Deck 7: Monetary Policy and Institutions in China and the United States

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/9

العب

ملء الشاشة (f)

Deck 7: Monetary Policy and Institutions in China and the United States

1

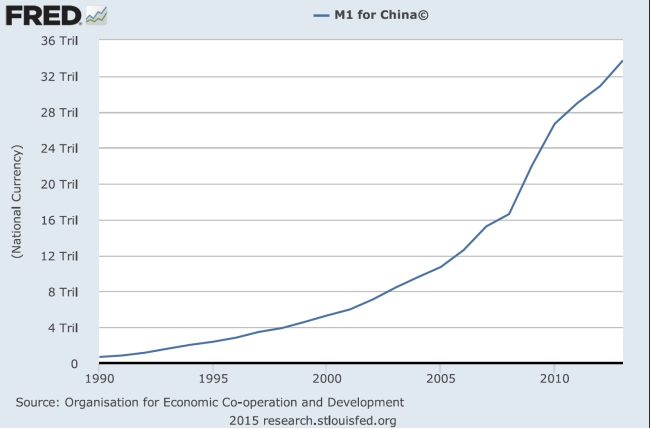

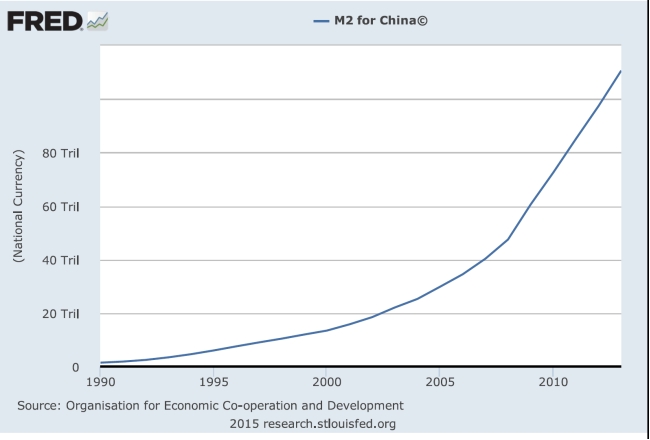

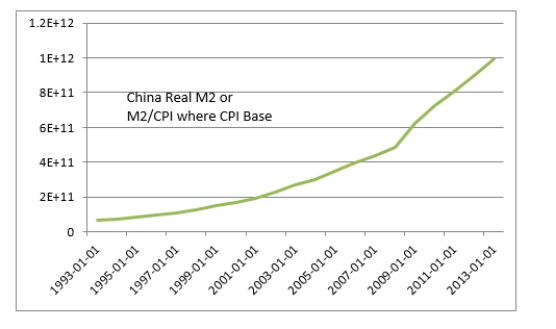

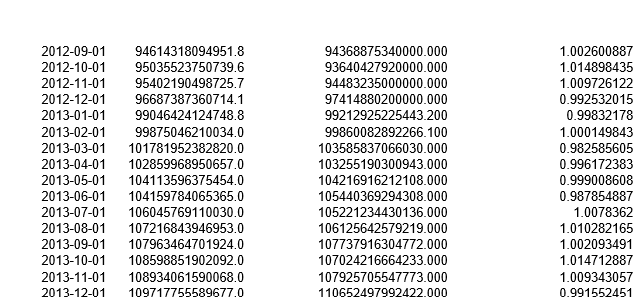

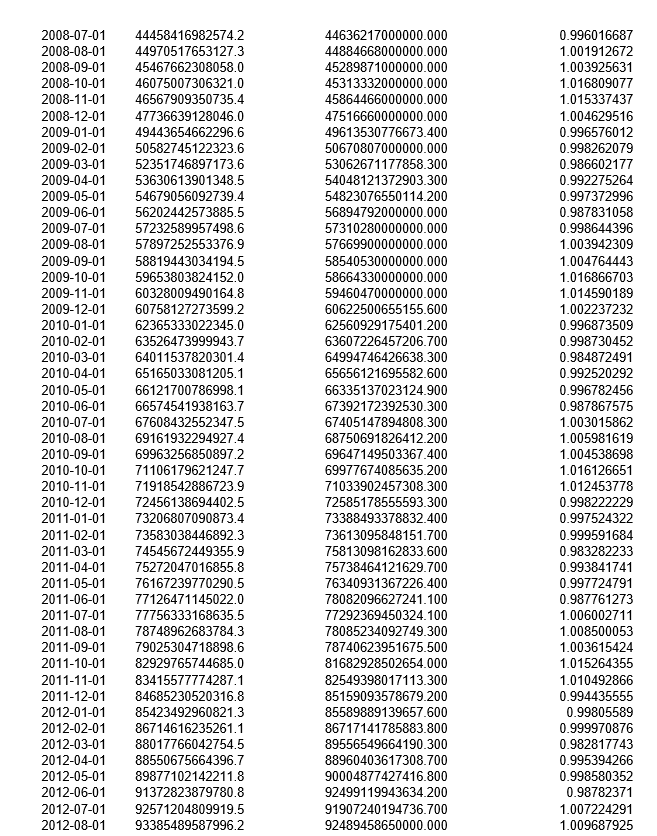

Go to FRED (the Federal Reserve Economic Database) and provide three different charts depicting China's money supply, with at least one in terms of China's real money supply.

Or in real terms monetary growth has been about 14 percent per year over the past twenty years. This is higher than real GDP growth over the same period, suggesting some long-run inflationary pressure.

2

Explain China's relatively large holdings of M1 in terms of the transactions motive, precautionary motive, or holding of wealth motive. In terms of excess money holdings (relative to the United States), which factor appears more important?

China tends to consume less of its GDP than say the United States, so on that basis at least we would expect the transactions motive to be less important for China. That suggests that the precautionary motive (being liquid in case of urgent needs or opportunities) and the store of wealth motive are likely culprits for the relatively high holdings of M2. The latter is particularly acute, since Chinese citizens have so few other ways of holding their wealth.

3

Using the Walras relationship, explain the impact of an excess supply of money on other asset prices (the prices of other ways of holding wealth) in China. Be specific about which assets you are referring to.

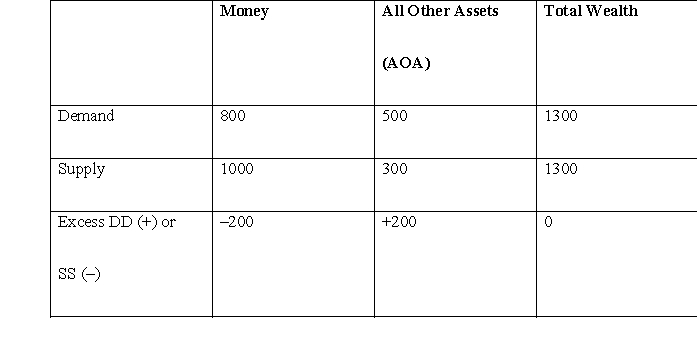

Consider the following table with two assets: Money and All Other Assets (e.g., real estate, stocks and bonds).

Consider the following table with two assets: Money and All Other Assets (e.g., real estate, stocks and bonds).

Excess Supply of Money yields an excess DD in some other market-in China that has been the asset market (as opposed to consumer goods market) leading to pressure on prices to rise of AOA, specifically stock prices and real estate prices and maybe even the price of luxury watches.

4

Suppose new ways of holding wealth start to appear in China (as in the case of Taobao and other Internet bankers offering high-yielding money market funds).

a. Explain the impact on bank deposits (sight deposits, for example) as Chinese citizens learn of these opportunities.

b. Is the arrival of this alternative a good or bad thing? What might be the impact on the prices in equity or real estate markets?

c. Why might China's Banking Regulatory Commission (CBRC) cast a wary (regulatory) eye toward such new asset classes?

a. Explain the impact on bank deposits (sight deposits, for example) as Chinese citizens learn of these opportunities.

b. Is the arrival of this alternative a good or bad thing? What might be the impact on the prices in equity or real estate markets?

c. Why might China's Banking Regulatory Commission (CBRC) cast a wary (regulatory) eye toward such new asset classes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

5

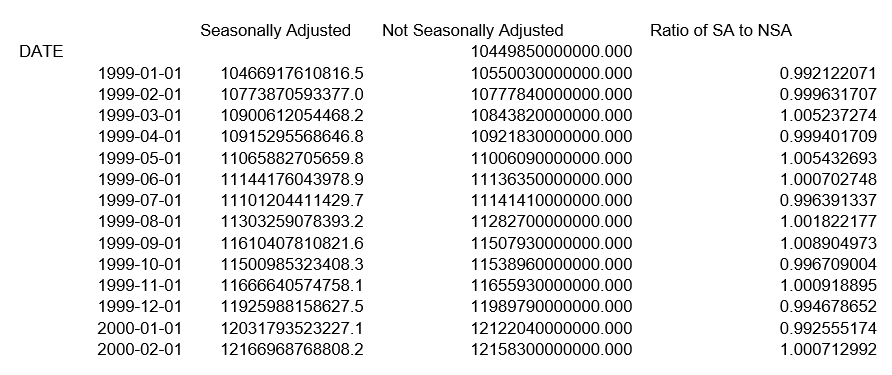

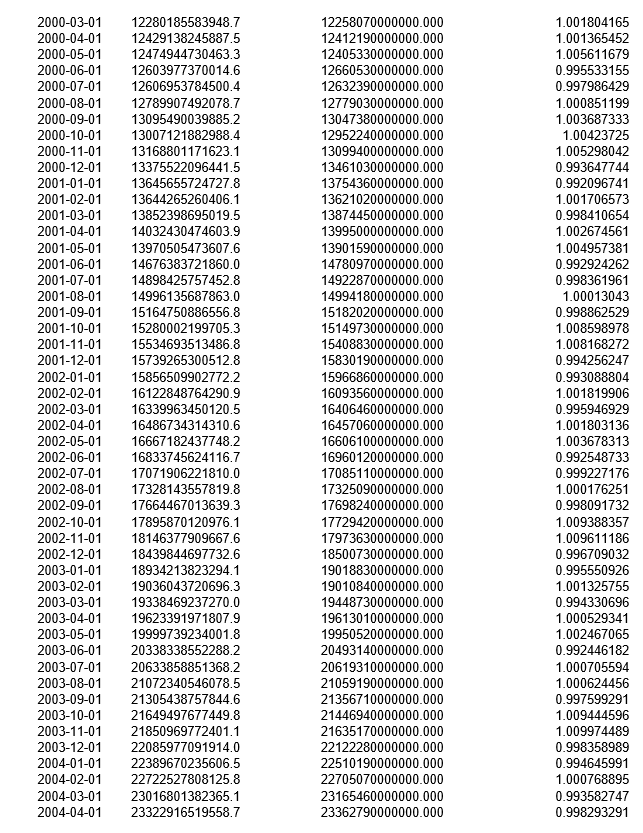

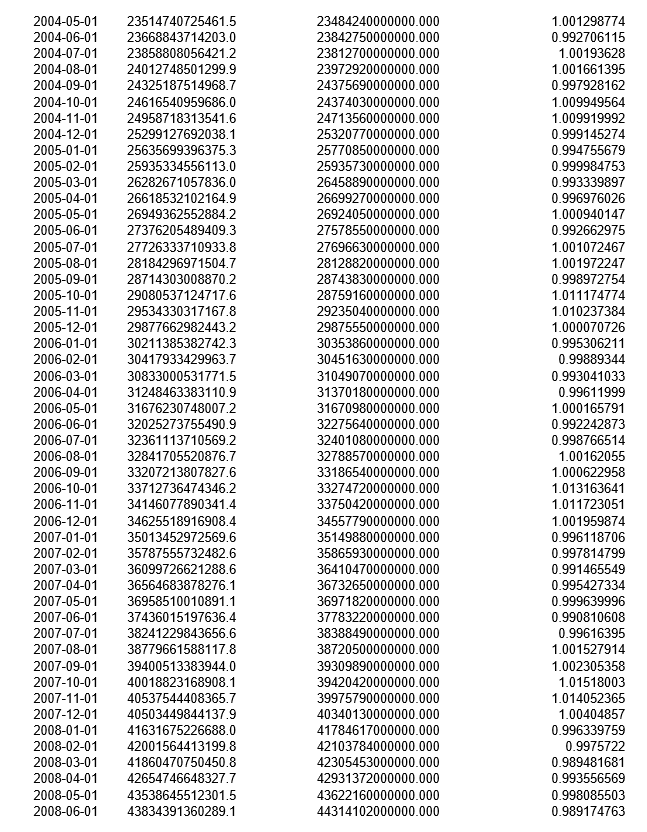

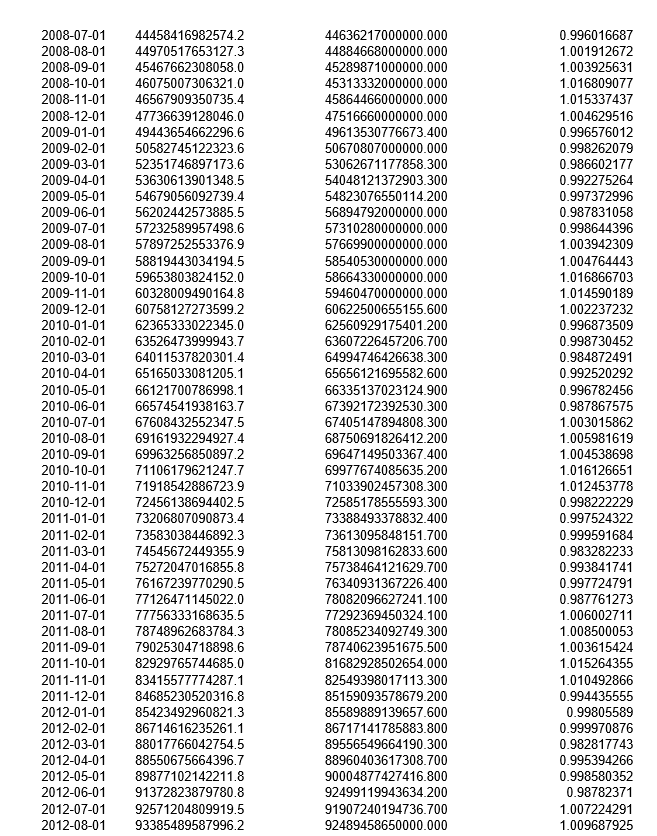

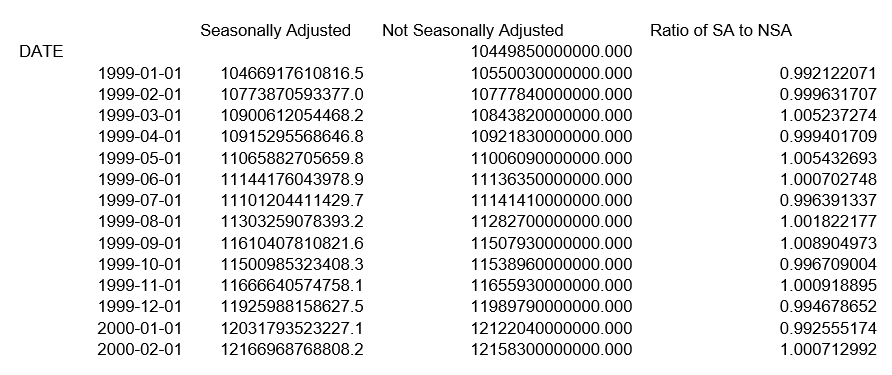

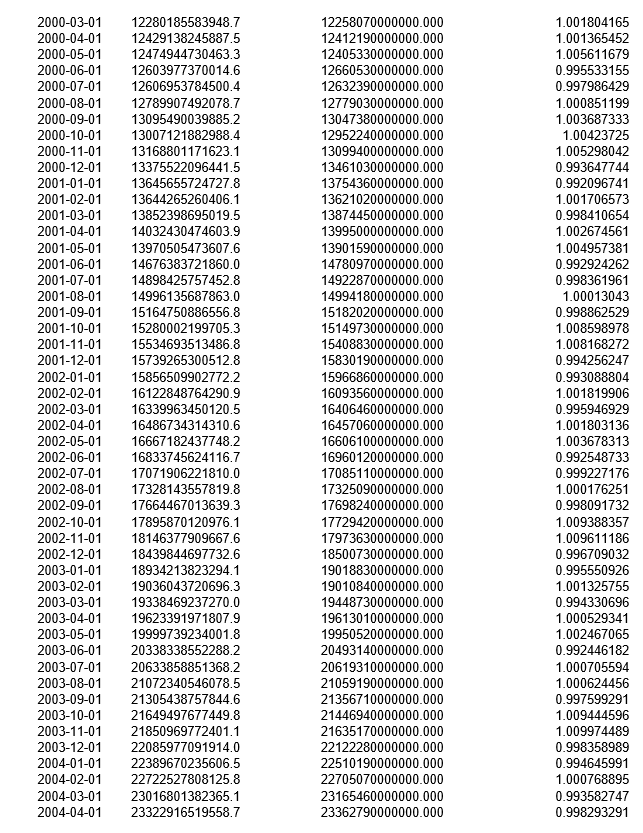

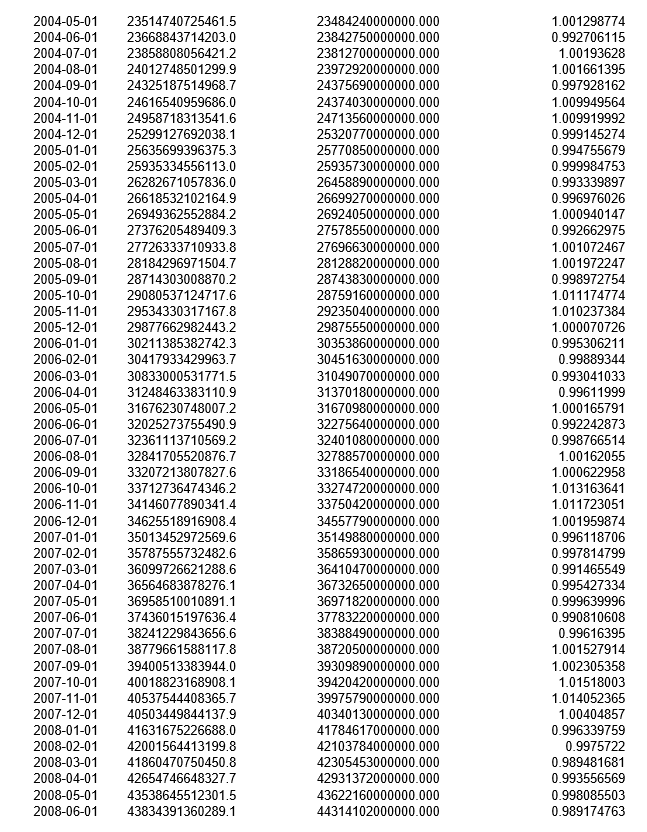

Go to FRED (the Federal Reserve Economic Database) and provide monthly seasonally adjusted and non-seasonally adjusted money supplies for China. Calculate (infer) the seasonal adjustment factor for China.

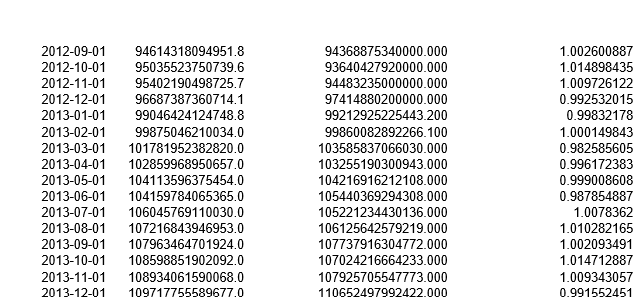

In the far right column, a figure above 1 suggests a "low seasonal month" in China and below 1 suggests a "high seasonal month."

In the far right column, a figure above 1 suggests a "low seasonal month" in China and below 1 suggests a "high seasonal month."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

6

If China's capital markets were fully open (which they are not), explain as a hedge fund manager how you might arbitrage the seasonal difference in credit demands between China and the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

7

Explain the notion of "directed credit" and its relative importance in China compared to the United States as a tool of monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

8

Explain why in periods of normal economic growth, capital adequacy types of rules will allow for more rapid loan growth in China than in the United States. Explain why in times of financial turmoil, when companies are losing money, such rules may slow lending growth more dramatically in China compared to the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck

9

In the first half of September 2014 it was estimated that China's PBC lent the five largest Chinese banks around RMB 100 billion to spur slowing economic growth.

a. Using some economic model discussed in this chapter explain how this policy is intended to have an impact on the real economy.

b. Because the injection of high-powered money came not through open market operations but through some of the other monetary policy tools (such as discount window lending) discussed in this chapter, Western economists criticized the move as a step backward in terms of financial market liberalization in China. Discuss.

a. Using some economic model discussed in this chapter explain how this policy is intended to have an impact on the real economy.

b. Because the injection of high-powered money came not through open market operations but through some of the other monetary policy tools (such as discount window lending) discussed in this chapter, Western economists criticized the move as a step backward in terms of financial market liberalization in China. Discuss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 9 في هذه المجموعة.

فتح الحزمة

k this deck