Deck 20: Public Finance: Expenditures and Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/336

العب

ملء الشاشة (f)

Deck 20: Public Finance: Expenditures and Taxes

1

The efficiency loss of a tax is the tax revenue collected by government minus the value of the public goods financed through the tax.

False

2

Economists agree that corporations always shift the corporate income tax to consumers by raising product prices.

False

3

Government assumes some responsibility for providing a minimum standard of living for all citizens to compensate for the increase in income inequality caused by government tax revenues and expenditures.

False

4

The government is like business firms in that it provides goods and services to households and businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

5

A tax is progressive if the average tax rate rises as income increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

6

A highly progressive tax takes relatively more from the rich than it does from the poor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

7

About two-thirds of all federal spending is for national defense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

8

A progressive tax takes relatively more from the rich than it does from the poor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

9

If you pay a $2,000 tax on $10,000 of taxable income and a $4,000 tax on a taxable income of $16,000, the tax is progressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

10

The major expenditure of local governments is for education.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

11

Sales taxes on consumer goods are regressive because poor people consume a larger proportion of their incomes than do rich people.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

12

Given demand, the more inelastic the supply of a product, the larger the portion of an excise tax that is borne by producers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

13

Sales taxes are proportional in relation to income because the same tax rate applies regardless of the size of a purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

14

The benefits-received principle of taxation is used to support corporate and personal income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

15

The greater the elasticity of demand and supply, the greater is the efficiency loss of a tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

16

The marginal tax rate is the tax rate that applies to additional income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

17

Although state and local taxes are highly progressive, federal taxation is predominantly regressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

18

Given supply, the more inelastic the demand for a product, the larger the portion of an excise tax that is shifted to consumers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

19

The largest source of local government's revenue is the sales tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

20

The basic source of state government's revenue is the property tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

21

Transfer payments are "exhaustive" in that they directly absorb resources, whereas government purchases are "nonexhaustive."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

22

Between the government and households, money or funds tend to flow only in one direction: from households to government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

23

In general for an excise tax on a product, given supply, the more elastic is the demand for the product, the larger will be the portion of the tax shouldered by the buyers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

24

When an excise tax or sales tax is imposed on a product, the sellers are always able to shift the burden of the tax on to the buyers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Social Security tax is regressive because it applies only on income below a "cap" income level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

26

The largest source of tax revenue for state governments is the property tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

27

If an income tax is progressive, the average tax rate will increase as incomes increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

28

The levying of licensing fees for automobiles is an example of taxation based on the ability-to-pay principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

29

The largest portion of federal employees work in the national defense sector.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

30

The interest on public debt is more than 10 percent of federal government expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

31

From 1960 to 2018, government purchases in the United States have shrunk as a percentage of GDP, but transfer payments have expanded greatly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

32

When the government is doing "deficit spending," it will be increasing its total debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

33

Payroll taxes account for more than one-third of federal tax revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

34

Just like businesses, the public sector uses resources in order to produce goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

35

Only a few states use state-run lotteries to increase their revenues and pay for expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

36

More than 50 percent of local and state employees are employed in the education sector.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

37

The probable incidence of the tax on business property is on consumers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

38

The largest category of federal government expenditures is national defense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

39

Education is the largest expenditure item for state governments as well as local governments in the U.S.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

40

Corporate income taxes contribute more to federal tax revenues than do personal income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

41

The state and local tax structure is largely progressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

42

Assume that in year 1 you pay an average tax rate of 25 percent on a taxable income of $50,000. In year 2, you pay an average tax rate of 30 percent on a taxable income of $75,000. Assuming no change in tax rates, the marginal tax rate on your additional $25,000 of income is

A)13 percent.

B)35 percent.

C)40 percent.

D)20 percent.

A)13 percent.

B)35 percent.

C)40 percent.

D)20 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

43

Assume that in year 1 your average tax rate is 10 percent on a taxable income of $10,000. If the marginal tax rate on the next $10,000 of taxable income is 15 percent, what will be the average tax rate if your taxable income rises to $20,000?

A)25 percent.

B)15 percent.

C)12.5 percent.

D)about 14 percent.

A)25 percent.

B)15 percent.

C)12.5 percent.

D)about 14 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

44

If the supply of a product is upsloping and demand is downsloping, an excise tax of $2 per unit will increase price by

A)more than $2.

B)$2.

C)less than $2 and increase equilibrium output.

D)less than $2 and reduce equilibrium output.

A)more than $2.

B)$2.

C)less than $2 and increase equilibrium output.

D)less than $2 and reduce equilibrium output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

45

If the demand for a product is perfectly inelastic and supply is upsloping, a $1 excise tax per unit on suppliers will

A)raise price by $1.

B)not raise price at all.

C)raise price by more than $1.

D)raise price by less than $1.

A)raise price by $1.

B)not raise price at all.

C)raise price by more than $1.

D)raise price by less than $1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

46

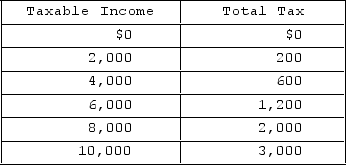

Refer to the personal income tax schedule given in the table. If your taxable income is $4,000, your average tax rate is

Refer to the personal income tax schedule given in the table. If your taxable income is $4,000, your average tax rate isA)15 percent; your marginal rate on the last $2,000 is 15 percent.

B)15 percent; your marginal rate on the last $2,000 is 20 percent.

C)15 percent; your marginal rate on the last $2,000 cannot be determined from the information given.

D)20 percent; your marginal rate on the last $2,000 is 15 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

47

In the U.S., the taxes mostly come from the rich and government spending mostly goes to programs that benefit the rich.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

48

The overall tax structure of the United States is proportional or slightly regressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

49

If you would have to pay $5,000 in taxes on $50,000 taxable income and $8,000 in taxes on $60,000 taxable income, then the marginal tax rate on the additional $10,000 of income is

A)30 percent, and the average tax rate is about 13 percent at the $60,000 income level.

B)15 percent, and the average tax rate is 30 percent at the $60,000 income level.

C)30 percent, and the average tax rate is 20 percent at the $50,000 income level.

D)30 percent, but average tax rates cannot be determined from the information given.

A)30 percent, and the average tax rate is about 13 percent at the $60,000 income level.

B)15 percent, and the average tax rate is 30 percent at the $60,000 income level.

C)30 percent, and the average tax rate is 20 percent at the $50,000 income level.

D)30 percent, but average tax rates cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

50

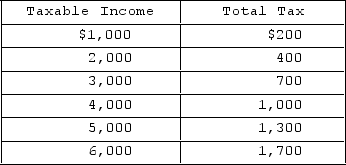

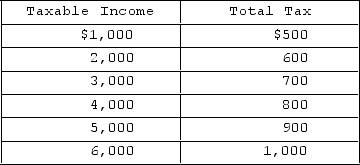

Refer to the income tax schedule given in the table. The tax represented is

Refer to the income tax schedule given in the table. The tax represented isA)optimal.

B)proportional.

C)regressive.

D)progressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

51

Indy currently earns $50,000 in taxable income and pays $8,000 in taxes. Suppose that Indy faces a marginal tax rate of 20 percent and his boss offers him a raise of $3,000 per year. Indy should

A)accept the raise because his after-tax income will rise by $2,400.

B)accept the raise because his after-tax income will rise by $400.

C)reject the raise because his after-tax income will fall by $2,000.

D)reject the raise because his after-tax income will fall by $1,500.

A)accept the raise because his after-tax income will rise by $2,400.

B)accept the raise because his after-tax income will rise by $400.

C)reject the raise because his after-tax income will fall by $2,000.

D)reject the raise because his after-tax income will fall by $1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

52

Suppose that government imposes a specific excise tax on product X of $6 per unit and that the price elasticity of supply of X is unitary (coefficient = 1). If the incidence of the tax is such that the producers of X pay $1.25 of the tax and the consumers pay $4.75, we can conclude that the

A)supply of X is inelastic.

B)demand for X is unitary elastic.

C)demand for X is elastic.

D)demand for X is inelastic.

A)supply of X is inelastic.

B)demand for X is unitary elastic.

C)demand for X is elastic.

D)demand for X is inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

53

Assume you pay a tax of $6,000 on a taxable income of $40,000. If your taxable income were $50,000, your tax payment would be $7,000. This suggests that the tax is

A)proportional.

B)regressive.

C)progressive.

D)discriminatory.

A)proportional.

B)regressive.

C)progressive.

D)discriminatory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

54

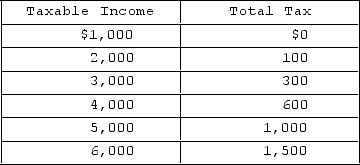

Refer to the income tax schedule given in the table. If your taxable income increases from $4,000 to $5,000, you will encounter a marginal tax rate of

Refer to the income tax schedule given in the table. If your taxable income increases from $4,000 to $5,000, you will encounter a marginal tax rate ofA)10 percent.

B)15 percent.

C)25 percent.

D)40 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

55

Refer to the income tax schedule given in the table. If your taxable income is $4,000, your average tax rate will be

Refer to the income tax schedule given in the table. If your taxable income is $4,000, your average tax rate will beA)30 percent.

B)15 percent.

C)10 percent.

D)20 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

56

Suppose that government imposes a specific excise tax on product X of $2 per unit and that the price elasticity of demand for X is unitary (coefficient = 1). If the incidence of the tax is such that consumers pay $0.20 of the tax and the producers pay $1.80, we can conclude that the

A)supply of X is inelastic.

B)supply of X is elastic.

C)supply of X is unitary elastic.

D)demand for X is elastic.

A)supply of X is inelastic.

B)supply of X is elastic.

C)supply of X is unitary elastic.

D)demand for X is elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

57

Suppose that government imposes a specific excise tax on product X of $4 per unit and that the price elasticity of supply of X is unitary (coefficient = 1). If the incidence of the tax is such that the consumers of X pay $2 of the tax and the producers pay $2, we can conclude that the

A)supply of X is inelastic.

B)demand for X is elastic.

C)demand for X is inelastic.

D)demand for X is unitary elastic.

A)supply of X is inelastic.

B)demand for X is elastic.

C)demand for X is inelastic.

D)demand for X is unitary elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

58

Assume you pay a tax of $15,000 on a taxable income of $80,000. If your taxable income were $160,000, your tax payment would be $30,000. This suggests that the tax is

A)progressive.

B)proportional.

C)regressive.

D)discriminatory.

A)progressive.

B)proportional.

C)regressive.

D)discriminatory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

59

In the U.S., the progressive income-tax system substantially redistributes income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

60

Suppose that government imposes a specific excise tax on product X of $2 per unit and that the price elasticity of demand for X is unitary (coefficient = 1). If the incidence of the tax is such that the producers of X pay $1.75 of the tax and the consumers pay $0.25, we can conclude that the

A)supply of X is inelastic.

B)supply of X is elastic.

C)supply of X is unitary elastic.

D)demand for X is elastic.

A)supply of X is inelastic.

B)supply of X is elastic.

C)supply of X is unitary elastic.

D)demand for X is elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

61

Revenues flowing to the government from government-run or government-sponsored businesses, such as public utilities and state lotteries, are known as

A)proprietary income.

B)transfer payments.

C)tax revenue.

D)subsidies.

A)proprietary income.

B)transfer payments.

C)tax revenue.

D)subsidies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

62

The more inelastic are demand and supply, the

A)larger is the efficiency loss of an excise tax.

B)smaller is the efficiency loss of an excise tax.

C)higher is the proportion of an excise tax paid by consumers.

D)smaller is the proportion of an excise tax paid by producers.

A)larger is the efficiency loss of an excise tax.

B)smaller is the efficiency loss of an excise tax.

C)higher is the proportion of an excise tax paid by consumers.

D)smaller is the proportion of an excise tax paid by producers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

63

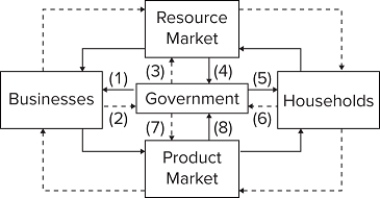

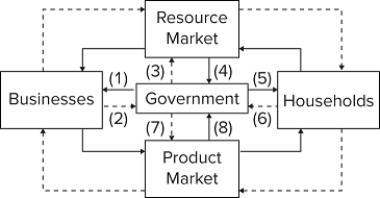

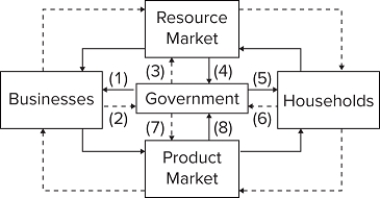

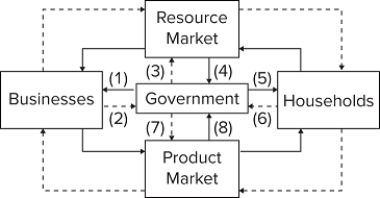

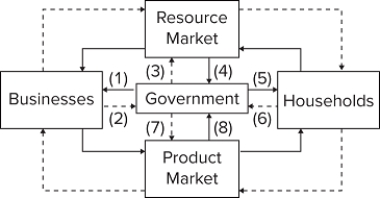

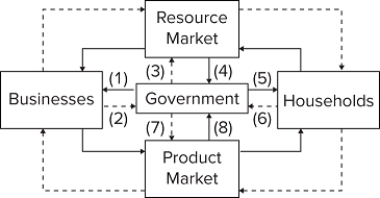

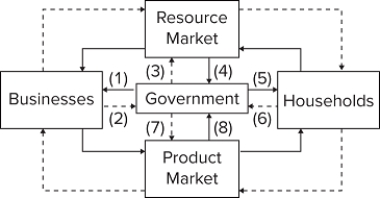

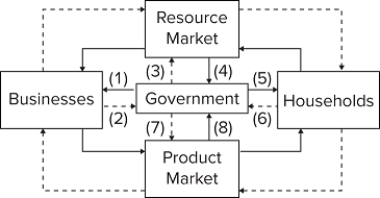

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (6)might represent

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (6)might representA)the payment of payroll taxes by households.

B)corporate income tax payments.

C)the employment of teachers by the Ogallala school district.

D)the purchase of armored personnel vehicles by government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

64

The addition of government to the circular-flow model illustrates that government

A)purchases resources in the resource market.

B)provides services to businesses and households.

C)purchases goods in the product market.

D)does all of the things stated in the other possible answers.

A)purchases resources in the resource market.

B)provides services to businesses and households.

C)purchases goods in the product market.

D)does all of the things stated in the other possible answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

65

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (1)might represent

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (1)might representA)corporate income tax payments.

B)government provision of highways for truck transportation.

C)business property tax payments.

D)transfer payments to low-income families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

66

(Advanced analysis)The equations for the demand and supply curves for a particular product are P = 10 − 0.4 Q and P = 1 + 0.4 Q, where P is price and Q is quantity expressed in units of 100. After an excise tax is imposed on the product, the supply equation is P = 2 + 0.4 Q. Government's revenue from this tax is

A)$1,000.

B)$1,125.

C)$875.

D)$1,400.

A)$1,000.

B)$1,125.

C)$875.

D)$1,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

67

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (8)might represent

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (8)might representA)personal income taxes.

B)automobile purchases by the state of Maine.

C)the services of firefighters.

D)subsidies to farmers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

68

If the marginal tax rate is 25 percent, by how much must income have increased if your tax bill increases by $200?

A)$200

B)$50

C)$800

D)The amount cannot be determined.

A)$200

B)$50

C)$800

D)The amount cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

69

(Advanced analysis)The equations for the demand and supply curves for a particular product are P = 10 − 0.4 Q and P = 2 + 0.4 Q, where P is price and Q is quantity expressed in units of 100. After an excise tax is imposed on the product, the supply equation is P = 3 + 0.4 Q. The equilibrium quantity after the excise tax is imposed is

A)875 units.

B)800 units.

C)1,200 units.

D)1,000 units.

A)875 units.

B)800 units.

C)1,200 units.

D)1,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

70

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (4)might represent

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (4)might representA)the services of NASA astrophysicists.

B)the purchase of stealth bombers.

C)personal income taxes.

D)investment spending by private corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

71

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (7)might represent

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (7)might representA)a transfer payment to disabled persons.

B)wage payments to public schoolteachers.

C)subsidies to corporations to stimulate exports.

D)the U.S. Bureau of Engraving and Printing's expenditures for paper.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

72

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (5)might represent

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (5)might representA)personal income tax revenues.

B)the provision of public schools by local governments.

C)the purchase of laptop computers by the state of Iowa.

D)wage payments to police officers and firefighters.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

73

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (2)might represent

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (2)might representA)the provision of national defense by government.

B)a government subsidy to farmers.

C)corporate income tax payments.

D)welfare payments to low-income families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

74

(Advanced analysis)The equations for the demand and supply curves for a particular product are P = 10 − 0.4 Q and P = 1 + 0.4 Q, where P is price and Q is quantity expressed in units of 100. After an excise tax is imposed on the product, the supply equation is P = 2 + 0.4 Q. The efficiency loss of this tax is

A)$62.50.

B)$125.

C)$87.50.

D)$1.00.

A)$62.50.

B)$125.

C)$87.50.

D)$1.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

75

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (3)might represent

In the diagram, solid arrows reflect real flows, while broken arrows are monetary flows. Flow (3)might representA)government salaries paid to schoolteachers.

B)property tax payments.

C)a state university's purchase of computers.

D)social security payments to retirees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

76

(Advanced analysis)The equations for the demand and supply curves for a particular product are P = 10 − 0.4 Q and P = 2 + 0.4 Q, where P is price and Q is quantity expressed in units of 100. After an excise tax is imposed on the product, the supply equation is P = 4 + 0.4 Q. The equilibrium quantity before the excise tax is imposed is

A)1,000 units.

B)750 units.

C)875 units.

D)1,200 units.

A)1,000 units.

B)750 units.

C)875 units.

D)1,200 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

77

(Advanced analysis)The equations for the demand and supply curves for a particular product are P = 10 − 0.4 Q and P = 2 + 0.4 Q, where P is price and Q is quantity expressed in units of 100. After an excise tax is imposed on the product, the supply equation is P = 3 + 0.4 Q. The excise tax on each unit of the product

A)is $1.

B)is $2.

C)is $3.

D)cannot be determined with the information given.

A)is $1.

B)is $2.

C)is $3.

D)cannot be determined with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

78

A progressive tax means that if someone earning $40,000 pays $10,000, someone earning $80,000 must pay

A)less than $10,000.

B)more than $20,000.

C)more than $10,000 but less than $30,000.

D)more than $30,000 but less than $40,000.

A)less than $10,000.

B)more than $20,000.

C)more than $10,000 but less than $30,000.

D)more than $30,000 but less than $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

79

Proprietary income refers to

A)revenue flowing to the government from taxes.

B)money borrowed by the government to finance its operations.

C)revenue generated by government-run businesses.

D)transfer payments from the government to the owners of property resources.

A)revenue flowing to the government from taxes.

B)money borrowed by the government to finance its operations.

C)revenue generated by government-run businesses.

D)transfer payments from the government to the owners of property resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck

80

Assume the demand for automobile tires is highly elastic and that the supply is highly inelastic. The burden of a $2 excise tax on each tire will be

A)borne by resource suppliers that provide the inputs for manufacturing tires.

B)shared about equally by buyers and sellers of tires.

C)borne primarily by sellers of tires.

D)borne primarily by buyers of tires.

A)borne by resource suppliers that provide the inputs for manufacturing tires.

B)shared about equally by buyers and sellers of tires.

C)borne primarily by sellers of tires.

D)borne primarily by buyers of tires.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 336 في هذه المجموعة.

فتح الحزمة

k this deck