Deck 2: Introduction to the Statement of Profit or Loss

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/10

العب

ملء الشاشة (f)

Deck 2: Introduction to the Statement of Profit or Loss

1

Kate sells candles at £5 each and each one costs her £2. During June she bought 300 candles and sold 220 candles. Her expenses amounted to £130 for the month. Kate's profit for June was:

A) £930.

B) £660.

C) £770.

D) £530.

A) £930.

B) £660.

C) £770.

D) £530.

D

2

Which of the following statements regarding trade receivables is NOT true?

A) Trade receivables owe money to the business.

B) Trade receivables have supplied goods to the business.

C) Trade receivables are customers of the business who owe for the goods they have received.

D) Trade receivables are treated as current assets.

A) Trade receivables owe money to the business.

B) Trade receivables have supplied goods to the business.

C) Trade receivables are customers of the business who owe for the goods they have received.

D) Trade receivables are treated as current assets.

B

3

Shirley has made the following predictions for her business for the first six months of trading to 30 June:

Sales in Jan, Feb and March = £30,000 per month.

Sales in Apr, May and June = £45,000 per month.

Sales will be on one month's credit.

The trade receivables figure as of 30 June will be:

A) £NIL

B) £30,000.

C) £45,000.

D) £90,000.

Sales in Jan, Feb and March = £30,000 per month.

Sales in Apr, May and June = £45,000 per month.

Sales will be on one month's credit.

The trade receivables figure as of 30 June will be:

A) £NIL

B) £30,000.

C) £45,000.

D) £90,000.

C

4

Which of the following payments is capital expenditure?

A) Money put into the business by the owner.

B) Purchase of a motor van.

C) Cost of servicing the motor van.

D) Cost of hiring a motor van.

A) Money put into the business by the owner.

B) Purchase of a motor van.

C) Cost of servicing the motor van.

D) Cost of hiring a motor van.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is not a revenue expense?

A) Drawings

B) Rent and rates.

C) Salaries.

D) Advertising.

A) Drawings

B) Rent and rates.

C) Salaries.

D) Advertising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is prepared to determine a business's net profit or net loss for the year?

A) A trial balance.

B) A statement of financial position.

C) A statement of cash flows.

D) A statement of profit or loss.

A) A trial balance.

B) A statement of financial position.

C) A statement of cash flows.

D) A statement of profit or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

7

During the year ended 31 December, the business made sales of £35,000 and purchases of £20,000. Inventory at the beginning of the year was valued at £6,000 and, at 31 December, inventory was valued at £3,500. The gross profit for the year was:

A) £17,500.

B) £24,500.

C) £12,500.

D) £5,500.

A) £17,500.

B) £24,500.

C) £12,500.

D) £5,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

8

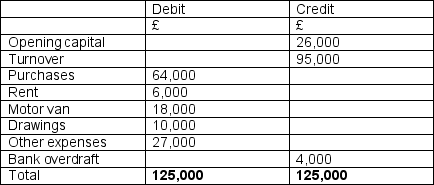

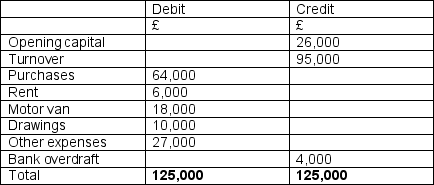

Ben started trading on 1 January. His trial balance at 31 December, the end of his first year of trading is given below.

If the closing inventory at 31 December was £5,000 and depreciation is to be ignored, which one of the following is true?

If the closing inventory at 31 December was £5,000 and depreciation is to be ignored, which one of the following is true?

A) The gross profit will be £31,500 and the net profit will be £25,000.

B) The gross profit will be £36,000 and the net profit will be £9,000.

C) The gross profit will be £31,000 and the net profit will be £3,000.

D) The gross profit will be £36,000 and the net profit will be £3,000.

If the closing inventory at 31 December was £5,000 and depreciation is to be ignored, which one of the following is true?

If the closing inventory at 31 December was £5,000 and depreciation is to be ignored, which one of the following is true?A) The gross profit will be £31,500 and the net profit will be £25,000.

B) The gross profit will be £36,000 and the net profit will be £9,000.

C) The gross profit will be £31,000 and the net profit will be £3,000.

D) The gross profit will be £36,000 and the net profit will be £3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

9

If the purchase of shop fitting for £25,000 is included in the cost of sales, then:

A) Gross profit ONLY will be understated by £25,000.

B) Gross profit ONLY will be overstated by £25,000.

C) Net profit ONLY will be understated by £25,000.

D) Both gross profit and net profit will be understated by £25,000.

A) Gross profit ONLY will be understated by £25,000.

B) Gross profit ONLY will be overstated by £25,000.

C) Net profit ONLY will be understated by £25,000.

D) Both gross profit and net profit will be understated by £25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck

10

In accounting what is meant by the term 'purchases'?

A) All items bought.

B) All good purchased and paid for.

C) All good bought for re-sale.

D) All goods held in inventory.

A) All items bought.

B) All good purchased and paid for.

C) All good bought for re-sale.

D) All goods held in inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 10 في هذه المجموعة.

فتح الحزمة

k this deck