Deck 6: Variable Costing for Management Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

الفرضيات:

Treats fixed manufacturing cost as a period cost.

Treats fixed manufacturing cost as a period cost.

Treats fixed manufacturing cost as a period cost.

Treats fixed selling cost as a period cost.

Treats fixed selling cost as a period cost.

Treats fixed selling cost as a period cost.

Required by generally accepted accounting principles.

Required by generally accepted accounting principles.

Required by generally accepted accounting principles.

الردود:

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/153

العب

ملء الشاشة (f)

Deck 6: Variable Costing for Management Analysis

1

On the variable costing income statement, deduction of the variable cost of goods sold from sales yields gross profit.

False

2

On the variable costing income statement, variable selling and administrative expenses are deducted from manufacturing margin to yield contribution margin.

True

3

Under absorption costing, the cost of finished goods includes only direct materials, direct labor, and variable factory overhead.

False

4

The absorption costing income statement does not distinguish between variable and fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

5

Fixed factory overhead costs are included as part of the cost of products manufactured under the absorption costing concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

6

Variable costing is also known as direct costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

7

In the absorption costing income statement, deduction of the cost of goods sold from sales yields net profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

8

In the absorption costing income statement, deduction of the cost of goods sold from sales yields gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

9

On the variable costing income statement, all of the fixed costs are deducted from the contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

10

The factory superintendent's salary would be included as part of the cost of products manufactured under the absorption costing concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

11

In determining cost of goods sold, two alternate costing concepts can be used: direct costing and variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

12

In variable costing, the cost of products manufactured is composed of only those manufacturing costs that increase or decrease as the volume of production rises or falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

13

In the absorption costing income statement, deduction of the cost of goods sold from sales yields contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

14

The taxes on the factory superintendent's salary would be included as part of the cost of products manufactured under the variable costing concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

15

Electricity purchased to operate factory machinery would be included as part of the cost of products manufactured under the absorption costing concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

16

Under absorption costing, the cost of finished goods includes direct materials, direct labor, and all factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

17

In variable costing, fixed costs do not become part of the cost of goods manufactured, but are considered an expense of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

18

On the variable costing income statement, deduction of the variable cost of goods sold from sales yields manufacturing margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

19

In determining cost of goods sold, two alternate costing concepts can be used: absorption costing and variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

20

Property taxes on a factory building would be included as part of the cost of products manufactured under the absorption costing concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

21

For a period during which the quantity of product manufactured equals the quantity sold, income from operations reported under absorption costing will equal the income from operations reported under variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

22

On the variable costing income statement, variable costs are deducted from contribution margin to yield manufacturing margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

23

For an accounting period during which the quantity of inventory at the end was smaller than the quantity at the beginning, income from operations reported under variable costing will be larger than income from operations reported under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

24

For a period during which the quantity of product manufactured exceeded the quantity sold, income from operations reported under absorption costing will be larger than income from operations reported under variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

25

For a period during which the quantity of product manufactured was less than the quantity sold, income from operations reported under absorption costing will be larger than income from operations reported under variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

26

For a period during which the quantity of inventory at the end was smaller than that at the beginning, income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

27

For a period during which the quantity of product manufactured was less than the quantity sold, income from operations reported under absorption costing will be smaller than income from operations reported under variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

28

Under absorption costing, which of the following costs would not be included in finished goods inventory?

A) hourly wages of assembly worker

B) straight-line depreciation on factory equipment

C) overtime wages paid to factory workers

D) the salaries for salespeople

A) hourly wages of assembly worker

B) straight-line depreciation on factory equipment

C) overtime wages paid to factory workers

D) the salaries for salespeople

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

29

For a period during which the quantity of inventory at the end equals the inventory at the beginning, income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

30

Another name for variable costing is:

A) indirect costing

B) process costing

C) direct costing

D) differential costing

A) indirect costing

B) process costing

C) direct costing

D) differential costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

31

What term is commonly used to describe the concept whereby the cost of manufactured products is composed of direct materials cost, direct labor cost, and variable factory overhead cost?

A) Absorption costing

B) Differential costing

C) Standard costing

D) Variable costing

A) Absorption costing

B) Differential costing

C) Standard costing

D) Variable costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

32

The contribution margin and the manufacturing margin are usually equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

33

What term is commonly used to describe the concept whereby the cost of manufactured products is composed of direct materials cost, direct labor cost, and all factory overhead cost?

A) Standard costing

B) Variable costing

C) Absorption costing

D) Marginal costing

A) Standard costing

B) Variable costing

C) Absorption costing

D) Marginal costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

34

For a period during which the quantity of inventory at the end was larger than that at the beginning, income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

35

For a period during which the quantity of product manufactured equals the quantity sold, income from operations reported under absorption costing will be smaller than the income from operations reported under variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

36

For a period during which the quantity of product manufactured exceeded the quantity sold, income from operations reported under absorption costing will be smaller than income from operations reported under variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

37

For a period during which the quantity of inventory at the end equals the inventory at the beginning, income from operations reported under variable costing will equal income from operations reported under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

38

Under absorption costing, which of the following costs would not be included in finished goods inventory?

A) direct labor cost

B) direct materials cost

C) variable and fixed factory overhead cost

D) variable and fixed selling and administrative expenses

A) direct labor cost

B) direct materials cost

C) variable and fixed factory overhead cost

D) variable and fixed selling and administrative expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

39

For a period during which the quantity of inventory at the end was larger than that at the beginning, income from operations reported under variable costing will be larger than income from operations reported under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

40

On the variable costing income statement, the amounts representing the difference between the contribution margin and income from operations is the fixed manufacturing costs and fixed selling and administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements is correct using the direct costing concept?

A) All manufacturing costs are included in the calculation of cost of goods manufactured.

B) Only fixed costs are included in the calculation of cost of goods manufactured while variable costs are considered period costs.

C) Only variable manufacturing costs are included in the calculation of cost of goods manufactured while fixed costs are considered period costs.

D) All manufacturing costs are considered period costs.

A) All manufacturing costs are included in the calculation of cost of goods manufactured.

B) Only fixed costs are included in the calculation of cost of goods manufactured while variable costs are considered period costs.

C) Only variable manufacturing costs are included in the calculation of cost of goods manufactured while fixed costs are considered period costs.

D) All manufacturing costs are considered period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

42

Fixed costs are $50 per unit and variable costs are $125 per unit. Production was 130,000 units, while sales were 125,000 units. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption costing income from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

43

Under variable costing, which of the following costs would not be included in finished goods inventory?

A) wages of machine operator

B) steel costs for a machine tool manufacturer

C) salary of factory supervisor

D) electricity used by factory machinery

A) wages of machine operator

B) steel costs for a machine tool manufacturer

C) salary of factory supervisor

D) electricity used by factory machinery

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

44

Under variable costing, which of the following costs would be included in finished goods inventory?

A) salary of salesperson

B) salary of vice-president of finance

C) wages of carpenters in a furniture factory

D) straight-line depreciation on factory equipment

A) salary of salesperson

B) salary of vice-president of finance

C) wages of carpenters in a furniture factory

D) straight-line depreciation on factory equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

45

In the variable costing income statement, deduction of variable selling and administrative expenses from manufacturing margin yields:

A) differential margin

B) contribution margin

C) gross profit

D) marginal expenses

A) differential margin

B) contribution margin

C) gross profit

D) marginal expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

46

On the variable costing income statement, the figure representing the difference between manufacturing margin and contribution margin is the:

A) fixed manufacturing costs

B) variable cost of goods sold

C) fixed selling and administrative expenses

D) variable selling and administrative expenses

A) fixed manufacturing costs

B) variable cost of goods sold

C) fixed selling and administrative expenses

D) variable selling and administrative expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

47

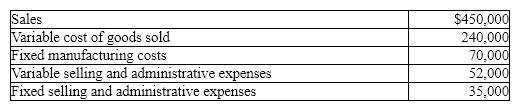

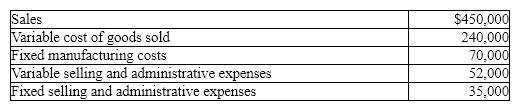

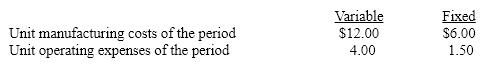

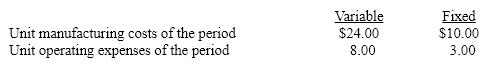

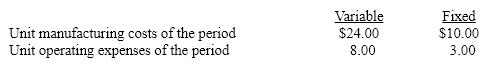

Philadelphia Company has the following information for March:

Determine the March

(a) manufacturing margin

(b) contribution margin

(c) income from operations for Philadelphia Company.

Determine the March

(a) manufacturing margin

(b) contribution margin

(c) income from operations for Philadelphia Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

48

The amount of income under absorption costing will be more than the amount of income under variable costing when units manufactured:

A) exceed units sold

B) equal units sold

C) are less than units sold

D) are equal to or greater than units sold

A) exceed units sold

B) equal units sold

C) are less than units sold

D) are equal to or greater than units sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

49

Under variable costing, which of the following costs would not be included in finished goods inventory?

A) direct labor cost

B) direct materials cost

C) variable factory overhead cost

D) fixed factory overhead cost

A) direct labor cost

B) direct materials cost

C) variable factory overhead cost

D) fixed factory overhead cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following would be included in the cost of a product manufactured according to variable costing?

A) sales commissions

B) office supply costs

C) interest expense

D) direct materials

A) sales commissions

B) office supply costs

C) interest expense

D) direct materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

51

Fixed costs are $10 per unit and variable costs are $25 per unit. Production was 13,000 units, while sales were 12,000 units. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption costing income from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

52

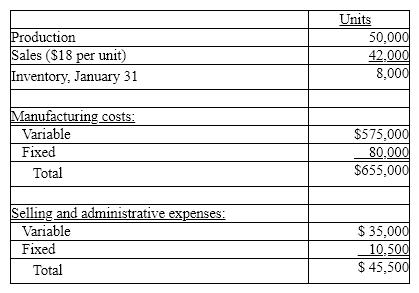

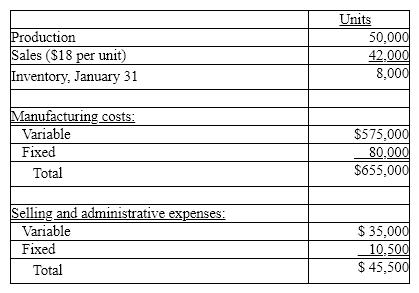

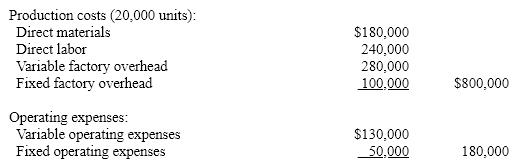

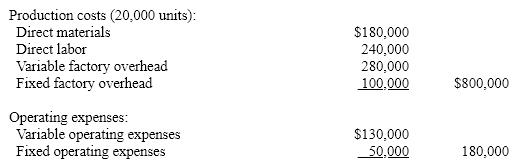

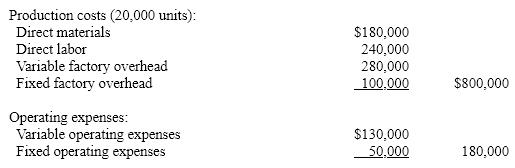

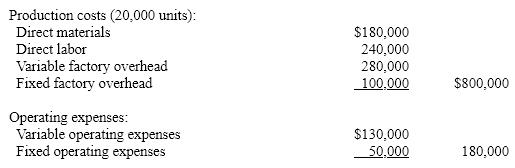

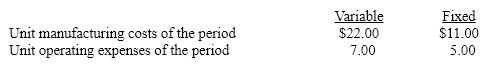

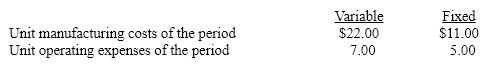

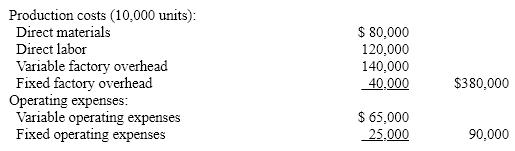

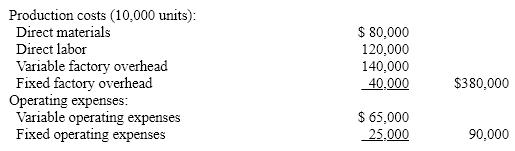

On January 1 of the current year, Townsend Co. commenced operations. It operated its plant at 100% of capacity during January. The following data summarized the results for January:

(a) Prepare an income statement using absorption costing.

(b) Prepare an income statement using variable costing.

(a) Prepare an income statement using absorption costing.

(b) Prepare an income statement using variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

53

The beginning inventory is 5,000 units. All of the units manufactured during the period and 3,000 units of the beginning inventory were sold. The beginning inventory fixed costs are $25 per unit, and variable costs are $55 per unit. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption income from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

54

The amount of income under absorption costing will equal the amount of income under variable costing when units manufactured:

A) exceed units sold

B) equal units sold

C) are less than units sold

D) are equal to or greater than units sold

A) exceed units sold

B) equal units sold

C) are less than units sold

D) are equal to or greater than units sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

55

Under variable costing, which of the following costs would be included in finished goods inventory?

A) neither variable nor fixed factory overhead cost

B) both variable and fixed factory overhead cost

C) only variable factory overhead cost

D) only fixed factory overhead cost

A) neither variable nor fixed factory overhead cost

B) both variable and fixed factory overhead cost

C) only variable factory overhead cost

D) only fixed factory overhead cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following would be included in the cost of a product manufactured according to absorption costing?

A) advertising expense

B) sales salaries

C) depreciation expense on factory building

D) office supplies costs

A) advertising expense

B) sales salaries

C) depreciation expense on factory building

D) office supplies costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

57

At EOM Inc., the beginning inventory is 20,000 units. All of the units manufactured during the period and 16,000 units of the beginning inventory were sold. The beginning inventory fixed costs are $50 per unit, and variable costs are $300 per unit. Determine (a) whether variable costing income from operations is less than or greater than absorption costing income from operations, and (b) the difference in variable costing and absorption income from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

58

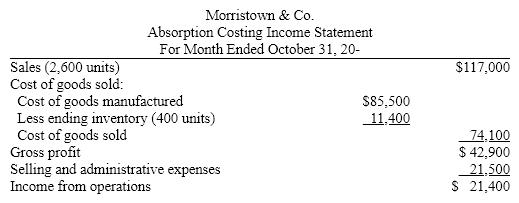

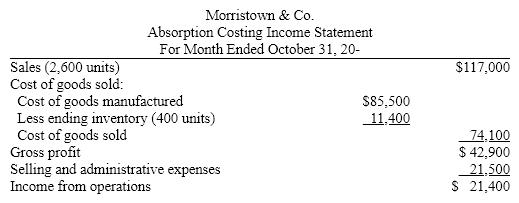

On October 31, the end of the first month of operations, Morristown & Co. prepared the following income statement based on absorption costing:

If the fixed manufacturing costs were $42,900 and the variable selling and administrative expenses were $14,600, prepare an income statement using variable costing.

If the fixed manufacturing costs were $42,900 and the variable selling and administrative expenses were $14,600, prepare an income statement using variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

59

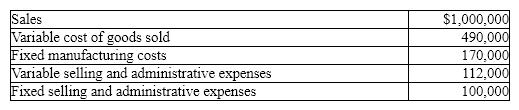

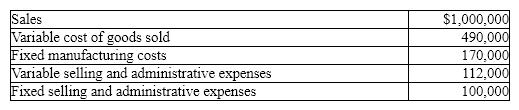

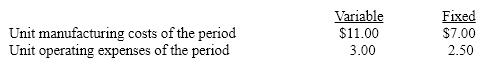

Tony's Company has the following information for March:

Determine the March

(a) manufacturing margin

(b) contribution margin

(c) income from operations for Tony's Company.

Determine the March

(a) manufacturing margin

(b) contribution margin

(c) income from operations for Tony's Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

60

The amount of income under absorption costing will be less than the amount of income under variable costing when units manufactured:

A) exceed units sold

B) equal units sold

C) are less than units sold

D) are equal to or greater than units sold

A) exceed units sold

B) equal units sold

C) are less than units sold

D) are equal to or greater than units sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

61

Match between columns

الفرضيات:

Treats fixed manufacturing cost as a period cost.

Treats fixed manufacturing cost as a period cost.

Treats fixed manufacturing cost as a period cost.

Treats fixed selling cost as a period cost.

Treats fixed selling cost as a period cost.

Treats fixed selling cost as a period cost.

Required by generally accepted accounting principles.

Required by generally accepted accounting principles.

Required by generally accepted accounting principles.

الردود:

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

Both absorption and variable costing

Absorption costing only

Variable costing only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

62

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,600 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

If 1,600 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

A) $64,000

B) $56,000

C) $66,400

D) $78,400

If 1,600 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

If 1,600 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?A) $64,000

B) $56,000

C) $66,400

D) $78,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

63

In which of the following types of firms would it be appropriate to prepare contribution margin reporting and analysis?

A) boat manufacturing

B) a chain of beauty salons

C) home building

D) all of the above

A) boat manufacturing

B) a chain of beauty salons

C) home building

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following causes the difference between the planned and actual contribution margin?

A) an increase or decrease in the amount of sales

B) an increase in the amount of variable costs and expenses

C) a decrease in the amount of variable costs and expenses

D) all of the above

A) an increase or decrease in the amount of sales

B) an increase in the amount of variable costs and expenses

C) a decrease in the amount of variable costs and expenses

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

65

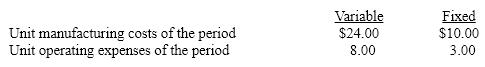

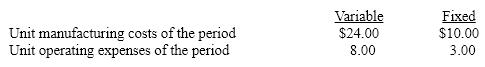

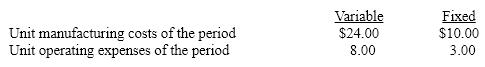

The level of inventory of a manufactured product has increased by 8,000 units during a period. The following data are also available:  What would be the effect on income from operations if variable costing is used rather than absorption costing?

What would be the effect on income from operations if variable costing is used rather than absorption costing?

A) $80,000 decrease

B) $80,000 increase

C) $104,000 decrease

D) $104,000 increase

What would be the effect on income from operations if variable costing is used rather than absorption costing?

What would be the effect on income from operations if variable costing is used rather than absorption costing?A) $80,000 decrease

B) $80,000 increase

C) $104,000 decrease

D) $104,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

66

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,500 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

If 1,500 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

A) $62,500

B) $73,500

C) $60,000

D) $52,500

If 1,500 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

If 1,500 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?A) $62,500

B) $73,500

C) $60,000

D) $52,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

67

Service firms can only have one activity base for analyzing changes in costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

68

Under absorption costing, the amount of income reported from operations can be increased by producing more units than are sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

69

Changes in the quantity of finished goods inventory, caused by differences in the levels of sales and production, directly affect the amount of income from operations reported under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

70

If the variable selling and administrative expenses totaled $120,000 for the year (80,000 units at $1.50 each) and the planned variable selling and administrative expenses totaled $136,500 (78,000 units at $1.75 each), the effect of the unit cost factor on the change in contribution margin is:

A) $19,500 decrease

B) $19,500 increase

C) $20,000 decrease

D) $20,000 increase

A) $19,500 decrease

B) $19,500 increase

C) $20,000 decrease

D) $20,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

71

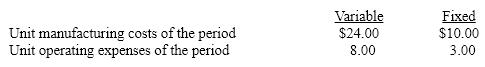

The level of inventory of a manufactured product has increased by 4,000 units during a period. The following data are also available:  What would be the effect on income from operations if absorption costing is used rather than variable costing?

What would be the effect on income from operations if absorption costing is used rather than variable costing?

A) $44,000 decrease

B) $44,000 increase

C) $64,000 increase

D) $64,000 decrease

What would be the effect on income from operations if absorption costing is used rather than variable costing?

What would be the effect on income from operations if absorption costing is used rather than variable costing?A) $44,000 decrease

B) $44,000 increase

C) $64,000 increase

D) $64,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

72

Under absorption costing, increases or decreases in income from operations due to changes in inventory levels could be misinterpreted to be the result of operating efficiencies or inefficiencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

73

The level of inventory of a manufactured product has increased by 7,000 units during a period. The following data are also available:  What would be the effect on income from operations if absorption costing is used rather than variable costing?

What would be the effect on income from operations if absorption costing is used rather than variable costing?

A) $42,000 decrease

B) $42,000 increase

C) $52,500 increase

D) $52,500 decrease

What would be the effect on income from operations if absorption costing is used rather than variable costing?

What would be the effect on income from operations if absorption costing is used rather than variable costing?A) $42,000 decrease

B) $42,000 increase

C) $52,500 increase

D) $52,500 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

74

S&P Enterprises sold 10,000 units of inventory during a given period. The level of inventory of the manufactured product remained unchanged. The manufacturing costs were as follows:  Which of the following statements is true?

Which of the following statements is true?

A) Net income will be the same under both variable and absorption costing.

B) Net income under variable costing will be $45,000 less than net income under absorption costing.

C) Net income under absorption costing will be $40,000 more than under variable costing.

D) The difference in net income cannot be determined.

Which of the following statements is true?

Which of the following statements is true?A) Net income will be the same under both variable and absorption costing.

B) Net income under variable costing will be $45,000 less than net income under absorption costing.

C) Net income under absorption costing will be $40,000 more than under variable costing.

D) The difference in net income cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

75

The level of inventory of a manufactured product has increased by 5,000 units during a period. The following data are also available:  What would be the effect on income from operations if variable costing is used rather than absorption costing?

What would be the effect on income from operations if variable costing is used rather than absorption costing?

A) $50,000 decrease

B) $50,000 increase

C) $65,000 increase

D) $65,000 decrease

What would be the effect on income from operations if variable costing is used rather than absorption costing?

What would be the effect on income from operations if variable costing is used rather than absorption costing?A) $50,000 decrease

B) $50,000 increase

C) $65,000 increase

D) $65,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

76

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,000 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the absorption costing balance sheet?

If 1,000 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the absorption costing balance sheet?

A) $38,000

B) $40,500

C) $34,000

D) $47,000

If 1,000 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the absorption costing balance sheet?

If 1,000 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the absorption costing balance sheet?A) $38,000

B) $40,500

C) $34,000

D) $47,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

77

The level of inventory of a manufactured product has increased by 8,000 units during a period. The following data are also available:  What would be the effect on income from operations if absorption costing is used rather than variable costing?

What would be the effect on income from operations if absorption costing is used rather than variable costing?

A) $80,000 decrease

B) $80,000 increase

C) $104,000 increase

D) $104,000 decrease

What would be the effect on income from operations if absorption costing is used rather than variable costing?

What would be the effect on income from operations if absorption costing is used rather than variable costing?A) $80,000 decrease

B) $80,000 increase

C) $104,000 increase

D) $104,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

78

In a service firm, it may be necessary to have several activity bases to properly match the change in costs with the changes in various activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

79

If the variable cost of goods sold totaled $80,000 for the year (16,000 units at $5.00 each) and the planned variable cost of goods sold totaled $86,250 (15,000 units at $5.75 each), the effect of the quantity factor on the change in contribution margin is:

A) $5,000 decrease

B) $5,000 increase

C) $5,750 increase

D) $5,750 decrease

A) $5,000 decrease

B) $5,000 increase

C) $5,750 increase

D) $5,750 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

80

If sales totaled $800,000 for the year (80,000 units at $10.00 each) and the planned sales totaled $799,500 (78,000 units at $10.25 each), the effect of the quantity factor on the change in sales is:

A) $20,500 increase

B) $20,000 decrease

C) $20,500 decrease

D) $20,000 increase

A) $20,500 increase

B) $20,000 decrease

C) $20,500 decrease

D) $20,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck