Deck 4: Equivalence for Repeated Cash Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/22

العب

ملء الشاشة (f)

Deck 4: Equivalence for Repeated Cash Flows

1

A set of cash flows are given in table below, using the principles of equivalence, determine the value "Y" for an interest rate of 8% compounded annually.

A) $1,402.34

B) $1,887.50

C) $1,107.78

D) $2,328.25

A) $1,402.34

B) $1,887.50

C) $1,107.78

D) $2,328.25

$1,887.50

2

For an interest rate of 10% compounded annually, evaluate the value of "X" from the cash flows given in table below.

A) $2,316.85

B) $3,295.43

C) $1,064.74

D) $1,102.75

A) $2,316.85

B) $3,295.43

C) $1,064.74

D) $1,102.75

$2,316.85

3

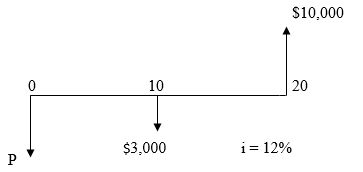

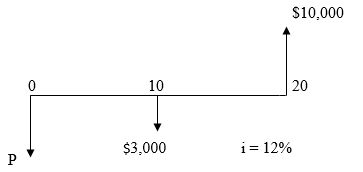

For the cash flow diagram below, determine the value of P

A) $119.26

B) $195.49

C) $71

D) $147.20

A) $119.26

B) $195.49

C) $71

D) $147.20

$71

4

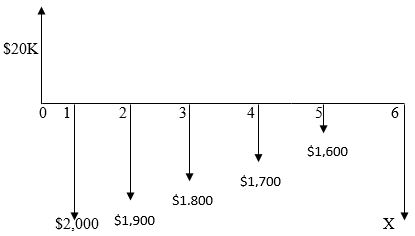

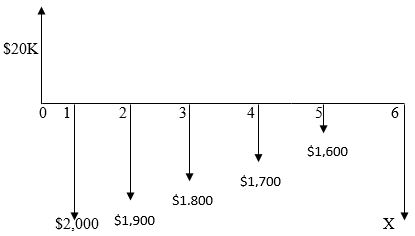

Four different choices are given to determine the unknown value of "X" from the cash flow diagram given below. Use an interest rate of i =6%.

A) X= {20,000 - 2,000(P/A, 6%, 6) +100(P/G, 6%, 6)} (P/F, 6%, 6)

B) X= {20,000 - 2,000(P/A, 6%, 5) +100(P/G, 6%, 5)} (F/P, 6%, 6)

C) X= {20,000 - 2,000(P/A, 6%, 6) +100(P/G, 6%, 6)} (F/P, 6%, 6)

D) X= {20,000 - 2,000(P/A, 6%, 6) +100(P/G, 6%, 5)} (P/F, 4%, 6)

A) X= {20,000 - 2,000(P/A, 6%, 6) +100(P/G, 6%, 6)} (P/F, 6%, 6)

B) X= {20,000 - 2,000(P/A, 6%, 5) +100(P/G, 6%, 5)} (F/P, 6%, 6)

C) X= {20,000 - 2,000(P/A, 6%, 6) +100(P/G, 6%, 6)} (F/P, 6%, 6)

D) X= {20,000 - 2,000(P/A, 6%, 6) +100(P/G, 6%, 5)} (P/F, 4%, 6)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

5

What is the present worth of the cash flows in table below? Use an interest rate of 6% compounded annually.

A) $89,263

B) $85,496

C) $89,915.77

D) $91,611

A) $89,263

B) $85,496

C) $89,915.77

D) $91,611

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

6

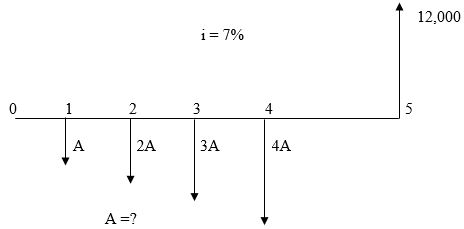

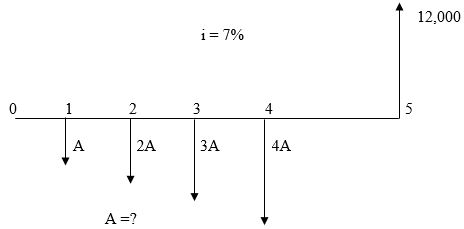

Given the cash flow diagram below, evaluate the value of "A" for an interest rate of 7%.

A) $585

B) $1045.72

C) $1200

D) $915

A) $585

B) $1045.72

C) $1200

D) $915

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

7

Mary is planning to repay a debt of 50,000 with a quarterly payment $2,400 for the next 23 quarters and a final payment of "X" dollars at the end of 24-th quarter. If the interest rate is 12% per year, compounded quarterly, how much will be Mary's final payment?

A) $21,426

B) $22,176

C) $23,010

D) $23,920

A) $21,426

B) $22,176

C) $23,010

D) $23,920

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

8

Determine the value of P from the cash flows shown in table below. Interest rate = 10%.

A) $8,102

B) $5,197.5

C) $9,211.2

D) $7,284.9

A) $8,102

B) $5,197.5

C) $9,211.2

D) $7,284.9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

9

Tom started investing, as soon as he started his first job, at the rate of $400 per month as soon as get paid into a savings account that earns an interest of 1% per month. Which of the following expression may be used to determine the account value 10 years from now?

A) F = [4,800(P/A, 12%, 10)] [(F/P, 12%, 10)]

B) F = 400[(P/A, 1%, 120) (F/P, 12%, 5)]

C) F= [400/0.01] (F/P, 1%, 60)

D) F= 400(F/A, 1%, 120)

A) F = [4,800(P/A, 12%, 10)] [(F/P, 12%, 10)]

B) F = 400[(P/A, 1%, 120) (F/P, 12%, 5)]

C) F= [400/0.01] (F/P, 1%, 60)

D) F= 400(F/A, 1%, 120)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

10

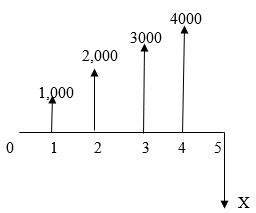

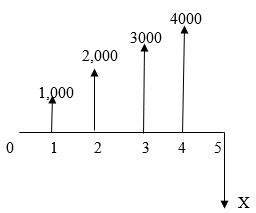

Choose the equation below that can be used to determine the value of "P" for a known interest rate, i.

A) P = 10,000(P/F, i%, 5) - 2,000(P/G, i%, 5)

B) P = 10,000- 1,000(P/G, i%, 5) (F/P, i%, 5)

C) P= 10,000(P/F, i%, 5) -2,000(P/G, i%, 5)

D) P= -10,000(P/F, i%, 5) + 2,000(P/G, i%, 4)

A) P = 10,000(P/F, i%, 5) - 2,000(P/G, i%, 5)

B) P = 10,000- 1,000(P/G, i%, 5) (F/P, i%, 5)

C) P= 10,000(P/F, i%, 5) -2,000(P/G, i%, 5)

D) P= -10,000(P/F, i%, 5) + 2,000(P/G, i%, 4)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

11

Ben invested $20,000 into a money market account and took out $5,000 at the end of year 5. He found out at the end of 10 years that he had as of $50,000 in the account.

What is the annual interest rate Ben had earned on this investment?

A) 8%

B) 12.93%

C) 15.23%

D) 11.38%

What is the annual interest rate Ben had earned on this investment?

A) 8%

B) 12.93%

C) 15.23%

D) 11.38%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

12

Given the cash flow diagram below, evaluate the "X" value using an interest rate of 8%.

A) $7,201

B) $6,781

C) $3410.23

D) $6,525

A) $7,201

B) $6,781

C) $3410.23

D) $6,525

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

13

IAN Tech is saving $10,000 a month in a money fund to pay for equipment that will cost $700,000 five years from now. If the interest rate is 1/4% per month, how much additional funds will be needed to pay for this equipment?

A) $48,239

B) $53,530

C) $59,750

D) $25,070

A) $48,239

B) $53,530

C) $59,750

D) $25,070

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

14

Determine the unknown from the cash flow diagram shown below. i = 10%.

A) $12,160

B) $14,500

C) $10,108

D) $12,809

A) $12,160

B) $14,500

C) $10,108

D) $12,809

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

15

Given a series of cash flows in the table below, determine the value of "y". i=6%

A) $21,025

B) $21,960

C) $23,821

D) $22,507

A) $21,025

B) $21,960

C) $23,821

D) $22,507

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

16

Given the cash flow table below, determine the unknown value "X" for an interest rate of 6%.

A) $2436.89

B) $3129.41

C) $2935.66

D) $1610.53

A) $2436.89

B) $3129.41

C) $2935.66

D) $1610.53

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

17

Case Study 4

Daniel borrowed $20,000 with a promise to repay the loan in 6 years with a uniform monthly payment and a single payment of $2,000 at the end of six years at a nominal interest rate of 12% per year.

-A. What is the amount of each payment?

B. What is the amount of interest paid in the first payment?

C. What will be the loan balance immediately after the 48th payment?

Daniel borrowed $20,000 with a promise to repay the loan in 6 years with a uniform monthly payment and a single payment of $2,000 at the end of six years at a nominal interest rate of 12% per year.

-A. What is the amount of each payment?

B. What is the amount of interest paid in the first payment?

C. What will be the loan balance immediately after the 48th payment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

18

In order to use the gradient series factors to solve a set of given cash flows, the cash flows must increase or decrease gradually by the same amount every year, starting year 2 and must have zero cash flow in year 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

19

In developing cash flow diagrams the convention is to use a negative cash flow for receipts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

20

The weekly payment for a $500 loan to be paid back in 104 payments at an interest rate of 0.25% per week is $6.82.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

21

Interest compounding daily than continuous compounding for a known interest rate will provide a larger yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck

22

If the uniform series capital recovery factor is 0.1359 and the sinking fund factor is 0.0759, then the interest rate is 6%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 22 في هذه المجموعة.

فتح الحزمة

k this deck