Deck 4: Future Value, Present Value and Interest Rates

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/118

العب

ملء الشاشة (f)

Deck 4: Future Value, Present Value and Interest Rates

1

Suppose a family wants to save $60,000 for a child's tuition. The child will be attending college in 18 years. For simplicity, assume the family is saving for a one-time college tuition payment. If the interest rate is 6%, then about how much does this family need to deposit in the bank today?

A) $10,000

B) $21,000

C) $42,000

D) $57,000

A) $10,000

B) $21,000

C) $42,000

D) $57,000

B

2

Compound interest means that:

A) you get an interest deduction for paying your loan off early.

B) you get interest on interest.

C) you get an interest deduction if you take out a loan for longer than one year.

D) interest rates will rise on larger loans.

A) you get an interest deduction for paying your loan off early.

B) you get interest on interest.

C) you get an interest deduction if you take out a loan for longer than one year.

D) interest rates will rise on larger loans.

B

3

Which of the following best expresses the proceeds a lender receives from a one-year simple loan when the annual interest rate equals i?

A) PV + i

B) FV/i

C) PV(1 + i)

D) PV/i

A) PV + i

B) FV/i

C) PV(1 + i)

D) PV/i

C

4

A promise of a $100 payment to be received one year from today is:

A) more valuable than receiving the payment today.

B) less valuable than receiving the payment two years from now.

C) equally valuable as a payment received today if the interest rate is zero.

D) not enough information is provided to answer the question.

A) more valuable than receiving the payment today.

B) less valuable than receiving the payment two years from now.

C) equally valuable as a payment received today if the interest rate is zero.

D) not enough information is provided to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

5

Suppose Mary receives an $8,000 loan from First National Bank. Mary repays $8,480 to First National Bank at the end of one year. Assuming the simple calculation of interest, the interest rate on Mary's loan was:

A) 8.00%

B) $480

C) 6.00%

D) 5.66%

A) 8.00%

B) $480

C) 6.00%

D) 5.66%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following expresses 4.85%?

A) 0.0485

B) 4.850

C) 0.00485

D) 0.485

A) 0.0485

B) 4.850

C) 0.00485

D) 0.485

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

7

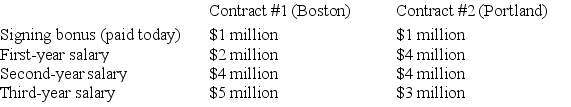

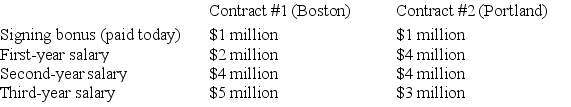

Suppose that Stephen Curry, a basketball player for the Golden State Warriors, will become a free agent at the end of this NBA season. Suppose that Curry is considering two possible contracts from different teams. Note that the salaries are paid at the end of EACH year.

The interest rate is 10%. Based on this information, which of the following is true?

A) Curry should take the Boston contract because it has a higher present value.

B) Curry should take the Portland contract because it has a higher present value.

C) Curry is indifferent between the two contracts because they are both worth $12 million.

D) Curry is indifferent between the two contracts because they are both worth $10.9 million.

The interest rate is 10%. Based on this information, which of the following is true?

A) Curry should take the Boston contract because it has a higher present value.

B) Curry should take the Portland contract because it has a higher present value.

C) Curry is indifferent between the two contracts because they are both worth $12 million.

D) Curry is indifferent between the two contracts because they are both worth $10.9 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

8

An investor deposits $400 into a bank account that earns an annual interest rate of 8%. Based on this information, how much interest will he earn during the second year alone?

A) $25.60

B) $32

C) $34.56

D) $64

A) $25.60

B) $32

C) $34.56

D) $64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a saver has a positive rate of time preference then the present value of $100 to be received 1 year from today is:

A) more than $100.

B) not calculable.

C) less than 100.

D) unknown to the saver.

A) more than $100.

B) not calculable.

C) less than 100.

D) unknown to the saver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose Paul borrows $4,000 for one year from his grandfather who charges Paul 7% interest. At the end of the year Paul will have to repay his grandfather:

A) $4,280

B) $4,290

C) $4,350

D) $4,820

A) $4,280

B) $4,290

C) $4,350

D) $4,820

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

11

A lender is promised a $100 payment (including interest) one year from today. If the lender has a 6% opportunity cost of money, he/she should be willing to accept what amount today?

A) $100.00

B) $106.20

C) $96.40

D) $94.34

A) $100.00

B) $106.20

C) $96.40

D) $94.34

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

12

The future value of $100 at a 5% per year interest rate at the end of one year is:

A) $95.00

B) $105.00

C) $97.50

D) 107.50

A) $95.00

B) $105.00

C) $97.50

D) 107.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following expresses 5.5%?

A) 0.0055

B) 5.50

C) 0.550

D) 0.0550

A) 0.0055

B) 5.50

C) 0.550

D) 0.0550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following best expresses the payment a saver receives for investing their money for two years?

A) PV + PV

B) PV + PV (1 + i)

C) PV(1 + i)²

D) 2PV(1 + i)

A) PV + PV

B) PV + PV (1 + i)

C) PV(1 + i)²

D) 2PV(1 + i)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

15

Suppose Tom receives a one-year loan from ABC Bank for $5,000.00. At the end of the year, Tom repays $5,400.00 to ABC Bank. Assuming the simple calculation of interest, the interest rate on Tom's loan was:

A) $400

B) 8.00%

C) 7.41%

D) 20%

A) $400

B) 8.00%

C) 7.41%

D) 20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

16

Credit:

A) probably came into being at the same time as coinage.

B) predates coinage by 2,000 years.

C) did not exist until the middle ages.

D) first became popular due to the writings of Aristotle.

A) probably came into being at the same time as coinage.

B) predates coinage by 2,000 years.

C) did not exist until the middle ages.

D) first became popular due to the writings of Aristotle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following expresses 5.65%?

A) 0.565

B) 0.00565

C) 5.65

D) 0.0565

A) 0.565

B) 0.00565

C) 5.65

D) 0.0565

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following best expresses the payment a lender receives for lending money for three years?

A) 3PV

B) PV/(1+i)³

C) PV/(1 + i)³

D) FV/ (1 + i)³

A) 3PV

B) PV/(1+i)³

C) PV/(1 + i)³

D) FV/ (1 + i)³

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

19

Farou invests $2,000 at 8% interest. About how long will it take for Farou to double his investment (e.g., to have $4,000)?

A) 4 years

B) 5 years

C) 8 years

D) 9 years

A) 4 years

B) 5 years

C) 8 years

D) 9 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

20

If the interest rate is zero, a promise to receive a $100 payment one year from now is:

A) more valuable than receiving $100 today.

B) less valuable than receiving $100 today.

C) equal in value to receiving $100 today.

D) equal in value to receiving $101 today.

A) more valuable than receiving $100 today.

B) less valuable than receiving $100 today.

C) equal in value to receiving $100 today.

D) equal in value to receiving $101 today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

21

In reading the national business news, you hear that mortgage rates increased by 50 basis points. If mortgage rates were initially at 6.5%, what are they after this increase?

A) 6.55%

B) 7.0%

C) 11.5%

D) 56.5%

A) 6.55%

B) 7.0%

C) 11.5%

D) 56.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

22

The future value of $200 that is left in account earning 6.5% interest for three years is best expressed by which of the following?

A) $200(1.065) × 3

B) $200(1.065)/3

C) $200(1.065)ⁿ

D) $200(1.065)³

A) $200(1.065) × 3

B) $200(1.065)/3

C) $200(1.065)ⁿ

D) $200(1.065)³

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

23

What is the future value of $1,000 after six months earning 12% annually?

A) $1,050.00

B) $1,060.00

C) $1,120.00

D) $1,058.30

A) $1,050.00

B) $1,060.00

C) $1,120.00

D) $1,058.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following best expresses the future value of $100 left in a savings account earning 3.5% for three and a half years?

A) $100(1.035)³.⁵

B) $100(0.35)³.⁵

C) $100 × 3.5 × (1.035)

D) $100(1.035)³/2

A) $100(1.035)³.⁵

B) $100(0.35)³.⁵

C) $100 × 3.5 × (1.035)

D) $100(1.035)³/2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

25

Sharon deposits $150.00 in her savings account at the bank. At the end of one year she has $156.38. What was the interest rate that Sharon earned?

A) 4.25%

B) 6.38%

C) 4.52%

D) 5.63%

A) 4.25%

B) 6.38%

C) 4.52%

D) 5.63%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

26

A saver knows that if she put $95 in the bank today she will receive $100 from the bank one year from now, including the interest she will earn. What is the interest rate she is earning?

A) 5.10%

B) 6.00%

C) 5.52%

D) 5.26%

A) 5.10%

B) 6.00%

C) 5.52%

D) 5.26%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

27

Tom deposits funds in his savings account at the bank which is paying 3.5% interest. If he keeps his funds in the bank for one year he will have $155.25. What amount is Tom depositing?

A) $151.75

B) $150.00

C) $148.75

D) $147.50

A) $151.75

B) $150.00

C) $148.75

D) $147.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

28

Mary deposits funds into a CD at her bank. The CD has an annual interest of 4.0%. If Mary leaves the funds in the CD for two years she will have $540.80. Assuming no penalties for withdrawing the funds early, what amount would Mary have at the end of one year?

A) $521.60

B) $490.00

C) $500.00

D) $520.00

A) $521.60

B) $490.00

C) $500.00

D) $520.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

29

One hundred basis points could be expressed as:

A) 0.01%

B) 1.00%

C) 100.0%

D) 0.10%

A) 0.01%

B) 1.00%

C) 100.0%

D) 0.10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

30

What is the present value of $200 promised two years from now at 5% annual interest?

A) $190.00

B) $220.00

C) $180.00

D) $181.41

A) $190.00

B) $220.00

C) $180.00

D) $181.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

31

The value of $100 left in a certificate of deposit for four years that earns 4.5% annually will be:

A) $120.00

B) $119.25

C) $117.00

D) $145.00

A) $120.00

B) $119.25

C) $117.00

D) $145.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

32

The rule of 72 says that at 6% interest $100 should become $200 in about:

A) 72 months

B) 100 months

C) 12 years

D) 7.2 years

A) 72 months

B) 100 months

C) 12 years

D) 7.2 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

33

According to the rule of 72:

A) any amount should double in value in 72 months if invested at 10%.

B) 72/interest rate is the number of years approximately it will take for an amount to double.

C) 72 × interest rate is the number of years it will take for an amount to double.

D) the interest rate divided by the number of years invested will always equal 72%.

A) any amount should double in value in 72 months if invested at 10%.

B) 72/interest rate is the number of years approximately it will take for an amount to double.

C) 72 × interest rate is the number of years it will take for an amount to double.

D) the interest rate divided by the number of years invested will always equal 72%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

34

The future value of $100 that earns 10% annually for n years is best expressed by which of the following?

A) $100(0.1)ⁿ

B) $100 × n × (1.1)

C) $100(1.1)ⁿ

D) $100/(1.1)ⁿ

A) $100(0.1)ⁿ

B) $100 × n × (1.1)

C) $100(1.1)ⁿ

D) $100/(1.1)ⁿ

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is the present value of $100 promised one year from now at 10% annual interest?

A) $89.50

B) $90.00

C) $90.91

D) $91.25

A) $89.50

B) $90.00

C) $90.91

D) $91.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

36

Mary deposits funds into a CD at her bank. The CD has an annual interest of 4.0%. If Mary leaves the funds in the CD for two years she will have $540.80. What amount is Mary depositing?

A) $520.00

B) $514.50

C) $500.00

D) $512.40

A) $520.00

B) $514.50

C) $500.00

D) $512.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

37

The value of $100 left in a savings account earning 5% a year, will be worth what amount after ten years?

A) $150.00

B) $160.50

C) $159.84

D) $162.89

A) $150.00

B) $160.50

C) $159.84

D) $162.89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

38

The decimal equivalent of a basis point is:

A) 0.0001

B) 1.00

C) 0.001

D) 0.01

A) 0.0001

B) 1.00

C) 0.001

D) 0.01

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following best expresses the present value of $500 that you have to wait four years and three months to receive?

A) ($500/4.25) × (1 + i)

B) $500 × 4.25 × (1 + i)

C) $500/(1 + i)⁴.²⁵

D) ($500/4) × (1 + i)³

A) ($500/4.25) × (1 + i)

B) $500 × 4.25 × (1 + i)

C) $500/(1 + i)⁴.²⁵

D) ($500/4) × (1 + i)³

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

40

If 10% is the annual rate, considering compounding, the monthly rate is:

A) 0.0833%

B) 0.833%

C) 0.80%

D) 1.0833%

A) 0.0833%

B) 0.833%

C) 0.80%

D) 1.0833%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

41

Doubling the future value will cause:

A) the present value to fall by half.

B) the interest rate, i, to double.

C) no change to present value, only the interest rate.

D) the present value to double.

A) the present value to fall by half.

B) the interest rate, i, to double.

C) no change to present value, only the interest rate.

D) the present value to double.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

42

The present value and the interest rate have:

A) a direct relationship; as i increases, pv increases.

B) an inverse relationship; as i increases, pv decreases.

C) an unclear relationship; whether it is direct or inverse depends on the interest rate.

D) no relationship.

A) a direct relationship; as i increases, pv increases.

B) an inverse relationship; as i increases, pv decreases.

C) an unclear relationship; whether it is direct or inverse depends on the interest rate.

D) no relationship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

43

Doubling the future value will cause the:

A) present value to double.

B) present value to decrease.

C) present value to increase by less than 100%.

D) interest rate, i, to decrease.

A) present value to double.

B) present value to decrease.

C) present value to increase by less than 100%.

D) interest rate, i, to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

44

A mortgage, where the monthly payments are the same for the duration of the loan, is an example of a(n):

A) variable payment loan.

B) installment loan.

C) fixed payment loan.

D) equity security.

A) variable payment loan.

B) installment loan.

C) fixed payment loan.

D) equity security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

45

If the internal rate of return from an investment is more than the opportunity cost of funds the firm should:

A) make the investment.

B) not make the investment.

C) only make the investment using retained earnings.

D) only make part of the investment and wait to see if interest rates decrease.

A) make the investment.

B) not make the investment.

C) only make the investment using retained earnings.

D) only make part of the investment and wait to see if interest rates decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

46

The "coupon rate" is:

A) the annual amount of interest payments made on a bond as a percentage of the amount borrowed.

B) the change in the value of a bond expressed as a percentage of the amount borrowed.

C) another name for the yield on a bond, assuming the bond is sold before it matures.

D) the total amount of interest payments made on a bond as a percentage of the amount borrowed.

A) the annual amount of interest payments made on a bond as a percentage of the amount borrowed.

B) the change in the value of a bond expressed as a percentage of the amount borrowed.

C) another name for the yield on a bond, assuming the bond is sold before it matures.

D) the total amount of interest payments made on a bond as a percentage of the amount borrowed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

47

An investment has grown from $100.00 to $130.00 or by 30% over four years. What annual increase gives a 30% increase over four years?

A) 7.50%

B) 6.30%

C) 6.78%

D) 7.24%

A) 7.50%

B) 6.30%

C) 6.78%

D) 7.24%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

48

An investment carrying a current cost of $120,000 is going to generate $50,000 of revenue for each of the next three years. To calculate the internal rate of return we need to:

A) calculate the present value of each of the $50,000 payments and multiply these and set this equal to $120,000.

B) find the interest rate at which the present value of $150,000 for three years from now equals $120,000.

C) find the interest rate at which the sum of the present values of $50,000 for each of the next three years equals $120,000.

D) subtract $120,000 from $150,000 and set this difference equal to the interest rate.

A) calculate the present value of each of the $50,000 payments and multiply these and set this equal to $120,000.

B) find the interest rate at which the present value of $150,000 for three years from now equals $120,000.

C) find the interest rate at which the sum of the present values of $50,000 for each of the next three years equals $120,000.

D) subtract $120,000 from $150,000 and set this difference equal to the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

49

A monthly growth rate of 0.6% is an annual growth rate of:

A) 7.20%

B) 6.00%

C) 7.60%

D) 7.44%

A) 7.20%

B) 6.00%

C) 7.60%

D) 7.44%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

50

A change in the interest rate:

A) has a smaller impact on the present value of a payment to be made far into the future than on one to be made sooner.

B) will not make a difference in the present values of two equal payments to be made at different times.

C) has a larger impact on the present value of a payment to be made far into the future than on one to be made sooner.

D) has a larger impact on the present value of a bigger payment to be made far into the future than on one of lesser value.

A) has a smaller impact on the present value of a payment to be made far into the future than on one to be made sooner.

B) will not make a difference in the present values of two equal payments to be made at different times.

C) has a larger impact on the present value of a payment to be made far into the future than on one to be made sooner.

D) has a larger impact on the present value of a bigger payment to be made far into the future than on one of lesser value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

51

The internal rate of return of an investment is:

A) the same as return on investment.

B) zero when the present value of an investment equals its cost.

C) the interest rate that equates the present value of an investment with its cost.

D) equal to the market rate of interest when an investment is made.

A) the same as return on investment.

B) zero when the present value of an investment equals its cost.

C) the interest rate that equates the present value of an investment with its cost.

D) equal to the market rate of interest when an investment is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

52

The shorter the time until a payment the:

A) higher the present value.

B) lower the present value because time is valuable.

C) lower must be the interest rate.

D) higher must be the interest rate.

A) higher the present value.

B) lower the present value because time is valuable.

C) lower must be the interest rate.

D) higher must be the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

53

At any fixed interest rate, an increase in time, n, until a payment is made:

A) increases the present value.

B) has no impact on the present value since the interest rate is fixed.

C) reduces the present value.

D) affects only the future value.

A) increases the present value.

B) has no impact on the present value since the interest rate is fixed.

C) reduces the present value.

D) affects only the future value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

54

An investment grows from $100.00 to $150.00 or 50% over five years. What annual increase gives a 50% increase over five years?

A) 12.00%

B) 10.00%

C) 9.25%

D) 8.45%

A) 12.00%

B) 10.00%

C) 9.25%

D) 8.45%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

55

A monthly growth rate of 0.5% is an annual growth rate of:

A) 6.00%

B) 5.00%

C) 6.17%

D) 6.50%

A) 6.00%

B) 5.00%

C) 6.17%

D) 6.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

56

What is the present value of $500 promised four years from now at 5% annual interest?

A) $411.35

B) $400.00

C) $607.75

D) $520.00

A) $411.35

B) $400.00

C) $607.75

D) $520.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

57

Higher savings usually requires higher interest rates because:

A) everyone prefers to save more instead of consuming.

B) saving requires sacrifice and people must be compensated for this sacrifice.

C) higher savings means we expect interest rates to decrease.

D) of the rule of 72.

A) everyone prefers to save more instead of consuming.

B) saving requires sacrifice and people must be compensated for this sacrifice.

C) higher savings means we expect interest rates to decrease.

D) of the rule of 72.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

58

The lower the interest rate, i, the:

A) lower is the present value.

B) greater must be n.

C) higher is the present value.

D) higher is the future value.

A) lower is the present value.

B) greater must be n.

C) higher is the present value.

D) higher is the future value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

59

The higher the future value of the payment the:

A) lower the present value.

B) higher the present value.

C) future value doesn't impact the present value, only the interest rate really matters.

D) lower the present value because the interest rate must fall.

A) lower the present value.

B) higher the present value.

C) future value doesn't impact the present value, only the interest rate really matters.

D) lower the present value because the interest rate must fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

60

A monthly interest rate of 1% is a compounded annual rate of :

A) 12.68%

B) 10.00%

C) 14.11%

D) 6.00%

A) 12.68%

B) 10.00%

C) 14.11%

D) 6.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

61

The price of a coupon bond is determined by taking the present value of:

A) the bond's final payment and subtracting the coupon payments.

B) the coupon payments and adding this to the face value.

C) the bond's final payment.

D) all of the bond's payments.

A) the bond's final payment and subtracting the coupon payments.

B) the coupon payments and adding this to the face value.

C) the bond's final payment.

D) all of the bond's payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

62

The price of a coupon bond is determined by:

A) taking the present value of the bond's final payment and subtracting the coupon payments.

B) taking the present value of the coupon payments and adding this to the face value.

C) taking the present value of all of the bond's payments.

D) estimating its future value.

A) taking the present value of the bond's final payment and subtracting the coupon payments.

B) taking the present value of the coupon payments and adding this to the face value.

C) taking the present value of all of the bond's payments.

D) estimating its future value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which formula below best expresses the real interest rate, (r)?

A) i = r - e

B) r = i + e

C) r = i - e

D) e = i + r

A) i = r - e

B) r = i + e

C) r = i - e

D) e = i + r

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

64

A coupon bond is a bond that:

A) always sells at a price that is less than the face value.

B) provides the owner with regular payments.

C) pays the owner the sum of the coupons at the bond's maturity.

D) pays a variable coupon rate depending on the bond's price.

A) always sells at a price that is less than the face value.

B) provides the owner with regular payments.

C) pays the owner the sum of the coupons at the bond's maturity.

D) pays a variable coupon rate depending on the bond's price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

65

A credit card that charges a monthly interest rate of 1.5% has an effective annual interest rate of:

A) 18.0%

B) 19.6%

C) 15.0%

D) 17.50%

A) 18.0%

B) 19.6%

C) 15.0%

D) 17.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

66

Suppose the nominal interest rate on a one-year car loan is 8% and the inflation rate is expected to be 3% over the next year. Based on this information, we know:

A) the ex ante real interest rate is 5%.

B) the lender benefits more than the borrower because of the difference in the nominal versus real interest rates.

C) at the end of the year, the borrower pays only 5% in nominal interest.

D) the ex post real interest rate 11%.

A) the ex ante real interest rate is 5%.

B) the lender benefits more than the borrower because of the difference in the nominal versus real interest rates.

C) at the end of the year, the borrower pays only 5% in nominal interest.

D) the ex post real interest rate 11%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

67

If a bond has a face value of $1,000 and the bondholder receives coupon payments of $27.50 semi-annually, the bond's coupon rate is:

A) 2.75%

B) 5.50%

C) 27.5%

D) a value that cannot be determined from the information provided.

A) 2.75%

B) 5.50%

C) 27.5%

D) a value that cannot be determined from the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

68

If a bond has a face value of $1,000 and a coupon rate of 4.25%, the bond owner will receive annual coupon payments of:

A) $425.00

B) $4.25

C) $42.50

D) a value that cannot be determined from the information provided.

A) $425.00

B) $4.25

C) $42.50

D) a value that cannot be determined from the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

69

Compounding refers to the

A) calculation of after tax interest returns.

B) internal rate of return a firm earns on an investment.

C) real interest return after taxes.

D) process of earning interest on both the principal and the interest of an investment.

A) calculation of after tax interest returns.

B) internal rate of return a firm earns on an investment.

C) real interest return after taxes.

D) process of earning interest on both the principal and the interest of an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is necessarily true of coupon bonds?

A) The price exceeds the face value.

B) The coupon rate exceeds the interest rate.

C) The price is equal to the coupon payments.

D) The price is the sum of the present value of coupon payments and the face value.

A) The price exceeds the face value.

B) The coupon rate exceeds the interest rate.

C) The price is equal to the coupon payments.

D) The price is the sum of the present value of coupon payments and the face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

71

Considering the data on real and nominal interest rates for the U.S. from 1979 to 2012, which of the following statements is most accurate?

A) The real interest rate remains unchanged over time.

B) There have been times when the real interest rate has been negative.

C) Nominal interest rates higher in 2000 than they had been at any other point in time.

D) The inflation rate is always greater than the real interest rate.

A) The real interest rate remains unchanged over time.

B) There have been times when the real interest rate has been negative.

C) Nominal interest rates higher in 2000 than they had been at any other point in time.

D) The inflation rate is always greater than the real interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

72

Usually an investment will be profitable if:

A) the internal rate of return is less than the cost of borrowing.

B) the cost of borrowing is equal to the internal rate of return.

C) it is financed with retained earnings.

D) the cost of borrowing is less than the internal rate of return.

A) the internal rate of return is less than the cost of borrowing.

B) the cost of borrowing is equal to the internal rate of return.

C) it is financed with retained earnings.

D) the cost of borrowing is less than the internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following statements is most correct?

A) We can always compute the ex post real interest rate but not the ex ante real rate.

B) We cannot compute either the ex post or ex ante real interest rates accurately.

C) We can accurately compute the ex ante real interest rate but not the ex post real rate.

D) None of the statements are correct.

A) We can always compute the ex post real interest rate but not the ex ante real rate.

B) We cannot compute either the ex post or ex ante real interest rates accurately.

C) We can accurately compute the ex ante real interest rate but not the ex post real rate.

D) None of the statements are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

74

The price of a coupon bond will increase as the:

A) face value decreases.

B) yield increases.

C) coupon payments increase.

D) term to maturity is shorter.

A) face value decreases.

B) yield increases.

C) coupon payments increase.

D) term to maturity is shorter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

75

The coupon rate for a coupon bond is equal to the:

A) annual coupon payment divided by the face value of the bond.

B) annual coupon payment divided by the purchase price of the bond.

C) purchase price of the bond divided by the coupon payment.

D) annual coupon payment divided by the selling price of the bond.

A) annual coupon payment divided by the face value of the bond.

B) annual coupon payment divided by the purchase price of the bond.

C) purchase price of the bond divided by the coupon payment.

D) annual coupon payment divided by the selling price of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

76

As inflation increases, for any fixed nominal interest rate, the real interest rate:

A) also increases.

B) remains the same, that's why it is real.

C) decreases.

D) decreases by less than the increase in inflation.

A) also increases.

B) remains the same, that's why it is real.

C) decreases.

D) decreases by less than the increase in inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

77

Consider a bond that costs $1,000 today and promises a one-time future payment of $1,080 in four years. What is the approximate interest rate on this bond?

A) 2%

B) 4%

C) 8%

D) 10.8%

A) 2%

B) 4%

C) 8%

D) 10.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

78

A borrower who makes a $1,000 loan for one year and earns interest in the amount of $75, earns what nominal interest rate and what real interest rate if inflation is two percent?

A) A nominal rate of 5.5% and a real rate of 2.0%.

B) A nominal rate of 7.5% and a real rate of 5.0%.

C) A nominal rate of 7.5% and a real rate of 9.5%.

D) A nominal rate of 7.5% and a real rate of 5.5%.

A) A nominal rate of 5.5% and a real rate of 2.0%.

B) A nominal rate of 7.5% and a real rate of 5.0%.

C) A nominal rate of 7.5% and a real rate of 9.5%.

D) A nominal rate of 7.5% and a real rate of 5.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

79

The interest rate that equates the price of a bond with the present value of its payments:

A) will vary directly with the value of the bond.

B) should be the one that makes the value equal to the par value of the bond.

C) will vary inversely with the value of the bond.

D) should always be greater than the coupon rate.

A) will vary directly with the value of the bond.

B) should be the one that makes the value equal to the par value of the bond.

C) will vary inversely with the value of the bond.

D) should always be greater than the coupon rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

80

Interest rates that are adjusted for expected inflation are known as:

A) coupon rates.

B) ex ante real interest rates.

C) ex post real interest rates.

D) nominal interest rates.

A) coupon rates.

B) ex ante real interest rates.

C) ex post real interest rates.

D) nominal interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck