Deck 16: Bond Markets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/35

العب

ملء الشاشة (f)

Deck 16: Bond Markets

1

The bond market makes up what percentage of the total debt market?

A)35%

B)50%

C)70%

D)90%

A)35%

B)50%

C)70%

D)90%

D

2

A corporate bond has an 8% interest rate. The saver faces a marginal tax rate of 28%. What is the equivalent tax-free rate?

A)4.97%

B)5.76%

C)6.50%

D)7.07%

A)4.97%

B)5.76%

C)6.50%

D)7.07%

B

3

Which of these is a disadvantage of municipal bonds?

A)At least one study found a correlation between inflation and municipal bond default rates.

B)They have longer terms to maturity.

C)They are less liquid than US Treasury bonds.

D)As the economy slows, the level of defaults in municipal bonds increases.

A)At least one study found a correlation between inflation and municipal bond default rates.

B)They have longer terms to maturity.

C)They are less liquid than US Treasury bonds.

D)As the economy slows, the level of defaults in municipal bonds increases.

D

4

WordTechGuru Corporation issues bonds with a bond covenant that specifies a stated debt-to-equity ratio range that management must maintain and further requires management to provide financial information to bondholders, including the buying and selling of major assets. Which of these statements is most likely true of the bonds they are issuing?

A)The bonds will likely be very long term.

B)The bonds will likely have a call provision.

C)The bonds will be considered more risky and thus have a higher interest rate.

D)The bonds will be considered less risky and thus have a lower interest rate.

A)The bonds will likely be very long term.

B)The bonds will likely have a call provision.

C)The bonds will be considered more risky and thus have a higher interest rate.

D)The bonds will be considered less risky and thus have a lower interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

5

When bonds are issued by Ginnie Mae, Fannie Mae, and Freddie Mac, for what purpose are the proceeds typically used?

A)Mortgages are purchased and resold individually to investors.

B)Mortgages are purchased, pooled together, and then sold in small groups of three to five mortgages to wealthy investors.

C)Mortgages are purchased, pooled together in large groupings, and then the pooled groupings are sold in pieces.

D)Mortgages are purchased and resold, with the risk being evenly divided between the government agency and the purchaser.

A)Mortgages are purchased and resold individually to investors.

B)Mortgages are purchased, pooled together, and then sold in small groups of three to five mortgages to wealthy investors.

C)Mortgages are purchased, pooled together in large groupings, and then the pooled groupings are sold in pieces.

D)Mortgages are purchased and resold, with the risk being evenly divided between the government agency and the purchaser.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

6

William recently purchased $20,000 worth of Treasury bonds. The type of bonds that he purchased protect him from increases in the rate of inflation. William purchased

A)TIPS.

B)revenue bonds.

C)general obligation bonds.

D)convertible bonds.

A)TIPS.

B)revenue bonds.

C)general obligation bonds.

D)convertible bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

7

WordTechGuru issues bonds with a call provision, which allows them the option to pay off all or part of their bonds before the maturity date. Assuming WordTechGuru is like most companies whose bonds have a call provision, which of these statements best describes the WordTechGuru's call provision?

A)The call provision will list call dates and prices.

B)The call provision will likely list call dates, but without prices specified until closer to those dates.

C)The call provision will be adjusted as to dates and prices at any time after issue, but before the maturity date.

D)The call provision will likely have a single stated buyback price, regardless of the date it is called.

A)The call provision will list call dates and prices.

B)The call provision will likely list call dates, but without prices specified until closer to those dates.

C)The call provision will be adjusted as to dates and prices at any time after issue, but before the maturity date.

D)The call provision will likely have a single stated buyback price, regardless of the date it is called.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

8

What were the big bond-rating agencies doing in the 2000s?

A)They were sounding the alarm about Enron and WorldCom and downgraded these companies years before either failed.

B)They were conducting business as usual and did not lower the bond ratings of Enron and WorldCom until after these companies failed.

C)They were sounding the alarm about Enron and WorldCom and downgraded these companies months before either failed.

D)They were nearly forced out of business by market forces.

A)They were sounding the alarm about Enron and WorldCom and downgraded these companies years before either failed.

B)They were conducting business as usual and did not lower the bond ratings of Enron and WorldCom until after these companies failed.

C)They were sounding the alarm about Enron and WorldCom and downgraded these companies months before either failed.

D)They were nearly forced out of business by market forces.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of these statements is true of the main bond-rating agencies today?

A)Bond-rating agencies are subject to numerous regulations imposed by the Fed.

B)There are six main recognized bond-rating agencies today, as compared to only three in the past.

C)Each of the three main bond-rating agencies has a slightly different system for rating bonds.

D)Only two of the main bond-rating agencies today came into existence within the past forty years.

A)Bond-rating agencies are subject to numerous regulations imposed by the Fed.

B)There are six main recognized bond-rating agencies today, as compared to only three in the past.

C)Each of the three main bond-rating agencies has a slightly different system for rating bonds.

D)Only two of the main bond-rating agencies today came into existence within the past forty years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

10

Northwest Power Corporation has a Caa bond rating according to Moody's. This means that Northwest's bonds are rated

A)high quality.

B)lower medium quality.

C)poor grade.

D)speculative.

A)high quality.

B)lower medium quality.

C)poor grade.

D)speculative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

11

Bonds with a call provision normally pay a lower call price the

A)further the bond is from its maturity date.

B)higher the bond rating of the bond issuer.

C)lower the default risk in the bond.

D)closer the bond is to its maturity date.

A)further the bond is from its maturity date.

B)higher the bond rating of the bond issuer.

C)lower the default risk in the bond.

D)closer the bond is to its maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

12

A(n)__________ is a pool of money a corporation sets aside to help repay a bond issue.

A)call provision

B)indenture

C)sinking fund

D)bond covenant

A)call provision

B)indenture

C)sinking fund

D)bond covenant

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

13

A corporate bond has a 7% interest rate. The saver faces a marginal tax rate of 32%. What is the equivalent tax-free rate?

A)3.88%

B)4.06%

C)4.32%

D)4.76%

A)3.88%

B)4.06%

C)4.32%

D)4.76%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

14

Jordan recently purchased a 20-year bond from the federal government with a face value of $10,000. Jordan has purchased a

A)Treasury note.

B)municipal bond.

C)Treasury bond.

D)government agency bond.

A)Treasury note.

B)municipal bond.

C)Treasury bond.

D)government agency bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following best describes the difference between a "financial" bond covenant and a "nonfinancial" bond covenant?

A)A financial covenant ensures that management does not spend beyond yearly budgeted amounts; a nonfinancial covenant ensures that management does not take on too much debt.

B)A financial covenant ensures that management does not take on too much debt; nonfinancial covenants ensure that assets are insured, among other possible requirements.

C)A financial covenant requires management to provide financial information to bondholders; a nonfinancial covenant requires management to provide a detailed description of the operations of the company on a yearly basis.

D)A financial covenant requires that the assets of a company have adequate levels of insurance; a nonfinancial covenant requires management to provide a detailed description of the operations of the company on a yearly basis.

A)A financial covenant ensures that management does not spend beyond yearly budgeted amounts; a nonfinancial covenant ensures that management does not take on too much debt.

B)A financial covenant ensures that management does not take on too much debt; nonfinancial covenants ensure that assets are insured, among other possible requirements.

C)A financial covenant requires management to provide financial information to bondholders; a nonfinancial covenant requires management to provide a detailed description of the operations of the company on a yearly basis.

D)A financial covenant requires that the assets of a company have adequate levels of insurance; a nonfinancial covenant requires management to provide a detailed description of the operations of the company on a yearly basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

16

Kayla recently inherited a substantial sum of money and is looking to invest some of it in the bond market. She prefers to know exactly how much she will be paid when her bonds mature. Of the following options, what type of bond should she purchase?

A)Revenue bonds

B)STRIPS

C)General obligation bonds

D)Treasury notes

A)Revenue bonds

B)STRIPS

C)General obligation bonds

D)Treasury notes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

17

B&G Corporation issues convertible bonds. Convertible bonds allow B&G bondholders to do which of the following?

A)Convert their bonds into shares of common stock at some point in the future

B)Convert their bonds into shares of preferred stock at some point in the future

C)Convert their bonds into cash on certain call dates before maturity of the bonds

D)Convert their bonds into either common or preferred stock at some point in the future

A)Convert their bonds into shares of common stock at some point in the future

B)Convert their bonds into shares of preferred stock at some point in the future

C)Convert their bonds into cash on certain call dates before maturity of the bonds

D)Convert their bonds into either common or preferred stock at some point in the future

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

18

The local government of Clintonville wants to install a sewer system and use the revenue generated from providing the sewer services to residents. To raise the funds to install the sewer system, the local government might issue

A)general obligation bonds.

B)STRIPS.

C)revenue bonds.

D)convertible bonds.

A)general obligation bonds.

B)STRIPS.

C)revenue bonds.

D)convertible bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of these best describes how bond-rating agencies affect the interest rate that bonds must provide to attract borrowers?

A)Bond rating agencies in the past provided an initial evaluation of bonds; today, evaluations are daily and more reliable.

B)Bond rating agencies today provide significant warning for any changes in risk related to bond-issuing companies.

C)Bond rating agencies historically provide initial evaluation only of bonds; subsequent changes in performance must be noted by borrowers.

D)Bond rating agencies historically provide initial and ongoing evaluation of bonds to alert borrowers to their risk level.

A)Bond rating agencies in the past provided an initial evaluation of bonds; today, evaluations are daily and more reliable.

B)Bond rating agencies today provide significant warning for any changes in risk related to bond-issuing companies.

C)Bond rating agencies historically provide initial evaluation only of bonds; subsequent changes in performance must be noted by borrowers.

D)Bond rating agencies historically provide initial and ongoing evaluation of bonds to alert borrowers to their risk level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

20

ABC Manufacturing Corporation has an AA bond rating according to Standard & Poor. This means that ABC's bonds are rated

A)speculative .

B)high quality.

C)low quality.

D)medium quality.

A)speculative .

B)high quality.

C)low quality.

D)medium quality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

21

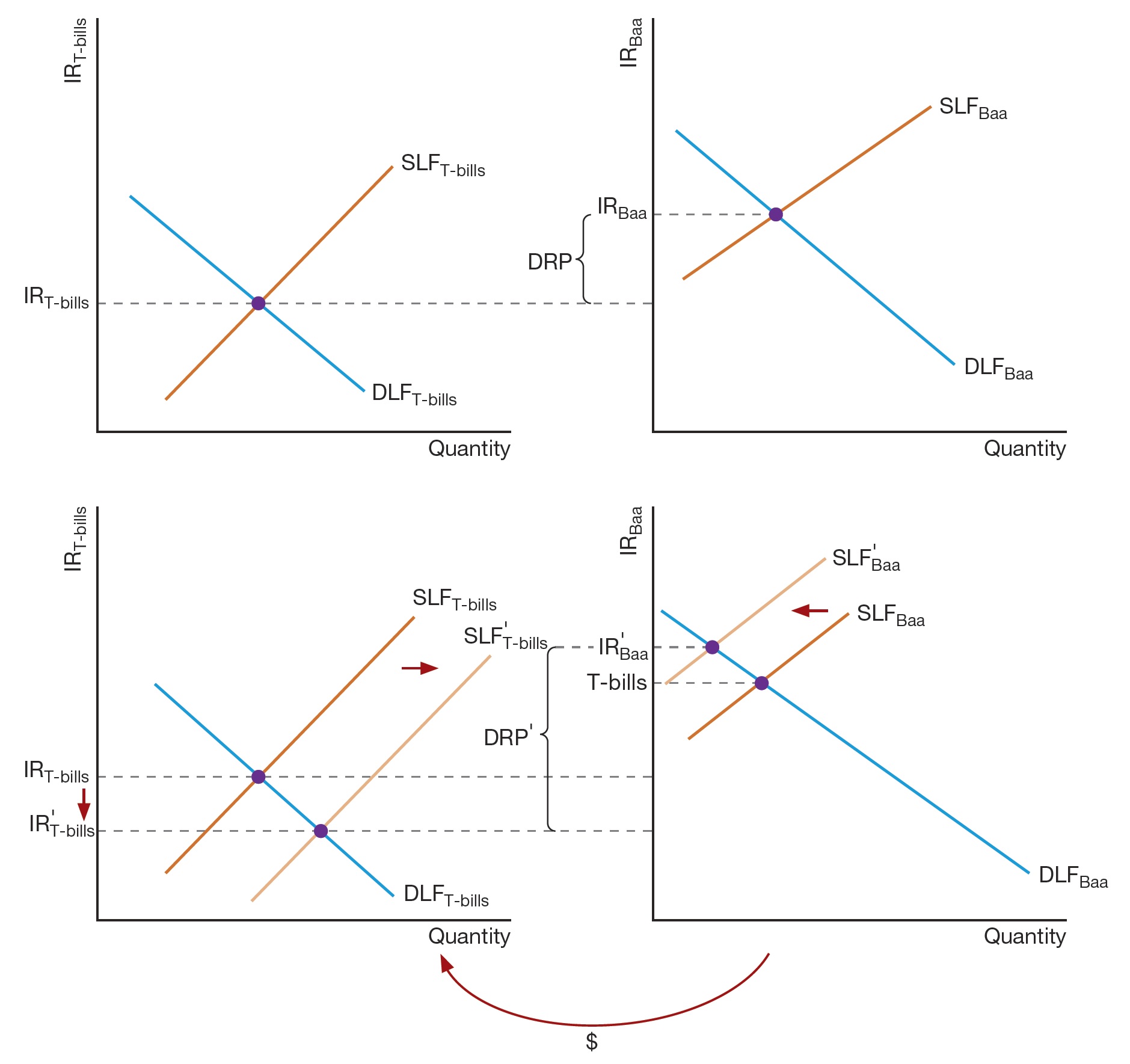

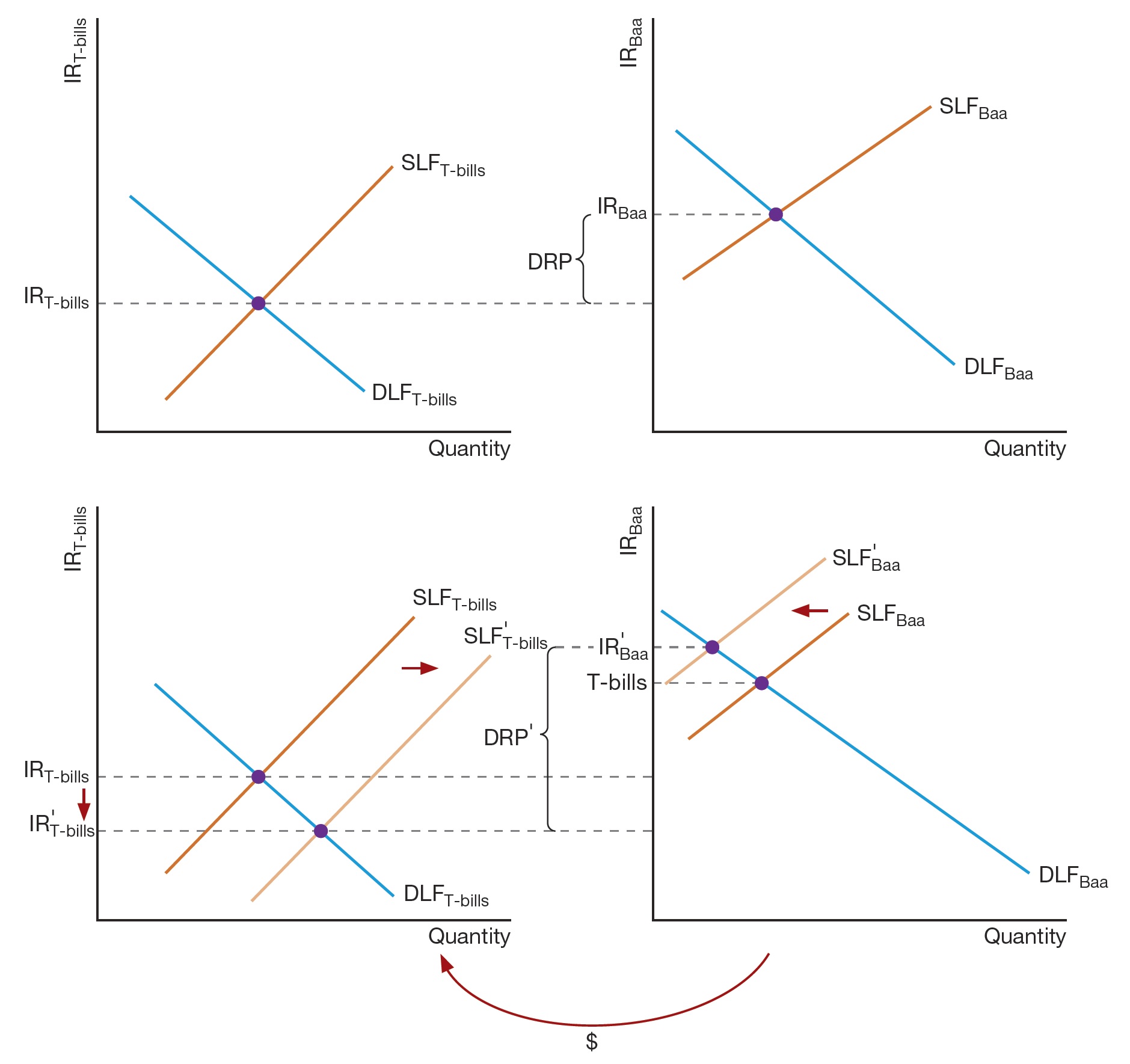

The following graphs show what occurs during a flight to quality for the loanable funds market for T-bills (left)and the market for investment grade bonds (right).

Based on the information presented in the graphs, which of the following statements is true?

A)As a result of the flight to quality, the interest rate in the Baa market increases, while the interest rate in the T-bill market falls.

B)As a result of the flight to quality, there is an increase in the supply of loanable funds in the Baa market.

C)As a result of the flight to quality, there is an increase in the supply of loanable funds in the both the T-bill market and the Baa market.

D)As a result of the flight to quality, there is an increase in the demand of loanable funds in the Baa market.

Based on the information presented in the graphs, which of the following statements is true?

A)As a result of the flight to quality, the interest rate in the Baa market increases, while the interest rate in the T-bill market falls.

B)As a result of the flight to quality, there is an increase in the supply of loanable funds in the Baa market.

C)As a result of the flight to quality, there is an increase in the supply of loanable funds in the both the T-bill market and the Baa market.

D)As a result of the flight to quality, there is an increase in the demand of loanable funds in the Baa market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

22

A saver is trying to decide whether to invest in a corporate bond or a municipal bond. The corporate bond has a 5% interest rate, and the saver faces a marginal tax rate of 25%. The municipal bond has a rate of 4%. Which should the saver choose?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

23

How did a change in the business model for bond rating agencies contribute to a conflict of interest today?

A)Bond rating agencies now sell manuals of financial data to the purchasers of bonds.

B)Bond rating agencies are paid a fee by the federal government.

C)Bond rating agencies are now paid by the bond issuers.

D)Bond rating agencies now make roughly half their income from those who purchase bonds and half from those who issue bonds.

A)Bond rating agencies now sell manuals of financial data to the purchasers of bonds.

B)Bond rating agencies are paid a fee by the federal government.

C)Bond rating agencies are now paid by the bond issuers.

D)Bond rating agencies now make roughly half their income from those who purchase bonds and half from those who issue bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is true of issuers with a lower bond rating?

A)They will offer purchase incentives.

B)There will typically be repayment guarantees .

C)The bonds will have a lower interest rate .

D)The bonds will have a higher interest rate .

A)They will offer purchase incentives.

B)There will typically be repayment guarantees .

C)The bonds will have a lower interest rate .

D)The bonds will have a higher interest rate .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

25

During a flight to quality, the default risk premium spread between medium-quality and low-quality Baa bonds and high-quality T-bills will

A)widen.

B)narrow.

C)not change.

D)diminish to zero.

A)widen.

B)narrow.

C)not change.

D)diminish to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following markets were hard hit first (and most)by the flight to quality in 2008?

A)Municipal bonds and commercial paper

B)T-bills and AA-rated bonds

C)AAA-rated corporate bonds and municipal bonds

D)T-bills and municipal bonds

A)Municipal bonds and commercial paper

B)T-bills and AA-rated bonds

C)AAA-rated corporate bonds and municipal bonds

D)T-bills and municipal bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

27

If the Ohio Teachers Retirement Fund is considering buying bonds issued by Johnson Electric Corporation and is wanting to evaluate the default risk of the bonds, under the current business model used by the bond-rating agencies, Johnson Electric Corporation must pay the bond-rating agencies to provide the bond rating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

28

Describe the potential conflict of interest that arises due to the way bond-rating agencies earn income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

29

How is a sinking fund different from a call provision?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of these statements best describes the flight to quality that began in the autumn of 2008?

A)Money quickly flowed out of low-graded and speculative corporate bonds and into the T-bill market.

B)Money slowly moved out of low-graded and speculative corporate bonds and into the T-bill market.

C)Money slowly moved out from even medium-rated corporate bonds and into the T-bill market.

D)Money quickly flowed out of even medium-rated corporate bonds and into the T-bill market.

A)Money quickly flowed out of low-graded and speculative corporate bonds and into the T-bill market.

B)Money slowly moved out of low-graded and speculative corporate bonds and into the T-bill market.

C)Money slowly moved out from even medium-rated corporate bonds and into the T-bill market.

D)Money quickly flowed out of even medium-rated corporate bonds and into the T-bill market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

31

If Luis buys a bond from Robinson Manufacturing Company and the company has a sinking fund, an early buyback of the bonds may be required under the terms of the sinking fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

32

General obligation bonds generally do not have to be approved by taxpayers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

33

Given the spotty performance of the bond-rating agencies in sounding the alarm of impending failure among many large borrowers, what action was taken in 2011 to ensure better performance?

A)The Dodd-Frank Act of 2011 gave enforcement power regarding rating agencies to a new agency within the SEC.

B)The Dodd-Frank Act of 2011 created an office within the Treasury to oversee the bond-rating agencies.

C)The Dodd-Frank Act of 2011 created an office within the SEC to oversee the bond-rating agencies.

D)The Dodd-Frank Act of 2011 gave enforcement power regarding rating agencies to the Fed.

A)The Dodd-Frank Act of 2011 gave enforcement power regarding rating agencies to a new agency within the SEC.

B)The Dodd-Frank Act of 2011 created an office within the Treasury to oversee the bond-rating agencies.

C)The Dodd-Frank Act of 2011 created an office within the SEC to oversee the bond-rating agencies.

D)The Dodd-Frank Act of 2011 gave enforcement power regarding rating agencies to the Fed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

34

The global financial crisis that began in 2008 involved a flight to quality and a flight to liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

35

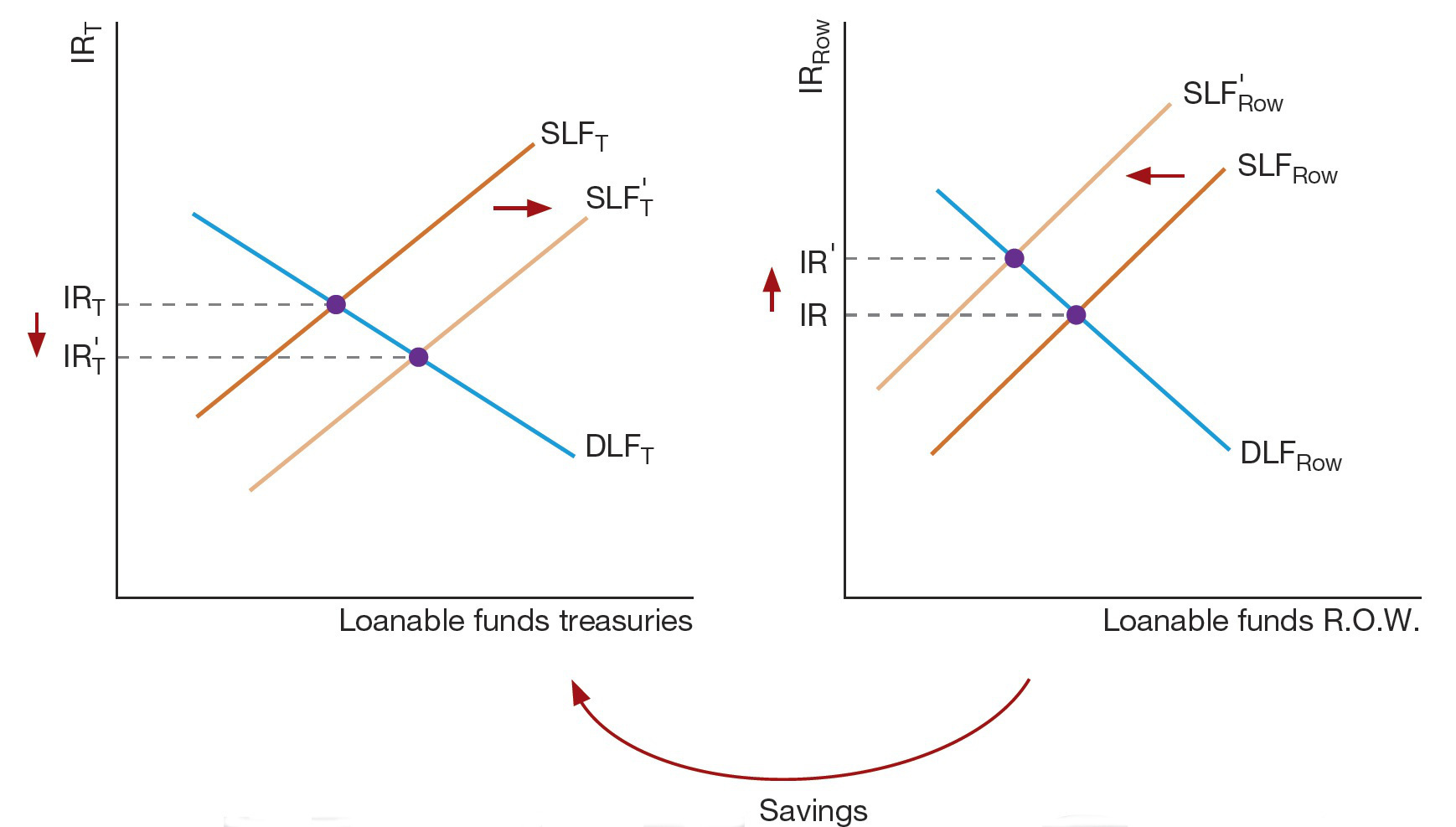

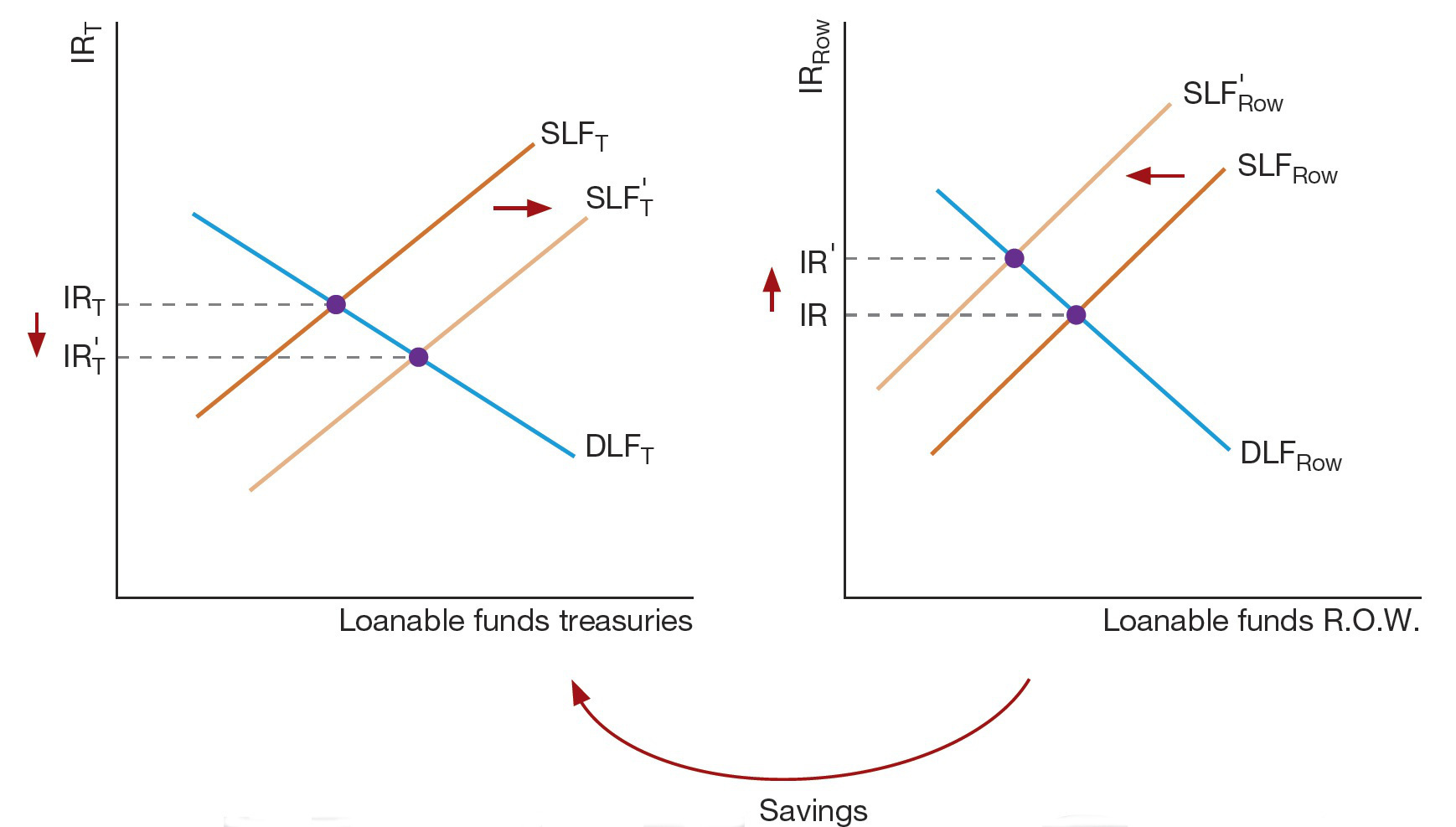

The following graph shows what occurred during a flight to quality for the loanable funds market for US Treasury securities and the loanable funds market for the rest of the world.

Based on the information presented in the graph, which of the following statements is true?

A)The global flight to quality resulted in an increase in demand in the loanable funds market for the rest of the world.

B)The global flight to quality pushed up the borrowing costs for the rest of the world.

C)The global flight to quality pushed up the borrowing costs for loanable funds in the market for US Treasury securities.

D)The global flight to quality resulted in an increase in supply in both the loanable funds market for US Treasury securities and in the loanable funds market for the rest of the world.

Based on the information presented in the graph, which of the following statements is true?

A)The global flight to quality resulted in an increase in demand in the loanable funds market for the rest of the world.

B)The global flight to quality pushed up the borrowing costs for the rest of the world.

C)The global flight to quality pushed up the borrowing costs for loanable funds in the market for US Treasury securities.

D)The global flight to quality resulted in an increase in supply in both the loanable funds market for US Treasury securities and in the loanable funds market for the rest of the world.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck