Deck 4: Tariffs

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

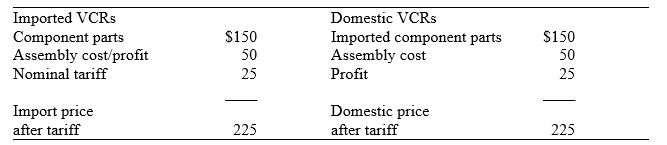

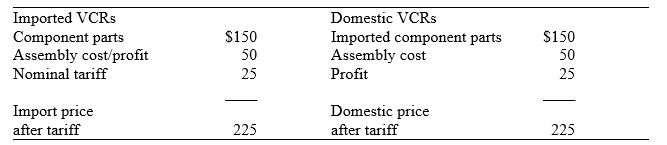

سؤال

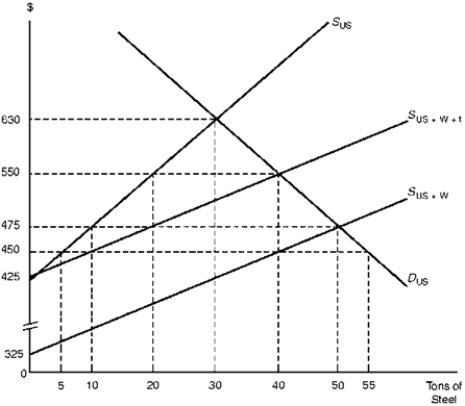

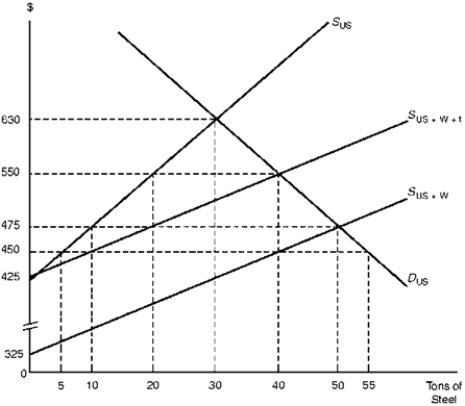

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

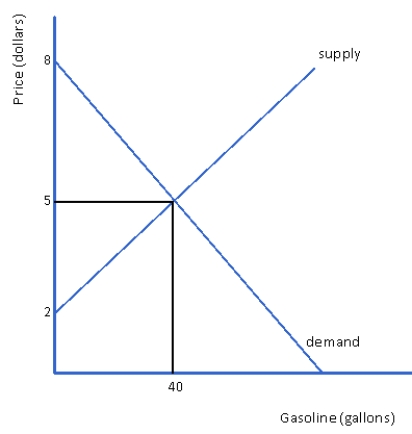

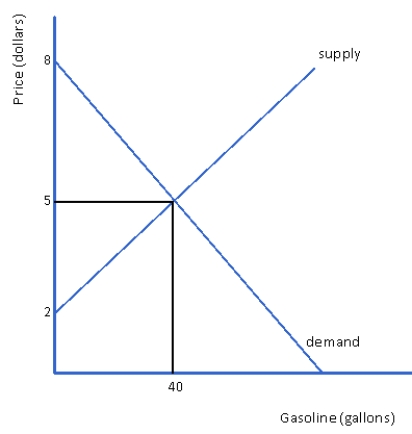

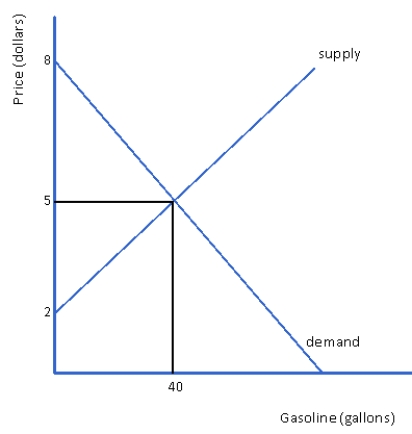

سؤال

سؤال

سؤال

سؤال

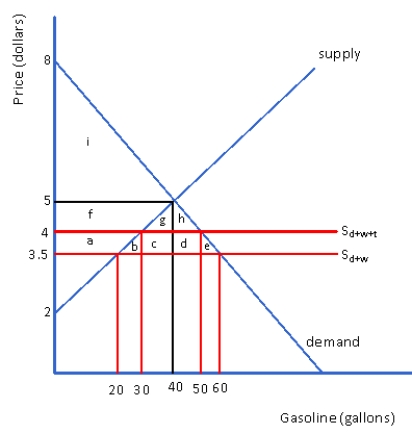

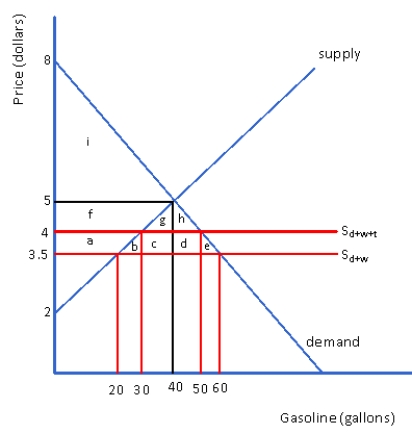

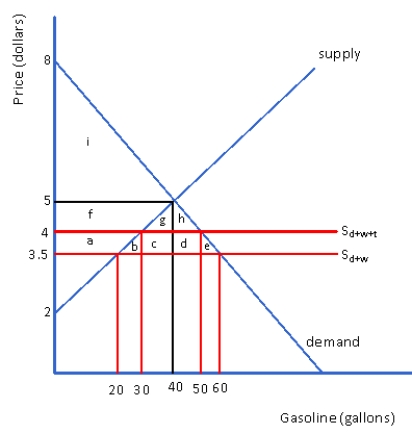

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/162

العب

ملء الشاشة (f)

Deck 4: Tariffs

1

The redistribution effect of an import tariff is the transfer of income from the domestic:

A) Producers to domestic buyers of the good

B) Buyers to domestic producers of the good

C) Buyers to the domestic government

D) Government to the domestic buyers

A) Producers to domestic buyers of the good

B) Buyers to domestic producers of the good

C) Buyers to the domestic government

D) Government to the domestic buyers

B

2

Suppose that the United States eliminates its tariff on steel imports,permitting foreign-produced steel to enter the U.S.market.Steel prices to U.S.consumers would be expected to:

A) Increase,and the foreign demand for U.S.exports would increase

B) Decrease,and the foreign demand for U.S.exports would increase

C) Increase,and the foreign demand for U.S.exports would decrease

D) Decrease,and the foreign demand for U.S.exports would decrease

A) Increase,and the foreign demand for U.S.exports would increase

B) Decrease,and the foreign demand for U.S.exports would increase

C) Increase,and the foreign demand for U.S.exports would decrease

D) Decrease,and the foreign demand for U.S.exports would decrease

B

3

Assume the United States adopts a tariff quota on steel in which the quota is set at 2 million tons,the within-quota tariff rate equals 5 percent,and the over-quota tariff rate equals 10 percent.Suppose the U.S.imports 1 million tons of steel.The resulting revenue effect of the tariff quota would accrue to:

A) The U.S.government only

B) U.S.importing companies only

C) Foreign exporting companies only

D) The U.S.government and either U.S.importers or foreign exporters

A) The U.S.government only

B) U.S.importing companies only

C) Foreign exporting companies only

D) The U.S.government and either U.S.importers or foreign exporters

A

4

A lower tariff on imported aluminum would most likely benefit:

A) Foreign producers at the expense of domestic consumers

B) Domestic manufacturers of aluminum

C) Domestic consumers of aluminum

D) Workers in the domestic aluminum industry

A) Foreign producers at the expense of domestic consumers

B) Domestic manufacturers of aluminum

C) Domestic consumers of aluminum

D) Workers in the domestic aluminum industry

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

5

The principal benefit of tariff protection goes to:

A) Domestic consumers of the good produced

B) Domestic producers of the good produced

C) Foreign producers of the good produced

D) Foreign consumers of the good produced

A) Domestic consumers of the good produced

B) Domestic producers of the good produced

C) Foreign producers of the good produced

D) Foreign consumers of the good produced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

6

When the production of a commodity does not utilize imported inputs,the effective tariff rate on the commodity:

A) Exceeds the nominal tariff rate on the commodity

B) Equals the nominal tariff rate on the commodity

C) Is less than the nominal tariff rate on the commodity

D) None of the above

A) Exceeds the nominal tariff rate on the commodity

B) Equals the nominal tariff rate on the commodity

C) Is less than the nominal tariff rate on the commodity

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

7

A $100 specific tariff provides home producers more protection from foreign competition when:

A) The home market buys cheaper products rather than expensive products

B) It is applied to a commodity with many grade variations

C) The home demand for a good is elastic with respect to price changes

D) It is levied on manufactured goods rather than primary products

A) The home market buys cheaper products rather than expensive products

B) It is applied to a commodity with many grade variations

C) The home demand for a good is elastic with respect to price changes

D) It is levied on manufactured goods rather than primary products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is a fixed percentage of the value of an imported product as it enters the country?

A) Specific tariff

B) Ad valorem tariff

C) Nominal tariff

D) Effective tariff

A) Specific tariff

B) Ad valorem tariff

C) Nominal tariff

D) Effective tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

9

Of the many arguments in favor of tariffs,the one that has enjoyed the most significant economic justification has been the:

A) Infant industry argument

B) Cheap foreign labor argument

C) Balance of payments argument

D) Domestic living standard argument

A) Infant industry argument

B) Cheap foreign labor argument

C) Balance of payments argument

D) Domestic living standard argument

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

10

A beggar-thy-neighbor policy is the imposition of:

A) Free trade to increase domestic productivity

B) Trade barriers to increase domestic demand and employment

C) Import tariffs to curb domestic inflation

D) Revenue tariffs to make products cheaper for domestic consumers

A) Free trade to increase domestic productivity

B) Trade barriers to increase domestic demand and employment

C) Import tariffs to curb domestic inflation

D) Revenue tariffs to make products cheaper for domestic consumers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

11

When a government allows raw materials and other intermediate products to enter a country duty free,its tariff policy generally results in a:

A) Effective tariff rate less than the nominal tariff rate

B) Nominal tariff rate less than the effective tariff rate

C) Rise in both nominal and effective tariff rates

D) Fall in both nominal and effective tariff rates

A) Effective tariff rate less than the nominal tariff rate

B) Nominal tariff rate less than the effective tariff rate

C) Rise in both nominal and effective tariff rates

D) Fall in both nominal and effective tariff rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

12

The deadweight loss of a tariff:

A) Is a social loss since it promotes inefficient production

B) Is a social loss since it reduces the revenue for the government

C) Is not a social loss because society as a whole doesn't pay for the loss

D) Is not a social loss since only business firms suffer revenue losses

A) Is a social loss since it promotes inefficient production

B) Is a social loss since it reduces the revenue for the government

C) Is not a social loss because society as a whole doesn't pay for the loss

D) Is not a social loss since only business firms suffer revenue losses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

13

Should Canada impose a tariff on imports,one would expect Canada's:

A) Terms of trade to improve and volume of trade to decrease

B) Terms of trade to worsen and volume of trade to decrease

C) Terms of trade to improve and volume of trade to increase

D) Terms of trade to worsen and volume of trade to increase

A) Terms of trade to improve and volume of trade to decrease

B) Terms of trade to worsen and volume of trade to decrease

C) Terms of trade to improve and volume of trade to increase

D) Terms of trade to worsen and volume of trade to increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

14

Should the home country be "large" relative to the world,its imposition of a tariff on imports would lead to an increase in domestic welfare if the terms-of-trade effect exceeds the sum of the:

A) Revenue effect plus redistribution effect

B) Protective effect plus revenue effect

C) Consumption effect plus redistribution effect

D) Protective effect plus consumption effect

A) Revenue effect plus redistribution effect

B) Protective effect plus revenue effect

C) Consumption effect plus redistribution effect

D) Protective effect plus consumption effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

15

The imposition of tariffs on imports results in deadweight welfare losses for the home economy.These losses consist of the:

A) Protective effect plus consumption effect

B) Redistribution effect plus revenue effect

C) Revenue effect plus protective effect

D) Consumption effect plus redistribution effect

A) Protective effect plus consumption effect

B) Redistribution effect plus revenue effect

C) Revenue effect plus protective effect

D) Consumption effect plus redistribution effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is true concerning a specific tariff?

A) It is exclusively used by the U.S.in its tariff schedules.

B) It refers to a flat percentage duty applied to a good's market value.

C) It is plagued by problems associated with assessing import product values.

D) It affords less protection to home producers during eras of rising prices.

A) It is exclusively used by the U.S.in its tariff schedules.

B) It refers to a flat percentage duty applied to a good's market value.

C) It is plagued by problems associated with assessing import product values.

D) It affords less protection to home producers during eras of rising prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

17

A problem encountered when implementing an "infant industry" tariff is that:

A) Domestic consumers will purchase the foreign good regardless of the tariff

B) Political pressure may prevent the tariff's removal when the industry matures

C) Most industries require tariff protection when they are mature

D) Labor unions will capture the protective effect in higher wages

A) Domestic consumers will purchase the foreign good regardless of the tariff

B) Political pressure may prevent the tariff's removal when the industry matures

C) Most industries require tariff protection when they are mature

D) Labor unions will capture the protective effect in higher wages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following policies permits a specified quantity of goods to be imported at one tariff rate and applies a higher tariff rate to imports above this quantity?

A) Tariff quota

B) Import tariff

C) Specific tariff

D) Ad valorem tariff

A) Tariff quota

B) Import tariff

C) Specific tariff

D) Ad valorem tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

19

Developing nations often maintain that industrial countries permit raw materials to be imported at very low tariff rates while maintaining high tariff rates on manufactured imports.Which of the following refers to the above statement?

A) Tariff-quota effect

B) Nominal tariff effect

C) Tariff escalation effect

D) Protective tariff effect

A) Tariff-quota effect

B) Nominal tariff effect

C) Tariff escalation effect

D) Protective tariff effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

20

Tariffs are not defended on the ground that they:

A) Improve the terms of trade of foreign nations

B) Protect jobs and reduce unemployment

C) Promote growth and development of young industries

D) Prevent overdependence of a country on only a few industries

A) Improve the terms of trade of foreign nations

B) Protect jobs and reduce unemployment

C) Promote growth and development of young industries

D) Prevent overdependence of a country on only a few industries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

21

If we consider the interests of both consumers and producers,then a policy of tariff reduction in the U.S.auto industry is:

A) In the interest of the United States as a whole,but not in the interest of auto-producing states

B) In the interest of the United States as a whole,and in the interest of auto-producing states

C) Not in the interest of the United States as a whole,nor in the interest of auto-producing states

D) Not in the interest of the United States as a whole,but is in the interest of auto-producing states

A) In the interest of the United States as a whole,but not in the interest of auto-producing states

B) In the interest of the United States as a whole,and in the interest of auto-producing states

C) Not in the interest of the United States as a whole,nor in the interest of auto-producing states

D) Not in the interest of the United States as a whole,but is in the interest of auto-producing states

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

22

Free traders point out that:

A) There is usually an efficiency gain from having tariffs

B) There is usually an efficiency loss from having tariffs

C) Producers lose from tariffs at the expense of consumers

D) Producers lose from tariffs at the expense of the government

A) There is usually an efficiency gain from having tariffs

B) There is usually an efficiency loss from having tariffs

C) Producers lose from tariffs at the expense of consumers

D) Producers lose from tariffs at the expense of the government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

23

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

According to Figure 4.1,the tariff results in the Mexican government collecting:

A) $100

B) $120

C) $140

D) $160

Figure 4.1.Import Tariff Levied by a "Small" Country

According to Figure 4.1,the tariff results in the Mexican government collecting:

A) $100

B) $120

C) $140

D) $160

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

24

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.In the absence of trade,Mexico produces and consumes:

A) 10 calculators

B) 40 calculators

C) 60 calculators

D) 80 calculators

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.In the absence of trade,Mexico produces and consumes:

A) 10 calculators

B) 40 calculators

C) 60 calculators

D) 80 calculators

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

25

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

According to Figure 4.1,Mexican manufacturers gain ____ because of the tariff.

A) $75

B) $85

C) $95

D) $105

Figure 4.1.Import Tariff Levied by a "Small" Country

According to Figure 4.1,Mexican manufacturers gain ____ because of the tariff.

A) $75

B) $85

C) $95

D) $105

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which type of tariff is not used by the American government?

A) Import tariff

B) Export tariff

C) Specific tariff

D) Ad valorem tariff

A) Import tariff

B) Export tariff

C) Specific tariff

D) Ad valorem tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

27

A tax of 20 cents per unit of imported cheese would be an example of:

A) Compound tariff

B) Effective tariff

C) Ad valorem tariff

D) Specific tariff

A) Compound tariff

B) Effective tariff

C) Ad valorem tariff

D) Specific tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

28

The most vocal political pressure for tariffs is generally made by:

A) Consumers lobbying for export tariffs

B) Consumers lobbying for import tariffs

C) Producers lobbying for export tariffs

D) Producers lobbying for import tariffs

A) Consumers lobbying for export tariffs

B) Consumers lobbying for import tariffs

C) Producers lobbying for export tariffs

D) Producers lobbying for import tariffs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

29

If we consider the impact on both consumers and producers,then protection of the steel industry is:

A) In the interest of the United States as a whole,but not in the interest of the state of Pennsylvania

B) In the interest of the United States as a whole and in the interest of the state of Pennsylvania

C) Not in the interest of the United States as a whole,but it might be in the interest of the state of Pennsylvania

D) Not in the interest of the United States as a whole,nor in the interest of the state of Pennsylvania

A) In the interest of the United States as a whole,but not in the interest of the state of Pennsylvania

B) In the interest of the United States as a whole and in the interest of the state of Pennsylvania

C) Not in the interest of the United States as a whole,but it might be in the interest of the state of Pennsylvania

D) Not in the interest of the United States as a whole,nor in the interest of the state of Pennsylvania

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

30

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.With free trade,Mexico's producer surplus and consumer surplus respectively equal:

A) $5,$605

B) $25,$380

C) $45,$250

D) $85,$195

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.With free trade,Mexico's producer surplus and consumer surplus respectively equal:

A) $5,$605

B) $25,$380

C) $45,$250

D) $85,$195

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

31

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.With free trade,Mexico imports:

A) 40 calculators

B) 60 calculators

C) 80 calculators

D) 100 calculators

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.With free trade,Mexico imports:

A) 40 calculators

B) 60 calculators

C) 80 calculators

D) 100 calculators

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

32

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.In the absence of trade,Mexico's producer surplus and consumer surplus respectively equal:

A) $120,$240

B) $180,$180

C) $180,$320

D) $240,$240

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.In the absence of trade,Mexico's producer surplus and consumer surplus respectively equal:

A) $120,$240

B) $180,$180

C) $180,$320

D) $240,$240

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

33

A decrease in the import tariff will result in:

A) An increase in imports but a decrease in domestic production

B) A decrease in imports but an increase in domestic production

C) An increase in price but a decrease in quantity purchased

D) A decrease in price and a decrease in quantity purchased

A) An increase in imports but a decrease in domestic production

B) A decrease in imports but an increase in domestic production

C) An increase in price but a decrease in quantity purchased

D) A decrease in price and a decrease in quantity purchased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

34

If I purchase a stereo from South Korea,I obtain the stereo and South Korea obtains the dollars.But if I purchase a stereo produced in the United States,I obtain the stereo and the dollars remain in America.This line of reasoning is:

A) Valid for stereos,but not for most products imported by the United States

B) Valid for most products imported by the United States,but not for stereos

C) Deceptive since Koreans eventually spend the dollars on U.S.goods

D) Deceptive since the dollars spent on a stereo built in the United States eventually wind up overseas

A) Valid for stereos,but not for most products imported by the United States

B) Valid for most products imported by the United States,but not for stereos

C) Deceptive since Koreans eventually spend the dollars on U.S.goods

D) Deceptive since the dollars spent on a stereo built in the United States eventually wind up overseas

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

35

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

According to Figure 4.1,the deadweight cost of the tariff totals:

A) $60

B) $70

C) $80

D) $90

Figure 4.1.Import Tariff Levied by a "Small" Country

According to Figure 4.1,the deadweight cost of the tariff totals:

A) $60

B) $70

C) $80

D) $90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

36

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.With free trade,the total value of Mexico's imports equal:

A) $220

B) $260

C) $290

D) $300

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.With free trade,the total value of Mexico's imports equal:

A) $220

B) $260

C) $290

D) $300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which trade policy results in the government levying a "two-tier" tariff on imported goods?

A) Tariff quota

B) Nominal tariff

C) Effective tariff

D) Revenue tariff

A) Tariff quota

B) Nominal tariff

C) Effective tariff

D) Revenue tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

38

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

According to Figure 4.1,the loss in Mexican consumer surplus due to the tariff equals:

A) $225

B) $265

C) $285

D) $325

Figure 4.1.Import Tariff Levied by a "Small" Country

According to Figure 4.1,the loss in Mexican consumer surplus due to the tariff equals:

A) $225

B) $265

C) $285

D) $325

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

39

Figure 4.1 illustrates the demand and supply schedules for pocket calculators in Mexico,a "small" nation that is unable to affect the world price.

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.With a per-unit tariff of $3,the quantity of imports decreases to:

A) 20 calculators

B) 40 calculators

C) 50 calculators

D) 70 calculators

Figure 4.1.Import Tariff Levied by a "Small" Country

Consider Figure 4.1.With a per-unit tariff of $3,the quantity of imports decreases to:

A) 20 calculators

B) 40 calculators

C) 50 calculators

D) 70 calculators

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

40

A tax of 15 percent per imported item would be an example of:

A) Ad valorem tariff

B) Specific tariff

C) Effective tariff

D) Compound tariff

A) Ad valorem tariff

B) Specific tariff

C) Effective tariff

D) Compound tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

41

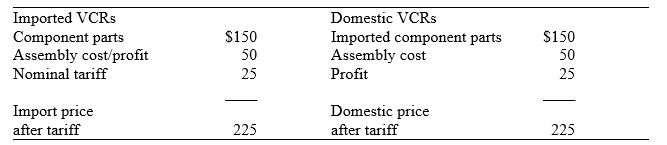

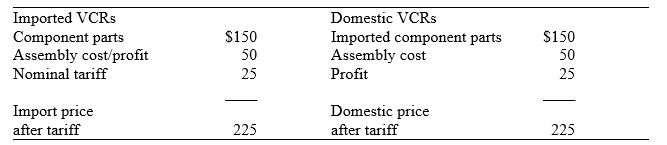

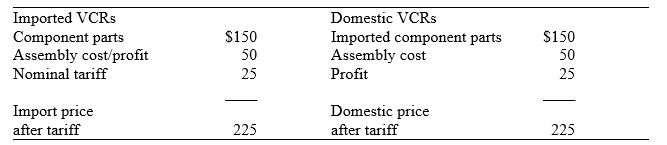

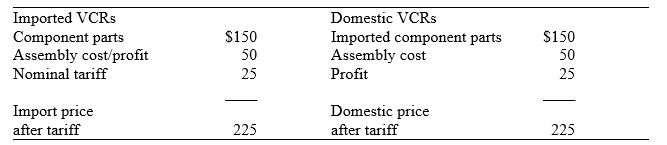

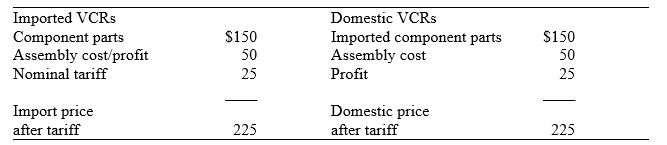

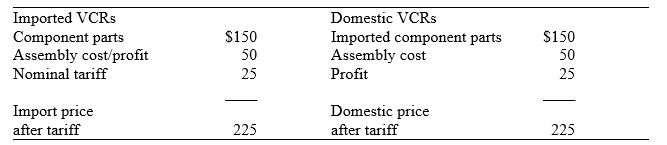

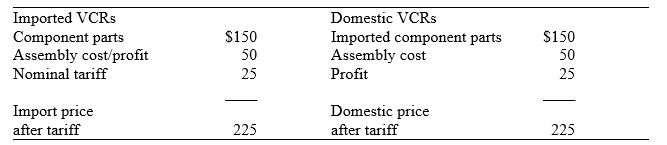

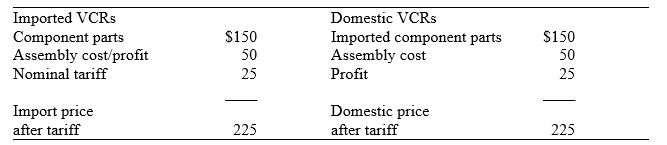

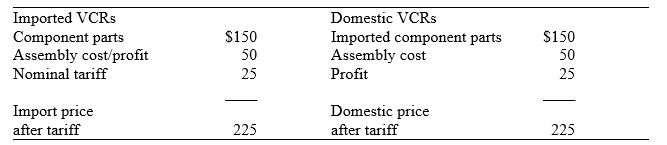

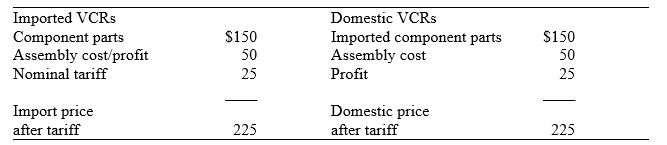

Table 4.1.Production Costs and Prices of Imported and Domestic VCRs

Consider Table 4.1.Prior to the tariff,the total price of imported VCRs is:

A) $150

B) $200

C) $225

D) $235

Consider Table 4.1.Prior to the tariff,the total price of imported VCRs is:

A) $150

B) $200

C) $225

D) $235

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

42

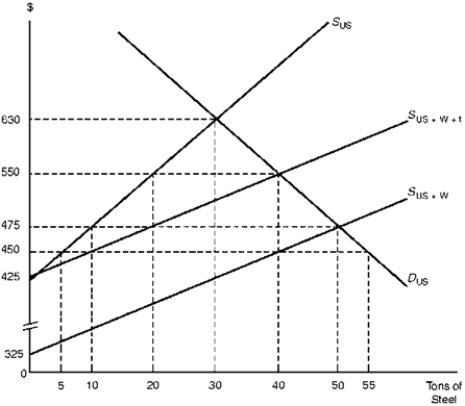

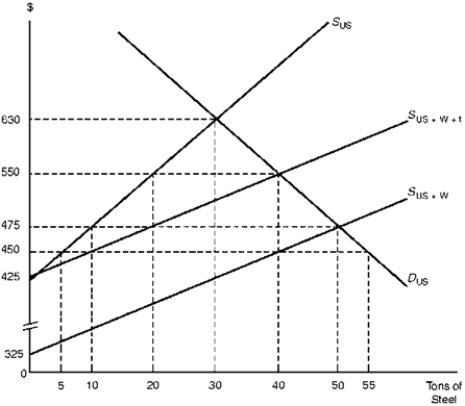

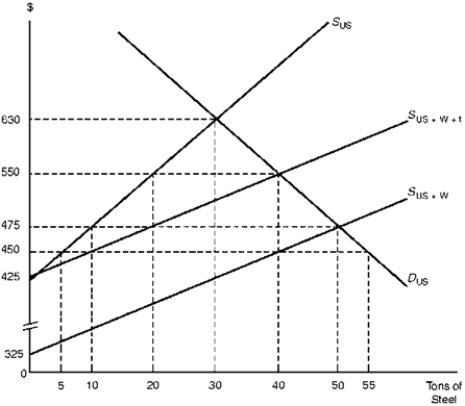

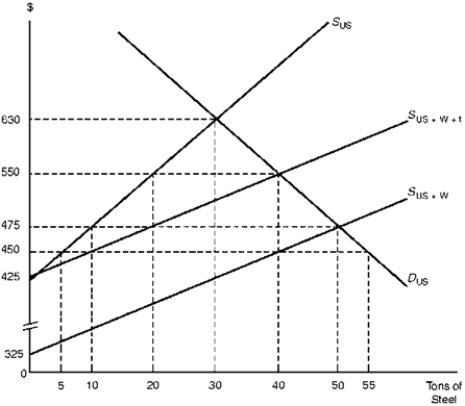

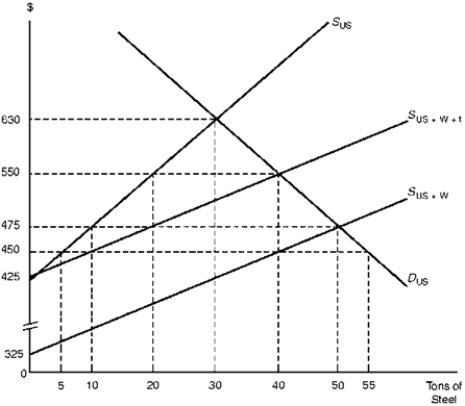

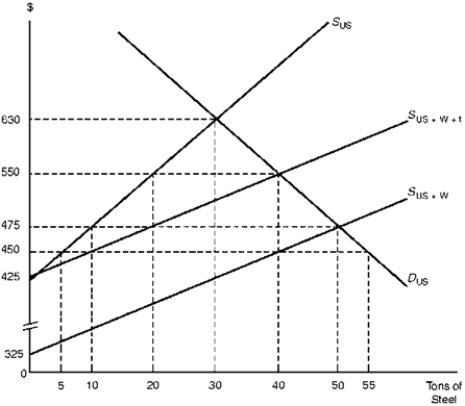

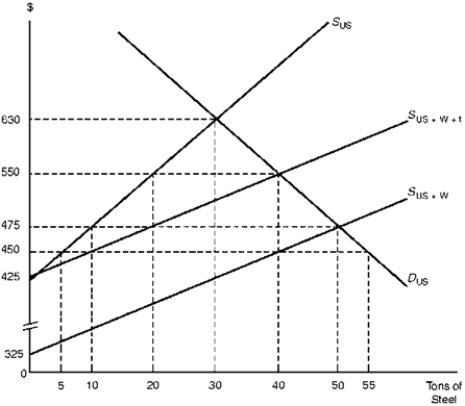

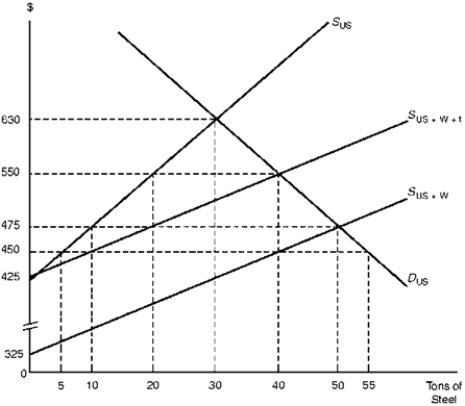

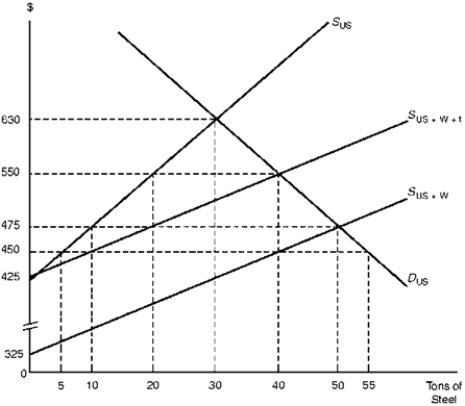

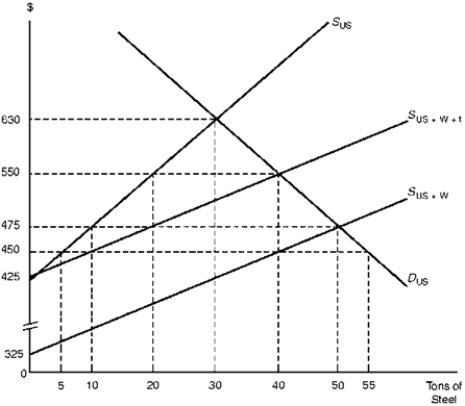

Assume the United States is a large consumer of steel that is able to influence the world price.Its demand and supply schedules are respectively denoted by DU.S.and SU.S.in Figure 4.2.The overall (United States plus world) supply schedule of steel is denoted by SU.S.+W.

Figure 4.2.Import Tariff Levied by a "Large" Country

Consider Figure 4.2.Suppose the United States imposes a tariff of $100 on each ton of steel imported.With the tariff,the price of steel rises to $____ and imports fall to ____ tons.

A) $550,20 tons

B) $550,30 tons

C) $575,20 tons

D) $575,30 tons

Figure 4.2.Import Tariff Levied by a "Large" Country

Consider Figure 4.2.Suppose the United States imposes a tariff of $100 on each ton of steel imported.With the tariff,the price of steel rises to $____ and imports fall to ____ tons.

A) $550,20 tons

B) $550,30 tons

C) $575,20 tons

D) $575,30 tons

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

43

Table 4.1.Production Costs and Prices of Imported and Domestic VCRs

Consider Table 4.1.The effective tariff rate equals:

A) 11.1 percent

B) 16.7 percent

C) 50.0 percent

D) 100.0 percent

Consider Table 4.1.The effective tariff rate equals:

A) 11.1 percent

B) 16.7 percent

C) 50.0 percent

D) 100.0 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

44

Consider Figure 4.1.The tariff would be prohibitive (i.e.,eliminate imports) if it equaled:

A) $2

B) $3

C) $4

D) $5

A) $2

B) $3

C) $4

D) $5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

45

A compound tariff is a combination of a (an):

A) Tariff quota and a two-tier tariff

B) Revenue tariff and a protective tariff

C) Import tariff and an export tariff

D) Specific tariff and an ad valorem tariff

A) Tariff quota and a two-tier tariff

B) Revenue tariff and a protective tariff

C) Import tariff and an export tariff

D) Specific tariff and an ad valorem tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

46

Table 4.1.Production Costs and Prices of Imported and Domestic VCRs

Consider Table 4.1.The nominal tariff rate on imported VCRs equals:

A) 11.1 percent

B) 12.5 percent

C) 16.7 percent

D) 50.0 percent

Consider Table 4.1.The nominal tariff rate on imported VCRs equals:

A) 11.1 percent

B) 12.5 percent

C) 16.7 percent

D) 50.0 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

47

Assume the United States is a large consumer of steel that is able to influence the world price.Its demand and supply schedules are respectively denoted by DU.S.and SU.S.in Figure 4.2.The overall (United States plus world) supply schedule of steel is denoted by SU.S.+W.

Figure 4.2.Import Tariff Levied by a "Large" Country

According to Figure 4.2,the tariff leads to the overall welfare of the United States:

A) Rising by $250

B) Rising by $500

C) Falling by $250

D) Falling by $500

Figure 4.2.Import Tariff Levied by a "Large" Country

According to Figure 4.2,the tariff leads to the overall welfare of the United States:

A) Rising by $250

B) Rising by $500

C) Falling by $250

D) Falling by $500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

48

Exhibit 4.1

Assume that the United States imports automobiles from South Korea at a price of $20,000 per vehicle and that these vehicles are subject to an import tariff of 20 percent.Also assume that U.S.components are used in the vehicles assembled by South Korea and that these components have a value of $10,000.

Refer to Exhibit 4.1.Under the Offshore Assembly Provision of U.S.tariff policy,the price of an imported vehicle to the U.S.consumer after the tariff has been levied is:

A) $22,000

B) $23,000

C) $24,000

D) $25,000

Assume that the United States imports automobiles from South Korea at a price of $20,000 per vehicle and that these vehicles are subject to an import tariff of 20 percent.Also assume that U.S.components are used in the vehicles assembled by South Korea and that these components have a value of $10,000.

Refer to Exhibit 4.1.Under the Offshore Assembly Provision of U.S.tariff policy,the price of an imported vehicle to the U.S.consumer after the tariff has been levied is:

A) $22,000

B) $23,000

C) $24,000

D) $25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

49

Table 4.1.Production Costs and Prices of Imported and Domestic VCRs

Consider Table 4.1.Prior to the tariff,the total price of domestically-produced VCRs is:

A) $150

B) $200

C) $225

D) $250

Consider Table 4.1.Prior to the tariff,the total price of domestically-produced VCRs is:

A) $150

B) $200

C) $225

D) $250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

50

If the domestic value added before an import tariff for a product is $500 and the domestic value added after the tariff is $550,the effective rate of protection is:

A) 5 percent

B) 8 percent

C) 10 percent

D) 15 percent

A) 5 percent

B) 8 percent

C) 10 percent

D) 15 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

51

Suppose that the production of $500,000 worth of steel in the United States requires $100,000 worth of iron ore.The U.S.nominal tariff rates for importing these goods are 15 percent for steel and 5 percent for iron ore.Given this information,the effective rate of protection for the U.S.steel industry is approximately:

A) 6 percent

B) 12 percent

C) 18 percent

D) 24 percent

A) 6 percent

B) 12 percent

C) 18 percent

D) 24 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

52

Assume the United States is a large consumer of steel that is able to influence the world price.Its demand and supply schedules are respectively denoted by DU.S.and SU.S.in Figure 4.2.The overall (United States plus world) supply schedule of steel is denoted by SU.S.+W.

Figure 4.2.Import Tariff Levied by a "Large" Country

Consider Figure 4.2.With free trade,the United States achieves market equilibrium at a price of $____.At this price,____ tons of steel are produced by U.S.firms,____ tons are bought by U.S.buyers,and ____ tons are imported.

A) $450,5 tons,60 tons,55 tons

B) $475,10 tons,50 tons,40 tons

C) $525,5 tons,60 tons,55 tons

D) $630,30 tons,30 tons,0 tons

Figure 4.2.Import Tariff Levied by a "Large" Country

Consider Figure 4.2.With free trade,the United States achieves market equilibrium at a price of $____.At this price,____ tons of steel are produced by U.S.firms,____ tons are bought by U.S.buyers,and ____ tons are imported.

A) $450,5 tons,60 tons,55 tons

B) $475,10 tons,50 tons,40 tons

C) $525,5 tons,60 tons,55 tons

D) $630,30 tons,30 tons,0 tons

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

53

Assume the United States is a large consumer of steel that is able to influence the world price.Its demand and supply schedules are respectively denoted by DU.S.and SU.S.in Figure 4.2.The overall (United States plus world) supply schedule of steel is denoted by SU.S.+W.

Figure 4.2.Import Tariff Levied by a "Large" Country

According to Figure 4.2,the tariff's terms-of-trade effect equals:

A) $300

B) $400

C) $500

D) $600

Figure 4.2.Import Tariff Levied by a "Large" Country

According to Figure 4.2,the tariff's terms-of-trade effect equals:

A) $300

B) $400

C) $500

D) $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

54

Suppose an importer of steel is required to pay a tariff of $20 per ton plus 5 percent of the value of steel.This is an example of a (an):

A) Specific tariff

B) Ad valorem tariff

C) Compound tariff

D) Tariff quota

A) Specific tariff

B) Ad valorem tariff

C) Compound tariff

D) Tariff quota

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

55

Assume the United States is a large consumer of steel that is able to influence the world price.Its demand and supply schedules are respectively denoted by DU.S.and SU.S.in Figure 4.2.The overall (United States plus world) supply schedule of steel is denoted by SU.S.+W.

Figure 4.2.Import Tariff Levied by a "Large" Country

Referring to Figure 4.2,the tariff's deadweight welfare loss to the United States totals:

A) $450

B) $550

C) $650

D) $750

Figure 4.2.Import Tariff Levied by a "Large" Country

Referring to Figure 4.2,the tariff's deadweight welfare loss to the United States totals:

A) $450

B) $550

C) $650

D) $750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

56

Exhibit 4.1

Assume that the United States imports automobiles from South Korea at a price of $20,000 per vehicle and that these vehicles are subject to an import tariff of 20 percent.Also assume that U.S.components are used in the vehicles assembled by South Korea and that these components have a value of $10,000.

Refer to Exhibit 4.1.In the absence of the Offshore Assembly Provision of U.S.tariff policy,the price of an imported vehicle to the U.S.consumer after the tariff has been levied is:

A) $22,000

B) $23,000

C) $24,000

D) $25,000

Assume that the United States imports automobiles from South Korea at a price of $20,000 per vehicle and that these vehicles are subject to an import tariff of 20 percent.Also assume that U.S.components are used in the vehicles assembled by South Korea and that these components have a value of $10,000.

Refer to Exhibit 4.1.In the absence of the Offshore Assembly Provision of U.S.tariff policy,the price of an imported vehicle to the U.S.consumer after the tariff has been levied is:

A) $22,000

B) $23,000

C) $24,000

D) $25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

57

Table 4.1.Production Costs and Prices of Imported and Domestic VCRs

Consider Table 4.1.After the tariff,domestic value added equals:

A) $25

B) $50

C) $75

D) $100

Consider Table 4.1.After the tariff,domestic value added equals:

A) $25

B) $50

C) $75

D) $100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

58

Table 4.1.Production Costs and Prices of Imported and Domestic VCRs

Consider Table 4.1.Prior to the tariff,domestic value added equals:

A) $25

B) $50

C) $75

D) $100

Consider Table 4.1.Prior to the tariff,domestic value added equals:

A) $25

B) $50

C) $75

D) $100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

59

Assume the United States is a large consumer of steel that is able to influence the world price.Its demand and supply schedules are respectively denoted by DU.S.and SU.S.in Figure 4.2.The overall (United States plus world) supply schedule of steel is denoted by SU.S.+W.

Figure 4.2.Import Tariff Levied by a "Large" Country

Consider Figure 4.2.Of the $100 tariff,$____ is passed on to the U.S.consumer via a higher price,while $____ is borne by the foreign exporter; the U.S.terms of trade:

A) $25,$75,improve

B) $25,$75,worsen

C) $75,$25,improve

D) $75,$25,worsen

Figure 4.2.Import Tariff Levied by a "Large" Country

Consider Figure 4.2.Of the $100 tariff,$____ is passed on to the U.S.consumer via a higher price,while $____ is borne by the foreign exporter; the U.S.terms of trade:

A) $25,$75,improve

B) $25,$75,worsen

C) $75,$25,improve

D) $75,$25,worsen

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

60

Suppose that the production of a $30,000 automobile in Canada requires $10,000 worth of steel.The Canadian nominal tariff rates for importing these goods are 25 percent for automobiles and 10 percent for steel.Given this information,the effective rate of protection for the Canadian automobile industry is approximately:

A) 15 percent

B) 32 percent

C) 48 percent

D) 67 percent

A) 15 percent

B) 32 percent

C) 48 percent

D) 67 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

61

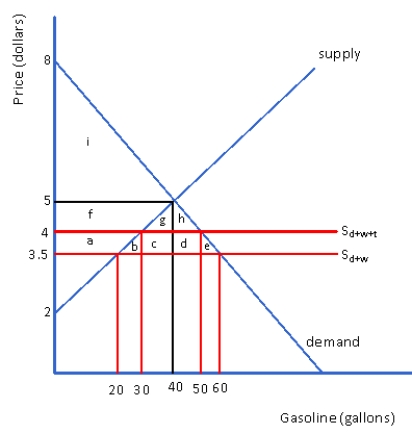

Figure 4.3 Domestic Market for Gasoline in the United States

Figure 4.3 represents the domestic market for gasoline in the United States.What is the producer surplus in this market?

A) 60 gallons of gasoline

B) $120

C) $60

D) $3

Figure 4.3 represents the domestic market for gasoline in the United States.What is the producer surplus in this market?

A) 60 gallons of gasoline

B) $120

C) $60

D) $3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

62

When material inputs enter a country at a very low duty while the final imported product is protected by a high duty,the result tends to be a high rate of protection for domestic producers of the final product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

63

For the United States,a foreign trade zone (FTZ) is

A) A site within the United States

B) A site outside the United States

C) Always located in poorer developing countries

D) Is used to discourage trade

A) A site within the United States

B) A site outside the United States

C) Always located in poorer developing countries

D) Is used to discourage trade

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

64

Arguments for U.S.trade restrictions include all of the following except

A) Job protection

B) Infant industry support

C) Maintenance of domestic living standard

D) Improving incomes for developing countries

A) Job protection

B) Infant industry support

C) Maintenance of domestic living standard

D) Improving incomes for developing countries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

65

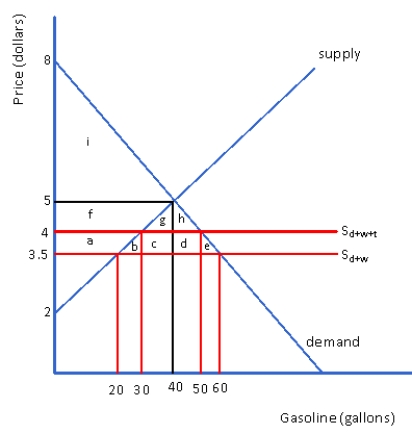

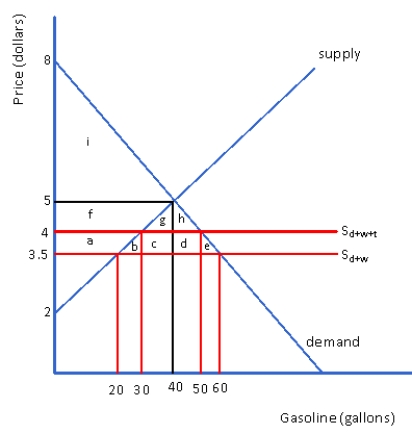

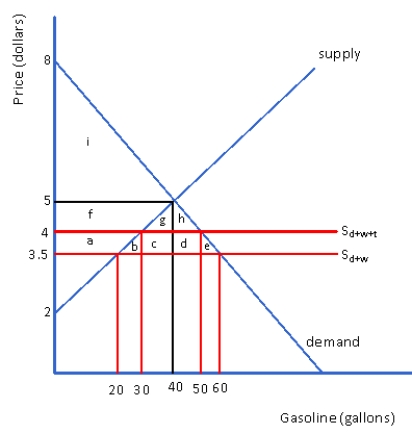

Figure 4.4 Market for Gasoline in a Small Nation

Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in consumer surplus would be

A) $15

B) $12.50

C) $27.50

D) $57.50

Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in consumer surplus would be

A) $15

B) $12.50

C) $27.50

D) $57.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

66

When a tariff on imported inputs exceeds that on the finished good,

A) The nominal tariff rate on the finished product would tend to overstate its protective effect

B) The nominal tariff rate would tend to understate it's protective effect

C) It is impossible to determine the protective effect of a tariff

D) Tariff escalation occurs

A) The nominal tariff rate on the finished product would tend to overstate its protective effect

B) The nominal tariff rate would tend to understate it's protective effect

C) It is impossible to determine the protective effect of a tariff

D) Tariff escalation occurs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

67

Figure 4.4 Market for Gasoline in a Small Nation

Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in consumer surplus would be

A) area a + b

B) area a

C) area a + b + c + d + e

D) area a + b + f + g + h

Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in consumer surplus would be

A) area a + b

B) area a

C) area a + b + c + d + e

D) area a + b + f + g + h

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

68

With a compound tariff,a domestic importer of an automobile might be required to pay a duty of $200 plus 4 percent of the value of the automobile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

69

Figure 4.3 Domestic Market for Gasoline in the United States

Figure 4.3 represents the domestic market for gasoline in the United States.What is the consumer surplus in this market?

A) 60 gallons of gasoline

B) $120

C) $60

D) $3

Figure 4.3 represents the domestic market for gasoline in the United States.What is the consumer surplus in this market?

A) 60 gallons of gasoline

B) $120

C) $60

D) $3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

70

With a compound duty,its "specific" portion neutralizes the cost disadvantage of domestic manufacturers that results from tariff protection granted to domestic suppliers of raw materials,and the "ad valorem" portion of the duty grants protection to the finished-goods industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

71

During a business recession,when cheaper products are purchased,a specific tariff provides domestic producers a greater amount of protection against import-competing goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

72

Figure 4.4 Market for Gasoline in a Small Nation

Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in producer surplus would be

A) $15

B) $12.5

C) $47.50

D) $57.50

Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in producer surplus would be

A) $15

B) $12.5

C) $47.50

D) $57.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

73

Under the Offshore Assembly Provision of U.S.tariff policy,U.S.import duties apply only to the value added in the foreign assembly process,provided that U.S.-made components are used by overseas companies in their assembly operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

74

According to the tariff escalation effect,industrial countries apply low tariffs to imports of finished goods and high tariffs to imports of raw materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

75

To protect domestic producers from foreign competition,the U.S.government levies both import tariffs and export tariffs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

76

With a specific tariff,the degree of protection afforded domestic producers varies directly with changes in import prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

77

The nominal tariff rate signifies the total increase in domestic productive activities compared to what would occur under free-trade conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

78

The offshore assembly provision in the U.S.

A) Provides favorable treatment to U.S.trading partners

B) Discriminates against primary product importers

C) Provides favorable treatment to products assembled abroad from U.S.manufactured components

D) Hurts the U.S.consumer

A) Provides favorable treatment to U.S.trading partners

B) Discriminates against primary product importers

C) Provides favorable treatment to products assembled abroad from U.S.manufactured components

D) Hurts the U.S.consumer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

79

A ad valorem tariff provides domestic producers a declining degree of protection against import-competing goods during periods of changing prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck

80

Figure 4.4 Market for Gasoline in a Small Nation

Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in producer surplus would be

A) area a + b

B) area a

C) area a + b + f

D) area a + b + f + g + h

Figure 4.4 represents the market for gasoline in a small nation.The free trade world price of gasoline is $3.50.Suppose this small nation imposes a tariff on gasoline of $.50 per gallon.The change in producer surplus would be

A) area a + b

B) area a

C) area a + b + f

D) area a + b + f + g + h

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 162 في هذه المجموعة.

فتح الحزمة

k this deck