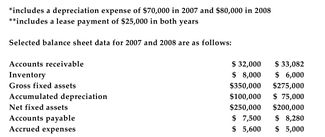

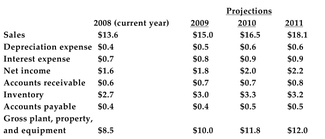

The following information is provided for Hypothetical Corporation:

Refer to the information above. Forecast Hypothetical's net income for 2009, assuming that it grows at the same rate as last year.

A)$236.97

B)$235.23

C)$254.99

D)$263.03

Refer to the information above. Forecast Hypothetical's net income for 2009, assuming that it grows at the same rate as last year.

A)$236.97

B)$235.23

C)$254.99

D)$263.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is a major difference between the goals of an external analyst and the goals of an

entrepreneur when constructing pro formas?

entrepreneur when constructing pro formas?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

9

What are the two guidelines presented in this chapter to use when determining the

length of your detailed projection period?

length of your detailed projection period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

10

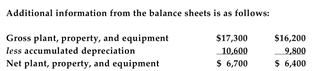

The following information is provided for Hypothetical Corporation:

Refer to the information above. Calculate Hypothetical's economic project cash flows for 2007 and 2008.

A)2007: $458.2; 2008: $584.2

B)2007: $411.3; 2008: $450.2

C)2007: $495.3; 2008: $526.2

D)2007: $547.5; 2008: $488.2

Refer to the information above. Calculate Hypothetical's economic project cash flows for 2007 and 2008.

A)2007: $458.2; 2008: $584.2

B)2007: $411.3; 2008: $450.2

C)2007: $495.3; 2008: $526.2

D)2007: $547.5; 2008: $488.2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

11

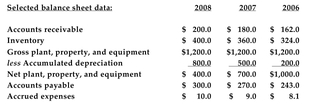

The following information has been collected from the most recent three years of financial statements for the Dougherty Corporation: (All numbers are in thousands.)

Refer to the information above. Project Dougherty's cash flow for 2009, assuming it will grow at the same rate as it averaged over the last two years. Round your answer to the nearest

Hundred dollars.

A)$1,027.3 thousand

B)$853.3 thousand

C)$847.7 thousand

D)$726.6 thousand

Refer to the information above. Project Dougherty's cash flow for 2009, assuming it will grow at the same rate as it averaged over the last two years. Round your answer to the nearest

Hundred dollars.

A)$1,027.3 thousand

B)$853.3 thousand

C)$847.7 thousand

D)$726.6 thousand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

12

What does the "terminal value" represent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following would be expected to produce an economic rent?

A)a patent on a drug that will cure AIDs

B)a new pizzeria in Little Italy

C)the fountain of youth

D)both A and C

A)a patent on a drug that will cure AIDs

B)a new pizzeria in Little Italy

C)the fountain of youth

D)both A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

14

The following information has been collected from the most recent three years of financial statements for the Dougherty Corporation: (All numbers are in thousands.)

Refer to the information above. Calculate Dougherty's economic project cash flow for each of the three years.

A)2006: $557; 2007: $562; 2008: $600

B)2006: $477; 2007: $478; 2008: $700

C)2006: $617; 2007: $638; 2008: $680

D)2006: $417; 2007: $402; 2008: $620

Refer to the information above. Calculate Dougherty's economic project cash flow for each of the three years.

A)2006: $557; 2007: $562; 2008: $600

B)2006: $477; 2007: $478; 2008: $700

C)2006: $617; 2007: $638; 2008: $680

D)2006: $417; 2007: $402; 2008: $620

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

15

The following information has been collected from the most recent three years of financial statements for the Dougherty Corporation: (All numbers are in thousands.)

Refer to the information above. What was the average annual growth rate of Dougherty's cash flows from 2006 to 2008? Round your answer to the nearest tenth of a percent.

A)3.8%

B)21.1%

C)46.8%

D)21.9%

Refer to the information above. What was the average annual growth rate of Dougherty's cash flows from 2006 to 2008? Round your answer to the nearest tenth of a percent.

A)3.8%

B)21.1%

C)46.8%

D)21.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements about pro formas is true?

A)Because tax laws depend on the whims of politicians, pro formas are always done on a before-tax basis.

B)The estimation errors in pro forma statements can be extremely large, in which case they are simply not worth the effort involved.

C)The guidelines for developing a pro forma will be different depending on the type of business.

D)Pro formas can predict sales levels easily, but they are not very useful in determining when cash might be needed and how much will be needed.

A)Because tax laws depend on the whims of politicians, pro formas are always done on a before-tax basis.

B)The estimation errors in pro forma statements can be extremely large, in which case they are simply not worth the effort involved.

C)The guidelines for developing a pro forma will be different depending on the type of business.

D)Pro formas can predict sales levels easily, but they are not very useful in determining when cash might be needed and how much will be needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not a necessary input when developing a pro forma?

A)the number of years the firm or project will continue to exist

B)a terminal market value at time T-1

C)detailed financials from time +1 to T-1

D)a defined time horizon

A)the number of years the firm or project will continue to exist

B)a terminal market value at time T-1

C)detailed financials from time +1 to T-1

D)a defined time horizon

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

18

An economic rent refers to

A)the exact point at which the supply for a good equals the demand for a good.

B)a return that is significantly higher than the cost of capital.

C)a situation in which supply significantly exceeds demand.

D)returns earned by exporters when their home country currency appreciates unexpectedly relative to other currencies.

A)the exact point at which the supply for a good equals the demand for a good.

B)a return that is significantly higher than the cost of capital.

C)a situation in which supply significantly exceeds demand.

D)returns earned by exporters when their home country currency appreciates unexpectedly relative to other currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following statements about economic rents is (are)true?

A)Firms that are in capital intensive industries are less likely to enjoy economic rents because of their high fixed costs.

B)The greater the barriers to entry, the longer a firm will enjoy economic rents.

C)If properly managed, almost all firms will enjoy economic rents in their first one to three years of operation.

D)Both A and B are true statements.

A)Firms that are in capital intensive industries are less likely to enjoy economic rents because of their high fixed costs.

B)The greater the barriers to entry, the longer a firm will enjoy economic rents.

C)If properly managed, almost all firms will enjoy economic rents in their first one to three years of operation.

D)Both A and B are true statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

20

The following information is provided for Hypothetical Corporation:

Refer to the information above. What was Hypothetical's earnings growth rate from 2007 to 2008?

A)-17.4%

B)9.1%

C)21.1%

D)8.3%

Refer to the information above. What was Hypothetical's earnings growth rate from 2007 to 2008?

A)-17.4%

B)9.1%

C)21.1%

D)8.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

21

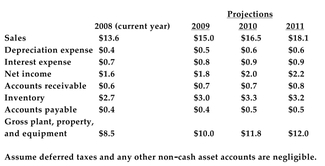

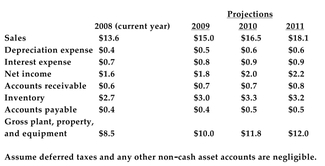

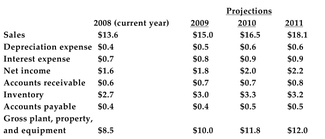

The following information is provided for the Delta Corporation (amounts are in millions):

Refer to the information above. Forecast the 2009, 2010, and 2011 operating cash flows for Delta Corporation.

A)2009: $1.9; 2010: $2.4; 2011: $2.8

B)2009: $2.7; 2010: $2.8; 2011: $2.8

C)2009: $2.7; 2010: $2.2; 2011: $2.8

D)2009: $0.9; 2010: $1.2; 2011: $1.4

Refer to the information above. Forecast the 2009, 2010, and 2011 operating cash flows for Delta Corporation.

A)2009: $1.9; 2010: $2.4; 2011: $2.8

B)2009: $2.7; 2010: $2.8; 2011: $2.8

C)2009: $2.7; 2010: $2.2; 2011: $2.8

D)2009: $0.9; 2010: $1.2; 2011: $1.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

22

The following information is provided for Hypothetical Corporation:

Refer to the information above. Forecast Hypothetical's economic project cash flow for 2009, assuming that it grows at the same rate as it did last year.

A)$566.71

B)$637.28

C)$558.82

D)$560.40

Refer to the information above. Forecast Hypothetical's economic project cash flow for 2009, assuming that it grows at the same rate as it did last year.

A)$566.71

B)$637.28

C)$558.82

D)$560.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

23

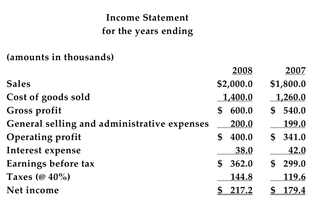

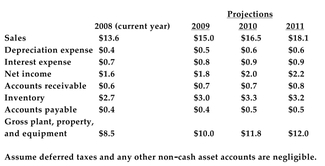

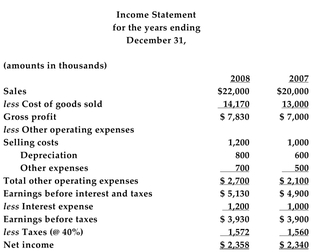

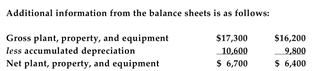

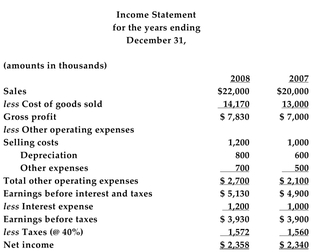

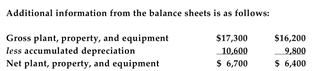

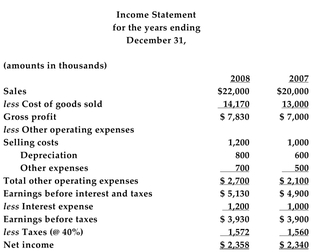

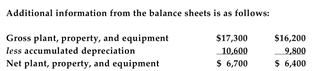

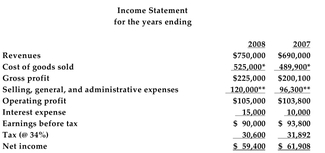

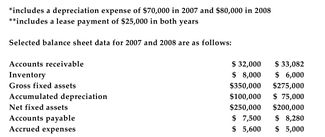

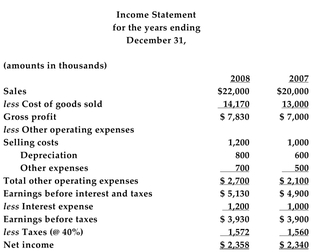

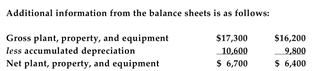

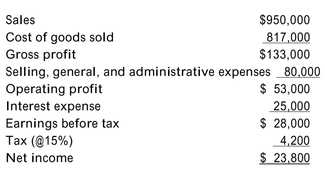

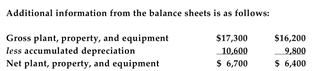

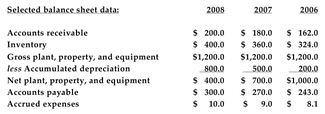

The income statements for Infonext Corporation for 2007 and 2008 are provided below:

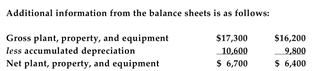

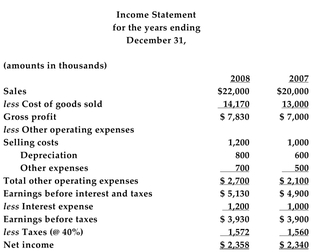

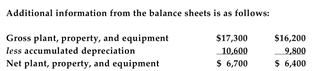

Refer to the information above. Assume sales will grow at the same rate as they did last year and that depreciation is expected to increase to $850 and interest expense to $1,370. Also

Assume the tax rate will remain a flat 40% in 2009. Gross plant, property, and equipment is

Expected to increase by 6.8% and will be the only investment cash flow. Infonext's additional

Investment in net working capital is expected to be 2% of the change in sales. Forecast

Infonext's 2009 economic project cash flow.

A)$3,582

B)$3,194

C)$3,626

D)none of the above

Refer to the information above. Assume sales will grow at the same rate as they did last year and that depreciation is expected to increase to $850 and interest expense to $1,370. Also

Assume the tax rate will remain a flat 40% in 2009. Gross plant, property, and equipment is

Expected to increase by 6.8% and will be the only investment cash flow. Infonext's additional

Investment in net working capital is expected to be 2% of the change in sales. Forecast

Infonext's 2009 economic project cash flow.

A)$3,582

B)$3,194

C)$3,626

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following balance sheet accounts is least likely to vary directly with sales?

A)accounts payable

B)inventory

C)accounts receivable

D)long-term debt

A)accounts payable

B)inventory

C)accounts receivable

D)long-term debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

25

The following information is provided for the Delta Corporation (amounts are in millions):

Refer to the information above. Forecast the 2009, 2010, and 2011 project cash flows for Delta Corporation. Assume the only investments are the investments in plant, property, and

Equipment.

A)2009: $1.2; 2010: $1.5; 2011: $3.5

B)2009: $4.2; 2010: $5.1; 2011: $3.9

C)2009: $2.0; 2010: $1.9; 2011: $3.5

D)2009: $2.6; 2010: $3.3; 2011: $2.1

Refer to the information above. Forecast the 2009, 2010, and 2011 project cash flows for Delta Corporation. Assume the only investments are the investments in plant, property, and

Equipment.

A)2009: $1.2; 2010: $1.5; 2011: $3.5

B)2009: $4.2; 2010: $5.1; 2011: $3.9

C)2009: $2.0; 2010: $1.9; 2011: $3.5

D)2009: $2.6; 2010: $3.3; 2011: $2.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

26

The income statements for Infonext Corporation for 2007 and 2008 are provided below:

Refer to the information above. Assume that Infonext's depreciation expense will be $850 in 2009, that the interest expense will increase to $1,370, and that the firm will pay taxes in 2009 at

A flat rate of 40%. What will the firm's 2009 net income be if you assume that all other accounts

Will grow at their historical relationship to sales and that sales will grow at the same rate as

Last year?

A)$2,508

B)$2,266

C)$2,582

D)$2,288

Refer to the information above. Assume that Infonext's depreciation expense will be $850 in 2009, that the interest expense will increase to $1,370, and that the firm will pay taxes in 2009 at

A flat rate of 40%. What will the firm's 2009 net income be if you assume that all other accounts

Will grow at their historical relationship to sales and that sales will grow at the same rate as

Last year?

A)$2,508

B)$2,266

C)$2,582

D)$2,288

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following balance sheet accounts is most likely to vary directly with sales?

A)depreciation

B)accounts receivable

C)long-term debt

D)common equity

A)depreciation

B)accounts receivable

C)long-term debt

D)common equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

28

The following information is provided for Hypothetical Corporation:

Refer to the information above. What was the growth rate of Hypothetical's economic project cash flow from 2007 to 2008?

A)6.2%

B)6.5%

C)7.7%

D)5.3%

Refer to the information above. What was the growth rate of Hypothetical's economic project cash flow from 2007 to 2008?

A)6.2%

B)6.5%

C)7.7%

D)5.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

29

The income statements for Infonext Corporation for 2007 and 2008 are provided below:

Refer to the information above. Assume that both sales and cost of goods sold will grow at the same rates that they each grew last year. Project the 2009 sales and cost of goods sold for

Infonext Corporation. Round your answer to the nearest dollar.

A)Sales = $24,200; Cost of goods sold = $15,730

B)Sales = $24,200; Cost of goods sold = $15,445

C)Sales = $23,980; Cost of goods sold = $15,587

D)none of the above

Refer to the information above. Assume that both sales and cost of goods sold will grow at the same rates that they each grew last year. Project the 2009 sales and cost of goods sold for

Infonext Corporation. Round your answer to the nearest dollar.

A)Sales = $24,200; Cost of goods sold = $15,730

B)Sales = $24,200; Cost of goods sold = $15,445

C)Sales = $23,980; Cost of goods sold = $15,587

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

30

The income statements for Infonext Corporation for 2007 and 2008 are provided below:

Refer to the information above. Assume sales will grow at the same rate as they did last year and that depreciation is expected to increase to $850 and interest expense to $1,370. Also

Assume the tax rate will remain a flat 40% in 2009. Gross plant, property, and equipment is

Expected to increase by 6.8% and will be the only investment cash flow. Infonext's additional

Investment in net working capital is expected to be 2% of the change in sales. Forecast

Infonext's 2009 operating cash flow.

A)$3,388

B)$2,948

C)$3,432

D)$1,776

Refer to the information above. Assume sales will grow at the same rate as they did last year and that depreciation is expected to increase to $850 and interest expense to $1,370. Also

Assume the tax rate will remain a flat 40% in 2009. Gross plant, property, and equipment is

Expected to increase by 6.8% and will be the only investment cash flow. Infonext's additional

Investment in net working capital is expected to be 2% of the change in sales. Forecast

Infonext's 2009 operating cash flow.

A)$3,388

B)$2,948

C)$3,432

D)$1,776

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

31

The most recent two income statements for Chinook Sailing School are provided below:

Refer to the information above. Assume that revenues are expected to grow by 10% in

2009. Also assume the following:

*Cost of goods sold will maintain its 2008 relationship to sales.

*The lease expense will remain the same as in the previous two years, and the other expense will be 12.5% of sales.

expense will be 12.5% of sales.

*Interest expense will increase to $20,000.

*The tax rate will be a flat 34%.

**Net working capital will remain at its 2008 percent of sales.

*Chinook will invest another $100,000 in plant and equipment.

*The depreciation expense will be 20% of the gross plant, property, and equipment.

*The only investing cash flow in 2009 will be the firm's planned capital expenditures.

There are no deferred taxes or other non-cash items to worry about. Round all

percentages to the nearest tenth of a percent.

a. Prepare a pro forma income statement for 2009 for Chinook Sailing School.

b.Forecast the 2009 project cash flow for Chinook Sailing School.

Refer to the information above. Assume that revenues are expected to grow by 10% in

2009. Also assume the following:

*Cost of goods sold will maintain its 2008 relationship to sales.

*The lease expense will remain the same as in the previous two years, and the other

expense will be 12.5% of sales.

expense will be 12.5% of sales.*Interest expense will increase to $20,000.

*The tax rate will be a flat 34%.

**Net working capital will remain at its 2008 percent of sales.

*Chinook will invest another $100,000 in plant and equipment.

*The depreciation expense will be 20% of the gross plant, property, and equipment.

*The only investing cash flow in 2009 will be the firm's planned capital expenditures.

There are no deferred taxes or other non-cash items to worry about. Round all

percentages to the nearest tenth of a percent.

a. Prepare a pro forma income statement for 2009 for Chinook Sailing School.

b.Forecast the 2009 project cash flow for Chinook Sailing School.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

32

To determine the required discount rate to use in calculating a terminal value for project cash flows, you should apply the CAPM,

A)and use the weighted average beta of the debt and the equity, based on book values.

B)and use the beta of the firm's debt.

C)and use the beta of the firm's equity.

D)and use the weighted average beta of the debt and the equity, based on market values.

A)and use the weighted average beta of the debt and the equity, based on book values.

B)and use the beta of the firm's debt.

C)and use the beta of the firm's equity.

D)and use the weighted average beta of the debt and the equity, based on market values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

33

What are the problems involved in using a pure proportion of sales forecast for all the

income statement accounts?

income statement accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

34

The income statements for Infonext Corporation for 2007 and 2008 are provided below:

Refer to the information above. Assume that Infonext's gross profit margin in 2009 will be the same as the 2008 industry average of 40% and that sales will grow at the same rate as last year.

Project the 2009 sales and cost of goods sold for Infonext Corporation.

A)Sales = $24,200; Cost of goods sold = $9,680

B)Sales - $24,200; Cost of goods sold = $15,730

C)Sales = $23,980; Cost of goods sold = $14,388

D)Sales = $24,200; Cost of goods sold = $14,520

Refer to the information above. Assume that Infonext's gross profit margin in 2009 will be the same as the 2008 industry average of 40% and that sales will grow at the same rate as last year.

Project the 2009 sales and cost of goods sold for Infonext Corporation.

A)Sales = $24,200; Cost of goods sold = $9,680

B)Sales - $24,200; Cost of goods sold = $15,730

C)Sales = $23,980; Cost of goods sold = $14,388

D)Sales = $24,200; Cost of goods sold = $14,520

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

35

The income statements for Infonext Corporation for 2007 and 2008 are provided below:

Refer to the information above. Assume that Infonext's depreciation expense in 2009 will be the same as it was in 2008 and that the remaining "total other operating expenses" are expected

To be 8.5% of sales. Assume, too, that sales growth will be the same as last year. Forecast the

2009 "total other operating expenses" for Infonext.

A)$2,857

B)$2,670

C)$2,970

D)$2,891

Refer to the information above. Assume that Infonext's depreciation expense in 2009 will be the same as it was in 2008 and that the remaining "total other operating expenses" are expected

To be 8.5% of sales. Assume, too, that sales growth will be the same as last year. Forecast the

2009 "total other operating expenses" for Infonext.

A)$2,857

B)$2,670

C)$2,970

D)$2,891

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

36

The following information is provided for Hypothetical Corporation:

Refer to the information above. Forecast Hypothetical's economic project cash flow for 2009, assuming that it grows at the same rate as earnings grew last year.

A)$605.21

B)$637.28

C)$569.87

D)$574.08

Refer to the information above. Forecast Hypothetical's economic project cash flow for 2009, assuming that it grows at the same rate as earnings grew last year.

A)$605.21

B)$637.28

C)$569.87

D)$574.08

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

37

The income statements for Infonext Corporation for 2007 and 2008 are provided below:

Refer to the information above. Assume that sales will grow in 2009 at the same rate as last year and that cost of goods sold will vary directly with sales. Project the 2009 sales and cost of

Goods sold for Infonext Corporation.

A)Sales = $24,200; Cost of goods sold = $15,587

B)Sales = $23,980; Cost of goods sold = $15,587

C)Sales = $24,200; Cost of goods sold = $15,730

D)none of the above

Refer to the information above. Assume that sales will grow in 2009 at the same rate as last year and that cost of goods sold will vary directly with sales. Project the 2009 sales and cost of

Goods sold for Infonext Corporation.

A)Sales = $24,200; Cost of goods sold = $15,587

B)Sales = $23,980; Cost of goods sold = $15,587

C)Sales = $24,200; Cost of goods sold = $15,730

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

38

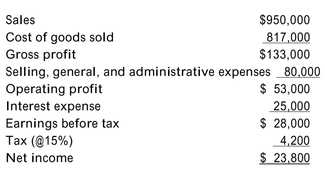

The 2008 income statement for Newman Foods is provided below:  Sales are expected to increase by 15% in 2009. The firm will have to take on more debt

Sales are expected to increase by 15% in 2009. The firm will have to take on more debt

to support its growth, and the interest expense is expected to increase to $32,000. The

tax rate is expected to remain at a flat 15%. All other accounts will remain at their

historical relationship to sales. Develop a pro forma income statement for Newman

Foods for 2009.

Sales are expected to increase by 15% in 2009. The firm will have to take on more debt

Sales are expected to increase by 15% in 2009. The firm will have to take on more debtto support its growth, and the interest expense is expected to increase to $32,000. The

tax rate is expected to remain at a flat 15%. All other accounts will remain at their

historical relationship to sales. Develop a pro forma income statement for Newman

Foods for 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

39

A firm must maintain a minimum current ratio of 2 to 1 in order to be in compliance with one of its bond covenants. Sales are forecast to be $10,000 next year. Historically, current assets

Have averaged 75% of sales. Accounts payable have averaged 20% of sales. Assuming these

Historical ratios will continue, determine the maximum amount of additional short-term debt

Available to the firm next year.

A)$3,750

B)$5,500

C)$13,000

D)$1,750

Have averaged 75% of sales. Accounts payable have averaged 20% of sales. Assuming these

Historical ratios will continue, determine the maximum amount of additional short-term debt

Available to the firm next year.

A)$3,750

B)$5,500

C)$13,000

D)$1,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

40

The income statements for Infonext Corporation for 2007 and 2008 are provided below:

Refer to the information above. Assume sales will grow at the same rate as they did last year and that depreciation is expected to increase to $850 and interest expense to $1,370. Also

Assume the tax rate will remain a flat 40% in 2009. Gross plant, property, and equipment is

Expected to increase by 6.8% and will be the only investment cash flow. Infonext's additional

Investment in net working capital is expected to be 2% of the change in sales. Forecast

Infonext's 2009 investing cash flow.

A)-$1,176

B)+$456

C)+$7,156

D)-$18,476

Refer to the information above. Assume sales will grow at the same rate as they did last year and that depreciation is expected to increase to $850 and interest expense to $1,370. Also

Assume the tax rate will remain a flat 40% in 2009. Gross plant, property, and equipment is

Expected to increase by 6.8% and will be the only investment cash flow. Infonext's additional

Investment in net working capital is expected to be 2% of the change in sales. Forecast

Infonext's 2009 investing cash flow.

A)-$1,176

B)+$456

C)+$7,156

D)-$18,476

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

41

A firm is currently valued at $10.6 million. This year's cash flow was $0.6 million, and the firm's cash flow is expected to grow at a constant rate indefinitely. If the cost of capital of the

Firm is 14.1%, what is the implied growth rate of the cash flows? Round your answer to the

Nearest tenth of a percent.

A)12.2%

B)6.1%

C)8.0%

D)8.4%

Firm is 14.1%, what is the implied growth rate of the cash flows? Round your answer to the

Nearest tenth of a percent.

A)12.2%

B)6.1%

C)8.0%

D)8.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

42

The cash flow for the Cooke Company is expected to be $15,000 next year. The cash

flows are expected to grow at 20% for the following three years before slowing to an

8% annual growth rate from that point forward. If the appropriate cost of capital for

the Cooke Company is 12%, what is the market value of the firm?

flows are expected to grow at 20% for the following three years before slowing to an

8% annual growth rate from that point forward. If the appropriate cost of capital for

the Cooke Company is 12%, what is the market value of the firm?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

43

When determining a terminal value with which to value a firm that you are negotiating to buy, you might

A)decrease the expected growth rate.

B)decrease your required rate of return.

C)increase the expected growth rate.

D)both A and B.

A)decrease the expected growth rate.

B)decrease your required rate of return.

C)increase the expected growth rate.

D)both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements regarding the use of pro formas is correct?

A)You should base your decision on the sales and expense projections that are the most likely to occur.

B)You should base your decisions using the most optimistic sales and the most pessimistic expense projections.

C)You should base your decision using projections based on the most pessimistic scenario in order to be safe.

D)You should base your decision using projections based on the most optimistic scenario, or you are likely to miss some exceptional opportunities.

A)You should base your decision on the sales and expense projections that are the most likely to occur.

B)You should base your decisions using the most optimistic sales and the most pessimistic expense projections.

C)You should base your decision using projections based on the most pessimistic scenario in order to be safe.

D)You should base your decision using projections based on the most optimistic scenario, or you are likely to miss some exceptional opportunities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following business ventures should you be most wary of investing in?

A)The terminal value of the project cash flows is less than or equal to 10% of the present value of all the project cash flows.

B)The terminal value is zero.

C)The terminal value of the project cash flows is greater than or equal to 75% of the present value of all the project cash flows.

D)The terminal value of the project cash flows is less than or equal to 25% of the present value of all the project cash flows.

A)The terminal value of the project cash flows is less than or equal to 10% of the present value of all the project cash flows.

B)The terminal value is zero.

C)The terminal value of the project cash flows is greater than or equal to 75% of the present value of all the project cash flows.

D)The terminal value of the project cash flows is less than or equal to 25% of the present value of all the project cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

46

The following information is provided for the Delta Corporation (amounts are in millions):

Refer to the information above. The expected return on the market is 11%, and the relevant risk-free rate is 6.5%. Delta's equity beta is 0.8, and the beta of its debt is 0.2. Cash flows are

Expected to grow indefinitely at 6% from 2011. Delta uses 1/3 debt financing and 2/3 equity

Financing. What is the fair market value of the firm? Round your answer to the nearest

Hundred thousand dollars.

A)$5.0 million

B)$106.2 million

C)$178.0 million

D)$94.1 million

Refer to the information above. The expected return on the market is 11%, and the relevant risk-free rate is 6.5%. Delta's equity beta is 0.8, and the beta of its debt is 0.2. Cash flows are

Expected to grow indefinitely at 6% from 2011. Delta uses 1/3 debt financing and 2/3 equity

Financing. What is the fair market value of the firm? Round your answer to the nearest

Hundred thousand dollars.

A)$5.0 million

B)$106.2 million

C)$178.0 million

D)$94.1 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

47

In order to increase a firm's market value to match the current market value of a firm's stock, you might

A)increase the expected cash flows.

B)increase the expected growth rate of the firm's cash flows.

C)increase the firm's cost of capital.

D)both A and B.

A)increase the expected cash flows.

B)increase the expected growth rate of the firm's cash flows.

C)increase the firm's cost of capital.

D)both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

48

The following information is provided for the Delta Corporation (amounts are in millions):  Assume deferred taxes and any other non-cash asset accounts are negligible.

Assume deferred taxes and any other non-cash asset accounts are negligible.

Refer to the information above. Cash flows are expected to grow indefinitely at 6% after 2011. The firm's cost of capital is 10%. What is the terminal value of the firm at the end of 2011?

Round your answer to the nearest hundred thousand dollars.

A)$92.8 million

B)$37.1 million

C)$87.5 million

D)$35.0 million

Assume deferred taxes and any other non-cash asset accounts are negligible.

Assume deferred taxes and any other non-cash asset accounts are negligible.Refer to the information above. Cash flows are expected to grow indefinitely at 6% after 2011. The firm's cost of capital is 10%. What is the terminal value of the firm at the end of 2011?

Round your answer to the nearest hundred thousand dollars.

A)$92.8 million

B)$37.1 million

C)$87.5 million

D)$35.0 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

49

True, False, or Uncertain: Although there can be "incorrect" pro formas, there can be

more than one "correct" pro forma. Explain your answer.

more than one "correct" pro forma. Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

50

One of the biggest problems with pro formas is

A)that they provide too many scenarios of cash flows from which to choose.

B)that they typically ignore the probability of total failure.

C)the specificity requirement.

D)that the projections have a tendency to be overly pessimistic.

A)that they provide too many scenarios of cash flows from which to choose.

B)that they typically ignore the probability of total failure.

C)the specificity requirement.

D)that the projections have a tendency to be overly pessimistic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

51

A firm's cash flow this year was $2,000. Cash flows are expected to grow at 15% for the next three years and then taper off to a growth rate of 5% indefinitely. The firm is financed with 25% debt. The beta of the debt is 0.0, and the equity beta is 1.2. The expected return on the market is 10%, and the relevant risk-free rate is 5%.

Refer to the information above. Calculate the fair market value of the firm.

A)$6,443

B)$70,978

C)$60,684

D)$58,342

Refer to the information above. Calculate the fair market value of the firm.

A)$6,443

B)$70,978

C)$60,684

D)$58,342

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

52

A firm's cash flow this year was $2,000. Cash flows are expected to grow at 15% for the next three years and then taper off to a growth rate of 5% indefinitely. The firm is financed with 25% debt. The beta of the debt is 0.0, and the equity beta is 1.2. The expected return on the market is 10%, and the relevant risk-free rate is 5%.

Refer to the information above. Calculate the terminal value at the end of year 3. Round your answer to the nearest ten dollars.

A)$64,820

B)$70,980

C)$54,020

D)none of the above

Refer to the information above. Calculate the terminal value at the end of year 3. Round your answer to the nearest ten dollars.

A)$64,820

B)$70,980

C)$54,020

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

53

One negative effect of using more debt in your capital structure is

A)greater threat of a hostile takeover.

B)higher corporate income taxes.

C)lower debt-equity ratio.

D)lower credit ratings.

A)greater threat of a hostile takeover.

B)higher corporate income taxes.

C)lower debt-equity ratio.

D)lower credit ratings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

54

A firm's cash flow this year was $3,100. Cash flows are expected to grow at 30% for the next two years and then taper off to a growth rate of 9% indefinitely. The beta of the firm is 1.2, and

The relevant risk-free rate is 4%. The equity risk premium is expected to be 6%. What is the

Firm's terminal value at the end of the second year? Round your answer to the nearest dollar.

A)$237,958

B)$259,591

C)$238,136

D)none of the above

The relevant risk-free rate is 4%. The equity risk premium is expected to be 6%. What is the

Firm's terminal value at the end of the second year? Round your answer to the nearest dollar.

A)$237,958

B)$259,591

C)$238,136

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

55

The income statements for Infonext Corporation for 2007 and 2008 are provided below:

Refer to the information above. Assume sales will grow at the same rate as they did last year and that depreciation is expected to increase to $850 and interest expense to $1,370. Also

Assume the tax rate will remain a flat 40% in 2009. Gross plant, property, and equipment is

Expected to increase by 6.8% and will be the only investment cash flow. Infonext's additional

Investment in net working capital is expected to be 2% of the change in sales. The cost of capital

Is 14%, and Infonext's 2009 cash flows are expected to remain at that level forever. Calculate

Infonext's terminal value at the end of 2009. Round your answer to the nearest thousand

Dollars.

A)$25,586

B)$29,720

C)$28,002

D)$25,900

Refer to the information above. Assume sales will grow at the same rate as they did last year and that depreciation is expected to increase to $850 and interest expense to $1,370. Also

Assume the tax rate will remain a flat 40% in 2009. Gross plant, property, and equipment is

Expected to increase by 6.8% and will be the only investment cash flow. Infonext's additional

Investment in net working capital is expected to be 2% of the change in sales. The cost of capital

Is 14%, and Infonext's 2009 cash flows are expected to remain at that level forever. Calculate

Infonext's terminal value at the end of 2009. Round your answer to the nearest thousand

Dollars.

A)$25,586

B)$29,720

C)$28,002

D)$25,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

56

To determine the appropriate cost of capital to use when calculating the value of a firm, you should discount the project cash flows

A)at the equity premium.

B)at the weighted average cost of capital of the firm.

C)at the firm's cost of equity.

D)at the firm's cost of debt.

A)at the equity premium.

B)at the weighted average cost of capital of the firm.

C)at the firm's cost of equity.

D)at the firm's cost of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

57

If you are negotiating the sale of your company, would you prefer to use a higher or a

lower cost of capital to estimate the market value of your firm? Explain.

lower cost of capital to estimate the market value of your firm? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

58

A firm has a project cash flow of $1,000 today. This cash flow is expected to grow at a rate of 30% for the next five years and then taper off to a growth rate of 5% indefinitely. What is the

Terminal value of this project at the end of the fifth year if the cost of capital is 10%? Round

Your answer to the nearest dollar.

A)$74,259

B)$38,986

C)$77,972

D)none of the above

Terminal value of this project at the end of the fifth year if the cost of capital is 10%? Round

Your answer to the nearest dollar.

A)$74,259

B)$38,986

C)$77,972

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

59

You would want your firm to issue debt to repurchase shares of stock if you believed

A)your firm's debt was overvalued.

B)your firm's debt was undervalued.

C)your firm's equity was undervalued.

D)your firm's equity was overvalued.

A)your firm's debt was overvalued.

B)your firm's debt was undervalued.

C)your firm's equity was undervalued.

D)your firm's equity was overvalued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

60

A firm is projected to have a cash flow of $5,100 next year, after which the cash flow is expected to remain constant forever. What is the the terminal value of this cash flow at the end

Of this year if the cost of capital is 10%? Round your answer to the nearest dollar.

A)$46,364

B)$4,636

C)$51,000

D)none of the above

Of this year if the cost of capital is 10%? Round your answer to the nearest dollar.

A)$46,364

B)$4,636

C)$51,000

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following estimation errors would result in a cash flow forecast that would have been too low?

A)Estimated depreciation expense was too low.

B)Estimated growth rate was too high.

C)Initial period (time = 1)cash flow forecast was too low.

D)both A and B

A)Estimated depreciation expense was too low.

B)Estimated growth rate was too high.

C)Initial period (time = 1)cash flow forecast was too low.

D)both A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

62

An analyst estimated that a firm's cash flow would be $2 million at the end of a year.

In actuality, it was only $1.5 million. Should the analyst be fired? What are possible

reasons that this underestimation might occur? Give some examples.

In actuality, it was only $1.5 million. Should the analyst be fired? What are possible

reasons that this underestimation might occur? Give some examples.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

63

If a firm issues an additional $1 million in debt at an interest rate of 12% and pays taxes at a marginal rate of 35%, the present value of the corporate income tax avoided, assuming the debt

Is perpetual is

A)$120,000.

B)$350,000.

C)$78,000.

D)none of the above.

Is perpetual is

A)$120,000.

B)$350,000.

C)$78,000.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

64

A firm issues a $100 million bond with a coupon rate of 8%. If the firm pays taxes at the marginal rate of 38%, what is the present value of the tax savings on the debt, assuming the

Debt is perpetual?

A)$5,333,333

B)$38,000,000

C)$62,000,000

D)$3,040,000

Debt is perpetual?

A)$5,333,333

B)$38,000,000

C)$62,000,000

D)$3,040,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

65

In the average, publicly traded firm, which of the following accounts seems to have a negative relationship with sales?

A)accounts payable

B)long-term debt

C)long-term investments other than PP&E

D)plant, property and equipment

A)accounts payable

B)long-term debt

C)long-term investments other than PP&E

D)plant, property and equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

66

The appendix to this chapter provides some formulas that describe how the various

components of publicly traded companies' financial statements vary with sales, on

average. If you are an entrepreneur interested in establishing your own business, how

comfortable would you be with using these relationships to project your firm's future

financing needs?

components of publicly traded companies' financial statements vary with sales, on

average. If you are an entrepreneur interested in establishing your own business, how

comfortable would you be with using these relationships to project your firm's future

financing needs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

67

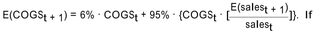

Refer to the information above. The expected COGS for the average publicly traded company is estimated to be:

Hypothetical's sales are expected to grow by 10% in 2009, what would you expect

Hypothetical's sales are expected to grow by 10% in 2009, what would you expectHypothetical's cost of goods sold to be, assuming it followed this same relationship?

A)$1,547

B)$1,624

C)$1,562

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following estimation errors would result in a market value that would have been too high?

A)The growth rate used was too low.

B)The estimated firm beta was too low.

C)The cost of capital used was too high.

D)The expected equity risk premium used was too high.

A)The growth rate used was too low.

B)The estimated firm beta was too low.

C)The cost of capital used was too high.

D)The expected equity risk premium used was too high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements about pro formas is true?

A)It is equally important to look at the big picture presented by a pro forma as well as the detailed discussions of the individual components within the pro forma.

B)When studying a pro forma, you should concentrate primarily on the detailed assumptions underlying the pro forma to determine if management is trying to fleece you.

C)When studying a pro forma, you should be concerned only with the big picture presented if you are an external analyst since you are not privy to the minute operational details of

The firm.

D)You can trust pro formas of well-managed companies to be accurate.

A)It is equally important to look at the big picture presented by a pro forma as well as the detailed discussions of the individual components within the pro forma.

B)When studying a pro forma, you should concentrate primarily on the detailed assumptions underlying the pro forma to determine if management is trying to fleece you.

C)When studying a pro forma, you should be concerned only with the big picture presented if you are an external analyst since you are not privy to the minute operational details of

The firm.

D)You can trust pro formas of well-managed companies to be accurate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

70

What are two characteristics of a good pro forma?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

71

A firm issues a $200 million perpetual bond with a coupon rate of 7%. The firm's marginal tax rate is 35%. What is the present value of the tax savings on the debt?

A)$70 million

B)$45.5 million

C)$130 million

D)$14 million

A)$70 million

B)$45.5 million

C)$130 million

D)$14 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

72

A firm issues a $100 million bond with a coupon rate of 8%. If the firm pays taxes at the marginal rate of 38%, what is its annual after-tax interest expense?

A)$5,760,000

B)$4,960,000

C)$3,040,000

D)none of the above

A)$5,760,000

B)$4,960,000

C)$3,040,000

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

73

What pro forma accounts will be affected by an increased use of debt? How,

specifically, will these accounts be affected?

specifically, will these accounts be affected?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck