Deck 15: Financial Statements and Ratios

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/54

العب

ملء الشاشة (f)

Deck 15: Financial Statements and Ratios

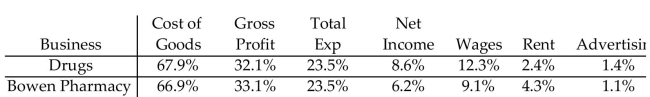

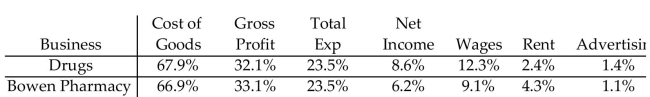

1

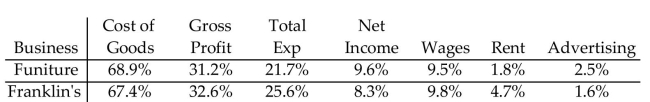

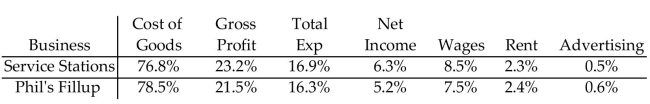

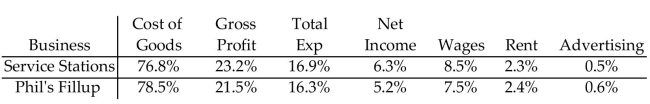

The table compares the national averages for an industry to the results for a given company in the industry. Identify any areas that might require attention by management and offer suggestions.

Net income is lower while wages are lower and rent is higher than average. (Suggestions will vary.)

2

Provide an appropriate response.

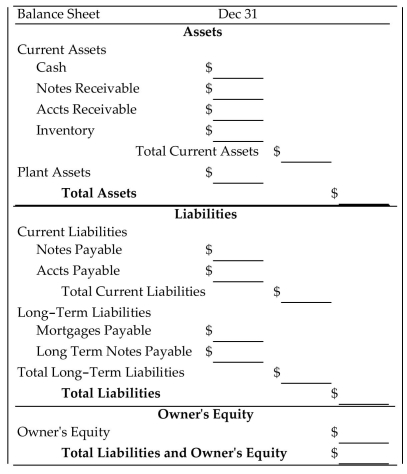

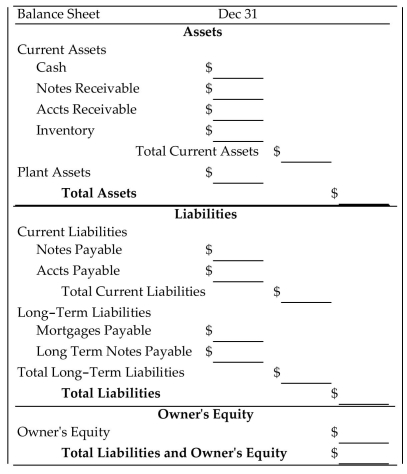

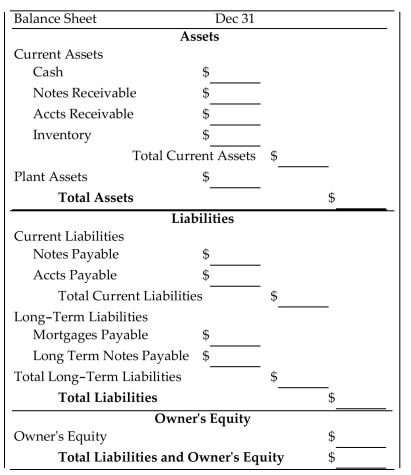

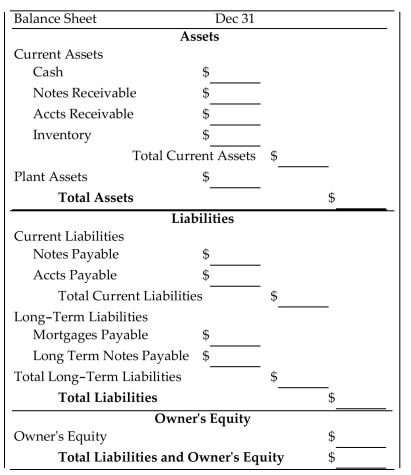

Explain the purpose of a balance sheet.

Explain the purpose of a balance sheet.

Answers will vary.

3

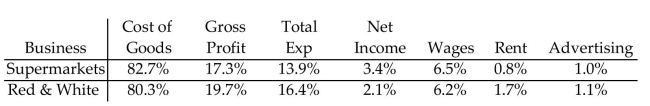

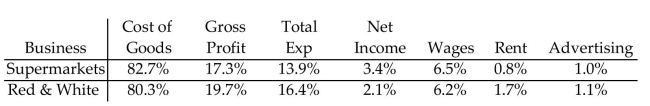

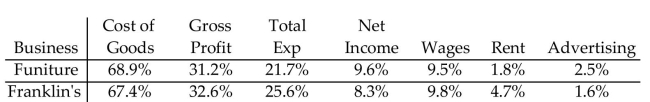

The table compares the national averages for an industry to the results for a given company in the industry. Identify any areas that might require attention by management and offer suggestions.

Net income is lower while total expenses and rent are higher than average. (Suggestions will vary.)

4

Provide an appropriate response.

Explain the purpose of the ratio of net income after taxes to average owner's equity.

Explain the purpose of the ratio of net income after taxes to average owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

5

Provide an appropriate response.

Explain why the acid-test ratio is a better measure of financial health than the current ratio.

Explain why the acid-test ratio is a better measure of financial health than the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

6

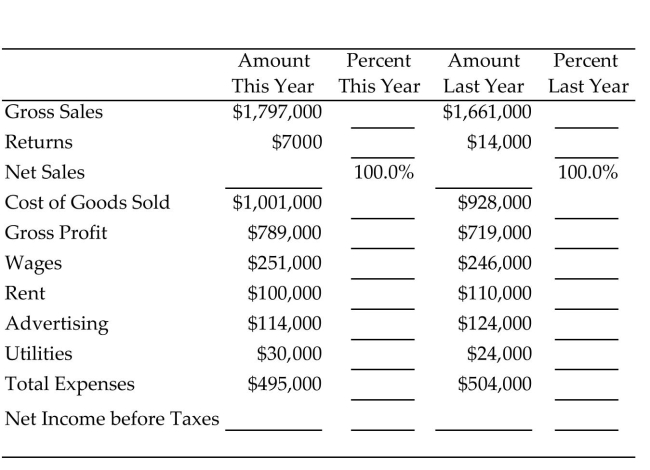

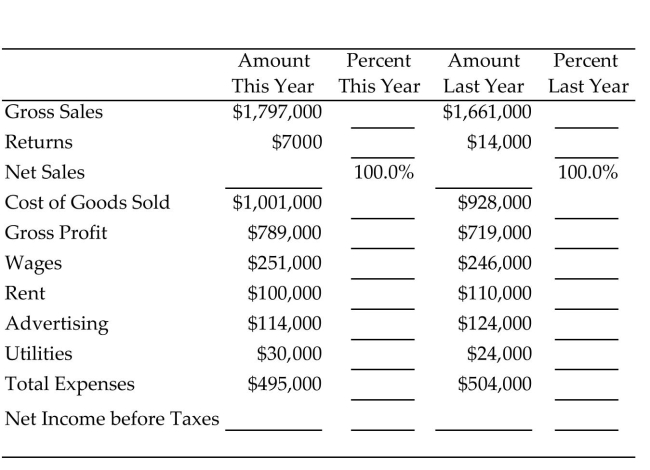

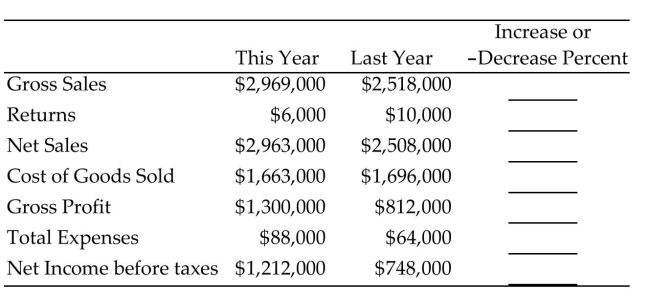

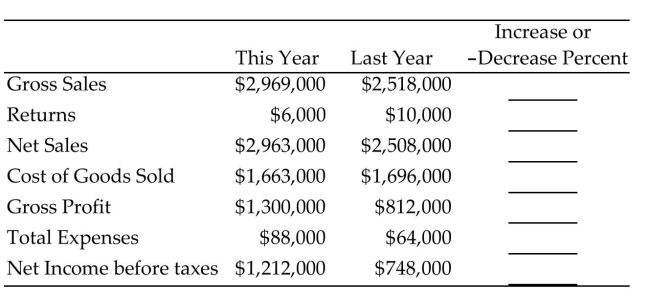

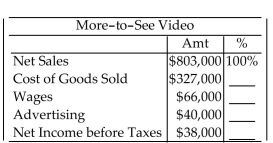

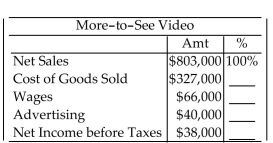

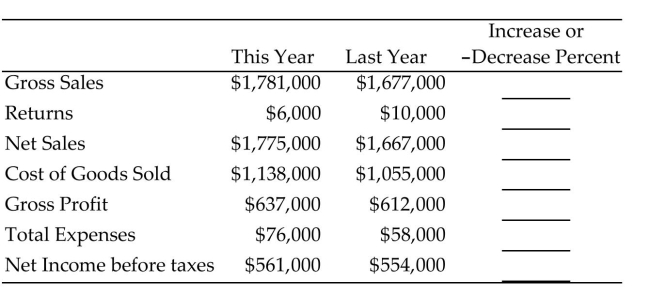

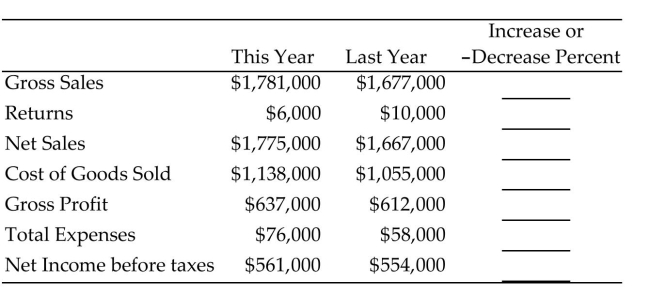

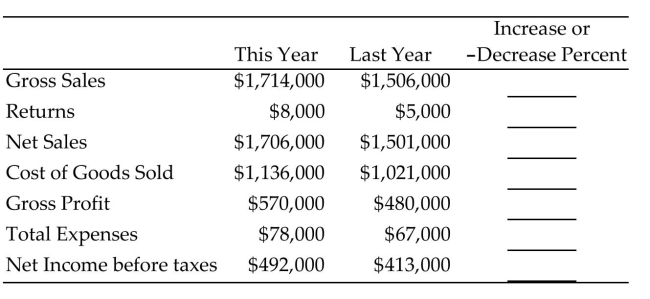

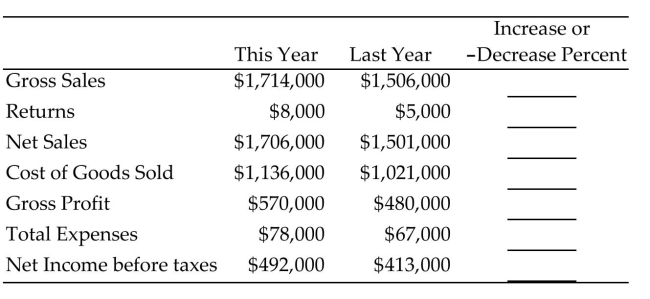

Complete the comparative income statement. Round percents to the nearest tenth of a percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

7

Provide an appropriate response.

Explain how to determine the cost of goods sold.

Explain how to determine the cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

8

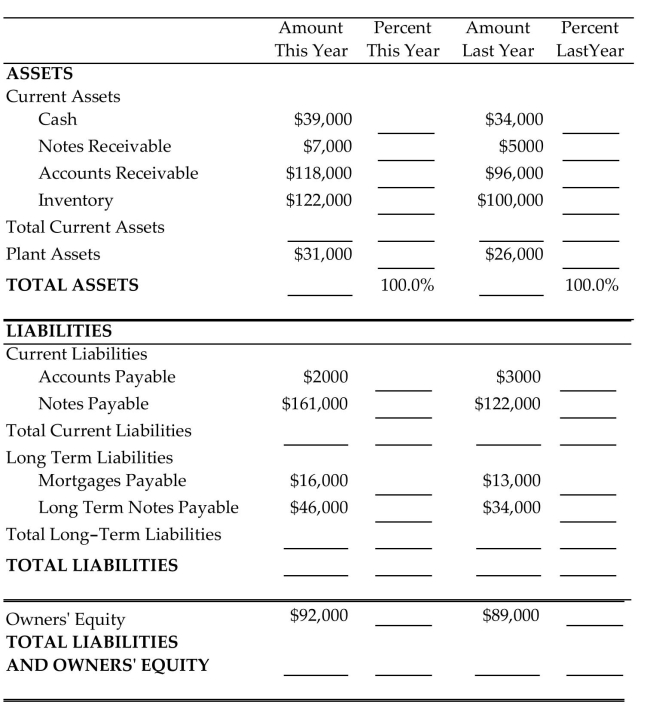

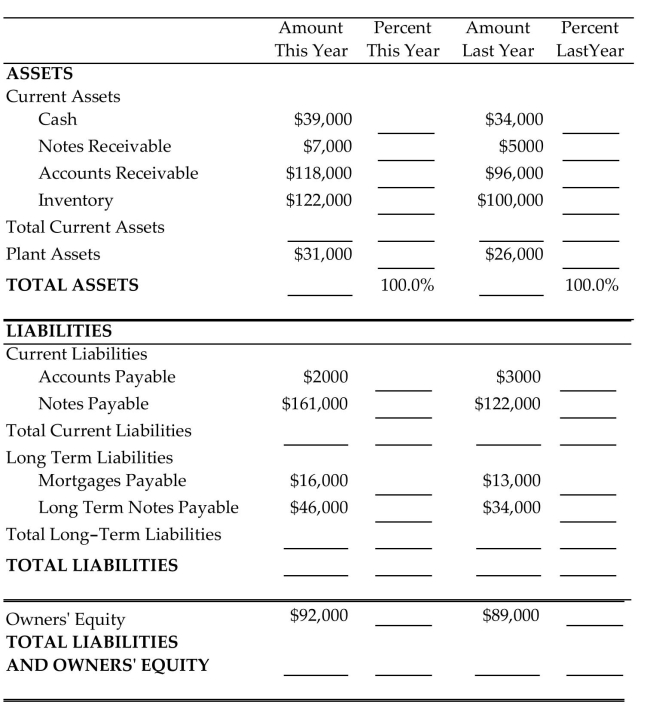

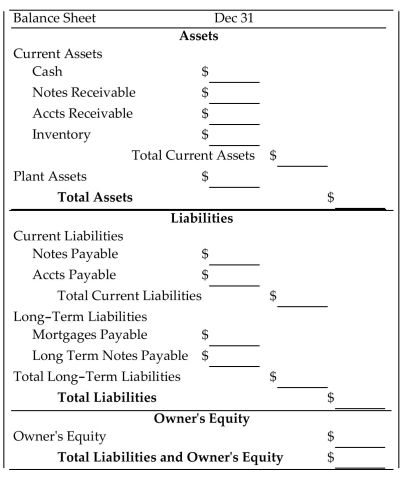

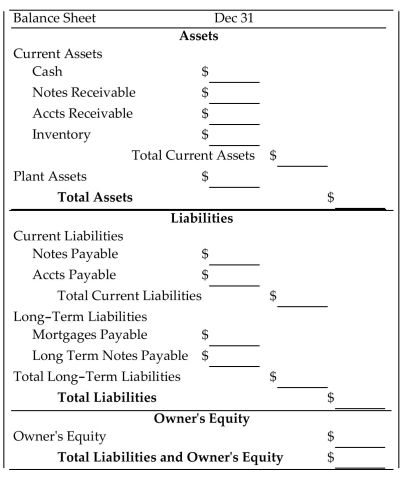

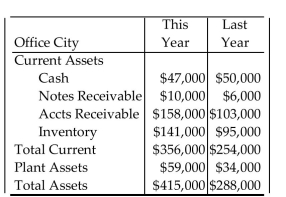

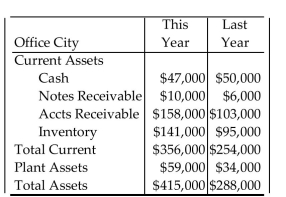

Complete the balance sheet using vertical analysis. Round to the nearest tenth of a percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

9

Find (a) the gross profit, (b) the net income before taxes, and (c) the net income after taxes.

MidState Machinery has a cost of goods sold of $90,000, operating expenses of $66,000, taxes of $9,000, and net sales of $288,000.

A)(a)$24,000 (b)$132,000 (c)$123,000

B)(a)$222,000 (b)$132,000 (c)$123,000

C)(a)$24,000 (b)$198,000 (c)$189,000

D)(a)$198,000 (b)$132,000 (c)$123,000

MidState Machinery has a cost of goods sold of $90,000, operating expenses of $66,000, taxes of $9,000, and net sales of $288,000.

A)(a)$24,000 (b)$132,000 (c)$123,000

B)(a)$222,000 (b)$132,000 (c)$123,000

C)(a)$24,000 (b)$198,000 (c)$189,000

D)(a)$198,000 (b)$132,000 (c)$123,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

10

Provide an appropriate response.

Explain the purpose of a horizontal analysis of an income statement.

Explain the purpose of a horizontal analysis of an income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

11

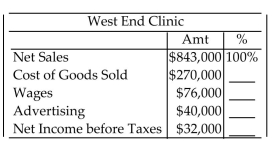

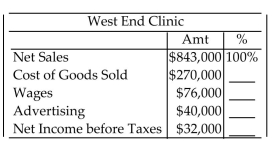

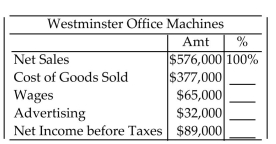

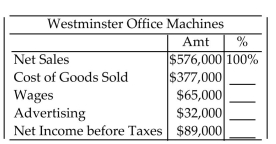

The following chart shows some figures from an income statement. Prepare a vertical analysis by expressing each item as a percent of net sales. Round percents to the nearest tenth of a percent.

A)32.0%, 9.0%, 52.6%, 3.8%

B)32.0%, 9.1%, 14.8%, 11.9%

C)32.0%, 28.1%, 14.8%, 11.9%

D)32.0%, 9.0%, 4.7%, 3.8%

A)32.0%, 9.0%, 52.6%, 3.8%

B)32.0%, 9.1%, 14.8%, 11.9%

C)32.0%, 28.1%, 14.8%, 11.9%

D)32.0%, 9.0%, 4.7%, 3.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

12

Provide an appropriate response.

Explain the purpose of an income statement.

Explain the purpose of an income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

13

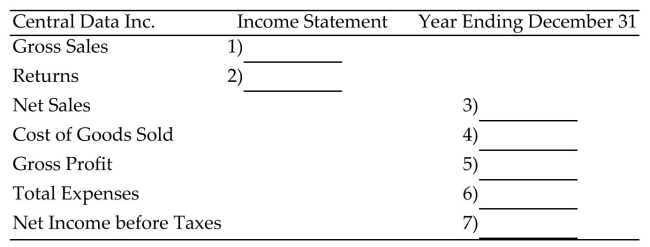

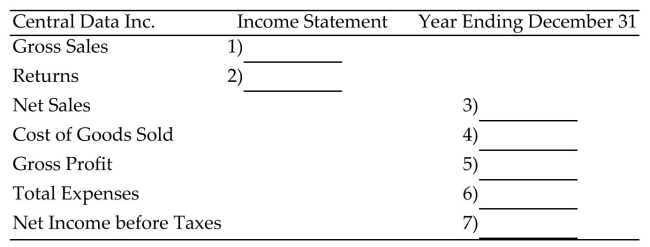

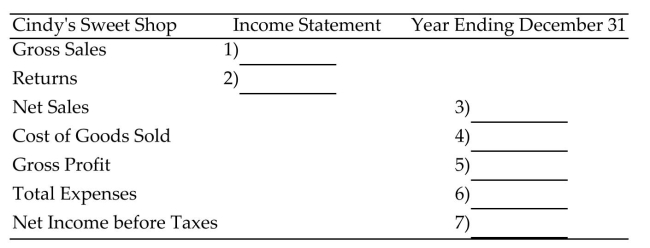

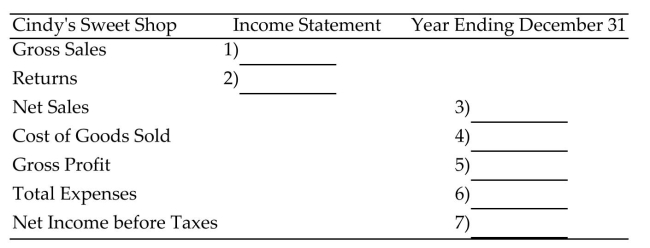

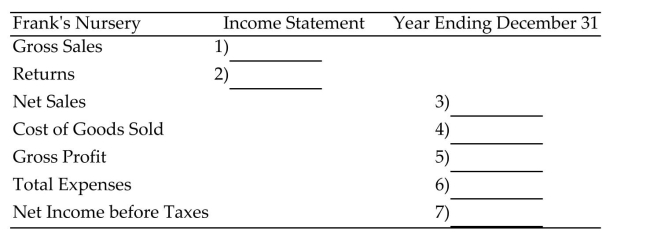

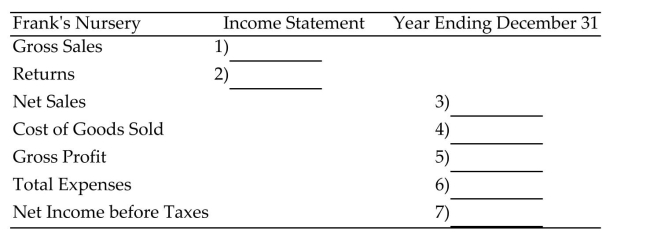

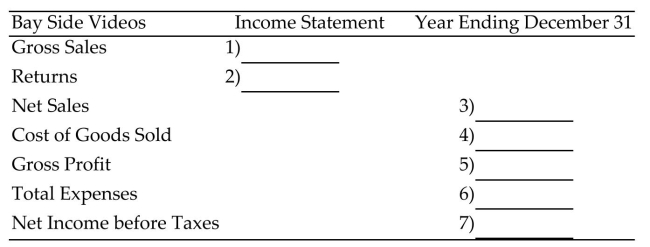

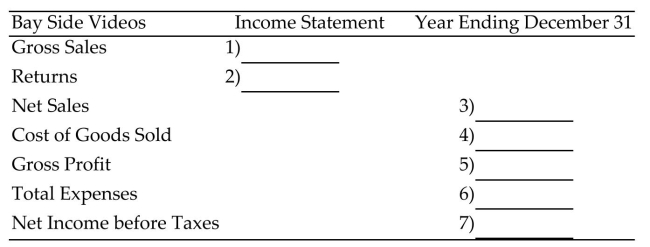

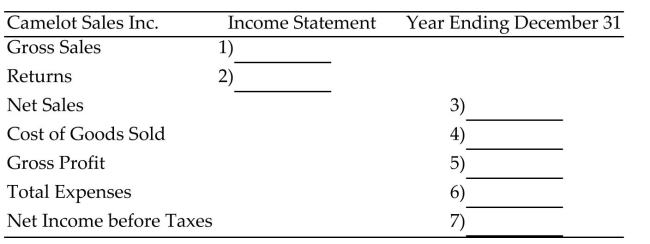

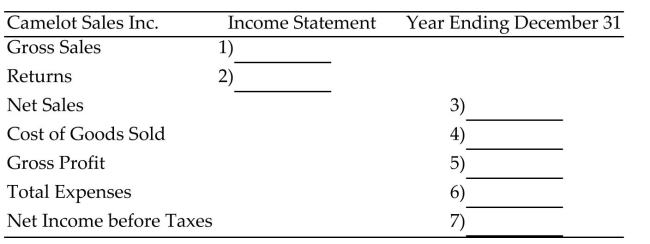

Complete the income statement.

Central Data Inc. had gross sales of $212,000 with returns of $5,100. The inventory on January 1 was $56,000. During the year $101,000 worth of goods was purchased with freight of $1,700. The inventory on December 31 was $53,000. Wages and salaries were $54,400, rent was $13,600, advertising was $2,200, utilities were $2,700, business taxes totaled $5,600, and miscellaneous expenses were $3,800.

A)1)$212,000, 2)$5,100, 3)$206,900, 4)$105,700, 5)$101,200, 6)$82,300, 7)$18,900

B)1)$212,000, 2)$5,100, 3)$206,900, 4)$105,700, 5)$101,200, 6)$82,300, 7)$29,100

C)1)$212,000, 2)$5,100, 3)$217,100, 4)$105,700, 5)$111,400, 6)$82,300, 7)$29,100

D)1)$212,000, 2)$5,100, 3)$206,900, 4)$102,300, 5)$104,600, 6)$82,300, 7)$18,900

Central Data Inc. had gross sales of $212,000 with returns of $5,100. The inventory on January 1 was $56,000. During the year $101,000 worth of goods was purchased with freight of $1,700. The inventory on December 31 was $53,000. Wages and salaries were $54,400, rent was $13,600, advertising was $2,200, utilities were $2,700, business taxes totaled $5,600, and miscellaneous expenses were $3,800.

A)1)$212,000, 2)$5,100, 3)$206,900, 4)$105,700, 5)$101,200, 6)$82,300, 7)$18,900

B)1)$212,000, 2)$5,100, 3)$206,900, 4)$105,700, 5)$101,200, 6)$82,300, 7)$29,100

C)1)$212,000, 2)$5,100, 3)$217,100, 4)$105,700, 5)$111,400, 6)$82,300, 7)$29,100

D)1)$212,000, 2)$5,100, 3)$206,900, 4)$102,300, 5)$104,600, 6)$82,300, 7)$18,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

14

The table compares the national averages for an industry to the results for a given company in the industry. Identify any areas that might require attention by management and offer suggestions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

15

Complete the income statement.

Cindy's Sweet Shop had gross sales of $370,000 with returns of $6,900. The inventory on January 1 was $50,000. During the year $181,000 worth of goods was purchased with freight of $1,900. The

Inventory on December 31 was $50,000. Wages and salaries were $23,100, rent was $8,700,

Advertising was $5,100, utilities were $2,300, business taxes totaled $5,400, and miscellaneous

Expenses were $3,500.

A)1)$370,000, 2)$6,900, 3)$363,100, 4)$182,900, 5)$180,200, 6)$48,100, 7)$132,100

B)1)$370,000, 2)$6,900, 3)$363,100, 4)$182,900, 5)$180,200, 6)$48,100, 7)$145,900

C)1)$370,000, 2)$6,900, 3)$363,100, 4)$179,100, 5)$184,000, 6)$48,100, 7)$132,100

D)1)$370,000, 2)$6,900, 3)$376,900, 4)$182,900, 5)$194,000, 6)$48,100, 7)$145,900

Cindy's Sweet Shop had gross sales of $370,000 with returns of $6,900. The inventory on January 1 was $50,000. During the year $181,000 worth of goods was purchased with freight of $1,900. The

Inventory on December 31 was $50,000. Wages and salaries were $23,100, rent was $8,700,

Advertising was $5,100, utilities were $2,300, business taxes totaled $5,400, and miscellaneous

Expenses were $3,500.

A)1)$370,000, 2)$6,900, 3)$363,100, 4)$182,900, 5)$180,200, 6)$48,100, 7)$132,100

B)1)$370,000, 2)$6,900, 3)$363,100, 4)$182,900, 5)$180,200, 6)$48,100, 7)$145,900

C)1)$370,000, 2)$6,900, 3)$363,100, 4)$179,100, 5)$184,000, 6)$48,100, 7)$132,100

D)1)$370,000, 2)$6,900, 3)$376,900, 4)$182,900, 5)$194,000, 6)$48,100, 7)$145,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

16

The table compares the national averages for an industry to the results for a given company in the industry. Identify any areas that might require attention by management and offer suggestions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

17

Find the ratio of net income after taxes to average owner's equity. Round to the nearest tenth of a percent.

Owner's equity at beginning of year: $1,748,000. Owner's equity at end of year: $2,122,000. Net income after taxes: $447,500.

A)23.1%

B)21.1%

C)25.7%

D)25.6%

Owner's equity at beginning of year: $1,748,000. Owner's equity at end of year: $2,122,000. Net income after taxes: $447,500.

A)23.1%

B)21.1%

C)25.7%

D)25.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

18

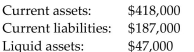

Complete the balance sheet.

Clara's Secretarial Services: net worth $71,000; cash $39,000; accounts receivable $24,000; inventory $41,000; fixed assets $40,000; long-term notes $26,000; mortgages $10,000; accounts payable

$14,000; notes payable $23,000

A)Assets: 39,000; 0; 24,000; 41,000; 104,000; 40,000; 144,000

Liabilities: 26,000; 14,000; 40,000; 10,000; 23,000; 33,000; 73,000

Owner's Equity: 71,000; 144,000

B)Assets: 39,000; 0; 24,000; 41,000; 104,000; 40,000; 144,000

Liabilities: 23,000; 14,000; 37,000; 10,000; 26,000; 36,000; 73,000

Owner's Equity: 71,000; 144,000

C)Assets: 39,000; 0; 24,000; 104,000; 41,000; 40,000; 144,000

Liabilities: 26,000; 14,000; 40,000; 10,000; 23,000; 33,000; 73,000

Owner's Equity: 71,000; 144,000

D)Assets: 39,000; 0; 24,000; 41,000; 104,000; 40,000; 144,000

Liabilities: 26,000; 14,000; 40,000; 10,000; 23,000; 33,000; 71,000

Owner's Equity: 73,000; 144,000

Clara's Secretarial Services: net worth $71,000; cash $39,000; accounts receivable $24,000; inventory $41,000; fixed assets $40,000; long-term notes $26,000; mortgages $10,000; accounts payable

$14,000; notes payable $23,000

A)Assets: 39,000; 0; 24,000; 41,000; 104,000; 40,000; 144,000

Liabilities: 26,000; 14,000; 40,000; 10,000; 23,000; 33,000; 73,000

Owner's Equity: 71,000; 144,000

B)Assets: 39,000; 0; 24,000; 41,000; 104,000; 40,000; 144,000

Liabilities: 23,000; 14,000; 37,000; 10,000; 26,000; 36,000; 73,000

Owner's Equity: 71,000; 144,000

C)Assets: 39,000; 0; 24,000; 104,000; 41,000; 40,000; 144,000

Liabilities: 26,000; 14,000; 40,000; 10,000; 23,000; 33,000; 73,000

Owner's Equity: 71,000; 144,000

D)Assets: 39,000; 0; 24,000; 41,000; 104,000; 40,000; 144,000

Liabilities: 26,000; 14,000; 40,000; 10,000; 23,000; 33,000; 71,000

Owner's Equity: 73,000; 144,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

19

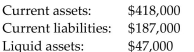

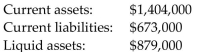

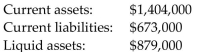

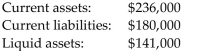

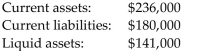

Calculate the current ratio and the acid-test ratio. Is the company healthy based on the guidelines given in the text?

A)Current ratio = 2.24 which is fine

Acid-test ratio = 0.25 which is very low

B)Current ratio = 2.24 which is fine

Acid-test ratio = 8.89 which is fine

C)Current ratio = 0.25 which is very low

Acid-test ratio = 2.24 which is fine

D)Current ratio = 8.89 which is fine

Acid-test ratio = 0.25 which is very low

A)Current ratio = 2.24 which is fine

Acid-test ratio = 0.25 which is very low

B)Current ratio = 2.24 which is fine

Acid-test ratio = 8.89 which is fine

C)Current ratio = 0.25 which is very low

Acid-test ratio = 2.24 which is fine

D)Current ratio = 8.89 which is fine

Acid-test ratio = 0.25 which is very low

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

20

Provide an appropriate response.

Explain the purpose of a vertical analysis of an income statement.

Explain the purpose of a vertical analysis of an income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

21

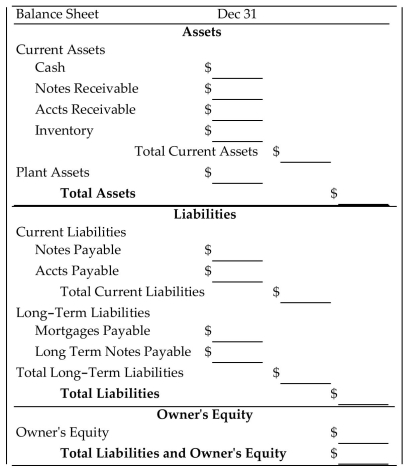

Complete the balance sheet.

Mullen's Hardware: mortgage $36,000; notes payable $20,000; accounts payable $18,000; long-term notes $27,000; fixed assets $92,000; inventory $65,000; accounts receivable $42,000; notes receivable

$17,000; cash $9,000; owner's equity $124,000

A)Assets: 9,000; 17,000; 42,000; 65,000; 133,000; 92,000; 225,000

Liabilities: 20,000; 18,000; 38,000; 36,000; 27,000; 63,000; 101,000

Owner's Equity: 124,000; 225,000

B)Assets: 9,000; 17,000; 42,000; 65,000; 133,000; 92,000; 225,000

Liabilities: 27,000; 18,000; 45,000; 36,000; 20,000; 56,000; 124,000

Owner's Equity: 101,000; 225,000

C)Assets: 9,000; 17,000; 42,000; 65,000; 133,000; 92,000; 225,000

Liabilities: 27,000; 18,000; 45,000; 36,000; 20,000; 56,000; 101,000

Owner's Equity: 124,000; 225,000

D)Assets: 9,000; 17,000; 42,000; 133,000; 65,000; 92,000; 225,000

Liabilities: 27,000; 18,000; 45,000; 36,000; 20,000; 56,000; 101,000

Owner's Equity: 124,000; 225,000

Mullen's Hardware: mortgage $36,000; notes payable $20,000; accounts payable $18,000; long-term notes $27,000; fixed assets $92,000; inventory $65,000; accounts receivable $42,000; notes receivable

$17,000; cash $9,000; owner's equity $124,000

A)Assets: 9,000; 17,000; 42,000; 65,000; 133,000; 92,000; 225,000

Liabilities: 20,000; 18,000; 38,000; 36,000; 27,000; 63,000; 101,000

Owner's Equity: 124,000; 225,000

B)Assets: 9,000; 17,000; 42,000; 65,000; 133,000; 92,000; 225,000

Liabilities: 27,000; 18,000; 45,000; 36,000; 20,000; 56,000; 124,000

Owner's Equity: 101,000; 225,000

C)Assets: 9,000; 17,000; 42,000; 65,000; 133,000; 92,000; 225,000

Liabilities: 27,000; 18,000; 45,000; 36,000; 20,000; 56,000; 101,000

Owner's Equity: 124,000; 225,000

D)Assets: 9,000; 17,000; 42,000; 133,000; 65,000; 92,000; 225,000

Liabilities: 27,000; 18,000; 45,000; 36,000; 20,000; 56,000; 101,000

Owner's Equity: 124,000; 225,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

22

Find the ratio of net income after taxes to average owner's equity. Round to the nearest tenth of a percent.

Owner's equity at beginning of year: $614,000. Owner's equity at end of year: $2,058,000. Net income after taxes: $316,500.

A)51.6%

B)51.5%

C)23.7%

D)15.4%

Owner's equity at beginning of year: $614,000. Owner's equity at end of year: $2,058,000. Net income after taxes: $316,500.

A)51.6%

B)51.5%

C)23.7%

D)15.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

23

Complete the horizontal analysis for the comparative income statement. Round to the nearest tenth of a percent.

A)13.9%, -140.0%, 14.2%, -7.8%, 47.8%, -118.7%, 48.7%

B)17.9%, -40.0%, 18.1%, -1.9%, 60.1%, 37.5%, 62.0%

C)-17.9%, 40.0%, -18.1%, 1.9%, -60.1%, -37.5%, -62.0%

D)15.2%, -66.7%, 15.4%, -2.0%, 37.5%, 27.3%, 38.3%

A)13.9%, -140.0%, 14.2%, -7.8%, 47.8%, -118.7%, 48.7%

B)17.9%, -40.0%, 18.1%, -1.9%, 60.1%, 37.5%, 62.0%

C)-17.9%, 40.0%, -18.1%, 1.9%, -60.1%, -37.5%, -62.0%

D)15.2%, -66.7%, 15.4%, -2.0%, 37.5%, 27.3%, 38.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

24

Find the ratio of net income after taxes to average owner's equity. Round to the nearest tenth of a percent.

Owner's equity at beginning of year: $531,000. Owner's equity at end of year: $852,000. Net income after taxes: $10,500

A)2.1%

B)1.5%

C)2.0%

D)1.2%

Owner's equity at beginning of year: $531,000. Owner's equity at end of year: $852,000. Net income after taxes: $10,500

A)2.1%

B)1.5%

C)2.0%

D)1.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

25

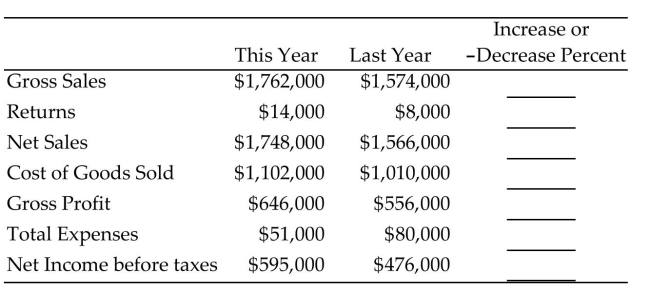

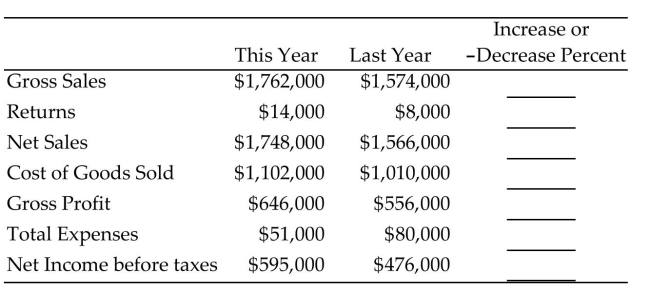

Complete the horizontal analysis for the comparative income statement. Round to the nearest tenth of a percent.

A)11.9%, 75.0%, 11.6%, 9.1%, 16.2%, -36.2%, 25.0%

B)5.6%, -50.0%, 5.2%, -0.8%, -1.8%, -161.2%, 4.0%

C)10.7%, 42.9%, 10.4%, 8.3%, 13.9%, -56.9%, 20.0%

D)-11.9%, -75.0%, -11.6%, -9.1%, -16.2%, 36.2%, -25.0%

A)11.9%, 75.0%, 11.6%, 9.1%, 16.2%, -36.2%, 25.0%

B)5.6%, -50.0%, 5.2%, -0.8%, -1.8%, -161.2%, 4.0%

C)10.7%, 42.9%, 10.4%, 8.3%, 13.9%, -56.9%, 20.0%

D)-11.9%, -75.0%, -11.6%, -9.1%, -16.2%, 36.2%, -25.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

26

Find (a) the gross profit, (b) the net income before taxes, and (c) the net income after taxes.

Eddie's TV and Appliance had gross sales of $619,000, returns of $27,000, operating expenses of $153,000, taxes of $30,950, and a cost of goods sold of $241,000.

A)(a)$351,000 (b)$198,000 (c)$167,050

B)(a)$466,000 (b)$198,000 (c)$167,050

C)(a)$378,000 (b)$198,000 (c)$167,050

D)(a)$439,000 (b)$198,000 (c)$167,050

Eddie's TV and Appliance had gross sales of $619,000, returns of $27,000, operating expenses of $153,000, taxes of $30,950, and a cost of goods sold of $241,000.

A)(a)$351,000 (b)$198,000 (c)$167,050

B)(a)$466,000 (b)$198,000 (c)$167,050

C)(a)$378,000 (b)$198,000 (c)$167,050

D)(a)$439,000 (b)$198,000 (c)$167,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

27

Complete the income statement.

Frank's Nursery had gross sales of $2,273,000 with returns of $57,800. The inventory on January 1 was $567,000. During the year $1,130,000 worth of goods was purchased with freight of $5,600. The

Inventory on December 31 was $525,000. Wages and salaries were $81,600, rent was $10,200,

Advertising was $17,700, utilities were $5,200, business taxes totaled $8,500, and miscellaneous

Expenses were $6,100.

A)1)$2,273,000, 2)$57,800, 3)$2,215,200, 4)$1,177,600, 5)$1,037,600, 6)$129,300, 7)$908,300

B)1)$2,273,000, 2)$57,800, 3)$2,215,200, 4)$1,166,400, 5)$1,048,800, 6)$129,300, 7)$908,300

C)1)$2,273,000, 2)$57,800, 3)$2,330,800, 4)$1,177,600, 5)$1,153,200, 6)$129,300, 7)$1,023,900

D)1)$2,273,000, 2)$57,800, 3)$2,215,200, 4)$1,177,600, 5)$1,037,600, 6)$129,300, 7)$1,023,900

Frank's Nursery had gross sales of $2,273,000 with returns of $57,800. The inventory on January 1 was $567,000. During the year $1,130,000 worth of goods was purchased with freight of $5,600. The

Inventory on December 31 was $525,000. Wages and salaries were $81,600, rent was $10,200,

Advertising was $17,700, utilities were $5,200, business taxes totaled $8,500, and miscellaneous

Expenses were $6,100.

A)1)$2,273,000, 2)$57,800, 3)$2,215,200, 4)$1,177,600, 5)$1,037,600, 6)$129,300, 7)$908,300

B)1)$2,273,000, 2)$57,800, 3)$2,215,200, 4)$1,166,400, 5)$1,048,800, 6)$129,300, 7)$908,300

C)1)$2,273,000, 2)$57,800, 3)$2,330,800, 4)$1,177,600, 5)$1,153,200, 6)$129,300, 7)$1,023,900

D)1)$2,273,000, 2)$57,800, 3)$2,215,200, 4)$1,177,600, 5)$1,037,600, 6)$129,300, 7)$1,023,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

28

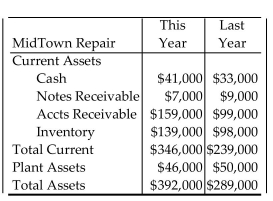

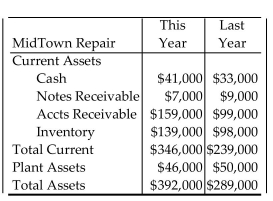

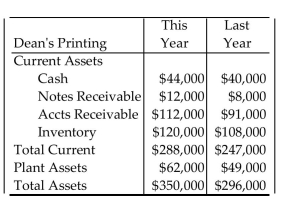

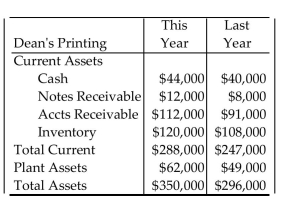

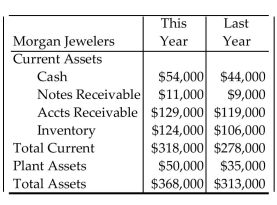

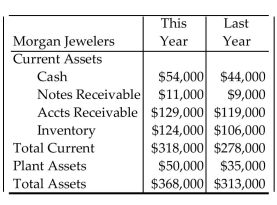

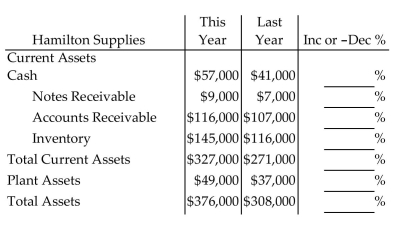

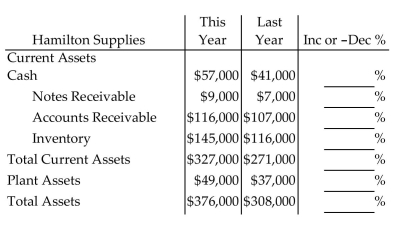

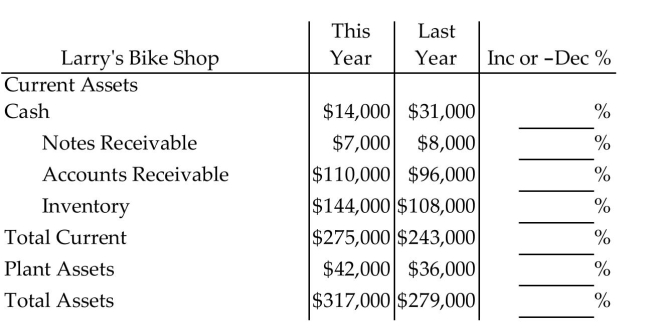

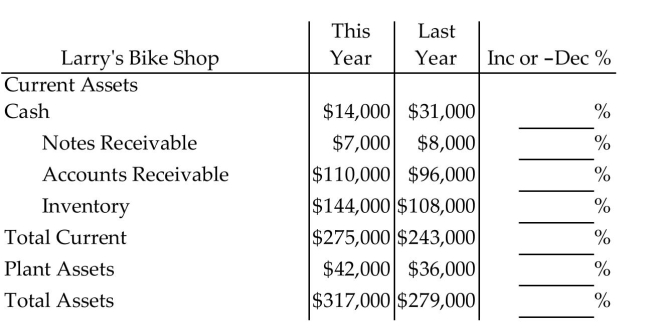

Find the current ratio and the acid-test ratio for the indicated year. Round each ratio to the nearest hundredth of a percent.

This year current liabilities are $234,000.

This year current liabilities are $234,000.

A)1.24; 0.60

B)1.48; 0.88

C)1.48; 0.56

D)1.24; 0.88

This year current liabilities are $234,000.

This year current liabilities are $234,000.A)1.24; 0.60

B)1.48; 0.88

C)1.48; 0.56

D)1.24; 0.88

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

29

Complete the income statement.

Bay Side Videos had gross sales of $530,000 with returns of $6,300. The inventory on January 1 was $56,000. During the year $237,000 worth of goods was purchased with freight of $1,900. The

Inventory on December 31 was $56,000. Wages and salaries were $57,500, rent was $11,100,

Advertising was $4,000, utilities were $2,500, business taxes totaled $5,700, and miscellaneous

Expenses were $3,200.

A)1)$530,000, 2)$6,300, 3)$523,700, 4)$235,100, 5)$288,600, 6)$84,000, 7)$200,800

B)1)$530,000, 2)$6,300, 3)$523,700, 4)$238,900, 5)$284,800, 6)$84,000, 7)$213,400

C)1)$530,000, 2)$6,300, 3)$523,700, 4)$238,900, 5)$284,800, 6)$84,000, 7)$200,800

D)1)$530,000, 2)$6,300, 3)$536,300, 4)$238,900, 5)$297,400, 6)$84,000, 7)$213,400

Bay Side Videos had gross sales of $530,000 with returns of $6,300. The inventory on January 1 was $56,000. During the year $237,000 worth of goods was purchased with freight of $1,900. The

Inventory on December 31 was $56,000. Wages and salaries were $57,500, rent was $11,100,

Advertising was $4,000, utilities were $2,500, business taxes totaled $5,700, and miscellaneous

Expenses were $3,200.

A)1)$530,000, 2)$6,300, 3)$523,700, 4)$235,100, 5)$288,600, 6)$84,000, 7)$200,800

B)1)$530,000, 2)$6,300, 3)$523,700, 4)$238,900, 5)$284,800, 6)$84,000, 7)$213,400

C)1)$530,000, 2)$6,300, 3)$523,700, 4)$238,900, 5)$284,800, 6)$84,000, 7)$200,800

D)1)$530,000, 2)$6,300, 3)$536,300, 4)$238,900, 5)$297,400, 6)$84,000, 7)$213,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

30

The following chart shows some figures from an income statement. Prepare a vertical analysis by expressing each item as a percent of net sales. Round percents to the nearest tenth of a percent.

A)40.7%, 8.2%, 5.0%, 4.7%

B)40.7%, 8.3%, 12.2%, 11.6%

C)40.7%, 8.2%, 60.6%, 4.7%

D)40.7%, 20.2%, 12.2%, 11.6%

A)40.7%, 8.2%, 5.0%, 4.7%

B)40.7%, 8.3%, 12.2%, 11.6%

C)40.7%, 8.2%, 60.6%, 4.7%

D)40.7%, 20.2%, 12.2%, 11.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

31

Complete the horizontal analysis for the comparative income statement. Round to the nearest tenth of a percent.

A)0.2%, -140.0%, 0.5%, -1.6%, -12.3%, -141.4%, -16.8%

B)5.8%, -66.7%, 6.1%, 7.3%, 3.9%, 23.7%, 1.2%

C)-6.2%, 40.0%, -6.5%, -7.9%, -4.1%, -31.0%, -1.3%

D)6.2%, -40.0%, 6.5%, 7.9%, 4.1%, 31.0%, 1.3%

A)0.2%, -140.0%, 0.5%, -1.6%, -12.3%, -141.4%, -16.8%

B)5.8%, -66.7%, 6.1%, 7.3%, 3.9%, 23.7%, 1.2%

C)-6.2%, 40.0%, -6.5%, -7.9%, -4.1%, -31.0%, -1.3%

D)6.2%, -40.0%, 6.5%, 7.9%, 4.1%, 31.0%, 1.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

32

Find the current ratio and the acid-test ratio for the indicated year. Round each ratio to the nearest hundredth of a percent.

This year current liabilities are $227,000.

This year current liabilities are $227,000.

A)1.27; 0.95

B)1.57; 0.67

C)1.57; 0.95

D)1.27; 0.70

This year current liabilities are $227,000.

This year current liabilities are $227,000.A)1.27; 0.95

B)1.57; 0.67

C)1.57; 0.95

D)1.27; 0.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

33

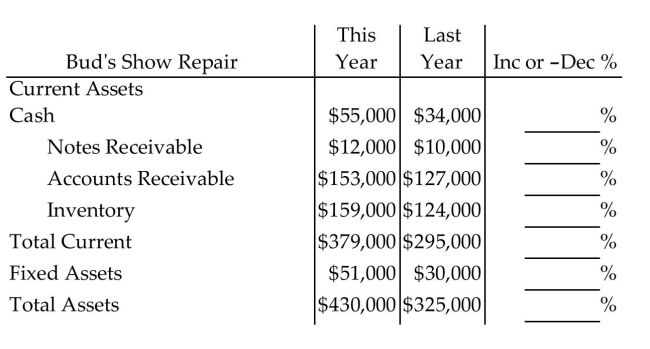

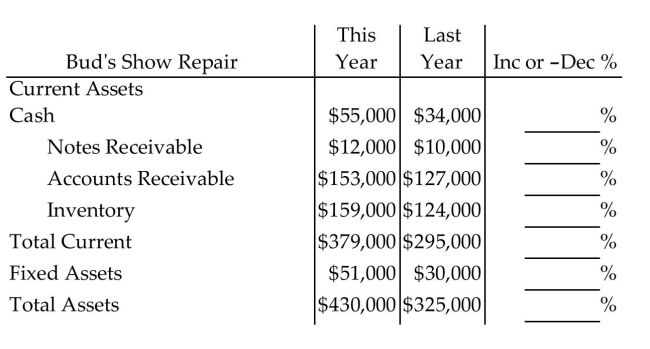

Find the current ratio and the acid-test ratio for the indicated year. Round each ratio to the nearest hundredth of a percent.

Last year current liabilities were $197,000.

Last year current liabilities were $197,000.

A)1.46; 0.85

B)1.46; 0.66

C)1.25; 0.71

D)1.25; 0.85

Last year current liabilities were $197,000.

Last year current liabilities were $197,000.A)1.46; 0.85

B)1.46; 0.66

C)1.25; 0.71

D)1.25; 0.85

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

34

Calculate the current ratio and the acid-test ratio. Is the company healthy based on the guidelines given in the text?

A)Current ratio = 1.37 which is too low

Acid-test ratio = 2.88 which is fine

B)Current ratio = 2.11 which is fine

Acid-test ratio = 1.37 which is too low

C)Current ratio = 2.88 which is fine

Acid-test ratio = 2.11 which is fine

D)Current ratio = 2.88 which is fine

Acid-test ratio = 1.37 which is fine

A)Current ratio = 1.37 which is too low

Acid-test ratio = 2.88 which is fine

B)Current ratio = 2.11 which is fine

Acid-test ratio = 1.37 which is too low

C)Current ratio = 2.88 which is fine

Acid-test ratio = 2.11 which is fine

D)Current ratio = 2.88 which is fine

Acid-test ratio = 1.37 which is fine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

35

Find the current ratio and the acid-test ratio for the indicated year. Round each ratio to the nearest hundredth of a percent.

Last year current liabilities were $234,000.

Last year current liabilities were $234,000.

A)1.19; 0.74

B)1.36; 0.70

C)1.36; 0.83

D)1.19; 0.83

Last year current liabilities were $234,000.

Last year current liabilities were $234,000.A)1.19; 0.74

B)1.36; 0.70

C)1.36; 0.83

D)1.19; 0.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

36

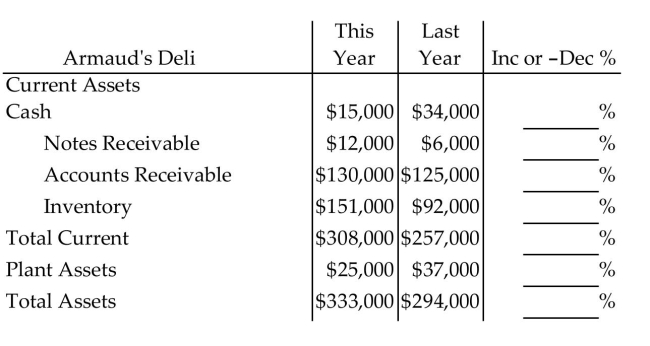

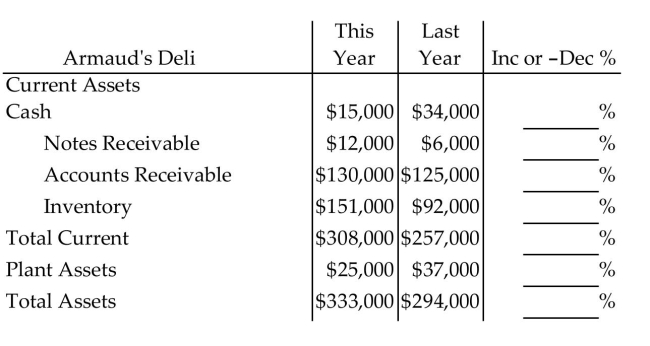

Complete the horizontal analysis for the balance sheet. Round to the nearest tenth of a percent.

A)-55.8%, 99.8%, 4.0%, 64.1%, 19.8%, -32.4%, 13.2%

B)-126.7%, 50.0%, 3.8%, 39.1%, 16.6%, -48.0%, 11.7%

C)226.7%, 50.0%, 96.2%, 60.9%, 83.4%, 148.0%, 88.3%

D)-55.9%, 100.0%, 4.0%, 64.1%, 19.8%, -32.4%, 13.3%

A)-55.8%, 99.8%, 4.0%, 64.1%, 19.8%, -32.4%, 13.2%

B)-126.7%, 50.0%, 3.8%, 39.1%, 16.6%, -48.0%, 11.7%

C)226.7%, 50.0%, 96.2%, 60.9%, 83.4%, 148.0%, 88.3%

D)-55.9%, 100.0%, 4.0%, 64.1%, 19.8%, -32.4%, 13.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

37

Complete the horizontal analysis for the comparative income statement. Round to the nearest tenth of a percent.

A)-27.6%, 35.7%, -28.9%, -7.6%, -40.6%, -34.4%, -41.0%

B)27.6%, -35.7%, 28.9%, 7.6%, 40.6%, 34.4%, 41.0%

C)21.6%, -55.6%, 22.4%, 7.0%, 28.9%, 25.6%, 29.1%

D)13.7%, -107.1%, 14.7%, -32.3%, 18.6%, -278.1%, 17.5%

A)-27.6%, 35.7%, -28.9%, -7.6%, -40.6%, -34.4%, -41.0%

B)27.6%, -35.7%, 28.9%, 7.6%, 40.6%, 34.4%, 41.0%

C)21.6%, -55.6%, 22.4%, 7.0%, 28.9%, 25.6%, 29.1%

D)13.7%, -107.1%, 14.7%, -32.3%, 18.6%, -278.1%, 17.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

38

Complete the horizontal analysis for the balance sheet. Round to the nearest tenth of a percent.

A)71.9%, 77.8%, 92.2%, 80.0%, 82.9%, 75.5%, 81.9%

B)39.1%, 28.4%, 8.4%, 25.0%, 20.7%, 32.4%, 22.0%

C)28.1%, 22.2%, 7.8%, 20.0%, 17.1%, 24.5%, 18.1%

D)39.0%, 28.6%, 8.4%, 25.0%, 20.7%, 32.4%, 22.1%

A)71.9%, 77.8%, 92.2%, 80.0%, 82.9%, 75.5%, 81.9%

B)39.1%, 28.4%, 8.4%, 25.0%, 20.7%, 32.4%, 22.0%

C)28.1%, 22.2%, 7.8%, 20.0%, 17.1%, 24.5%, 18.1%

D)39.0%, 28.6%, 8.4%, 25.0%, 20.7%, 32.4%, 22.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

39

Calculate the current ratio and the acid-test ratio. Is the company healthy based on the guidelines given in the text?

A)Current ratio = 1.31 which is too low

Acid-test ratio = 2.09 which is fine

B)Current ratio = 2.09 which is fine

Acid-test ratio = 1.60 which is fine

C)Current ratio = 2.09 which is fine

Acid-test ratio = 1.31 which is fine

D)Current ratio = 1.60 which is low

Acid-test ratio = 1.31 which is fine

A)Current ratio = 1.31 which is too low

Acid-test ratio = 2.09 which is fine

B)Current ratio = 2.09 which is fine

Acid-test ratio = 1.60 which is fine

C)Current ratio = 2.09 which is fine

Acid-test ratio = 1.31 which is fine

D)Current ratio = 1.60 which is low

Acid-test ratio = 1.31 which is fine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

40

The following chart shows some figures from an income statement. Prepare a vertical analysis by expressing each item as a percent of net sales. Round percents to the nearest tenth of a percent.

A)65.5%, 11.3%, 5.6%, 15.5%

B)65.5%, 17.2%, 8.5%, 23.6%

C)65.5%, 11.5%, 8.5%, 23.6%

D)65.5%, 11.3%, 49.2%, 15.5%

A)65.5%, 11.3%, 5.6%, 15.5%

B)65.5%, 17.2%, 8.5%, 23.6%

C)65.5%, 11.5%, 8.5%, 23.6%

D)65.5%, 11.3%, 49.2%, 15.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

41

Calculate the current ratio and the acid-test ratio. Is the company healthy based on the guidelines given in the text?

A)Current ratio = 1.31 which is too low

Acid-test ratio = 1.67 which is fine

B)Current ratio = 0.78 which is too low

Acid-test ratio = 1.31 which is too low

C)Current ratio = 1.67 which is too low

Acid-test ratio = 0.78 which is too low

D)Current ratio = 1.31 which is too low

Acid-test ratio = 0.78 which is too low

A)Current ratio = 1.31 which is too low

Acid-test ratio = 1.67 which is fine

B)Current ratio = 0.78 which is too low

Acid-test ratio = 1.31 which is too low

C)Current ratio = 1.67 which is too low

Acid-test ratio = 0.78 which is too low

D)Current ratio = 1.31 which is too low

Acid-test ratio = 0.78 which is too low

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

42

The following chart shows some figures from an income statement. Prepare a vertical analysis by expressing each item as a percent of net sales. Round percents to the nearest tenth of a percent.

A)34.3%, 6.1%, 4.7%, 11.2%

B)34.3%, 6.1%, 76.5%, 11.2%

C)34.3%, 6.2%, 13.6%, 32.5%

D)34.3%, 17.8%, 13.6%, 32.5%

A)34.3%, 6.1%, 4.7%, 11.2%

B)34.3%, 6.1%, 76.5%, 11.2%

C)34.3%, 6.2%, 13.6%, 32.5%

D)34.3%, 17.8%, 13.6%, 32.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

43

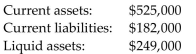

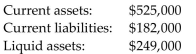

Prepare a vertical analysis. Round percents to the nearest tenth of a percent.

Current assets: $407,000 Current liabilities: $189,000

Liquid assets: $149,000

A)Current ratio = 2.15 which is fine

Acid-test ratio = 0.79 which is too low

B)Current ratio = 2.73 which is fine

Acid-test ratio = 0.79 which is too low

C)Current ratio = 2.15 which is fine

Acid-test ratio = 2.73 which is fine

D)Current ratio = 0.79 which is too low

Acid-test ratio = 2.15 which is fine

Current assets: $407,000 Current liabilities: $189,000

Liquid assets: $149,000

A)Current ratio = 2.15 which is fine

Acid-test ratio = 0.79 which is too low

B)Current ratio = 2.73 which is fine

Acid-test ratio = 0.79 which is too low

C)Current ratio = 2.15 which is fine

Acid-test ratio = 2.73 which is fine

D)Current ratio = 0.79 which is too low

Acid-test ratio = 2.15 which is fine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

44

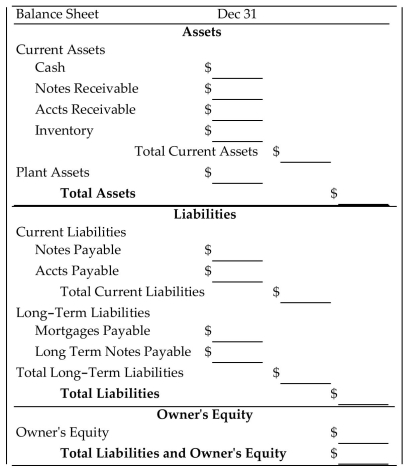

Complete the balance sheet.

Data-Serve Computer Services: fixed assets $59,000; mortgages $36,000; accounts payable $19,000; notes payable $15,000; long-term notes $26,000; equity $60,000; cash $17,000; inventory $18,000;

Notes receivable $9,000; accounts receivable $53,000

A)Assets: 17,000; 9,000; 53,000; 18,000; 97,000; 59,000; 156,000

Liabilities: 26,000; 19,000; 45,000; 36,000; 15,000; 51,000; 96,000

Owner's Equity: 60,000; 156,000

B)Assets: 17,000; 9,000; 53,000; 18,000; 97,000; 59,000; 156,000

Liabilities: 15,000; 19,000; 34,000; 36,000; 26,000; 62,000; 96,000

Owner's Equity: 60,000; 156,000

C)Assets: 17,000; 9,000; 53,000; 97,000; 18,000; 59,000; 156,000

Liabilities: 26,000; 19,000; 45,000; 36,000; 15,000; 51,000; 96,000

Owner's Equity: 60,000; 156,000

D)Assets: 17,000; 9,000; 53,000; 18,000; 97,000; 59,000; 156,000

Liabilities: 26,000; 19,000; 45,000; 36,000; 15,000; 51,000; 60,000

Owner's Equity: 96,000; 156,000

Data-Serve Computer Services: fixed assets $59,000; mortgages $36,000; accounts payable $19,000; notes payable $15,000; long-term notes $26,000; equity $60,000; cash $17,000; inventory $18,000;

Notes receivable $9,000; accounts receivable $53,000

A)Assets: 17,000; 9,000; 53,000; 18,000; 97,000; 59,000; 156,000

Liabilities: 26,000; 19,000; 45,000; 36,000; 15,000; 51,000; 96,000

Owner's Equity: 60,000; 156,000

B)Assets: 17,000; 9,000; 53,000; 18,000; 97,000; 59,000; 156,000

Liabilities: 15,000; 19,000; 34,000; 36,000; 26,000; 62,000; 96,000

Owner's Equity: 60,000; 156,000

C)Assets: 17,000; 9,000; 53,000; 97,000; 18,000; 59,000; 156,000

Liabilities: 26,000; 19,000; 45,000; 36,000; 15,000; 51,000; 96,000

Owner's Equity: 60,000; 156,000

D)Assets: 17,000; 9,000; 53,000; 18,000; 97,000; 59,000; 156,000

Liabilities: 26,000; 19,000; 45,000; 36,000; 15,000; 51,000; 60,000

Owner's Equity: 96,000; 156,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

45

Prepare a vertical analysis. Round percents to the nearest tenth of a percent.

Wandell's Garden Shop had a cost of goods sold of $111,000, operating expenses of $43,000, and net sales of $203,000.

A)Percent cost of goods sold = 21.2%

Percent operating expenses = 54.7%

B)Percent cost of goods sold = 33.5%

Percent operating expenses = 54.7%

C)Percent cost of goods sold = 54.7%

Percent operating expenses = 21.2%

D)Percent cost of goods sold = 54.7%

Percent operating expenses = 33.5%

Wandell's Garden Shop had a cost of goods sold of $111,000, operating expenses of $43,000, and net sales of $203,000.

A)Percent cost of goods sold = 21.2%

Percent operating expenses = 54.7%

B)Percent cost of goods sold = 33.5%

Percent operating expenses = 54.7%

C)Percent cost of goods sold = 54.7%

Percent operating expenses = 21.2%

D)Percent cost of goods sold = 54.7%

Percent operating expenses = 33.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

46

Complete the horizontal analysis for the comparative income statement. Round to the nearest tenth of a percent.

A)12.1%, 37.5%, 12.0%, 10.1%, 15.8%, 14.1%, 16.1%

B)-13.8%, -60.0%, -13.7%, -11.3%, -18.8%, -16.4%, -19.1%

C)7.2%, -140.0%, 7.0%, 1.5%, -2.1%, -132.8%, -5.1%

D)13.8%, 60.0%, 13.7%, 11.3%, 18.8%, 16.4%, 19.1%

A)12.1%, 37.5%, 12.0%, 10.1%, 15.8%, 14.1%, 16.1%

B)-13.8%, -60.0%, -13.7%, -11.3%, -18.8%, -16.4%, -19.1%

C)7.2%, -140.0%, 7.0%, 1.5%, -2.1%, -132.8%, -5.1%

D)13.8%, 60.0%, 13.7%, 11.3%, 18.8%, 16.4%, 19.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

47

Complete the horizontal analysis for the balance sheet. Round to the nearest tenth of a percent.

A)-121.4%, -14.3%, 12.7%, 25.0%, 11.6%, 14.3%, 12.0%

B)221.4%, 114.3%, 87.3%, 75.0%, 88.4%, 85.7%, 88.0%

C)-54.9%, -12.7%, 14.6%, 33.3%, 13.2%, 16.7%, 13.5%

D)-54.8%, -12.5%, 14.6%, 33.3%, 13.2%, 16.7%, 13.6%

A)-121.4%, -14.3%, 12.7%, 25.0%, 11.6%, 14.3%, 12.0%

B)221.4%, 114.3%, 87.3%, 75.0%, 88.4%, 85.7%, 88.0%

C)-54.9%, -12.7%, 14.6%, 33.3%, 13.2%, 16.7%, 13.5%

D)-54.8%, -12.5%, 14.6%, 33.3%, 13.2%, 16.7%, 13.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

48

Find (a) the gross profit, (b) the net income before taxes, and (c) the net income after taxes.

Steel Master Sales had a cost of goods sold of $244,000, operating expenses of $157,000, returns of $16,000, taxes of $26,900, and gross sales of $538,000.

A)(a)$381,000 (b)$121,000 (c)$94,100

B)(a)$294,000 (b)$121,000 (c)$94,100

C)(a)$278,000 (b)$121,000 (c)$94,100

D)(a)$365,000 (b)$121,000 (c)$94,100

Steel Master Sales had a cost of goods sold of $244,000, operating expenses of $157,000, returns of $16,000, taxes of $26,900, and gross sales of $538,000.

A)(a)$381,000 (b)$121,000 (c)$94,100

B)(a)$294,000 (b)$121,000 (c)$94,100

C)(a)$278,000 (b)$121,000 (c)$94,100

D)(a)$365,000 (b)$121,000 (c)$94,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

49

Prepare a vertical analysis. Round percents to the nearest tenth of a percent.

Rosie's Cleaning Service had a cost of goods sold of $48,000, operating expenses of $218,000, and net sales of $365,000.

A)Percent cost of goods sold = 59.7%

Percent operating expenses = 13.2%

B)Percent cost of goods sold = 13.2%

Percent operating expenses = 72.9%

C)Percent cost of goods sold = 72.9%

Percent operating expenses = 13.2%

D)Percent cost of goods sold = 13.2%

Percent operating expenses = 59.7%

Rosie's Cleaning Service had a cost of goods sold of $48,000, operating expenses of $218,000, and net sales of $365,000.

A)Percent cost of goods sold = 59.7%

Percent operating expenses = 13.2%

B)Percent cost of goods sold = 13.2%

Percent operating expenses = 72.9%

C)Percent cost of goods sold = 72.9%

Percent operating expenses = 13.2%

D)Percent cost of goods sold = 13.2%

Percent operating expenses = 59.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

50

Find (a) the gross profit, (b) the net income before taxes, and (c) the net income after taxes.

Jill's Cleaning Service had net sales of $415,000, operating expenses of $96,000, taxes of $20,750,and a cost of goods sold of $51,000.

A)(a)$45,000 (b)$268,000 (c)$247,250

B)(a)$364,000 (b)$268,000 (c)$247,250

C)(a)$45,000 (b)$364,000 (c)$343,250

D)(a)$319,000 (b)$268,000 (c)$247,250

Jill's Cleaning Service had net sales of $415,000, operating expenses of $96,000, taxes of $20,750,and a cost of goods sold of $51,000.

A)(a)$45,000 (b)$268,000 (c)$247,250

B)(a)$364,000 (b)$268,000 (c)$247,250

C)(a)$45,000 (b)$364,000 (c)$343,250

D)(a)$319,000 (b)$268,000 (c)$247,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

51

Complete the horizontal analysis for the balance sheet. Round to the nearest tenth of a percent.

A)61.8%, 20.0%, 20.5%, 28.2%, 28.5%, 70.0%, 32.3%

B)61.8%, 83.3%, 83.0%, 78.0%, 77.8%, 58.8%, 75.6%

C)61.9%, 19.8%, 20.5%, 28.2%, 28.5%, 70.0%, 32.2%

D)38.2%, 16.7%, 17.0%, 22.0%, 22.2%, 41.2%, 24.4%

A)61.8%, 20.0%, 20.5%, 28.2%, 28.5%, 70.0%, 32.3%

B)61.8%, 83.3%, 83.0%, 78.0%, 77.8%, 58.8%, 75.6%

C)61.9%, 19.8%, 20.5%, 28.2%, 28.5%, 70.0%, 32.2%

D)38.2%, 16.7%, 17.0%, 22.0%, 22.2%, 41.2%, 24.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

52

Complete the balance sheet.

Jake's Janitorial Service: fixed assets $80,000; long-term notes $58,000; equity $110,000; accounts payable $25,000; notes payable $10,000; inventory $55,000; accounts receivable $49,000; cash

$19,000

A)Assets: 19,000; 0; 49,000; 55,000; 123,000; 80,000; 203,000

Liabilities: 58,000; 25,000; 83,000; 0; 10,000; 10,000; 93,000

Owner's Equity: 110,000; 203,000

B)Assets: 19,000; 0; 49,000; 123,000; 55,000; 80,000; 203,000

Liabilities: 58,000; 25,000; 83,000; 0; 10,000; 10,000; 93,000

Owner's Equity: 110,000; 203,000

C)Assets: 19,000; 0; 49,000; 55,000; 123,000; 80,000; 203,000

Liabilities: 58,000; 25,000; 83,000; 0; 10,000; 10,000; 110,000

Owner's Equity: 93,000; 203,000

D)Assets: 19,000; 0; 49,000; 55,000; 123,000; 80,000; 203,000

Liabilities: 10,000; 25,000; 35,000; 0; 58,000; 58,000; 93,000

Owner's Equity: 110,000; 203,000

Jake's Janitorial Service: fixed assets $80,000; long-term notes $58,000; equity $110,000; accounts payable $25,000; notes payable $10,000; inventory $55,000; accounts receivable $49,000; cash

$19,000

A)Assets: 19,000; 0; 49,000; 55,000; 123,000; 80,000; 203,000

Liabilities: 58,000; 25,000; 83,000; 0; 10,000; 10,000; 93,000

Owner's Equity: 110,000; 203,000

B)Assets: 19,000; 0; 49,000; 123,000; 55,000; 80,000; 203,000

Liabilities: 58,000; 25,000; 83,000; 0; 10,000; 10,000; 93,000

Owner's Equity: 110,000; 203,000

C)Assets: 19,000; 0; 49,000; 55,000; 123,000; 80,000; 203,000

Liabilities: 58,000; 25,000; 83,000; 0; 10,000; 10,000; 110,000

Owner's Equity: 93,000; 203,000

D)Assets: 19,000; 0; 49,000; 55,000; 123,000; 80,000; 203,000

Liabilities: 10,000; 25,000; 35,000; 0; 58,000; 58,000; 93,000

Owner's Equity: 110,000; 203,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

53

Find the ratio of net income after taxes to average owner's equity. Round to the nearest tenth of a percent.

Owner's equity at beginning of year: $602,000. Owner's equity at end of year: $806,000. Net income after taxes: $93,500.

A)15.5%

B)11.6%

C)15.6%

D)13.3%

Owner's equity at beginning of year: $602,000. Owner's equity at end of year: $806,000. Net income after taxes: $93,500.

A)15.5%

B)11.6%

C)15.6%

D)13.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

54

Complete the income statement.

Camelot Sales Inc. had gross sales of $2,659,000 with returns of $59,700. The inventory on January 1 was $570,000. During the year $1,062,000 worth of goods was purchased with freight of $5,600. The

Inventory on December 31 was $519,000. Wages and salaries were $82,600, rent was $14,500,

Advertising was $17,400, utilities were $5,200, business taxes totaled $9,000, and miscellaneous

Expenses were $6,200.

A)1)$2,659,000, 2)$59,700, 3)$2,599,300, 4)$1,118,600, 5)$1,480,700, 6)$134,900, 7)$1,465,200

B)1)$2,659,000, 2)$59,700, 3)$2,718,700, 4)$1,118,600, 5)$1,600,100, 6)$134,900, 7)$1,465,200

C)1)$2,659,000, 2)$59,700, 3)$2,599,300, 4)$1,118,600, 5)$1,480,700, 6)$134,900, 7)$1,345,800

D)1)$2,659,000, 2)$59,700, 3)$2,599,300, 4)$1,107,400, 5)$1,491,900, 6)$134,900, 7)$1,345,800

Camelot Sales Inc. had gross sales of $2,659,000 with returns of $59,700. The inventory on January 1 was $570,000. During the year $1,062,000 worth of goods was purchased with freight of $5,600. The

Inventory on December 31 was $519,000. Wages and salaries were $82,600, rent was $14,500,

Advertising was $17,400, utilities were $5,200, business taxes totaled $9,000, and miscellaneous

Expenses were $6,200.

A)1)$2,659,000, 2)$59,700, 3)$2,599,300, 4)$1,118,600, 5)$1,480,700, 6)$134,900, 7)$1,465,200

B)1)$2,659,000, 2)$59,700, 3)$2,718,700, 4)$1,118,600, 5)$1,600,100, 6)$134,900, 7)$1,465,200

C)1)$2,659,000, 2)$59,700, 3)$2,599,300, 4)$1,118,600, 5)$1,480,700, 6)$134,900, 7)$1,345,800

D)1)$2,659,000, 2)$59,700, 3)$2,599,300, 4)$1,107,400, 5)$1,491,900, 6)$134,900, 7)$1,345,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck