Deck 5: Payroll

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 5: Payroll

1

Chris Gabarkowitz worked 40 hours straight time and 5 hours overtime at an hourly rate of $18.58. Which is her gross earnings if she earns time and one-half for overtime?

A) $743.20

B) $882.55

C) $929.20

D) $1,254.15

A) $743.20

B) $882.55

C) $929.20

D) $1,254.15

B

2

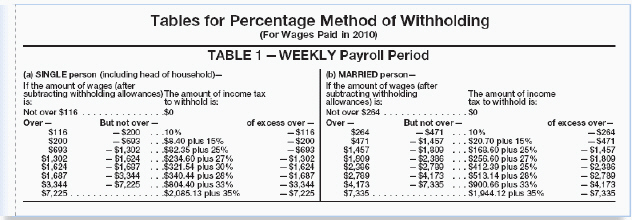

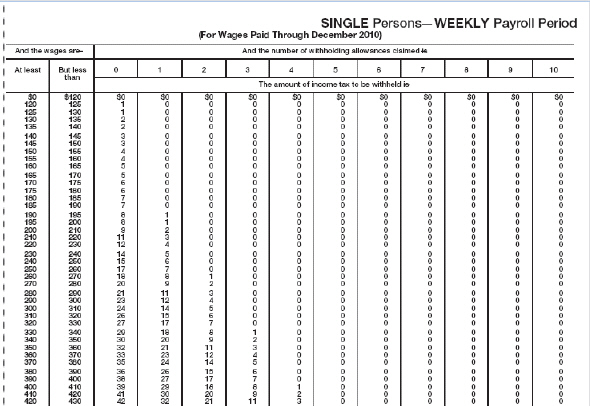

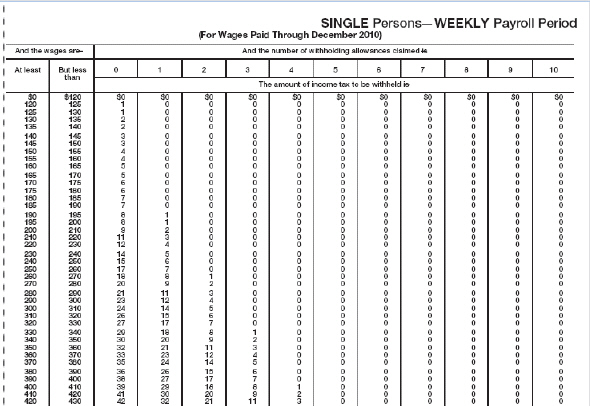

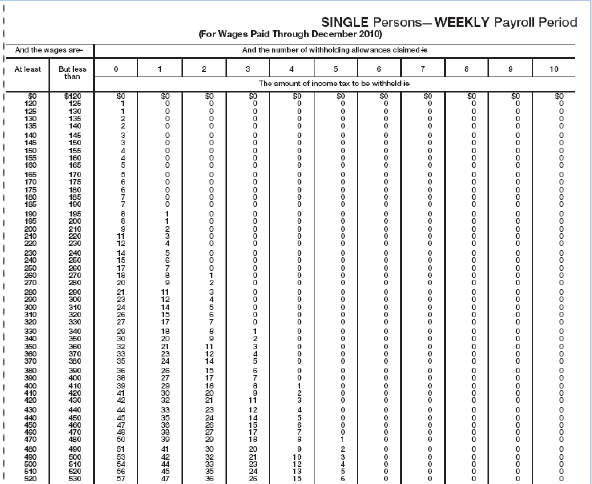

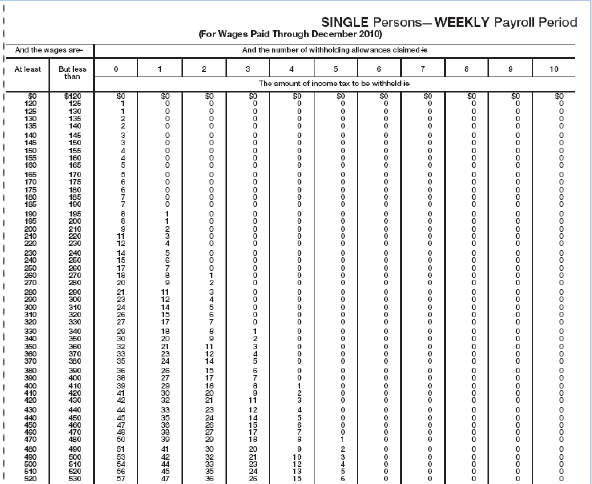

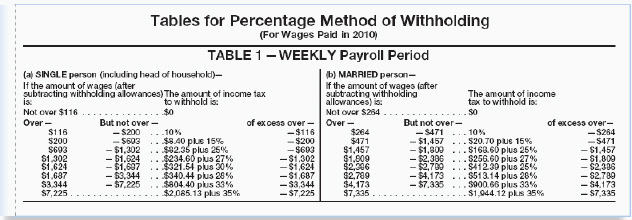

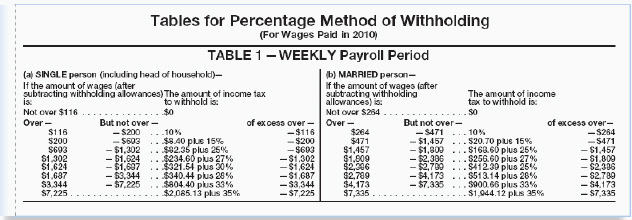

Lewis is single with one allowance. He has gross weekly earnings of $525.00. He can deduct $70.19 from his gross earnings for the allowance. Use the percentage method table to find the amount of weekly federal income tax withheld.

A) $38.22

B) $46.62

C) $74.42

D) $84.95

A) $38.22

B) $46.62

C) $74.42

D) $84.95

B

3

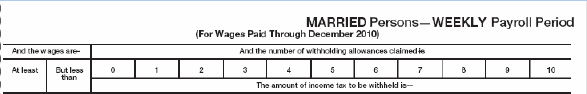

Attus Nasos is married with five allowances. He has gross weekly earnings of $1,175. For each withholding allowance, he can deduct $70.19 from his gross earnings. Use the percentage method table to find the amount of weekly federal income tax withheld.

A) $52.96

B) $73.66

C) $70.19

D) $123.60

A) $52.96

B) $73.66

C) $70.19

D) $123.60

B

4

Ramona worked 37 hours last week. She earns $11.79 an hour, so she earned $436.23.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

Raj lives in a state where there is a 3.75% state tax. If Raj's gross earnings last week were $675.39, how much state income tax was withheld?

A) $125.33

B) $55.33

C) $25.33

D) $24.90

A) $125.33

B) $55.33

C) $25.33

D) $24.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

Terrence worked as a lifeguard 23 hours last week. If he earns $9.95 an hour, how much did he make?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

Roberta Parke recently got hired as a mechanical engineer. Her annual salary is $62,850. How much will she earn biweekly?

A) $5,237.00

B) $2,618.75

C) $2,417.31

D) $1,208.65

A) $5,237.00

B) $2,618.75

C) $2,417.31

D) $1,208.65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

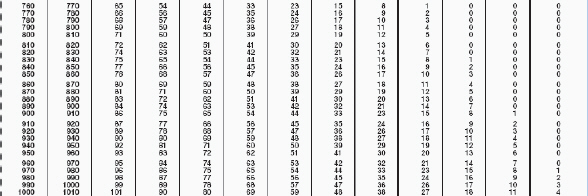

Kermit Jacobs is married with 5 allowances. His weekly gross earnings are $1,050.00. He has $56.92 withheld for medical insurance, which are pre-tax dollars. Kermit also contributes $125 in pre-tax dollars each paycheck to a 401k. According to the tax table, he should pay $43 in federal taxes. If Kermit also has 6.2% in Social Security and 1.45% in Medicare taxes withheld, what is his net pay?

A) $868.08

B) $825.08

C) $758.67

D) $749.11

A) $868.08

B) $825.08

C) $758.67

D) $749.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

Ron Woerner works in a factory. He is paid $7.50 for each item he assembles with a guaranteed minimum of $150 a day. In the last 5 days, he has assembled the following number of items: 19, 21, 23, 17, and 20. What are his gross earnings for the week?

A) $650

B) $680

C) $750

D) $780

A) $650

B) $680

C) $750

D) $780

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

Mrs. Thomson had gross earnings of $1,345.90 last week. Compute the total amount she paid in Social Security and Medicare taxes using 6.2% and 1.45% respectively.

A) $105.97

B) $102.97

C) $83.45

D) $19.52

A) $105.97

B) $102.97

C) $83.45

D) $19.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

A payroll clerk is calculating the amount that the company should send to the IRS. For one employee's paycheck, the federal income tax withheld is $43.24, the Social Security tax is $31.00, and the Medicare tax withheld is $7.25. How much should be sent for this employee?

A) $119.74

B) $88.74

C) $81.49

D) $473.74

A) $119.74

B) $88.74

C) $81.49

D) $473.74

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

Song Lee earns a weekly salary of $775 plus 17% commission on net sales over $2,000. Her total sales last week were $5,483.92 with no returned sales. Rounded to the nearest cent, what are Song Lee's gross earnings for the week?

A) $595.27

B) $775.00

C) $1,170.72

D) $1,367.27

A) $595.27

B) $775.00

C) $1,170.72

D) $1,367.27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

Erwin works as a plumber. He earns $37.00 an hour plus time and one-half for overtime on the weekdays. On the weekend, he earns double time. Last week, Erwin worked 40 hours of straight time, 7 hours of weekday overtime, and 10 hours over the weekend. How much did Erwin earn last week?

A) $1,868.50

B) $1,998.00

C) $2,608.50

D) $2,409.00

A) $1,868.50

B) $1,998.00

C) $2,608.50

D) $2,409.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

Kenya earns a biweekly salary of $575 plus 13.5% commission on net sales over $1,500. Her total sales in the past week were $1,968.00 with $105.00 in returned sales. Her total sales the week before were $2,245.91 with $256.90 in returned sales. What is Kenya's gross earnings for the two-week period?

A) $892.52

B) $568.88

C) $362.31

D) $317.52

A) $892.52

B) $568.88

C) $362.31

D) $317.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

Xavier has a job stocking groceries. He earns $7.86 an hour. If he worked 74 hours straight time last month, how much did he earn?

A) $157.20

B) $314.40

C) $471.60

D) $581.64

A) $157.20

B) $314.40

C) $471.60

D) $581.64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

Monica earns $1,250 each week. She lives in a state with a state income tax. If Monica had $35.63 taken out of her check in state tax last week, what is the state income tax rate to the nearest hundredth percent?

A) 4.05%

B) 3.37%

C) 3.36%

D) 2.85%

A) 4.05%

B) 3.37%

C) 3.36%

D) 2.85%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

Juanita Gonzalez works in an assembly plant. She is paid $0.60 for each item she assembles with a guaranteed minimum of $135 a day. In the last 3 days, she assembled 243, 217, and then 238 items. What are her gross earnings for the week?

A) $405.00

B) $423.60

C) $418.80

D) $523.60

A) $405.00

B) $423.60

C) $418.80

D) $523.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

Michael Lewis earns $71,500 a year, so his semimonthly paychecks are $2,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

Nigel has a $43.89 deduction from his paycheck for medical insurance. This deduction is pre-tax, which means that he deducts $43.89 from any federal taxes that he owes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

Josiah lives in a state with a state income tax. Last week, he earned $113.68. If Josiah had $4.38 taken out of his check in state tax, what is the state income tax rate to the nearest hundredth percent?

A) 4.05%

B) 3.95%

C) 3.90%

D) 3.85%

A) 4.05%

B) 3.95%

C) 3.90%

D) 3.85%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

Benji lives in a state with a 4.05% state tax. If Benji's gross earnings last week were $388.76, how much state income tax was withheld? Round to the nearest cent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

Michael Anaston was recently hired as a landscaper. He will earn $22,650 annually. What is his monthly salary?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

Katelyn works from home assembling craft kits. She is paid $1.22 for each kit she assembles. In the last 5 days she assembled 110, 98, 87, 102, and 96 kits. What are her gross earnings for the week?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

The FICA or Federal Insurance Contributions Act provides retirement and __________ benefits to workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

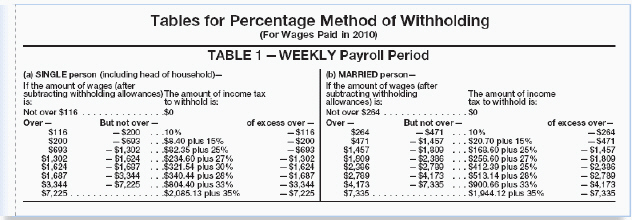

Loretta is single with two allowances. Her gross earnings are $263.00 a week. Use the table to find the amount of weekly federal income tax withheld.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

Mary Ellen works at a produce market where she earns $6.75 an hour. Last week, she worked 6 hours overtime. If Mary Ellen is paid time and one-half for overtime, how much did she make for those 6 hours?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

27

Latina had gross earnings of $562.90 last week. Compute the amounts she paid in Social Security using 6.2% and Medicare using 1.45%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

Mr. Griffin worked 40 hours straight time and 13 hours overtime at an hourly rate of $16.76. What are his gross earnings if he earns time and one-half for overtime?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

In the last four weeks, Case Janson has earned $1,333.00. Included in his pay are 8 hours of overtime at time and one-half. How much does Case earn per hour?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

As an electrician, Jason gets paid double time for any overtime hours. Last week, Jason worked 9.5 hours overtime. If he made $498.75 for those hours, what is Jason's straight time rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

31

Bhairav Nagesh is a computer programmer. Bhairav is paid an annual salary of $83,600 a year. What is his weekly salary?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

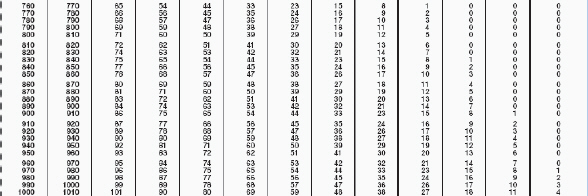

Jackson is married with four allowances. His gross earnings are $922 a week. Use the table to find the amount of weekly federal income tax withheld.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

The more withholding allowances that Rolanda claims, the ________ taxes are deducted from her paycheck.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

An accountant is calculating the amount to send to the IRS for an employee's taxes. For one particular employee who earned $613, the federal income tax withheld is $28. Social Security and Medicare taxes at 6.2% and 1.45% were also included. How much in all should be sent to the IRS for this employee?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

Social Security and Medicare taxes are collected from both the employee and the __________________, and then sent to the IRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

Tom Chambers had gross earning of $425.80 last week. Compute the total amount he paid in Social Security using 6.2% and Medicare using 1.45%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

Harlan does payroll for a local deli. During tax season, he worked 11 hours of overtime. If Harland earns $12.90 an hour and is paid time and one-half for overtime, how much did he earn for those hours?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

McKenzie earns a weekly salary of $350 plus 21% commission on net sales over $750. Her total sales last week were $1,390.50 with $85 in returned sales. Rounded to the nearest cent, what are McKenzie's gross earnings for the week?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

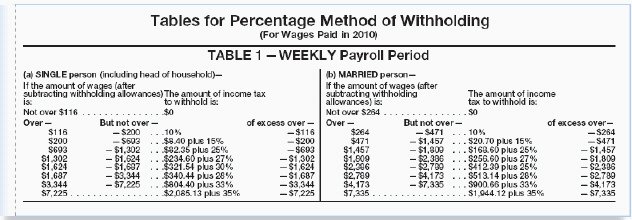

Tony is married with 3 allowances. His weekly gross earnings are $976.00. He has $87.19 in pre-tax dollars withheld for medical insurance. According to the tax table, he should pay $51 in federal taxes. If Tony also has 6.2% in Social Security and 1.45% in Medicare withheld, what is his net pay?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

Tanya Benson is single with three allowances and has gross weekly earnings of $480.00. Use the table to find the amount of weekly federal income tax withheld.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

Maya Costello is married with two allowances. She has gross weekly earnings of $378.90. For each withholding allowance she can deduct $70.19 from her gross earnings. Use the percentage method table to find the amount of weekly federal income tax withheld.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

Ronald Brown is a bookkeeper for Telacom. He is calculating the amount to send to the IRS for an employee's taxes. For one particular employee who earned $928, the federal income tax withheld is $68. Social Security and Medicare taxes at 6.2% and 1.45% were also included. How much in all should be sent to the IRS for this employee?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

In the last two weeks, McKenzie earned $1,311. Included in her pay is 8 hours of overtime at time and one-half. How much does McKenzie earn per hour?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

Nigay earns a biweekly salary of $830 plus 11% commission on net sales over $5,000. His total sales in the past two weeks were $16,390 with $2,560 in returned sales. What are Nigay's gross earnings for the two-week period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

Sue Raymore earns a weekly salary of $225 plus 23% commission on net sales over $1,500. Her total sales last week were $3,789 with $147.00 returned sales. What are Sue's gross earnings for the week?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

Kazuki Sato makes $46,835 annually as a maitre dé. What are his biweekly earnings?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

LeMonte earns $239.60 each week. He lives in a state with a state income tax. If LeMonte had $9.59 taken out of his check for state tax last week, what is the state income tax rate to the nearest hundredth percent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

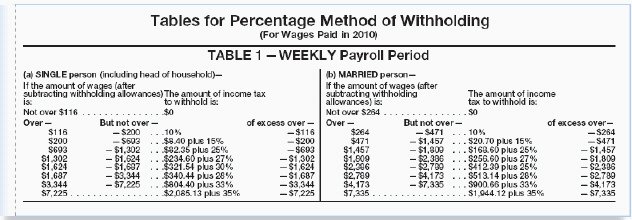

Manny is completing a payroll register for his business. One employee, Tomas Nigeria, is single with 4 allowances. Tomas's hourly rate is $13.45, and he earns time and one-half for overtime. This week, Tomas worked 40 hours of straight time and 7 overtime hours. Tomas has $87.25 withheld for medical insurance which is not taxed. According to the tax table, he should pay $25 in federal taxes. After 6.2% in Social Security and 1.45% in Medicare are withheld, what is Tomas's net pay?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

Tracy works from home entering data into the computer. She is paid $2.75 for each page she enters. In the past two weeks she has entered the following number of pages: 135, 187, 110, 213, and 161. What are her gross earnings?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

Mrs. Yung is completing a payroll register. One employee, Alice Kenta, is single with 2 allowances. Alice's hourly rate is $12.50 and she earns time and one-half for overtime. This week, Alice worked 40 hours of straight time and 4 overtime hours. Alice has $37.87 in pre-tax dollars withheld for medical insurance. According to the tax table, she should pay $38 in federal taxes. After 6.2% in Social Security and 1.45% in Medicare are withheld, what is Alice's net pay?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck