Deck 7: Taxation: An Economic Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/99

العب

ملء الشاشة (f)

Deck 7: Taxation: An Economic Analysis

1

_____ provide protection against the risk of hardship due to conditions such as poverty and unemployment.

A) Taxes

B) Government surpluses

C) Tax deductions

D) Social insurance programs

A) Taxes

B) Government surpluses

C) Tax deductions

D) Social insurance programs

D

2

An example of a social insurance program is:

A) an income tax.

B) social security.

C) an agricultural subsidy.

D) a price ceiling.

A) an income tax.

B) social security.

C) an agricultural subsidy.

D) a price ceiling.

B

3

An example of a social insurance program is:

A) Medicare.

B) an income tax.

C) an agricultural subsidy.

D) a price ceiling.

A) Medicare.

B) an income tax.

C) an agricultural subsidy.

D) a price ceiling.

A

4

An example of a social insurance program is:

A) a price ceiling.

B) an income tax.

C) an agricultural subsidy.

D) unemployment insurance.

A) a price ceiling.

B) an income tax.

C) an agricultural subsidy.

D) unemployment insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

5

A branch of economics that studies how governments spend and raise money is:

A) social economics.

B) public finance.

C) public accounting.

D) social accounting.

A) social economics.

B) public finance.

C) public accounting.

D) social accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

6

Another name for payroll taxes is _____ taxes.

A) income

B) sales

C) property

D) social insurance

A) income

B) sales

C) property

D) social insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

7

Taxes on personal and household income are ______ taxes.

A) income

B) sales

C) property

D) social insurance

A) income

B) sales

C) property

D) social insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

8

The largest category of spending for state and local governments is:

A) defense.

B) education.

C) welfare.

D) pensions.

A) defense.

B) education.

C) welfare.

D) pensions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

9

The largest two categories of spending for the federal government is:

A) defense and education.

B) education and healthcare.

C) healthcare and pensions.

D) pensions and defense.

A) defense and education.

B) education and healthcare.

C) healthcare and pensions.

D) pensions and defense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

10

FICA stands for the:

A) Federal Insurance Contributions Act.

B) Federal Insurance Combinations Action.

C) Family Insurance Contributions Act.

D) Family Insurance Combinations Action.

A) Federal Insurance Contributions Act.

B) Federal Insurance Combinations Action.

C) Family Insurance Contributions Act.

D) Family Insurance Combinations Action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

11

The federal government receives most of its revenues from the _____ tax.

A) property

B) sales

C) personal income

D) corporate income

A) property

B) sales

C) personal income

D) corporate income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

12

Taxes on the value of a motor vehicle are called _____ taxes.

A) property

B) sales

C) personal income

D) corporate

A) property

B) sales

C) personal income

D) corporate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

13

Taxes on the sale of goods expressed as a percentage of the selling price are called _____ taxes.

A) property

B) sales

C) personal income

D) corporate

A) property

B) sales

C) personal income

D) corporate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

14

The value-added tax (VAT), which is assessed primarily in Europe, is a type of national _____ tax.

A) property

B) sales

C) personal income

D) corporate

A) property

B) sales

C) personal income

D) corporate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

15

In a fiscal year when the government spends more than net tax revenue, the government is facing a:

A) budget surplus.

B) budget deficit.

C) government shutdown.

D) national debt crisis.

A) budget surplus.

B) budget deficit.

C) government shutdown.

D) national debt crisis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

16

In a fiscal year when government spends less than net tax revenue, the government is facing a:

A) budget surplus.

B) budget deficit.

C) government shutdown.

D) national debt crisis.

A) budget surplus.

B) budget deficit.

C) government shutdown.

D) national debt crisis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

17

In a fiscal year when the government spends more than it receives in tax revenues, the government is facing a:

A) budget surplus.

B) budget deficit.

C) government shutdown.

D) decreasing national debt.

A) budget surplus.

B) budget deficit.

C) government shutdown.

D) decreasing national debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

18

In a fiscal year when the government spends less than it receives in tax revenues, the government is facing a:

A) budget surplus.

B) budget deficit.

C) government shutdown.

D) national debt increase.

A) budget surplus.

B) budget deficit.

C) government shutdown.

D) national debt increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

19

The total stock of debt accumulated by the federal government over the years is called:

A) a budget surplus.

B) a budget deficit.

C) the amount covered by gold.

D) the national debt.

A) a budget surplus.

B) a budget deficit.

C) the amount covered by gold.

D) the national debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

20

A tax levied on a specific good or service is called:

A) a property tax.

B) an excise tax.

C) a VAT tax.

D) a tax incidence.

A) a property tax.

B) an excise tax.

C) a VAT tax.

D) a tax incidence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

21

A measure of who bears the economic burden of a tax after prices have adjusted is known as:

A) a property tax.

B) an excise tax.

C) a VAT tax.

D) a tax incidence.

A) a property tax.

B) an excise tax.

C) a VAT tax.

D) a tax incidence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

22

The _____ is the tax per unit, expressed as an exact dollar amount or percentage of sales price or income.

A) property tax

B) tax rate

C) VAT tax

D) tax incidence

A) property tax

B) tax rate

C) VAT tax

D) tax incidence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

23

Juan is one of several vendors selling beach umbrellas at the beach. The city places an excise tax on the sellers of beach umbrellas. As a result, the _____ of beach umbrellas _____

A) supply; increases.

B) supply; decreases.

C) demand; increases.

D) demand; decreases.

A) supply; increases.

B) supply; decreases.

C) demand; increases.

D) demand; decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

24

_____ occurs when the price that consumers pay exceeds the amount that producers receive.

A) A tax incidence

B) A tax wedge

C) A VAT tax

D) An excise

A) A tax incidence

B) A tax wedge

C) A VAT tax

D) An excise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

25

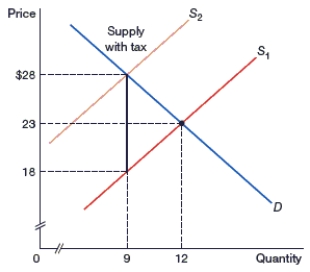

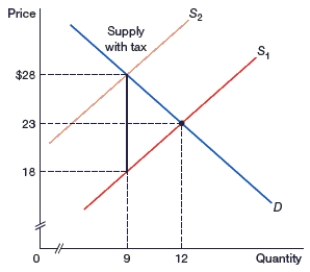

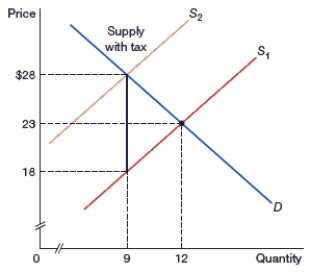

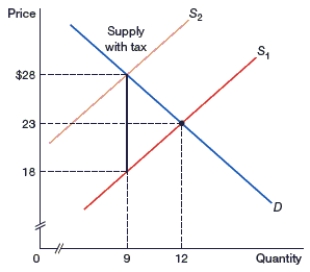

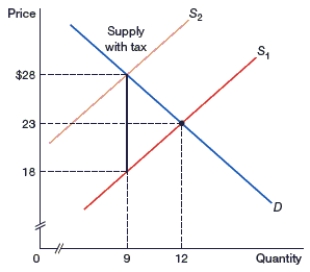

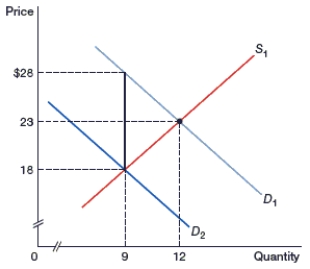

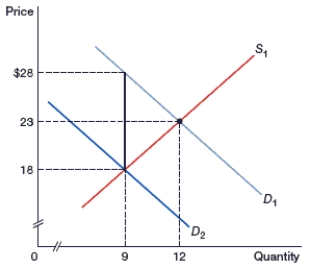

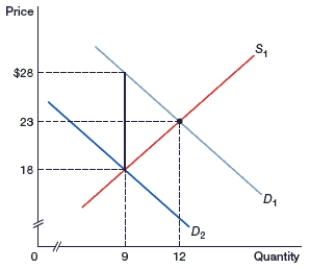

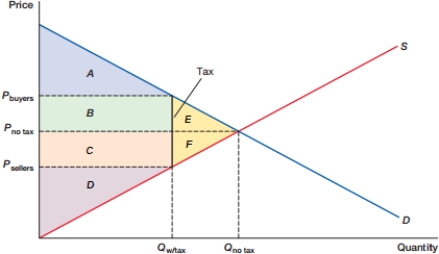

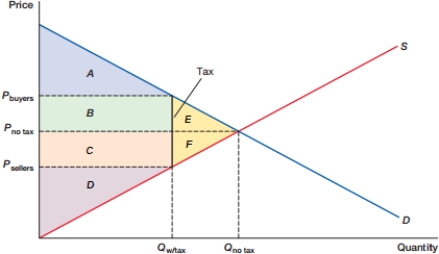

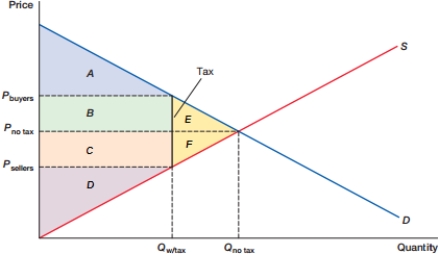

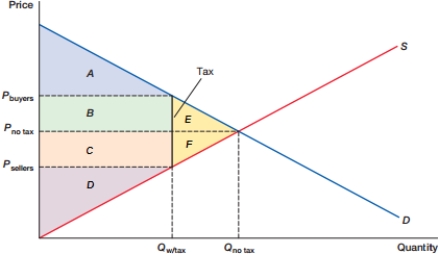

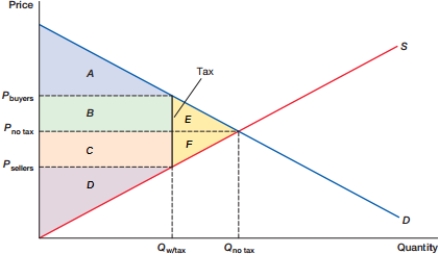

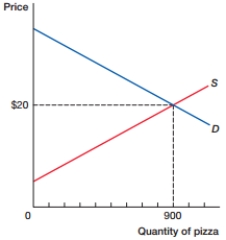

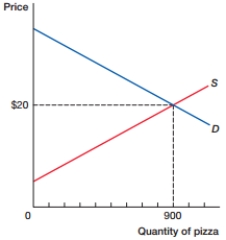

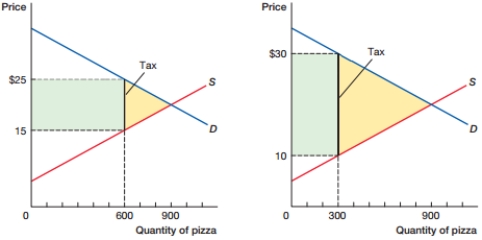

(Figure: An Excise Tax on Sellers) In the figure, what is the equilibrium quantity before the tax is applied?

A) 0

B) 9

C) 12

D) 21

A) 0

B) 9

C) 12

D) 21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

26

(Figure: An Excise Tax on Sellers) In the figure, what is the equilibrium price before the tax is applied?

A) 0

B) $18

C) $23

D) $28

A) 0

B) $18

C) $23

D) $28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

27

(Figure: An Excise Tax on Sellers) In the figure, what is the equilibrium quantity after the tax is applied?

A) 0

B) 9

C) 12

D) 21

A) 0

B) 9

C) 12

D) 21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

28

(Figure: An Excise Tax on Sellers) In the figure, what is the equilibrium price after the tax is applied?

A) 0

B) $18

C) $23

D) $28

A) 0

B) $18

C) $23

D) $28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

29

(Figure: An Excise Tax on Sellers) In the figure, what is the quantity demanded before the tax is applied?

A) 0

B) 9

C) 12

D) 21

A) 0

B) 9

C) 12

D) 21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

30

(Figure: An Excise Tax on Sellers) In the figure, what is the quantity demanded after the tax is applied?

A) 0

B) 9

C) 12

D) 21

A) 0

B) 9

C) 12

D) 21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

31

(Figure: An Excise Tax on Sellers) In the figure, what is the amount of the tax wedge?

A) $5

B) $10

C) $18

D) $23

A) $5

B) $10

C) $18

D) $23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

32

(Figure: An Excise Tax on Sellers) In the figure, what is the amount of tax revenue collected by the government?

A) $10

B) $28

C) $90

D) $120

A) $10

B) $28

C) $90

D) $120

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

33

(Figure: An Excise Tax on Sellers) In the figure, what is the amount that sellers receive after the tax is applied?

A) $5

B) $18

C) $23

D) $28

A) $5

B) $18

C) $23

D) $28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

34

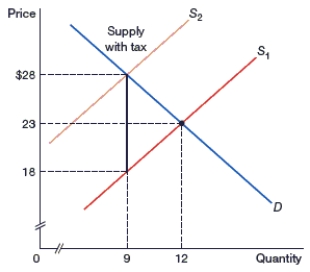

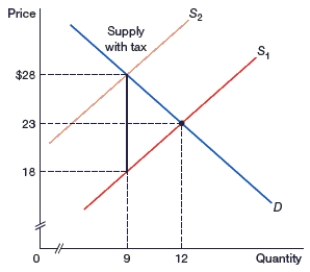

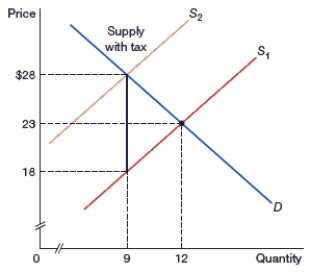

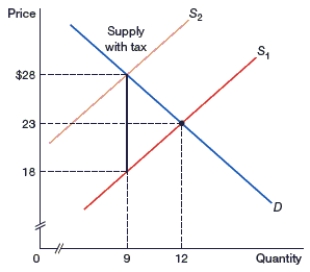

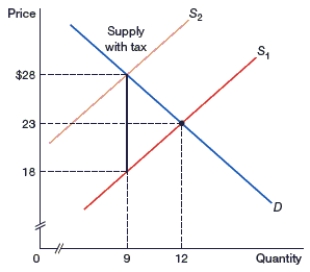

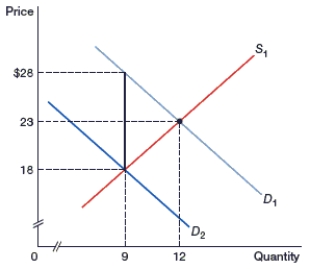

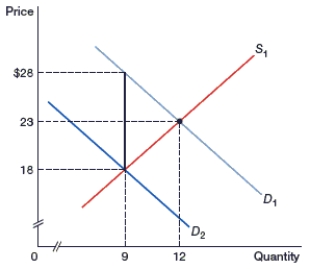

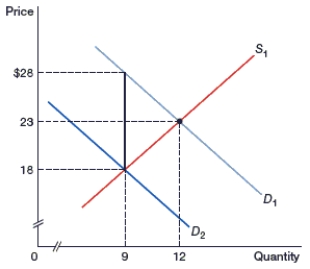

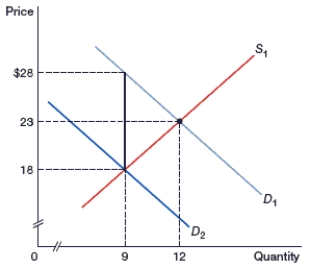

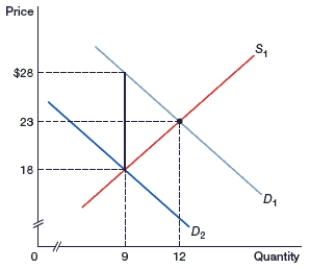

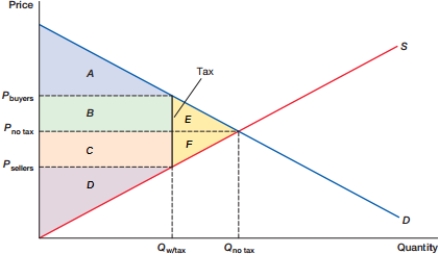

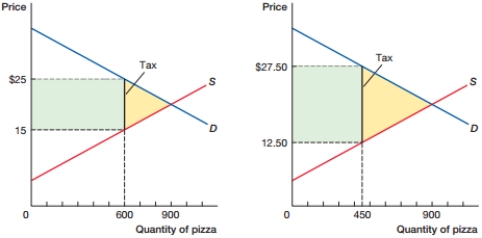

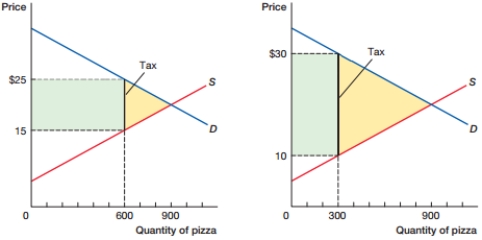

(Figure: An Excise Tax on Buyers) In the figure, what is the equilibrium price before the tax is applied?

A) $5

B) $18

C) $23

D) $28

A) $5

B) $18

C) $23

D) $28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

35

(Figure: An Excise Tax on Buyers) In the figure, what is the quantity demanded before the tax is applied?

A) 0

B) 9

C) 12

D) 21

A) 0

B) 9

C) 12

D) 21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

36

(Figure: An Excise Tax on Buyers) In the figure, what is the equilibrium quantity after the tax is applied?

A) 0

B) 9

C) 12

D) 21

A) 0

B) 9

C) 12

D) 21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

37

(Figure: An Excise Tax on Buyers) In the figure, what is the price that the buyer pays after the tax is applied?

A) $0

B) $18

C) $23

D) $28

A) $0

B) $18

C) $23

D) $28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

38

(Figure: An Excise Tax on Buyers) In the figure, what is the amount of the tax wedge?

A) $5

B) $10

C) $18

D) $23

A) $5

B) $10

C) $18

D) $23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

39

(Figure: An Excise Tax on Buyers) In the figure, what is the amount of tax revenue collected by the government?

A) $10

B) $28

C) $90

D) $120

A) $10

B) $28

C) $90

D) $120

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

40

The deadweight loss portion of a tax is called the:

A) tax incidence.

B) tax rate.

C) tax burden.

D) excess burden.

A) tax incidence.

B) tax rate.

C) tax burden.

D) excess burden.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

41

The total incidence of a tax is called the:

A) tax incidence.

B) tax rate.

C) tax burden.

D) excess burden.

A) tax incidence.

B) tax rate.

C) tax burden.

D) excess burden.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

42

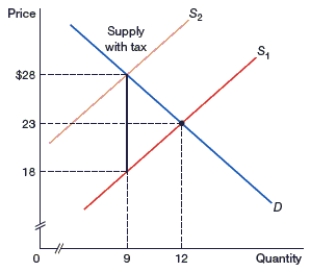

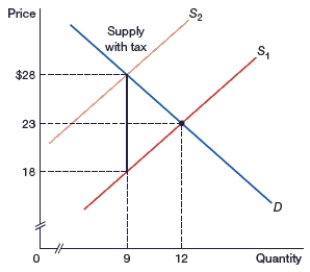

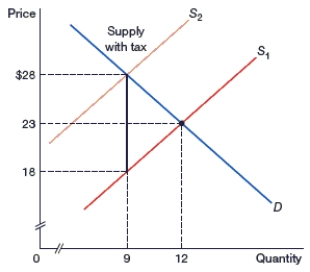

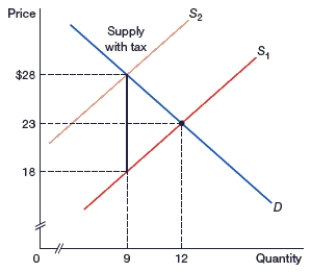

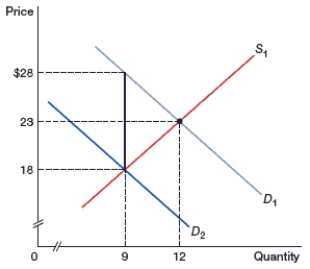

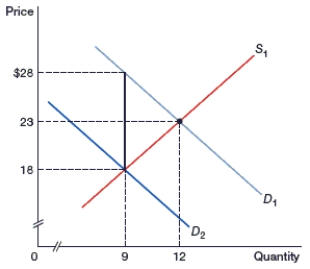

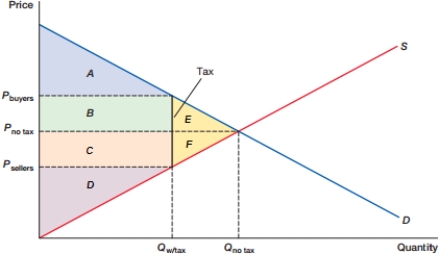

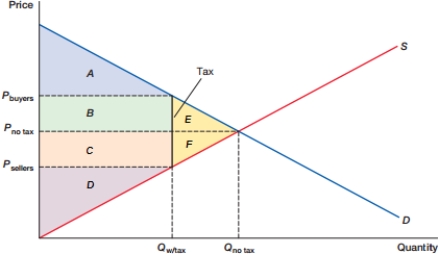

(Figure: Economic Impact of Taxation) In the figure, what area represents consumer surplus before the tax is introduced?

A) A

B) A + B

C) A + B + C

D) A + B + E

A) A

B) A + B

C) A + B + C

D) A + B + E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

43

(Figure: Economic Impact of Taxation) In the figure, what area represents consumer surplus after the tax is introduced?

A) A

B) A + B

C) A + B + C

D) A + B + E

A) A

B) A + B

C) A + B + C

D) A + B + E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

44

(Figure: Economic Impact of Taxation) In the figure, what area represents producer surplus before the tax is introduced?

A) B + C + D

B) C + D

C) C + D + F

D) D

A) B + C + D

B) C + D

C) C + D + F

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

45

(Figure: Economic Impact of Taxation) In the figure, what area represents producer surplus after the tax is introduced?

A) B + C + D

B) C + D

C) C + D + F

D) D

A) B + C + D

B) C + D

C) C + D + F

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

46

(Figure: Economic Impact of Taxation)  In the figure, what area represents the revenue the government obtains from the tax?

In the figure, what area represents the revenue the government obtains from the tax?

A) A + B

B) B + C

C) C + D

D) E + F

In the figure, what area represents the revenue the government obtains from the tax?

In the figure, what area represents the revenue the government obtains from the tax?A) A + B

B) B + C

C) C + D

D) E + F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

47

(Figure: Economic Impact of Taxation) In the figure, what area represents the deadweight loss from the tax?

A) A + B

B) B + C

C) C + D

D) E + F

A) A + B

B) B + C

C) C + D

D) E + F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

48

The goal of a sales tax is to _____ money for the government while _____ private-sector economic activity.

A) raise; discouraging

B) raise; not discouraging

C) spend; discouraging

D) spend; not discouraging

A) raise; discouraging

B) raise; not discouraging

C) spend; discouraging

D) spend; not discouraging

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

49

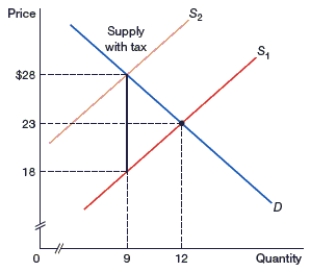

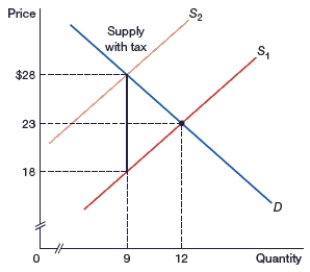

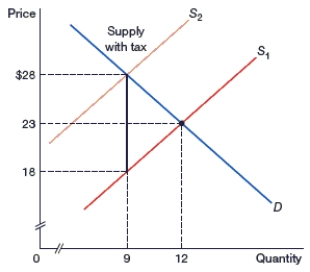

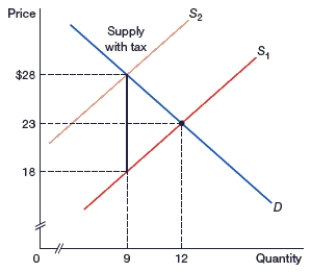

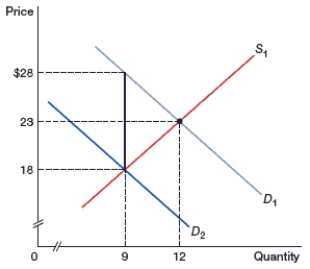

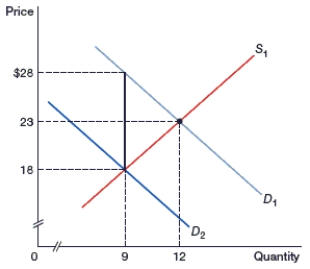

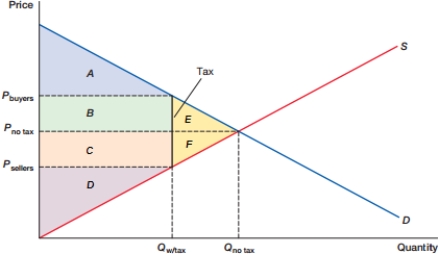

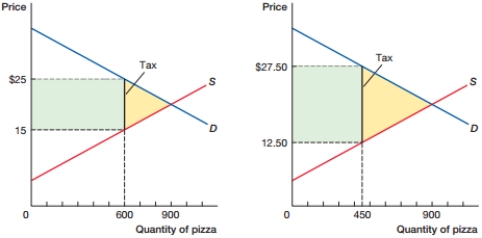

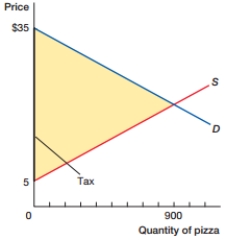

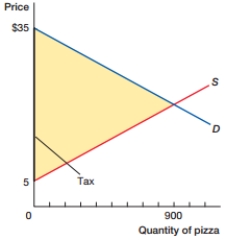

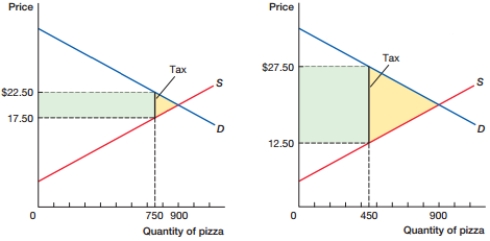

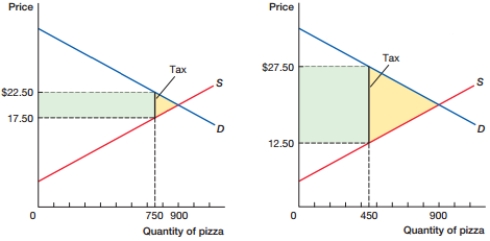

(Figure: Changing Tax Rates) The figure shows a market in equilibrium. The introduction of a tax would likely:

A) decrease tax revenue and decrease deadweight loss.

B) decrease tax revenue and increase deadweight loss.

C) increase tax revenue and decrease deadweight loss.

D) increase tax revenue and increase deadweight loss.

A) decrease tax revenue and decrease deadweight loss.

B) decrease tax revenue and increase deadweight loss.

C) increase tax revenue and decrease deadweight loss.

D) increase tax revenue and increase deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

50

(Figure: Changing Tax Rates 0) In the figure, suppose that the tax rate is changed so that the market moves from the graph on the left to the graph on the right. This change would:

A) decrease tax revenue and decrease deadweight loss.

B) decrease tax revenue and increase deadweight loss.

C) increase tax revenue and decrease deadweight loss.

D) increase tax revenue and increase deadweight loss.

A) decrease tax revenue and decrease deadweight loss.

B) decrease tax revenue and increase deadweight loss.

C) increase tax revenue and decrease deadweight loss.

D) increase tax revenue and increase deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

51

(Figure: Changing Tax Rates A) In the figure, suppose that the tax rate is changed so that the market moves from the graph on the left to the graph on the right. This change would:

A) maintain tax revenue and decrease deadweight loss.

B) maintain tax revenue and increase deadweight loss.

C) decrease tax revenue and maintain deadweight loss.

D) increase tax revenue and maintain deadweight loss.

A) maintain tax revenue and decrease deadweight loss.

B) maintain tax revenue and increase deadweight loss.

C) decrease tax revenue and maintain deadweight loss.

D) increase tax revenue and maintain deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

52

(Figure: Changing Tax Rates I) In the figure, suppose that the tax rate is decreased. This would likely:

A) decrease tax revenue and decrease deadweight loss.

B) decrease tax revenue and increase deadweight loss.

C) increase tax revenue and decrease deadweight loss.

D) increase tax revenue and increase deadweight loss.

A) decrease tax revenue and decrease deadweight loss.

B) decrease tax revenue and increase deadweight loss.

C) increase tax revenue and decrease deadweight loss.

D) increase tax revenue and increase deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

53

(Figure: Changing Tax Rates Alpha) In the figure, suppose that the tax rate is changed so that the market moves from the graph on the left to the graph on the right. This change would likely:

A) decrease tax revenue and decrease deadweight loss.

B) decrease tax revenue and increase deadweight loss.

C) increase tax revenue and decrease deadweight loss.

D) increase tax revenue and increase deadweight loss.

A) decrease tax revenue and decrease deadweight loss.

B) decrease tax revenue and increase deadweight loss.

C) increase tax revenue and decrease deadweight loss.

D) increase tax revenue and increase deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

54

In general, the burden of a tax falls on buyers when demand is _____ than supply.

A) more price inelastic

B) less price inelastic

C) more unit elastic

D) less unit elastic

A) more price inelastic

B) less price inelastic

C) more unit elastic

D) less unit elastic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

55

In general, the burden of a tax falls on sellers when supply is _____ than demand.

A) more price inelastic

B) less price inelastic

C) more unit elastic

D) less unit elastic

A) more price inelastic

B) less price inelastic

C) more unit elastic

D) less unit elastic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

56

When price elasticity of demand is _____, this tends to increase the portion of the tax paid by buyers.

A) inelastic

B) elastic

C) unit elastic

D) unchanged

A) inelastic

B) elastic

C) unit elastic

D) unchanged

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

57

When price elasticity of demand is _____, this tends to decrease the portion of the tax paid by sellers.

A) inelastic

B) elastic

C) unit elastic

D) unchanged

A) inelastic

B) elastic

C) unit elastic

D) unchanged

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

58

When price elasticity of supply is _____, this tends to increase the portion of the tax paid by sellers.

A) inelastic

B) elastic

C) unit elastic

D) unchanged

A) inelastic

B) elastic

C) unit elastic

D) unchanged

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

59

When price elasticity of supply is _____, this tends to decrease the portion of the tax paid by buyers.

A) inelastic

B) elastic

C) unit elastic

D) unchanged

A) inelastic

B) elastic

C) unit elastic

D) unchanged

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

60

The more output that is eliminated by a tax, the _____ the deadweight loss and the _____ the tax revenue collected.

A) smaller; smaller

B) smaller; greater

C) greater; smaller

D) greater; greater

A) smaller; smaller

B) smaller; greater

C) greater; smaller

D) greater; greater

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

61

When both supply and demand are price elastic, taxes tend to create _____ deadweight loss and _____ tax revenue collected than when one or both curves are inelastic.

A) smaller; less

B) larger; less

C) smaller; more

D) larger; more

A) smaller; less

B) larger; less

C) smaller; more

D) larger; more

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

62

Max's four-year-old son is in childcare while Max works. Therefore, Max can receive a tax _____ for his childcare expenses.

A) deduction

B) credit

C) loophole

D) dividend

A) deduction

B) credit

C) loophole

D) dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

63

A tax _____ is the tax rule that allows taxpayers to reduce the amount that they owe in taxes by the stated amount.

A) deduction

B) credit

C) loophole

D) dividend

A) deduction

B) credit

C) loophole

D) dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

64

A tax _____ is a tax rule that allows taxpayers to reduce their taxable income.

A) deduction

B) credit

C) loophole

D) dividend

A) deduction

B) credit

C) loophole

D) dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

65

During a fundraiser for a local children's hospital, Marvin donated $500. This donation may be considered a tax:

A) deduction.

B) credit.

C) loophole.

D) dividend.

A) deduction.

B) credit.

C) loophole.

D) dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is the average tax rate for a household that pays $10,000 in taxes on an income of $50,000?

A) 50%

B) 20%

C) 5%

D) 2%

A) 50%

B) 20%

C) 5%

D) 2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

67

What is the approximate average tax rate for a household that pays $20,000 in taxes on an income of $110,000?

A) 48%

B) 38%

C) 18%

D) 8%

A) 48%

B) 38%

C) 18%

D) 8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

68

What is the approximate average tax rate for a household that pays $25,000 in taxes on an income of $150,000?

A) 50%

B) 25%

C) 17%

D) 8%

A) 50%

B) 25%

C) 17%

D) 8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

69

What is the approximate average tax rate for a household that pays $5,000 in taxes on an income of $35,000?

A) 5%

B) 14%

C) 30%

D) 35%

A) 5%

B) 14%

C) 30%

D) 35%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

70

Tyrone has $45,000 in income. The marginal tax rates are 15% on the first $20,000 and 25% on everything above $20,000. Assuming that Tyrone has no tax deductions, how much does he pay in taxes?

A) $3,000

B) $6,000

C) $6,250

D) $9,250

A) $3,000

B) $6,000

C) $6,250

D) $9,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

71

Wendy has $32,500 in income. The marginal tax rates are 12% on the first $20,000 and 25% on everything above $20,000. Assuming that Wendy has no tax deductions, how much does she pay in taxes?

A) $3,125

B) $3,900

C) $5,525

D) $8,125

A) $3,125

B) $3,900

C) $5,525

D) $8,125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

72

Anitra has $120,000 in income. The marginal tax rates are 10% on the first $20,000, 20% on everything above $20,000 up to $60,000, and 45% on everything above $60,000. Assuming that Anitra has no tax deductions, how much does she pay in taxes?

A) $2,000

B) $8,000

C) $27,000

D) $37,000

A) $2,000

B) $8,000

C) $27,000

D) $37,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

73

A tax system where the average tax rate increases with income is a _____ system.

A) regressive

B) proportional

C) flat

D) progressive

A) regressive

B) proportional

C) flat

D) progressive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

74

A tax bracket is another name for a _____ tax rate for a specific taxpayer.

A) sales

B) regressive

C) marginal

D) proportional

A) sales

B) regressive

C) marginal

D) proportional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

75

The _____ tax principle implies that people should pay taxes in proportion to the value of what they receive in the form of government services.

A) progressive

B) ability-to-pay

C) benefits-received

D) marginal rate

A) progressive

B) ability-to-pay

C) benefits-received

D) marginal rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

76

The _____ tax principle implies that taxpayers should pay taxes in proportion to their wealth and income.

A) progressive

B) ability-to-pay

C) benefits-received

D) marginal rate

A) progressive

B) ability-to-pay

C) benefits-received

D) marginal rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

77

Toll roads are an example of which principle of taxation?

A) progressive

B) ability-to-pay

C) benefits-received

D) marginal rate

A) progressive

B) ability-to-pay

C) benefits-received

D) marginal rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

78

Edith falls and bumps her head. She calls 911 and an ambulance is sent to her location. A month later, Edith receives a bill for the ambulance services. This is an example of the _____ principle of taxation.

A) progressive

B) ability-to-pay

C) benefits-received

D) marginal rate

A) progressive

B) ability-to-pay

C) benefits-received

D) marginal rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

79

If yachts that are priced over $100,000 are taxed, which taxation principle would this most likely illustrate?

A) progressive principle

B) ability-to-pay principle

C) benefits-received principle

D) marginal rate principle

A) progressive principle

B) ability-to-pay principle

C) benefits-received principle

D) marginal rate principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

80

If luxury automobiles that are priced over $75,000 are taxed, which taxation principle would this most likely illustrate?

A) progressive principle

B) ability-to-pay principle

C) benefits-received principle

D) marginal rate principle

A) progressive principle

B) ability-to-pay principle

C) benefits-received principle

D) marginal rate principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck