Deck 13: Depreciation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/52

العب

ملء الشاشة (f)

Deck 13: Depreciation

1

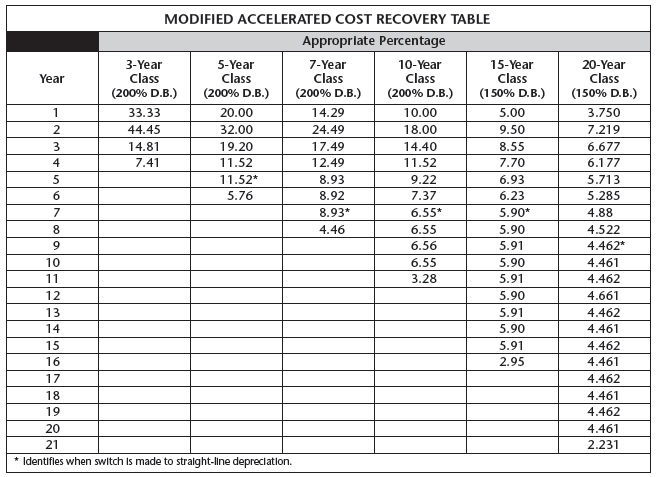

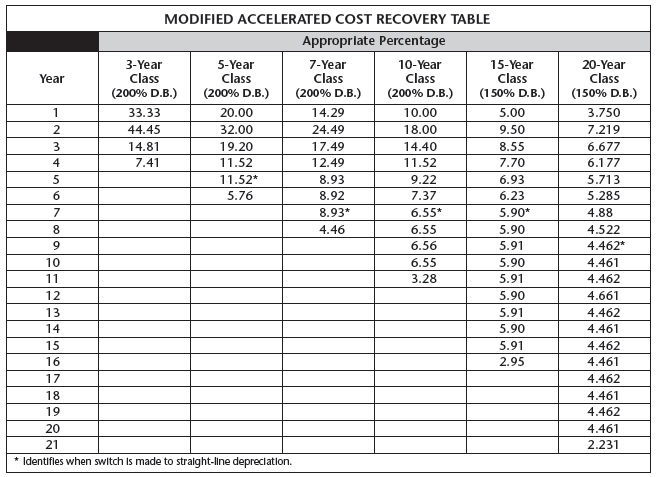

The original cost of a sailboat was $25,000 with an estimated life of 5 years. What is the second-year depreciation?

$6000;

2

Jed bought a car at the beginning of the year for $22,500. The car has an estimated life of 7 years and a salvage value of $5,000 at the end of the 7-year period. What is the depreciation using the straight-line method?

A) $27,500

B) $17,500

C) $3,929

D) $2,500

A) $27,500

B) $17,500

C) $3,929

D) $2,500

D

3

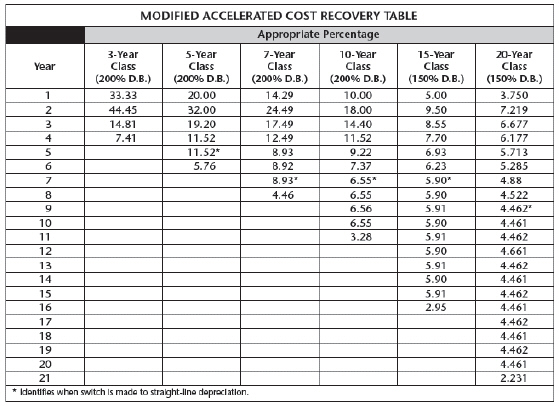

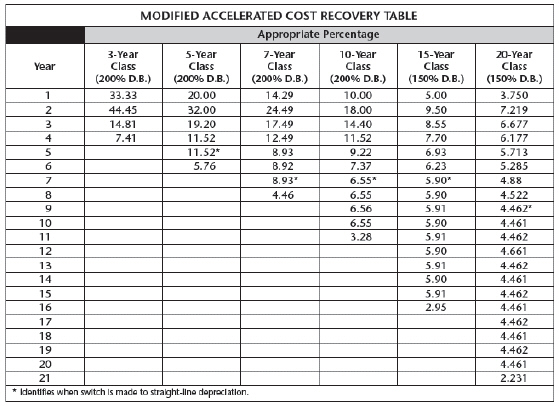

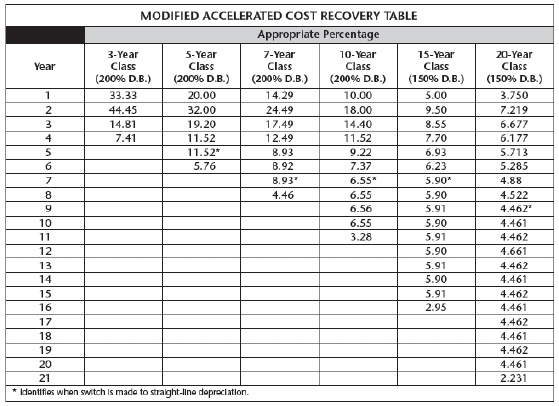

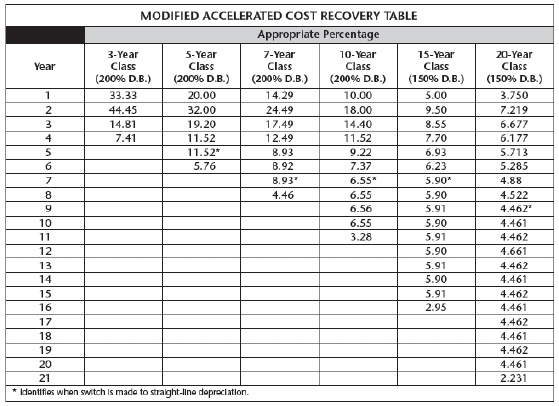

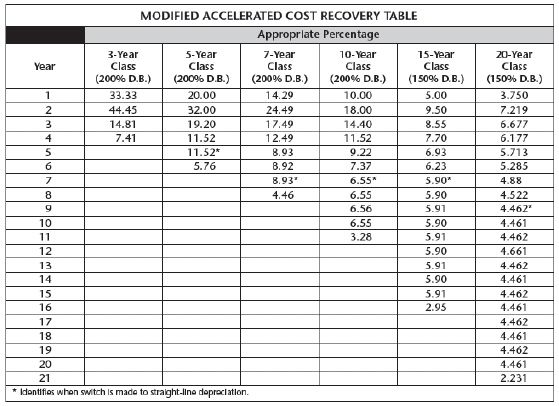

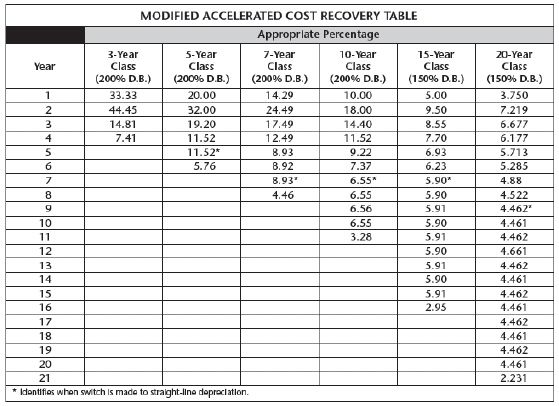

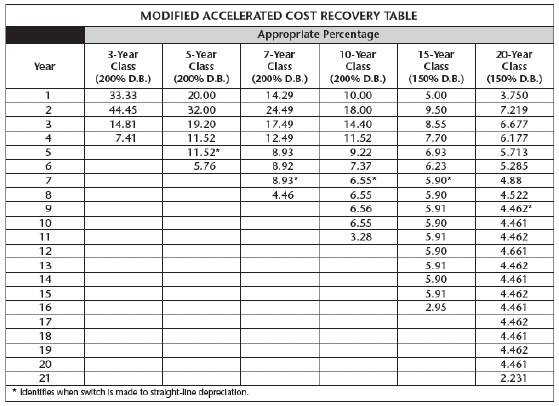

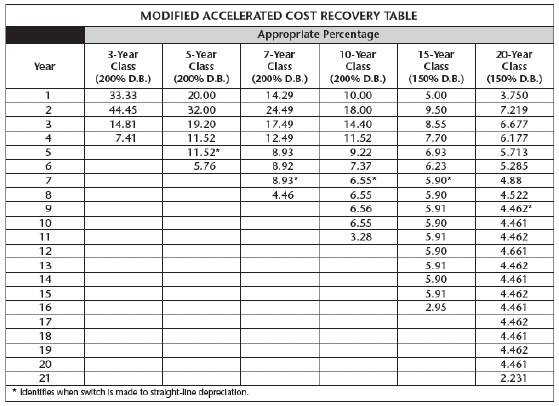

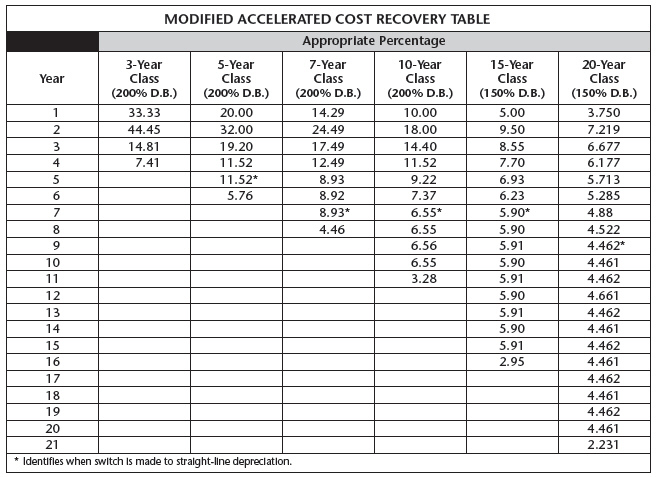

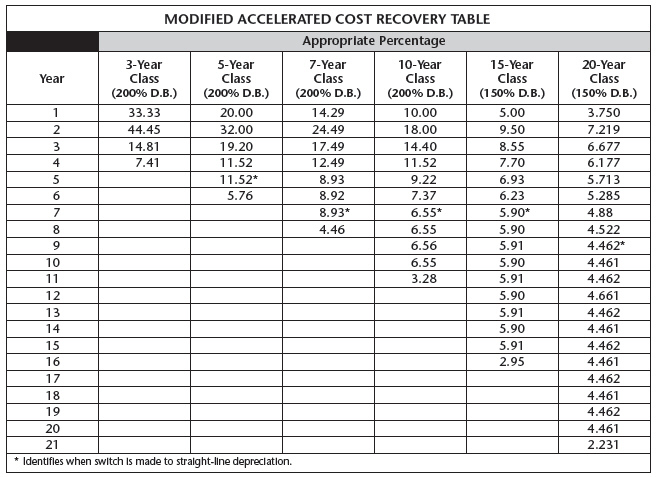

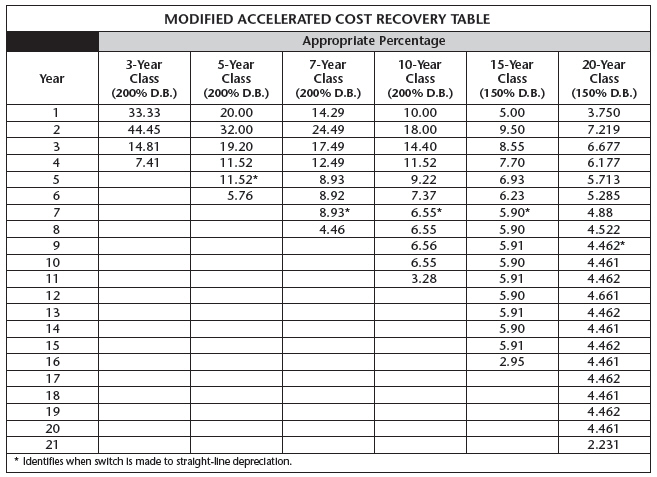

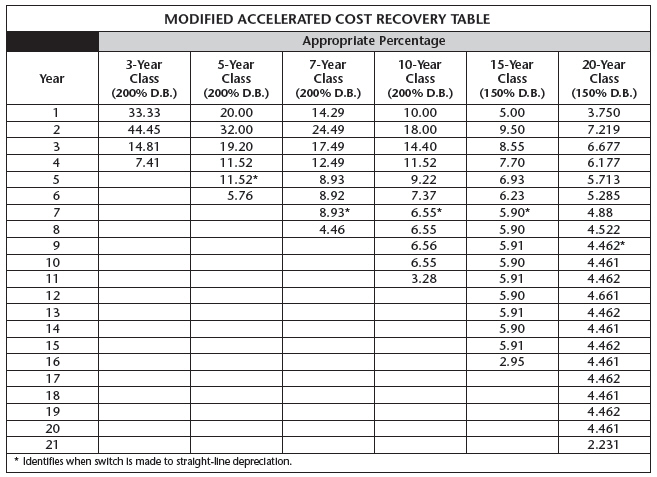

What is the fifth-year depreciation of an office desk that originally cost $1,500 and has a salvage value of $500? Use the MACRS method.

A) $44.65

B) $133.95

C) $138.30

D) $172.80

A) $44.65

B) $133.95

C) $138.30

D) $172.80

B

4

The life of a microwave is 7 years. The original cost of the microwave was $1,200 and the salvage value was $500. What is the first-year depreciation?

A) $175

B) $325

C) $700

D) $1,025

A) $175

B) $325

C) $700

D) $1,025

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

5

The life of a refrigerator is 8 years. What is the fraction to use in the annual depreciation formula for the second year?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

6

The life of an oven is 15 years. The original cost of the oven was $2,500 and the salvage value was $800. What is the depreciation amount?

A) $3,300

B) $1,700

C) $412.50

D) $212.50

A) $3,300

B) $1,700

C) $412.50

D) $212.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

7

Julie bought a boat at the beginning of the year for $35,000. The boat has an estimated life of 8 years and a salvage value of $14,000 at the end of the 8-year period. What is the book value after the first year?

A) $32,375

B) $29,750

C) $21,000

D) $2,625

A) $32,375

B) $29,750

C) $21,000

D) $2,625

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is the second-year depreciation of a rent-to-own property that originally cost $250,000 and has a salvage value of $25,000? Use the MACRS method.

A) $3,702.50

B) $11,112.50

C) $37,025

D) $111,125

A) $3,702.50

B) $11,112.50

C) $37,025

D) $111,125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

9

When adding all annual depreciation, the total should not equal the original cost of the item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is the sixth-year depreciation of a farm building that originally cost $30,000 and has a salvage value of $10,000? Use the MACRS method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

11

The original cost of a truck was $24,000 with an estimated life of 10 years. What is the end-of-year book value?

A) $4,800

B) $9,600

C) $14,400

D) $19,200

A) $4,800

B) $9,600

C) $14,400

D) $19,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

12

What is the third-year depreciation of a copier that originally cost $3,800? Use the MACRS method.

A) $224.58

B) $437.76

C) $729.60

D) $1,216

A) $224.58

B) $437.76

C) $729.60

D) $1,216

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

13

The original cost of a wave runner was $8,000 with an estimated life of 5 years. What is the first-year depreciation?

A) $3,200

B) $1,600

C) $800

D) $400

A) $3,200

B) $1,600

C) $800

D) $400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

14

The original cost of a car was $23,000 with an estimated life of 10 years. What is the annual double-declining-balance rate?

A) 5%

B) 10%

C) 20%

D) 40%

A) 5%

B) 10%

C) 20%

D) 40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

15

The original cost of a motorcycle was $18,000. The estimated life of the motorcycle is 8 years. What is the straight-line rate?

A) 5.6%

B) 12.5%

C) 180%

D) 225%

A) 5.6%

B) 12.5%

C) 180%

D) 225%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

16

The salvage value is deducted when calculating the double-declining-balance method of depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

17

Full Depreciation is the total amount of depreciation used from the date the asset was purchased to the present date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

18

The depreciable amount is always equal to the cost of the asset minus salvage value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

19

A relative cell reference is used in Excel formulas to indicate to Excel that it must return to the same cell to find part of a formula.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

20

The double-declining-balance method of depreciation requires that you double the straight-line rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

21

James bought a wave runner at the beginning of the year for $7,500. The wave runner has an estimated life of 4 years and a salvage value of $2,000 at the end of the 4-year period. What is the book value after the first year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

22

If the asset is bought during the year, depreciation is taken on the number of _________ remaining in that year. If the asset is purchased before the _________ of a month, the full month is taken. If it is purchased after the 15th, __________ depreciation for that month is taken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

23

The original cost of a car was $32,000 with an estimated life of 8 years. What is the first-year depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

24

Tammy purchased an office building for a company that originally cost $200,000 and has a salvage value of $20,000? What depreciation class is used? Use the MACRS method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

25

The life of a dishwasher is 6 years. The original cost of the dishwasher was $4,000 and the salvage value was $1,000. What is the first-year depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

26

The life of a car is 5 years. The original cost of the car was $25,000 and the salvage value was $5,000. What is the second-year depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

27

Jed bought a truck at the beginning of the year for $18,750. The truck has an estimated life of 6 years and a salvage value of $4,500 at the end of the 6-year period. What is the depreciation using the straight-line method?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Modified Accelerated Cost Recovery System (MACRS) applies to depreciation for all assets put into service after ___________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

29

The rate of depreciation is obtained by dividing the estimated life in years into _________ and multiplying by __________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

30

What is the third-year depreciation of a natural gas distribution line that originally cost $45,000 and has a salvage value of $12,000? Use the MACRS method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

31

The life of a toaster oven is 8 years. The original cost of the toaster oven was $200 and the salvage value was $75. What is the third-year depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

32

The original cost of a jet ski was $12,000 with an estimated life of 4 years. What is the second-year accumulated depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

33

Stephanie purchased a pickup truck that cost $22,400 and has a salvage value of $3,000. Stephanie plans to use the truck 80% for business purposes and 20% for personal use. What is the fourth-year depreciation? Use the MACRS method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

34

What depreciation class is used for the purchase of a barge? Use the MACRS method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

35

Paul purchased a mobile home that originally cost $185,000 and has a salvage value of $42,000? What depreciation class is used? Use the MACRS method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

36

The life of a semitruck is 11 years. The original cost of the semitruck was $35,000 and the salvage value was $17,000. What is the second-year depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

37

The original cost of a Jeep was $35,000 with an estimated life of 5 years. What is the end-of-year book value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

38

Dawn bought a van at the beginning of the year for $24,000. The van has an estimated life of 8 years and a salvage value of $5,500 at the end of the 8-year period. What is the depreciation using the straight-line method?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

39

The life of a Jeep is 12 years. What is the fraction to use in the Annual Depreciation formula for the fifth year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

40

The original cost of a dirt bike was $9,000 with an estimated life of 10 years. What is the end-of-year book value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

41

Miguel bought a boat at the beginning of the year for $48,000. The boat has an estimated life of 16 years and a salvage value of $19,000 at the end of the 16-year period. What is the book value after the first year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

42

The life of an SUV is 7 years. The original cost of the SUV was $40,000 and the salvage value was $12,000. What is the fourth-year depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

43

The depreciation schedule for a school bus is created in Excel. The cost of the asset is in Cell C4, the salvage value is in Cell C5, the length of service is in Cell C6, and the annual double-declining-balance rate is in Cell C7. Column A contains the year, Column B contains the depreciable amount, Column C contains the double-declining-balance rate, Column D contains the annual depreciation, Column E contains the accumulated depreciation, and Column F contains the end-of-year book value. Using the double-declining-balance method of depreciation, what formula should be keyed into Cell C10 to calculate the first-year end-of-year book value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

44

The depreciation schedule for a piece of office equipment is created in Excel. The cost of the asset is in Cell C4, the salvage value is in Cell C5, the length of service is in Cell C6, and the depreciable base is in Cell C7. Using the straight-line method of depreciation, what formula should be keyed into Cell C8 to calculate Annual depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

45

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

46

Lani bought a car at the beginning of the year for $28,000. The van has an estimated life of 10 years and a salvage value of $8,000 at the end of the 10-year period. What is the book value after the first year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

47

The original cost of a van was $26,000 with an estimated life of 12 years. What is the first-year depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

48

The original cost of a bus was $50,000 with an estimated life of 20 years. What is the second-year depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

49

The depreciation schedule for office furniture is created in Excel. The cost of the asset is in Cell C4, the life of the asset is in Cell C5. Column A contains the year, Column B contains the rate percent, Column C contains the cost basis, Column D contains the annual depreciation, Column E contains the accumulated depreciation, and Column F contains the end-of-year book value. Using the modified accelerated cost recovery system of depreciation, what formula should be keyed into Cell E9 to calculate the second-year accumulated depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

50

Steven purchased a safe for his office that cost $3,800 and has a salvage value of $1,000. Steven plans to use the safe 95% for business purposes and 5% for personal use. What is the second-year depreciation? Use the MACRS method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

51

The depreciation schedule for a copier/printer is created in Excel. The cost of the asset is in Cell C4, the salvage value is in Cell C5, the length of service is in Cell C6, the depreciable amount is in Cell C7, and the sum of the years digits is in Cell C8. Column A contains the year, Column B contains the depreciable amount, Column C contains the fraction for the years remaining, Column D contains the annual depreciation, Column E contains the accumulated depreciation, and Column F contains the end-of-year book value. Using the sum of the year's digits method of depreciation, what formula should be keyed into Cell D11 to calculate the first-year annual depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

52

The life of a garbage disposal is 9 years. The original cost of the garbage disposal was $2,000 and the salvage value was $750. What is the third-year depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck