Deck 10: Forecasting Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/51

العب

ملء الشاشة (f)

Deck 10: Forecasting Financial Statements

1

Given the information provided about Card Sharks, what are the company's 2013 projected annual sales?

A) $656,191

B) $493,377

C) $618,482

D) $542,333

A) $656,191

B) $493,377

C) $618,482

D) $542,333

C

2

If a firm competes in a capital-intensive industry with excess capacity, all of the following are true except :

A) price increases will be less likely.

B) price increases will be more likely.

C) companies in competitive industries face high exit barriers.

D) companies in competitive industries may experience future price decreases.

A) price increases will be less likely.

B) price increases will be more likely.

C) companies in competitive industries face high exit barriers.

D) companies in competitive industries may experience future price decreases.

B

3

All of the following are the fundamental bases for future payoffs to equity shareholders and share value except :

A) earnings

B) cash flows

C) dividends

D) depreciation

A) earnings

B) cash flows

C) dividends

D) depreciation

D

4

An analyst using the inventory turnover ratio to calculate future levels of inventory may face the problem that:

A) the method reduces the potential understatement inherent in average balances.

B) the method can introduce artificial volatility in ending balances.

C) the method results in understating inventory each year.

D) the method results in overstating inventory each year.

A) the method reduces the potential understatement inherent in average balances.

B) the method can introduce artificial volatility in ending balances.

C) the method results in understating inventory each year.

D) the method results in overstating inventory each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

5

To ensure that the financial statements articulate, it is important that the change in the cash balance on the balance sheet each year agrees with:

A) the cash collections from sales in the projected income statement.

B) the cash provided by or used by operations on the projected statement of cash flows.

C) the net change in cash on the projected statement of cash flows.

D) the net change in working capital from period to period.

A) the cash collections from sales in the projected income statement.

B) the cash provided by or used by operations on the projected statement of cash flows.

C) the net change in cash on the projected statement of cash flows.

D) the net change in working capital from period to period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

6

Given the information provided about Card Sharks, what is the company's 2013 projected cash balance?

A) $53,934

B) $49,524

C) $21,873

D) $50,820

A) $53,934

B) $49,524

C) $21,873

D) $50,820

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

7

Sparky's forecasts that sales will grow by 25% in 2013 and that its cost of goods sold to sales ratio will be the same in 2013 as it was in 2012. If these assumptions prove correct and Sparky's inventory turnover ratio for 2013 is 4.5 what will be the level of inventory at the end of 2013?

A) $31,353

B) $26,475

C) $40,000

D) $42,314

A) $31,353

B) $26,475

C) $40,000

D) $42,314

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

8

When projecting operating expenses, it is important to determine the mix of fixed and variable costs; one clue suggesting the presence of fixed costs is:

A) the percentage change in cost of goods sold in prior years is significantly greater than the percentage change in sales.

B) the percentage change in cost of goods sold in prior years is significantly less than the percentage change in sales.

C) low capital intensity in the production process.

D) the percentage change in sales in prior years is significantly greater than the percentage change in receivables.

A) the percentage change in cost of goods sold in prior years is significantly greater than the percentage change in sales.

B) the percentage change in cost of goods sold in prior years is significantly less than the percentage change in sales.

C) low capital intensity in the production process.

D) the percentage change in sales in prior years is significantly greater than the percentage change in receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

9

The objective of forecasting is to develop:

A) stand-alone financial statements for future analysis.

B) a set of realistic expectations for future value-relevant payoffs.

C) a balance sheet and income statement that articulate.

D) financial statements for comparison to industry averages.

A) stand-alone financial statements for future analysis.

B) a set of realistic expectations for future value-relevant payoffs.

C) a balance sheet and income statement that articulate.

D) financial statements for comparison to industry averages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

10

Projecting sales price changes depends on factors specific to the firm and its industry that might affect demand and price elasticity. Which of the following types of companies would most likely be able to increase prices?

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to experience technological improvements in its production process.

D) A firm operating in an industry that is transitioning from the high growth to the maturity phase of its life cycle.

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to experience technological improvements in its production process.

D) A firm operating in an industry that is transitioning from the high growth to the maturity phase of its life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

11

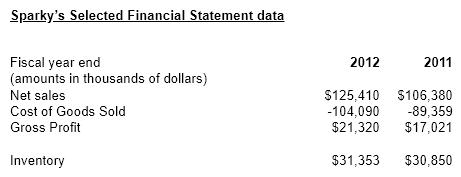

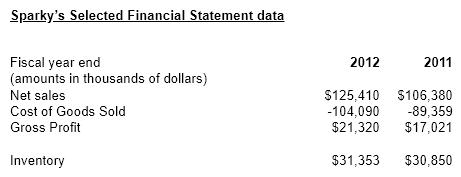

Sparky's

Sparky's sells auto parts. Provided below is selected financial information from the company's 2012 annual report:

Using Sparky's financial information what is the company's inventory turnover ratio for 2012?

Using Sparky's financial information what is the company's inventory turnover ratio for 2012?

A) 0.69

B) 1.00

C) 3.35

D) 4.03

Sparky's sells auto parts. Provided below is selected financial information from the company's 2012 annual report:

Using Sparky's financial information what is the company's inventory turnover ratio for 2012?

Using Sparky's financial information what is the company's inventory turnover ratio for 2012?A) 0.69

B) 1.00

C) 3.35

D) 4.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

12

Using common-size balance sheet percentages to project individual assets, liabilities, or shareholders' equity has all of the following shortcomings except :

A) Individual assets, liabilities, and shareholders' equity are not independent of each other.

B) If a company experiences changing proportions for investments in securities among its assets, other asset categories may show decreasing percentages in some years even though their dollar amounts are increasing.

C) Individual assets, liabilities, and shareholders' equity are independent of each other.

D) The common-size percentages do not permit the analyst to easily change the assumptions about the future behavior of an individual asset or liability.

A) Individual assets, liabilities, and shareholders' equity are not independent of each other.

B) If a company experiences changing proportions for investments in securities among its assets, other asset categories may show decreasing percentages in some years even though their dollar amounts are increasing.

C) Individual assets, liabilities, and shareholders' equity are independent of each other.

D) The common-size percentages do not permit the analyst to easily change the assumptions about the future behavior of an individual asset or liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

13

Given the information provided about Card Sharks, what is the company's 2012 projected year-end cash balance?

A) $966

B) $50,820

C) $15,623

D) $38,524

A) $966

B) $50,820

C) $15,623

D) $38,524

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

14

All of the following are true regarding the key principles of forecasting except :

A) Financial statement forecasts need not be comprehensive.

B) Forecasts should not manifest wishful thinking.

C) Financial statement forecasts must be internally consistent.

D) Financial statement forecasts must rely on assumptions that have external validity.

A) Financial statement forecasts need not be comprehensive.

B) Forecasts should not manifest wishful thinking.

C) Financial statement forecasts must be internally consistent.

D) Financial statement forecasts must rely on assumptions that have external validity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

15

Nichols and Wahlen's 2004 study showed that superior forecasting provides the potential to earn superior security returns. Nichols and Wahlen's findings indicate:

A) that an investor could earn excess returns if the investor could predict accurately the sign of the change in earnings one year ahead.

B) that an investor could earn excess returns if the investor could predict accurately the magnitude of the change in earnings one year ahead.

C) that an investor could earn excess returns if the investor could predict accurately the sign of the change in cash flows from operations one year ahead.

D) that an investor could earn excess returns if the investor could predict accurately the sign of the change in working capital one year ahead.

A) that an investor could earn excess returns if the investor could predict accurately the sign of the change in earnings one year ahead.

B) that an investor could earn excess returns if the investor could predict accurately the magnitude of the change in earnings one year ahead.

C) that an investor could earn excess returns if the investor could predict accurately the sign of the change in cash flows from operations one year ahead.

D) that an investor could earn excess returns if the investor could predict accurately the sign of the change in working capital one year ahead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

16

Projecting sales price changes depends on factors specific to the firm and its industry that might affect demand and price elasticity. Which of the following companies would most likely not be able to increase prices in the near future?

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to maintain its current production processes.

D) A firm operating in an industry that is transitioning from the introduction phase to the high growth phase of its life cycle.

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to maintain its current production processes.

D) A firm operating in an industry that is transitioning from the introduction phase to the high growth phase of its life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a company has very low operating leverage (i.e., a low proportion of fixed costs in the cost structure) and no changes are expected in operations:

A) percentage change income statement percentages can serve as the basis for projecting operating expenses.

B) using common-size income statement percentages will overstate future projected operating expenses.

C) using common-size income statement percentages will understate future projected operating expenses.

D) using common-size income statement percentages can serve as a reasonable basis for projecting future operating expenses.

A) percentage change income statement percentages can serve as the basis for projecting operating expenses.

B) using common-size income statement percentages will overstate future projected operating expenses.

C) using common-size income statement percentages will understate future projected operating expenses.

D) using common-size income statement percentages can serve as a reasonable basis for projecting future operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following statements does not apply to preventing "garbage in, garbage out" when implementing a forecasting game plan?

A) The quality of the financial statement forecasts will depend on the quality of the forecast assumptions.

B) The quantities forecasted within financial statement forecasts will depend on the quantity of the forecast assumptions.

C) Analysts should justify and evaluate the most important assumptions that reflect the critical risk and success factors of the firm's strategy.

D) Analysts can impose reality checks on the assumptions by analyzing the forecasted financial statements using ratios, common-size, and rate-of-change financial statements.

A) The quality of the financial statement forecasts will depend on the quality of the forecast assumptions.

B) The quantities forecasted within financial statement forecasts will depend on the quantity of the forecast assumptions.

C) Analysts should justify and evaluate the most important assumptions that reflect the critical risk and success factors of the firm's strategy.

D) Analysts can impose reality checks on the assumptions by analyzing the forecasted financial statements using ratios, common-size, and rate-of-change financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

19

Financial statement forecasts rely on additivity within financial statements and articulation across financial statements. Given this information forecasts of future growth in inventory will most likely affect growth in:

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

20

Financial statement forecasts rely on additivity within financial statements and articulation across financial statements. Given this information sales growth forecasts will most likely affect growth in:

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

21

Common-size financial statements recast each statement item as:

A) a percentage of the "bottom line."

B) a percentage using industry averages for the "base number."

C) a percentage using a base year number for each line item.

D) a percentage of some "base number" on the financial statement in question.

A) a percentage of the "bottom line."

B) a percentage using industry averages for the "base number."

C) a percentage using a base year number for each line item.

D) a percentage of some "base number" on the financial statement in question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

22

A firm in a mature industry with little expected change in its market share might anticipate volume increases equal to the growth rate in the _________________________ within its geographic markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

23

To develop forecasts of individual assets, the analyst must first link historical growth rates for individual assets to historical growth rates in ____________________ and other activity-based drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

24

Financial statement forecasts are important analysis tools because forecasts of ______________________________ play a central role in valuation and many other financial decision contexts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

25

All of the following are true regarding projected financial statements except :

A) The statement of cash flows is the most critical forecast since it reflects profitability rather than viability.

B) Preparing projected financial statements must incorporate a company's past performance records.

C) Preparing projected financial statements must incorporate a company's current performance records.

D) The income statement demonstrates immediate capability to service debt for banks or real potential for growth in returns for venture capital.

A) The statement of cash flows is the most critical forecast since it reflects profitability rather than viability.

B) Preparing projected financial statements must incorporate a company's past performance records.

C) Preparing projected financial statements must incorporate a company's current performance records.

D) The income statement demonstrates immediate capability to service debt for banks or real potential for growth in returns for venture capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

26

As a firm progresses through the introduction life-cycle stage, what type of flexible account will it be more likely to use to balance the balance sheet?

A) dividends

B) growth related assets

C) issued equity

D) stock buy-backs

A) dividends

B) growth related assets

C) issued equity

D) stock buy-backs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

27

Projected financial statements can be used to assess the sensitivity of all of the following except :

A) a firm's liquidity.

B) a firm's leverage to changes in assumptions.

C) conditions under which the firm's debt covenants may become binding.

D) unusual patterns for projected total assets.

A) a firm's liquidity.

B) a firm's leverage to changes in assumptions.

C) conditions under which the firm's debt covenants may become binding.

D) unusual patterns for projected total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

28

In developing forecasts of expenses the analyst must take into consideration that expenses can be broken down into ________________________ or ______________________ components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

29

Financial statement forecasts should rely on ____________________ within financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

30

All of the following statements are true regarding ratios and forecasts except :

A) Ratios cannot confirm whether forecast assumptions will turn out to be correct.

B) Ratios can tell whether future sales growth was accurately captured.

C) Ratios cannot tell whether assumptions about future cash flows are realistic.

D) Ratios can tell whether growth rates for sales are consistent with past sales growth performance.

A) Ratios cannot confirm whether forecast assumptions will turn out to be correct.

B) Ratios can tell whether future sales growth was accurately captured.

C) Ratios cannot tell whether assumptions about future cash flows are realistic.

D) Ratios can tell whether growth rates for sales are consistent with past sales growth performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

31

As a firm progresses through the growth life-cycle stage, what type of flexible account will it be more likely to use to balance the balance sheet?

A) issued debt

B) paying down of debt

C) dividends

D) stock buy-backs

A) issued debt

B) paying down of debt

C) dividends

D) stock buy-backs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

32

As a firm progresses through the decline life-cycle stage, what type of flexible account will it be more likely to use to balance the balance sheet?

A) issued debt

B) growth related assets

C) issued equity

D) stock buy-backs

A) issued debt

B) growth related assets

C) issued equity

D) stock buy-backs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

33

Firms that have differentiated ___________________________________ for its products may have a greater potential to increase prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

34

It may be difficult to forecast sales for firms with _________________________ patterns because their historical growth rates reflect wide variations in both direction and amount from year to year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

35

Realistic expectations are ____________________ and ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

36

Financial ratio, percentage, and trend comparisons can be distorted by all of the following except:

A) aggressive revenue recognition practices.

B) the timing of asset purchases.

C) accounting for similar economic fundamentals in similar fashion.

D) the presence of nonrecurring items among the firms being analyzed.

A) aggressive revenue recognition practices.

B) the timing of asset purchases.

C) accounting for similar economic fundamentals in similar fashion.

D) the presence of nonrecurring items among the firms being analyzed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

37

Financial statement forecasts should rely on _________________________ across financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company that has a cost structure in which its costs grow at a lesser rate than its sale enjoys ___________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

39

For some types of assets, such as plant, property and equipment, asset growth typically ____________________ future sales growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

40

The formula for forecasting inventory is ____________ /365 X.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

41

As an analyst it is important when projecting sales to make estimates about future changes in sales volume. Compare how you might make estimates about future sales value for a company in a mature industry and one in a rapidly growing industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

42

Analysts must develop realistic expectations for the outcomes of future business activities. To develop these expectations, analysts build a set of _____________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

43

When projecting ____________________, the analyst should consider economy-wide factors such as the expected rate of general price inflation in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

44

For some types of assets, such as accounts receivable, asset growth typically ____________________ future sales growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

45

A firm in transition from the high growth to the mature phase of its life cycle, or a firm with significant technological improvements in its production processes, might expect increases in ______________________________ but decreases in sales prices per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

46

Based on the following statement from the text-"to develop forecasts of individual operating assets and liabilities, you must first determine the underlying operating activities that drive them"-explain what those underlying activities are.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

47

If a firm operates at less than full capacity, then price _______________________ are not likely

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

48

The first step in the forecasting game plan is to project sales and other operating activities. Sales numbers are determined by both a volume component and price component. Projecting prices depends on factors specific to the firm and its industry that might affect demand and price elasticity. For the following types of firms, discuss whether it would be likely that the firm would be able to raise future prices:

a. A firm in a capital-intensive industry that is expected to operate near capacity for the near future.

b. A firm in an industry that is expected to experience numerous technological improvements.

c. A firm with products that are transitioning from the growth to maturity phase of the product life cycle.

d. A firm that has established a well-known brand name and image.

a. A firm in a capital-intensive industry that is expected to operate near capacity for the near future.

b. A firm in an industry that is expected to experience numerous technological improvements.

c. A firm with products that are transitioning from the growth to maturity phase of the product life cycle.

d. A firm that has established a well-known brand name and image.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

49

In comparison of 2010 to 2009 performance, Watson Company's inventory turnover decreased substantially, although sales and inventory amounts were essentially unchanged.

Required:

During a corporate meeting you heard the following managers postulate why the decreased inventory turnover ratio happened. Which statement best explains the decreased inventory turnover ratio and why?

a. The marketing manager said: The decreased inventory turnover ratio is due to an increase in the cost of goods sold.

b. The operations manager said: The decreased inventory turnover ratio is due to increased gross profit percentage.

c. The credit manager said: The decreased inventory turnover ratio is due to a decrease in the accounts receivable turnover.

d. The shipping manager said: The decreased inventory turnover ratio is due to inventory being shipped FOB destination point that keeps those items in inventory until they reach the purchasers warehouse.

Required:

During a corporate meeting you heard the following managers postulate why the decreased inventory turnover ratio happened. Which statement best explains the decreased inventory turnover ratio and why?

a. The marketing manager said: The decreased inventory turnover ratio is due to an increase in the cost of goods sold.

b. The operations manager said: The decreased inventory turnover ratio is due to increased gross profit percentage.

c. The credit manager said: The decreased inventory turnover ratio is due to a decrease in the accounts receivable turnover.

d. The shipping manager said: The decreased inventory turnover ratio is due to inventory being shipped FOB destination point that keeps those items in inventory until they reach the purchasers warehouse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

50

The authors set forth a seven-step forecasting game plan for preparing pro forma financial statements. Discuss the seven steps necessary to prepare the three principal financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

51

One problem caused by using turnover ratios to calculate asset balances is that it can lead to volatility in projected ending balances. What might an analyst do to reduce the "sawtooth" pattern caused by using turnover ratios?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck