Deck 7: Assessing the Risk of Material Misstatement

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/62

العب

ملء الشاشة (f)

Deck 7: Assessing the Risk of Material Misstatement

1

Three conditions for fraud are referred to as the "fraud triangle." One of the sides of this triangle is incentives or pressures.The other two sides are

A)opportunities and a desire to meet debt repayment obligations.

B)opportunities and attitudes or rationalizations.

C)attitudes or rationalizations and the need to maintain stock prices.

D)the need to maintain stock prices and the need to meet debt repayment obligations.

A)opportunities and a desire to meet debt repayment obligations.

B)opportunities and attitudes or rationalizations.

C)attitudes or rationalizations and the need to maintain stock prices.

D)the need to maintain stock prices and the need to meet debt repayment obligations.

B

2

Which of the following is a factor that relates to "incentives or pressures" to commit fraudulent financial reporting?

A)significant accounting estimates involving subjective judgments

B)excessive pressure for management to meet debt covenant requirements

C)management's practice of making overly achievable forecasts

D)high turnover of accounting,internal audit,and information technology staff

A)significant accounting estimates involving subjective judgments

B)excessive pressure for management to meet debt covenant requirements

C)management's practice of making overly achievable forecasts

D)high turnover of accounting,internal audit,and information technology staff

B

3

As per CAS 240,when an auditor inquires about the risk of fraud and errors within the organization,what are the auditors not required to discuss with management?

A)Management's assessment of the risk that the financial statements may be materially misstated due to fraud.

B)Management's communication,if any,to those charged with governance regarding its processes for identifying and responding to the risks of fraud.

C)Management's process for identifying and responding to the risks of fraud in the entity.

D)The auditor's analytical procedures.

A)Management's assessment of the risk that the financial statements may be materially misstated due to fraud.

B)Management's communication,if any,to those charged with governance regarding its processes for identifying and responding to the risks of fraud.

C)Management's process for identifying and responding to the risks of fraud in the entity.

D)The auditor's analytical procedures.

D

4

What are the components of risk of material misstatement at the assertion level?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

5

Why does an auditor perform audit risk assessment procedures? What activities are included in risk assessment procedures?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following best describes risk assessment,from an auditor's perspective?

A)Financial statements cannot be audited,for example,because the auditor was appointed after the year end.

B)Financial statements distributed by the auditee are not materially false and misleading.

C)The auditor will not overlook significant errors in the financial statements.

D)Identify and assess the risk of material misstatements.

A)Financial statements cannot be audited,for example,because the auditor was appointed after the year end.

B)Financial statements distributed by the auditee are not materially false and misleading.

C)The auditor will not overlook significant errors in the financial statements.

D)Identify and assess the risk of material misstatements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

7

Risk in auditing means that the auditor accepts some level of uncertainty in performing the audit function.An effective auditor will

A)take any means available to reduce the risk to the lowest possible level.

B)set the risk level between 5% and 10%.

C)perform the audit procedures first and quantitatively set the risk level before forming an opinion and writing the report.

D)recognize that risks exist and deal with those risks by performing high quality audits.

A)take any means available to reduce the risk to the lowest possible level.

B)set the risk level between 5% and 10%.

C)perform the audit procedures first and quantitatively set the risk level before forming an opinion and writing the report.

D)recognize that risks exist and deal with those risks by performing high quality audits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

8

Fraud risk factors are examples of factors that increase the risk of fraud.Which of the following is an example of a management "opportunities" risk factor?

A)The company has lost a major account and income is falling.

B)Two major competitors have gone bankrupt as margins decline in the industry.

C)The Chief Executive Officer owns forty percent of the outstanding share capital.

D)New accounting standards provide three different methods for valuing financial instruments.

A)The company has lost a major account and income is falling.

B)Two major competitors have gone bankrupt as margins decline in the industry.

C)The Chief Executive Officer owns forty percent of the outstanding share capital.

D)New accounting standards provide three different methods for valuing financial instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is a factor that relates to "attitudes or rationalization" to commit fraudulent financial reporting?

A)significant accounting estimates involving subjective judgments

B)excessive pressure for management to meet debt repayment requirements

C)management's practice of making overly aggressive forecasts

D)high turnover of accounting,internal audit,and information technology staff

A)significant accounting estimates involving subjective judgments

B)excessive pressure for management to meet debt repayment requirements

C)management's practice of making overly aggressive forecasts

D)high turnover of accounting,internal audit,and information technology staff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is a nonroutine transaction,and give two examples of a nonroutine transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

11

Auditors' responsibility relating to fraud risk is

A)detecting any type of fraud that occurred during the reporting period.

B)detecting fraud only if it is above the planning materiality level.

C)not an issue because the auditor is not responsible for detecting fraud.

D)making inquiries of management about fraud and considering fraud risks.

A)detecting any type of fraud that occurred during the reporting period.

B)detecting fraud only if it is above the planning materiality level.

C)not an issue because the auditor is not responsible for detecting fraud.

D)making inquiries of management about fraud and considering fraud risks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

12

List the audit procedures outlined in CAS 240 that the auditor should perform to assess fraud risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

13

Senior managers of Mega Corp.are entitled to receive large bonuses if they achieve earnings targets.What is the effect of this on the risks associated with recording of revenue?

A)It increases fraud risks associated with revenue.

B)It decreases fraud risks associated with revenue.

C)It increases detection risks associated with revenue.

D)It decreases control risks associated with revenue.

A)It increases fraud risks associated with revenue.

B)It decreases fraud risks associated with revenue.

C)It increases detection risks associated with revenue.

D)It decreases control risks associated with revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

14

Fraud risk factors are examples of factors that increase the risk of fraud.Which of the following is an example of a management "incentives or pressures" risk factor?

A)Customer demand for a new product line was significantly less than expected.

B)Management and the auditors disagree on how to value a large contract in progress.

C)There is only one board member who understands financial statements and she has suffered a heart attack.

D)There has been significant turnover in the accounting department in the last year.

A)Customer demand for a new product line was significantly less than expected.

B)Management and the auditors disagree on how to value a large contract in progress.

C)There is only one board member who understands financial statements and she has suffered a heart attack.

D)There has been significant turnover in the accounting department in the last year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

15

List the audit procedures outlined in CAS 240 that the auditor should perform to address the risk of management override of controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

16

What are the factors that increase the risk of material misstatement at the overall financial statement level?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

17

What audit procedure would be an auditor's response to address management override of controls ?

A)Evaluate business rationale for significant unusual transactions.

B)Evaluate systematic processing of large volumes of day-to-day ordinary transactions.

C)Evaluate possibilities of petty cash embezzlements.

D)Evaluate in detail payroll transactions.

A)Evaluate business rationale for significant unusual transactions.

B)Evaluate systematic processing of large volumes of day-to-day ordinary transactions.

C)Evaluate possibilities of petty cash embezzlements.

D)Evaluate in detail payroll transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

18

The possibility that fraud has resulted in intentional misstatement in the financial statements is known as

A)acceptable audit risk.

B)detection risk.

C)control risk.

D)fraud risk.

A)acceptable audit risk.

B)detection risk.

C)control risk.

D)fraud risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

19

CAS 315.28 requires the auditor to consider various factors to identify significant risks.List the factors the auditors are required to consider.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

20

Significant risk often relates to

A)low-dollar-value transactions.

B)simple transactions.

C)routine transactions.

D)nonroutine transactions.

A)low-dollar-value transactions.

B)simple transactions.

C)routine transactions.

D)nonroutine transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

21

As the effectiveness of internal control increases,what happens to control risk?

A)It stays the same.

B)It increases.

C)It changes based on the audit procedures conducted.

D)It decreases.

A)It stays the same.

B)It increases.

C)It changes based on the audit procedures conducted.

D)It decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

22

Using the acceptable audit risk model,audit risk describes targeted assurance,while control risk and inherent risk are assessed based upon a variety of factors.Of the components of the audit risk model,which is most likely to be set to 100%?

A)acceptable audit risk

B)control risk

C)detection risk

D)inherent risk

A)acceptable audit risk

B)control risk

C)detection risk

D)inherent risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

23

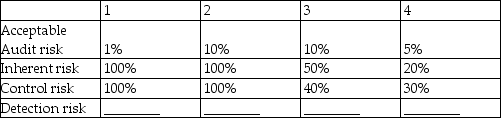

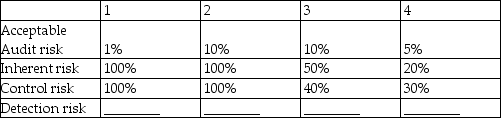

Below are four situations that involve the audit risk model as it is used for planning audit evidence requirements in the audit of inventory.For each situation,calculate planned detection risk.

SITUATION

SITUATION

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the auditor assessed the detection risk as high,the extent of evidence the auditor plans to accumulate is

A)low.

B)high.

C)medium.

D)uncertain: more information is needed.

A)low.

B)high.

C)medium.

D)uncertain: more information is needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

25

What is the role of internal controls during the assessment of inherent risk?

A)Internal controls are considered separately,so they are ignored during the assessment of inherent risk.

B)As the quality of internal controls increases,inherent risk decreases.

C)As the quality of internal controls improves,inherent risk increases.

D)There is a direct relationship between the quality of internal controls and inherent risk.

A)Internal controls are considered separately,so they are ignored during the assessment of inherent risk.

B)As the quality of internal controls increases,inherent risk decreases.

C)As the quality of internal controls improves,inherent risk increases.

D)There is a direct relationship between the quality of internal controls and inherent risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

26

Your firm has been appointed as the auditor of Bush Mining Inc.(BMI),a company that runs small mining operations in remote areas of northern Canada,primarily in surface mines.You have been assigned the job of senior auditor for BMI.

BMI's operations are subject to provincial and federal laws and regulations.These laws and regulations have become stricter in recent years and some of BMI's older mines may be in violation of environmental laws.Surface mining produces tailings (toxic wastes that are dangerous to animal and plant life).These tailings are either further processed and buried or retained in tailings ponds.BMI is required to restore the mining property to a safe condition after a mine is exhausted.BMI has programs in place to monitor and control pollutants that are released to the air and to local waterways.

Required:A)What factors would affect the client business risk of BMI? Based upon your assessment of BMI's client business risk,would you adjust acceptable audit risk? Why or why not? B)What is your preliminary assessment of acceptable audit risk? Justify your answer.

BMI's operations are subject to provincial and federal laws and regulations.These laws and regulations have become stricter in recent years and some of BMI's older mines may be in violation of environmental laws.Surface mining produces tailings (toxic wastes that are dangerous to animal and plant life).These tailings are either further processed and buried or retained in tailings ponds.BMI is required to restore the mining property to a safe condition after a mine is exhausted.BMI has programs in place to monitor and control pollutants that are released to the air and to local waterways.

Required:A)What factors would affect the client business risk of BMI? Based upon your assessment of BMI's client business risk,would you adjust acceptable audit risk? Why or why not? B)What is your preliminary assessment of acceptable audit risk? Justify your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

27

An inherent risk (IR)of 40% and a control risk (CR)of 60% affect detection risk and planned evidence differently than an

A)IR of 60% and CR of 40%.

B)IR of 100% and CR of 24%.

C)IR of 80% and CR of 30%.

D)IR of 70% and CR of 30%.

A)IR of 60% and CR of 40%.

B)IR of 100% and CR of 24%.

C)IR of 80% and CR of 30%.

D)IR of 70% and CR of 30%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

28

When inherent risk is assessed as higher (i.e.more material errors are likely to exist)and control risk is assessed the same from one year to the next,what is the likely effect on detection risk?

A)Detection risk will increase.

B)Detection risk will decrease.

C)Detection risk will stay the same.

D)Detection risk will need less documentation.

A)Detection risk will increase.

B)Detection risk will decrease.

C)Detection risk will stay the same.

D)Detection risk will need less documentation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

29

The risk that an auditor's procedures will lead to the conclusion that a material error does not exist in an account balance when,in fact,such error does exist is referred to as

A)acceptable audit risk.

B)inherent risk.

C)control risk.

D)planned detection risk.

A)acceptable audit risk.

B)inherent risk.

C)control risk.

D)planned detection risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

30

The auditor set acceptable audit risk at 5%,inherent risk at 100%,and control risk at 50%,and determined a detection risk of 10%.If control risk had been 80%,detection risk would be about

A)16%.

B)10%.

C)6%.

D)5%.

A)16%.

B)10%.

C)6%.

D)5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

31

If from last year to the current year's audit,inherent risk has stayed constant but control risk is higher (it is more likely that controls do not detect material errors),what is the likely effect on detection risk?

A)Detection risk will increase.

B)Detection risk will decrease.

C)Detection risk will stay the same.

D)Detection risk will need less documentation.

A)Detection risk will increase.

B)Detection risk will decrease.

C)Detection risk will stay the same.

D)Detection risk will need less documentation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

32

Assessing design effectiveness and conducting tests of controls are required when the auditor

A)chooses to set control risk below 100 percent and relies on the controls.

B)chooses to set control risk below 100 percent even if there is no reliance placed on controls.

C)is planning the audit.

D)tests the design effectiveness.

A)chooses to set control risk below 100 percent and relies on the controls.

B)chooses to set control risk below 100 percent even if there is no reliance placed on controls.

C)is planning the audit.

D)tests the design effectiveness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

33

The audit risk model is used primarily

A)for planning purposes in determining how much evidence to accumulate.

B)while doing tests of controls.

C)to determine the type of opinion to express.

D)to evaluate the evidence that has been gathered.

A)for planning purposes in determining how much evidence to accumulate.

B)while doing tests of controls.

C)to determine the type of opinion to express.

D)to evaluate the evidence that has been gathered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

34

A)Explain how auditors use the audit risk model when planning an audit.B)Describe the audit risk model and each of its components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

35

Because control risk and inherent risk vary from cycle to cycle,account to account,or objective to objective,

A)acceptable audit risk must also change.

B)planned detection risk and required audit evidence will also vary.

C)planned detection risk will vary but audit evidence will remain constant.

D)planned detection risk will remain constant but audit evidence will vary.

A)acceptable audit risk must also change.

B)planned detection risk and required audit evidence will also vary.

C)planned detection risk will vary but audit evidence will remain constant.

D)planned detection risk will remain constant but audit evidence will vary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

36

Acceptable audit risk is a measure of

A)the auditor's assessment of the likelihood that a material misstatement might occur in the first place.

B)the probability that the financial statements contain errors.

C)how willing the auditor is to accept that the financial statements may be materially misstated after the audit is completed.

D)the probability that errors in the financial statements that were not detected by the internal controls of the firm are not detected by the auditor.

A)the auditor's assessment of the likelihood that a material misstatement might occur in the first place.

B)the probability that the financial statements contain errors.

C)how willing the auditor is to accept that the financial statements may be materially misstated after the audit is completed.

D)the probability that errors in the financial statements that were not detected by the internal controls of the firm are not detected by the auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

37

The audit risk model is

A)a planning,testing,and evaluation model.

B)a primary planning tool but of limited value in evaluating results.

C)useful in evaluating results but of limited use in planning.

D)useful when performing the tests of balances,but of little value in either the planning or evaluation stages.

A)a planning,testing,and evaluation model.

B)a primary planning tool but of limited value in evaluating results.

C)useful in evaluating results but of limited use in planning.

D)useful when performing the tests of balances,but of little value in either the planning or evaluation stages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

38

In addition to representing an assessment of whether a client's internal control is effective for preventing or detecting misstatements,control risk also represents the

A)reliability of management in preventing or detecting fraud.

B)auditor's intention to rely on internal controls.

C)likelihood that the auditor will detect illegal acts.

D)possibility of collusion occurring between two employees.

A)reliability of management in preventing or detecting fraud.

B)auditor's intention to rely on internal controls.

C)likelihood that the auditor will detect illegal acts.

D)possibility of collusion occurring between two employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

39

PA has set acceptable audit risk at 5% and determined that inherent risk and control risk is at 100%.What is the detection risk?

A)5%

B)50%

C)95%

D)20%

A)5%

B)50%

C)95%

D)20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following describes the components of the audit risk model that are used to describe the risk of material misstatement (RMM)?

A)AAR / DR

B)IR × CR

C)IR × DR

D)CR × DR

A)AAR / DR

B)IR × CR

C)IR × DR

D)CR × DR

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

41

If inherent risk is considered at the assertion level,why does the nature of the client's business affect inherent risk?

A)Certain accounts,such as inventory,are affected by the nature of the client's business.

B)If the client has very basic manufacturing processes,inherent risk is low.

C)When there is a risk of technological obsolescence,a specialist must be used during the engagement.

D)Accounts such as cash,notes,and mortgages payable vary depending upon the type of business.

A)Certain accounts,such as inventory,are affected by the nature of the client's business.

B)If the client has very basic manufacturing processes,inherent risk is low.

C)When there is a risk of technological obsolescence,a specialist must be used during the engagement.

D)Accounts such as cash,notes,and mortgages payable vary depending upon the type of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

42

If acceptable audit risk is increased,what happens to detection risk?

A)It stays the same.

B)It increases.

C)It changes based upon the audit procedures conducted.

D)It decreases.

A)It stays the same.

B)It increases.

C)It changes based upon the audit procedures conducted.

D)It decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

43

How much control does the auditor have over inherent risk?

A)The auditor adjusts the controls that are considered (high level of control).

B)The auditor considers inherent risk for the business as a whole (some control).

C)The auditor assesses the factors that make up inherent risk (no control).

D)The auditor calculates inherent risk values as a residual (no control).

A)The auditor adjusts the controls that are considered (high level of control).

B)The auditor considers inherent risk for the business as a whole (some control).

C)The auditor assesses the factors that make up inherent risk (no control).

D)The auditor calculates inherent risk values as a residual (no control).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

44

PA is comparing the liabilities section of ABC Ltd.from last year to this year.Last year,ABC Ltd.had large loans due to major shareholders and officers and to one bank.This year,the debt has been reorganized so there are now two different banks used for loans.Instead of having debt to shareholders and officers,the company now owes notes to 25 different foreign investors,who are entitled to convert the debt to shares if interest is not paid or if principal installments are not paid on time.For this year's audit,how will the change in debt structure affect the audit risk model?

A)no effect on the audit risk model

B)higher control risk

C)lower acceptable audit risk

D)higher acceptable audit risk

A)no effect on the audit risk model

B)higher control risk

C)lower acceptable audit risk

D)higher acceptable audit risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

45

GreenGrow Limited is a local landscaping company that does household and commercial landscaping.Primarily,it helps businesses select plants and manage the plants.It also has regular maintenance contracts such as watering,weeding,and mowing.In the winter,it has some contracts for managing the indoor plants in shopping malls and does snow clearing to help boost this low-income season.

Joey,the majority shareholder of GreenGrow is ecstatic.He has managed to come in as the low bidder for a new type of contract.He bid on the construction of a track for the track and field area of a local university.A piece of land on the north end of the university is being cleared and GreenGrow will be leveling the land and placing a bed of crushed stone for the track.Joey has just the right person to be in charge.Jack has previous experience working as an assistant on a road crew and knows how to use the surveying equipment needed to keep the track level.This is a big contract,and will increase revenues by one third!

Required:

Assess inherent risk for revenue for GreenGrow Limited.

Joey,the majority shareholder of GreenGrow is ecstatic.He has managed to come in as the low bidder for a new type of contract.He bid on the construction of a track for the track and field area of a local university.A piece of land on the north end of the university is being cleared and GreenGrow will be leveling the land and placing a bed of crushed stone for the track.Joey has just the right person to be in charge.Jack has previous experience working as an assistant on a road crew and knows how to use the surveying equipment needed to keep the track level.This is a big contract,and will increase revenues by one third!

Required:

Assess inherent risk for revenue for GreenGrow Limited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

46

A PA firm can experience high levels of business risk if the audit firm

A)does a poor job preparing client risk profiles.

B)pays its employees wages that are not in line with the market.

C)experiences significant litigation or has clients declare bankruptcy.

D)has a generous vacation policy for its staff.

A)does a poor job preparing client risk profiles.

B)pays its employees wages that are not in line with the market.

C)experiences significant litigation or has clients declare bankruptcy.

D)has a generous vacation policy for its staff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

47

Mugsy Brights Limited (MBL)is a private company in Winnipeg that sells mugs,jars,and bottles in a variety of colours,sizes,and materials.MBL has been owned by four equal owners since its inception.The owners have different skills-creative design,marketing,finance,and information systems.The company attributes much of its success to the use of materials that can be easily shipped without breaking,and unique designs that appeal to a variety of buyers,particularly commercial buyers who purchase for restaurants,or for businesses who choose to advertise their business by giving away or selling regular or travel mugs.

The owners meet formally every month and have informal meetings two or three times per week to discuss particular clients or new approaches.About a quarter of the company's sales are completed via the company's secure website,while the remainder are by telephone or purchase order.MBL works with distributors of kitchenware,selling wholesale to hundreds of outlets in Canada.Most of these sales are done over the phone,although a salesperson does spend some time in major cities across the country visiting some of the large customers and helping with shelf layout and marketing to the ultimate consumers for larger distributors.These efforts have resulted in gradually increasing market share for the company.

All sales are recorded in the accounting software package used by the company.The accounting manager reports directly to one of the owners,and there are two other employees in the accounting department.Password controls are used to limit functions that are accessible by employees.For example,only the controller can implement wage rate increases or product price increases (which are reviewed and approved by the owner responsible for marketing).Two owners are required to sign cheques,and do so with source documents attached.Similarly,two owners are required to approve new employees.

All manufacturing is outsourced to local producers who work with different materials.For example,a different supplier handles steel mugs versus plastics or glass.Ceramics are rarely used as they are quite breakable,whereas some forms of glass are very durable.MBL does not hold any inventory,as manufacturing is all done to order.However,as there have been some collection problems from customers,the company has had to go to the maximum of its line of credit and has no additional borrowing capacity available.It is waiting for the results of the audited financial statements to approach its bank for an increase in its line of credit.

Internet sales are prepared (via credit card),while sales to distributors are net thirty.The company has an April year end.Following are extracts from the annual financial statements.

![Mugsy Brights Limited (MBL)is a private company in Winnipeg that sells mugs,jars,and bottles in a variety of colours,sizes,and materials.MBL has been owned by four equal owners since its inception.The owners have different skills-creative design,marketing,finance,and information systems.The company attributes much of its success to the use of materials that can be easily shipped without breaking,and unique designs that appeal to a variety of buyers,particularly commercial buyers who purchase for restaurants,or for businesses who choose to advertise their business by giving away or selling regular or travel mugs. The owners meet formally every month and have informal meetings two or three times per week to discuss particular clients or new approaches.About a quarter of the company's sales are completed via the company's secure website,while the remainder are by telephone or purchase order.MBL works with distributors of kitchenware,selling wholesale to hundreds of outlets in Canada.Most of these sales are done over the phone,although a salesperson does spend some time in major cities across the country visiting some of the large customers and helping with shelf layout and marketing to the ultimate consumers for larger distributors.These efforts have resulted in gradually increasing market share for the company. All sales are recorded in the accounting software package used by the company.The accounting manager reports directly to one of the owners,and there are two other employees in the accounting department.Password controls are used to limit functions that are accessible by employees.For example,only the controller can implement wage rate increases or product price increases (which are reviewed and approved by the owner responsible for marketing).Two owners are required to sign cheques,and do so with source documents attached.Similarly,two owners are required to approve new employees. All manufacturing is outsourced to local producers who work with different materials.For example,a different supplier handles steel mugs versus plastics or glass.Ceramics are rarely used as they are quite breakable,whereas some forms of glass are very durable.MBL does not hold any inventory,as manufacturing is all done to order.However,as there have been some collection problems from customers,the company has had to go to the maximum of its line of credit and has no additional borrowing capacity available.It is waiting for the results of the audited financial statements to approach its bank for an increase in its line of credit. Internet sales are prepared (via credit card),while sales to distributors are net thirty.The company has an April year end.Following are extracts from the annual financial statements. Required:A)What acceptable audit risk would you assign to the company? Why? [Tip: Do some calculations and consider client business risk.] B)Calculate preliminary materiality.Justify your decision of materiality base and choice of materiality.](https://d2lvgg3v3hfg70.cloudfront.net/TB1491/11ea2fda_778d_0d8a_b41d_91cdf89bc895_TB1491_00.jpg)

Required:A)What acceptable audit risk would you assign to the company? Why? [Tip: Do some calculations and consider client business risk.] B)Calculate preliminary materiality.Justify your decision of materiality base and choice of materiality.

The owners meet formally every month and have informal meetings two or three times per week to discuss particular clients or new approaches.About a quarter of the company's sales are completed via the company's secure website,while the remainder are by telephone or purchase order.MBL works with distributors of kitchenware,selling wholesale to hundreds of outlets in Canada.Most of these sales are done over the phone,although a salesperson does spend some time in major cities across the country visiting some of the large customers and helping with shelf layout and marketing to the ultimate consumers for larger distributors.These efforts have resulted in gradually increasing market share for the company.

All sales are recorded in the accounting software package used by the company.The accounting manager reports directly to one of the owners,and there are two other employees in the accounting department.Password controls are used to limit functions that are accessible by employees.For example,only the controller can implement wage rate increases or product price increases (which are reviewed and approved by the owner responsible for marketing).Two owners are required to sign cheques,and do so with source documents attached.Similarly,two owners are required to approve new employees.

All manufacturing is outsourced to local producers who work with different materials.For example,a different supplier handles steel mugs versus plastics or glass.Ceramics are rarely used as they are quite breakable,whereas some forms of glass are very durable.MBL does not hold any inventory,as manufacturing is all done to order.However,as there have been some collection problems from customers,the company has had to go to the maximum of its line of credit and has no additional borrowing capacity available.It is waiting for the results of the audited financial statements to approach its bank for an increase in its line of credit.

Internet sales are prepared (via credit card),while sales to distributors are net thirty.The company has an April year end.Following are extracts from the annual financial statements.

![Mugsy Brights Limited (MBL)is a private company in Winnipeg that sells mugs,jars,and bottles in a variety of colours,sizes,and materials.MBL has been owned by four equal owners since its inception.The owners have different skills-creative design,marketing,finance,and information systems.The company attributes much of its success to the use of materials that can be easily shipped without breaking,and unique designs that appeal to a variety of buyers,particularly commercial buyers who purchase for restaurants,or for businesses who choose to advertise their business by giving away or selling regular or travel mugs. The owners meet formally every month and have informal meetings two or three times per week to discuss particular clients or new approaches.About a quarter of the company's sales are completed via the company's secure website,while the remainder are by telephone or purchase order.MBL works with distributors of kitchenware,selling wholesale to hundreds of outlets in Canada.Most of these sales are done over the phone,although a salesperson does spend some time in major cities across the country visiting some of the large customers and helping with shelf layout and marketing to the ultimate consumers for larger distributors.These efforts have resulted in gradually increasing market share for the company. All sales are recorded in the accounting software package used by the company.The accounting manager reports directly to one of the owners,and there are two other employees in the accounting department.Password controls are used to limit functions that are accessible by employees.For example,only the controller can implement wage rate increases or product price increases (which are reviewed and approved by the owner responsible for marketing).Two owners are required to sign cheques,and do so with source documents attached.Similarly,two owners are required to approve new employees. All manufacturing is outsourced to local producers who work with different materials.For example,a different supplier handles steel mugs versus plastics or glass.Ceramics are rarely used as they are quite breakable,whereas some forms of glass are very durable.MBL does not hold any inventory,as manufacturing is all done to order.However,as there have been some collection problems from customers,the company has had to go to the maximum of its line of credit and has no additional borrowing capacity available.It is waiting for the results of the audited financial statements to approach its bank for an increase in its line of credit. Internet sales are prepared (via credit card),while sales to distributors are net thirty.The company has an April year end.Following are extracts from the annual financial statements. Required:A)What acceptable audit risk would you assign to the company? Why? [Tip: Do some calculations and consider client business risk.] B)Calculate preliminary materiality.Justify your decision of materiality base and choice of materiality.](https://d2lvgg3v3hfg70.cloudfront.net/TB1491/11ea2fda_778d_0d8a_b41d_91cdf89bc895_TB1491_00.jpg)

Required:A)What acceptable audit risk would you assign to the company? Why? [Tip: Do some calculations and consider client business risk.] B)Calculate preliminary materiality.Justify your decision of materiality base and choice of materiality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

48

Big Box Distribution Company has an in-house information systems department of 50 people.The company generally does its own programming,although some software was acquired as a software package.A software package was purchased for customer relationship management,which will be modified by the programming staff.

Procedures for implementing programs vary by department.All major changes are approved by the Management Information Systems steering committee.The committee is also given a list of the maintenance changes that are planned in the coming year.Some departments request that the data processing department handle testing,while other users are rather picky and want to do their own testing.Requirements are generally prepared in writing,although small maintenance changes may be handled verbally.

Required:

Assess inherent risk associated with program changes at Big Box.

Procedures for implementing programs vary by department.All major changes are approved by the Management Information Systems steering committee.The committee is also given a list of the maintenance changes that are planned in the coming year.Some departments request that the data processing department handle testing,while other users are rather picky and want to do their own testing.Requirements are generally prepared in writing,although small maintenance changes may be handled verbally.

Required:

Assess inherent risk associated with program changes at Big Box.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

49

If detection risk is reduced,the amount of evidence the auditor accumulates will

A)increase.

B)decrease.

C)remain unchanged.

D)be indeterminate.

A)increase.

B)decrease.

C)remain unchanged.

D)be indeterminate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

50

You generally consider your audit client's management to be honest.However,they do have a bias towards wanting to understate their income to lower income taxes.How would this bias be implemented in the audit risk model?

A)reduce acceptable audit risk and reduce inherent risk

B)increase acceptable audit risk and reduce inherent risk

C)reduce acceptable audit risk and increase inherent risk

D)increase acceptable audit risk and increase inherent risk

A)reduce acceptable audit risk and reduce inherent risk

B)increase acceptable audit risk and reduce inherent risk

C)reduce acceptable audit risk and increase inherent risk

D)increase acceptable audit risk and increase inherent risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

51

All other factors held constant,if the auditor decreases acceptable audit risk then

A)there will be less documentation in the audit file.

B)total audit evidence and audit costs will increase.

C)it will also be necessary to decrease either control risk or inherent risk.

D)less supervision of the audit team will be required.

A)there will be less documentation in the audit file.

B)total audit evidence and audit costs will increase.

C)it will also be necessary to decrease either control risk or inherent risk.

D)less supervision of the audit team will be required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

52

A PA is working on the audit of a publicly held corporation.At what level will the acceptable auditor likely set audit risk?

A)low

B)medium

C)high

D)very high

A)low

B)medium

C)high

D)very high

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

53

When external users place heavy reliance on the financial statements,it is appropriate that

A)acceptable audit risk be increased.

B)inherent risk be decreased.

C)inherent risk be increased.

D)acceptable audit risk be decreased.

A)acceptable audit risk be increased.

B)inherent risk be decreased.

C)inherent risk be increased.

D)acceptable audit risk be decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

54

PA is auditing a client where the accounts receivable are in worse shape than last year: many accounts are significantly overdue.How would this fact be dealt with in the audit risk model?

A)increase inherent risk for accounts receivable

B)decrease inherent risk for accounts receivable

C)increase control risk for accounts receivable

D)decrease control risk for accounts receivable

A)increase inherent risk for accounts receivable

B)decrease inherent risk for accounts receivable

C)increase control risk for accounts receivable

D)decrease control risk for accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

55

Acceptable audit risk is ordinarily set by the auditor during planning and

A)held constant for each major cycle and account.

B)held constant for each major cycle but varies by account.

C)varies by each major cycle and by each account.

D)varies by each major cycle but is constant by account.

A)held constant for each major cycle and account.

B)held constant for each major cycle but varies by account.

C)varies by each major cycle and by each account.

D)varies by each major cycle but is constant by account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

56

When a different extent of evidence is needed for the various cycles,the difference is caused by

A)errors in the client's accounting system.

B)the client's need to achieve an unqualified opinion.

C)the auditor's need to follow GAAS.

D)the auditor's expectations of errors and assessment of internal control.

A)errors in the client's accounting system.

B)the client's need to achieve an unqualified opinion.

C)the auditor's need to follow GAAS.

D)the auditor's expectations of errors and assessment of internal control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

57

Discuss three factors that affect client business risk and therefore acceptable audit risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following would be a signal of possible problems with management integrity?

A)reliance on debt rather than equity for financing permanent assets

B)rotation of holidays in the supervisory area over a period of months

C)rapidly declining profits or increasing losses over a period of years

D)frequent disagreements with regulators and the Canada Revenue Agency

A)reliance on debt rather than equity for financing permanent assets

B)rotation of holidays in the supervisory area over a period of months

C)rapidly declining profits or increasing losses over a period of years

D)frequent disagreements with regulators and the Canada Revenue Agency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

59

An important role of inherent risk assessment during the audit process is the need to

A)document the quality of the disaster recovery plan.

B)attempt to predict where misstatements are most and least likely in the financial statement segments.

C)train the audit staff to assess the integrity of management.

D)increase the level of analytical review.

A)document the quality of the disaster recovery plan.

B)attempt to predict where misstatements are most and least likely in the financial statement segments.

C)train the audit staff to assess the integrity of management.

D)increase the level of analytical review.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

60

A PA recently finished the audit of a family-owned business.Now she is working on a large client with about 50 times the assets and 30 times total revenue.For the larger client,the PA will likely have

A)no changes to the audit risk model.

B)higher control risk.

C)higher acceptable audit risk.

D)lower acceptable audit risk.

A)no changes to the audit risk model.

B)higher control risk.

C)higher acceptable audit risk.

D)lower acceptable audit risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

61

When the auditor has the same level of willingness to risk that material errors will exist after the audit is finished for all five cycles,

A)the same amount of evidence will be gathered for each cycle.

B)a different extent of evidence is needed for various cycles.

C)he/she has not followed generally accepted auditing standards.

D)the level for each cycle must be no more than 2% so that the entire audit does not exceed 10%.

A)the same amount of evidence will be gathered for each cycle.

B)a different extent of evidence is needed for various cycles.

C)he/she has not followed generally accepted auditing standards.

D)the level for each cycle must be no more than 2% so that the entire audit does not exceed 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

62

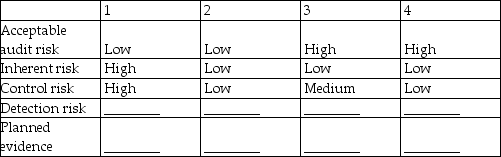

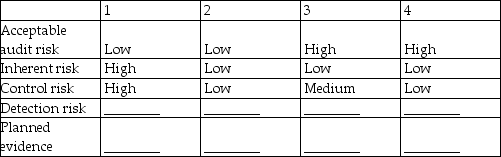

In practice,auditors rarely assign numerical probabilities to inherent risk,control risk,or acceptable audit risk.It is more common to assess these risks as high,medium,or low.For each of the four situations below,fill in the blanks for detection risk and the amount of evidence you would plan to gather ("planned evidence")using the terms high,medium,or low.

SITUATION

SITUATION

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck