Deck 14: Capital Structure and Leverage

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/198

العب

ملء الشاشة (f)

Deck 14: Capital Structure and Leverage

1

The underlying reason that leverage may increase stock price is that under certain conditions:

A)it increases risk, which in turn requires a larger return on equity.

B)it improves performance measured in terms of EBIT and EPS.

C)it improves performance measured in terms of ROE and EPS.

D)it is cheaper to raise new debt than it is to raise new equity.

A)it increases risk, which in turn requires a larger return on equity.

B)it improves performance measured in terms of EBIT and EPS.

C)it improves performance measured in terms of ROE and EPS.

D)it is cheaper to raise new debt than it is to raise new equity.

C

2

Financial leverage may benefit shareholders when the:

A)return on capital employed is greater than the after tax cost of debt.

B)return on equity is greater than the cost of debt.

C)return on investments is less than the cost of capital.

D)None of the above

A)return on capital employed is greater than the after tax cost of debt.

B)return on equity is greater than the cost of debt.

C)return on investments is less than the cost of capital.

D)None of the above

A

3

Which of the following is most correct?

A)When the return on capital employed (ROCE)is less than the before tax cost of debt, a company can increase its ROE by trading out equity and into debt.

B)When the return on capital employed (ROCE)is more than the before tax cost of debt, a company can increase its ROE by trading out equity and into debt.

C)When the return on capital employed (ROCE)is less than the after tax cost of debt, a company can increase its ROE by trading out equity and into debt.

D)When the return on capital employed (ROCE)is more than the after tax cost of debt, a company can increase its ROE by trading out equity and into debt.

A)When the return on capital employed (ROCE)is less than the before tax cost of debt, a company can increase its ROE by trading out equity and into debt.

B)When the return on capital employed (ROCE)is more than the before tax cost of debt, a company can increase its ROE by trading out equity and into debt.

C)When the return on capital employed (ROCE)is less than the after tax cost of debt, a company can increase its ROE by trading out equity and into debt.

D)When the return on capital employed (ROCE)is more than the after tax cost of debt, a company can increase its ROE by trading out equity and into debt.

D

4

Which of the following is correct?

A)The variation in ROE and EPS for an unleveraged firm is identical to variation in EBIT.

B)In a leveraged firm, the variation in ROE and EPS is always greater than the variation in EBIT.

C)Financial risk is the additional variation in ROE and EPS arising from the use of debt.

D)All of the above

A)The variation in ROE and EPS for an unleveraged firm is identical to variation in EBIT.

B)In a leveraged firm, the variation in ROE and EPS is always greater than the variation in EBIT.

C)Financial risk is the additional variation in ROE and EPS arising from the use of debt.

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

5

The use of fixed-cost financing is referred to as:

A)operating leverage.

B)a leveraged buyout.

C)financial leverage.

D)combined leverage.

A)operating leverage.

B)a leveraged buyout.

C)financial leverage.

D)combined leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

6

The degree of financial leverage is measured by relating the percentage change in earnings per share to the percentage change in:

A)sales.

B)EBIT.

C)debt ratio.

D)share price.

A)sales.

B)EBIT.

C)debt ratio.

D)share price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

7

A DFL (degree of financial leverage)of 3.0 indicates that a 27% increase in EPS is the result of a(n)____ increase in EBIT.

A)81%

B)3%

C)9%

D)6%

A)81%

B)3%

C)9%

D)6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

8

If a firm's EBIT changes by 20% and it has a degree of financial leverage (DFL)of 2.5, what is the expected change in earnings per share (EPS)?

A)20%

B)40%

C)50%

D)60%

A)20%

B)40%

C)50%

D)60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

9

Granting a tax deduction for corporate interest enables financial leverage to increase a firm's value by:

A)increasing EBIT.

B)decreasing the lender's share of EBIT.

C)decreasing the government's share of EBIT.

D)b and c

A)increasing EBIT.

B)decreasing the lender's share of EBIT.

C)decreasing the government's share of EBIT.

D)b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

10

The increased variability in earnings per share due to the use of debt is:

A)combined leverage.

B)business risk.

C)financial risk.

D)operating risk.

A)combined leverage.

B)business risk.

C)financial risk.

D)operating risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

11

Financial leverage is a direct function of the ratio of:

A)net income to sales.

B)EBIT to sales.

C)interest expense to EBIT.

D)net income to the number of shares of common stock.

A)net income to sales.

B)EBIT to sales.

C)interest expense to EBIT.

D)net income to the number of shares of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

12

A firm that employs a relatively large proportion of debt in its capital structure will have a relatively ____ degree of financial leverage.

A)low

B)high

C)insignificant

D)constant

A)low

B)high

C)insignificant

D)constant

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

13

The central issue in the study of leverage is:

A)whether leverage affects stock price.

B)whether an optimal capital structure exists that maximizes stock price.

C)whether an optimal capital structure exists that minimizes the cost of capital.

D)All of the above

A)whether leverage affects stock price.

B)whether an optimal capital structure exists that maximizes stock price.

C)whether an optimal capital structure exists that minimizes the cost of capital.

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

14

When the return on equity is equal to the return on capital employed:

A)the return on borrowed money equals the cost of borrowing the money.

B)the firm has optimized its financial leverage.

C)the firm is unleveraged.

D)All of the above

A)the return on borrowed money equals the cost of borrowing the money.

B)the firm has optimized its financial leverage.

C)the firm is unleveraged.

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

15

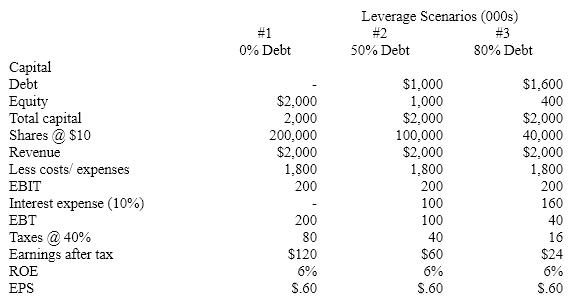

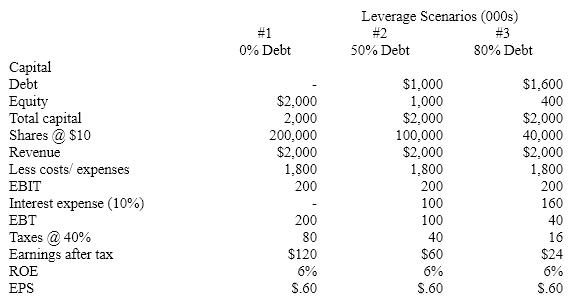

Consider the following leverage scenarios:  If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case?

If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case?

A)The company hasn't repurchased enough shares of stock with borrowed money.

B)The money the company is earning on its capital is exactly what it costs to borrow.

C)ROCE is too high.

D)ROCE is equal to the after tax cost of debt.

If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case?

If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case?A)The company hasn't repurchased enough shares of stock with borrowed money.

B)The money the company is earning on its capital is exactly what it costs to borrow.

C)ROCE is too high.

D)ROCE is equal to the after tax cost of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

16

The term "financial leverage" originated from the notion that there is a multiplicative effect on financial performance measured at ____ when borrowed money is used to support the firm.

A)return on assets

B)return on equity

C)earnings per share

D)Both b and c

A)return on assets

B)return on equity

C)earnings per share

D)Both b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

17

The use of fixed cost sources of funds, such as debt and preferred stock, affect a firm's:

A)financial risk.

B)degree of operating leverage.

C)market power.

D)business risk.

A)financial risk.

B)degree of operating leverage.

C)market power.

D)business risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

18

Financial leverage has the following effect on financial performance:

A)during periods of reasonably good performance, leverage enhances results in terms of ROE and EPS.

B)leverage adds variability to financial performance making the firm's stock a riskier investment.

C)leverage always makes performance better and thereby increases stock price.

D)Both a and b

A)during periods of reasonably good performance, leverage enhances results in terms of ROE and EPS.

B)leverage adds variability to financial performance making the firm's stock a riskier investment.

C)leverage always makes performance better and thereby increases stock price.

D)Both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is true of financial leverage?

A)It affects the sensitivity of net income to changes in sales.

B)It arises from the use of debt financing.

C)It is increased by an increase in operating leverage.

D)a and b

A)It affects the sensitivity of net income to changes in sales.

B)It arises from the use of debt financing.

C)It is increased by an increase in operating leverage.

D)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

20

Financial leverage increases a firm's ROE and EPS under which of the following circumstances?

A)ROCE = cost of debt

B)ROCE > after tax cost of debt

C)ROCE

D)ROCE = cost of equity

A)ROCE = cost of debt

B)ROCE > after tax cost of debt

C)ROCE

D)ROCE = cost of equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

21

A firm that employs relatively large amounts of labor-saving equipment in its operations will have a relatively ____ degree of operating leverage.

A)low

B)constant

C)insignificant

D)high

A)low

B)constant

C)insignificant

D)high

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

22

An analytical technique called ____ can be used to help determine how much leverage a firm should use.

A)DFL-EPS analysis

B)EBIT-EPS analysis

C)DOL-EPS analysis

D)DOL-EBIT analysis

A)DFL-EPS analysis

B)EBIT-EPS analysis

C)DOL-EPS analysis

D)DOL-EBIT analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is an overall measure of business performance?

A)Interest coverage ratio

B)ROE

C)Debt to equity ratio

D)Revenue

A)Interest coverage ratio

B)ROE

C)Debt to equity ratio

D)Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

24

The difference between fixed and variable costs is that:

A)variable costs move up and down with changes in sales while fixed costs remain constant.

B)variable costs are only found in factory operations while fixed costs occur only in expenses.

C)fixed costs are the costs of fixed assets, everything else is a variable cost.

D)Both a and b

A)variable costs move up and down with changes in sales while fixed costs remain constant.

B)variable costs are only found in factory operations while fixed costs occur only in expenses.

C)fixed costs are the costs of fixed assets, everything else is a variable cost.

D)Both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

25

Common characteristics of operating and financial leverage include:

A)both involve the substitution of fixed for variable cash outflows.

B)both are affected by a firm's investing decisions.

C)both are affected by a firm's financing decisions.

D)None of the above

A)both involve the substitution of fixed for variable cash outflows.

B)both are affected by a firm's investing decisions.

C)both are affected by a firm's financing decisions.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

26

When a firm's cost structure consists principally of fixed costs,:

A)it is said to have a great deal of operating leverage.

B)those costs consist of rent, depreciation, direct labor, management salaries, direct materials, and utilities.

C)the firm might be a factory with many people and few machines.

D)All of the above

A)it is said to have a great deal of operating leverage.

B)those costs consist of rent, depreciation, direct labor, management salaries, direct materials, and utilities.

C)the firm might be a factory with many people and few machines.

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

27

If a firm's EBIT changes by 20% and it has a degree of financial leverage (DFL)of 2.0, what is the expected change in earnings per share (EPS)?

A)20%

B)40%

C)50%

D)60%

A)20%

B)40%

C)50%

D)60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

28

The process of evaluating a firm's operations to determine the minimum volume it must sell to avoid losing money is referred to as:

A)operating leverage analysis.

B)direct analysis of operations.

C)breakeven analysis.

D)cost, volume, and profit analysis.

A)operating leverage analysis.

B)direct analysis of operations.

C)breakeven analysis.

D)cost, volume, and profit analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is correct?

A)Capital structure affects both financial leverage and operating leverage.

B)Cost structure affects both financial leverage and operating leverage.

C)Capital structure affects financial leverage and cost structure affects operating leverage.

D)Capital structure affects operating leverage and cost structure affects financial leverage.

E)None of the above is correct.

A)Capital structure affects both financial leverage and operating leverage.

B)Cost structure affects both financial leverage and operating leverage.

C)Capital structure affects financial leverage and cost structure affects operating leverage.

D)Capital structure affects operating leverage and cost structure affects financial leverage.

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

30

The breakeven point on a breakeven diagram is:

A)the point where the fixed cost line and the revenue line intersect.

B)the point where the total cost line and the revenue line intersect.

C)the point where the total cost line intersects the horizontal axis.

D)the point where the total cost line intersects the vertical axis.

A)the point where the fixed cost line and the revenue line intersect.

B)the point where the total cost line and the revenue line intersect.

C)the point where the total cost line intersects the horizontal axis.

D)the point where the total cost line intersects the vertical axis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

31

Financial leverage involves substituting debt for equity in the firm's capital structure, operating leverage involves:

A)substituting variable costs for fixed costs in the firm's cost structure.

B)substituting fixed costs for variable costs in the firm's cost structure.

C)increasing financial risk.

D)None of the above

A)substituting variable costs for fixed costs in the firm's cost structure.

B)substituting fixed costs for variable costs in the firm's cost structure.

C)increasing financial risk.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

32

A decrease in the level of a firm's interest expense (holding all other factors constant)would:

A)increase operating leverage.

B)decrease operating leverage.

C)decrease financial leverage.

D)have no impact on operating leverage.

E)c and d

A)increase operating leverage.

B)decrease operating leverage.

C)decrease financial leverage.

D)have no impact on operating leverage.

E)c and d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

33

When fixed operating costs are incurred by the firm, a relative change in ____ is magnified into a larger relative change in earnings before interest and taxes.

A)overhead expenses

B)interest charges

C)labor costs

D)sales revenue

A)overhead expenses

B)interest charges

C)labor costs

D)sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

34

EBIT, earnings before interest and taxes, is also called:

A)operating income.

B)net income.

C)financial income.

D)revenue.

A)operating income.

B)net income.

C)financial income.

D)revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is not true with respect to operating leverage?

A)Higher operating leverage insulates a firm from losses in bad times.

B)Firms with higher operating leverage have a larger contribution from each sale, so they accumulate profits or losses faster as they move away from the breakeven point in sales.

C)Increased operating leverage increases business risk.

D)Virtually all firms have at least some operating leverage.

A)Higher operating leverage insulates a firm from losses in bad times.

B)Firms with higher operating leverage have a larger contribution from each sale, so they accumulate profits or losses faster as they move away from the breakeven point in sales.

C)Increased operating leverage increases business risk.

D)Virtually all firms have at least some operating leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

36

Operating leverage involves the use of:

A)equity and debt in equal proportions.

B)market power.

C)debt.

D)fixed costs.

A)equity and debt in equal proportions.

B)market power.

C)debt.

D)fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

37

The variability in a firm's EPS is affected by:

A)variability in its sales.

B)operating leverage.

C)financial leverage.

D)a and c

E)All of the above

A)variability in its sales.

B)operating leverage.

C)financial leverage.

D)a and c

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

38

Metcalf, Inc. is planning to buy a new machine to begin making one of its component parts internally rather than contracting it out to a supplier. Since this is a major investment, they plan to fund it by issuing additional common stock. Assuming that this change has no initial impact on EBIT, the change should:

A)increase operating leverage and decrease financial leverage.

B)decrease operating leverage and increase financial leverage.

C)increase both operating and financial leverage.

D)decrease both operating and financial leverage.

E)The impact on financial and operating leverage cannot be determined.

A)increase operating leverage and decrease financial leverage.

B)decrease operating leverage and increase financial leverage.

C)increase both operating and financial leverage.

D)decrease both operating and financial leverage.

E)The impact on financial and operating leverage cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is true of the breakeven diagrams?

A)Cost is plotted along the vertical axis and unit sales (Q for quantity)along the horizontal axis.

B)Cost is plotted along the horizontal axis and unit sales (Q for quantity)along the vertical axis.

C)Fixed cost is plotted along the horizontal axis and variable cost along the vertical axis.

D)Revenue is plotted along the horizontal axis and unit sales (Q for quantity)along the vertical.

A)Cost is plotted along the vertical axis and unit sales (Q for quantity)along the horizontal axis.

B)Cost is plotted along the horizontal axis and unit sales (Q for quantity)along the vertical axis.

C)Fixed cost is plotted along the horizontal axis and variable cost along the vertical axis.

D)Revenue is plotted along the horizontal axis and unit sales (Q for quantity)along the vertical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

40

Business risk, as defined in terms of variation in a firm's operating performance and measured by EBIT, would be effected by variation in all of the following, except:

A)anticipated changes in federal regulations.

B)business operations.

C)expenses.

D)revenues.

A)anticipated changes in federal regulations.

B)business operations.

C)expenses.

D)revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

41

The degree of total leverage is equal to the degree of ____ multiplied by the ____.

A)operating leverage, variable cost ratio

B)financial leverage, variable cost ratio

C)operating leverage, degree of financial leverage

D)operating leverage, fixed cost ratio

A)operating leverage, variable cost ratio

B)financial leverage, variable cost ratio

C)operating leverage, degree of financial leverage

D)operating leverage, fixed cost ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

42

In the MM model, as the proportion of debt in the capital structure increases, the cost of equity:

A)increases.

B)decreases.

C)remains unchanged; there is no relationship between the two.

D)initially rises rapidly, then increases slowly beyond some point.

A)increases.

B)decreases.

C)remains unchanged; there is no relationship between the two.

D)initially rises rapidly, then increases slowly beyond some point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

43

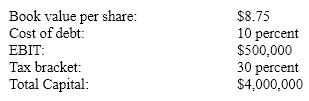

Yang Centers wants to report at least $1.75 in earnings per share. Given the following information, how much debt should be in its capital structure?

A)$457,142

B)$520,050

C)$2,800,000

D)$3,461,538

A)$457,142

B)$520,050

C)$2,800,000

D)$3,461,538

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

44

Khandker Motors finances 40% of its total capital with debt. The cost of debt is 11%. The firm is in the 37% tax bracket and earned an operating profit of $2.5 million dollars. If the Khandker's total capital amounts to $22 million and its book value per share is $20, what are the firm's earnings per share?

A)$0.85

B)$0.88

C)$1.43

D)$1.46

A)$0.85

B)$0.88

C)$1.43

D)$1.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following assumptions was not part of the original Modigliani and Miller Model?

A)Securities trade in perfectly efficient capital markets.

B)Securities trade with no transaction costs.

C)Income taxes are fixed.

D)Rates for borrowing do not change regardless of the amount borrowed.

E)Rates for borrowing are the same for investors and companies.

A)Securities trade in perfectly efficient capital markets.

B)Securities trade with no transaction costs.

C)Income taxes are fixed.

D)Rates for borrowing do not change regardless of the amount borrowed.

E)Rates for borrowing are the same for investors and companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

46

According to the MM model of capital structure, the present value of the tax shield is offset by potential ____, resulting in an optimal capital structure.

A)bankruptcy costs

B)interest expense

C)operating costs

D)a and b

A)bankruptcy costs

B)interest expense

C)operating costs

D)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

47

All other things being equal, the Modigliani and Miller Model, modified for tax and bankruptcy costs concludes that:

A)no matter what level of debt a company is operating at, increasing the percent of debt in the capital structure will increase the stock price. b. if a company has a very low percent debt, increasing the percent of debt in the capital structure will increase the stock price.

B)and c. are correct.

C)at moderate levels of debt, it is difficult to tell what will happen to the stock price (whether it will go up or down)if the percent debt in the capital structure is increased.

D)there is no relationship between the percent of debt in the capital structure and the stock price.

E)b. and c. are correct.

A)no matter what level of debt a company is operating at, increasing the percent of debt in the capital structure will increase the stock price. b. if a company has a very low percent debt, increasing the percent of debt in the capital structure will increase the stock price.

B)and c. are correct.

C)at moderate levels of debt, it is difficult to tell what will happen to the stock price (whether it will go up or down)if the percent debt in the capital structure is increased.

D)there is no relationship between the percent of debt in the capital structure and the stock price.

E)b. and c. are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

48

In the MM model, the risk of bankruptcy:

A)reduces the present value of the tax shield of debt.

B)reduces the positive effect of financial leverage on firm value.

C)eliminates the possibility of a net positive effect of financial leverage on firm value.

D)has no impact on the relationship between financial leverage and firm value.

E)a and b

A)reduces the present value of the tax shield of debt.

B)reduces the positive effect of financial leverage on firm value.

C)eliminates the possibility of a net positive effect of financial leverage on firm value.

D)has no impact on the relationship between financial leverage and firm value.

E)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

49

The combined impact of operating leverage and financial leverage on the firm's EPS is:

A)additive.

B)geometric.

C)multiplicative.

D)None of the above

A)additive.

B)geometric.

C)multiplicative.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

50

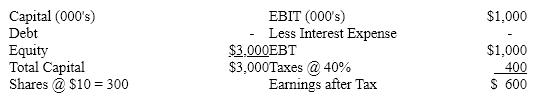

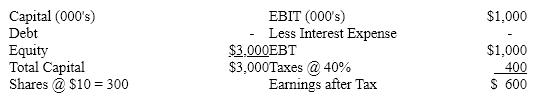

Assume the following facts about a company:  What will be the company's new EPS if it borrows money at 10% interest and uses it to retire stock until capital is 40% debt? The stock can be purchased at its book value of $10 per share.

What will be the company's new EPS if it borrows money at 10% interest and uses it to retire stock until capital is 40% debt? The stock can be purchased at its book value of $10 per share.

A)$3.33

B)$4.89

C)$2.93

D)None of the above

What will be the company's new EPS if it borrows money at 10% interest and uses it to retire stock until capital is 40% debt? The stock can be purchased at its book value of $10 per share.

What will be the company's new EPS if it borrows money at 10% interest and uses it to retire stock until capital is 40% debt? The stock can be purchased at its book value of $10 per share.A)$3.33

B)$4.89

C)$2.93

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

51

The degree of total leverage is equal to the degree of operating leverage ____ the degree of financial leverage.

A)added to

B)divided by

C)multiplied by

D)subtracted from

A)added to

B)divided by

C)multiplied by

D)subtracted from

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is accepted wisdom regarding the optimal capital structure?

A)For most firms, the optimal capital structure is somewhere between 30% and 50% debt.

B)A firm with good profit prospects and little to no debt is probably missing an opportunity by not using borrowed money if interest rates are reasonable.

C)Debt levels above 60% create excessive risk and should be avoided.

D)All of the above

A)For most firms, the optimal capital structure is somewhere between 30% and 50% debt.

B)A firm with good profit prospects and little to no debt is probably missing an opportunity by not using borrowed money if interest rates are reasonable.

C)Debt levels above 60% create excessive risk and should be avoided.

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

53

If a firm's sales change by 15% and it has a degree of operating leverage (DOL)of 2.0, what is the expected change in earnings before interest and taxes (EBIT)?

A)30%

B)40%

C)50%

D)60%

A)30%

B)40%

C)50%

D)60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

54

Financial leverage amplifies relative changes in EBIT into larger relative changes in ROE and EPS, operating leverage amplifies:

A)relative changes in EBIT into larger relative changes in sales revenue.

B)relative changes in sales revenue into larger relative changes in EBIT.

C)relative changes in sales revenue into larger relative changes in ROE and EPS.

D)relative changes in ROE and EPS into larger relative changes in EBIT.

A)relative changes in EBIT into larger relative changes in sales revenue.

B)relative changes in sales revenue into larger relative changes in EBIT.

C)relative changes in sales revenue into larger relative changes in ROE and EPS.

D)relative changes in ROE and EPS into larger relative changes in EBIT.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

55

A firm which has a 2.5 DOL (degree of operating leverage)would find that an 8% increase in EBIT would result from a(n)____ increase in sales.

A)3.2%

B)5.4%

C)20.0%

D)2.0%

A)3.2%

B)5.4%

C)20.0%

D)2.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

56

In the MM model, the mix of debt and equity that minimizes the cost of capital is the:

A)optimal corporate structure.

B)target financial structure.

C)optimal capital structure.

D)optimal degree of combined leverage.

A)optimal corporate structure.

B)target financial structure.

C)optimal capital structure.

D)optimal degree of combined leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

57

When MM theory recognizes taxes and bankruptcy costs, firm value:

A)is unaffected by financial leverage.

B)steadily increases with financial leverage.

C)steadily decreases with financial leverage.

D)initially increases but then decreases as financial leverage rises.

A)is unaffected by financial leverage.

B)steadily increases with financial leverage.

C)steadily decreases with financial leverage.

D)initially increases but then decreases as financial leverage rises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

58

According to MM, if we ignore bankruptcy costs, an increase in financial leverage can increase the value of the firm:

A)in a world without taxes.

B)if interest is tax-deductible.

C)if interest is not tax-deductible.

D)a and b

E)All of the above

A)in a world without taxes.

B)if interest is tax-deductible.

C)if interest is not tax-deductible.

D)a and b

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

59

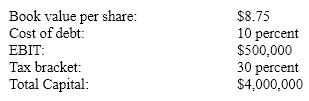

Yang Centers has a book value of $8.75, a 10% cost of debt, operating income of $500,000, and a 30% tax rate. If Yang Centers finances 75% of its $4 million of total capital needs with debt, what is its earnings per share?

A)$0.88

B)$1.22

C)$1.75

D)$2.21

A)$0.88

B)$1.22

C)$1.75

D)$2.21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is true of the degree of total leverage?

A)It is the product of the degree of financial leverage and the degree of operating leverage.

B)It is the sum of the degree of financial leverage and the degree of operating leverage.

C)It is the difference between the degree of financial leverage and the degree of operating leverage.

D)It is the relative change in financial leverage with respect to the operational leverage.

A)It is the product of the degree of financial leverage and the degree of operating leverage.

B)It is the sum of the degree of financial leverage and the degree of operating leverage.

C)It is the difference between the degree of financial leverage and the degree of operating leverage.

D)It is the relative change in financial leverage with respect to the operational leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

61

If a firm's degree of operating leverage is 8, what percentage change in sales revenue is required to double the firm's EBIT?

A)100%

B)8%

C)12.5%

D)None of the above

A)100%

B)8%

C)12.5%

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

62

Assume that Herron, Inc. has a degree of financial leverage of 1.50. If EBIT increases from $150,000 this year to $165,000 next year, how much will earnings per share (EPS)increase, assuming no change in capital structure?

A)6.7%

B)10.0%

C)15.0%

D)22.5%

E)Cannot be determined from the information given.

A)6.7%

B)10.0%

C)15.0%

D)22.5%

E)Cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

63

If a company sells 10,000 units at $25 each, has fixed costs of $20,000, and a variable cost of $20 per unit, what is its degree of operating leverage (DOL)?

A)1.67

B)2.5

C)2.0

D)1.6

A)1.67

B)2.5

C)2.0

D)1.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

64

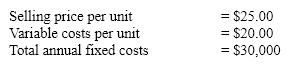

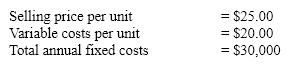

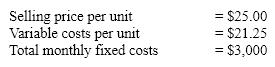

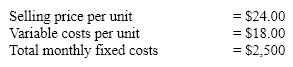

Assume the following facts about a single product firm:  What is the firm's annual breakeven volume in sales revenues?

What is the firm's annual breakeven volume in sales revenues?

A)$6,000

B)$250,000

C)$150,000

D)$1,500

What is the firm's annual breakeven volume in sales revenues?

What is the firm's annual breakeven volume in sales revenues?A)$6,000

B)$250,000

C)$150,000

D)$1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

65

A firm has a product that sells for $25. The direct cost of manufacturing the product is $15 per unit. The product's contribution margin is:

A)$10.

B)40%.

C)60%.

D)67%.

A)$10.

B)40%.

C)60%.

D)67%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

66

Porter Productions sells video tapes for $15.00 each. Their variable cost per unit is $9.00. In addition, they incur $180,000 in fixed costs each year. What is the Porter's annual breakeven point in sales revenue?

A)$30,000

B)$180,000

C)$300,000

D)$450,000

E)$720,000

A)$30,000

B)$180,000

C)$300,000

D)$450,000

E)$720,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

67

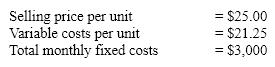

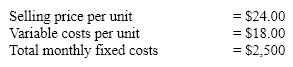

Assume the following facts about a single product firm:  What is the firm's annual breakeven volume in sales revenues?

What is the firm's annual breakeven volume in sales revenues?

A)$540,000

B)$240,000

C)$20,000

D)$9,600

What is the firm's annual breakeven volume in sales revenues?

What is the firm's annual breakeven volume in sales revenues?A)$540,000

B)$240,000

C)$20,000

D)$9,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

68

Porter Productions sells video tapes for $15.00 each. Their variable cost per unit is $9.00. In addition, they incur $180,000 in fixed costs each year. How many units will Porter have to produce and sell in order to generate an operating income (revenues minus expenses)of $54,000?

A)9,000 units

B)18,000 units

C)30,000 units

D)39,000 units

E)54,000 units

A)9,000 units

B)18,000 units

C)30,000 units

D)39,000 units

E)54,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

69

If a company sells 20,000 units at $20 each, has fixed costs of $50,000 and a variable cost of $10 per unit, what is their degree of operating leverage (DOL)?

A)1.6

B)2.5

C)1.33

D)1.7

A)1.6

B)2.5

C)1.33

D)1.7

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

70

Illinois Tool Company's (ITC)fixed operating costs are $1,260,000. Its variable costs average 70% of the price of its products. The firm currently has sales revenue of $9 million per year. What is ITC's degree of operating leverage?

A)1.60

B)1.875

C)3.0

D)None of the above

A)1.60

B)1.875

C)3.0

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

71

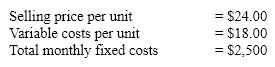

Assume the following facts about a firm that sells just one product:  What is the firm's annual breakeven volume in units?

What is the firm's annual breakeven volume in units?

A)417 units

B)1,250 units

C)5,000 units

D)1,667 units

What is the firm's annual breakeven volume in units?

What is the firm's annual breakeven volume in units?A)417 units

B)1,250 units

C)5,000 units

D)1,667 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

72

A firm markets a product for $30 per unit that has a direct manufacturing cost of $15 per unit. Its contribution margin is:

A)50%.

B)33.33%.

C)$15.

D)None of the above

A)50%.

B)33.33%.

C)$15.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

73

Last year Avator's operating income (EBIT)increased by 22 percent while its dollar sales increased by 15%. What is Avator's degree of operating leverage (DOL)?

A).68

B)2.0

C)1.47

D).32

A).68

B)2.0

C)1.47

D).32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

74

Illinois Tool Company's (ITC)fixed operating costs are $1,260,000 and its variable cost ratio (i.e., variable costs as a fraction of sales)is 0.70. The firm's debt consists of a $6,000,000 bond issue (par value)which pays a coupon rate of 9%. Sales are $9 million per year. What is ITC's degree of financial leverage?

A)1.20

B)1.875

C)3.0

D)1.60

A)1.20

B)1.875

C)3.0

D)1.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

75

Porter Productions sells video tapes for $15.00 each. Their variable cost per unit is $9.00. In addition, they incur $180,000 in fixed costs each year. At 40,000 units of sale, what is Porter's degree of operating leverage (DOL)?

A)1.33

B)2.50

C)3.00

D)4.00

E)6.00

A)1.33

B)2.50

C)3.00

D)4.00

E)6.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

76

Harris Inc. has EBIT of $1,500 and debt of $5,000 on which it pays 12% interest. Its EPS is currently $2.35 per share. Management anticipates a difficult period ahead and fears EBIT could decline by as much as 20%. What will the new EPS be if that happens?

A)$1.88

B)$1.41

C)$1.57

D)Can't tell from the information given

A)$1.88

B)$1.41

C)$1.57

D)Can't tell from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

77

Internet Corporation has EBIT of $1 million, 30% debt in their capital structure, and total capital of $10 million. Their tax rate is 35%. What is their return on capital employed (ROCE)?

A)6.5%

B)10.0%

C)33.33%

D)21.67%

A)6.5%

B)10.0%

C)33.33%

D)21.67%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

78

A firm has EBIT of $3.6M and debt of $15M on which it pays 8% interest. What is its Degree of Financial Leverage (DFL)?

A)1.0

B)1.4

C)1.5

D)1.6

A)1.0

B)1.4

C)1.5

D)1.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

79

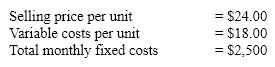

Assume the following facts about a firm that sells just one product:  What is the firm's monthly breakeven volume in units?

What is the firm's monthly breakeven volume in units?

A)417 units

B)1,250 units

C)5,000 units

D)1,667 units

What is the firm's monthly breakeven volume in units?

What is the firm's monthly breakeven volume in units?A)417 units

B)1,250 units

C)5,000 units

D)1,667 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck

80

Wayside Corporation has an EBIT of $2 million, 40% debt in their capital structure, and has total capital of $10 million. If they are in the 35% tax bracket, what is their return on capital employed (ROCE)?

A)20.0%

B)13.0%

C)40.0%

D)21.67%

A)20.0%

B)13.0%

C)40.0%

D)21.67%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 198 في هذه المجموعة.

فتح الحزمة

k this deck