Deck 7: Trade Policies for the Developing Nations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

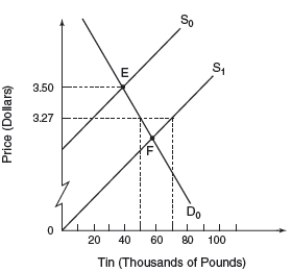

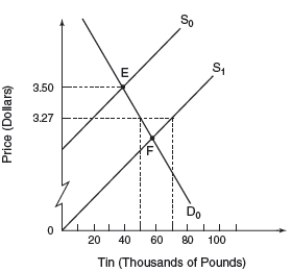

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/305

العب

ملء الشاشة (f)

Deck 7: Trade Policies for the Developing Nations

1

To help developing countries expand their industrial base,some industrial countries have reduced tariffs on designated manufactured imports from developing countries below the levels applied to imports from industrial countries.This scheme is referred to as:

A) Generalized system of preferences

B) Export-led growth

C) International commodity agreement

D) Reciprocal trade agreement

A) Generalized system of preferences

B) Export-led growth

C) International commodity agreement

D) Reciprocal trade agreement

A

2

One factor that has prevented the formation of cartels for producers of commodities is that:

A) The demand for commodities tends to be price inelastic

B) Substitute products exist for many commodities

C) Commodity produces have been able to dominate world markets

D) Production of most commodities is capital intensive

A) The demand for commodities tends to be price inelastic

B) Substitute products exist for many commodities

C) Commodity produces have been able to dominate world markets

D) Production of most commodities is capital intensive

B

3

Which of the following could partially explain why the terms of trade of developing countries might deteriorate over time?

A) Developing-country exports mainly consist of manufactured goods

B) Developing-country imports mainly consist of primary products

C) Commodity export prices are determined in highly competitive markets

D) Commodity export prices are solely determined by developing countries

A) Developing-country exports mainly consist of manufactured goods

B) Developing-country imports mainly consist of primary products

C) Commodity export prices are determined in highly competitive markets

D) Commodity export prices are solely determined by developing countries

C

4

Which of the following is not a major factor that encourages developing nations to form international commodity agreements?

A) Inelastic commodity supply schedules

B) Inelastic commodity demand schedules

C) Export markets that tend to be unstable

D) Secular increases in their terms of trade

A) Inelastic commodity supply schedules

B) Inelastic commodity demand schedules

C) Export markets that tend to be unstable

D) Secular increases in their terms of trade

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

5

Concerning the price elasticities of supply and demand for commodities,empirical estimates suggest that most commodities have:

A) Inelastic supply schedules and inelastic demand schedules

B) Inelastic supply schedules and elastic demand schedules

C) Elastic supply schedules and inelastic demand schedules

D) Elastic supply schedules and elastic demand schedules

A) Inelastic supply schedules and inelastic demand schedules

B) Inelastic supply schedules and elastic demand schedules

C) Elastic supply schedules and inelastic demand schedules

D) Elastic supply schedules and elastic demand schedules

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following situations reduces the likelihood of successful operation of a cartel?

A) Cartel sales experience a rapid expansion

B) The demand for cartel output is price inelastic

C) The number of firms in the cartel is large

D) It is very difficult for new firms to enter the market

A) Cartel sales experience a rapid expansion

B) The demand for cartel output is price inelastic

C) The number of firms in the cartel is large

D) It is very difficult for new firms to enter the market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

7

If the supply schedule for tin is relatively inelastic to price changes,a decrease in the demand schedule for tin will cause a:

A) Decrease in price and an increase in sales revenue

B) Decrease in price and a decrease in sales revenue

C) Increase in price and an increase in sales revenue

D) Increase in price and a decrease in sales revenue

A) Decrease in price and an increase in sales revenue

B) Decrease in price and a decrease in sales revenue

C) Increase in price and an increase in sales revenue

D) Increase in price and a decrease in sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

8

The OPEC nations during the 1970s manifested their market power by utilizing:

A) Export tariffs levied for revenue purposes

B) Export tariffs levied for protective purposes

C) Import tariffs levied for protective purposes

D) Import tariffs levied for revenue purposes

A) Export tariffs levied for revenue purposes

B) Export tariffs levied for protective purposes

C) Import tariffs levied for protective purposes

D) Import tariffs levied for revenue purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

9

Assuming identical cost and demand curves,OPEC as a cartel will,in comparison to a competitive industry:

A) Produce greater output and charge a lower price

B) Produce greater output and charge a higher price

C) Produce less output and charge a higher price

D) Produce less output and charge a lower price

A) Produce greater output and charge a lower price

B) Produce greater output and charge a higher price

C) Produce less output and charge a higher price

D) Produce less output and charge a lower price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

10

If the bauxite exporting countries form a cartel to boost the price of bauxite so as to increase sales revenue,they believe that the demand for bauxite:

A) Is inelastic with respect to price changes

B) Is elastic with respect to price changes

C) Will increase in response to a price increase

D) Will not change in response to a price change

A) Is inelastic with respect to price changes

B) Is elastic with respect to price changes

C) Will increase in response to a price increase

D) Will not change in response to a price change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which trade strategy have developing countries used to restrict imports of manufactured goods so that the domestic market is preserved for home producers,who thus can take over markets already established in the country?

A) International commodity agreement

B) Export promotion

C) Multilateral contract

D) Import substitution

A) International commodity agreement

B) Export promotion

C) Multilateral contract

D) Import substitution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which method has not generally been used by the international commodity agreements to stabilize commodity prices?

A) Production quotas applied to the level of commodity output

B) Buffer stock arrangements among producing nations

C) Export restrictions applied to international sales of commodities

D) Measures to nationalize foreign-owned production operations

A) Production quotas applied to the level of commodity output

B) Buffer stock arrangements among producing nations

C) Export restrictions applied to international sales of commodities

D) Measures to nationalize foreign-owned production operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which terms-of-trade concept emphasizes a nation's capacity to import?

A) Income terms of trade

B) Commodity terms of trade

C) Barter terms of trade

D) Price terms of trade

A) Income terms of trade

B) Commodity terms of trade

C) Barter terms of trade

D) Price terms of trade

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which device has been used by the International Wheat Agreement to stipulate the minimum prices at which importers will buy stipulated quantities from producers and the maximum prices at which producers will sell stipulated quantities to importers?

A) Buffer stocks

B) Export controls

C) Multilateral contracts

D) Production controls

A) Buffer stocks

B) Export controls

C) Multilateral contracts

D) Production controls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

15

A primary goal of international commodity agreements has been the:

A) Maximization of members' revenues via export taxes

B) Nationalization of corporations operating in member nations

C) Adoption of tariff protection against industrialized nation sellers

D) Moderation of commodity price fluctuations when markets are unstable

A) Maximization of members' revenues via export taxes

B) Nationalization of corporations operating in member nations

C) Adoption of tariff protection against industrialized nation sellers

D) Moderation of commodity price fluctuations when markets are unstable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

16

International commodity agreements do not:

A) Consist of consuming and producing nations who desire market stability

B) Levy export cutbacks so as to offset rising commodity prices

C) Utilize buffer stocks to generate commodity price stability

D) Increase the supply of commodities to prevent rising prices

A) Consist of consuming and producing nations who desire market stability

B) Levy export cutbacks so as to offset rising commodity prices

C) Utilize buffer stocks to generate commodity price stability

D) Increase the supply of commodities to prevent rising prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which nation accounts for the largest amount of OPEC's oil reserves and production?

A) Iran

B) Libya

C) Iraq

D) Saudi Arabia

A) Iran

B) Libya

C) Iraq

D) Saudi Arabia

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the demand schedule for bauxite is relatively inelastic to price changes,an increase in the supply schedule of bauxite will cause a:

A) Decrease in price and a decrease in sales revenue

B) Decrease in price and an increase in sales revenue

C) Increase in price and a decrease in sales revenue

D) Increase in price and an increase in sales revenue

A) Decrease in price and a decrease in sales revenue

B) Decrease in price and an increase in sales revenue

C) Increase in price and a decrease in sales revenue

D) Increase in price and an increase in sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which trade strategy have developing countries used to replace commodity exports with exports such as processed primary products,semi-manufacturers,and manufacturers?

A) Multilateral contract

B) Buffer stock

C) Export promotion

D) Export quota

A) Multilateral contract

B) Buffer stock

C) Export promotion

D) Export quota

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which device has the International Tin Agreement utilized as a way of stabilizing tin prices?

A) Multilateral contracts

B) Export subsidies

C) Buffer stocks

D) Export tariffs

A) Multilateral contracts

B) Export subsidies

C) Buffer stocks

D) Export tariffs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

21

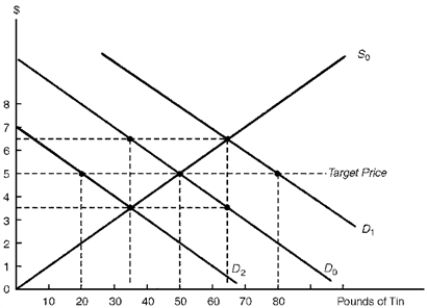

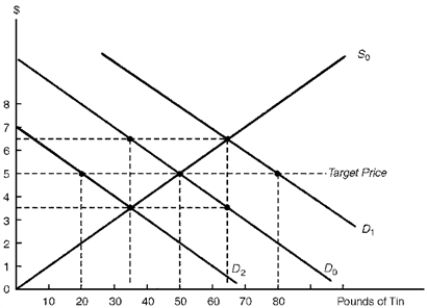

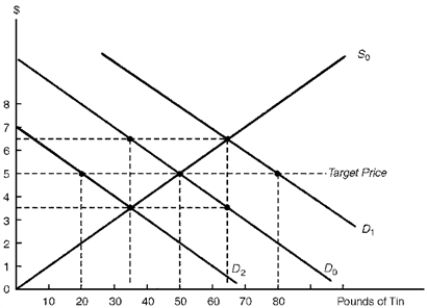

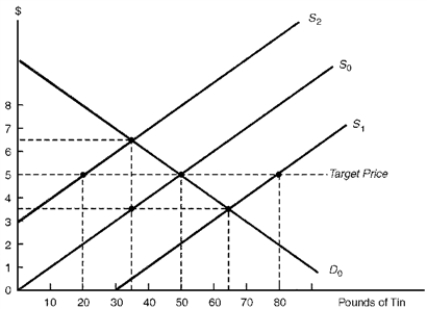

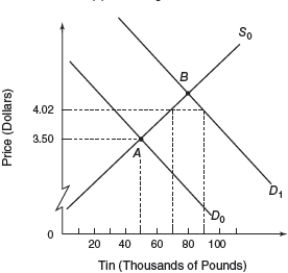

The diagram below illustrates the international tin market.Assume that producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.1.Defending the Target Price in Face of Changing Demand Conditions

Consider Figure 7.1.Suppose the demand for tin decreases from D0 to D2.Under a system of export quotas,the tin producers could maintain the target price by:

A) Increasing the quantity of tin supplied by 15 pounds

B) Increasing the quantity of tin supplied by 30 pounds

C) Decreasing the quantity of tin supplied by 15 pounds

D) Decreasing the quantity of tin supplied by 30 pounds

Figure 7.1.Defending the Target Price in Face of Changing Demand Conditions

Consider Figure 7.1.Suppose the demand for tin decreases from D0 to D2.Under a system of export quotas,the tin producers could maintain the target price by:

A) Increasing the quantity of tin supplied by 15 pounds

B) Increasing the quantity of tin supplied by 30 pounds

C) Decreasing the quantity of tin supplied by 15 pounds

D) Decreasing the quantity of tin supplied by 30 pounds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

22

Stabilizing commodity prices around long-term trends tends to benefit exporters at the expense of importers in markets characterized by:

A) Demand-side disturbances

B) Supply-side disturbances

C) Demand-side and supply-side disturbances

D) None of the above

A) Demand-side disturbances

B) Supply-side disturbances

C) Demand-side and supply-side disturbances

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

23

Once a cartel establishes its profit-maximizing price:

A) Entry into the industry of new competitors will not affect the cartel's profits

B) Output changes by cartel members have no effect on the market price

C) Each cartel member is tempted to cheat on the cartel price in order to add to its profit

D) All cartel members have a strong incentive to adhere to the agreed-upon price

A) Entry into the industry of new competitors will not affect the cartel's profits

B) Output changes by cartel members have no effect on the market price

C) Each cartel member is tempted to cheat on the cartel price in order to add to its profit

D) All cartel members have a strong incentive to adhere to the agreed-upon price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

24

To be considered a good candidate for an export cartel,a commodity should:

A) Be a manufactured good

B) Be a primary product

C) Have a high price elasticity of supply

D) Have a low price elasticity of demand

A) Be a manufactured good

B) Be a primary product

C) Have a high price elasticity of supply

D) Have a low price elasticity of demand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

25

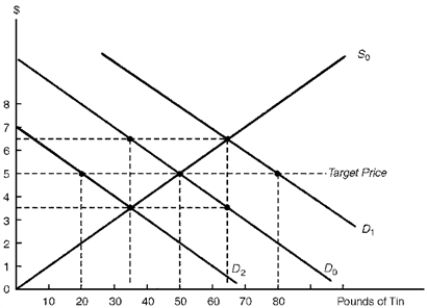

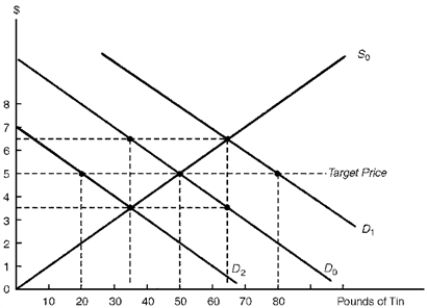

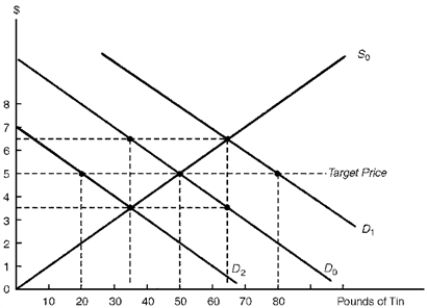

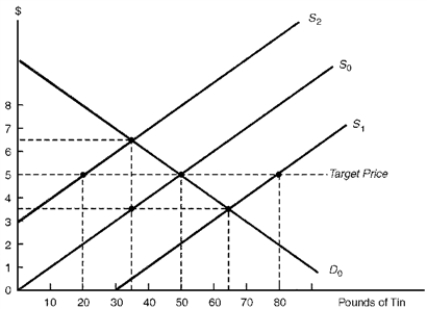

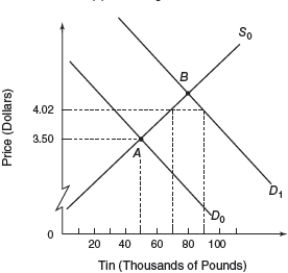

The diagram below illustrates the international tin market.Assume that the producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.2.Defending the Target Price in Face of Changing Supply Conditions

Consider Figure 7.2.Assume there exists a cartel of several producers that is maximizing total profit.If one producer cheats on the cartel agreement by decreasing its price and increasing its output,rational action of the other producers is to:

A) Increase their price in order to regain sacrificed profits

B) Decrease their price as well

C) Keep on selling at the agreed-upon price

D) Give the product away for free

Figure 7.2.Defending the Target Price in Face of Changing Supply Conditions

Consider Figure 7.2.Assume there exists a cartel of several producers that is maximizing total profit.If one producer cheats on the cartel agreement by decreasing its price and increasing its output,rational action of the other producers is to:

A) Increase their price in order to regain sacrificed profits

B) Decrease their price as well

C) Keep on selling at the agreed-upon price

D) Give the product away for free

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

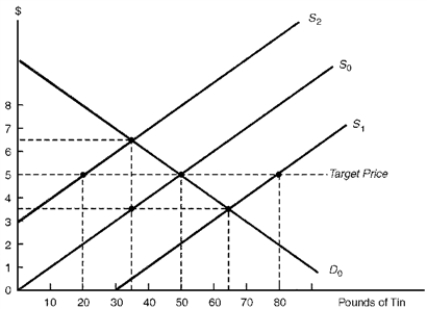

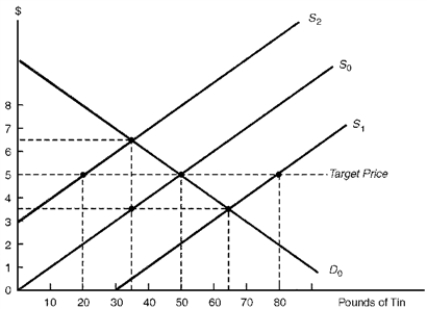

26

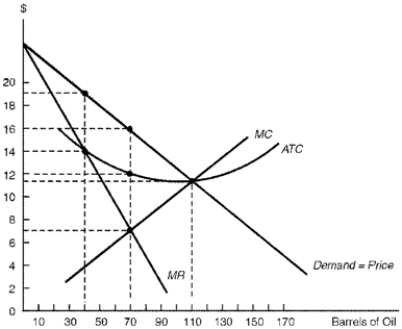

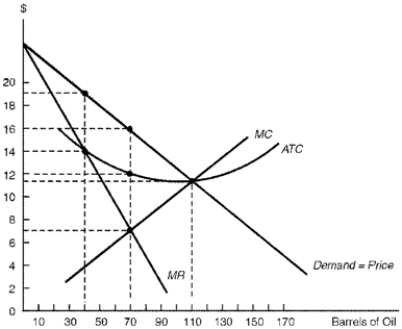

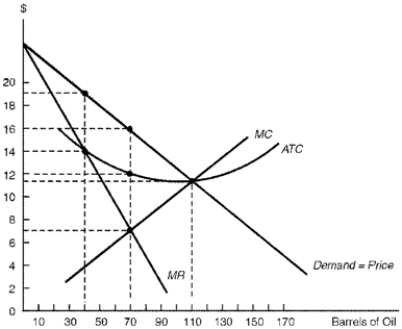

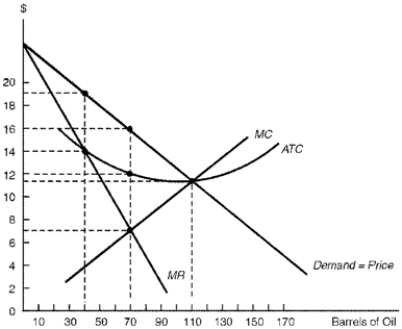

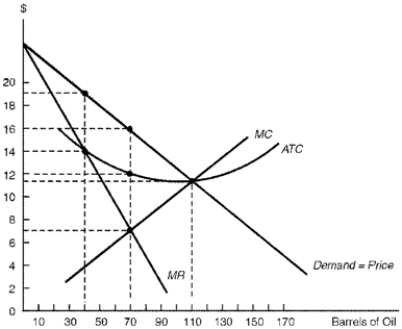

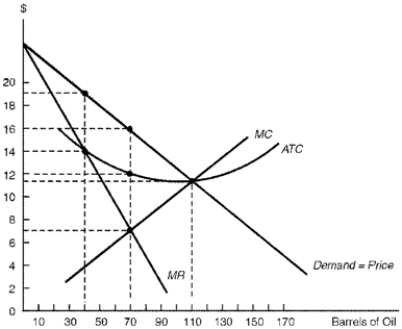

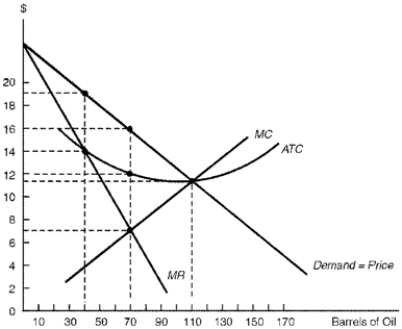

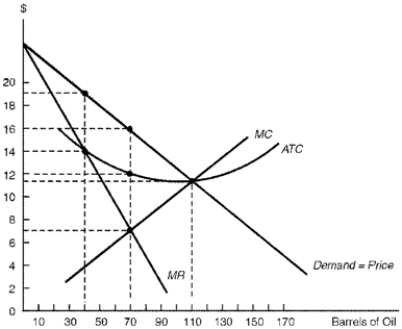

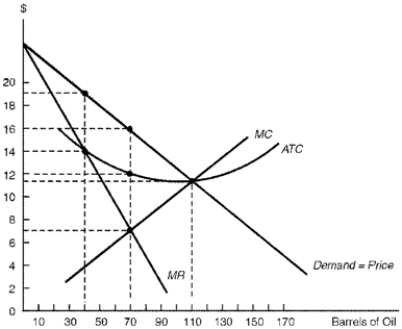

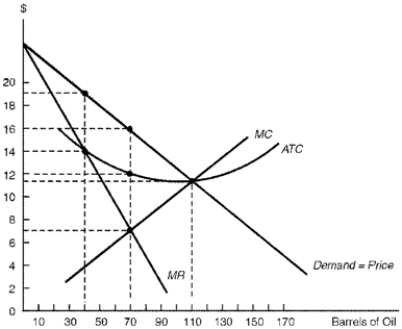

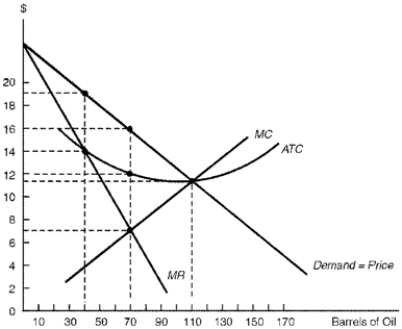

Figure 7.3.World Oil Market

Consider Figure 7.3.Under competitive conditions,the quantity of oil produced equals:

A) 40 barrels

B) 70 barrels

C) 90 barrels

D) 110 barrels

Consider Figure 7.3.Under competitive conditions,the quantity of oil produced equals:

A) 40 barrels

B) 70 barrels

C) 90 barrels

D) 110 barrels

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

27

Concerning the hypothesis that there has occurred a long-run deterioration in the developing countries' terms of trade,empirical studies provide:

A) Mixed evidence that does not substantiate the deterioration hypothesis

B) Overwhelming support for the deterioration hypothesis

C) Overwhelming opposition to the deterioration hypothesis

D) None of the above

A) Mixed evidence that does not substantiate the deterioration hypothesis

B) Overwhelming support for the deterioration hypothesis

C) Overwhelming opposition to the deterioration hypothesis

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

28

For the oil-importing countries,the increases in oil prices in 1973-1974 and 1979-1980 resulted in all of the following except:

A) Balance of trade deficits

B) Price inflation

C) Constrained economic growth

D) Improving terms of trade

A) Balance of trade deficits

B) Price inflation

C) Constrained economic growth

D) Improving terms of trade

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

29

A widely used indicator to differentiate developed countries from developing countries is:

A) International trade per capita

B) Real income per capita

C) Unemployment per capita

D) Calories per capita

A) International trade per capita

B) Real income per capita

C) Unemployment per capita

D) Calories per capita

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

30

To help developing nations strengthen their international competitiveness,many industrial nations have granted nonreciprocal tariff reductions to developing nations under the:

A) International commodity agreements program

B) Multilateral contract program

C) Generalized system of preferences program

D) Export-led growth program

A) International commodity agreements program

B) Multilateral contract program

C) Generalized system of preferences program

D) Export-led growth program

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

31

The diagram below illustrates the international tin market.Assume that producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.1.Defending the Target Price in Face of Changing Demand Conditions

Consider Figure 7.1.Suppose the demand for tin decreases from D0 to D2.Under a buffer stock system,the buffer-stock manager could maintain the target price by:

A) Selling 15 pounds of tin

B) Selling 30 pounds of tin

C) Buying 15 pounds of tin

D) Buying 30 pounds of tin

Figure 7.1.Defending the Target Price in Face of Changing Demand Conditions

Consider Figure 7.1.Suppose the demand for tin decreases from D0 to D2.Under a buffer stock system,the buffer-stock manager could maintain the target price by:

A) Selling 15 pounds of tin

B) Selling 30 pounds of tin

C) Buying 15 pounds of tin

D) Buying 30 pounds of tin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

32

A reason why it is difficult for producers to maintain a cartel is that:

A) The elasticity of demand for the cartel's output decreases over time

B) Producers in the cartel have the economic incentive to cheat

C) Economic profits discourage other producers from entering the industry

D) Producers in the cartel have the motivation to lower price but not to raise price

A) The elasticity of demand for the cartel's output decreases over time

B) Producers in the cartel have the economic incentive to cheat

C) Economic profits discourage other producers from entering the industry

D) Producers in the cartel have the motivation to lower price but not to raise price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which industrialization policy used by developing countries places emphasis on the comparative advantage principle as a guide to resource allocation?

A) Export promotion

B) Import substitution

C) International commodity agreements

D) Multilateral contract

A) Export promotion

B) Import substitution

C) International commodity agreements

D) Multilateral contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

34

The diagram below illustrates the international tin market.Assume that producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.1.Defending the Target Price in Face of Changing Demand Conditions

Consider Figure 7.1.Suppose the demand for tin increases from D0 to D1.Under a buffer stock system,the buffer-stock manager could maintain the target price by:

A) Selling 15 pounds of tin

B) Selling 30 pounds of tin

C) Buying 15 pounds of tin

D) Buying 30 pounds of tin

Figure 7.1.Defending the Target Price in Face of Changing Demand Conditions

Consider Figure 7.1.Suppose the demand for tin increases from D0 to D1.Under a buffer stock system,the buffer-stock manager could maintain the target price by:

A) Selling 15 pounds of tin

B) Selling 30 pounds of tin

C) Buying 15 pounds of tin

D) Buying 30 pounds of tin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

35

The diagram below illustrates the international tin market.Assume that the producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.2.Defending the Target Price in Face of Changing Supply Conditions

Consider Figure 7.2.Suppose the supply of tin decreases from S0 to S2.Under a buffer stock system,the buffer-stock manager could maintain the target price by:

A) Purchasing 15 pounds of tin

B) Purchasing 30 pounds of tin

C) Selling 15 pounds of tin

D) Selling 30 pounds of tin

Figure 7.2.Defending the Target Price in Face of Changing Supply Conditions

Consider Figure 7.2.Suppose the supply of tin decreases from S0 to S2.Under a buffer stock system,the buffer-stock manager could maintain the target price by:

A) Purchasing 15 pounds of tin

B) Purchasing 30 pounds of tin

C) Selling 15 pounds of tin

D) Selling 30 pounds of tin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

36

To be considered a good candidate for an export cartel,a commodity should:

A) Be a manufactured good

B) Be a primary product

C) Have a low price elasticity of supply

D) Have a high price elasticity of demand

A) Be a manufactured good

B) Be a primary product

C) Have a low price elasticity of supply

D) Have a high price elasticity of demand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

37

Stabilizing commodity prices around long-term trends tends to benefit importers at the expense of exporters in markets characterized by:

A) Demand-side disturbances

B) Supply-side disturbances

C) Demand-side and supply-side disturbances

D) None of the above

A) Demand-side disturbances

B) Supply-side disturbances

C) Demand-side and supply-side disturbances

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

38

The diagram below illustrates the international tin market.Assume that the producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.2.Defending the Target Price in Face of Changing Supply Conditions

Consider Figure 7.2.Suppose the supply of tin increases from S0 to S1.Under a buffer stock system,the buffer-stock manager could maintain the target price by:

A) Purchasing 15 pounds of tin

B) Purchasing 30 pounds of tin

C) Selling 15 pounds of tin

D) Selling 30 pounds of tin

Figure 7.2.Defending the Target Price in Face of Changing Supply Conditions

Consider Figure 7.2.Suppose the supply of tin increases from S0 to S1.Under a buffer stock system,the buffer-stock manager could maintain the target price by:

A) Purchasing 15 pounds of tin

B) Purchasing 30 pounds of tin

C) Selling 15 pounds of tin

D) Selling 30 pounds of tin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

39

Figure 7.3.World Oil Market

Consider Figure 7.3.Under competitive conditions,the price of a barrel of oil equals:

A) $7

B) $11

C) $12

D) $16

Consider Figure 7.3.Under competitive conditions,the price of a barrel of oil equals:

A) $7

B) $11

C) $12

D) $16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

40

Hong Kong and South Korea are examples of developing nations that have recently pursued industrialization policies.

A) Import substitution

B) Export promotion

C) Commercial dumping

D) Multilateral contract

A) Import substitution

B) Export promotion

C) Commercial dumping

D) Multilateral contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

41

All of the following nations except ____ have recently utilized export-led (outward oriented) growth policies.

A) Hong Kong

B) South Korea

C) Argentina

D) Singapore

A) Hong Kong

B) South Korea

C) Argentina

D) Singapore

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

42

Prior to the formation of the Organization of Petroleum Exporting Countries,individual oil producing nations,

A) Operated like sellers in a competitive market

B) Behaved like individual sellers in a monopoly market

C) Had considerable control over the price of oil

D) Both b and c

A) Operated like sellers in a competitive market

B) Behaved like individual sellers in a monopoly market

C) Had considerable control over the price of oil

D) Both b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

43

Most developing-nation exports go to industrial nations while most developing-nation imports originate in industrial nations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

44

The characteristics that have underlaid the economic success of the "high-performing Asian Economies" have included all of the following except:

A) High rates of domestic investment

B) Diseconomies of scale occurring at low output levels

C) Large endowments of human capital

D) High levels of labor productivity

A) High rates of domestic investment

B) Diseconomies of scale occurring at low output levels

C) Large endowments of human capital

D) High levels of labor productivity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

45

A key factor underlying the instability of primary product prices and export receipts of developing nations is the

A) Low price elasticity of the demand of primary products

B) High price elasticity of supply of primary products

C) High price elasticity of demand of primary products

D) None of the above

A) Low price elasticity of the demand of primary products

B) High price elasticity of supply of primary products

C) High price elasticity of demand of primary products

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

46

The developing nations are most of those in Africa,Asia,North America,and Western Europe.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

47

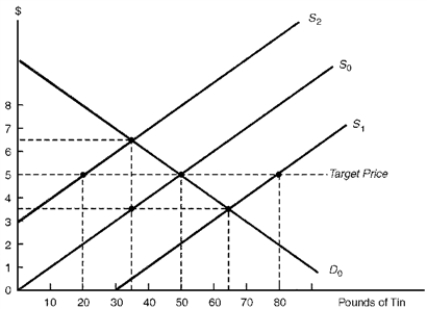

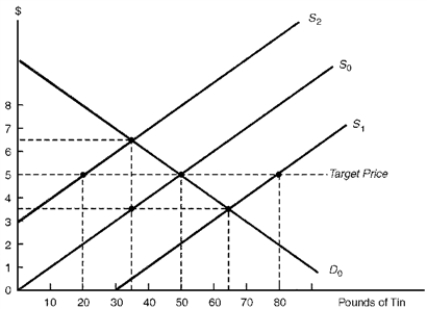

Figure 7.4 Global Market for Tin

Consider the global market for tin represented by figure 7.4.Initially equilibrium is at point A with a market price of $3.50 per pound and 50,000 pounds.In ordr to keep tin price relatively stable an International Tin Agreement has set a price floor of $3.27 and a ceiling of $4.02.As the demand for tin increases to D1 how will the buffer-stock manager need to respond?

A) buy 10,000 pounds of tin

B) buy 20,000 pounds of tin

C) sell 10,000 pounds of tin

D) sell 20,000 pounds of tin

Consider the global market for tin represented by figure 7.4.Initially equilibrium is at point A with a market price of $3.50 per pound and 50,000 pounds.In ordr to keep tin price relatively stable an International Tin Agreement has set a price floor of $3.27 and a ceiling of $4.02.As the demand for tin increases to D1 how will the buffer-stock manager need to respond?

A) buy 10,000 pounds of tin

B) buy 20,000 pounds of tin

C) sell 10,000 pounds of tin

D) sell 20,000 pounds of tin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

48

Figure 7.3.World Oil Market

Consider Figure 7.3.Under competitive conditions,producer profits total:

A) $0

B) $140

C) $200

D) $280

Consider Figure 7.3.Under competitive conditions,producer profits total:

A) $0

B) $140

C) $200

D) $280

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

49

Developing nations overwhelmingly acknowledge that they have benefited from international trade according to the principle of comparative advantage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

50

For most developing countries:

A) Productivity is high among domestic workers

B) Population-growth and illiteracy rates are low

C) Saving and investment levels are high

D) Agricultural goods and raw materials constitute much of domestic output

A) Productivity is high among domestic workers

B) Population-growth and illiteracy rates are low

C) Saving and investment levels are high

D) Agricultural goods and raw materials constitute much of domestic output

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

51

Import substitution policies make use of:

A) Tariffs that discourage goods from entering a country

B) Quotas applied to goods that are shipped abroad

C) Production subsidies granted to industries with comparative advantages

D) Tax breaks granted to industries with comparative advantages

A) Tariffs that discourage goods from entering a country

B) Quotas applied to goods that are shipped abroad

C) Production subsidies granted to industries with comparative advantages

D) Tax breaks granted to industries with comparative advantages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

52

East Asian economies have performed well by

A) Obtaining foreign technology

B) Remaining open to international trade

C) Investing in their people

D) All of the above

A) Obtaining foreign technology

B) Remaining open to international trade

C) Investing in their people

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

53

The majority of developing-nation exports are primary products such as agricultural goods and raw materials; of the manufactured goods exported by developing nations,most are labor-intensive goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

54

Figure 7.3.World Oil Market

Consider Figure 7.3.Under a profit-maximizing cartel,the quantity of oil produced equals:

A) 40 barrels

B) 70 barrels

C) 90 barrels

D) 110 barrels

Consider Figure 7.3.Under a profit-maximizing cartel,the quantity of oil produced equals:

A) 40 barrels

B) 70 barrels

C) 90 barrels

D) 110 barrels

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

55

Figure 7.3.World Oil Market

Consider Figure 7.3.Under a profit-maximizing cartel,producers realize:

A) Profits totaling $280

B) Profits totaling $360

C) Losses totaling $140

D) Losses totaling $180

Consider Figure 7.3.Under a profit-maximizing cartel,producers realize:

A) Profits totaling $280

B) Profits totaling $360

C) Losses totaling $140

D) Losses totaling $180

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

56

Figure 7.5 Global Market for Tin

Figure 7.5 represents the global market for tin.The initial equilibrium price and quantity is at point A.As a result of an International Tin Agreement a price range of $3.27 - $4.02 is set.As the supply of tin increases from S0 to S1,the buffer-stock manager will need to

A) buy 10,000 pounds of tin

B) buy 20,000 pounds of tin

C) sell 10,000 pounds of tin

D) sell 20,000 pounds of tin

Figure 7.5 represents the global market for tin.The initial equilibrium price and quantity is at point A.As a result of an International Tin Agreement a price range of $3.27 - $4.02 is set.As the supply of tin increases from S0 to S1,the buffer-stock manager will need to

A) buy 10,000 pounds of tin

B) buy 20,000 pounds of tin

C) sell 10,000 pounds of tin

D) sell 20,000 pounds of tin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

57

Export-led growth tends to:

A) Exploit domestic comparative advantages

B) Discourage competition in the global economy

C) Lead to unemployment among domestic workers

D) Help firms benefit from diseconomies of large-scale production

A) Exploit domestic comparative advantages

B) Discourage competition in the global economy

C) Lead to unemployment among domestic workers

D) Help firms benefit from diseconomies of large-scale production

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

58

Figure 7.3.World Oil Market

Consider Figure 7.3.Under a profit-maximizing cartel,the price of a barrel of oil equals:

A) $7

B) $11

C) $16

D) $19

Consider Figure 7.3.Under a profit-maximizing cartel,the price of a barrel of oil equals:

A) $7

B) $11

C) $16

D) $19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

59

The development of countries like South Korea and Singapore has been underlaid by all of the following except:

A) High domestic interest rates

B) R&D and product innovation

C) Education and on-the-job training

D) High levels of saving and investment

A) High domestic interest rates

B) R&D and product innovation

C) Education and on-the-job training

D) High levels of saving and investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

60

East Asian economies started enacting export-push strategies

A) By late 1950s and 1960s

B) Immediately after World War II

C) In the late 1980s

D) In the early 2000s

A) By late 1950s and 1960s

B) Immediately after World War II

C) In the late 1980s

D) In the early 2000s

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

61

Empirical research indicates that the demand and supply schedules for most primary products are relatively inelastic to changes in price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

62

Under the Generalized System of Preferences program,the major industrial countries agree to temporarily reduce tariffs on designated imports from other industrial countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

63

The purpose of a cartel is to support prices higher than would occur under more competitive conditions,thus increasing the profits of cartel members.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the demand for coffee is price inelastic,an increase in the supply of coffee leads to falling prices and rising sales revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

65

In recent decades,the East Asian "newly industrializing countries" have pursued export-led growth (outward orientation) as an industrialization strategy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

66

A cartel tends to be most successful in maximizing the profits of its members when there are a large number of producers in the cartel and these producers' cost and demand conditions greatly differ from each other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

67

To prevent the market price of tin from falling below the target price,the manager of a buffer stock would purchase any excess supply of tin that exists at the target price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

68

The "newly industrializing countries" of East Asia have emphasized the implementation of import-substitution policies to insulate their industries from international competition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

69

Developing countries have complained that because their commodity terms of trade has deteriorated in recent decades,they should receive preferential tariff treatment from industrialized countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

70

It is widely agreed that import-substitution policies have been a main contributor to above-average growth rates in developing countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

71

Not only do changes in demand induce relatively wide fluctuations in price when supply is inelastic,but changes in supply induce relatively wide fluctuations in price when demand is inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

72

To promote stability in commodity markets,International Commodity Agreements have utilized production and export controls,buffer stocks,and multilateral contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

73

To prevent the market price of tin from rising above the target price,the manager of a buffer stock will purchase excess supplies of tin from the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

74

For developing countries,a key factor underlying the instability of primary-product prices and export receipts is the high price elasticity of demand for products such as tin and copper.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

75

When cartel members agree to restrict output to increase the price of their product,a single member of the cartel has an economic incentive to violate the agreement by increasing its output so as to increase profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

76

Among the economic problems facing developing countries have been low dependence on primary-product exports,unstable export markets,and worsening terms of trade.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

77

During periods of falling demand for coffee,an International Commodity Agreement could offset downward pressure on price by implementing policies to increase the supply of coffee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

78

Rather than conduct massive stabilization operations,buffer stock officials will periodically revise target prices should they move out of line with long-term price trends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

79

Prolonged defense of a price ceiling tends to increase the supply of a commodity held by a buffer stock manager,thus putting downward pressure on price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck

80

A multilateral contract stipulates the maximum price at which importing nations will purchase guaranteed quantities from producing nations and the minimum price at which producing nations will sell guaranteed amounts to importing nations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 305 في هذه المجموعة.

فتح الحزمة

k this deck