Deck 23: Supplement F Financial Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/55

العب

ملء الشاشة (f)

Deck 23: Supplement F Financial Analysis

1

The ________ is the concept that a dollar in hand today is worth more than a dollar to be received in the future.

time value of money

2

The reduction of the value of money received in the future when the interest rate is known is called ________.

discounting

3

The present value of an investment is the amount that must be invested now to accumulate to a certain amount in the future at a specific interest rate.

True

4

An investor puts $10,000 in an account earning 4 percent compounded interest. At the end of three years, the account will have a value of:

A) less than $11,000.

B) between $11,000 and $11,200.

C) between $11,200 and $11,400.

D) more than $11,400.

A) less than $11,000.

B) between $11,000 and $11,200.

C) between $11,200 and $11,400.

D) more than $11,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

5

A(n) ________ is a series of payments of a fixed amount for a specified number of years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

6

It is estimated that the cost for the first year of college at Massive University, the state school with the best operations management program, will be $60,000 by the time your son is ready to enroll as a student. If prevailing interest rates will average 5 percent, what amount should you invest now to pay his first year's tuition eight years from now?

A) less than $35,000

B) between $35,000 and $38,000

C) between $38,000 and $41,000

D) more than $41,000

A) less than $35,000

B) between $35,000 and $38,000

C) between $38,000 and $41,000

D) more than $41,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

7

Conhugeco is eyeing a new Plotzer 3,000, which has a list price of $12,000,000. How much should they set aside today if they want to make their purchase one year from now and their interest-bearing checking account pays 3% annually?

A) about $11.6 million

B) about $11.2 million

C) about $12.3 million

D) about $12.8 million

A) about $11.6 million

B) about $11.2 million

C) about $12.3 million

D) about $12.8 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

8

The amount to be invested now to accumulate to a certain amount in the future at a specified interest rate is called the:

A) time value of money.

B) present value of an investment.

C) future value of an investment.

D) None of the above.

A) time value of money.

B) present value of an investment.

C) future value of an investment.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

9

Discounting is the process by which interest on an investment accumulates, and then earns interest itself for the remainder of the investment period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

10

The value of an investment at the end of the period over which interest is compounded is called the:

A) time value of money.

B) present value of an investment.

C) future value of an investment.

D) None of the above.

A) time value of money.

B) present value of an investment.

C) future value of an investment.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

11

If an invested amount and its accumulated interest is continually reinvested, its future value is the principle multiplied by one plus the interest rate raised to the number of periods the investment continues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

12

The process by which interest on an investment accumulates and then earns interest itself for the remainder of the investment period is called ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

13

The interest rate is also called the discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

14

In the formula

P = the term r is ________.

the term r is ________.

P =

the term r is ________.

the term r is ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

15

The time value of money implies that a dollar in hand today is worth more than a dollar to be received in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

16

Cash flows should be converted to ________ amounts before applying the net present value, payback, or internal rate of return method to them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

17

The amount that must be invested now to accumulate to a certain amount in the future at a specified interest rate is called the ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

18

Conhugeco's CEO is ready to step down and wants to sock away enough money in his offshore Caribbean accounts to generate $150,000 per year for the next ten years. If he can secure a 4% interest rate from the bank, how much does he need to earmark today?

A) about $1.1 million

B) about $1.2 million

C) about $1.5 million

D) about $1.4 million

A) about $1.1 million

B) about $1.2 million

C) about $1.5 million

D) about $1.4 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

19

The present value factors found in Table F.1 were calculated by changing the values of ________ and ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

20

The value of an investment at the end of the period over which interest is compounded is called the future value of the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

21

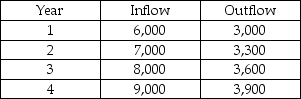

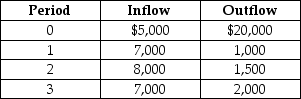

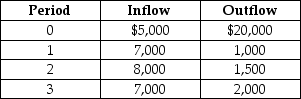

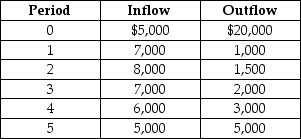

Lisa is pondering the construction and operation of a home-based cattery. She expects it will cost $35,000 to construct and will have a lifespan of four years before it collapses due to faulty construction and ammonia rot. Cash flows during those four glorious years are estimated as follows:

If the interest rate is 5%, what is the present value of the cattery project?

A) -18,800

B) -20,790

C) -26,378

D) -47,168

If the interest rate is 5%, what is the present value of the cattery project?

A) -18,800

B) -20,790

C) -26,378

D) -47,168

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

22

Acapella University offers to lock-in a student's tuition for a four year period. If tuition is $30,000 per year (payable at the end of each year) and the interest rate is currently 8%, what amount of money now would enable you to withdraw the $30,000 figure at the end of each of the next four years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

23

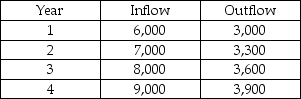

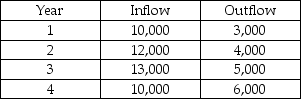

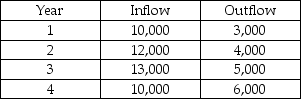

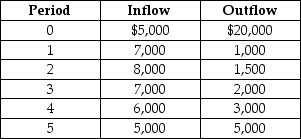

Lisa is pondering the construction and operation of a home-based cattery. She expects it will cost $15,000 to construct and will have a lifespan of four years before it collapses due to faulty construction and ammonia rot. Cash flows during those four glorious years are estimated as follows:

If the interest rate is 5%, what is the present value of the cattery project?

A) 2,756

B) 3,124

C) 2,983

D) 3,277

If the interest rate is 5%, what is the present value of the cattery project?

A) 2,756

B) 3,124

C) 2,983

D) 3,277

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

24

To calculate straight-line depreciation, you divide the purchase price of the investment by the asset's expected economic life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

25

The NCX10 now features a coffee brewing subassembly, so Alex budgets the following cash outlays and incomes for the next three years. If the interest rate is 25%, what is the present value of this investment?

A) -$3,264

B) -$3,397

C) -$3,422

D) -$3,480

A) -$3,264

B) -$3,397

C) -$3,422

D) -$3,480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

26

A poultry farmer is interested in purchasing an egg tester that can measure weight, albumin height, yolk color, and Haugh units all at the touch of a button. The unit will cost $6,900 and is expected to last 10 years at which point it can be sold for $500 to a farmer in a less stringently controlled egg market. What is the annual depreciation under the straight line method?

A) $640

B) $690

C) $50

D) $740

A) $640

B) $690

C) $50

D) $740

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

27

A poultry farmer is interested in purchasing an industrial egg tester that can measure weight, albumin height, yolk color, and Haugh units all at the touch of a button. The unit will cost $6900 and is expected to last 10 years at which point it can be sold for $1,000 to a farmer in a less stringently controlled egg market. What is the annual depreciation for year 4 under the MACRS method? A copy of Table F.3 is appended to your exam.

A) $862

B) $795

C) $737

D) $680

A) $862

B) $795

C) $737

D) $680

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is an accelerated depreciation method?

A) straight-line depreciation

B) MACRS

C) net present value

D) after-tax cash flow

A) straight-line depreciation

B) MACRS

C) net present value

D) after-tax cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

29

Straight-line depreciation is the simplest way to calculate depreciation and usually is adequate for internal planning purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

30

Nathan would have to wait until he was 35 to receive his inheritance, which was entirely too long in light of his impressive shopping list. He had almost given up hope when he saw an interesting offer one afternoon while watching television. In the advertisement, a company expressed a willingness to give him cash now if he would sign over his inheritance 11 years from now. If they use a 15% interest rate, what percentage of his inheritance will Nathan receive today?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

31

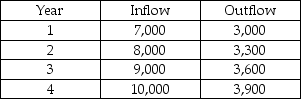

Lisa is pondering the construction and operation of a home-based cattery. She expects it will cost $25,000 to construct and will have a lifespan of four years before it collapses due to faulty construction and ammonia rot. Cash flows during those four glorious years are estimated as follows:

If the interest rate is 5%, what is the present value of the cattery project?

A) 8,522

B) 8,823

C) 9,124

D) 9,625

If the interest rate is 5%, what is the present value of the cattery project?

A) 8,522

B) 8,823

C) 9,124

D) 9,625

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which method of analysis does not consider the time value of money?

A) net present value (NPV)

B) internal rate of return (IRR)

C) payback

D) future value of an investment (FVI)

A) net present value (NPV)

B) internal rate of return (IRR)

C) payback

D) future value of an investment (FVI)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

33

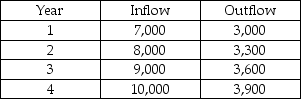

The NCX10 now features a coffee brewing subassembly, so Alex budgets the following cash outlays and incomes for the next five years. If the interest rate is 8%, what is the present value of this investment after the second year?

A) $3,264

B) $5,572

C) -$3,871

D) -$9,444

A) $3,264

B) $5,572

C) -$3,871

D) -$9,444

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

34

Explain the time-value-of-money concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

35

Depreciation is not a legitimate cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is the future value of an investment of $10,000 at 8% interest after 10 years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

37

Straight-line depreciation is an accelerated depreciation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

38

Jake buys a new work truck every four years regardless of the condition of his current vehicle. His next truck will cost $45,000 and Jake estimates it will have a salvage value of $20,000 when it's time to buy a replacement. What is the annual depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

39

Depreciation:

A) is not an allowance for the consumption of capital.

B) is not a legitimate cash flow.

C) does not act as a tax shield.

D) does not consider the salvage value of an item.

A) is not an allowance for the consumption of capital.

B) is not a legitimate cash flow.

C) does not act as a tax shield.

D) does not consider the salvage value of an item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

40

The net present value (NPV) method evaluates an investment by calculating the present values of all after-tax total cash flows and then subtracting the original investment amount from their total.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

41

What are the different types of depreciation? What are the advantages and disadvantages of each?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

42

Since 1986, the only acceptable accelerated depreciation method is the ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

43

What is payback from the financial perspective? Why would a manager choose to use this approach to investment analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

44

The ________ is used to evaluate projects by calculating the amount of time that will elapse before the total of after-tax cash flows will equal the initial investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

45

________ are the amounts of cash that flow into and out of the organization solely because of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

46

What is managing by the numbers? Explain whether this is beneficial and support your position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

47

________ is an allowance for the consumption of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

48

The ________ is the interest rate that is the lowest desired return on an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

49

Describe the basic techniques of financial analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

50

The ________ method of calculating annual depreciation is the simplest, and usually is adequate for internal planning purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

51

What are the problems and advantages of managing by the numbers?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

52

The cash flow from the sale or disposal of plant and equipment at the end of a project's life is its ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

53

________ is the cash that will flow into and out of the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

54

The ________ is the discount rate that makes the NPV of a project zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

55

The term ________ is often used to describe the common U.S. business practice of focusing on short-term results from low-risk projects via analysis by NPV or IRR calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck