Deck 10: Investment Returns and Aggregate Measures of Stock Markets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/42

العب

ملء الشاشة (f)

Deck 10: Investment Returns and Aggregate Measures of Stock Markets

1

With dollar-cost averaging, the investor purchases more securities when their prices rise.

False

2

Averaging down will prove to be profitable only if the price of the stock subsequently rises.

True

3

The rate of return on a stock considers the price change but not dividend income.

False

4

Historical studies of investment returns suggest that the stocks of small companies generate higher returns than the stocks of larger companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

5

Movements in stock prices are often illustrated using relative (percentage)price changes instead of absolute price changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

6

Comparisons of stock performance should use percentage changes instead of absolute price changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

7

Aggregate securities prices may be measured by using value-weighted or geometric averages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

8

The Dow Jones industrial and utility averages include a relatively small number of stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

9

Dollar-cost averaging is achieved by periodic, equal dollar investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

10

Bond averages that are expressed in percentages are not comparable to the S&P 500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

11

Stock indices do not consider taxes on capital gains.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

12

Studies of investments returns (e.g., the Ibbotson Associates studies of investment returns)determined that large-cap stocks in the S&P earned higher returns than the smaller companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

13

Indices of Nasdaq stocks tend to be less volatile than the S&P 500 index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

14

The Russell 3000 is a broad-based measure of bond prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

15

Realized returns should include both dividends and price changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

16

Studies of investment returns suggest that investors can expect to earn at least 15 percent annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

17

Aggregate measures of stock prices include dividend income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a stock increased from $25 to $50 in five years, the annual rate of return was 20 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

19

The S&P 500 stock index is value-weighted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

20

Averaging down may result in the investor sending good money after bad.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

21

The Wilshire 5000 stock index is more broad based than the S&P 500 stock index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

22

If a stock rose from $10 to $30 over ten years, the annual rate of return

A)was 20 percent

B)was greater than 20 percent

C)was less than 20 percent

D)cannot be determined

A)was 20 percent

B)was greater than 20 percent

C)was less than 20 percent

D)cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Standard & Poor's 500 stock index illustrates

A)a value-weighted index

B)a simple average

C)a geometric index

D)an exponential index

A)a value-weighted index

B)a simple average

C)a geometric index

D)an exponential index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

24

Over time, holding period returns tend to overstate the true annualized rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

25

Studies of realized rates of return assume that Dividend income is not reinvested.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

26

Movements in individual stock prices tend to be

A)positively correlated

B)positively correlated with inflation

C)negatively correlated

D)positively correlated with changes in interest rates

A)positively correlated

B)positively correlated with inflation

C)negatively correlated

D)positively correlated with changes in interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

27

a. Given the following information concerning three stocks, construct a simple average, a value-weighted average, and a geometric average.

Stock Price Shares Outstanding

A $10 1,000,000

B $14 3,000,000

C $21 10,000,000

b. What are averages if each price rises to $11, $17, and $35, respectively?

c. What is the percentage increase in each average?

Stock Price Shares Outstanding

A $10 1,000,000

B $14 3,000,000

C $21 10,000,000

b. What are averages if each price rises to $11, $17, and $35, respectively?

c. What is the percentage increase in each average?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

28

An investment's internal rate of return equates

A)dividend payments and capital gains

B)cash outflows and subsequent cash inflows

C)initial cash outflow and the sale price

D)dividend payments and the investment's cost

A)dividend payments and capital gains

B)cash outflows and subsequent cash inflows

C)initial cash outflow and the sale price

D)dividend payments and the investment's cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

29

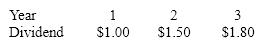

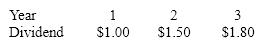

You bought a stock for $28.29 that paid the following dividends

After the third year, you sold the stock for $35. What was the annual rate of return?

After the third year, you sold the stock for $35. What was the annual rate of return?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

30

The calculation of a rate of return assumes dividend income is reinvested at the current dividend yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

31

Dollar cost averaging is

A)periodically buying a round lot of stock

B)periodically investing a specified dollar amount in a stock

C)a means to increase the average cost basis

D)a means to insure a positive return

A)periodically buying a round lot of stock

B)periodically investing a specified dollar amount in a stock

C)a means to increase the average cost basis

D)a means to insure a positive return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Russell 1000 index

A)combines 1000 stocks and bonds

B)uses the 1000 largest Nasdaq stocks

C)is a broad measure of NYSE-listed and over-the-counter (Nasdaq)stocks

D)is a broad-based measure of bonds

A)combines 1000 stocks and bonds

B)uses the 1000 largest Nasdaq stocks

C)is a broad measure of NYSE-listed and over-the-counter (Nasdaq)stocks

D)is a broad-based measure of bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

33

The S&P 500 uses

A)a simple average

B)a compound average

C)a geometric average

D)a value-weighted average

A)a simple average

B)a compound average

C)a geometric average

D)a value-weighted average

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

34

Holding period returns for greater than a year do not give an accurate measure of the true rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is the least broad-based measure of stock prices?

A)Nasdaq market index

B)Dow Jones industrial average

C)S&P 500 stock index

D)Russell 3000

A)Nasdaq market index

B)Dow Jones industrial average

C)S&P 500 stock index

D)Russell 3000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

36

You bought a stock for $20 and sold it for $59.72 after six years. What was the annual rate of return?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

37

The S&P 500 stock index is more sensitive to changes in the prices of small stocks than the stocks of large companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

38

To determine the realized return on an investment, the investor needs to know

1. income received

2. the cost of an investment

3. the sale price of the investment

A)1 and 2

B)1 and 3

C)2 and 3

D)all of the above

1. income received

2. the cost of an investment

3. the sale price of the investment

A)1 and 2

B)1 and 3

C)2 and 3

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

39

A strategy of averaging down will be profitable if

A)the price of the stock continues to fall

B)the firm pays more dividends

C)the firm retains earnings

D)the price of the stock subsequently rises

A)the price of the stock continues to fall

B)the firm pays more dividends

C)the firm retains earnings

D)the price of the stock subsequently rises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

40

Historical studies of rates of return on large stocks suggest

A)the average return is about 6.4 percent annually

B)over a period of years, the rate approximates 9-10 percent

C)equity investors rarely sustain losses

D)dividends account for over half the return

A)the average return is about 6.4 percent annually

B)over a period of years, the rate approximates 9-10 percent

C)equity investors rarely sustain losses

D)dividends account for over half the return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

41

The market consists of the following stocks. Their prices and number of shares are as follows:

Stock Price Number of Shares Outstanding

A $10 100,000

B 20 10,000

C 30 200,000

D 40 50,000

a. The price of Stock C doubles to $60. What is the percentage increase in the market if a S&P 500 type of measure of the market (value-weighted average)is used?

b. Repeat question (a)but use a Value Line type of measure of the market (i.e., a geometric average)to determine the percentage increase.

c. Suppose the price of stock B doubled instead of stock C. How would the market have fared using the aggregate measures employed in (a)and (b)? Why are your answers different?

Stock Price Number of Shares Outstanding

A $10 100,000

B 20 10,000

C 30 200,000

D 40 50,000

a. The price of Stock C doubles to $60. What is the percentage increase in the market if a S&P 500 type of measure of the market (value-weighted average)is used?

b. Repeat question (a)but use a Value Line type of measure of the market (i.e., a geometric average)to determine the percentage increase.

c. Suppose the price of stock B doubled instead of stock C. How would the market have fared using the aggregate measures employed in (a)and (b)? Why are your answers different?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck

42

You sold 200 shares of DOG short for $24. After three years you closed your position at $17. DOG paid an annual dividend of $1, what was the annualized (compound)return on the trade?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 42 في هذه المجموعة.

فتح الحزمة

k this deck