Deck 10: Depreciation: Having Your Cake and Eating It Too

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/2

العب

ملء الشاشة (f)

Deck 10: Depreciation: Having Your Cake and Eating It Too

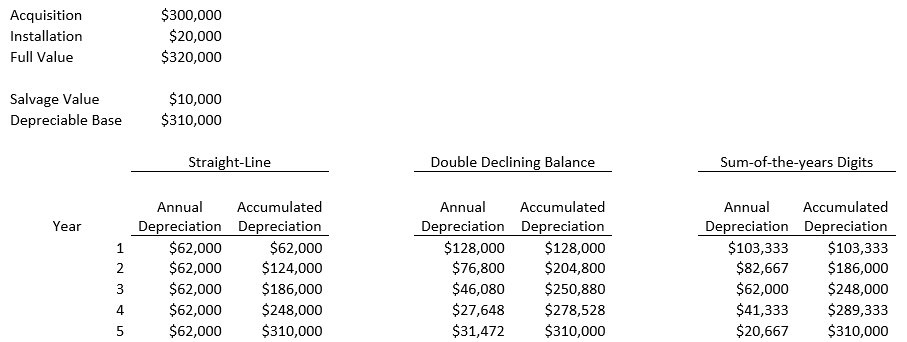

Healthy Practices Hospital purchases $300,000 of testing equipment that has a useful life of 5 years. The hospital also pays $20,000 to install the equipment and make it usable. The hospital also expects that after 5 years, it can sell the equipment for $10,000. Calculate the five years of depreciation using straight line, double declining balance, and sum-of-the-years digits.

Explain why we depreciate assets over their useful lives instead of just expensing them in the year they are acquired?

The matching principle requires it because the asset allows the organization to generate revenues over many years. Depreciation spreads out the acquisition cost and allows revenues and expenses to be appropriately matched throughout the life of the asset.