Deck 12: Audit of the Revenue Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/138

العب

ملء الشاشة (f)

Deck 12: Audit of the Revenue Cycle

1

A document prepared for shipment of the goods sold using a trucking company is called the

A)sales order.

B)bill of lading.

C)sales invoice.

D)customer order.

A)sales order.

B)bill of lading.

C)sales invoice.

D)customer order.

B

2

Audit risk is assessed for

A)the financial statements as a whole and is not usually allocated to various accounts or objectives.

B)the financial statements as a whole and then allocated to various accounts.

C)various accounts but not for the financial statements as a whole.

D)various accounts and objectives,and the sum is then assigned to the financial statements as a whole.

A)the financial statements as a whole and is not usually allocated to various accounts or objectives.

B)the financial statements as a whole and then allocated to various accounts.

C)various accounts but not for the financial statements as a whole.

D)various accounts and objectives,and the sum is then assigned to the financial statements as a whole.

A

3

Typical source documents involved in the revenue and collection cycle would be

A)cash disbursements.

B)vendor invoices.

C)shipping documents.

D)customer invoices.

A)cash disbursements.

B)vendor invoices.

C)shipping documents.

D)customer invoices.

C

4

A document sent to each customer showing his or her beginning accounts receivable balance and the amount and date of each sale,cash payment received,credit memo issued,and the ending balance is the

A)accounts receivable subsidiary ledger.

B)monthly statement.

C)remittance advice.

D)sales invoice.

A)accounts receivable subsidiary ledger.

B)monthly statement.

C)remittance advice.

D)sales invoice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following documents and records is used to record the packages,weights,and sizes shipped using an external trucking company?

A)remittance advice

B)shipping advice containing shipment tracking number

C)returns receiving report

D)bill of lading

A)remittance advice

B)shipping advice containing shipment tracking number

C)returns receiving report

D)bill of lading

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

6

Before goods are shipped on account to a new customer,a properly authorized person must

A)prepare the sales invoice.

B)approve the journal entry.

C)approve credit.

D)verify that the unit price is accurate.

A)prepare the sales invoice.

B)approve the journal entry.

C)approve credit.

D)verify that the unit price is accurate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

7

Some companies use a lockbox system,whereby customers mail payments to a post office box address.The lockbox contents could be handled by a bank,another external organization,or the owner of the company.One of the advantages of using a lockbox is that it

A)improves segregation of duties.

B)results in more accurate bank deposits.

C)results in more accurate accounts receivables.

D)provides more detailed bank deposit information.

A)improves segregation of duties.

B)results in more accurate bank deposits.

C)results in more accurate accounts receivables.

D)provides more detailed bank deposit information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following lists outlines the best order for a typical sequence of activities in the revenue and collection cycle?

A)delivering goods,billing customers,credit granting,collection activity

B)customer ordering,delivering goods,credit granting,collection activity

C)customer ordering,delivering goods,billing customer,cash receipts

D)credit granting,billing customers,delivering goods,cash receipts

A)delivering goods,billing customers,credit granting,collection activity

B)customer ordering,delivering goods,credit granting,collection activity

C)customer ordering,delivering goods,billing customer,cash receipts

D)credit granting,billing customers,delivering goods,cash receipts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

9

What are the six classes of transactions in the revenue cycle and what entries relate to each class of transactions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

10

Poor controls over credit limit approval or in changing the credit limit in the master file may result in

A)confused and frustrated customers.

B)incomplete sales records.

C)financial statement errors for sales and AR accounts.

D)excessive bad debts and uncollectible accounts receivable.

A)confused and frustrated customers.

B)incomplete sales records.

C)financial statement errors for sales and AR accounts.

D)excessive bad debts and uncollectible accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

11

A)Describe the four business functions that result in sales transactions in a typical sales and collection cycle,and state the key documents and records involved in each function.B)State the five classes of transactions that comprise the sales and collection cycle.C)The sales and collections cycle is comprised of nine business functions.The first four functions result in sales transactions.Discuss the remaining four business functions that occur after sales transactions,and identify the key documents and records involved in each of the five functions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

12

The two primary classes of transactions in the sales and collection cycle are

A)sales and sales returns.

B)sales and sales discounts.

C)sales and accounts receivable.

D)sales and cash receipts.

A)sales and sales returns.

B)sales and sales discounts.

C)sales and accounts receivable.

D)sales and cash receipts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

13

Your audit client has many different types of accounts receivable: Canadian,American,and other international accounts;and short- and long-term accounts.There are also some sales on consignment.The company has used forward exchange contracts to reduce its exposure due to foreign exchange fluctuations.How will this affect the audit engagement?

A)control risk will increase

B)inherent risks of error will decrease

C)risk of material misstatement increases

D)audit risk will be increased

A)control risk will increase

B)inherent risks of error will decrease

C)risk of material misstatement increases

D)audit risk will be increased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

14

Describe skimming.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following data elements would be included in the customer master file?

A)transaction date

B)credit limit

C)transaction amount

D)amount paid

A)transaction date

B)credit limit

C)transaction amount

D)amount paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

16

Most companies recognize sales when

A)a customer order is received.

B)the merchandise is shipped.

C)the merchandise is received by the customer.

D)cash is received on account.

A)a customer order is received.

B)the merchandise is shipped.

C)the merchandise is received by the customer.

D)cash is received on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following control weaknesses could result in problems with collectability of accounts receivable?

A)Unauthorized individuals can establish or change credit limits.

B)Matching shipping documents to sales records is done weekly.

C)When there is one error in a batch of transactions,the whole batch is rejected.

D)Cash receipts are matched to the customer accounts rather than against specific invoices.

A)Unauthorized individuals can establish or change credit limits.

B)Matching shipping documents to sales records is done weekly.

C)When there is one error in a batch of transactions,the whole batch is rejected.

D)Cash receipts are matched to the customer accounts rather than against specific invoices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

18

A document that describes which accounts receivable accounts are to be written off and why is called a(n)

A)uncollectible account authorization form.

B)journal entry authorization form.

C)master file change form.

D)sales returns and allowances journal.

A)uncollectible account authorization form.

B)journal entry authorization form.

C)master file change form.

D)sales returns and allowances journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

19

The document that is used to prepare and reconcile the deposit of cash and improve control over the custody of assets (cash)is the

A)sales invoice.

B)credit memo.

C)remittance advice.

D)cash receipts journal.

A)sales invoice.

B)credit memo.

C)remittance advice.

D)cash receipts journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

20

Zhang Corporation returned $6000 of defective goods to Meli Inc.Meli has a strict policy of no cash refund.Meli should

A)write off the account receivable.

B)issue a credit memo to Zhang.

C)wait until Zhang places its next order to record the return.

D)not adjust their accounting records since $6000 is not material for Meli.

A)write off the account receivable.

B)issue a credit memo to Zhang.

C)wait until Zhang places its next order to record the return.

D)not adjust their accounting records since $6000 is not material for Meli.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

21

As the quality of the enterprise risk management process declines,and the overall quality of internal controls declines,

A)risk of fraud decreases.

B)risk of fraud increases.

C)the extent of control testing increases.

D)the extent of substantive testing decreases.

A)risk of fraud decreases.

B)risk of fraud increases.

C)the extent of control testing increases.

D)the extent of substantive testing decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

22

A risk of material misstatement in accounts receivable associated with the allocation balance-related audit objective is that "long-term service revenue is recorded as current revenue or in the wrong period,overstating revenue and accounts receivable." Which of the following tests of detail of balances would respond to this risk?

A)Read customer contracts and audit the criteria used to allocate revenue to components of the sales contract.

B)Check cash received after the year end and trace to accounts receivable master file.

C)Read the notes to the financial statements and compare to audited financial information.

D)Enquire with management about the process used to make sure that revenue is recorded in the correct period.

A)Read customer contracts and audit the criteria used to allocate revenue to components of the sales contract.

B)Check cash received after the year end and trace to accounts receivable master file.

C)Read the notes to the financial statements and compare to audited financial information.

D)Enquire with management about the process used to make sure that revenue is recorded in the correct period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

23

There are three main types of revenue manipulations.Which of the following revenue manipulations affects the cutoff objective?

A)avoiding recording of returns and allowances for the year

B)recording subsequent period sales as current period sales

C)understatement of bad debts

D)creation of fictitious sales that are misclassified as revenue

A)avoiding recording of returns and allowances for the year

B)recording subsequent period sales as current period sales

C)understatement of bad debts

D)creation of fictitious sales that are misclassified as revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

24

List the common fraud schemes relating to revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

25

You are the auditor for GreenAcres,a non-profit home for homeless elderly.GreenAcres has a December 31 year end.It receives government funding and also relies on donations for revenue.GreenAcres has a major funding drive in November,when it collects pledges by means of activities at a garage sale,a walkathon,and bake sales in the community.

In late February you had a meeting with Ellen Famous,the President of GreenAcres,at the organization's premises.Ellen reviews and approves bank statements and is the second and final cheque signer.Two other accounting staff have the following responsibilities:

•Paul approves pledge write-offs (which normally average about 15%),opens the mail,endorses cheques received in the mail,prepares and delivers bank deposits,and posts transactions into the accounting system.

•Diana,a retired bookkeeper,volunteers about 10 hours per week to reconcile the bank account,review journal entries posted to the general ledger,and prepare payroll and accounts payable transactions for processing.

Ellen normally reviews pledge write-offs,but was very busy in February,so she took a look while you were there.To her surprise,she found that about 40% of the pledges had been written off.She asked Diana to investigate,and Diana found that most of the write-offs had actually been paid.

Required:A)What are possible causes of the inconsistency with the pledge write-offs? B)What are the weaknesses in internal control that could allow the excess write-offs to occur? Provide recommendations for improvement.C)Identify audit procedures that you would complete to quantify any potential misstatement with respect to the pledges receivable balance as at December 31.

In late February you had a meeting with Ellen Famous,the President of GreenAcres,at the organization's premises.Ellen reviews and approves bank statements and is the second and final cheque signer.Two other accounting staff have the following responsibilities:

•Paul approves pledge write-offs (which normally average about 15%),opens the mail,endorses cheques received in the mail,prepares and delivers bank deposits,and posts transactions into the accounting system.

•Diana,a retired bookkeeper,volunteers about 10 hours per week to reconcile the bank account,review journal entries posted to the general ledger,and prepare payroll and accounts payable transactions for processing.

Ellen normally reviews pledge write-offs,but was very busy in February,so she took a look while you were there.To her surprise,she found that about 40% of the pledges had been written off.She asked Diana to investigate,and Diana found that most of the write-offs had actually been paid.

Required:A)What are possible causes of the inconsistency with the pledge write-offs? B)What are the weaknesses in internal control that could allow the excess write-offs to occur? Provide recommendations for improvement.C)Identify audit procedures that you would complete to quantify any potential misstatement with respect to the pledges receivable balance as at December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following actions is more likely to be a result of error rather than fraud?

A)consignment sales are knowingly recorded as revenue

B)orders are shipped to a customer with a bad credit rating

C)fictitious revenue transactions are recorded and reported

D)subsequent period revenue is deliberately recorded in the current period

A)consignment sales are knowingly recorded as revenue

B)orders are shipped to a customer with a bad credit rating

C)fictitious revenue transactions are recorded and reported

D)subsequent period revenue is deliberately recorded in the current period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

27

An audit procedure that compares the name,amount,and dates shown on remittance advices with cash receipts journal entries and with related duplicate deposit slips would be effective in detecting

A)kiting.

B)lapping.

C)illicit write-offs of customers as uncollectible accounts.

D)sales without proper credit authorization.

A)kiting.

B)lapping.

C)illicit write-offs of customers as uncollectible accounts.

D)sales without proper credit authorization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which one of the following would the auditor consider to be an incompatible operation if the cashier receives remittances from the mail room? The cashier

A)prepares the daily deposit.

B)makes the daily deposit at a local bank.

C)records the receipts to the customer files.

D)endorses the cheques with the company endorsement stamp.

A)prepares the daily deposit.

B)makes the daily deposit at a local bank.

C)records the receipts to the customer files.

D)endorses the cheques with the company endorsement stamp.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

29

There are three main types of revenue manipulations.Which of the following revenue manipulations affects the valuation objective?

A)recording subsequent period sales as current period sales

B)the use of "bill and holds" (goods are invoiced but not shipped)

C)understatement of bad debts

D)creation of fictitious sales that are misclassified as revenue

A)recording subsequent period sales as current period sales

B)the use of "bill and holds" (goods are invoiced but not shipped)

C)understatement of bad debts

D)creation of fictitious sales that are misclassified as revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

30

Cash receipts from sales on account have been misappropriated.Which of the following acts would conceal this defalcation and be least likely to be detected by an auditor?

A)postponing recording of cash receipt entries

B)overstating the accounts receivable control account

C)overstating the accounts receivable subsidiary ledger

D)recording cash receipt entries early

A)postponing recording of cash receipt entries

B)overstating the accounts receivable control account

C)overstating the accounts receivable subsidiary ledger

D)recording cash receipt entries early

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

31

What are the common indicators that the entity may be engaged in fraudulent financial reporting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

32

Comparing bad debt expense as a percentage of gross sales with previous years will detect what kind of possible misstatement?

A)uncollectible accounts receivable not provided for

B)overstatement of sales and accounts receivable

C)understatement of sales and accounts receivable

D)understatement of allowance for uncollectible accounts

A)uncollectible accounts receivable not provided for

B)overstatement of sales and accounts receivable

C)understatement of sales and accounts receivable

D)understatement of allowance for uncollectible accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

33

In the planning phase,Denis conducted an analytical procedure to compare the allowance for doubtful accounts balance to the accounts receivable balance.In the prior years,the allowance for the doubtful accounts/accounts receivable ratio was between 2.5% to 3.5%.This year,the number is 1.25%.What should Denis do?

A)Change the assessed inherent risk

B)Conduct additional testing to justify the lower bad debt.

C)Advise management that they should increase the allowance for doubtful accounts provision.

D)Document this difference and continue with audit work to see if this is pervasive bias of management.

A)Change the assessed inherent risk

B)Conduct additional testing to justify the lower bad debt.

C)Advise management that they should increase the allowance for doubtful accounts provision.

D)Document this difference and continue with audit work to see if this is pervasive bias of management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

34

Discuss three examples of analytical procedures an auditor might perform while auditing the sales and collection cycle.Also discuss the potential misstatement(s)that may be revealed by each analytical procedure.

Note: students could also be asked to separately discuss ratios for planning and ratios as substantive tests.

Note: students could also be asked to separately discuss ratios for planning and ratios as substantive tests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

35

The most difficult type of cash defalcation for the auditor to detect is that which occurs

A)before the cash is recorded.

B)after cash is recorded but before it goes to the bank.

C)out of the balance kept in a cash register.

D)in amounts under $100.

A)before the cash is recorded.

B)after cash is recorded but before it goes to the bank.

C)out of the balance kept in a cash register.

D)in amounts under $100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

36

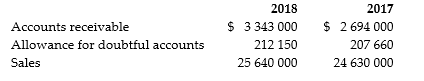

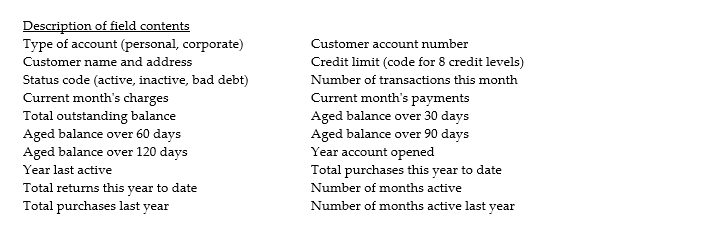

You are conducting an audit and have obtained the following figures with respect to sales and accounts receivable:

Required:A)What are the audit implications of these figures? B)Identify key audit steps that you would perform for any of the above accounts.

Required:A)What are the audit implications of these figures? B)Identify key audit steps that you would perform for any of the above accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

37

You are the auditor of Foundry Inc. ,a company that manufactures chocolate bars and assorted candies.The description of the sales and collection cycle for Foundry is as follows.

Clients and Credit Limits

Foundry has 50 clients,as it mostly sells to grocery stores' central purchasing departments or distributors.For each customer,Foundry performs a credit check prior to setting the credit limit for the client.The credit limit is reviewed each year.In the past year,the credit limits were increased by 10%.This is due to the growth in Foundryès product lines and increased demand from customers.This also came at the same time the CEO of Foundry set the objective of growing the company's revenue by 25% over the next two years.Increasing the credit limit has helped Foundry move towards that objective.

Allowance for Doubtful Accounts

The allowance for doubtful accounts is calculated by the controller by taking a percentage of the total sales for the month.The controller has been taking 3% of total sales.The estimate has not been revised in the current year,but it has always been sufficient to cover for any write-offs incurred.

Required:

For each of the two areas discussed above,identify the risk areas and the most likely misstatements for Foundry.

Clients and Credit Limits

Foundry has 50 clients,as it mostly sells to grocery stores' central purchasing departments or distributors.For each customer,Foundry performs a credit check prior to setting the credit limit for the client.The credit limit is reviewed each year.In the past year,the credit limits were increased by 10%.This is due to the growth in Foundryès product lines and increased demand from customers.This also came at the same time the CEO of Foundry set the objective of growing the company's revenue by 25% over the next two years.Increasing the credit limit has helped Foundry move towards that objective.

Allowance for Doubtful Accounts

The allowance for doubtful accounts is calculated by the controller by taking a percentage of the total sales for the month.The controller has been taking 3% of total sales.The estimate has not been revised in the current year,but it has always been sufficient to cover for any write-offs incurred.

Required:

For each of the two areas discussed above,identify the risk areas and the most likely misstatements for Foundry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

38

The defalcation process that postpones entries for the collection of accounts receivable to conceal an existing cash shortage is referred to as

A)kiting.

B)lapping.

C)computer fraud.

D)financial statement fraud.

A)kiting.

B)lapping.

C)computer fraud.

D)financial statement fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

39

There are three main types of revenue manipulations.Which of the following revenue manipulations affects the occurrence objective?

A)recording subsequent period sales as current period sales

B)the use of "bill and holds" (goods are invoiced but not shipped)

C)understatement of bad debts

D)creation of fictitious sales that are misclassified as revenue

A)recording subsequent period sales as current period sales

B)the use of "bill and holds" (goods are invoiced but not shipped)

C)understatement of bad debts

D)creation of fictitious sales that are misclassified as revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

40

Office Design Inc.(ODI)has been your audit client for five years.ODI designs and sells office furniture such as desks,cabinets,and couches used in office reception areas.ODI has sales in Canada and the U.S. ,with five distribution locations where furniture is available to prospective purchasers to try out before purchasing.These locations are in Toronto,Montreal,Halifax,New York,and Chicago.The company uses custom-designed software for its order processing and sales,which is kept current by one of the five information systems personnel.

The Vice President of Finance is new.Executive management is paid a salary and a bonus based on the annual net income of ODI.Unfortunately,the accounting staff at the head office (in Montreal)has been downsized from ten people to six due to a recent slowdown in sales.Your review of the aged accounts receivable trial balance revealed that one third of the accounts have been outstanding for more than one year.ODI's profits have declined substantially from last year.Its line of credit and bank loans are at their maximum and the company is considering selling its U.S.operations to provide cash flow.

Prior year working papers revealed few errors and indicate that you considered management integrity to be good.However,due to segregation issues,you did not rely on the internal controls in the prior year.

Required:A)What issues in corporate governance and in the control environment affect your assessment of internal controls for revenue? How does this affect the decision to conduct substantive testing (i.e.exclusion of tests of controls)? B)What is the likely assessment of computer general controls? How does this affect the type of audit testing conducted at ODI?

The Vice President of Finance is new.Executive management is paid a salary and a bonus based on the annual net income of ODI.Unfortunately,the accounting staff at the head office (in Montreal)has been downsized from ten people to six due to a recent slowdown in sales.Your review of the aged accounts receivable trial balance revealed that one third of the accounts have been outstanding for more than one year.ODI's profits have declined substantially from last year.Its line of credit and bank loans are at their maximum and the company is considering selling its U.S.operations to provide cash flow.

Prior year working papers revealed few errors and indicate that you considered management integrity to be good.However,due to segregation issues,you did not rely on the internal controls in the prior year.

Required:A)What issues in corporate governance and in the control environment affect your assessment of internal controls for revenue? How does this affect the decision to conduct substantive testing (i.e.exclusion of tests of controls)? B)What is the likely assessment of computer general controls? How does this affect the type of audit testing conducted at ODI?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

41

For sales,the occurrence transaction-related audit objective affects the existence balance-related audit objective.For cash receipts,the occurrence transaction-related audit objective affects which balance-related audit objective?

A)existence

B)completeness

C)cutoff

D)valuation

A)existence

B)completeness

C)cutoff

D)valuation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following presentation and disclosure-related audit objectives has a matching transaction-related audit objective,but not a matching balance-related audit objective?

A)accuracy

B)classification

C)occurrence

D)completeness

A)accuracy

B)classification

C)occurrence

D)completeness

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

43

A)Describe each of the six key control activities for sales.B)When assessing planned control risk for sales,the auditor is concerned about proper authorization at three key points.Discuss each of these three points.C)When testing the existence objective for sales,the auditor is concerned with the possibility of three types of misstatements.One type is sales being included in the journal for which no shipment was made.Discuss the other two types of misstatements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

44

For cash receipts,the occurrence transaction-related audit objective affects the completeness balance-related audit objective of accounts receivable.Which accounts receivable balance-related audit objective does the cash receipts transaction-related audit objective of completeness affect?

A)allocation

B)completeness

C)rights and obligations

D)existence

A)allocation

B)completeness

C)rights and obligations

D)existence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

45

Three presentation and disclosure audit objectives are not affected by assessed control risk for the sales transactions.These are

A)rights and obligations,valuation,and understandability.

B)understandability,valuation,and occurrence.

C)valuation,rights and obligations,and classification.

D)classification,understandability,and rights and obligations.

A)rights and obligations,valuation,and understandability.

B)understandability,valuation,and occurrence.

C)valuation,rights and obligations,and classification.

D)classification,understandability,and rights and obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

46

The appropriate test of controls for separation of duties is

A)documentation.

B)confirmation.

C)examination.

D)observation.

A)documentation.

B)confirmation.

C)examination.

D)observation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

47

After the auditor has identified the key internal controls and weaknesses and assessed control risk,it is appropriate to decide whether

A)substantive tests will be increased sufficiently to justify the cost of performing tests of controls.

B)substantive tests will be reduced sufficiently to justify the cost of performing tests of controls.

C)tests of controls will be increased sufficiently to justify the cost of performing substantive tests.

D)tests of controls will be reduced sufficiently to justify the cost of performing substantive tests.

A)substantive tests will be increased sufficiently to justify the cost of performing tests of controls.

B)substantive tests will be reduced sufficiently to justify the cost of performing tests of controls.

C)tests of controls will be increased sufficiently to justify the cost of performing substantive tests.

D)tests of controls will be reduced sufficiently to justify the cost of performing substantive tests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is an example of a key internal control for an online system that would help ensure that recorded sales are for the amount of goods shipped and are accurately billed and recorded?

A)Shipping documents are matched to invoices.

B)Shipping details and price list are automatically used as the invoicing source.

C)Shipping documents are prenumbered and accounted for.

D)Transactions are summarized daily for posting to the general ledger.

A)Shipping documents are matched to invoices.

B)Shipping details and price list are automatically used as the invoicing source.

C)Shipping documents are prenumbered and accounted for.

D)Transactions are summarized daily for posting to the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

49

An auditor selects a sample from the file of shipping documents to determine whether invoices were prepared.This test is performed to satisfy the audit objective of

A)accuracy.

B)completeness.

C)control.

D)existence.

A)accuracy.

B)completeness.

C)control.

D)existence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

50

The overall objective in the audit of the sales and collection cycle is to evaluate whether

A)the sales account and the accounts receivable account are free of errors.

B)the sales account and the accounts receivable account are free of material errors.

C)the sales account and the accounts receivable account are presented fairly in accordance with an applicable financial reporting framework.

D)the account balances affected by the cycle are fairly presented in accordance with an applicable financial reporting framework.

A)the sales account and the accounts receivable account are free of errors.

B)the sales account and the accounts receivable account are free of material errors.

C)the sales account and the accounts receivable account are presented fairly in accordance with an applicable financial reporting framework.

D)the account balances affected by the cycle are fairly presented in accordance with an applicable financial reporting framework.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

51

Two accounts receivable balance-related audit objectives are not affected by assessed control risk for the sales and cash receipts classes of transactions.These objectives are

A)valuation;allocation.

B)allocation;rights and obligations.

C)valuation;rights and obligations.

D)accuracy;existence.

A)valuation;allocation.

B)allocation;rights and obligations.

C)valuation;rights and obligations.

D)accuracy;existence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

52

The auditor traces items from the source documents to the journals in order to satisfy the

A)existence objective.

B)completeness objective.

C)accuracy objective.

D)classification objective.

A)existence objective.

B)completeness objective.

C)accuracy objective.

D)classification objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

53

One of the reasons that the auditor considers the type of information system and its functions is to

A)assess whether hardware functioning affects applications.

B)evaluate design effectiveness of internal controls.

C)complete risk assessment by audit assertion for cycles.

D)assess whether programmed controls can be relied upon.

A)assess whether hardware functioning affects applications.

B)evaluate design effectiveness of internal controls.

C)complete risk assessment by audit assertion for cycles.

D)assess whether programmed controls can be relied upon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following internal control procedures will most likely prevent the concealment of a cash shortage resulting from the improper write-off of a trade account receivable?

A)Write-offs must be approved by a responsible officer after review of credit department recommendations and supporting evidence.

B)Write-offs must be supported by an aging schedule showing that only receivables overdue several months have been written off.

C)Write-offs must be approved by the cashier who is in a position to know if the accounts receivable have,in fact,been collected.

D)Write-offs must be authorized by company field sales employees who are in a position to determine the financial standing of the customers.

A)Write-offs must be approved by a responsible officer after review of credit department recommendations and supporting evidence.

B)Write-offs must be supported by an aging schedule showing that only receivables overdue several months have been written off.

C)Write-offs must be approved by the cashier who is in a position to know if the accounts receivable have,in fact,been collected.

D)Write-offs must be authorized by company field sales employees who are in a position to determine the financial standing of the customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following control procedures may prevent the failure to bill customers for some shipments?

A)Each shipment should be supported by a prenumbered sales invoice that is accounted for.

B)Each sales order should be approved by authorized personnel.

C)Sales journal entries should be reconciled to daily sales summaries.

D)Each sales invoice should be supported by a shipping document.

A)Each shipment should be supported by a prenumbered sales invoice that is accounted for.

B)Each sales order should be approved by authorized personnel.

C)Sales journal entries should be reconciled to daily sales summaries.

D)Each sales invoice should be supported by a shipping document.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

56

Invoices are prepared using a date equal to the shipping date.This control pertains to which transaction-related audit objective?

A)posting and summarization

B)classification

C)cutoff

D)completeness

A)posting and summarization

B)classification

C)cutoff

D)completeness

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following presentation and disclosure-related audit objectives does not have a parallel audit objective for both the transaction-related audit objectives and balance-related audit objectives?

A)allocation

B)classification

C)understandability

D)rights and obligations

A)allocation

B)classification

C)understandability

D)rights and obligations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

58

One of the key internal controls to prevent transactions in the sales and collection cycle to fictitious customers is to

A)have the bank reconciliation done by someone who is independent of the treasury function.

B)account for the integrity of the numerical sequence of sales orders.

C)compare customer numbers entered to the customer master file.

D)include the sales price list of all products in the computer files.

A)have the bank reconciliation done by someone who is independent of the treasury function.

B)account for the integrity of the numerical sequence of sales orders.

C)compare customer numbers entered to the customer master file.

D)include the sales price list of all products in the computer files.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

59

Analytical procedures are substantive tests and if the results of the analytical procedures are favorable they will reduce

A)the extent of tests of details of balances.

B)the extent of tests of controls.

C)the analytical procedures.

D)all of the other tests.

A)the extent of tests of details of balances.

B)the extent of tests of controls.

C)the analytical procedures.

D)all of the other tests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

60

For each control on which the auditor plans to rely to reduce assessed control risk,he or she must

A)design one or more tests of controls to verify effectiveness.

B)report all weaknesses in the management letter.

C)quantitatively determine the effect on sampling error.

D)ensure that the test applies to several different transaction audit objectives.

A)design one or more tests of controls to verify effectiveness.

B)report all weaknesses in the management letter.

C)quantitatively determine the effect on sampling error.

D)ensure that the test applies to several different transaction audit objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

61

Certain internal controls satisfy more than one objective.It is desirable to consider

A)each objective separately.

B)the objectives together.

C)the objectives that can be tested.

D)only the controls that satisfy more than one objective.

A)each objective separately.

B)the objectives together.

C)the objectives that can be tested.

D)only the controls that satisfy more than one objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

62

The auditor would like to conduct dual purpose tests verifying that the programs performing the totaling and aging of accounts receivable are functioning correctly as well as quantifying any errors.Which of the following is a dual purpose test that the auditor could use?

A)use analytical review and compare amounts from current to prior

B)inquire how the calculations are performed

C)use test data and observe how the invoice(s)in the test are aged

D)use generalized audit software to reperform the calculations

A)use analytical review and compare amounts from current to prior

B)inquire how the calculations are performed

C)use test data and observe how the invoice(s)in the test are aged

D)use generalized audit software to reperform the calculations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

63

The auditor traces items from the journals back to the source documents in order to satisfy the

A)occurrence objective.

B)completeness objective.

C)ownership objective.

D)valuation objective.

A)occurrence objective.

B)completeness objective.

C)ownership objective.

D)valuation objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

64

A)State the five specific transaction-related audit objectives for sales and describe one common test of controls for each objective.B)Describe three tests of controls commonly used to test the accuracy objective for sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

65

A)State the five specific transaction-related audit objectives for cash receipts and describe one common test of controls for each objective.B)Describe three tests of controls commonly used to test the accuracy objective for cash receipts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

66

A document that is used to describe and authorize additions,changes,or deletion of sales prices or customer data is called a(n)

A)uncollectible account authorization form.

B)journal entry authorization form.

C)master file change form.

D)transaction file change form.

A)uncollectible account authorization form.

B)journal entry authorization form.

C)master file change form.

D)transaction file change form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is an example of a data entry input edit that could be used to improve the accuracy of online data entry of sales orders?

A)matching of customer number to master file

B)automatic posting of sales to the general ledger account

C)reconciliation of the customer master file to accounts receivable

D)daily point-of-sales control totals matched to cash receipts

A)matching of customer number to master file

B)automatic posting of sales to the general ledger account

C)reconciliation of the customer master file to accounts receivable

D)daily point-of-sales control totals matched to cash receipts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

68

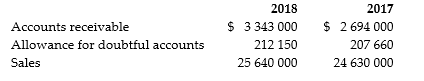

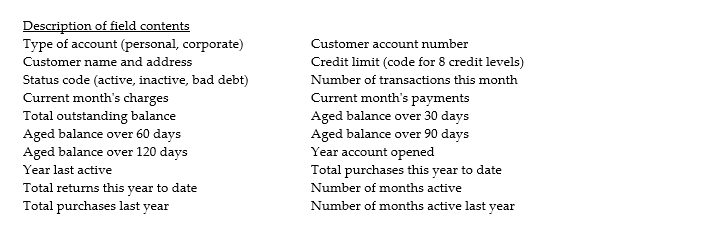

Your audit client is a large retail chain with its own credit card.It has annual sales of about $100 million.On December 31,there were approximately 40 000 open accounts with total receivables of approximately $18.5 million.Very few customer balances exceed $1000.The company's general office maintains the accounts receivable records.The large volume of transactions processed by the company has necessitated extensive segregation of duties and frequent balancing of data during processing.Accordingly,the company's general and system controls are considered to be very good.A complete record of each customer's account is stored on a relational database and includes the following information:

Source transactions are store purchase invoices,payments,and adjustments.Daily,all the orders are received,entered into the computer,and processed against the customer master file.Each account is updated and automatically analyzed to determine whether the transactions just processed have created a condition that should be brought to the attention of the authorization or collection departments.Exception reports are automatically printed and forwarded to these groups.

The company sends monthly statements to customers on a cyclical basis.About 2000 statements are mailed each billing day.As the accounts are updated,the day's transactions are accumulated and added to the starting control figure for each cycle.The new control figures are balanced with the sum of all the individual accounts in the cycle (accumulated as each account is processed).In addition,a detailed transaction and cycle control report is prepared,providing an audit trail in customer account number sequence.

Required:

Describe the audit procedures you would perform in your year-end audit work for this company's accounts receivable.For each audit test,state the relevant audit assertion(s).Be sure to include different types of tests as necessary (e.g.manual or computer-assisted audit techniques),and clearly identify those tests that can be completed using CAATs.

Source transactions are store purchase invoices,payments,and adjustments.Daily,all the orders are received,entered into the computer,and processed against the customer master file.Each account is updated and automatically analyzed to determine whether the transactions just processed have created a condition that should be brought to the attention of the authorization or collection departments.Exception reports are automatically printed and forwarded to these groups.

The company sends monthly statements to customers on a cyclical basis.About 2000 statements are mailed each billing day.As the accounts are updated,the day's transactions are accumulated and added to the starting control figure for each cycle.The new control figures are balanced with the sum of all the individual accounts in the cycle (accumulated as each account is processed).In addition,a detailed transaction and cycle control report is prepared,providing an audit trail in customer account number sequence.

Required:

Describe the audit procedures you would perform in your year-end audit work for this company's accounts receivable.For each audit test,state the relevant audit assertion(s).Be sure to include different types of tests as necessary (e.g.manual or computer-assisted audit techniques),and clearly identify those tests that can be completed using CAATs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

69

Tests of details of balances relate to which part of the Audit Risk Model?

A)control risk

B)inherent risk

C)substantive risk

D)planned detection risk

A)control risk

B)inherent risk

C)substantive risk

D)planned detection risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following key controls helps ensure that sales transactions are classified to the correct account?

A)Computer checks for gaps in shipping document numbers.

B)Invoices are prepared using prices and terms from the customer master file.

C)Management reviews sales reports regularly for reasonableness.

D)Posting is done automatically to the sales account based on periodic totals.

A)Computer checks for gaps in shipping document numbers.

B)Invoices are prepared using prices and terms from the customer master file.

C)Management reviews sales reports regularly for reasonableness.

D)Posting is done automatically to the sales account based on periodic totals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following controls pertains to audit trails in the batch processing of sales transactions?

A)groups of documents are totalled

B)audit trail is available in electronic form

C)the focus is on preventing incorrect transactions

D)remittance advice information is matched to sales invoice numbers

A)groups of documents are totalled

B)audit trail is available in electronic form

C)the focus is on preventing incorrect transactions

D)remittance advice information is matched to sales invoice numbers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

72

As part of audit planning,you have calculated gross margin for the last five years and compared gross margin to industry averages.Your client's gross margin has increased by about 5% in the current year,while the industry gross average has declined.One possible cause of this increased gross margin is

A)higher cost of goods sold.

B)increased bad debt expenses.

C)fictitious revenue.

D)fictitious expenses.

A)higher cost of goods sold.

B)increased bad debt expenses.

C)fictitious revenue.

D)fictitious expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

73

When the client's internal control structure is adequate,the cutoff can usually be verified by

A)the client's representation letter.

B)inquiries of the controller.

C)obtaining the last shipping document number of the year and comparing it with current and subsequent period recorded sales.

D)confirmation of the receivable for the last recorded sale.

A)the client's representation letter.

B)inquiries of the controller.

C)obtaining the last shipping document number of the year and comparing it with current and subsequent period recorded sales.

D)confirmation of the receivable for the last recorded sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

74

Proper accounting requires that an account receivable must be written off by the client when

A)the client company concludes that an amount is no longer collectible.

B)the customer files for bankruptcy.

C)a collection agency cannot inspire the customer to pay the debt.

D)the account is at least six months old.

A)the client company concludes that an amount is no longer collectible.

B)the customer files for bankruptcy.

C)a collection agency cannot inspire the customer to pay the debt.

D)the account is at least six months old.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

75

At every audit engagement the auditor is required to consider that there could be significant risks of misstatement for revenue recognition.At ABC Ltd. ,the auditor has concluded that,yes,there are material risks of misstatement associated with revenue recognition.How does this affect the extent of testing for accounts receivable?

A)Audit risk will be increased.

B)Inherent risks will be decreased.

C)Decreased control testing is required.

D)Increased substantive testing is required.

A)Audit risk will be increased.

B)Inherent risks will be decreased.

C)Decreased control testing is required.

D)Increased substantive testing is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

76

Following are three different situations with respect to the audit of accounts receivable and sales.For each,specify the evidence mix that you would use (tests of control,substantive tests,type of confirmation/timing),and explain why.A)The client is in a volatile industry,selling products that can quickly become obsolete.Total accounts receivable is $65 million with a bad debt allowance of $7 million.The company has recently laid off three accounting staff to save money.B)A small company has 45 different customers with balances ranging from $500 to $25 000 per customer.There is one accountant on staff and a professional accountant comes in once per week for three hours to review the staff accountant's work and prepare journal entries.Bad debts are rare,as the owner is actively involved in accounts receivable collection.C)Big Department Store Finance Corporation has fifty staff in the accounting department,a sophisticated software package,and about $250 million in accounts receivable.The corporation manages the department store's credit cards.About 100 000 credit card customers have balances less than $300 on their accounts,while the balances for the remaining customers range up to a maximum of $5000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

77

You are the audit senior responsible for a large photofinishing centre and camera store.The store uses automated cash registers tied to inventory (also known as point-of-sale devices).The point-of-sale devices take advantage of automated procedures and controls that can be programmed to reduce errors and improve controls over completeness of transactions.

Required:

Provide examples of interdependent controls that should be used to complement the programmed controls.

Required:

Provide examples of interdependent controls that should be used to complement the programmed controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

78

A risk of material misstatement in accounts receivable associated with the accuracy balance-related audit objective is that "sales recorded at the incorrect price result in revenue and accounts receivable that are over- or understated." Which of the following tests of detail of balances would respond to this risk?

A)Select a sample of master file change forms and verify that all sales prices changes were appropriately authorized.

B)Use audit software to match sales invoice price details to authorized prices in the sales price master files.

C)Enquire with management with respect to the procedures used to update the sales price master file.

D)Match shipping details for a sample of invoices to the invoice details on an item by item basis.

A)Select a sample of master file change forms and verify that all sales prices changes were appropriately authorized.

B)Use audit software to match sales invoice price details to authorized prices in the sales price master files.

C)Enquire with management with respect to the procedures used to update the sales price master file.

D)Match shipping details for a sample of invoices to the invoice details on an item by item basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

79

As part of audit planning,you have calculated gross margin for the last five years and compared gross margin to industry averages.Your client's gross margin has increased by about 5% in the current year,while the industry gross average has declined.One possible cause of this increased gross margin is

A)higher cost of goods sold.

B)increased bad debt expenses.

C)premature revenue recognition.

D)fictitious expenses.

A)higher cost of goods sold.

B)increased bad debt expenses.

C)premature revenue recognition.

D)fictitious expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck

80

A)State the five specific transaction-related audit objectives for cash receipts and describe one common test of controls for each objective.B)Discuss what is meant by proof of cash receipts and explain its purpose.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 138 في هذه المجموعة.

فتح الحزمة

k this deck