Deck 6: When Governments Intervene in Markets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/265

العب

ملء الشاشة (f)

Deck 6: When Governments Intervene in Markets

1

Which of the following is NOT a way that the government can intervene in markets?

A)The government can set minimum wages.

B)The government can raise taxes on a particular item.

C)The government can pass laws on sales taxes.

D)The government can stop the forces of demand and supply from working in markets.

A)The government can set minimum wages.

B)The government can raise taxes on a particular item.

C)The government can pass laws on sales taxes.

D)The government can stop the forces of demand and supply from working in markets.

D

2

A tax on sellers shifts the:

A)supply curve to the left.

B)supply curve to the right.

C)demand curve to the left.

D)demand curve to the right.

A)supply curve to the left.

B)supply curve to the right.

C)demand curve to the left.

D)demand curve to the right.

A

3

A tax on sellers:

A)decreases the price that the seller charges the buyer.

B)increases the price that buyers pay and decreases the price that sellers receive.

C)does not have any impact on the market price for the product.

D)does not represent any economic burden on the buyer.

A)decreases the price that the seller charges the buyer.

B)increases the price that buyers pay and decreases the price that sellers receive.

C)does not have any impact on the market price for the product.

D)does not represent any economic burden on the buyer.

B

4

In 2004, Kenya became the first country to abolish the sales tax on menstrual products. The effect of this tax repeal would be:

A)an increase in prices for consumers.

B)a decrease in profits for sellers.

C)an increase in sales of menstrual products.

D)a reduction of taxes on other products in the market.

A)an increase in prices for consumers.

B)a decrease in profits for sellers.

C)an increase in sales of menstrual products.

D)a reduction of taxes on other products in the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

5

In 2016, Amazon began charging a 5.75% sales tax on products it sells in the District of Columbia. Holding all else constant, the effect of this tax would be to _____ in the District of Columbia.

A)increase Amazon sales

B)decrease Amazon sales

C)decrease prices for local businesses

D)decrease the number of consumers

A)increase Amazon sales

B)decrease Amazon sales

C)decrease prices for local businesses

D)decrease the number of consumers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

6

In 2018, the state of Kentucky raised the tax on cigarettes by 50 cents per pack. Holding all else constant, the effect of this tax would be to _____ in Kentucky.

A)decrease prices of cigarettes

B)increase sales of cigarettes

C)increase profits for stores selling cigarettes

D)decrease smoking of cigarettes

A)decrease prices of cigarettes

B)increase sales of cigarettes

C)increase profits for stores selling cigarettes

D)decrease smoking of cigarettes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

7

In 2017, eBay started charging a 20% value-added tax on fees charged to small businesses in the United Kingdom. Holding all else constant, this would _____ in the United Kingdom.

A)raise the prices that eBay sellers charge their customers

B)shift the supply curve of eBay products to the right

C)lead to increased sales for eBay sellers

D)shift the demand for eBay products to the right

A)raise the prices that eBay sellers charge their customers

B)shift the supply curve of eBay products to the right

C)lead to increased sales for eBay sellers

D)shift the demand for eBay products to the right

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

8

The statutory burden of a tax is the:

A)government-designated burden of a tax payment.

B)burden created by the change in after-tax prices faced by buyers and sellers.

C)percentage increase in the tax on an item.

D)laws governing sales taxes in a country.

A)government-designated burden of a tax payment.

B)burden created by the change in after-tax prices faced by buyers and sellers.

C)percentage increase in the tax on an item.

D)laws governing sales taxes in a country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

9

The economic burden of a tax is the:

A)government-designated burden of a tax payment.

B)burden created by the change in after-tax prices faced by buyers and sellers.

C)percentage increase in the tax on an item.

D)laws governing sales taxes in a country.

A)government-designated burden of a tax payment.

B)burden created by the change in after-tax prices faced by buyers and sellers.

C)percentage increase in the tax on an item.

D)laws governing sales taxes in a country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

10

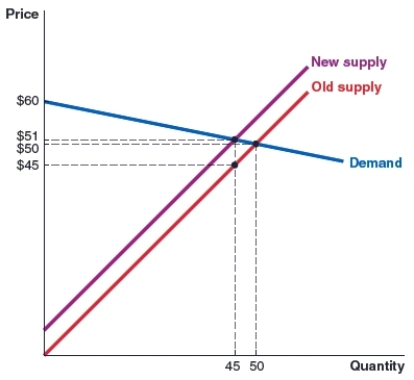

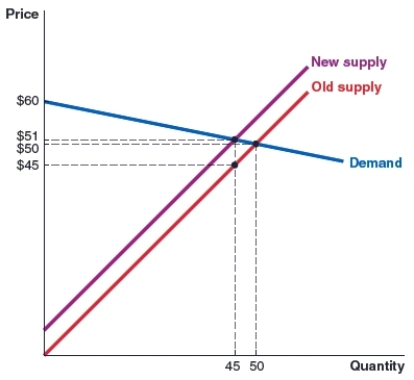

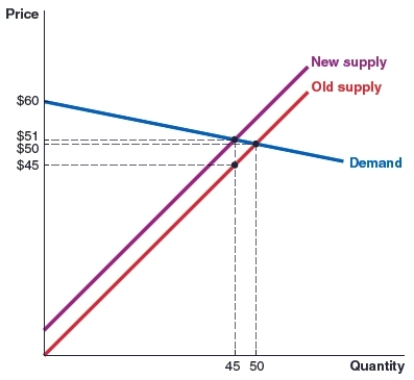

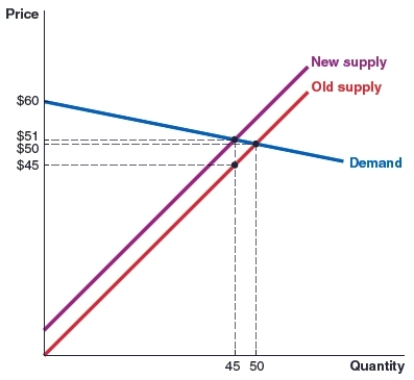

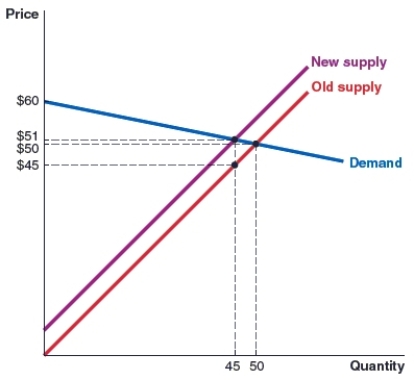

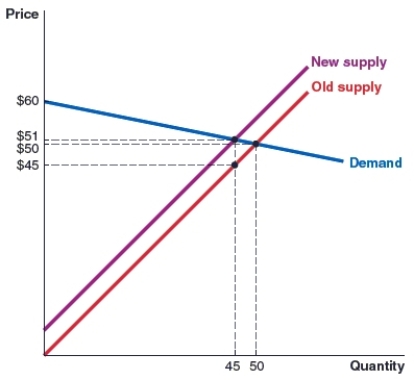

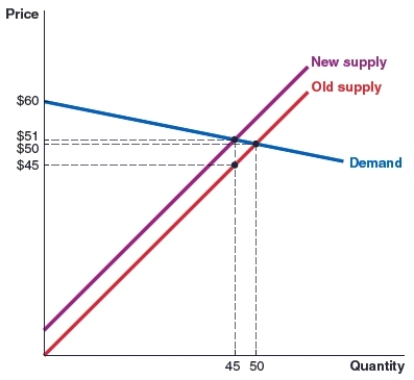

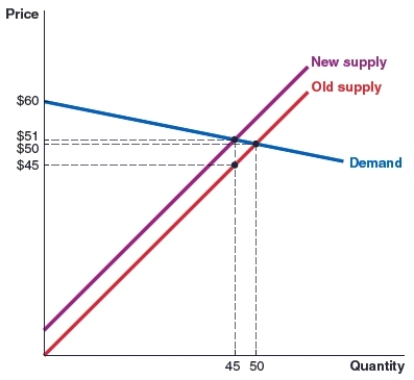

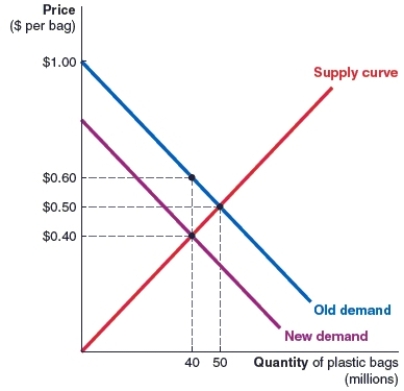

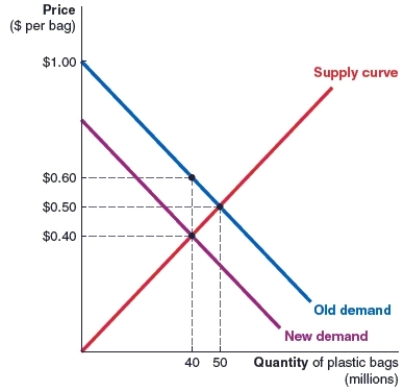

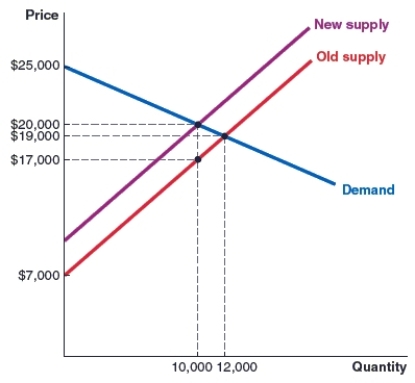

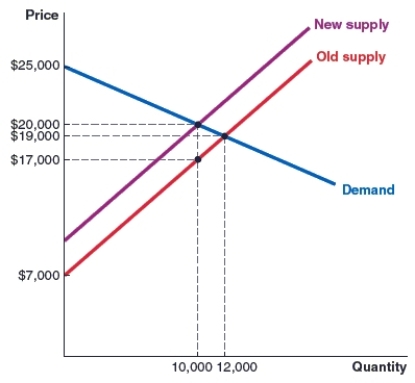

(Figure: Tax on Seller) In the graph shown, the original equilibrium price is $50. A $6 tax is placed on the seller in this market. Who bears the statutory burden of this tax?

A)the seller

B)the buyer

C)the government

D)the people who make the law on taxes

A)the seller

B)the buyer

C)the government

D)the people who make the law on taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

11

(Figure: Tax on Seller) In the graph shown, the original equilibrium price is $50. A $6 tax is placed on the seller in this market. The economic burden of this tax on the buyer is $_____.

A)6

B)1

C)2

D)5

A)6

B)1

C)2

D)5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

12

(Figure: Tax on Seller) In the graph shown, the original equilibrium price is $50. A $6 tax is placed on the seller in this market. The economic burden of this tax on the seller is $ _____.

A)6

B)1

C)2

D)5

A)6

B)1

C)2

D)5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

13

(Figure: Tax on Seller) In the graph shown, the original equilibrium price is $50. A $6 tax is placed on the seller in this market. As a result of the tax, the equilibrium quantity in the market changed from _____ units to _____ units.

A)50, 45

B)45, 51

C)50, 51

D)45, 50

A)50, 45

B)45, 51

C)50, 51

D)45, 50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

14

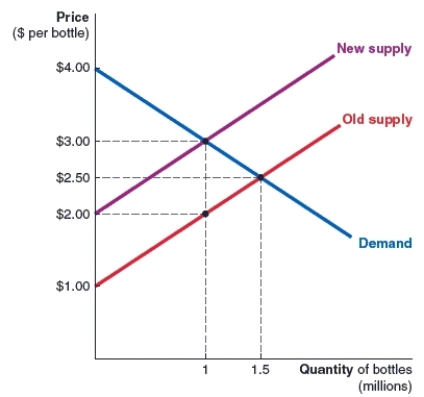

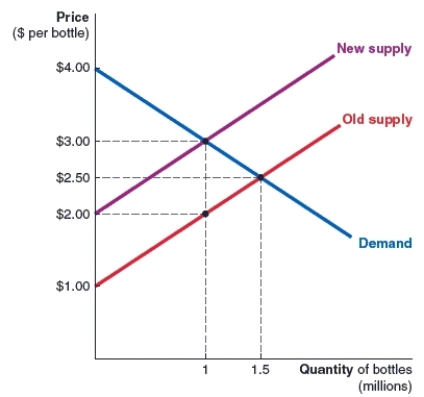

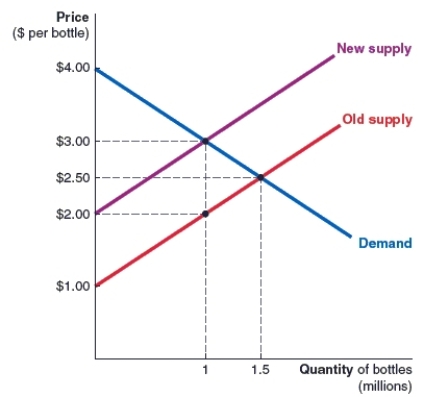

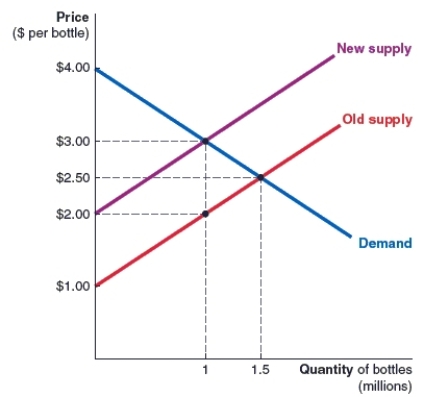

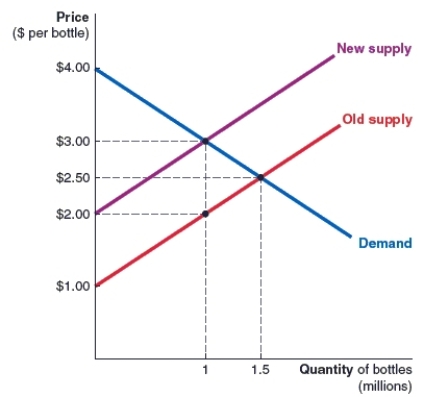

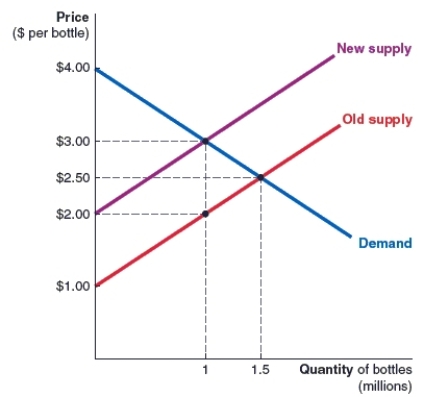

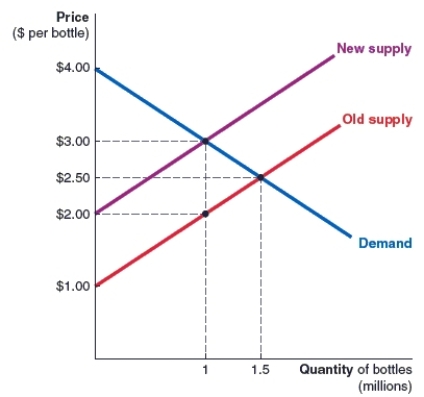

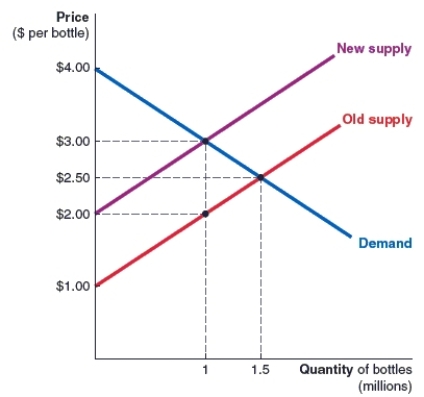

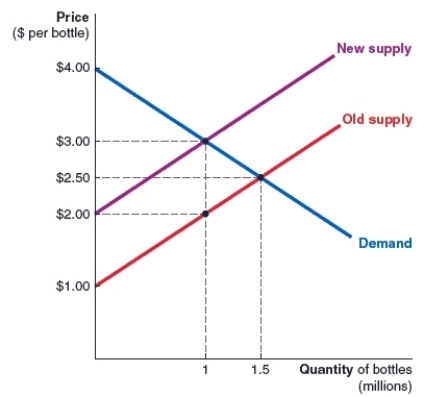

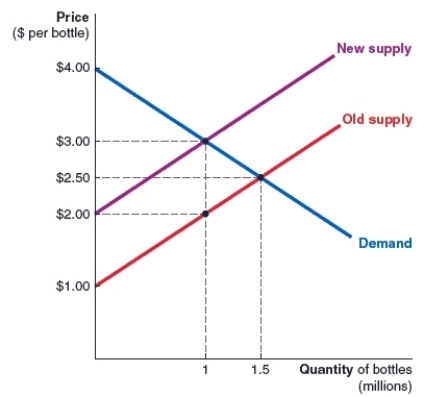

(Figure: Tax on Sellers of Soft Drinks) In the graph of the soft drink market shown here, the original equilibrium price is $2.50 per bottle. A tax is then placed on the sellers of soft drinks. The amount of the tax is $ _____.

A)3.00

B)0.50

C)1.00

D)1.50

A)3.00

B)0.50

C)1.00

D)1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

15

(Figure: Tax on Sellers of Soft Drinks) In the graph of the soft drink market shown here, the original equilibrium price is $2.50 per bottle. A tax is then placed on the sellers of soft drinks. The economic burden of this tax on the seller is $ _____.

A)3.00

B)0.50

C)1.00

D)1.50

A)3.00

B)0.50

C)1.00

D)1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

16

(Figure: Tax on Sellers of Soft Drinks) In the graph of the soft drink market shown here, the original equilibrium price is $2.50 per bottle. A tax is then placed on the sellers of soft drinks. The economic burden of this tax on the buyer is $ _____.

A)3.00

B)0.50

C)1.00

D)1.50

A)3.00

B)0.50

C)1.00

D)1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

17

(Figure: Tax on Sellers of Soft Drinks) In the graph of the soft drink market shown here, the original equilibrium price is $2.50 per bottle. A tax is then placed on the sellers of soft drinks. As a result of the tax, the equilibrium quantity in the market changed from _____ million bottles to _____ million bottles.

A)2.5, 1.5

B)0.5, 1

C)1.5, 1

D)1, 1.5

A)2.5, 1.5

B)0.5, 1

C)1.5, 1

D)1, 1.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

18

(Figure: Tax on Sellers of Soft Drinks) In the graph of the soft drink market shown here, the original equilibrium price is $2.50 per bottle. A tax is then placed on the sellers of soft drinks. The incidence of the tax on the buyer is ____ % and the incidence of the tax on the seller is _____ %.

A)50, 50

B)100, 0

C)20, 80

D)70, 30

A)50, 50

B)100, 0

C)20, 80

D)70, 30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

19

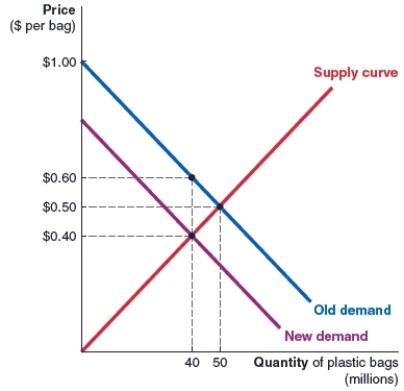

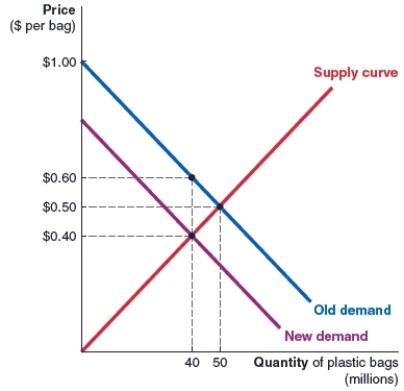

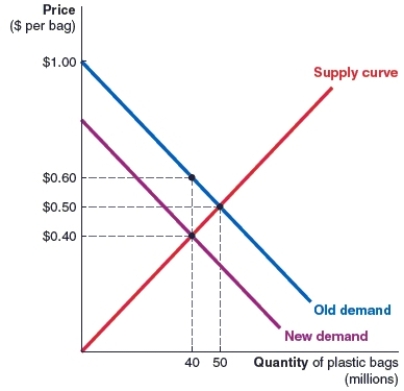

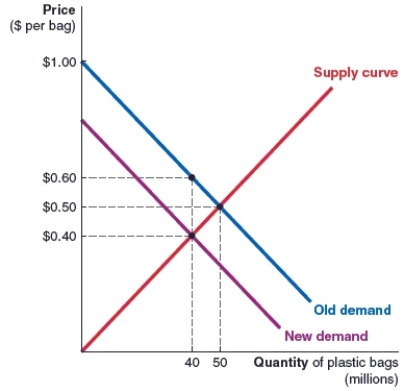

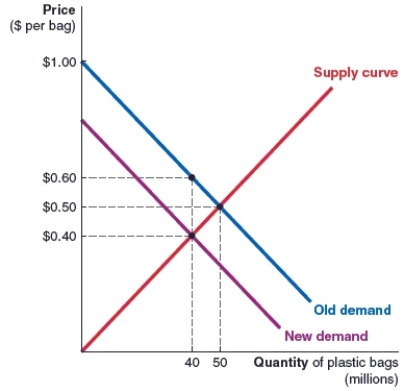

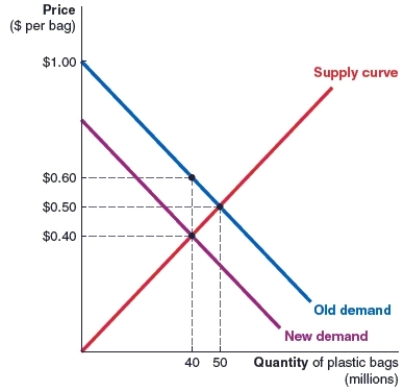

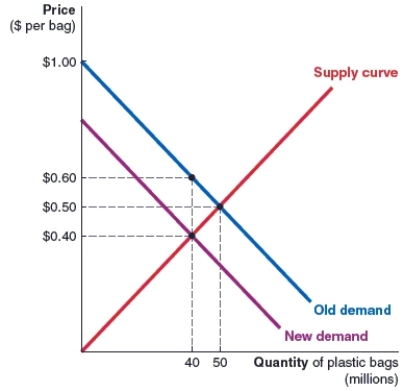

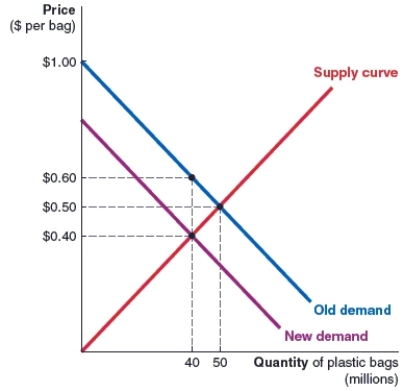

(Figure: Market for Plastic Bags) In the market for plastic bags shown here, the original equilibrium price is 50 cents per bag. In an effort to reduce plastics usage, a tax is then placed on the buyers of plastic bags. The amount of the tax is _____ cents.

A)20

B)10

C)40

D)60

A)20

B)10

C)40

D)60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

20

(Figure: Market for Plastic Bags) In the market for plastic bags shown here, the original equilibrium price is 50 cents per bag. In an effort to reduce plastics usage, a tax is then placed on the buyers of plastic bags. The economic burden of this tax on the seller is _____ cents.

A)20

B)10

C)40

D)60

A)20

B)10

C)40

D)60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

21

(Figure: Market for Plastic Bags) In the market for plastic bags shown here, the original equilibrium price is 50 cents per bag. In an effort to reduce plastics usage, a tax is then placed on the buyers of plastic bags. The economic burden of this tax on the buyer is _____ cents.

A)10

B)40

C)20

D)60

A)10

B)40

C)20

D)60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

22

(Figure: Market for Plastic Bags) In the market for plastic bags shown here, the original equilibrium price is 50 cents per bag. In an effort to reduce plastics usage, a tax is then placed on the buyers of plastic bags. As a result of the tax, the equilibrium quantity in the market _____ by _____ million plastic bags.

A)increased, 50

B)decreased, 10

C)increased, 10

D)decreased, 40

A)increased, 50

B)decreased, 10

C)increased, 10

D)decreased, 40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

23

(Figure: Market for Plastic Bags) In the market for plastic bags shown here, the original equilibrium price is 50 cents per bag. In an effort to reduce plastics usage, a tax is then placed on the buyers of plastic bags. The incidence of the tax on the buyer is ____ % and the incidence of the tax on the seller is _____ %.

A)60, 40

B)20, 80

C)40, 60

D)50, 50

A)60, 40

B)20, 80

C)40, 60

D)50, 50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

24

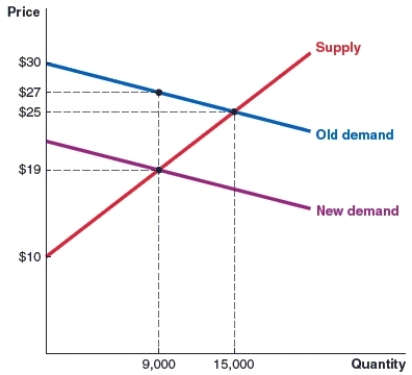

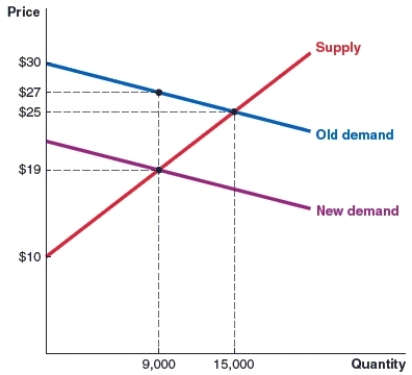

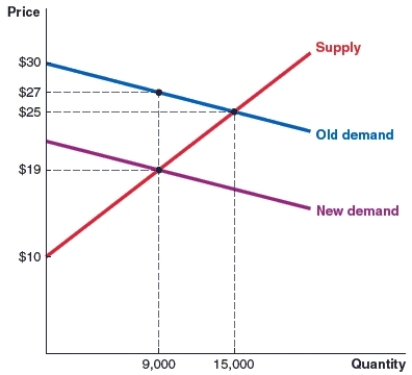

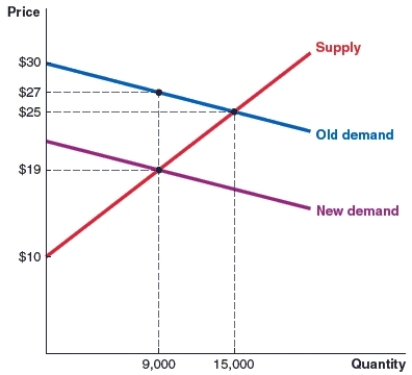

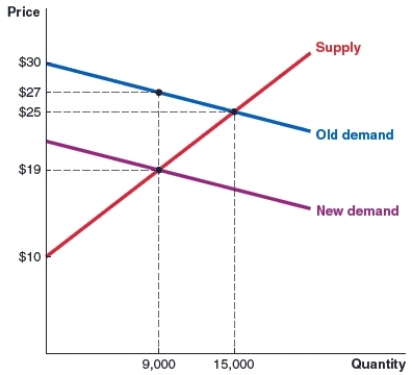

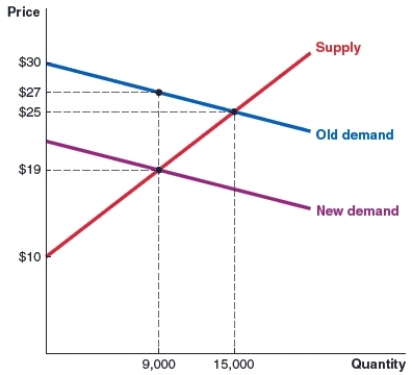

(Figure: Market for Pesticides) In the market for pesticides shown here, the original equilibrium price is $25. In an effort to reduce the usage of pesticides, a tax is then placed on the buyers in this market. Who bears the statutory burden of this tax?

A)the seller

B)the buyer

C)the government

D)the people who make the law on taxes

A)the seller

B)the buyer

C)the government

D)the people who make the law on taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

25

(Figure: Market for Pesticides) In the market for pesticides shown here, the original equilibrium price is $25. In an effort to reduce the usage of pesticides, a tax is then placed on the buyers in this market. The economic burden of this tax on the buyer is $ _____.

A)7

B)8

C)2

D)6

A)7

B)8

C)2

D)6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

26

(Figure: Market for Pesticides) In the market for pesticides shown here, the original equilibrium price is $25. In an effort to reduce the usage of pesticides, a tax is then placed on the buyers in this market. The economic burden of this tax on the seller is $ _____.

A)7

B)8

C)6

D)2

A)7

B)8

C)6

D)2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

27

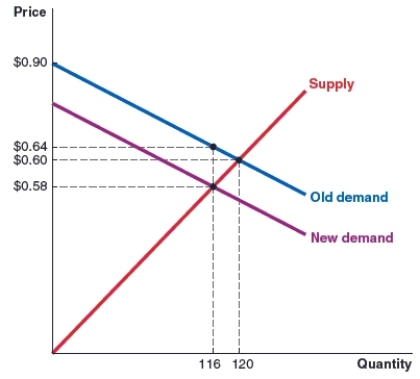

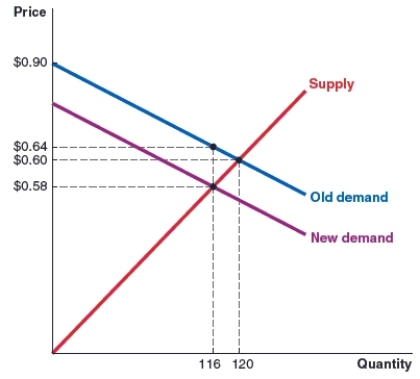

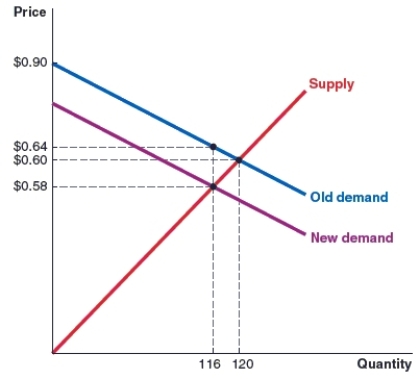

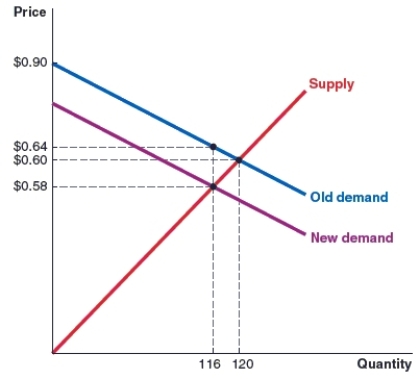

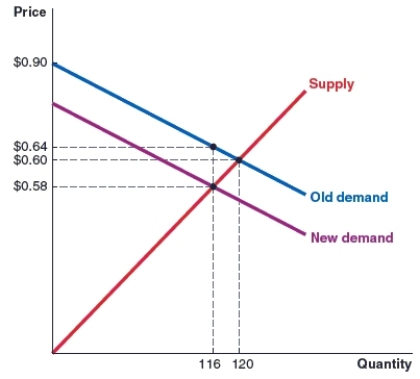

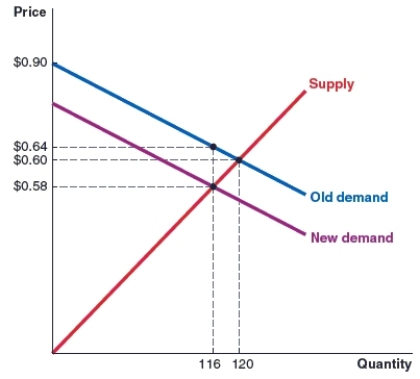

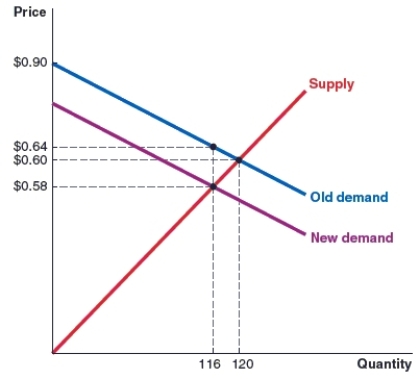

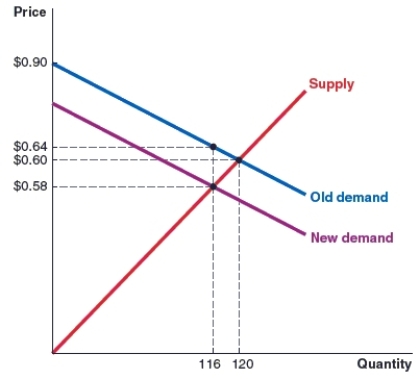

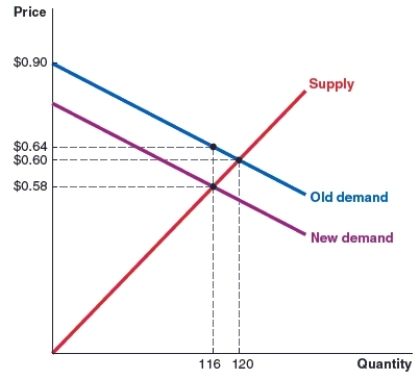

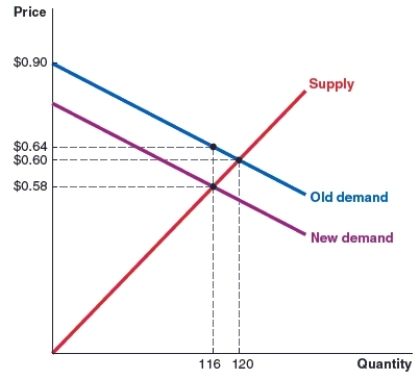

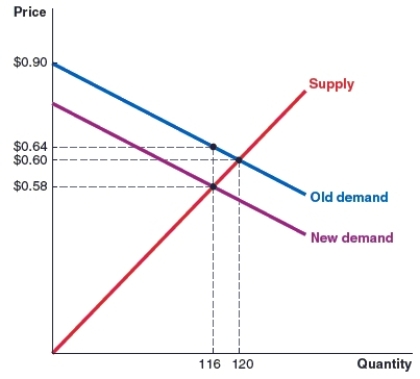

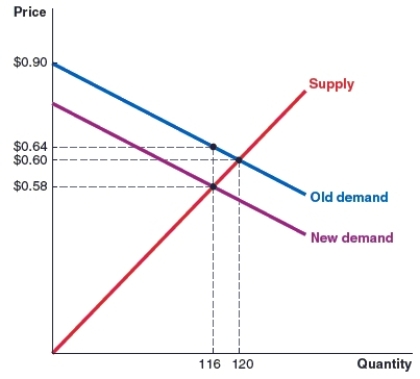

(Figure: Market) In the market shown, the original equilibrium price is 60 cents. A tax is then implemented on the buyer. The amount of the tax is _____ cents.

A)6

B)8

C)4

D)2

A)6

B)8

C)4

D)2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

28

(Figure: Market) In the market shown, the original equilibrium price is 60 cents. A tax is then implemented on the buyer. After the implementation of the tax, the buyer pays a price of _____ cents per unit of the product.

A)58

B)60

C)64

D)90

A)58

B)60

C)64

D)90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

29

(Figure: Market) In the market shown, the original equilibrium price is 60 cents. A tax is then implemented on the buyer. The economic burden of this tax on the buyer is _____ cents.

A)6

B)8

C)4

D)2

A)6

B)8

C)4

D)2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

30

(Figure: Market) In the market shown, the original equilibrium price is 60 cents. A tax is then implemented on the buyer. The economic burden of this tax on the seller is _____ cents.

A)6

B)8

C)4

D)2

A)6

B)8

C)4

D)2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

31

(Figure: Market) In the market shown, the original equilibrium price is 60 cents. A tax is then implemented on the buyer. After the implementation of the tax, the seller receives _____ cents per unit of the product.

A)58

B)60

C)64

D)90

A)58

B)60

C)64

D)90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

32

(Figure: Market) In the market shown, the original equilibrium price is 60 cents. A tax is then implemented on the buyer. After the introduction of the tax, the equilibrium quantity in this market _____ by _____ units.

A)increased, 4

B)decreased, 4

C)increased, 6

D)decreased, 6

A)increased, 4

B)decreased, 4

C)increased, 6

D)decreased, 6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

33

A tax on sellers causes which of the following?

(i) a leftward shift of the supply curve

(ii) a decrease in quantity sold

(iii) an increase in the price buyers pay

A)(i), (ii), and (iii)

B)(i) and (iii)

C)(ii) and (iii)

D)only (i)

(i) a leftward shift of the supply curve

(ii) a decrease in quantity sold

(iii) an increase in the price buyers pay

A)(i), (ii), and (iii)

B)(i) and (iii)

C)(ii) and (iii)

D)only (i)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

34

A tax on buyers causes which of the following?

(i) a leftward shift of the demand curve

(ii) a decrease in quantity sold

(iii) an increase in the price buyers pay

A)(i), (ii), and (iii)

B)(i) and (iii)

C)(ii) and (iii)

D)only (i)

(i) a leftward shift of the demand curve

(ii) a decrease in quantity sold

(iii) an increase in the price buyers pay

A)(i), (ii), and (iii)

B)(i) and (iii)

C)(ii) and (iii)

D)only (i)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

35

A tax on buyers shifts the:

A)supply curve to the left.

B)supply curve to the right.

C)demand curve to the left.

D)demand curve to the right.

A)supply curve to the left.

B)supply curve to the right.

C)demand curve to the left.

D)demand curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

36

A tax on sellers would not cause a decrease in quantity sold if:

A)supply is inelastic.

B)there are few competing products.

C)demand is perfectly inelastic.

D)demand is perfectly elastic.

A)supply is inelastic.

B)there are few competing products.

C)demand is perfectly inelastic.

D)demand is perfectly elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

37

A tax on buyers would not cause a decrease in quantity sold if:

A)demand is inelastic.

B)there are few competing products.

C)supply is perfectly elastic.

D)supply is perfectly inelastic.

A)demand is inelastic.

B)there are few competing products.

C)supply is perfectly elastic.

D)supply is perfectly inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

38

The statutory burden of a tax:

A)determines who finally pays the entire tax being levied.

B)does not change the incidence of the tax.

C)always leads to an equal allocation of the tax between buyer and seller.

D)does not play a role in determining where demand or supply shifts as a result of the tax.

A)determines who finally pays the entire tax being levied.

B)does not change the incidence of the tax.

C)always leads to an equal allocation of the tax between buyer and seller.

D)does not play a role in determining where demand or supply shifts as a result of the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

39

When the price elasticity of demand is _____ relative to the price elasticity of supply, then buyers bear _____ of the economic burden of a tax.

A)small; all

B)small; none

C)large; a smaller share

D)large; a bigger share

A)small; all

B)small; none

C)large; a smaller share

D)large; a bigger share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

40

When the price elasticity of supply is _____ relative to the price elasticity of demand, then sellers bear _____ of the economic burden of a tax.

A)small; all

B)small; none

C)large; a bigger share

D)large; a smaller share

A)small; all

B)small; none

C)large; a bigger share

D)large; a smaller share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

41

Buyers bear all the economic burden of a tax if the demand curve is _____, given an upward sloping supply curve.

A)perfectly elastic

B)relatively inelastic

C)perfectly inelastic

D)downward sloping

A)perfectly elastic

B)relatively inelastic

C)perfectly inelastic

D)downward sloping

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

42

(Figure: Market for Timber) Refer to the figure which shows the market for timber. Which of the following statements is correct?

A)There is no statutory burden for this tax.

B)The economic burden of this tax is greater on the buyer.

C)The economic burden of this tax is being split equally between buyer and seller.

D)The economic burden of this tax is greater on the seller.

A)There is no statutory burden for this tax.

B)The economic burden of this tax is greater on the buyer.

C)The economic burden of this tax is being split equally between buyer and seller.

D)The economic burden of this tax is greater on the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

43

(Figure: Market for Timber) Refer to the figure which shows the market for timber. Which of the following statements is correct?

A)The incidence of the tax on the buyer is 10% and on the seller is 90%.

B)The incidence of this tax is greater on the buyer.

C)The incidence of this tax is 50% on the buyer and 50% on the seller.

D)The incidence of this tax is greater on the seller.

A)The incidence of the tax on the buyer is 10% and on the seller is 90%.

B)The incidence of this tax is greater on the buyer.

C)The incidence of this tax is 50% on the buyer and 50% on the seller.

D)The incidence of this tax is greater on the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

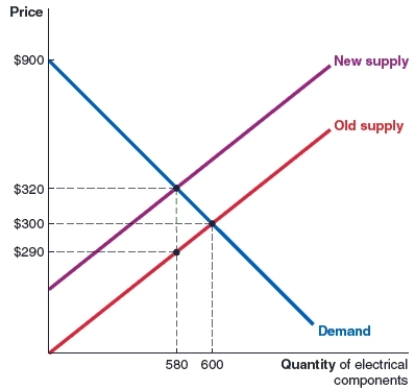

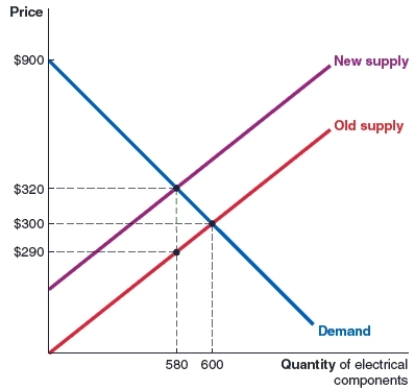

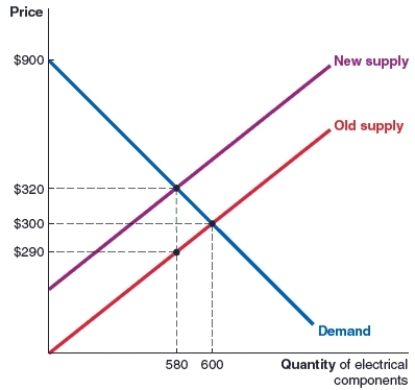

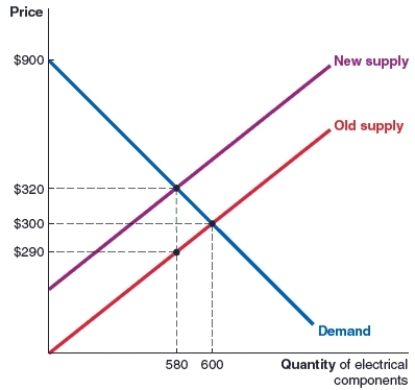

44

(Figure: Market for Electrical Components) Refer to the figure which shows the market for electrical components. Which of the following statements is correct?

A)There is no statutory burden for this tax.

B)The economic burden of this tax is greater on the buyer.

C)The economic burden of this tax is being split equally between buyer and seller.

D)The economic burden of this tax is greater on the seller.

A)There is no statutory burden for this tax.

B)The economic burden of this tax is greater on the buyer.

C)The economic burden of this tax is being split equally between buyer and seller.

D)The economic burden of this tax is greater on the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

45

(Figure: Market for Electrical Components) Refer to the figure which shows the market for electrical components. Which of the following statements is correct?

A)The incidence of the tax on the buyer is 45% and on the seller is 55%.

B)The incidence of this tax is greater on the buyer.

C)The incidence of this tax is 50% on the buyer and 50% on the seller.

D)The incidence of this tax is greater on the seller.

A)The incidence of the tax on the buyer is 45% and on the seller is 55%.

B)The incidence of this tax is greater on the buyer.

C)The incidence of this tax is 50% on the buyer and 50% on the seller.

D)The incidence of this tax is greater on the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

46

Buyers bear a smaller incidence of the tax when:

A)the tax is higher.

B)supply is more elastic than demand.

C)demand is more elastic than supply.

D)demand is perfectly inelastic.

A)the tax is higher.

B)supply is more elastic than demand.

C)demand is more elastic than supply.

D)demand is perfectly inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

47

Sellers bear a smaller incidence of a tax when:

A)the tax is higher.

B)supply is more elastic relative to demand.

C)demand is more elastic relative to supply.

D)demand is perfectly inelastic.

A)the tax is higher.

B)supply is more elastic relative to demand.

C)demand is more elastic relative to supply.

D)demand is perfectly inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

48

A subsidy is a:

A)form of tax.

B)government regulation of the quantity sold in a market.

C)a tax designed to encourage particular purchases or productive activities.

D)a government payment designed to encourage particular purchases or productive activities.

A)form of tax.

B)government regulation of the quantity sold in a market.

C)a tax designed to encourage particular purchases or productive activities.

D)a government payment designed to encourage particular purchases or productive activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

49

The incidence of a tax is

A)the same as the statutory burden of the tax.

B)the division of the economic burden of a tax between buyers and sellers.

C)determined by the government.

D)the same dollar amount as the subsidy on an item.

A)the same as the statutory burden of the tax.

B)the division of the economic burden of a tax between buyers and sellers.

C)determined by the government.

D)the same dollar amount as the subsidy on an item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

50

When looking at a demand and supply graph, if a tax is implemented on a buyer, the vertical distance between the old and new demand curves at the new equilibrium quantity will be equivalent to the

A)amount of the tax.

B)economic burden of the tax on the buyer.

C)economic burden of the tax on the seller.

D)price of the item.

A)amount of the tax.

B)economic burden of the tax on the buyer.

C)economic burden of the tax on the seller.

D)price of the item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

51

When looking at a demand and supply graph, if a tax is implemented on a seller, the vertical distance between the old and new supply curves at the new equilibrium quantity will be equivalent to the

A)economic burden of the tax on the seller.

B)economic burden of the tax on the buyer.

C)amount of the tax.

D)price of the item.

A)economic burden of the tax on the seller.

B)economic burden of the tax on the buyer.

C)amount of the tax.

D)price of the item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is caused by a subsidy for buyers of a particular item?

(i) a leftward shift of the demand curve

(ii) an increase in quantity sold

(iii) a rightward shift of the demand curve

A)(i), (ii), and (iii)

B)(i) and (iii)

C)(ii) and (iii)

D)only (i)

(i) a leftward shift of the demand curve

(ii) an increase in quantity sold

(iii) a rightward shift of the demand curve

A)(i), (ii), and (iii)

B)(i) and (iii)

C)(ii) and (iii)

D)only (i)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

53

A subsidy is

(i) a negative tax.

(ii) a tax rebate given to those who make a specific choice.

(iii) a payment made by the government to those who make a specific choice.

A)(i), (ii), and (iii)

B)(i) and (iii)

C)(ii) and (iii)

D)(i) only

(i) a negative tax.

(ii) a tax rebate given to those who make a specific choice.

(iii) a payment made by the government to those who make a specific choice.

A)(i), (ii), and (iii)

B)(i) and (iii)

C)(ii) and (iii)

D)(i) only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

54

A subsidy for buyers of a product shifts the:

A)supply curve to the left.

B)supply curve to the right.

C)demand curve to the left.

D)demand curve to the right.

A)supply curve to the left.

B)supply curve to the right.

C)demand curve to the left.

D)demand curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is caused by a subsidy for sellers of a particular item?

(i) a leftward shift of the supply curve

(ii) an increase in quantity sold

(iii) a rightward shift of the supply curve

A)(i), (ii), and (iii)

B)(i) and (iii)

C)(ii) and (iii)

D)only (i)

(i) a leftward shift of the supply curve

(ii) an increase in quantity sold

(iii) a rightward shift of the supply curve

A)(i), (ii), and (iii)

B)(i) and (iii)

C)(ii) and (iii)

D)only (i)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is caused by a subsidy for sellers of a particular item?

(i) an increase in supply

(ii) an increase in quantity sold

(iii) a leftward shift of demand curve

A)(i), (ii), and (iii)

B)(i) and (ii)

C)(ii) and (iii)

D)only (i)

(i) an increase in supply

(ii) an increase in quantity sold

(iii) a leftward shift of demand curve

A)(i), (ii), and (iii)

B)(i) and (ii)

C)(ii) and (iii)

D)only (i)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

57

A subsidy for a seller of a product shifts the:

A)supply curve to the left.

B)supply curve to the right.

C)demand curve to the left.

D)demand curve to the right.

A)supply curve to the left.

B)supply curve to the right.

C)demand curve to the left.

D)demand curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

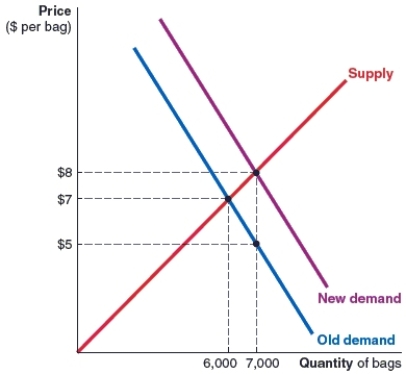

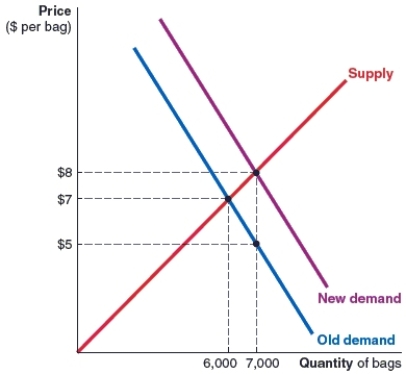

58

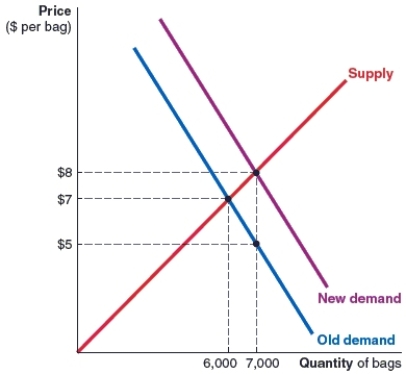

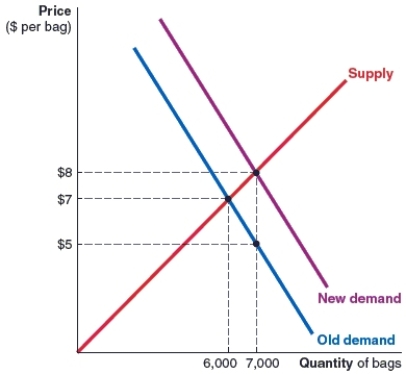

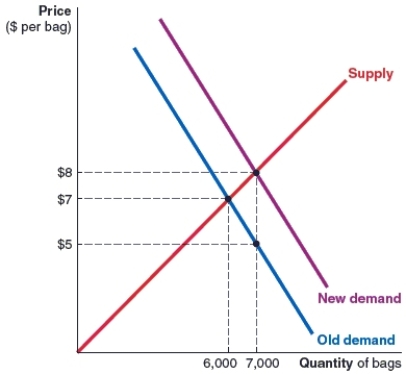

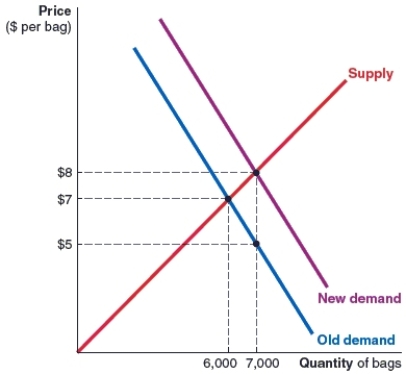

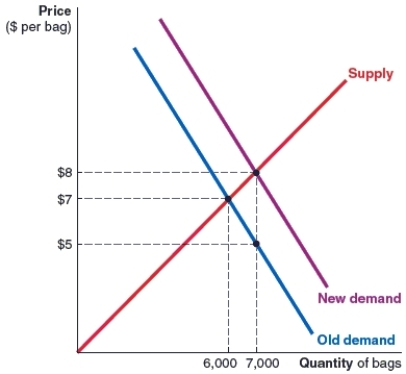

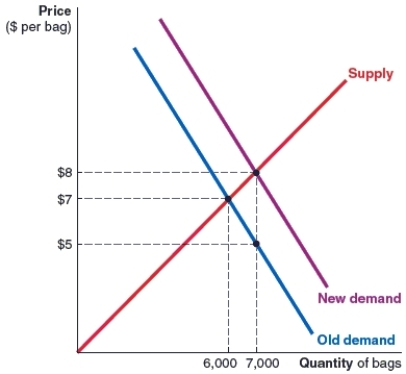

(Figure: Market for Reusable Jute Shopping Bags) Refer to the market for reusable jute shopping bags that is shown in the figure. The original equilibrium price is $7 per bag. A subsidy is now introduced for buyers of the bags. The amount of the subsidy is:

A)$2.

B)$8.

C)$1.

D)$3.

A)$2.

B)$8.

C)$1.

D)$3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

59

(Figure: Market for Reusable Jute Shopping Bags) Refer to the market for reusable jute shopping bags that is shown in the figure. The original equilibrium price is $7 per bag. A subsidy is now introduced for buyers of the bags. As a result of the subsidy, the equilibrium quantity in the market _____ by _____ units.

A)rises; 7,000

B)falls; 1,000

C)rises; 1,000

D)falls; 6,000

A)rises; 7,000

B)falls; 1,000

C)rises; 1,000

D)falls; 6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

60

(Figure: Market for Reusable Jute Shopping Bags) Refer to the market for reusable jute shopping bags that is shown in the figure. The original equilibrium price is $7 per bag. After the subsidy is implemented, the amount that buyers pay is:

A)$8.

B)$6.

C)$7.

D)$5.

A)$8.

B)$6.

C)$7.

D)$5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

61

(Figure: Market for Reusable Jute Shopping Bags) Refer to the market for reusable jute shopping bags that is shown in the figure. The original equilibrium price is $7 per bag. After the subsidy is implemented, the amount that sellers receive is:

A)$8.

B)$6.

C)$7.

D)$5.

A)$8.

B)$6.

C)$7.

D)$5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

62

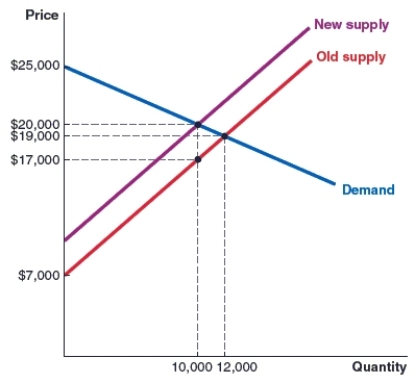

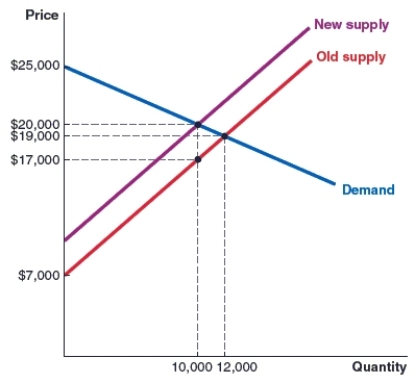

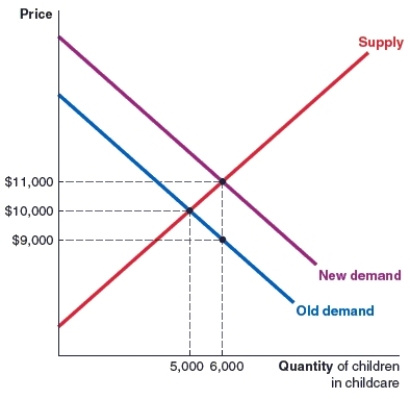

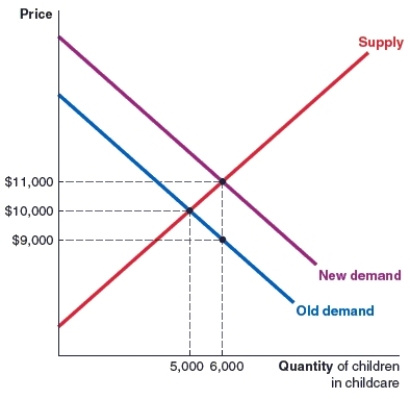

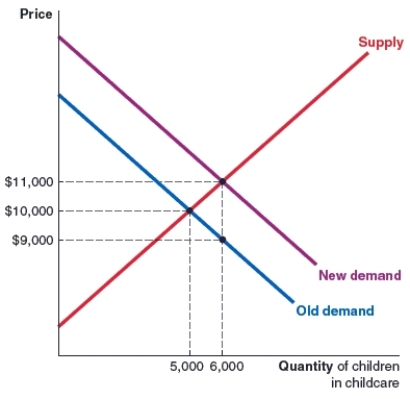

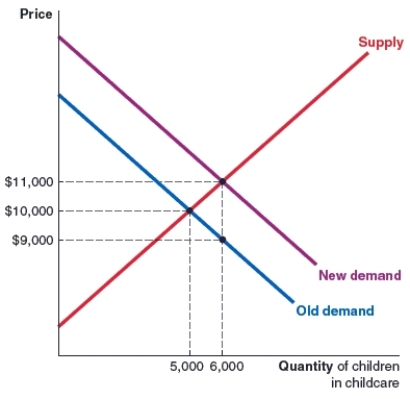

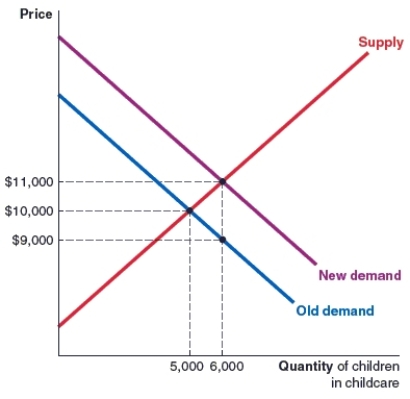

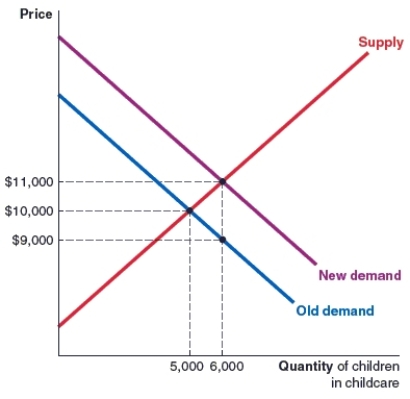

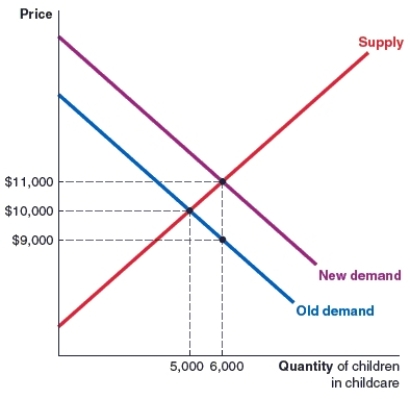

(Figure: Market for Child Care) Refer to the market for child care that is shown in the figure. The original equilibrium price is $10,000. A subsidy is now introduced for parents who pay for child care. The amount of the subsidy is:

A)$9,000.

B)$2,000.

C)$1,000.

D)$11,000.

A)$9,000.

B)$2,000.

C)$1,000.

D)$11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

63

(Figure: Market for Child Care) Refer to the market for child care that is shown in the figure. The original equilibrium price is $10,000. A subsidy is now introduced for parents who pay for child care. The equilibrium price and quantity before the subsidy were_____ and ____.

A)$9,000; 6,000

B)$10,000; 5,000

C)$1,000; 2,000

D)$10,000; 6,000

A)$9,000; 6,000

B)$10,000; 5,000

C)$1,000; 2,000

D)$10,000; 6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

64

(Figure: Market for Child Care) Refer to the market for child care that is shown in the figure. The original equilibrium price is $10,000. A subsidy is now introduced for parents who pay for child care. After the subsidy is implemented, the amount that parents pay is:

A)$9,000.

B)$2,000.

C)$1,000.

D)$11,000.

A)$9,000.

B)$2,000.

C)$1,000.

D)$11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

65

(Figure: Market for Child Care) Refer to the market for child care that is shown in the figure. The original equilibrium price is $10,000. A subsidy is now introduced for parents who pay for child care. After the subsidy is implemented, the amount that sellers receive is:

A)$9,000.

B)$2,000.

C)$1,000.

D)$11,000.

A)$9,000.

B)$2,000.

C)$1,000.

D)$11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

66

A price ceiling is:

A)the maximum price that a seller can charge in a market.

B)the minimum price that a seller can charge in a market.

C)the average price that a seller can charge in a market.

D)any price above the equilibrium price.

A)the maximum price that a seller can charge in a market.

B)the minimum price that a seller can charge in a market.

C)the average price that a seller can charge in a market.

D)any price above the equilibrium price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

67

A binding price ceiling is:

A)the minimum price that a seller can charge in a market.

B)always at the equilibrium price.

C)always above the equilibrium price.

D)always below the equilibrium price.

A)the minimum price that a seller can charge in a market.

B)always at the equilibrium price.

C)always above the equilibrium price.

D)always below the equilibrium price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

68

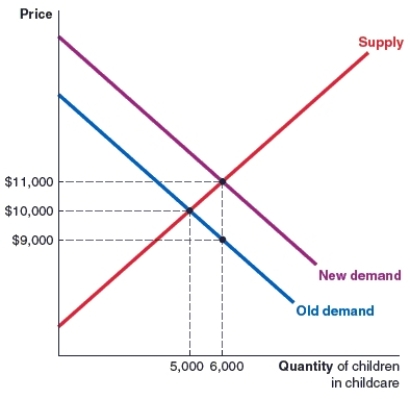

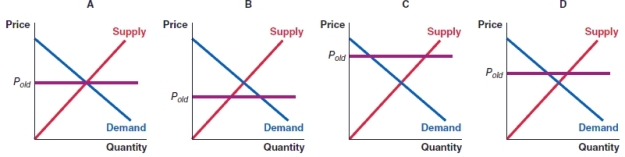

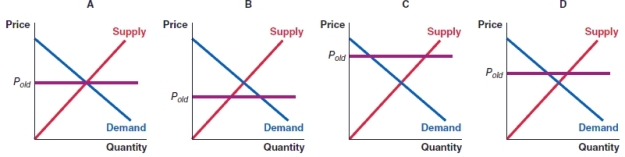

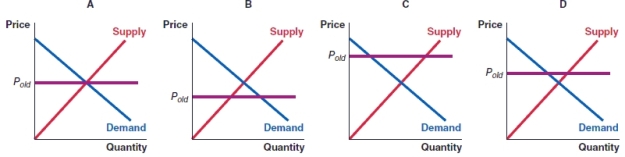

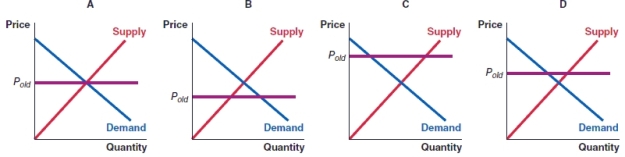

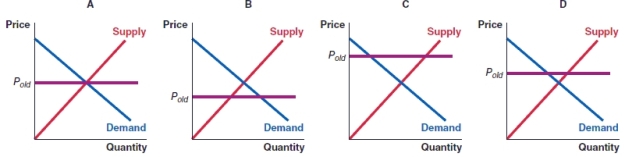

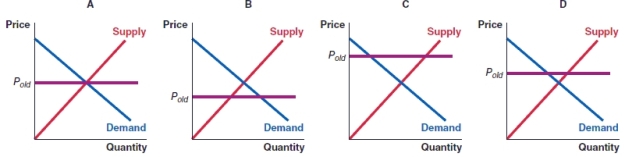

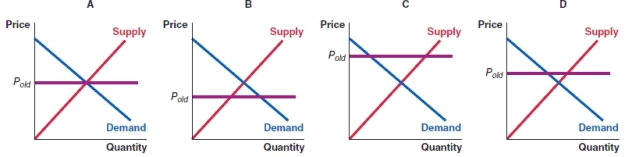

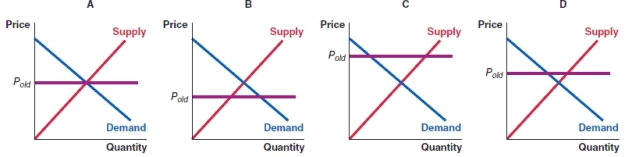

(Figure: Price Ceilings) A binding price ceiling can be seen in:

A) figure A.

B) figure B.

C) figure C.

D) figure D.

A) figure A.

B) figure B.

C) figure C.

D) figure D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

69

(Figure: Markets) In the set of figures shown, Figures A, C and D are all:

A)equilibrium prices.

B)binding price ceilings.

C)non-binding price ceilings.

D)prices that lead to shortages.

A)equilibrium prices.

B)binding price ceilings.

C)non-binding price ceilings.

D)prices that lead to shortages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

70

A binding price floor is:

A)the maximum price that a seller can charge in a market.

B)always at the equilibrium price.

C)always above the equilibrium price.

D)always below the equilibrium price.

A)the maximum price that a seller can charge in a market.

B)always at the equilibrium price.

C)always above the equilibrium price.

D)always below the equilibrium price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

71

(Figure: Markets) In the set of figures shown,

A)figure A is a binding price floor.

B)figure B is a binding price floor.

C)figure C is a binding price floor.

D)figure D is a binding price ceiling.

A)figure A is a binding price floor.

B)figure B is a binding price floor.

C)figure C is a binding price floor.

D)figure D is a binding price ceiling.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

72

(Figure: Markets) In the set of figures shown,

A)figure A is a binding ceiling.

B)figure B is a binding price floor.

C)figure C is a binding price ceiling.

D)figure D is a binding price floor.

A)figure A is a binding ceiling.

B)figure B is a binding price floor.

C)figure C is a binding price ceiling.

D)figure D is a binding price floor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

73

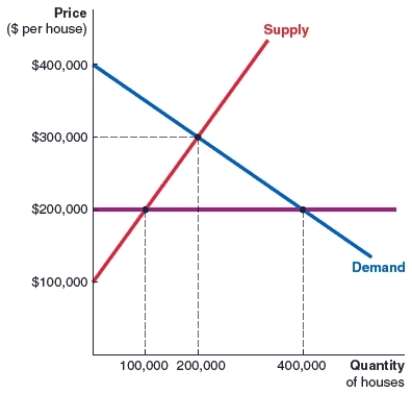

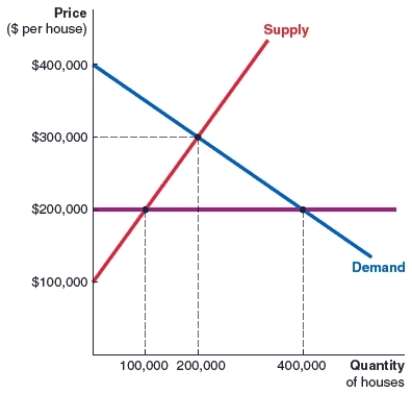

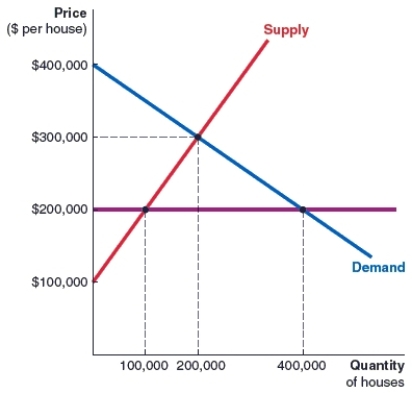

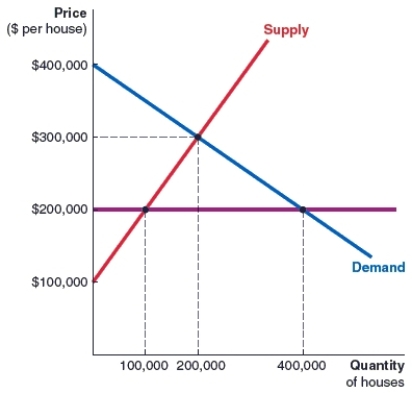

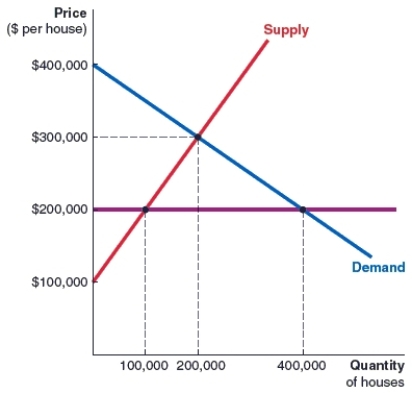

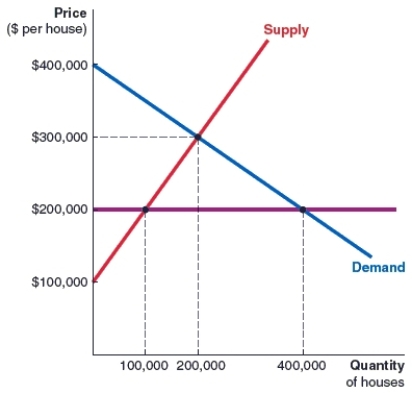

(Figure: Market for Printed Houses) Consider the market for environmentally friendly three-dimensional printed houses that is shown in the figure. The government wants to encourage buyers to buy such houses and places a price ceiling on the market at $200,000 per house. The market quantity sold after the implementation of the price ceiling is _____ houses.

A)200,000

B)400,000

C)300,000

D)100,000

A)200,000

B)400,000

C)300,000

D)100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

74

(Figure: Market for Printed Houses) Consider the market for environmentally friendly three-dimensional printed houses that is shown in the figure. The government wants to encourage buyers to buy such houses and places a price ceiling on the market at $200,000 per house. After the implementation of the price ceiling, the market quantity sold falls by _____ houses.

A)200,000

B)400,000

C)300,000

D)100,000

A)200,000

B)400,000

C)300,000

D)100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

75

(Figure: Market for Printed Houses) Consider the market for environmentally friendly three-dimensional printed houses that is shown in the figure. The government wants to encourage buyers to buy such houses and places a price ceiling on the market at $200,000 per house. What occurs in this market after the implementation of the price ceiling?

A)a shortage of 100,000 houses.

B)a shortage of 300,000 houses.

C)a surplus of 200,000 houses.

D)a surplus of 100,000 houses.

A)a shortage of 100,000 houses.

B)a shortage of 300,000 houses.

C)a surplus of 200,000 houses.

D)a surplus of 100,000 houses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

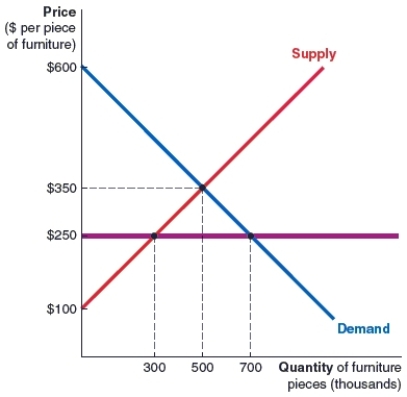

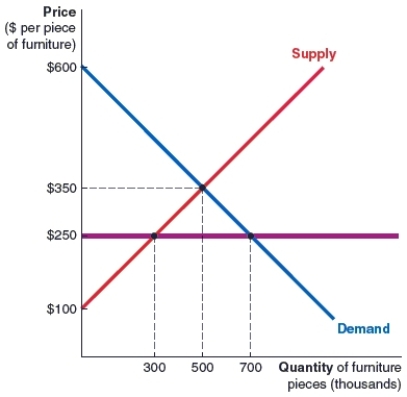

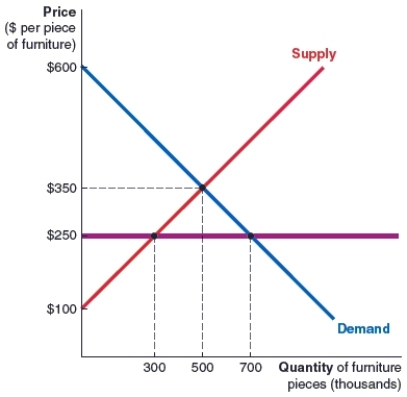

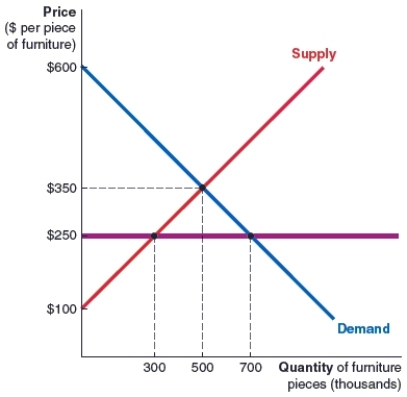

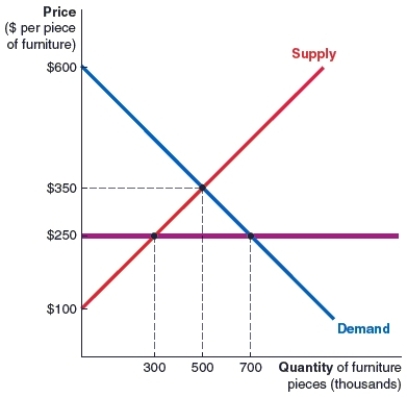

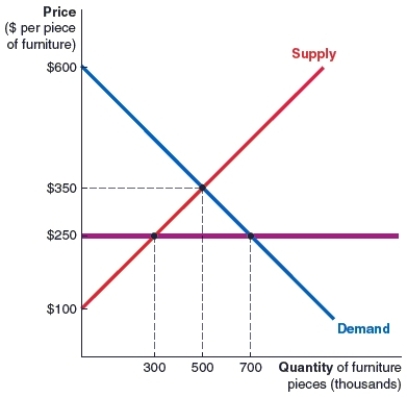

76

(Figure: Market for Sustainable Furniture) Consider the market for furniture made from sustainable, man-made forests that is shown in the figure. The government wants to encourage buyers to buy such furniture and places a price ceiling of $250 on the market. The market quantity actually sold after the implementation of the price ceiling is _____ thousand pieces of furniture.

A)700

B)300

C)500

D)350

A)700

B)300

C)500

D)350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

77

(Figure: Market for Sustainable Furniture) Consider the market for furniture made from sustainable, man-made forests that is shown in the figure. The government wants to encourage buyers to buy such furniture and places a price ceiling of $250 on the market. After the implementation of the price ceiling, the market quantity sold falls by _____ thousand units.

A)400

B)300

C)200

D)500

A)400

B)300

C)200

D)500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

78

(Figure: Market for Sustainable Furniture) The graph depicts the market for furniture made from sustainable, man-made forests. The government wants to encourage buyers to buy such furniture and imposes a price ceiling of $250. What occurs as a result of the price ceiling?

A)a shortage of 400,000 pieces of furniture.

B)a shortage of 200,000 pieces of furniture.

C)a surplus of 300,000 pieces of furniture.

D)a surplus of 400,000 pieces of furniture.

A)a shortage of 400,000 pieces of furniture.

B)a shortage of 200,000 pieces of furniture.

C)a surplus of 300,000 pieces of furniture.

D)a surplus of 400,000 pieces of furniture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

79

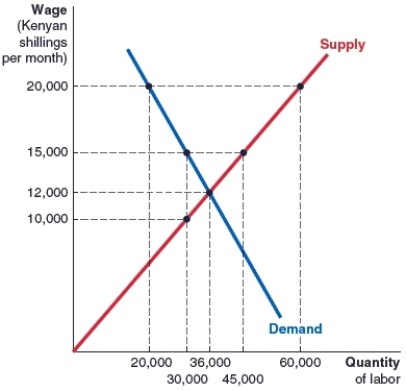

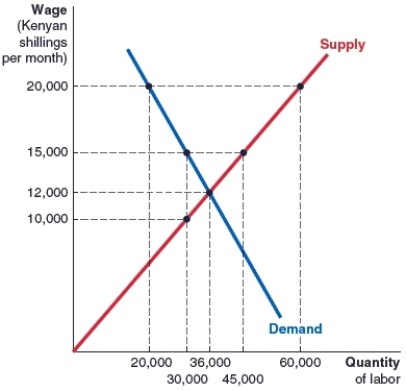

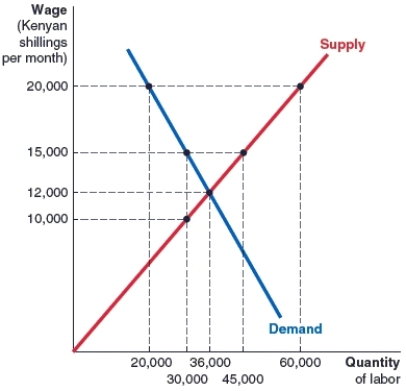

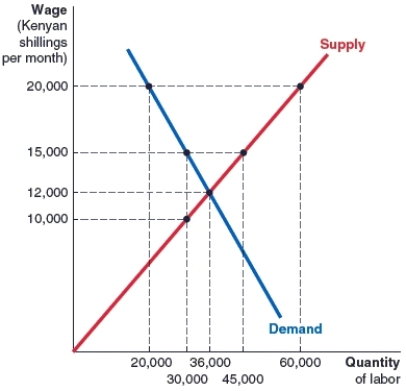

(Figure: Kenyan Labor Market) The government of Kenya implements a minimum wage of 15,000 Kenyan shillings per month. After the implementation of the wage, _____ workers are hired.

A)20,000

B)36,000

C)30,000

D)45,000

A)20,000

B)36,000

C)30,000

D)45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck

80

(Figure: Kenyan Labor Market) The labor market begins in equilibrium. Then, the government of Kenya implements a minimum wage of 15,000 Kenyan shillings per month. After the implementation of the minimum wage, the number of workers hired _____ people.

A)falls by 10,000

B)falls by 6,000

C)rises by 9,000

D)rises by 10,000

A)falls by 10,000

B)falls by 6,000

C)rises by 9,000

D)rises by 10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 265 في هذه المجموعة.

فتح الحزمة

k this deck