Deck 15: Money Markets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/35

العب

ملء الشاشة (f)

Deck 15: Money Markets

1

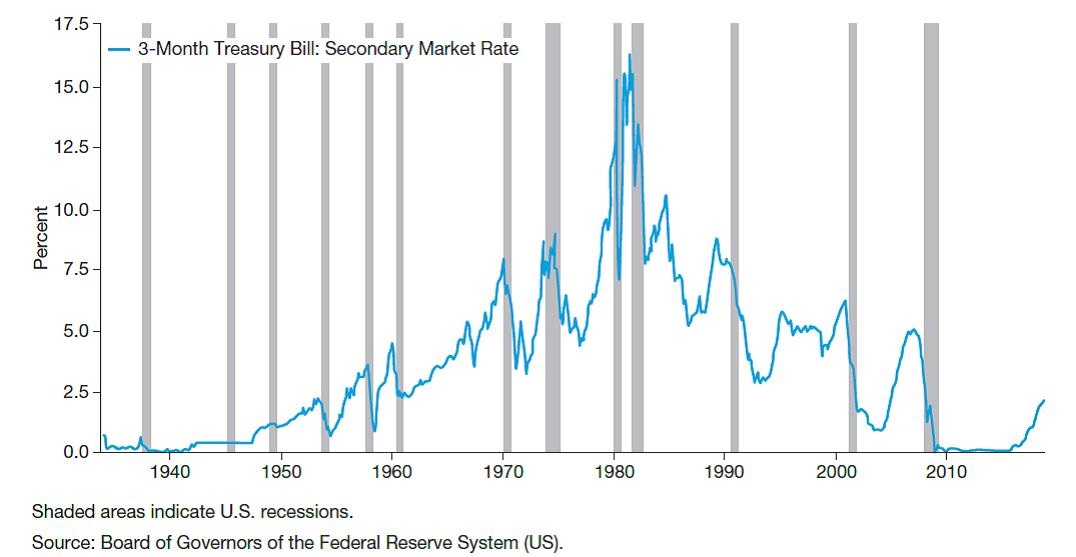

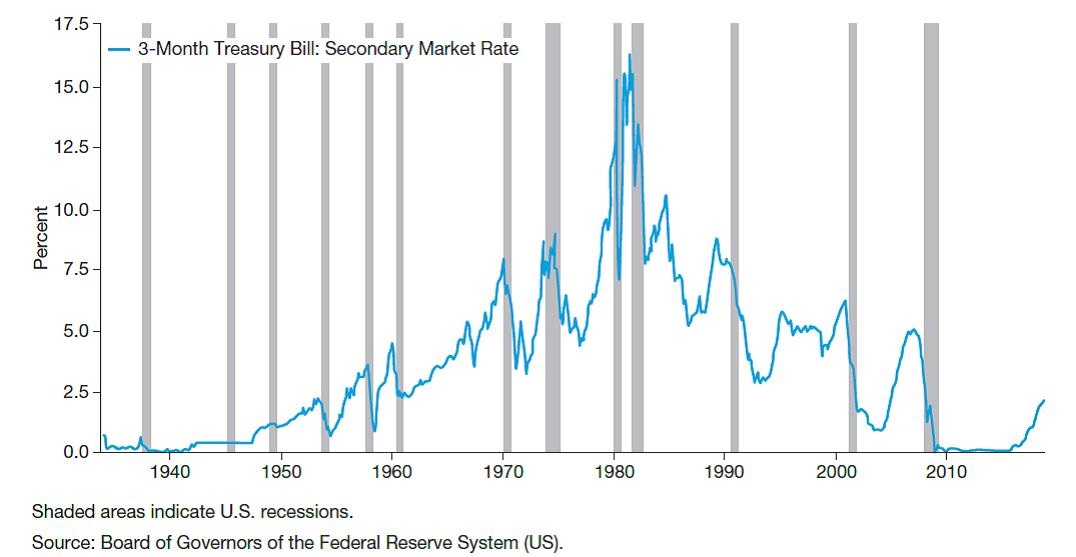

What concept does the following diagram illustrate regarding interest rates for three-month T-bills?

A)Interest rates for three-month Treasury bills have been both high and low during recessions.

B)Interest rates for three-month Treasury bills have been historically low during recessions.

C)Interest rates for three-month T-bills have been low, even during inflationary periods.

D)Interest rates for three-month T-bills have been relatively low since 1990.

A)Interest rates for three-month Treasury bills have been both high and low during recessions.

B)Interest rates for three-month Treasury bills have been historically low during recessions.

C)Interest rates for three-month T-bills have been low, even during inflationary periods.

D)Interest rates for three-month T-bills have been relatively low since 1990.

A

2

To raise the funds the federal government needs for its spending, the Treasury Department auctions T-bills

A)daily.

B)weekly.

C)every other week.

D)monthly.

A)daily.

B)weekly.

C)every other week.

D)monthly.

B

3

Suppose you buy a 120-day T-bill with a face value of $10,000 at a price of $9,900. Your discount rate yield (DRY)would be

A)3.0%.

B)3.5%.

C)4.0%.

D)4.5%.

A)3.0%.

B)3.5%.

C)4.0%.

D)4.5%.

A

4

Money market instruments have a low level of default risk for which of these reasons?

A)They are short-term IOUs.

B)Only governments can issue them.

C)They are issued by only the biggest and safest borrowers.

D)There is a well-organized secondary market for the instruments.

A)They are short-term IOUs.

B)Only governments can issue them.

C)They are issued by only the biggest and safest borrowers.

D)There is a well-organized secondary market for the instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of these is the most accurate description of the money market?

A)A market for financial assets that are borrowed and lent out between banks and large corporations

B)A market of IOUs between governments and banks

C)A market for financial assets that are a close substitute for money

D)A market of financial assets that are a close substitute for money, largely traded between banks

A)A market for financial assets that are borrowed and lent out between banks and large corporations

B)A market of IOUs between governments and banks

C)A market for financial assets that are a close substitute for money

D)A market of financial assets that are a close substitute for money, largely traded between banks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

6

Suppose you buy a 30-day T-bill with a face value of $1,000 at a price of $990. Your discount rate yield (DRY)would be

A)9.75%.

B)10%.

C)10.5%.

D)12%.

A)9.75%.

B)10%.

C)10.5%.

D)12%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

7

Trade in money markets is dominated by

A)investment banks and commercial banks.

B)brokers, dealers, investment banks, and commercial banks.

C)governments and banks.

D)Fortune 500 corporations, wealthy individuals, and investment banks.

A)investment banks and commercial banks.

B)brokers, dealers, investment banks, and commercial banks.

C)governments and banks.

D)Fortune 500 corporations, wealthy individuals, and investment banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following explains why both competitive bids and noncompetitive bids, no one bidder is allowed to purchase more than 35% of any one issue?

A)to make the bidding fair

B)to make the bidding unfair

C)to avoid the "winner's curse" due to the uncertainty over the value of the T-bills being auctioned

D)to avoid the "loser's curse" due to the uncertainty over the value of the T-bills being auctioned

A)to make the bidding fair

B)to make the bidding unfair

C)to avoid the "winner's curse" due to the uncertainty over the value of the T-bills being auctioned

D)to avoid the "loser's curse" due to the uncertainty over the value of the T-bills being auctioned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

9

Cameron is looking to buy $10,000 worth of T-bills. She can purchase them at all of the following places EXCEPT

A)directly from her bank.

B)over the Internet directly from the government.

C)indirectly from a broker.

D)indirectly through a mutual fund.

A)directly from her bank.

B)over the Internet directly from the government.

C)indirectly from a broker.

D)indirectly through a mutual fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of these statements best describes the type of debt instruments and the level of risk in the money market?

A)The debt instruments are long-term and the risk is high.

B)The debt instruments are short-term and the risk is low.

C)The debt instruments are long-term and the risk is low.

D)The debt instruments are short-term and the risk is high.

A)The debt instruments are long-term and the risk is high.

B)The debt instruments are short-term and the risk is low.

C)The debt instruments are long-term and the risk is low.

D)The debt instruments are short-term and the risk is high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

11

A money market is a wholesale market. In practice, and prior to 1998, this meant that transactions were best described in which of these ways?

A)Transactions were quite large in volume; most transactions are still for $1 to $10 million or more.

B)Transactions may be large or relatively small; individuals could commonly trade for as little as $5,000.

C)Transactions were large in volume, but most are for less than $1 million.

D)Extremely large transactions are common, meaning transactions of more than $500 million.

A)Transactions were quite large in volume; most transactions are still for $1 to $10 million or more.

B)Transactions may be large or relatively small; individuals could commonly trade for as little as $5,000.

C)Transactions were large in volume, but most are for less than $1 million.

D)Extremely large transactions are common, meaning transactions of more than $500 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

12

In 1998, the government lowered the minimum denomination of T-bills so that individuals can now purchase T-bills along with institutional investors. What is the current lowest denomination of T-bills?

A)$500

B)$1,000

C)$5,000

D)$10,000

A)$500

B)$1,000

C)$5,000

D)$10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

13

Commercial banks often buy money market instruments for the purpose of

A)having a place to "park" their funds temporarily.

B)trading in the secondary market.

C)reselling them to customers.

D)generating interest income.

A)having a place to "park" their funds temporarily.

B)trading in the secondary market.

C)reselling them to customers.

D)generating interest income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

14

Ryan is planning to enter a noncompetitive bid for a large amount of T-bills next Monday. In order to do so, what will Ryan need to include in his bid?

A)Only the price he is willing to pay for Treasury bills

B)Only the amount of Treasury bills he wishes to buy

C)Both the amount of Treasury bills he wishes to buy and the price he is willing to pay

D)Both the amount of Treasury bills he wishes to buy and when he will be ready to buy them

A)Only the price he is willing to pay for Treasury bills

B)Only the amount of Treasury bills he wishes to buy

C)Both the amount of Treasury bills he wishes to buy and the price he is willing to pay

D)Both the amount of Treasury bills he wishes to buy and when he will be ready to buy them

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is NOT a supplier of financial instruments in the primary market?

A)The federal government

B)Large corporations

C)Commercial banks

D)The Federal Reserve

A)The federal government

B)Large corporations

C)Commercial banks

D)The Federal Reserve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

16

The government doesn't actually pay interest on T-bills; instead, they are sold at

A)face value.

B)a discount.

C)principal value.

D)the highest bid price.

A)face value.

B)a discount.

C)principal value.

D)the highest bid price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

17

Suppose you buy a 30-day T-bill with a face value of $1,000 at a price of $990. Your investment return yield (IRY)would be

A)12.00%.

B)12.17%.

C)12.50%.

D)13.00%.

A)12.00%.

B)12.17%.

C)12.50%.

D)13.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

18

Suppose you buy a 120-day T-bill with a face value of $10,000 at price of $9,900. Your investment return yield (IRY)would be

A)2.9%.

B)3.0%.

C)3.4%.

D)3.7%.

A)2.9%.

B)3.0%.

C)3.4%.

D)3.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

19

XYZ Corporation is trying to decide whether it should buy money market instruments or leave its funds on deposit at a commercial bank. Which of the following is an advantage of buying money market instruments over leaving funds on deposit at a commercial bank that XYZ should be aware of?

A)Money market instruments offer a higher yield than leaving funds on deposit at a commercial bank.

B)Money market instruments are safer than leaving funds on deposit at a commercial bank.

C)Money market instruments are more liquid than funds on deposit at a commercial bank.

D)Money market instruments involve a financial middleman.

A)Money market instruments offer a higher yield than leaving funds on deposit at a commercial bank.

B)Money market instruments are safer than leaving funds on deposit at a commercial bank.

C)Money market instruments are more liquid than funds on deposit at a commercial bank.

D)Money market instruments involve a financial middleman.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

20

The money market is a market of debt instruments, mostly maturing within

A)18 months.

B)12 months.

C)16 months.

D)24 months.

A)18 months.

B)12 months.

C)16 months.

D)24 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following statements about negotiable certificates of deposit (CDs)is true?

A)Negotiable CDs are considered a liquid bank account.

B)To open a negotiable CD, savers must have large amounts of savings, usually at least $100,000.

C)The interest rates paid on negotiable CDs are determined solely by the issuing bank.

D)Funds can be withdrawn from negotiable CDs at any time.

A)Negotiable CDs are considered a liquid bank account.

B)To open a negotiable CD, savers must have large amounts of savings, usually at least $100,000.

C)The interest rates paid on negotiable CDs are determined solely by the issuing bank.

D)Funds can be withdrawn from negotiable CDs at any time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

22

How does the auction for US Treasury bills work?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

23

Assume that Merrill Lynch, a government securities dealer, sells T-bills to First Central Bank with a promise to buy the T-bills back the next day. This agreement is known as a

A)banker's acceptance.

B)commercial paper transaction.

C)repurchase agreement.

D)short-term IOU.

A)banker's acceptance.

B)commercial paper transaction.

C)repurchase agreement.

D)short-term IOU.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

24

In 2008, the Federal Reserve began paying interest on the bank deposits it holds. By doing this, its goal is to

A)establish a price floor on the interest rate on US Treasury securities.

B)establish a price floor on the interest rate in the federal funds market.

C)improve the liquidity of commercial banks.

D)improve the financial position of commercial banks.

A)establish a price floor on the interest rate on US Treasury securities.

B)establish a price floor on the interest rate in the federal funds market.

C)improve the liquidity of commercial banks.

D)improve the financial position of commercial banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

25

Why does the Fed pay interest on bank deposits?

A)The Fed pays interest on these deposits in an attempt to control inflation.

B)The Fed pays interest on these deposits in an attempt to prevent deflation.

C)The Fed is attempting to make monetary policy more effective.

D)The Fed is attempting to promote economic growth.

A)The Fed pays interest on these deposits in an attempt to control inflation.

B)The Fed pays interest on these deposits in an attempt to prevent deflation.

C)The Fed is attempting to make monetary policy more effective.

D)The Fed is attempting to promote economic growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

26

The federal funds market is where banks make short-term, usually overnight, loans to each other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

27

What are the main characteristics of money markets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is true of commercial paper?

A)It has a maturity of less than 90 days.

B)It can be issued by both small businesses and large corporations.

C)It is considered long-term debt.

D)It is essentially unsecured IOUs.

A)It has a maturity of less than 90 days.

B)It can be issued by both small businesses and large corporations.

C)It is considered long-term debt.

D)It is essentially unsecured IOUs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

29

The yields on money market instruments are relatively low compared with the yields of other debt instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

30

Why are there money markets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

31

IOUs are issued for the first time in the primary market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

32

Nancy is an institutional investor who wants to "park" her funds temporarily by purchasing money market instruments. Thus, Nancy is considered a demander in the money market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

33

A major automobile manufacturer typically has slow sales during the winter months, creating a cash flow problem for meeting payroll. In a situation like this, the automobile manufacturer may

A)issue commercial paper.

B)borrow federal funds.

C)purchase negotiable certificates of deposit (CDs).

D)issue banker's acceptances.

A)issue commercial paper.

B)borrow federal funds.

C)purchase negotiable certificates of deposit (CDs).

D)issue banker's acceptances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

34

A computer manufacturer in the United States does a lot of business with customers in China. Thus, it probably makes sense for the computer manufacturer to open which kind of account at its local bank?

A)Eurodollar

B)Foreign exchange

C)Commercial paper

D)Federal funds

A)Eurodollar

B)Foreign exchange

C)Commercial paper

D)Federal funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

35

Miserly Bank finds itself short of reserves at the end of the day. One solution to this dilemma would be for Miserly Bank to

A)issue commercial paper.

B)issue a banker's acceptance.

C)buy some T-bills in the secondary market.

D)borrow in the federal funds market.

A)issue commercial paper.

B)issue a banker's acceptance.

C)buy some T-bills in the secondary market.

D)borrow in the federal funds market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck