Deck 3: Preparing Your Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

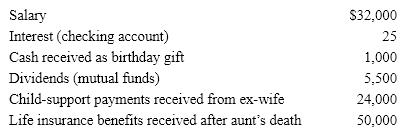

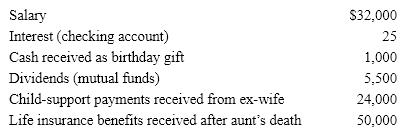

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

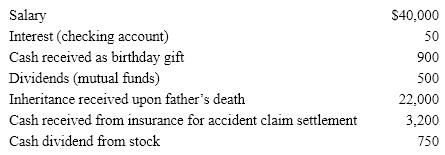

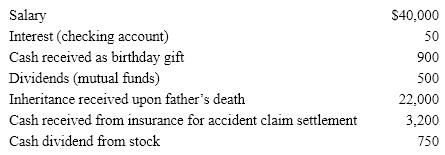

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/87

العب

ملء الشاشة (f)

Deck 3: Preparing Your Taxes

1

A progressive tax structure is one in which:

A) tax rates are directly proportional to inflation rates.

B) the larger the amount of taxable income, the higher the rate at which it is taxed.

C) tax rates are inversely related to inflation rates.

D) everyone pays the same income tax rate.

E) no exemptions or deductions are available.

A) tax rates are directly proportional to inflation rates.

B) the larger the amount of taxable income, the higher the rate at which it is taxed.

C) tax rates are inversely related to inflation rates.

D) everyone pays the same income tax rate.

E) no exemptions or deductions are available.

B

2

The highest marginal tax rate is currently:

A) 32%.

B) 35 %.

C) 37 %.

D) 41 %.

E) 45%.

A) 32%.

B) 35 %.

C) 37 %.

D) 41 %.

E) 45%.

C

3

The Internal Revenue Service (IRS) will compute taxes for those whose taxable income is less than $100,000 and who do not itemize deductions.

True

4

If you are legally separated from your spouse by a separation decree, you can legally file as a single taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

5

Qualified dividends are taxed at a higher rate than long-term capital gains.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

6

Mandi and Thomas were married and had a child, age 7, in 2018 . Mandi died in 2018, leaving Thomas a single parent. The most favorable filing status for Thomas in 2019 will be:

A) single.

B) married filing separately.

C) head of household.

D) qualifying widower with dependent child.

E) married filing jointly.

A) single.

B) married filing separately.

C) head of household.

D) qualifying widower with dependent child.

E) married filing jointly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

7

Tax avoidance is legal, whereas tax evasion is illegal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

8

Gross income minus tax-exempt income equals adjusted gross income (AGI).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

9

A tax audit is an examination by local government officials to identify people who do not pay enough taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

10

Adjustments to (gross) income will decrease your taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

11

Pete and Pam are married with four dependent children. Which of the following filing statuses can Pete and Pam use if they want to legally file one tax return?

A) Married filing separately

B) Married filing jointly

C) Head of household

D) Single

E) Qualifying widow or widower with dependent child

A) Married filing separately

B) Married filing jointly

C) Head of household

D) Single

E) Qualifying widow or widower with dependent child

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

12

A married couple filing a joint return has Ms. Cindy Cook, a certified public accountant (CPA), complete their return. The Internal Revenue Service (IRS) will hold only Ms. Cook responsible for any errors in the filed return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

13

Russ and Lois were married on December 30. Even though they were single for most of the year, they can legally file as married filing jointly taxpayers in the year of the wedding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

14

All taxpayers have an equal probability of having their tax returns audited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

15

Tax credits are dollar-for-dollar reductions in taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

16

The federal government receives a majority of its revenue from ____ taxes.

A) sales

B) property

C) excise

D) income

E) estate

A) sales

B) property

C) excise

D) income

E) estate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

17

Dwayne and Gayle were divorced on September 29. They have not remarried since and have no dependents. Their filing status for the year will be married filing separately since they were married for more than half of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

18

The alternative minimum tax (AMT) is applicable to taxpayers with moderate levels of income only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

19

Henry is married to Lillian, and they have two dependent children. Both of them want to file their own tax returns, reporting only his or her own income, deductions, and exemptions. The filing status of Henry and Lillian is:

A) single taxpayer.

B) married filing jointly.

C) head of household.

D) qualifying widow or widower with dependent child.

E) married filing separately.

A) single taxpayer.

B) married filing jointly.

C) head of household.

D) qualifying widow or widower with dependent child.

E) married filing separately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

20

Income shifting refers to the process of transferring income from the taxpayer to the Internal Revenue Service (IRS).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

21

A capital gain is the result of:

A) selling a capital asset for less than its purchase price.

B) holding a capital asset that has depreciated.

C) selling a capital asset at its purchase price.

D) selling a capital asset for more than its purchase price.

E) buying a new capital asset at a rate lower than the market rate of the asset.

A) selling a capital asset for less than its purchase price.

B) holding a capital asset that has depreciated.

C) selling a capital asset at its purchase price.

D) selling a capital asset for more than its purchase price.

E) buying a new capital asset at a rate lower than the market rate of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

22

Your income tax withholding is dependent on:

A) your age and educational qualification.

B) the number of deductions claimed by your spouse.

C) your level of earnings and the number of withholding allowances you have claimed.

D) the number of standard deductions you have claimed.

E) the number of withholding allowances allowed by your employer.

A) your age and educational qualification.

B) the number of deductions claimed by your spouse.

C) your level of earnings and the number of withholding allowances you have claimed.

D) the number of standard deductions you have claimed.

E) the number of withholding allowances allowed by your employer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

23

Ben and Jack both earned $60,000 this year. Ben (age 30) is married with two children, and Jack (age 68) is single with no dependents. Which of the following statements regarding the amount of Social Security taxes they will have to pay is true?

A) They will pay the same amount of Social Security taxes.

B) Ben will pay less Social Security taxes because he is married.

C) Ben will pay less Social Security taxes because he has children.

D) Jack will pay less Social Security taxes because he is single.

E) Jack will pay less Social Security taxes because he is over the age of 65.

A) They will pay the same amount of Social Security taxes.

B) Ben will pay less Social Security taxes because he is married.

C) Ben will pay less Social Security taxes because he has children.

D) Jack will pay less Social Security taxes because he is single.

E) Jack will pay less Social Security taxes because he is over the age of 65.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

24

Mark is not married and has dependent parents. He pays more than half of the cost of keeping up a home for himself and his parents. His tax filing status is:

A) single taxpayer.

B) married filing jointly.

C) married filing separately.

D) head of household.

E) qualifying widow with dependent child.

A) single taxpayer.

B) married filing jointly.

C) married filing separately.

D) head of household.

E) qualifying widow with dependent child.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following statements regarding the tax levied under the Federal Insurance Contributions Act (FICA) is true?

A) It is also known more commonly as property tax.

B) It is paid equally by employer and employee.

C) It is not applicable to self-employed persons.

D) It applies only to the first $100,000 of an employee's earnings.

E) It is used to provide insurance against theft.

A) It is also known more commonly as property tax.

B) It is paid equally by employer and employee.

C) It is not applicable to self-employed persons.

D) It applies only to the first $100,000 of an employee's earnings.

E) It is used to provide insurance against theft.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

26

For those under the age of 65, medical and dental expenses may be included as itemized deductions:

A) when they exceed 4% of adjusted gross income (AGI).

B) up to a maximum of $7,500 per individual per tax year.

C) only if they are less than 20% of gross income.

D) only for amounts in excess of 10% of adjusted gross income (AGI).

E) when they exceed 2% of taxable income.

A) when they exceed 4% of adjusted gross income (AGI).

B) up to a maximum of $7,500 per individual per tax year.

C) only if they are less than 20% of gross income.

D) only for amounts in excess of 10% of adjusted gross income (AGI).

E) when they exceed 2% of taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

27

Tom sold mutual fund shares, which he had owned for 3 years, so that he could use the proceeds to return to college. Tom is in the 12% ordinary tax bracket, and his capital gain from the sale was $12,000. How much tax does Tom owe on the gain?

A) $12,000

B) $3,080

C) $1,440

D) $1,200

E) $0

A) $12,000

B) $3,080

C) $1,440

D) $1,200

E) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

28

Murray (age 68, single) sold his home owned for 35 years so that he could relocate to a place that is closer to where his grandchildren live. He realized a $400,000 capital gain on the home. Murray's tax liability on the capital gain is computed on:

A) $400,000.

B) $300,000.

C) $250,000.

D) $150,000.

E) $0.

A) $400,000.

B) $300,000.

C) $250,000.

D) $150,000.

E) $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

29

A _____ would most likely have to pay estimated taxes.

A) school teacher

B) manager for an industrial firm

C) independent consultant

D) state police officer

E) corporate attorney

A) school teacher

B) manager for an industrial firm

C) independent consultant

D) state police officer

E) corporate attorney

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

30

Melinda sold mutual fund shares, which she had owned for 5 years, so that she could use the proceeds to travel with her sister. Melinda is in the 32% ordinary tax bracket, and her capital gain from the sale was $40,000. Melinda's tax liability on the gain is:

A) $10,500.

B) $8,400.

C) $6,000.

D) $4,500.

E) $1,500.

A) $10,500.

B) $8,400.

C) $6,000.

D) $4,500.

E) $1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

31

Molly and Justin are considering contributing to a qualified tax-exempt organization. Their adjusted gross income (AGI) is $100,000. What is the maximum amount they can claim as an itemized deduction under the Tax Cuts and Jobs Act of 2017?

A) $0

B) $600

C) $1,200

D) $6,000

E) $60,000

A) $0

B) $600

C) $1,200

D) $6,000

E) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

32

You would typically include _____ in your gross income.

A) child-support payments

B) life insurance death benefit payments

C) municipal bond interest

D) income from pensions

E) personal exemptions

A) child-support payments

B) life insurance death benefit payments

C) municipal bond interest

D) income from pensions

E) personal exemptions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

33

Molly and Jason were married. Their only dependent was Spot, their black standard poodle. Jason died in 2018. Assuming Molly does not remarry, the only legal filing status for Molly in 2019 will be:

A) single.

B) married filing separately.

C) head of household.

D) qualifying widow with dependent child.

E) married filing jointly.

A) single.

B) married filing separately.

C) head of household.

D) qualifying widow with dependent child.

E) married filing jointly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

34

_____ would be considered a part of your taxable income.

A) Your individual retirement account (IRA) contributions

B) A gift from your aunt

C) Your child-support payments

D) A gain from the sale of your assets

E) Your tuition scholarship

A) Your individual retirement account (IRA) contributions

B) A gift from your aunt

C) Your child-support payments

D) A gain from the sale of your assets

E) Your tuition scholarship

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

35

Sarah is a homeowner and a single taxpayer. She has owned and occupied the house as a principal residence for the last 8 years. In the current taxable year, she receives a promotion. She sells her home and moves to another area. The capital gain on the sale of the principal residence will:

A) be taxable as ordinary income.

B) be taxable at a rate of 25%.

C) be taxable at the appropriate short-term capital gains rate.

D) be taxable excluding the first $250,000 of the gain.

E) not be taxable because the relocation is a job-related move.

A) be taxable as ordinary income.

B) be taxable at a rate of 25%.

C) be taxable at the appropriate short-term capital gains rate.

D) be taxable excluding the first $250,000 of the gain.

E) not be taxable because the relocation is a job-related move.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is subject to federal income tax?

A) The tax credit earnings on a Roth individual retirement account (IRA)

B) Municipal bond interest

C) Child-support payments

D) Tips received

E) Personal exemptions

A) The tax credit earnings on a Roth individual retirement account (IRA)

B) Municipal bond interest

C) Child-support payments

D) Tips received

E) Personal exemptions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

37

If you do not wish to itemize deductions, the other deduction you can take is the:

A) pay-as-you-go deduction.

B) bracket deduction.

C) standard deduction.

D) exemption deduction.

E) withholding allowance deduction.

A) pay-as-you-go deduction.

B) bracket deduction.

C) standard deduction.

D) exemption deduction.

E) withholding allowance deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

38

Your take-home pay is what you are left with after subtracting withholdings from your:

A) gross earnings.

B) net earnings.

C) taxable income.

D) adjusted gross income (AGI).

E) tax-exempt income.

A) gross earnings.

B) net earnings.

C) taxable income.

D) adjusted gross income (AGI).

E) tax-exempt income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

39

Mr. and Mrs. Davenport, ages 40 and 38, respectively, have three children, ages 3, 6, and 13. For 2019, they have adjusted gross income (AGI) of $65,000 and unreimbursed medical expenses of $6,750. The Davenports' claim for itemized deductions for medical expenses is:

A) $0.

B) $1,875.

C) $3,500.

D) $2,750.

E) $4,500.

A) $0.

B) $1,875.

C) $3,500.

D) $2,750.

E) $4,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

40

In 2019, the total FICA tax rate was:

A) 6.0%.

B) 6.75 %.

C) 7.25 %.

D) 13.4 %.

E) 15.3 %.

A) 6.0%.

B) 6.75 %.

C) 7.25 %.

D) 13.4 %.

E) 15.3 %.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

41

Ben is 67 years old and single. He is also legally blind. When filing his 2018 income taxes, he opts to take the standard deduction rather than itemizing personal deductions. How much is Ben's standard deduction?

A) $0

B) $12,000

C) $13,600

D) $15,200

E) $24,000

A) $0

B) $12,000

C) $13,600

D) $15,200

E) $24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

42

A tax audit is a(n):

A) Internal Revenue Service (IRS) revision of a previously filed return.

B) Internal Revenue Service (IRS) attempt to verify the accuracy of a return.

C) Internal Revenue Service (IRS) charge of illegal action.

D) U.S. Tax Court action.

E) U.S. Tax Court decision.

A) Internal Revenue Service (IRS) revision of a previously filed return.

B) Internal Revenue Service (IRS) attempt to verify the accuracy of a return.

C) Internal Revenue Service (IRS) charge of illegal action.

D) U.S. Tax Court action.

E) U.S. Tax Court decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

43

When an individual gives his or her child an income-producing asset, he or she is:

A) shifting his or her income.

B) maximizing his or her deductions.

C) deferring his or her tax.

D) executing his or her will.

E) reducing his or her taxes by using technology.

A) shifting his or her income.

B) maximizing his or her deductions.

C) deferring his or her tax.

D) executing his or her will.

E) reducing his or her taxes by using technology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

44

Peter's tax computed per the tax rate schedule amounts to $2,000, and his tax credits amount to $500. His total tax liability is:

A) $2,500.

B) $1,500.

C) $3,000.

D) $2,200.

E) $4,000.

A) $2,500.

B) $1,500.

C) $3,000.

D) $2,200.

E) $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

45

Tax credits reduce your:

A) tax liability.

B) adjusted gross income (AGI).

C) tax refund.

D) tax withholding.

E) taxable income.

A) tax liability.

B) adjusted gross income (AGI).

C) tax refund.

D) tax withholding.

E) taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

46

Based on the given information, what is Max's portfolio income?

Interest from savings account $1,000

Capital gains realized 5,000

Salary 8,000

A) $13,000

B) $6,000

C) $8,000

D) $16,000

E) $18,000

Interest from savings account $1,000

Capital gains realized 5,000

Salary 8,000

A) $13,000

B) $6,000

C) $8,000

D) $16,000

E) $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following private tax preparers are required to pass an exam administered by the Internal Revenue Service (IRS)?

A) National and local tax services

B) Certified public accountants (CPAs)

C) Enrolled agents (EAs)

D) Tax attorneys

E) Corporate managers

A) National and local tax services

B) Certified public accountants (CPAs)

C) Enrolled agents (EAs)

D) Tax attorneys

E) Corporate managers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Robertsons, a couple with an adjusted gross income (AGI) of $28,500, decide to contribute the maximum amount possible toward their individual retirement accounts (IRAs), even though Mr. Robertson is covered by a pension plan where he works. He names his wife the beneficiary of the IRA. What is such a tax strategy called?

A) Tax deferral

B) Tax avoidance

C) Tax evasion

D) Tax ignorance

E) Income shifting

A) Tax deferral

B) Tax avoidance

C) Tax evasion

D) Tax ignorance

E) Income shifting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

49

Mr. and Mrs. McMurray have three children, ages 6, 12, and 18 in 2018. The McMurrays' tax liability calculated per the tax schedule is $10,000. The McMurrays' tax liability is:

A) $8,000.

B) $7,000.

C) $4,000.

D) $6,000.

E) $0.

A) $8,000.

B) $7,000.

C) $4,000.

D) $6,000.

E) $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

50

Jamil and Vicki have one child, age 3. How much will a tax credit reduce their tax liability?

A) $500

B) $1,000

C) $2,000

D) $2,500

E) $3,000

A) $500

B) $1,000

C) $2,000

D) $2,500

E) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

51

A tax credit could result from:

A) owning a home.

B) adopting a child.

C) charitable contributions.

D) investing in municipal bonds.

E) dental expenses.

A) owning a home.

B) adopting a child.

C) charitable contributions.

D) investing in municipal bonds.

E) dental expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

52

Tax practitioners who are federally licensed are called:

A) certified public accountants (CPAs).

B) certified financial planners (CFPs).

C) tax attorneys.

D) enrolled agents (EAs).

E) chartered financial analysts (CFAs).

A) certified public accountants (CPAs).

B) certified financial planners (CFPs).

C) tax attorneys.

D) enrolled agents (EAs).

E) chartered financial analysts (CFAs).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

53

If you are a professional who is likely to receive income that is not subject to withholding, then you are required to:

A) pay an estimated tax.

B) file an amended return.

C) file an extension.

D) deduct a tax credit.

E) calculate itemized deductions.

A) pay an estimated tax.

B) file an amended return.

C) file an extension.

D) deduct a tax credit.

E) calculate itemized deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

54

A declaration of estimated taxes is made on:

A) Schedule B.

B) Form 1040EZ.

C) Schedule Z.

D) Form 1040-ES.

E) Form 1040A.

A) Schedule B.

B) Form 1040EZ.

C) Schedule Z.

D) Form 1040-ES.

E) Form 1040A.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following statements regarding enrolled agents (EAs) is true?

A) They are tax professionals who advise only professionals in tax planning.

B) They are taxpayers with relatively common types of income and expenditures.

C) They are federally licensed individual tax practitioners.

D) They are lawyers who specialize in tax planning.

E) They are federal agents who collect taxes from taxpayers.

A) They are tax professionals who advise only professionals in tax planning.

B) They are taxpayers with relatively common types of income and expenditures.

C) They are federally licensed individual tax practitioners.

D) They are lawyers who specialize in tax planning.

E) They are federal agents who collect taxes from taxpayers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

56

A taxpayer can file for an automatic extension of _____ months.

A) 2

B) 4

C) 6

D) 9

E) 12

A) 2

B) 4

C) 6

D) 9

E) 12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is an illegal method of reducing your current tax liability?

A) Not reporting the taxable income you receive

B) Investing in a tax-deferred annuity

C) Shifting income to your children

D) Investing money in municipal bonds

E) Putting money in a Roth individual retirement account (IRA)

A) Not reporting the taxable income you receive

B) Investing in a tax-deferred annuity

C) Shifting income to your children

D) Investing money in municipal bonds

E) Putting money in a Roth individual retirement account (IRA)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

58

You made an error when you filed your tax return last year. You can correct this error by filing:

A) Form 1040-ES.

B) Form 1040X.

C) Form 1040EZ.

D) Schedule A.

E) Schedule D.

A) Form 1040-ES.

B) Form 1040X.

C) Form 1040EZ.

D) Schedule A.

E) Schedule D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following statements regarding tax credits is true?

A) They are deductions that depend on the taxpayer's filing status, age, and vision and that can be claimed by a taxpayer whose total itemized deductions are small.

B) They are deductions from adjusted gross income (AGI) based on the number of persons supported by the taxpayer's income.

C) They represent the income remaining after subtracting all allowable adjustments to (gross) income.

D) They are personal expenditures that can be deducted from adjusted gross income (AGI) when determining taxable income.

E) They are deductions from a taxpayer's tax liability that directly reduce his or her taxes due.

A) They are deductions that depend on the taxpayer's filing status, age, and vision and that can be claimed by a taxpayer whose total itemized deductions are small.

B) They are deductions from adjusted gross income (AGI) based on the number of persons supported by the taxpayer's income.

C) They represent the income remaining after subtracting all allowable adjustments to (gross) income.

D) They are personal expenditures that can be deducted from adjusted gross income (AGI) when determining taxable income.

E) They are deductions from a taxpayer's tax liability that directly reduce his or her taxes due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following determines the amount of income subject to federal income taxes?

A) Marginal tax rate

B) Tax-deferred income

C) Adjusted gross income (AGI)

D) Active income

E) Reported taxable income

A) Marginal tax rate

B) Tax-deferred income

C) Adjusted gross income (AGI)

D) Active income

E) Reported taxable income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

61

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

A tax credit is subtracted from your [ taxable income | tax liability ].

A tax credit is subtracted from your [ taxable income | tax liability ].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

62

From the following information, determine Steve's gross income for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

63

Sue and Tim are married taxpayers in the 32% marginal tax bracket. In 2018, they sold common stock shares, which they held for more than 3 months, for a capital gain of $3,800. They also sold some technology stock for a short-term capital loss of $9,000. In addition, they sold the home they had lived in for the past 10 years and experienced a $75,000 gain on the house. How much will their net capital gains (or losses) be for 2018? How much will they pay (or save) in taxes as a result of these transactions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

64

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

For tax years from 2018 through 2025, individuals are allowed a deduction of [ 20% | 25% ] of qualified business income.

For tax years from 2018 through 2025, individuals are allowed a deduction of [ 20% | 25% ] of qualified business income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

65

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

A tax credit could result from [ owning a home | adopting a child ].

A tax credit could result from [ owning a home | adopting a child ].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

66

Jamie has taxable income of $45,000. She is single, and her tax rate is 10% on the first $9,525 of the taxable income, 12% on the amount over $9,525 up to $38,700 of the taxable income, and 22% on the remainder. What are Jamie's tax liability, marginal tax rate, and average tax rate? (Show all work. Round dollar amounts to the nearest cent and percentages to two decimal places.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

67

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

Your income tax filing status is determined primarily by your [ economic | family ] situation.

Your income tax filing status is determined primarily by your [ economic | family ] situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

68

Shawn earns $65,000. If the total Social Security tax rate is 15.3%, how much is his Social Security tax? How much does his employer pay toward Social Security taxes for Shawn? (Show all work and round to the nearest dollar.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

69

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

Earnings from real estate investments are an example of [ active | passive ] income.

Earnings from real estate investments are an example of [ active | passive ] income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

70

Schedule E of Form 1040:

A) reports the amount of tax-exempt income an individual has.

B) reports any income from rental property.

C) reports common expenses that businesses and farms incur.

D) reports the gains or losses from the sale of capital assets.

E) lists the sources of interest income and dividend income.

A) reports the amount of tax-exempt income an individual has.

B) reports any income from rental property.

C) reports common expenses that businesses and farms incur.

D) reports the gains or losses from the sale of capital assets.

E) lists the sources of interest income and dividend income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

71

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

The lowest marginal tax rate is currently [10% | 15%].

The lowest marginal tax rate is currently [10% | 15%].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

72

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

The tax year corresponds to the [ April 15 filing deadline | calendar year ].

The tax year corresponds to the [ April 15 filing deadline | calendar year ].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

73

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

Your marital status [ will | will not ] have an effect on the amount of Social Security tax you pay.

Your marital status [ will | will not ] have an effect on the amount of Social Security tax you pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

74

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

[ Itemized deductions | Exemptions ] allow taxpayers to reduce their adjusted gross income (AGI) by the amount of their personal expenditures.

[ Itemized deductions | Exemptions ] allow taxpayers to reduce their adjusted gross income (AGI) by the amount of their personal expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

75

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

Dividends received from stocks are known as [ passive | portfolio ] income.

Dividends received from stocks are known as [ passive | portfolio ] income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

76

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

Christy lives with her dog, Tex, who is dependent on her for support. She [ can | cannot ] use the head of household filing status.

Christy lives with her dog, Tex, who is dependent on her for support. She [ can | cannot ] use the head of household filing status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

77

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

The [ capital gains tax | alternative minimum tax (AMT) ] is designed to ensure that high-income taxpayers with many deductions and tax shelter investments that provide attractive tax write-offs are paying their fair share of taxes .

The [ capital gains tax | alternative minimum tax (AMT) ] is designed to ensure that high-income taxpayers with many deductions and tax shelter investments that provide attractive tax write-offs are paying their fair share of taxes .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

78

Schedule _____ of Form 1040 reports capital gains and losses.

A) A

B) B

C) C

D) D

E) F

A) A

B) B

C) C

D) D

E) F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

79

From the following information, determine Marcie's gross income for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

80

INSTRUCTIONS: Choose the word or phrase in [ ] which will correctly complete the statement. Select A for the first item, B for the second item, and C if neither item will correctly complete the statement.

[ Interest | Child support ] received would be reported as taxable income.

[ Interest | Child support ] received would be reported as taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck