Deck 13: Taxes and Insurance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

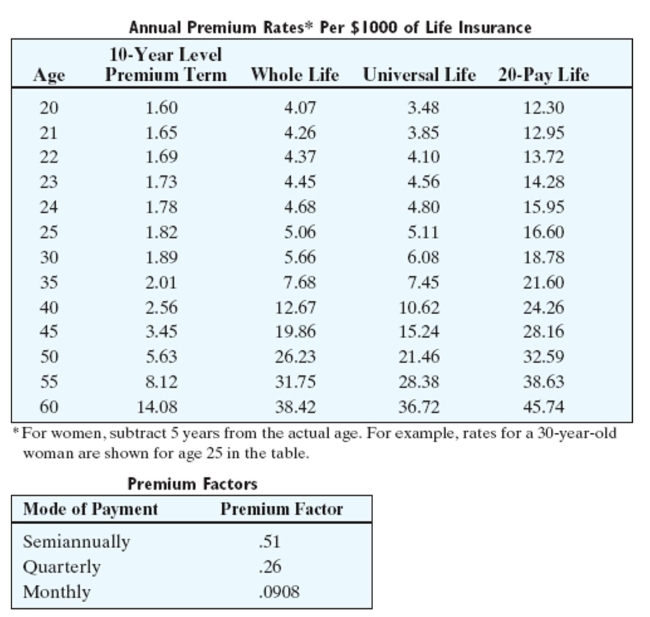

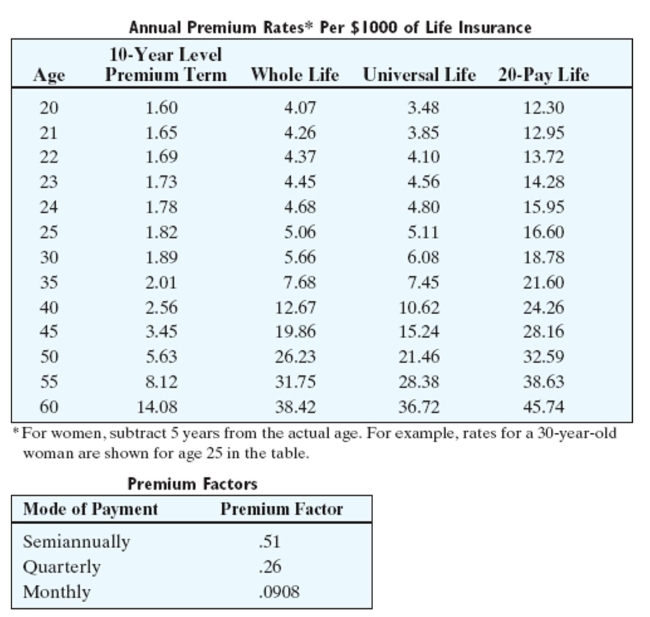

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

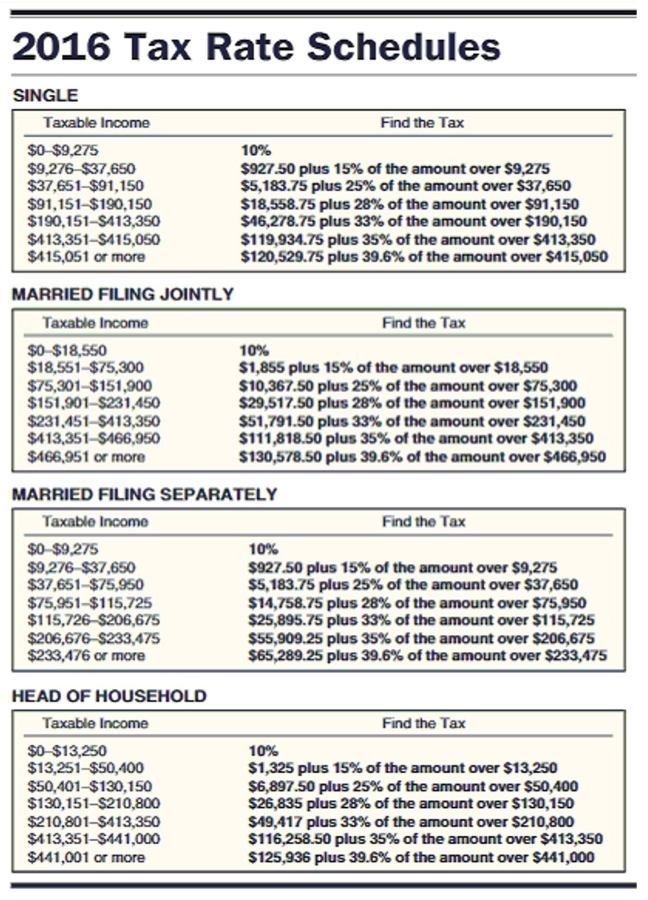

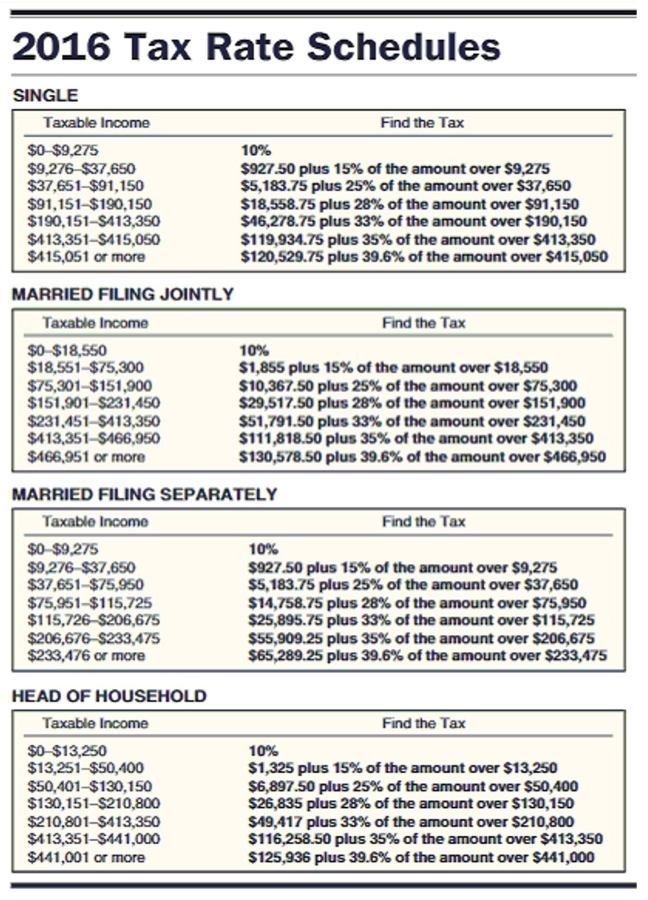

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

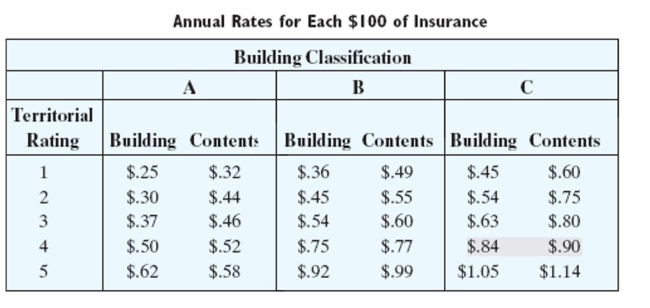

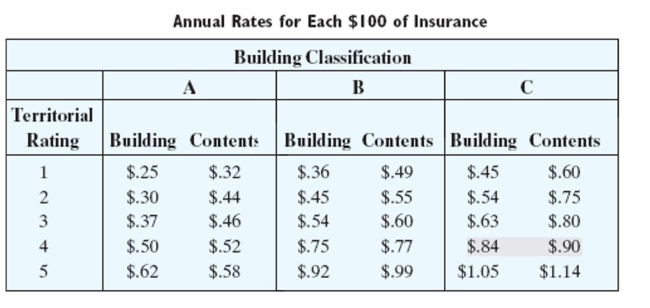

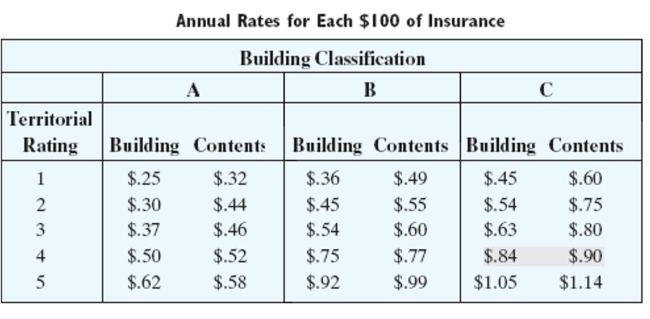

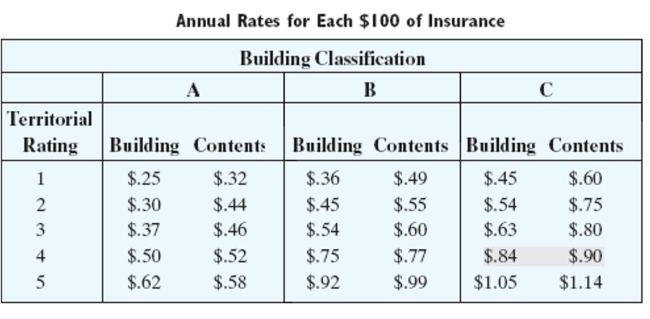

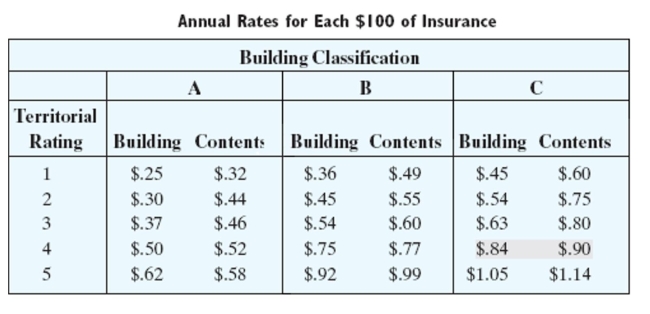

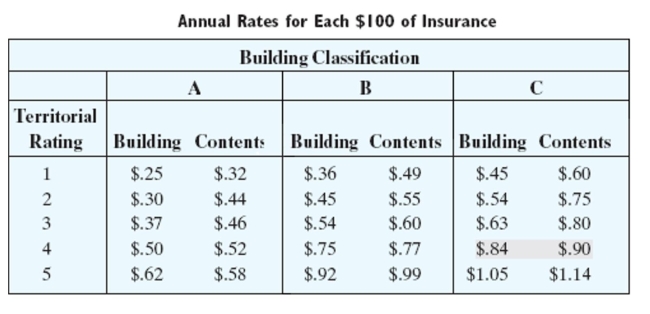

سؤال

سؤال

سؤال

سؤال

سؤال

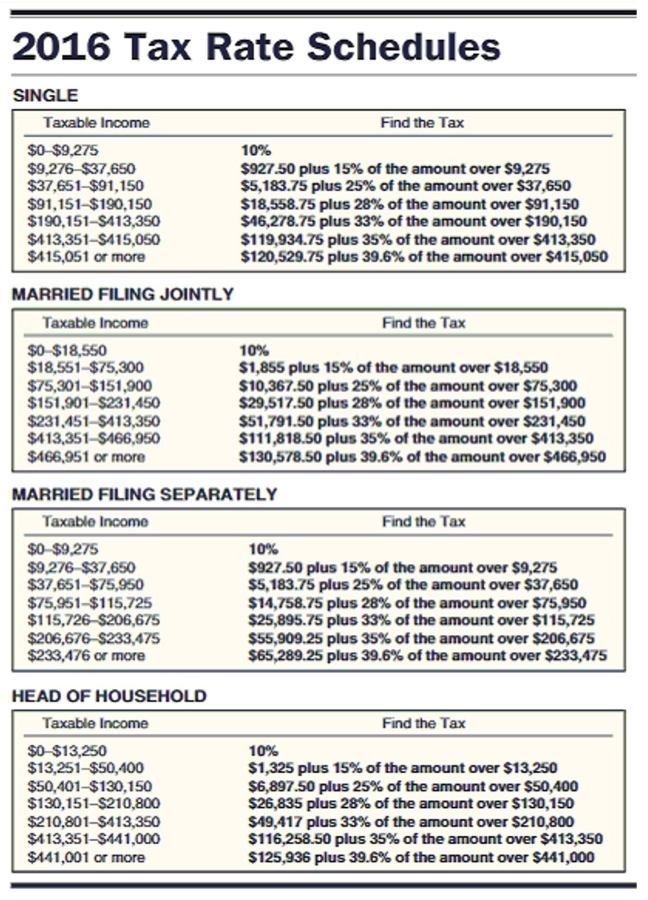

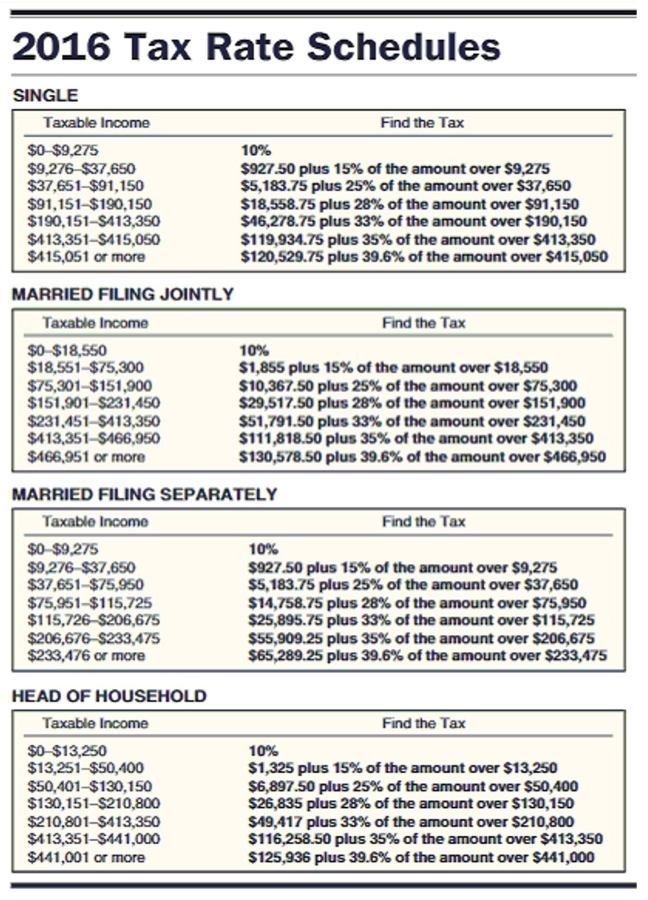

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/115

العب

ملء الشاشة (f)

Deck 13: Taxes and Insurance

1

Provide an appropriate response.

List four sources of income for which an individual might receive W-2 and 1099 forms.

List four sources of income for which an individual might receive W-2 and 1099 forms.

Answers will vary.

2

Provide an appropriate response.

List four possible tax deductions, and explain the effect that a tax deduction has on taxable income and on income tax due.

List four possible tax deductions, and explain the effect that a tax deduction has on taxable income and on income tax due.

Answers will vary.

3

Solve the problem.

Golden Oaks Apartments has a replacement cost of $202,000 and is insured for $121,000. A fire loss is for $14,000. Find the amount of loss paid by the company. Assume an 80% coinsurance clause.

A)$8,400

B)$11,200

C)$14,000

D)$10,483

Golden Oaks Apartments has a replacement cost of $202,000 and is insured for $121,000. A fire loss is for $14,000. Find the amount of loss paid by the company. Assume an 80% coinsurance clause.

A)$8,400

B)$11,200

C)$14,000

D)$10,483

$10,483

4

Provide an appropriate response.

Give four forms of a tax rate and explain what each form means.

Give four forms of a tax rate and explain what each form means.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

5

Provide an appropriate response.

Explain in your own words multiple carrier insurance. Give two reasons for dividing insurance among multiple carriers.

Explain in your own words multiple carrier insurance. Give two reasons for dividing insurance among multiple carriers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

6

Provide an appropriate response.

Explain in your own words the difference between comprehensive insurance and collision insurance.

Explain in your own words the difference between comprehensive insurance and collision insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

7

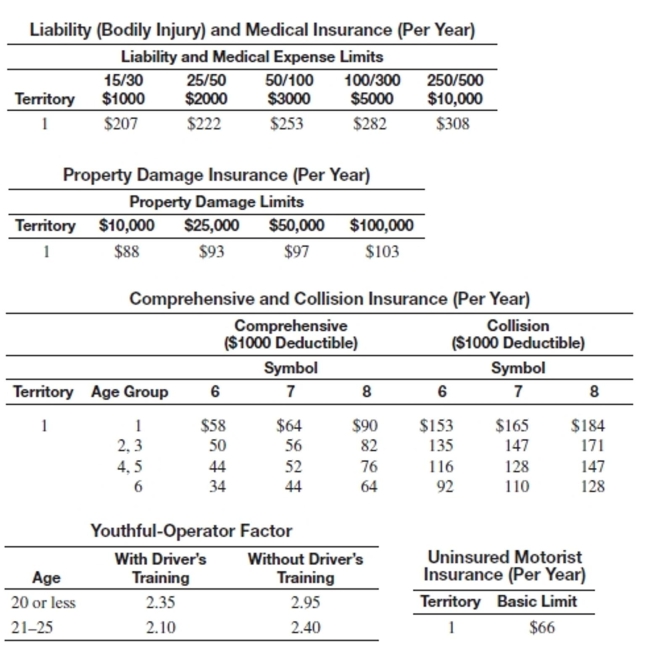

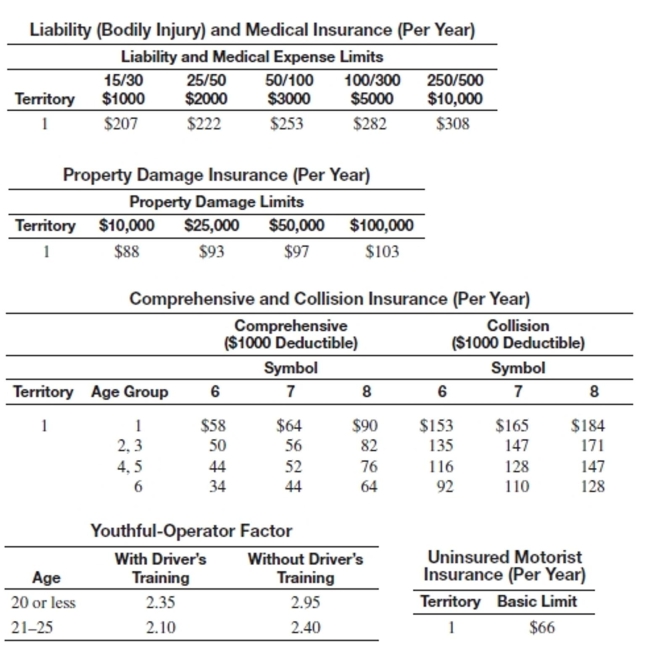

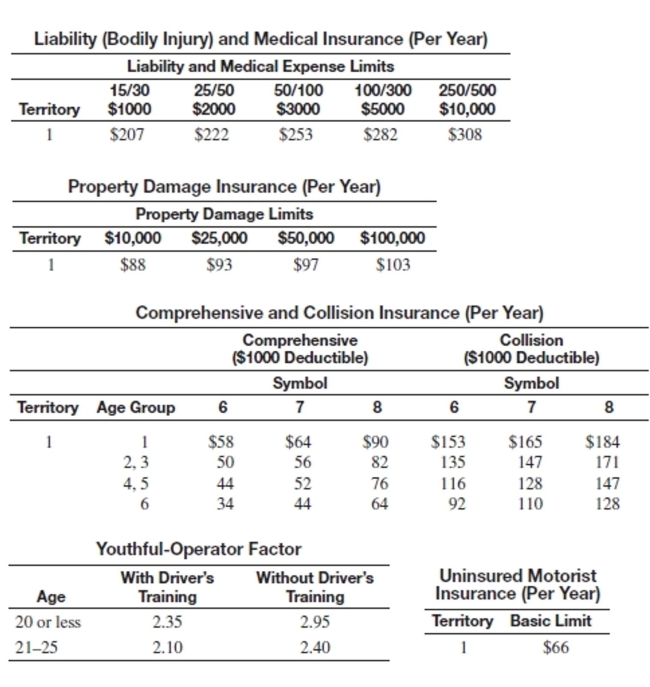

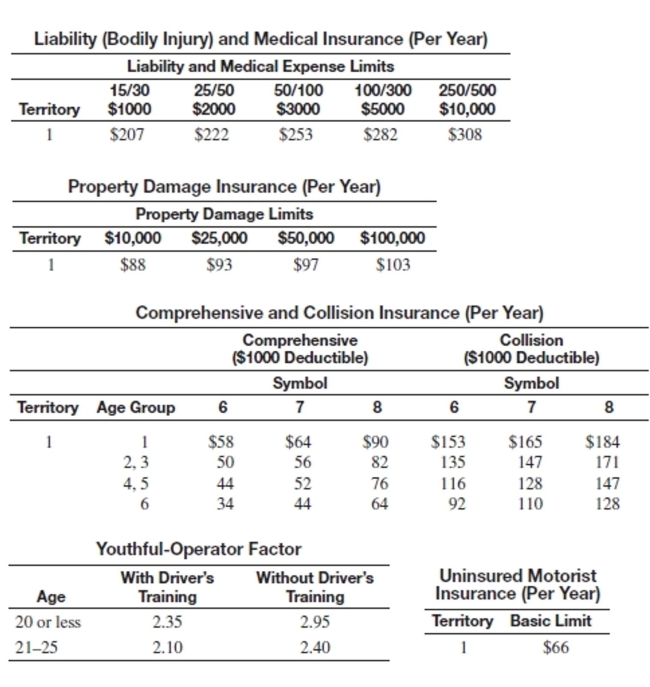

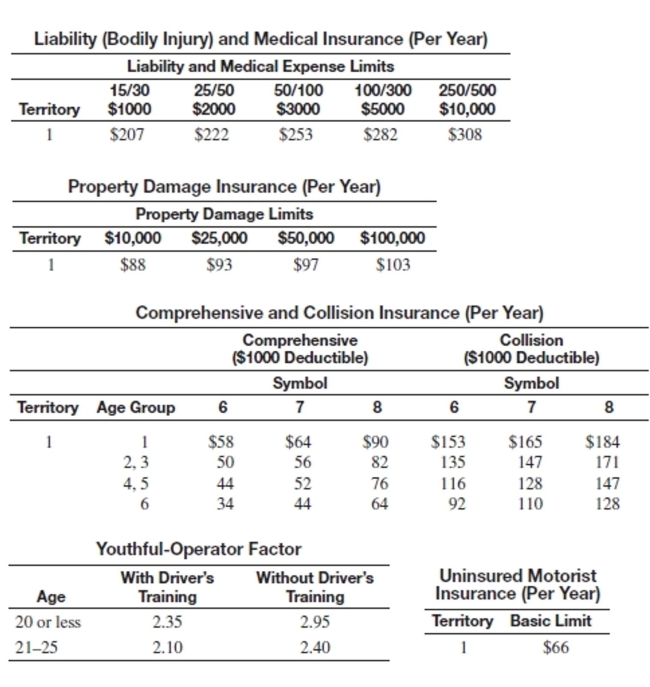

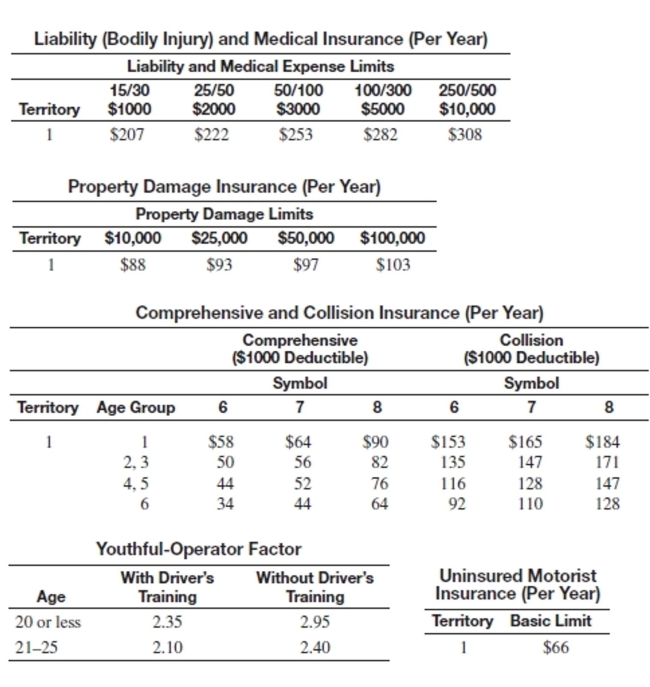

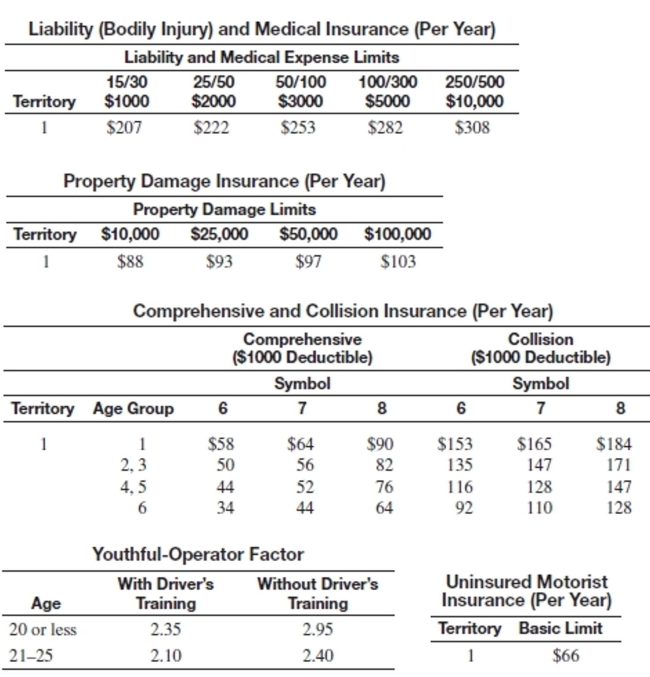

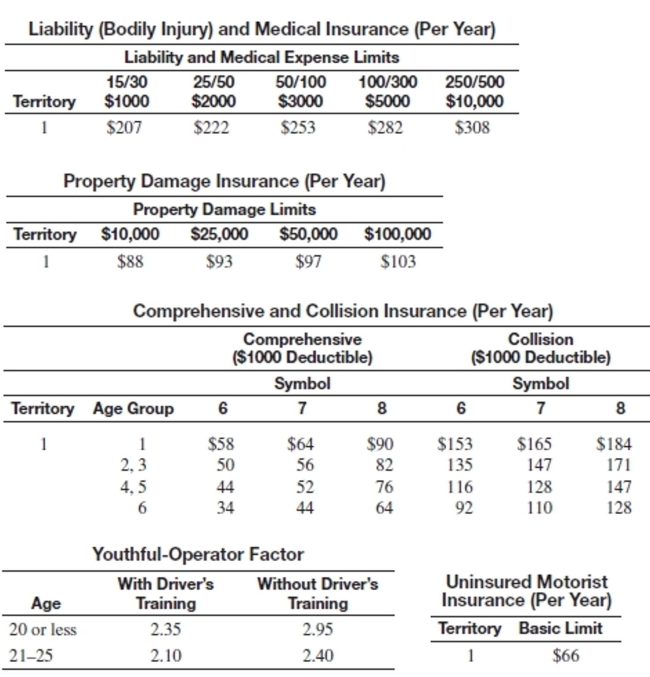

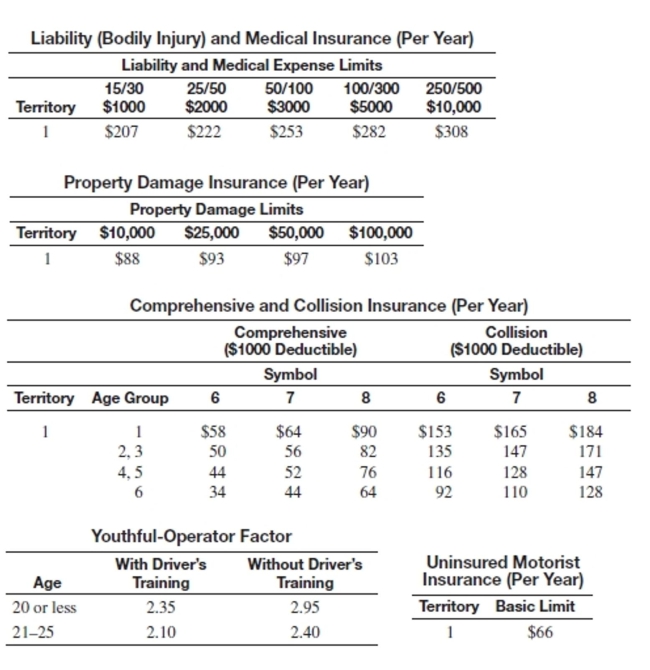

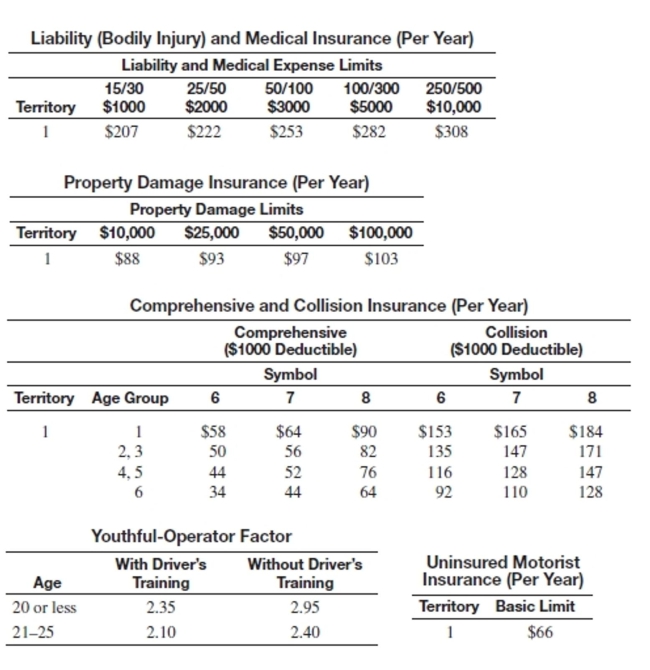

Find the annual premium in territory 1.

Operator age: 26

Comprehensive/Collision Age Group: 5

Driver's ed: yes

Symbol: 7

Liability: 50/100

Property: $25,000

Uninsured motorist: yes

A)$592.00

B)$917.60

C)$1036.00

D)$526.00

Operator age: 26

Comprehensive/Collision Age Group: 5

Driver's ed: yes

Symbol: 7

Liability: 50/100

Property: $25,000

Uninsured motorist: yes

A)$592.00

B)$917.60

C)$1036.00

D)$526.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

8

Provide an appropriate response.

Define in your own words fair market value and assessed value. How is the assessment rate used when finding the assessed value?

Define in your own words fair market value and assessed value. How is the assessment rate used when finding the assessed value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

9

Provide an appropriate response.

Describe three factors that determine the premium charged for fire insurance.

Describe three factors that determine the premium charged for fire insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

10

Find the indicated premium. Round to the nearest cent.

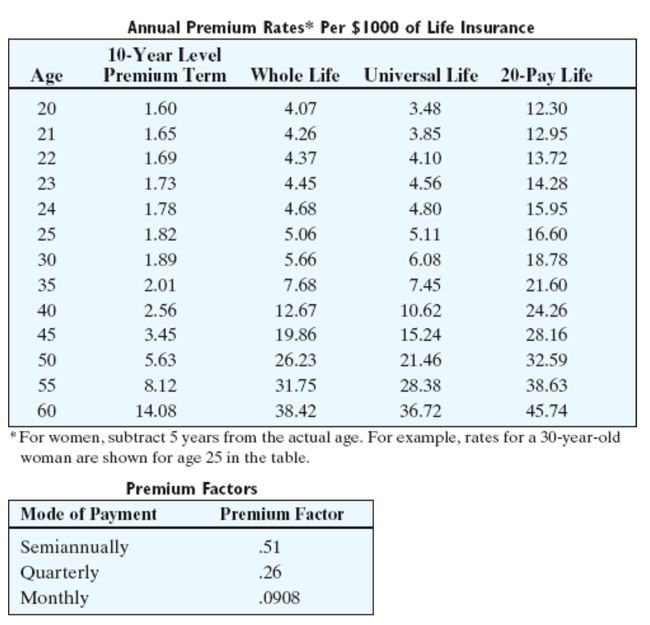

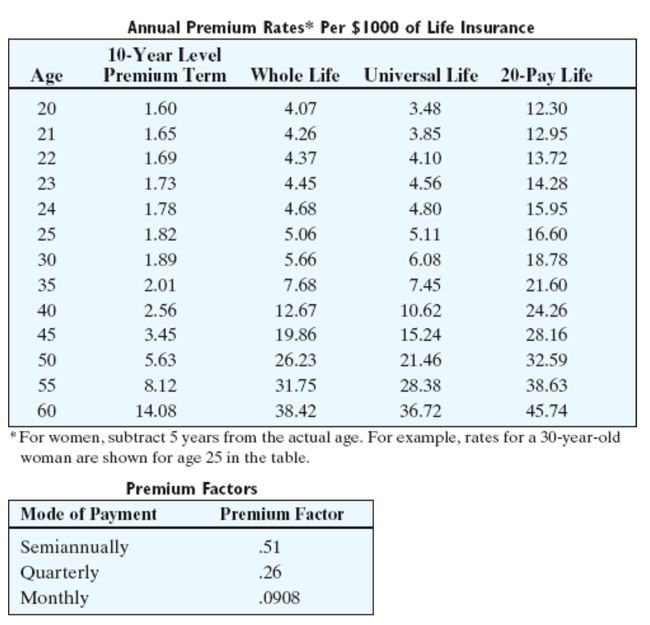

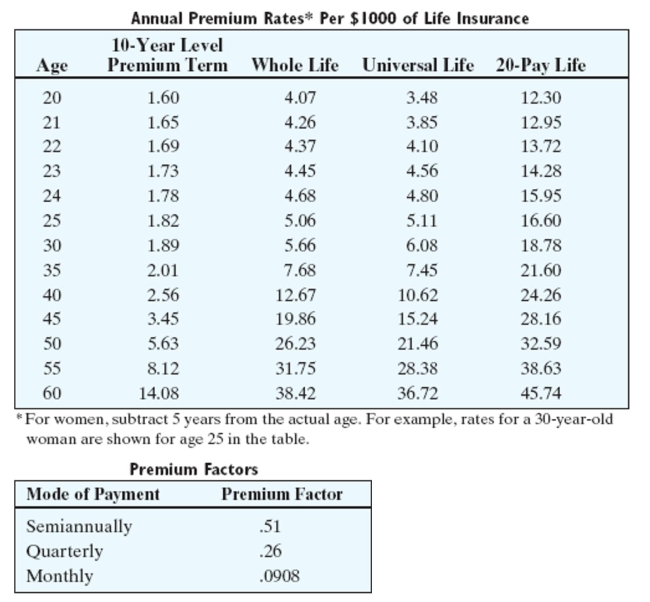

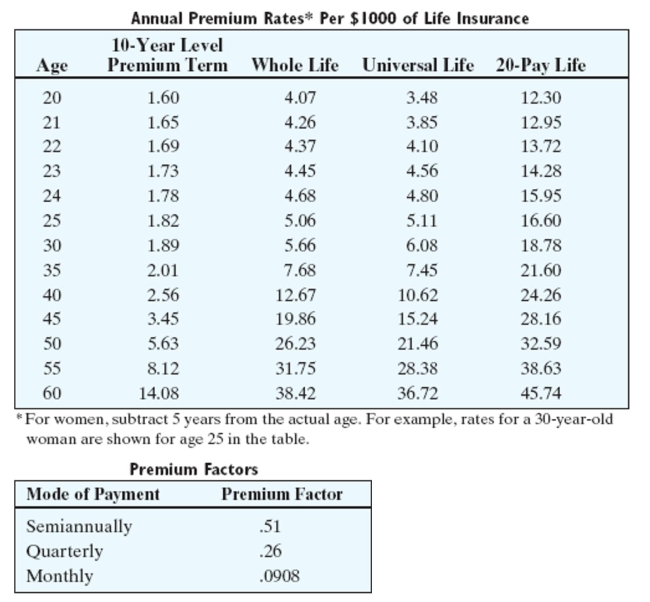

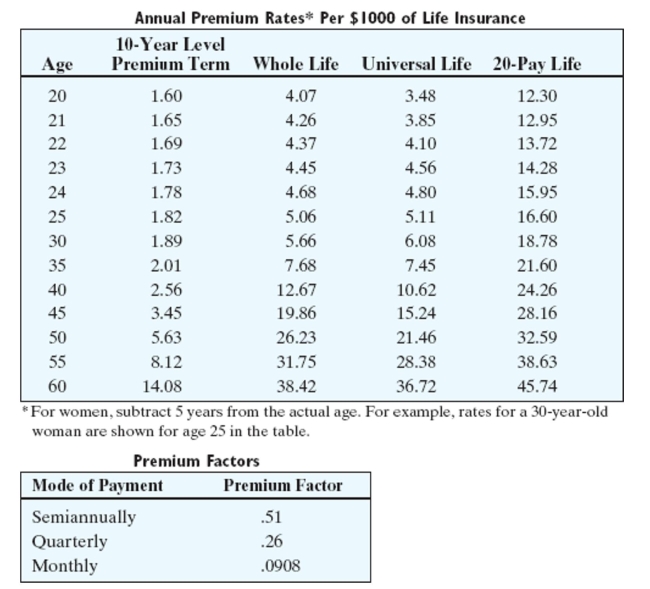

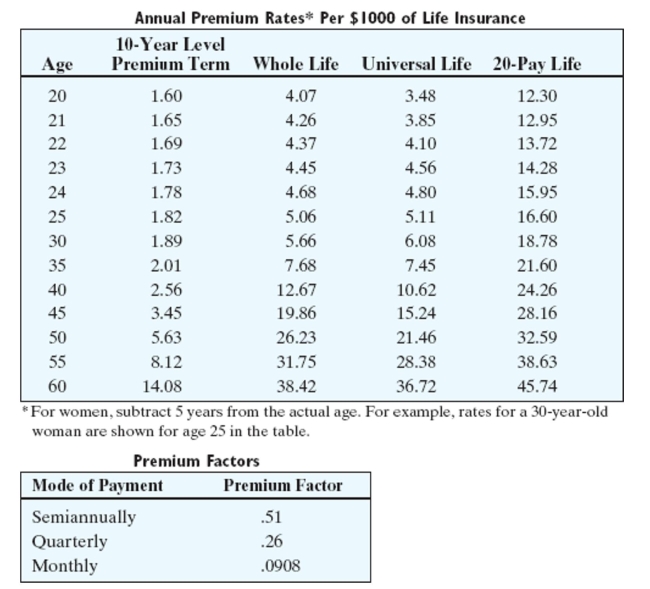

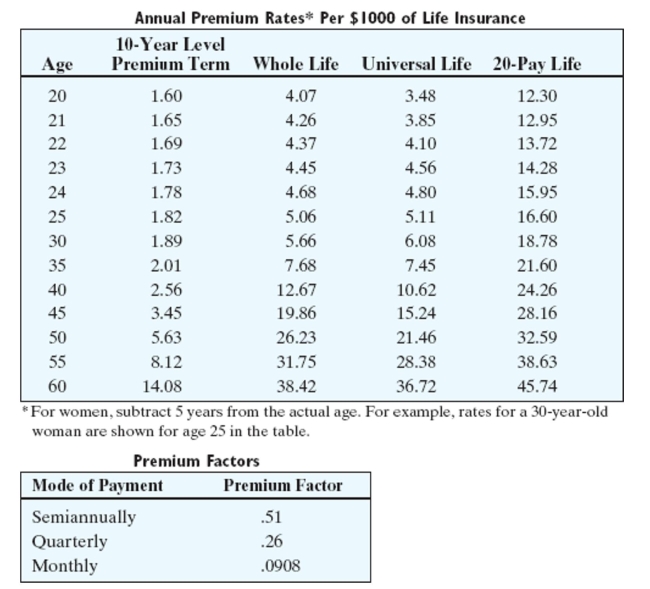

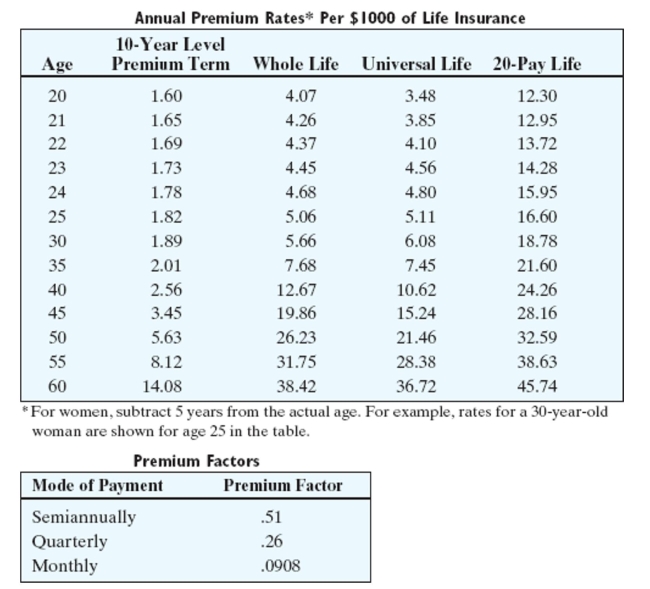

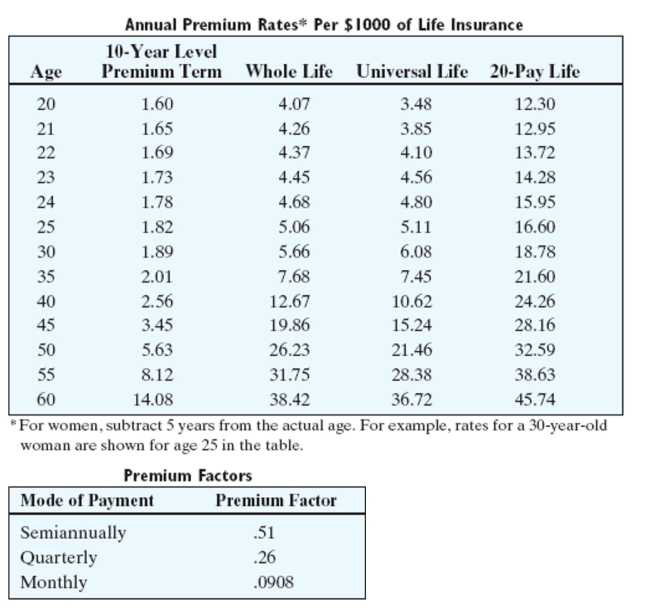

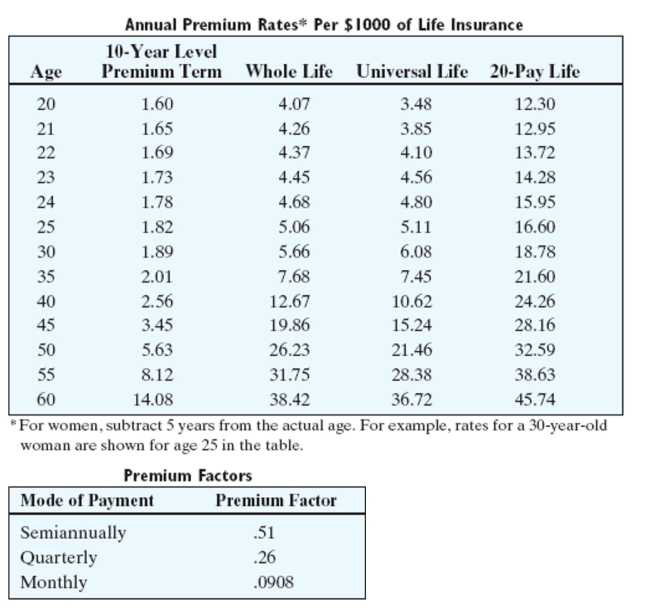

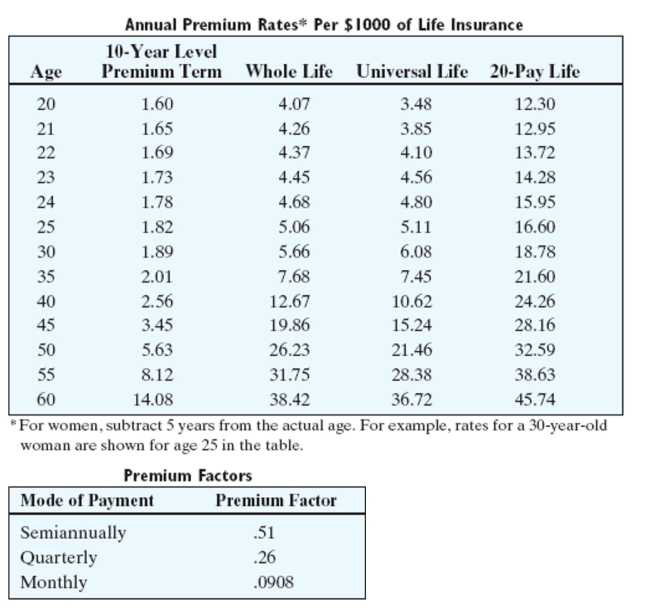

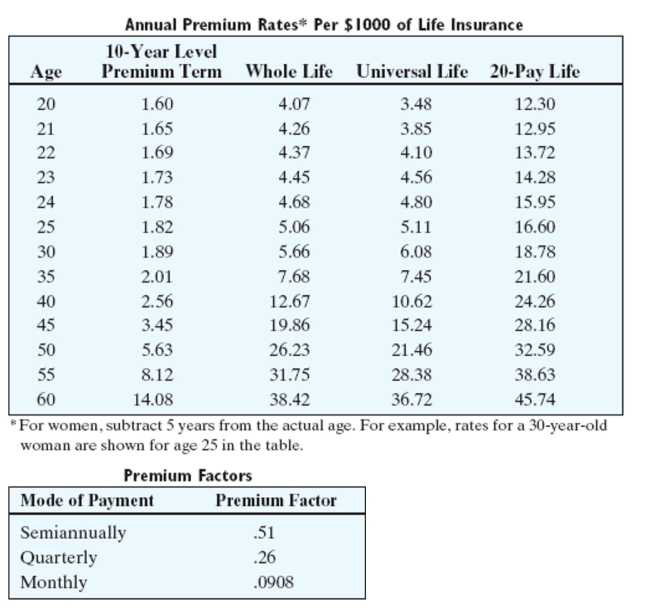

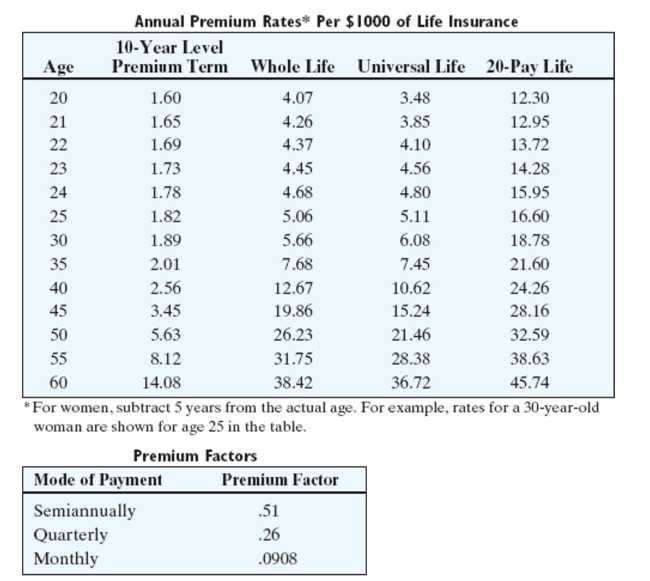

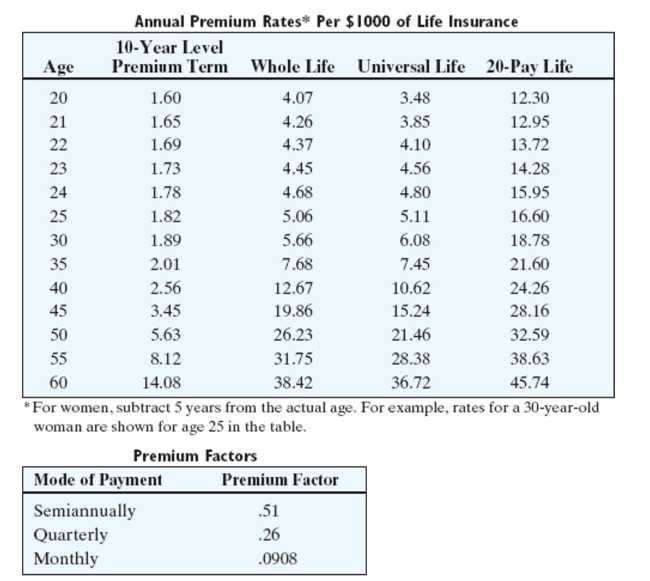

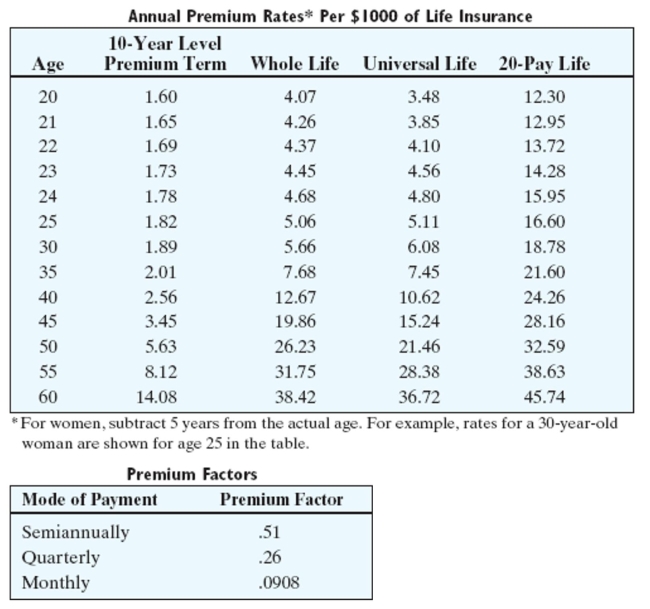

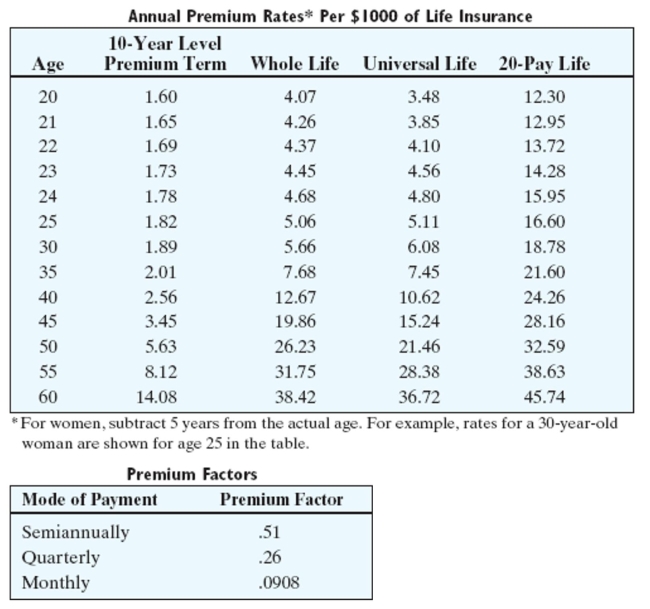

Find the total premium paid over 30 years for a universal life policy with a face value of $35,000. Assume the policy is taken out by a 25-year-old man.

A)$2,709.00

B)$5,313.00

C)$5,365.50

D)$5,040.00

Find the total premium paid over 30 years for a universal life policy with a face value of $35,000. Assume the policy is taken out by a 25-year-old man.

A)$2,709.00

B)$5,313.00

C)$5,365.50

D)$5,040.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

11

Provide an appropriate response.

Describe life insurance premium factors and how they are used.

Describe life insurance premium factors and how they are used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

12

Provide an appropriate response.

Describe the coinsurance clause and how it works.

Describe the coinsurance clause and how it works.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

13

Find the tax rate for the area. Round to the nearest tenth of a percent.

Total tax needed: $321,000 Total assessed value: $53,103,000

A)6.0%

B)0.6%

C)0.8%

D)0.5%

Total tax needed: $321,000 Total assessed value: $53,103,000

A)6.0%

B)0.6%

C)0.8%

D)0.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

14

Solve the problem.

A taxpayer's property has a fair market value of $110,000. The rate of assessment in the area is 50%. The tax rate is $3.35 per $100 of assessed valuation. Find the property tax.

A)$368,500.00

B)$184,250.00

C)$3,685.00

D)$1,842.50

A taxpayer's property has a fair market value of $110,000. The rate of assessment in the area is 50%. The tax rate is $3.35 per $100 of assessed valuation. Find the property tax.

A)$368,500.00

B)$184,250.00

C)$3,685.00

D)$1,842.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

15

Find the amount to be paid by the insurance company. Assume the policy includes an 80% coinsurance clause. Round to the nearest dollar.

Replacement Cost of Building: $982,000 Face Value of Policy: $589,200

Amount of Loss: $197,000

A)$118,200.00

B)$73,875.00

C)$147,750.00

D)$197,000.00

Replacement Cost of Building: $982,000 Face Value of Policy: $589,200

Amount of Loss: $197,000

A)$118,200.00

B)$73,875.00

C)$147,750.00

D)$197,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

16

Find the amount paid by each of the multiple carriers.

The Jason Manufacturing Company had an insured fire loss of $79,000. It had insurance coverage as follows: Company A, $450,000; Company B, $275,000; and Company C, $100,000. Find the

Amount paid by each carrier assuming that the coinsurance requirement had been met.

A)$41,893.94, $29,924.24, $7,181.82

B)$45,484.85, $27,530.30, $5,984.85

C)$43,090.91, $26,333.33, $9,575.76

D)$39,500.00, $28,727.27, $10,772.73

The Jason Manufacturing Company had an insured fire loss of $79,000. It had insurance coverage as follows: Company A, $450,000; Company B, $275,000; and Company C, $100,000. Find the

Amount paid by each carrier assuming that the coinsurance requirement had been met.

A)$41,893.94, $29,924.24, $7,181.82

B)$45,484.85, $27,530.30, $5,984.85

C)$43,090.91, $26,333.33, $9,575.76

D)$39,500.00, $28,727.27, $10,772.73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

17

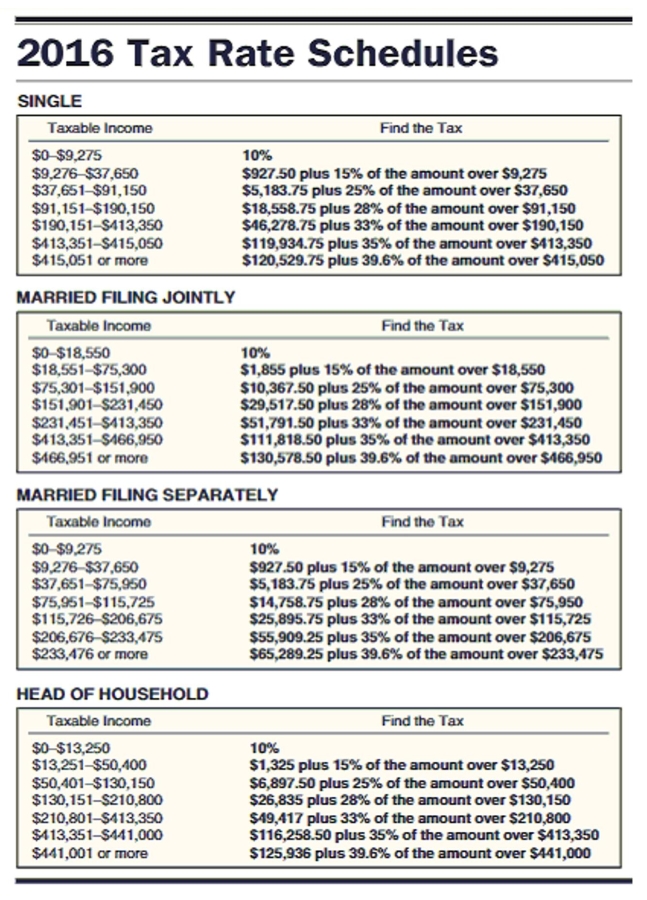

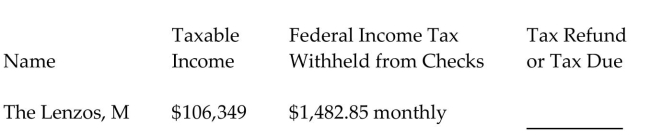

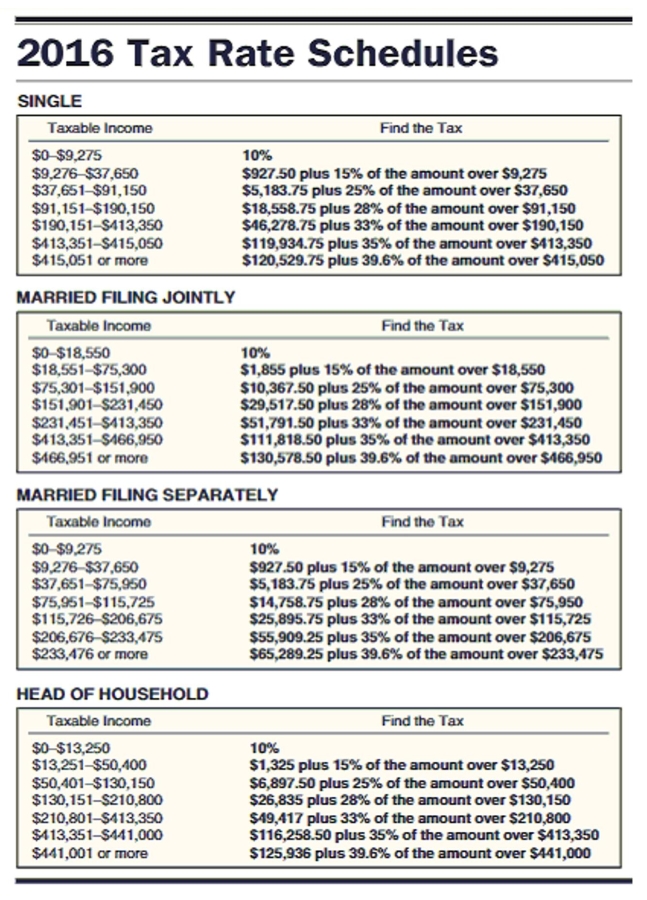

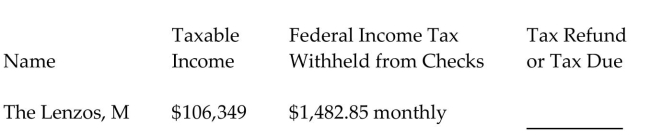

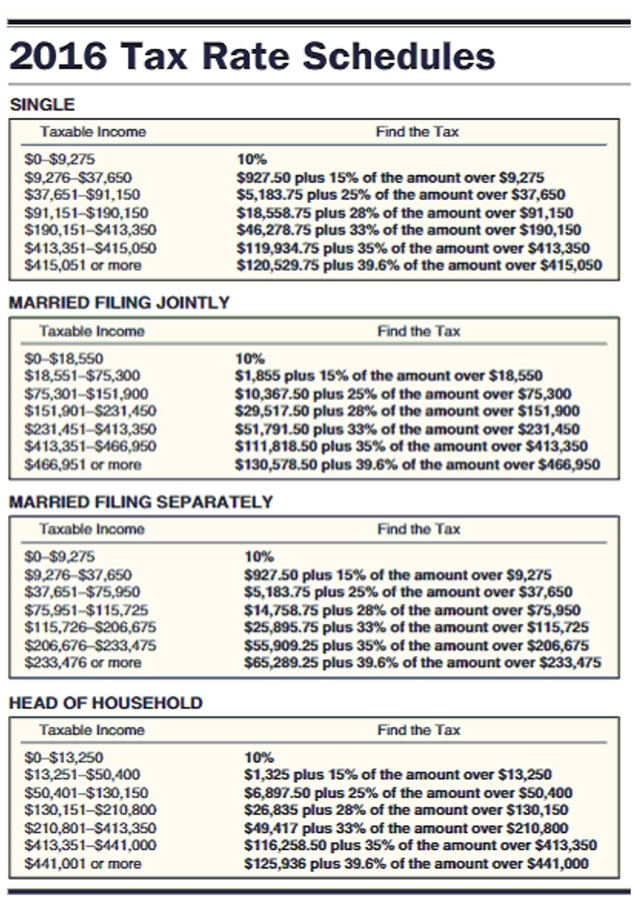

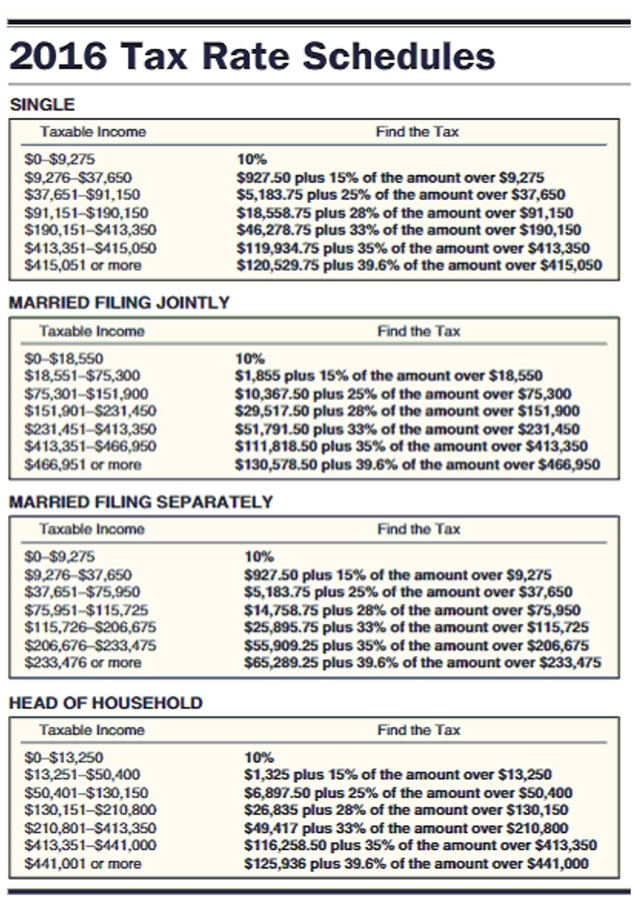

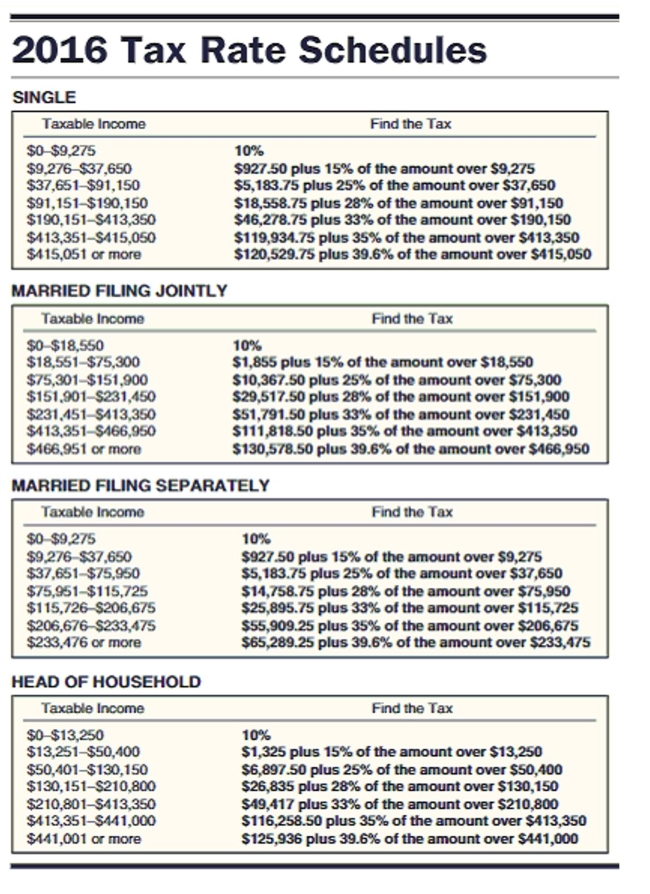

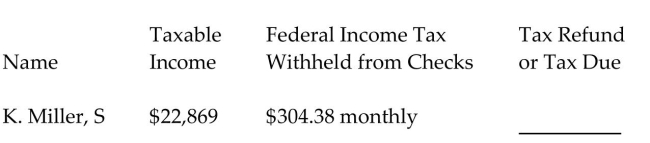

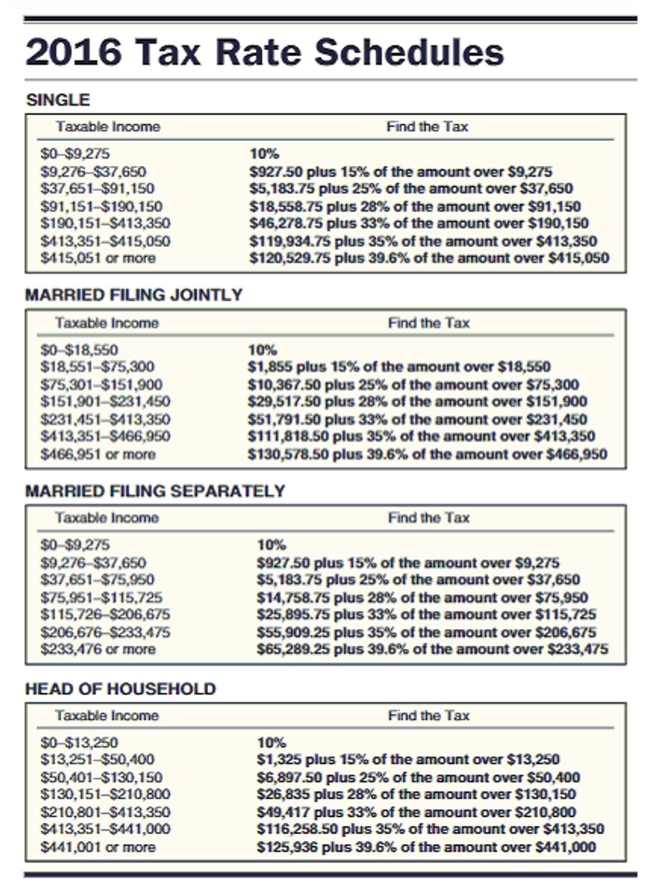

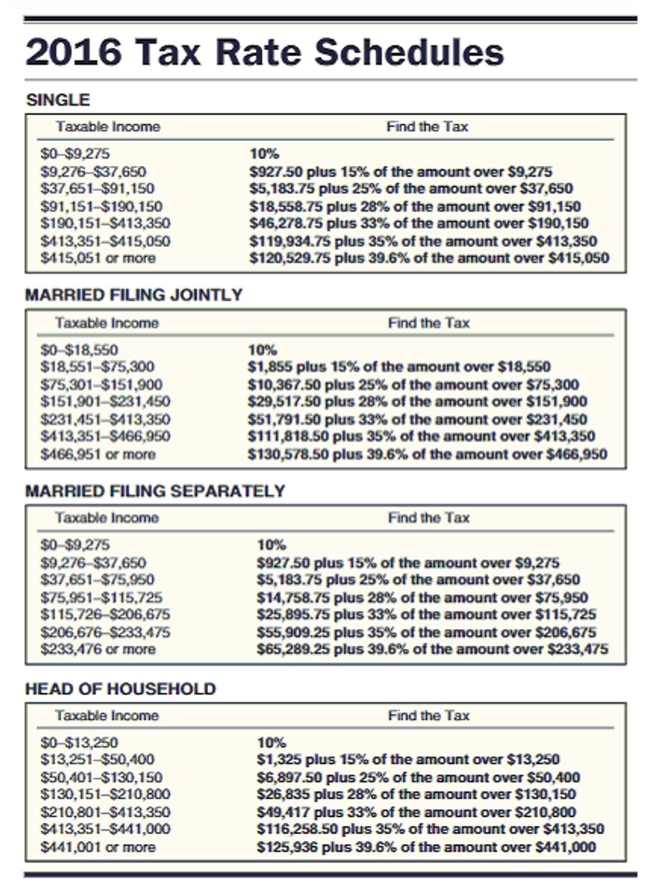

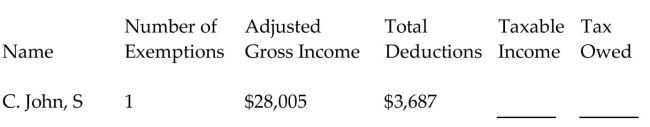

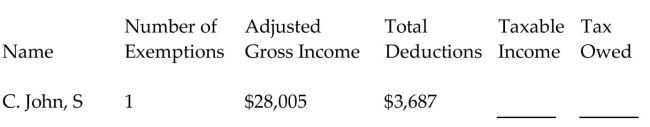

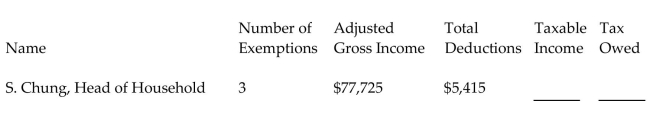

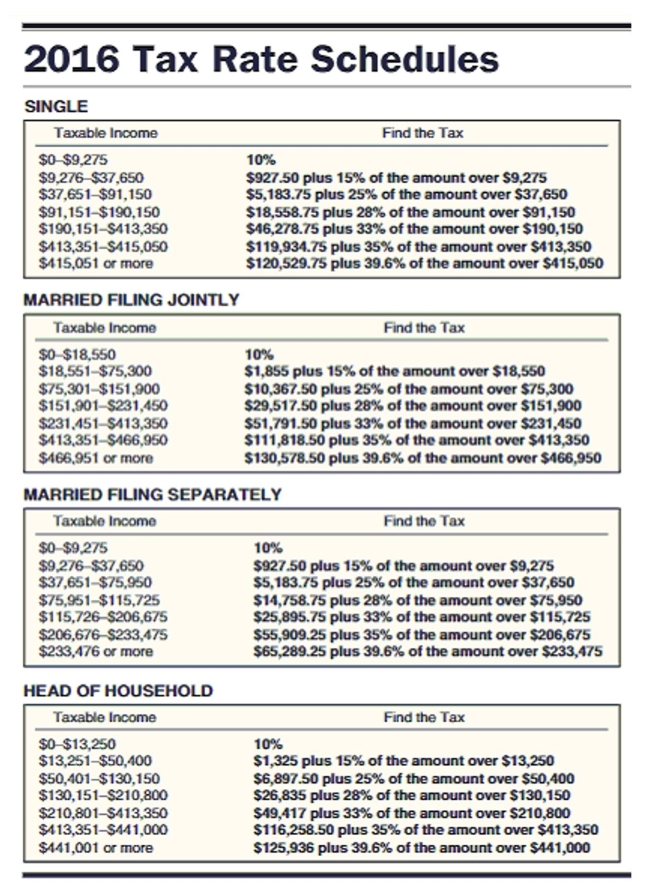

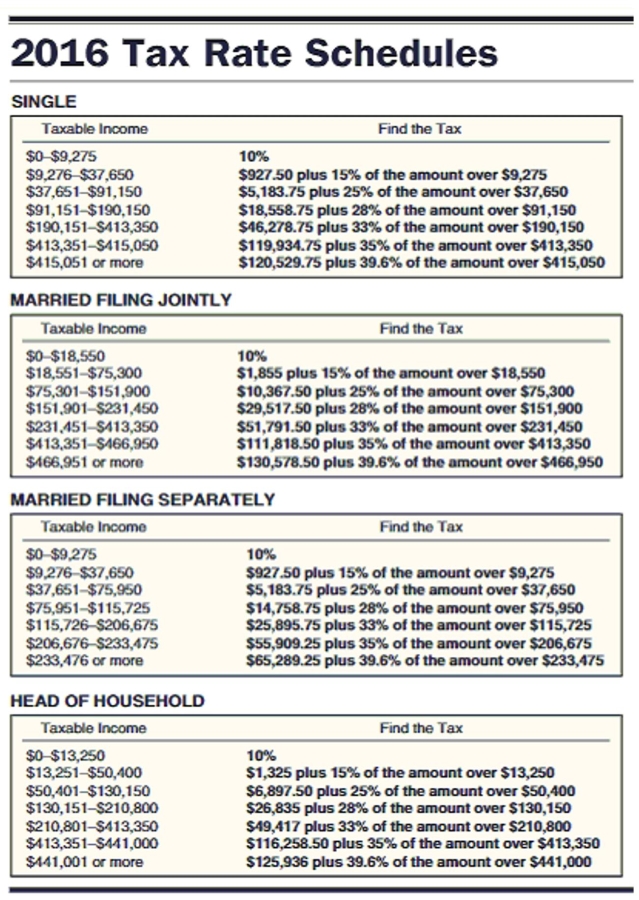

Find the tax refund or tax due for the following people. The letter following the name indicates the marital status. Assume a 52-week year and that all married people are filing jointly. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the tax rate schedule.

A)$16,646.90 due

B)$335.55 due

C)$335.55 refund

D)$16,646.90 refund

A)$16,646.90 due

B)$335.55 due

C)$335.55 refund

D)$16,646.90 refund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

18

Find the property tax. Round to the nearest cent.

Assessed Tax rate valuation :: $82,$7.00400 per $100

A)$1,177.14

B)$576.80

C)$5,768.00

D)$11,771.43

Assessed Tax rate valuation :: $82,$7.00400 per $100

A)$1,177.14

B)$576.80

C)$5,768.00

D)$11,771.43

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

19

Provide an appropriate response.

Describe four factors that determine the premium on an automobile insurance policy.

Describe four factors that determine the premium on an automobile insurance policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

20

Find the amount paid by each of the multiple carriers.

The Robinson Company had an insured fire loss of $708,000. It had insurance coverage as follows: Company A, $725,000; Company B, $500,000; and Company C, $200,000. Find the amount paid by

Each carrier assuming that the coinsurance requirement had been met.

A)$364,350.88, $252,561.40, $91,087.72

B)$358,140.35, $244,280.70, $105,578.95

C)$362,280.70, $258,771.93, $86,947.37

D)$360,210.53, $248,421.05, $99,368.42

The Robinson Company had an insured fire loss of $708,000. It had insurance coverage as follows: Company A, $725,000; Company B, $500,000; and Company C, $200,000. Find the amount paid by

Each carrier assuming that the coinsurance requirement had been met.

A)$364,350.88, $252,561.40, $91,087.72

B)$358,140.35, $244,280.70, $105,578.95

C)$362,280.70, $258,771.93, $86,947.37

D)$360,210.53, $248,421.05, $99,368.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

21

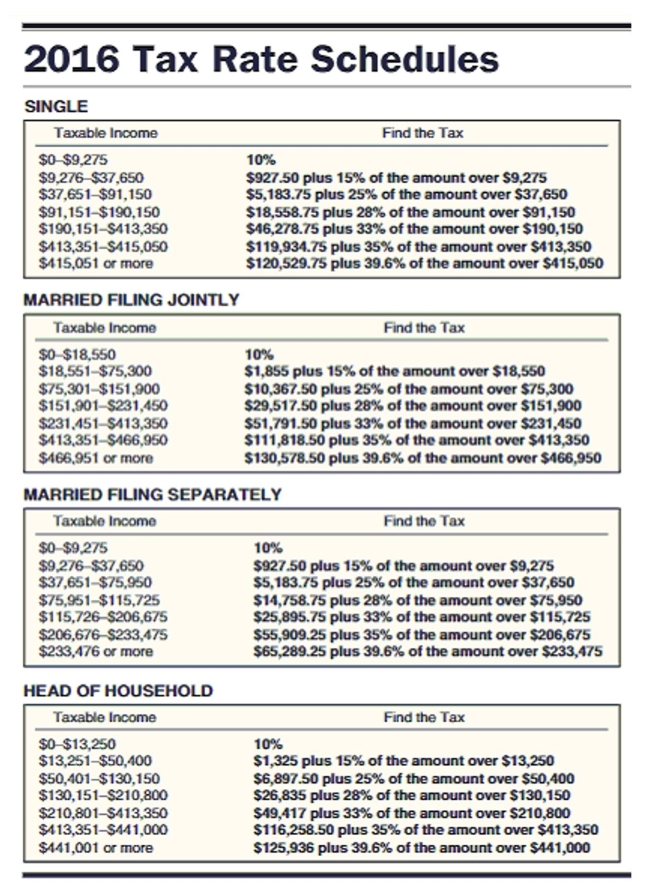

Find the tax refund or tax due for the following people. The letter following the name indicates the marital status. Assume a 52-week year and that all married people are filing jointly. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the tax rate schedule.

A)$1,384.17 refund

B)$11,424.23 refund

C)$1,384.17 due

D)$11,424.23 due

A)$1,384.17 refund

B)$11,424.23 refund

C)$1,384.17 due

D)$11,424.23 due

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

22

Find the indicated premium. Round to the nearest cent.

Find the quarterly premium.

Face Value: $40,000

Age of Insured: 30

Sex of Insured: F

Type of Policy: Whole life

A)$226.40

B)$52.62

C)$202.40

D)$58.86

Find the quarterly premium.

Face Value: $40,000

Age of Insured: 30

Sex of Insured: F

Type of Policy: Whole life

A)$226.40

B)$52.62

C)$202.40

D)$58.86

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

23

Find the adjusted gross income.

Tom and Sandy Bowles had incomes of $19,889 and $8,129. They also had $303 in interest income and an adjustment of $856 in moving expenses.

A)$28,321

B)$27,162

C)$29,177

D)$27,465

Tom and Sandy Bowles had incomes of $19,889 and $8,129. They also had $303 in interest income and an adjustment of $856 in moving expenses.

A)$28,321

B)$27,162

C)$29,177

D)$27,465

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

24

Find the indicated premium. Round to the nearest cent.

Find the annual premium. Face Value: $45,000

Age of Insured: 50

Sex of Insured: M

Type of Policy: Universal life

A)$1,466.55

B)$965.70

C)$477.90

D)$1,180.35

Find the annual premium. Face Value: $45,000

Age of Insured: 50

Sex of Insured: M

Type of Policy: Universal life

A)$1,466.55

B)$965.70

C)$477.90

D)$1,180.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

25

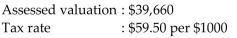

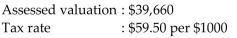

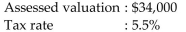

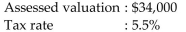

Find the property tax. Round to the nearest cent.

A)$2,359.77

B)$235.98

C)$6,665.50

D)$666.55

A)$2,359.77

B)$235.98

C)$6,665.50

D)$666.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

26

Solve the problem.

Pelican Lumber Company owns a building with a replacement cost of $738,000 which is insured for $531,360 with an 80% coinsurance clause. The building has a fire loss of $20,500. How much will the insurance company pay?

A)$20,500

B)$18,450

C)$14,760

D)$22,140

Pelican Lumber Company owns a building with a replacement cost of $738,000 which is insured for $531,360 with an 80% coinsurance clause. The building has a fire loss of $20,500. How much will the insurance company pay?

A)$20,500

B)$18,450

C)$14,760

D)$22,140

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

27

Solve the problem.

The Corner Cafe has a replacement cost of $232,000 and is insured for $174,000 with an 80% coinsurance clause. The building has a fire loss of $24,500. How much will the insurance company

Pay?

A)$18,375

B)$24,500

C)$27,563

D)$22,969

The Corner Cafe has a replacement cost of $232,000 and is insured for $174,000 with an 80% coinsurance clause. The building has a fire loss of $24,500. How much will the insurance company

Pay?

A)$18,375

B)$24,500

C)$27,563

D)$22,969

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

28

Find the indicated premium. Round to the nearest cent.

Albert Newsom buys a universal life policy with a face value of $60,000. He is 35 years old. Find the quarterly premium.

A)$227.97

B)$40.59

C)$116.22

D)$119.81

Albert Newsom buys a universal life policy with a face value of $60,000. He is 35 years old. Find the quarterly premium.

A)$227.97

B)$40.59

C)$116.22

D)$119.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

29

Find the annual insurance premium.

A person's youthful-operator factor is 2.35. The annual premium for liability coverage is $266.70 for bodily injury and $157.80 for property damage.

A)$1,021.08

B)$999.93

C)$424.50

D)$997.58

A person's youthful-operator factor is 2.35. The annual premium for liability coverage is $266.70 for bodily injury and $157.80 for property damage.

A)$1,021.08

B)$999.93

C)$424.50

D)$997.58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

30

Find the annual insurance premium.

A person's youthful-operator factor is 2.95. The annual premium for liability coverage is $124.00 for bodily injury and $101.00 for property damage.

A)$663.75

B)$666.70

C)$634.25

D)$225.00

A person's youthful-operator factor is 2.95. The annual premium for liability coverage is $124.00 for bodily injury and $101.00 for property damage.

A)$663.75

B)$666.70

C)$634.25

D)$225.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

31

Find the tax rate for the area. Round to the nearest tenth of a percent.

Total tax needed: $3,560,000 Total assessed value: $399,700,000

A)11.2%

B)0.1%

C)0.9%

D)112.3%

Total tax needed: $3,560,000 Total assessed value: $399,700,000

A)11.2%

B)0.1%

C)0.9%

D)112.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

32

Find the amount paid by each insurance company. Assume that any coinsurance requirement is met.

Insurance loss: $102,000

Company A coverage: $400,000

Company B coverage: $50,000

Company C coverage: $50,000

A)A pays: $81,600

B pays: $10,200

C pays: $10,200

B)A pays: $51,000

B pays: $34,000

C pays: $17,000

C)A pays: $34,000

B pays: $34,000

C pays: $34,000

D)A pays: $102,000

B pays: $0

C pays: $0

Insurance loss: $102,000

Company A coverage: $400,000

Company B coverage: $50,000

Company C coverage: $50,000

A)A pays: $81,600

B pays: $10,200

C pays: $10,200

B)A pays: $51,000

B pays: $34,000

C pays: $17,000

C)A pays: $34,000

B pays: $34,000

C pays: $34,000

D)A pays: $102,000

B pays: $0

C pays: $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

33

Find the indicated premium. Round to the nearest cent.

SLM Instruments wants to protect itself in case of the death of its founder and head. It buys a premium term policy on the executive with a face value of $115,000. She is 35 years old. Find the quarterly premium.

A)$117.89

B)$56.51

C)$60.10

D)$19.74

SLM Instruments wants to protect itself in case of the death of its founder and head. It buys a premium term policy on the executive with a face value of $115,000. She is 35 years old. Find the quarterly premium.

A)$117.89

B)$56.51

C)$60.10

D)$19.74

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

34

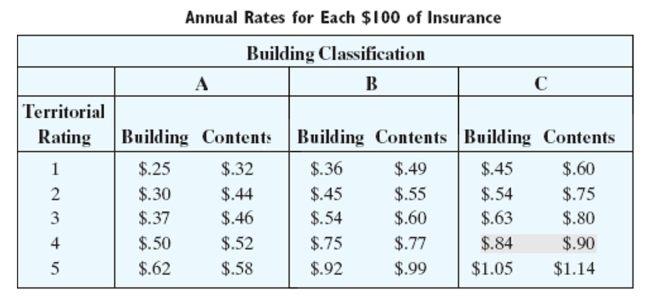

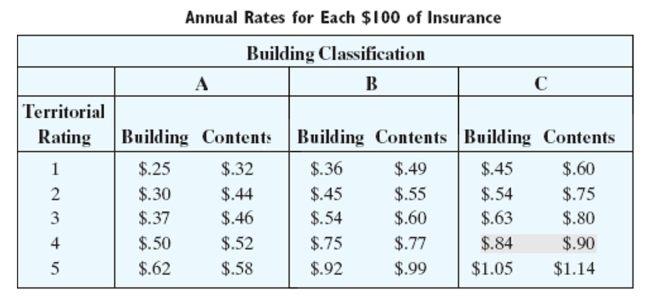

Find the total annual premium. Use the fire insurance rate table. Rates are for each $100 of insurance.

Area Rating: 2

Building Classification: C

Building Value: $512,000

Contents Value: $101,600

A)$4,038.40

B)$3,526.80

C)$4,388.64

D)$2,862.80

Area Rating: 2

Building Classification: C

Building Value: $512,000

Contents Value: $101,600

A)$4,038.40

B)$3,526.80

C)$4,388.64

D)$2,862.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

35

Find the indicated premium. Round to the nearest cent.

Find the semiannual premium.

Face Value: $70,000

Age of Insured: 40

Sex of Insured: M

Type of Policy: 20-pay life

A)$452.32

B)$866.08

C)$1,698.20

D)$771.12

Find the semiannual premium.

Face Value: $70,000

Age of Insured: 40

Sex of Insured: M

Type of Policy: 20-pay life

A)$452.32

B)$866.08

C)$1,698.20

D)$771.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

36

Find the annual premium in territory 1.

Operator age: 59 Comprehensive/Collision Age Group: 1

Driver's ed: yes

Symbol: 7

Liability: 100/300

Property: $50,000

Uninsured motorist: yes

A)$674.00

B)$608.00

C)$1179.50

D)$1044.70

Operator age: 59 Comprehensive/Collision Age Group: 1

Driver's ed: yes

Symbol: 7

Liability: 100/300

Property: $50,000

Uninsured motorist: yes

A)$674.00

B)$608.00

C)$1179.50

D)$1044.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

37

Find the annual premium in territory 1.

Operator age: 62 Comprehensive/Collision Age Group: 3

Driver's ed: yes

Symbol: 7

Liability: 100/300

Property: $50,000

Uninsured motorist: yes

A)$582.00

B)$745.20

C)$630.00

D)$648.00

Operator age: 62 Comprehensive/Collision Age Group: 3

Driver's ed: yes

Symbol: 7

Liability: 100/300

Property: $50,000

Uninsured motorist: yes

A)$582.00

B)$745.20

C)$630.00

D)$648.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

38

Find the property tax. Round to the nearest cent.

Assessed Tax rate valuation :: $50,$1.20400 per $100

A)$4,200.00

B)$42,000.00

C)$604.80

D)$60.48

Assessed Tax rate valuation :: $50,$1.20400 per $100

A)$4,200.00

B)$42,000.00

C)$604.80

D)$60.48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

39

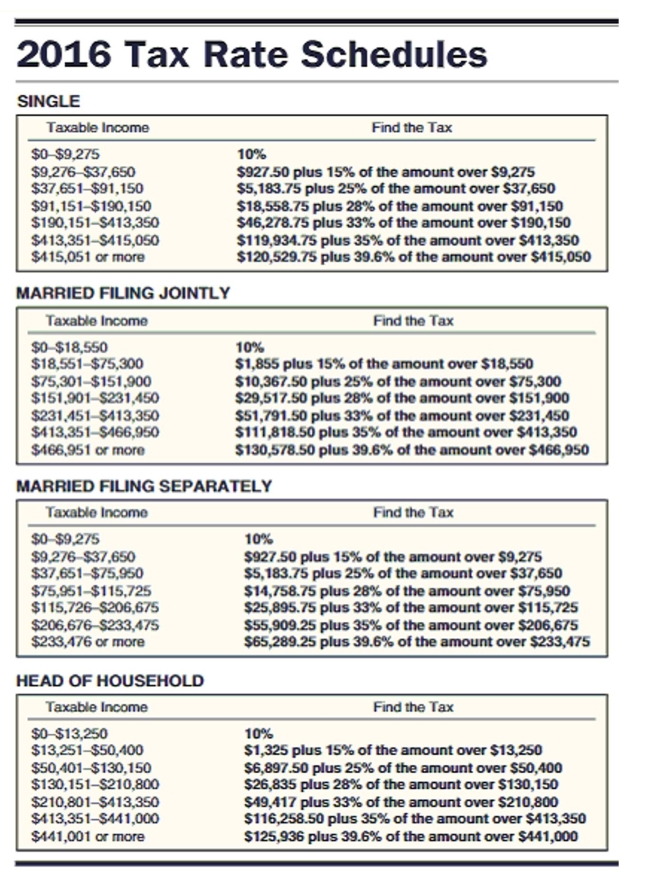

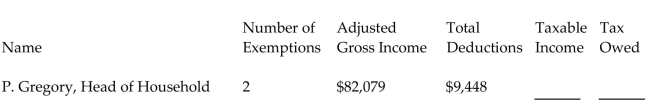

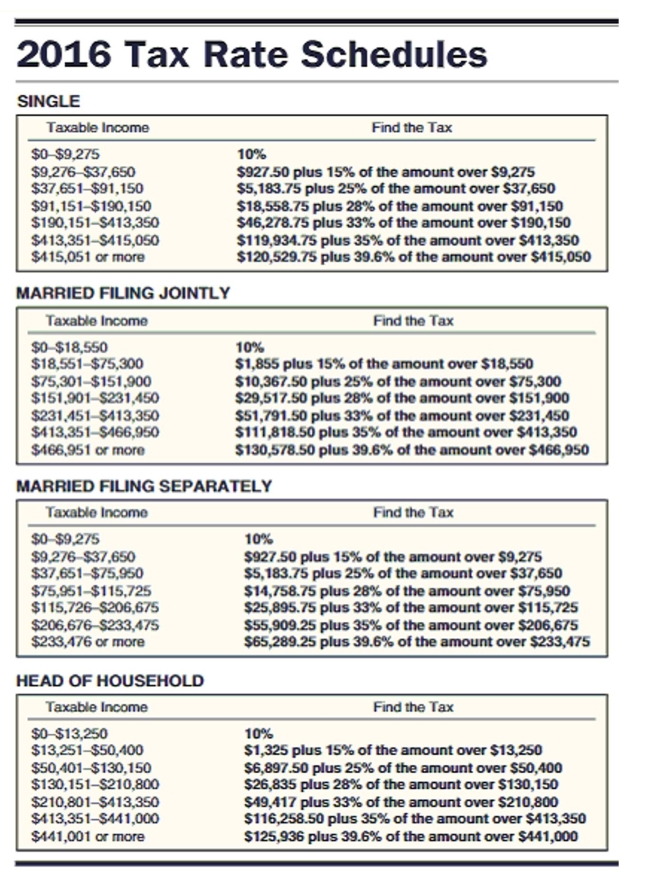

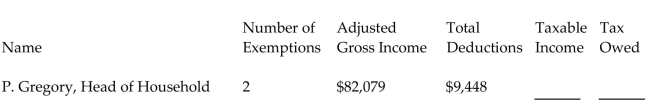

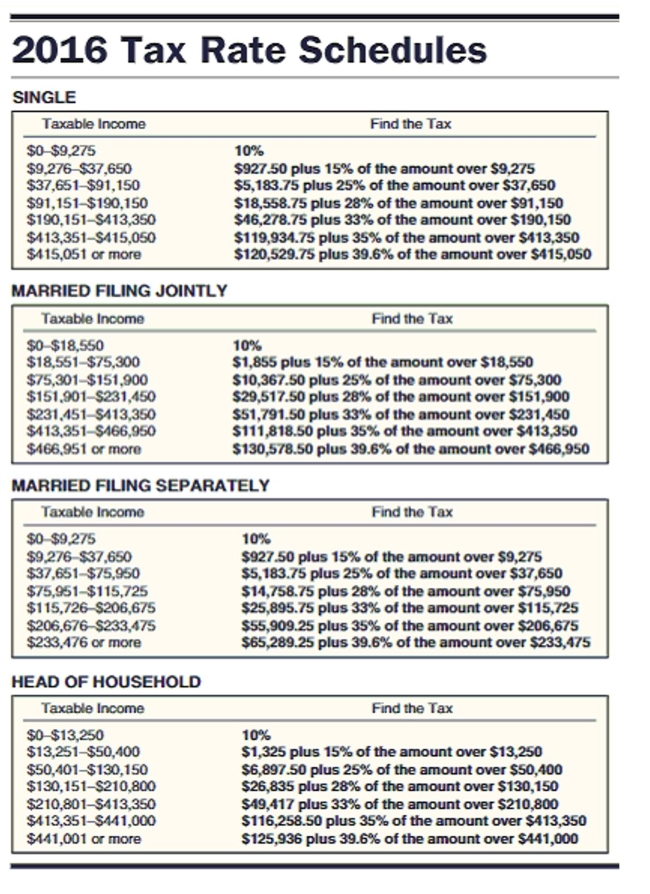

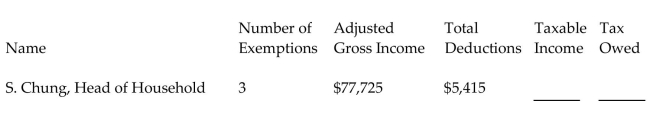

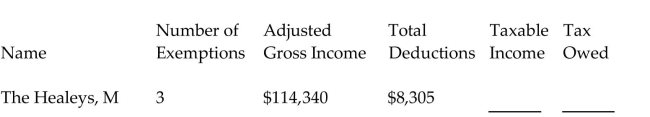

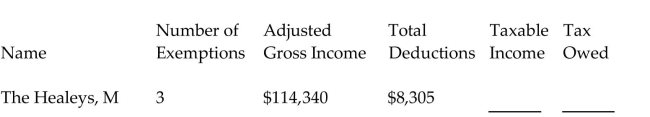

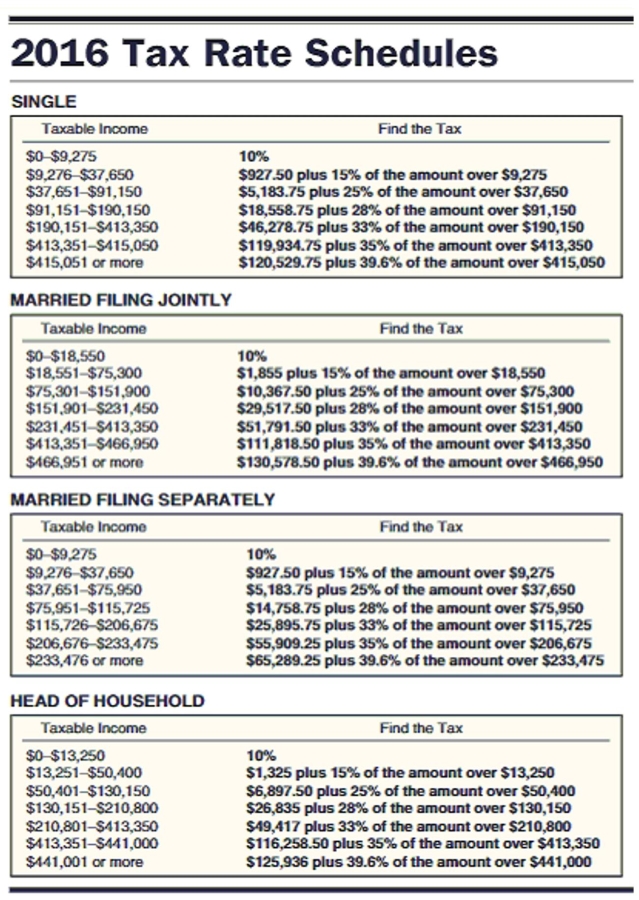

Find the amount of taxable income and the tax owed for the following people. The letter following the name indicates the marital status and all married people are filing jointly. Use $4050 for each personal exemption; $6300 as the standard deduction for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the following tax rate schedule.

A)$64,679; $11,075.25

B)$64,679; $11,312.25

C)$66,179; $11,910.12

D)$64,531; $10,430.25

A)$64,679; $11,075.25

B)$64,679; $11,312.25

C)$66,179; $11,910.12

D)$64,531; $10,430.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

40

Find the tax rate for the area. Round to the nearest tenth of a percent.

Total tax needed: $948,000

Total assessed value: $148,720,000

A)0.6%

B)0.8%

C)6.00%

D)0.5%

Total tax needed: $948,000

Total assessed value: $148,720,000

A)0.6%

B)0.8%

C)6.00%

D)0.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

41

Solve the problem.

Mark Stephens owns rental units with a replacement cost of $290,000 which are insured for $188,500 with an 80% coinsurance clause. There is a fire loss of $20,500. How much will the insurance company pay?

A)$13,325

B)$19,988

C)$20,500

D)$16,656

Mark Stephens owns rental units with a replacement cost of $290,000 which are insured for $188,500 with an 80% coinsurance clause. There is a fire loss of $20,500. How much will the insurance company pay?

A)$13,325

B)$19,988

C)$20,500

D)$16,656

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

42

Find the amount to be paid by the insurance company. Assume the policy includes an 80% coinsurance clause. Round to the nearest dollar.

Replacement Cost of Building: $367,000

Face Value of Policy: $257,000

Amount of Loss: $2,200

A)$2,200

B)$2,514

C)$1,760

D)$1,926

Replacement Cost of Building: $367,000

Face Value of Policy: $257,000

Amount of Loss: $2,200

A)$2,200

B)$2,514

C)$1,760

D)$1,926

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

43

Find the adjusted gross income.

Juan and Amy Marino had incomes of $23,730 and $25,661. They also had $175 in stock dividends and $859 in interest. They both contributed to their Individual Retirement Accounts in amounts of $1,068 and $1,134.

A)$48,223

B)$48,048

C)$50,425

D)$52,627

Juan and Amy Marino had incomes of $23,730 and $25,661. They also had $175 in stock dividends and $859 in interest. They both contributed to their Individual Retirement Accounts in amounts of $1,068 and $1,134.

A)$48,223

B)$48,048

C)$50,425

D)$52,627

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

44

Find the assessed value for the property.

Fair market value: $87,000

Rate of assessment: 80%

A)$696,000

B)$69,600

C)$17,400

D)$34,800

Fair market value: $87,000

Rate of assessment: 80%

A)$696,000

B)$69,600

C)$17,400

D)$34,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

45

Find the indicated premium. Round to the nearest cent.

Find the annual premium.

Face Value: $45,000

Age of Insured: 25

Sex of Insured: F

Type of Policy: Whole life

A)$102.60

B)$116.10

C)$183.15

D)$227.70

Find the annual premium.

Face Value: $45,000

Age of Insured: 25

Sex of Insured: F

Type of Policy: Whole life

A)$102.60

B)$116.10

C)$183.15

D)$227.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

46

Solve the problem.

In one county, property is assessed at 45% of market value with a tax rate of 35.8 mills. In a second county, property is assessed at 33% of market value with a tax rate of 42.0 mills. If you had $110,000 to spend on a house, which county would charge the lower property tax? Find the annual amount saved.

A)First county, $2,475.00

B)Second county, $2,475.00

C)Second county, $247.50

D)First county, $247.50

In one county, property is assessed at 45% of market value with a tax rate of 35.8 mills. In a second county, property is assessed at 33% of market value with a tax rate of 42.0 mills. If you had $110,000 to spend on a house, which county would charge the lower property tax? Find the annual amount saved.

A)First county, $2,475.00

B)Second county, $2,475.00

C)Second county, $247.50

D)First county, $247.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

47

Find the property tax. Round to

A)$618.18

B)$187.00

C)$6,181.82

D)$1,870.00

A)$618.18

B)$187.00

C)$6,181.82

D)$1,870.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

48

Find the annual premium in territory 1.

Operator age: 22

Comprehensive/Collision Age Group: 4

Driver's ed: no

Symbol: 7

Liability: 25/50

Property: $10,000

Uninsured motorist: no

A)$1029.00

B)$1176.00

C)$1445.50

D)$1151.50

Operator age: 22

Comprehensive/Collision Age Group: 4

Driver's ed: no

Symbol: 7

Liability: 25/50

Property: $10,000

Uninsured motorist: no

A)$1029.00

B)$1176.00

C)$1445.50

D)$1151.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

49

Find the annual premium in territory 1.

Operator age: 20

Comprehensive/Collision Age Group: 4

Driver's ed: yes

Symbol: 7

Liability: 15/30

Property: $10,000

Uninsured motorist: no

A)$541.00

B)$475.00

C)$1401.25

D)$1116.25

Operator age: 20

Comprehensive/Collision Age Group: 4

Driver's ed: yes

Symbol: 7

Liability: 15/30

Property: $10,000

Uninsured motorist: no

A)$541.00

B)$475.00

C)$1401.25

D)$1116.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

50

Find the indicated premium. Round to the nearest cent.

Find the total premium paid over 30 years for a whole life policy with a face value of $20,000. Assume the policy is taken out by a 25-year-old woman.

A)$3,036.00

B)$3,066.00

C)$2,442.00

D)$2,088.00

Find the total premium paid over 30 years for a whole life policy with a face value of $20,000. Assume the policy is taken out by a 25-year-old woman.

A)$3,036.00

B)$3,066.00

C)$2,442.00

D)$2,088.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

51

Solve the problem.

A taxpayer's property has a market value of $117,000. The rate of assessment in the area is 30%. The tax rate is $7.55 per $100 of assessed valuation. Find the property tax.

A)$265,005.00

B)$883,350.00

C)$8,833.50

D)$2,650.05

A taxpayer's property has a market value of $117,000. The rate of assessment in the area is 30%. The tax rate is $7.55 per $100 of assessed valuation. Find the property tax.

A)$265,005.00

B)$883,350.00

C)$8,833.50

D)$2,650.05

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

52

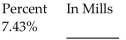

Find the indicated tax rate.

A)$74.30

B)7.43

C)$0.74

D)74.3

A)$74.30

B)7.43

C)$0.74

D)74.3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

53

Find the amount paid by each of the multiple carriers.

The Baker Fur Company had an insured fire loss of $2,364,000. It had insurance coverage as follows: Company A, $2,000,000; Company B, $750,000; and Company C, $325,000. Find the amount paid by each carrier assuming that the coinsurance requirement had been met.

A)$1,537,560.98, $576,585.37, $249,853.66

B)$1,569,593.50, $560,569.11, $233,837.40

C)$1,601,626.02, $528,536.59, $233,837.40

D)$1,441,463.41, $640,650.41, $281,886.18

The Baker Fur Company had an insured fire loss of $2,364,000. It had insurance coverage as follows: Company A, $2,000,000; Company B, $750,000; and Company C, $325,000. Find the amount paid by each carrier assuming that the coinsurance requirement had been met.

A)$1,537,560.98, $576,585.37, $249,853.66

B)$1,569,593.50, $560,569.11, $233,837.40

C)$1,601,626.02, $528,536.59, $233,837.40

D)$1,441,463.41, $640,650.41, $281,886.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

54

Find the total annual premium. Use the fire insurance rate table. Rates are for each $100 of insurance.

Area Rating: 4

Building Classification: B

Building Value: $291,000

Contents Value: $102,000

A)$2,967.90

B)$2,278.20

C)$3,005.70

D)$296.79

Area Rating: 4

Building Classification: B

Building Value: $291,000

Contents Value: $102,000

A)$2,967.90

B)$2,278.20

C)$3,005.70

D)$296.79

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

55

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

Glenn and Natalie Dowling had combined wages and salaries of $69,117, other income of $5,258, dividend income of $317, and interest income of $664. They have adjustments to income of $2,435. Their itemized deductions are $9,180 in mortgage interest, $1,611 in state income tax, $846 in real estate taxes, and $1,193 in charitable contributions. The Dowlings filed a joint return and claimed four exemptions.

A)$4,243.65

B)$8,772.75

C)$6,128.15

D)$5,656.15

Glenn and Natalie Dowling had combined wages and salaries of $69,117, other income of $5,258, dividend income of $317, and interest income of $664. They have adjustments to income of $2,435. Their itemized deductions are $9,180 in mortgage interest, $1,611 in state income tax, $846 in real estate taxes, and $1,193 in charitable contributions. The Dowlings filed a joint return and claimed four exemptions.

A)$4,243.65

B)$8,772.75

C)$6,128.15

D)$5,656.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

56

Find the amount paid by each insurance company. Assume that any coinsurance requirement is met.

Insurance loss: $10,000

Company A coverage: $84,000

Company B coverage: $28,000

A) A pays: $8,400

B pays: $1,600

B) A pays: $7,200

B pays: $2,800

C) A pays: $7,500

B pays: $2,500

D) A pays: $10,000

B pays: $0

Insurance loss: $10,000

Company A coverage: $84,000

Company B coverage: $28,000

A) A pays: $8,400

B pays: $1,600

B) A pays: $7,200

B pays: $2,800

C) A pays: $7,500

B pays: $2,500

D) A pays: $10,000

B pays: $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

57

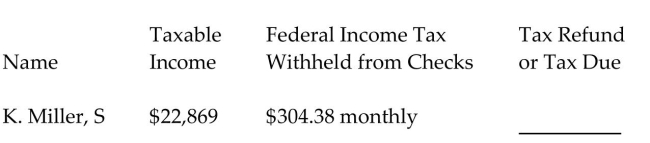

Find the tax refund or tax due for the following people. The letter following the name indicates the marital status. Assume a 52-week year and that all married people are filing jointly. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the tax rate schedule.

A)$2,662.22 due

B)$685.96 due

C)$2,662.22 refund

D)$685.96 refund

A)$2,662.22 due

B)$685.96 due

C)$2,662.22 refund

D)$685.96 refund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

58

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

Mark Collins had an adjusted gross income of $26,741 last year. He had deductions of $899 for state income tax, $555 for property tax, $2,824 in mortgage interest, and $221 in contributions. Collins claims one exemption and files as a single person.

A)$1,311.15

B)$1,994.90

C)$3,631.30

D)$2,356.30

Mark Collins had an adjusted gross income of $26,741 last year. He had deductions of $899 for state income tax, $555 for property tax, $2,824 in mortgage interest, and $221 in contributions. Collins claims one exemption and files as a single person.

A)$1,311.15

B)$1,994.90

C)$3,631.30

D)$2,356.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

59

Solve the problem.

A driver injures a bicycle rider. The driver has bodily injury limits of 15/30. In court, the injured rider is awarded damages of $23,000. Find the amount that the insurance company must pay and the amount that the insured must pay.

A)$0, $15,000

B)$30,000, $0

C)$23,000, $0

D)$15,000, $8,000

A driver injures a bicycle rider. The driver has bodily injury limits of 15/30. In court, the injured rider is awarded damages of $23,000. Find the amount that the insurance company must pay and the amount that the insured must pay.

A)$0, $15,000

B)$30,000, $0

C)$23,000, $0

D)$15,000, $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

60

Find the property tax. Round to

Assessed Tax rate valuation :: $167

A)$1,085.40

B)$2,417.91

C)$108,540.00

D)$10,854.00

Assessed Tax rate valuation :: $167

A)$1,085.40

B)$2,417.91

C)$108,540.00

D)$10,854.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

61

Find the total annual premium. Use the fire insurance rate table. Rates are for each $100 of insurance.

Area Rating: 2

Building Classification: B

Building Value: $878,000

Contents Value: $451,000

A)$6,431.50

B)$6,858.50

C)$643.15

D)$7,447.20

Area Rating: 2

Building Classification: B

Building Value: $878,000

Contents Value: $451,000

A)$6,431.50

B)$6,858.50

C)$643.15

D)$7,447.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

62

Find the indicated premium. Round to the nearest cent.

Susan Meyer buys a premium term policy at age 25. The policy has a face value of $45,000. Find the monthly premium.

A)$18.72

B)$21.29

C)$7.44

D)$6.54

Susan Meyer buys a premium term policy at age 25. The policy has a face value of $45,000. Find the monthly premium.

A)$18.72

B)$21.29

C)$7.44

D)$6.54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

63

Find the adjusted gross income.

Nancy earned $18,575 in salary, $1,084 in unemployment compensation, and $74 in dividends. She contributed $871 to her Individual Retirement Account.

A)$18,862

B)$20,604

C)$19,733

D)$18,788

Nancy earned $18,575 in salary, $1,084 in unemployment compensation, and $74 in dividends. She contributed $871 to her Individual Retirement Account.

A)$18,862

B)$20,604

C)$19,733

D)$18,788

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

64

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

Brian Moss had wages of $80,745, dividends of $374, interest of $684, and adjustments to income of $1,066 last year. He had deductions of $878 for state income tax, $452 for city income tax, $988 for property tax, $7,336 in mortgage interest, and $182 in contributions. He claims three exemptions and files as head of household.

A)$8,362.65

B)$10,051.75

C)$8,985.25

D)$3,387.75

Brian Moss had wages of $80,745, dividends of $374, interest of $684, and adjustments to income of $1,066 last year. He had deductions of $878 for state income tax, $452 for city income tax, $988 for property tax, $7,336 in mortgage interest, and $182 in contributions. He claims three exemptions and files as head of household.

A)$8,362.65

B)$10,051.75

C)$8,985.25

D)$3,387.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

65

Find the amount of taxable income and the tax owed for the following people. The letter following the name indicates the marital status and all married people are filing jointly. Use $4050 for each personal exemption; $6300 as the standard deduction for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the following tax rate schedule.

A)$23,955; $3,220.75

B)$17,655; $2,184.50

C)$20,268; $2,667.70

D)$22,205; $2,905.75

A)$23,955; $3,220.75

B)$17,655; $2,184.50

C)$20,268; $2,667.70

D)$22,205; $2,905.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

66

Find the amount to be paid by the insurance company. Assume the policy includes an 80% coinsurance clause. Round to the nearest dollar.

Replacement Cost of Building: $50,000

Face Value of Policy: $30,000

Amount of Loss: $2,800

A)$1,680

B)$2,100

C)$2,240

D)$2,800

Replacement Cost of Building: $50,000

Face Value of Policy: $30,000

Amount of Loss: $2,800

A)$1,680

B)$2,100

C)$2,240

D)$2,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

67

Solve the problem.

Haverty's Furniture owns a building with a replacement cost of $590,000 which is insured for $371,700 with an 80% coinsurance clause. The building has a fire loss of $20,500. How much will the insurance company pay?

A)$12,915

B)$16,144

C)$20,500

D)$19,373

Haverty's Furniture owns a building with a replacement cost of $590,000 which is insured for $371,700 with an 80% coinsurance clause. The building has a fire loss of $20,500. How much will the insurance company pay?

A)$12,915

B)$16,144

C)$20,500

D)$19,373

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

68

Find the total annual premium. Use the fire insurance rate table. Rates are for each $100 of insurance.

Area Rating: 1

Building Classification: A

Building Value: $182,000

Contents Value: $38,000

A)$57.66

B)$677.40

C)$576.60

D)$713.20

Area Rating: 1

Building Classification: A

Building Value: $182,000

Contents Value: $38,000

A)$57.66

B)$677.40

C)$576.60

D)$713.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

69

Find the assessed value for the property.

Fair market value: $189,000

Rate of assessment: 85%

A)$28,350

B)$160,650

C)$80,325

D)$1,606,500

Fair market value: $189,000

Rate of assessment: 85%

A)$28,350

B)$160,650

C)$80,325

D)$1,606,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

70

Find the amount of taxable income and the tax owed for the following people. The letter following the name indicates the marital status and all married people are filing jointly. Use $4050 for each personal exemption; $6300 as the standard deduction for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the following tax rate schedule.

A)$58,125; $9,655.00

B)$59,275; $9,973.75

C)$60,160; $10,070.00

D)$56,275; $8,366.25

A)$58,125; $9,655.00

B)$59,275; $9,973.75

C)$60,160; $10,070.00

D)$56,275; $8,366.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

71

Find the amount paid by each of the multiple carriers.

The Star Tool Company had an insured fire loss of $1,416,000. It had insurance coverage as follows: Company A, $4,500,000; Company B, $2,500,000; and Company C, $1,000,000. Find the amount paid by each carrier assuming that the coinsurance requirement had been met.

A)$767,000, $413,000, $236,000

B)$796,500, $442,500, $177,000

C)$826,000, $413,000, $177,000

D)$855,500, $354,000, $206,500

The Star Tool Company had an insured fire loss of $1,416,000. It had insurance coverage as follows: Company A, $4,500,000; Company B, $2,500,000; and Company C, $1,000,000. Find the amount paid by each carrier assuming that the coinsurance requirement had been met.

A)$767,000, $413,000, $236,000

B)$796,500, $442,500, $177,000

C)$826,000, $413,000, $177,000

D)$855,500, $354,000, $206,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

72

Find the amount paid by each of the multiple carriers.

The Hamilton Race Track had a fire loss of $207,000. They had insurance as follows: company A, $400,000; company B, $50,000; and company C, $50,000. Find the amount paid by each carrier. Assume the coinsurance requirement is met.

A)A pays: $103,500

B pays: $69,000

C pays: $34,500

B)A pays: $82,800

B pays: $82,800

C pays: $41,400

C)A pays: $165,600

B pays: $20,700

C pays: $20,700

D)A pays: $207,000

B pays: $0

C pays: $0

The Hamilton Race Track had a fire loss of $207,000. They had insurance as follows: company A, $400,000; company B, $50,000; and company C, $50,000. Find the amount paid by each carrier. Assume the coinsurance requirement is met.

A)A pays: $103,500

B pays: $69,000

C pays: $34,500

B)A pays: $82,800

B pays: $82,800

C pays: $41,400

C)A pays: $165,600

B pays: $20,700

C pays: $20,700

D)A pays: $207,000

B pays: $0

C pays: $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

73

Solve the problem.

A taxpayer's property has a fair market value of $92,000. The rate of assessment in the area is 25%. The tax rate is $6.76 per $100 of assessed valuation. Find the property tax.

A)$621,920.00

B)$155,480.00

C)$1,554.80

D)$6,219.20

A taxpayer's property has a fair market value of $92,000. The rate of assessment in the area is 25%. The tax rate is $6.76 per $100 of assessed valuation. Find the property tax.

A)$621,920.00

B)$155,480.00

C)$1,554.80

D)$6,219.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

74

Find the amount paid by each of the multiple carriers.

The London Coat Company had an insured fire loss of $167,000. It had insurance coverage as follows: Company A, $500,000; Company B, $350,000; and Company C, $150,000. Find the amount paid by each carrier assuming that the coinsurance requirement had been met.

A)$91,850, $54,275, $20,875

B)$87,675, $50,100, $29,225

C)$79,325, $54,275, $33,400

D)$83,500, $58,450, $25,050

The London Coat Company had an insured fire loss of $167,000. It had insurance coverage as follows: Company A, $500,000; Company B, $350,000; and Company C, $150,000. Find the amount paid by each carrier assuming that the coinsurance requirement had been met.

A)$91,850, $54,275, $20,875

B)$87,675, $50,100, $29,225

C)$79,325, $54,275, $33,400

D)$83,500, $58,450, $25,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

75

Find the amount paid by each of the multiple carriers.

A building with a replacement cost of $1,100,000 has fire damages of $360,000. The insurance coverage is split between Company A ($500,000)and Company B ($300,000). Find (a)the amount of the loss covered and (b)amount paid by each company. (Note that the coinsurance requirement has not been met.)

A)(a)$327,272.73$204,545.45

(b)Company A: $204,545.45

Company B: $122,727.27

B)(a $360,000

(b)Company A: $180,000.00

Company B: $180,000.00

C)(a)$327,272.73

(b)Company A: $163,636.36

Company B: $163,636.36

D)(a)$360,000

(b)Company A: $225,000.00

Company B: $135,000.00

A building with a replacement cost of $1,100,000 has fire damages of $360,000. The insurance coverage is split between Company A ($500,000)and Company B ($300,000). Find (a)the amount of the loss covered and (b)amount paid by each company. (Note that the coinsurance requirement has not been met.)

A)(a)$327,272.73$204,545.45

(b)Company A: $204,545.45

Company B: $122,727.27

B)(a $360,000

(b)Company A: $180,000.00

Company B: $180,000.00

C)(a)$327,272.73

(b)Company A: $163,636.36

Company B: $163,636.36

D)(a)$360,000

(b)Company A: $225,000.00

Company B: $135,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

76

Find the total annual premium. Use the fire insurance rate table. Rates are for each $100 of insurance.

Area Rating: 3

Building Classification: C

Building Value: $438,000

Contents Value: $149,000

A)$2,306.00

B)$3,951.40

C)$4,442.70

D)$395.14

Area Rating: 3

Building Classification: C

Building Value: $438,000

Contents Value: $149,000

A)$2,306.00

B)$3,951.40

C)$4,442.70

D)$395.14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

77

Find the amount of taxable income and the tax owed for the following people. The letter following the name indicates the marital status and all married people are filing jointly. Use $4050 for each personal exemption; $6300 as the standard deduction for single taxpayers, $12,600 for married taxpayers filing jointly, and $9300 for head of household and the following tax rate schedule.

A)$81,285; $15,013.75

B)$89,590; $13,940.00

C)$97,440; $16,610.00

D)$91,640; $15,839.20

A)$81,285; $15,013.75

B)$89,590; $13,940.00

C)$97,440; $16,610.00

D)$91,640; $15,839.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

78

Find the amount paid by each of the multiple carriers.

The Robins Furniture Company had an insured fire loss of $191,000. It had insurance coverage as follows: Company A, $475,000; Company B, $325,000; and Company C, $175,000. Find the amount paid by each carrier assuming that the coinsurance requirement had been met.

A)$93,051.28, $63,666.67, $34,282.05

B)$85,705.13, $61,217.95, $44,076.92

C)$88,153.85, $58,769.23, $44,076.92

D)$97,948.72, $61,217.95, $31,833.33

The Robins Furniture Company had an insured fire loss of $191,000. It had insurance coverage as follows: Company A, $475,000; Company B, $325,000; and Company C, $175,000. Find the amount paid by each carrier assuming that the coinsurance requirement had been met.

A)$93,051.28, $63,666.67, $34,282.05

B)$85,705.13, $61,217.95, $44,076.92

C)$88,153.85, $58,769.23, $44,076.92

D)$97,948.72, $61,217.95, $31,833.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

79

Find the adjusted gross income.

Curt had income from these sources: $19,794 from his job, $61 in interest, and $248 in dividends. He paid $3,189 in alimony.

A)$20,103

B)$16,914

C)$16,853

D)$23,292

Curt had income from these sources: $19,794 from his job, $61 in interest, and $248 in dividends. He paid $3,189 in alimony.

A)$20,103

B)$16,914

C)$16,853

D)$23,292

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

80

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

Jennifer Binh is single and claims one exemption. Her salary last year was $95,949, and she had other income of $5,852 and interest income of $8,110. She has adjustment to income of $2,218 for an IRA contribution. Her itemized deductions are $4,996 in mortgage interest, $2,376 in state income tax, $1,642 in real estate taxes, and $782 in charitable contributions.

A)$19,674.25

B)$19,313.91

C)$2,967.16

D)$21,111.04

Jennifer Binh is single and claims one exemption. Her salary last year was $95,949, and she had other income of $5,852 and interest income of $8,110. She has adjustment to income of $2,218 for an IRA contribution. Her itemized deductions are $4,996 in mortgage interest, $2,376 in state income tax, $1,642 in real estate taxes, and $782 in charitable contributions.

A)$19,674.25

B)$19,313.91

C)$2,967.16

D)$21,111.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck