Deck 9: Capital Structure and Investment Ratios

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/10

العب

ملء الشاشة (f)

Deck 9: Capital Structure and Investment Ratios

1

If Sybil Ltd issues shares with a £1 nominal value, for £2 per share, then the gearing proportion and the acid test ratio will be affected as follows:

A) Gearing will increase and the acid test ratio will reduce.

B) Gearing will reduce and the acid test ratio will reduce.

C) Gearing will reduce and the acid test ratio will increase.

D) Gearing will increase and the acid test ratio will increase.

A) Gearing will increase and the acid test ratio will reduce.

B) Gearing will reduce and the acid test ratio will reduce.

C) Gearing will reduce and the acid test ratio will increase.

D) Gearing will increase and the acid test ratio will increase.

C

2

Which of the following is not true?

A) Earnings per share measures the profit made per ordinary share.

B) Dividend yield measures the actual return that shareholders are receiving on their shares.

C) The price to earnings ratio compares the market price of a share to the dividends per share.

D) Dividend cover measures the extent to which profits cover dividend payments.

A) Earnings per share measures the profit made per ordinary share.

B) Dividend yield measures the actual return that shareholders are receiving on their shares.

C) The price to earnings ratio compares the market price of a share to the dividends per share.

D) Dividend cover measures the extent to which profits cover dividend payments.

C

3

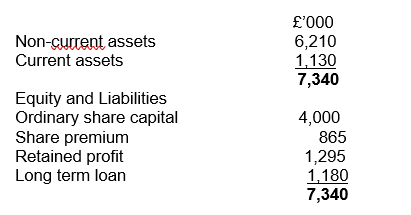

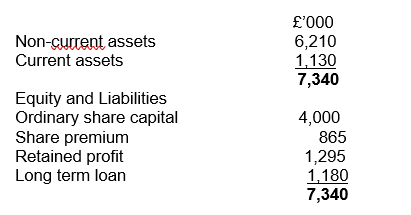

An extract from Alan plc's Statement of financial position as at 30 September 2024 is given below:

The gearing proportion at 30 September 2024 was:

The gearing proportion at 30 September 2024 was:

A) 50.8%.

B) 16.1%.

C) 24.2%.

D) 19.2%.

The gearing proportion at 30 September 2024 was:

The gearing proportion at 30 September 2024 was:A) 50.8%.

B) 16.1%.

C) 24.2%.

D) 19.2%.

B

4

Howard plc has a gearing proportion of 30% at 30 September 2024. Which of the following statements is NOT TRUE?

A) An ordinary share issue will reduce the gearing proportion.

B) Taking out a short-term loan issue will increase the gearing proportion.

C) Repayment of a long-term loan will reduce the gearing proportion.

D) Repayment of a short-term loan will reduce the gearing proportion.

A) An ordinary share issue will reduce the gearing proportion.

B) Taking out a short-term loan issue will increase the gearing proportion.

C) Repayment of a long-term loan will reduce the gearing proportion.

D) Repayment of a short-term loan will reduce the gearing proportion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

5

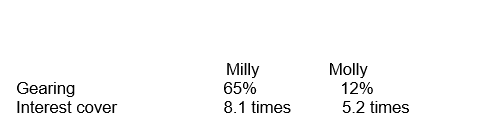

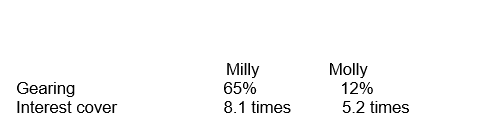

Two competitor companies, Milly Ltd and Molly Ltd, have the following ratios at 31 December :

Which of the following statements are true?

Which of the following statements are true?

A) Milly's capital structure is less risky than Molly but can cover its interest obligations more easily.

B) Milly's capital structure is less risky than Molly and it is less able to cover its interest obligations.

C) Milly's capital structure is more risky than Molly and it is less able to cover its interest obligations.

D) Milly's capital structure is more risky than Molly's but can cover its interest obligations more easily.

Which of the following statements are true?

Which of the following statements are true?A) Milly's capital structure is less risky than Molly but can cover its interest obligations more easily.

B) Milly's capital structure is less risky than Molly and it is less able to cover its interest obligations.

C) Milly's capital structure is more risky than Molly and it is less able to cover its interest obligations.

D) Milly's capital structure is more risky than Molly's but can cover its interest obligations more easily.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

6

Graham plc has the following information for the year to 30 June:

Profit for the year : £4.2 m

Ordinary dividend paid : £1.8 m

Number of ordinary shares : 18 m

Market price at 30 June : £2.90

Calculate the earnings per share for Graham Plc as at 30 June.

A) 10 pence

B) £2.33

C) 13.3 pence

D) 23.3 pence

Profit for the year : £4.2 m

Ordinary dividend paid : £1.8 m

Number of ordinary shares : 18 m

Market price at 30 June : £2.90

Calculate the earnings per share for Graham Plc as at 30 June.

A) 10 pence

B) £2.33

C) 13.3 pence

D) 23.3 pence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

7

Graham plc has the following information for the year to 30 June:

Profit for the year : £4.2m

Ordinary dividend paid : £1.8m

Number of ordinary shares : 18m

Market price at 30 June : £2.90

Calculate price to earnings for Graham Plc as at 30 June.

A) 1 time

B) 12 times

C) 22 times

D) 29 times

Profit for the year : £4.2m

Ordinary dividend paid : £1.8m

Number of ordinary shares : 18m

Market price at 30 June : £2.90

Calculate price to earnings for Graham Plc as at 30 June.

A) 1 time

B) 12 times

C) 22 times

D) 29 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

8

Graham plc has the following information for the year to 30 June:

Profit for the year : £4.2m

Ordinary dividend paid : £1.8m

Number of ordinary shares: 18m

Market price at 30 June : £2.90

Calculate the dividend yield for Graham plc.

A) 3.4%

B) 10%

C) 62%

D) 29%

Profit for the year : £4.2m

Ordinary dividend paid : £1.8m

Number of ordinary shares: 18m

Market price at 30 June : £2.90

Calculate the dividend yield for Graham plc.

A) 3.4%

B) 10%

C) 62%

D) 29%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

9

Graham plc has the following information for the year to 30 June:

Profit for the year : £4.2m

Ordinary dividend paid : £1.8m

Number of ordinary shares : 18m

Market price at 30 June : £2.90

Calculate the dividend cover for Graham plc.

A) 0.42 times

B) 2.3 times

C) 10 times

D) 1.33 times

Profit for the year : £4.2m

Ordinary dividend paid : £1.8m

Number of ordinary shares : 18m

Market price at 30 June : £2.90

Calculate the dividend cover for Graham plc.

A) 0.42 times

B) 2.3 times

C) 10 times

D) 1.33 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

10

Shareholders' funds in a company are made up of:

A) Share capital plus all of the reserves.

B) Share capital plus all of the reserves plus long-term loans.

C) Share capital only.

D) Share capital plus share premium.

A) Share capital plus all of the reserves.

B) Share capital plus all of the reserves plus long-term loans.

C) Share capital only.

D) Share capital plus share premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck