Deck 3: Risk and Return

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/18

العب

ملء الشاشة (f)

Deck 3: Risk and Return

1

A good measure of an investor's risk exposure if she/he only holds a single asset in her portfolio is:

A) The expected value of the asset's returns.

B) The standard deviation of possible returns on the asset.

C) The correlation coefficient with the market portfolio.

D) The normal probability distribution function.

A) The expected value of the asset's returns.

B) The standard deviation of possible returns on the asset.

C) The correlation coefficient with the market portfolio.

D) The normal probability distribution function.

The standard deviation of possible returns on the asset.

2

In terms of risk, labor union disputes, entry of a new competitor and embezzlement by management are all examples of factors affecting:

A) Diversifiable risk.

B) Market risk.

C) Systematic risk.

D) Company-specific risk that cannot be diversified away.

A) Diversifiable risk.

B) Market risk.

C) Systematic risk.

D) Company-specific risk that cannot be diversified away.

Diversifiable risk.

3

The standard deviation is a:

A) Numerical indicator of how widely dispersed possible values are distributed around the coefficient of variation.

B) Numerical indicator of how widely dispersed possible values are distributed around the correlation coefficient.

C) Numerical indicator of how widely dispersed possible values are distributed around the mean.

D) Measure of the relative risk of one asset compared with another.

A) Numerical indicator of how widely dispersed possible values are distributed around the coefficient of variation.

B) Numerical indicator of how widely dispersed possible values are distributed around the correlation coefficient.

C) Numerical indicator of how widely dispersed possible values are distributed around the mean.

D) Measure of the relative risk of one asset compared with another.

Numerical indicator of how widely dispersed possible values are distributed around the mean.

4

When we compare the risk of two investments that have the same expected return, the coefficient of variation:

A) Adjusts for the correlation between the two instruments.

B) Provides no additional information when compared with the standard deviation.

C) Gives conflicting results compared to the standard deviation.

D) Always gives us a value between 0 and 1.

A) Adjusts for the correlation between the two instruments.

B) Provides no additional information when compared with the standard deviation.

C) Gives conflicting results compared to the standard deviation.

D) Always gives us a value between 0 and 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

5

Currently XYZ Company has a required return of 12% and a beta of 1.2. According to the CAPM, XYZ:

A) Can't be compared since the risk-free rate is not known.

B) Is less risky than the market.

C) Has an equal risk to the market.

D) Is riskier than the market.

A) Can't be compared since the risk-free rate is not known.

B) Is less risky than the market.

C) Has an equal risk to the market.

D) Is riskier than the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

6

Beta is best described as a measure of:

A) Non-diversifiable risk.

B) Unsystematic risk.

C) Total risk.

D) Diversifiable risk.

A) Non-diversifiable risk.

B) Unsystematic risk.

C) Total risk.

D) Diversifiable risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

7

If two variables are perfectly positively correlated, it means:

A) Their values will change inversely to each other.

B) They have a correlation coefficient of ?1.

C) They change linearly in perfect lockstep.

D) They have a correlation coefficient of zero.

A) Their values will change inversely to each other.

B) They have a correlation coefficient of ?1.

C) They change linearly in perfect lockstep.

D) They have a correlation coefficient of zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

8

You are considering investing in Digital Consolidated's common stock. Based on your perception of Digital's riskiness, you will require a return of 8.5% on their stock. Digital's most recent beta is 1.20. The risk-free rate is currently 3.25%, while the market return is currently 7.75%. Based on these data, should you invest in Digital's stock?

A) No, because Digital's expected return is less than your required return.

B) You are indifferent, because Digital's expected return is equal to your required return.

C) Yes, because Digital's expected return is equal to your required return.

D) Yes, because Digital's expected return exceeds your required return.

A) No, because Digital's expected return is less than your required return.

B) You are indifferent, because Digital's expected return is equal to your required return.

C) Yes, because Digital's expected return is equal to your required return.

D) Yes, because Digital's expected return exceeds your required return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

9

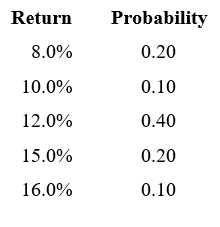

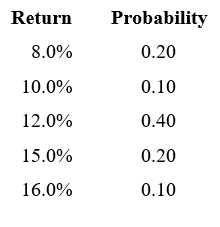

You are given the following probability distribution of returns for a stock. Use the data to calculate the expected return, standard deviation of returns and coefficient of variation of returns for the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

10

The beta for Beltrand Industries is 1.50. Assuming that the nominal risk-free rate is 6.0% and that the return to the market is 9.0%, what is Beltrand's required return?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

11

Farquar Manufacturing has a required return of 9.50%. If the market return is 13.0% and the nominal risk-free rate is 6.0%, what is Farquar's beta?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

12

You are a financial analyst, and you are tasked with calculating the expected return and standard deviation of returns for Kershaw Enterprises. Toward that end, you are given the following data:

In an expanding economy, Kershaw is expected to earn 5.30%;

In a booming economy, Kershaw is expected to earn 9.50%;

In a contracting economy, Kershaw is expected to earn 3.50%;

In a recession, Kershaw is expected to earn ?1.20%;

The probabilities for expansion, boom, contraction and recession are 20%, 25%, 35% and 20% respectively.

In an expanding economy, Kershaw is expected to earn 5.30%;

In a booming economy, Kershaw is expected to earn 9.50%;

In a contracting economy, Kershaw is expected to earn 3.50%;

In a recession, Kershaw is expected to earn ?1.20%;

The probabilities for expansion, boom, contraction and recession are 20%, 25%, 35% and 20% respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

13

You purchased 500 shares of Malfoy Manufacturing's common stock for $35.00 per share, and you sold it again one year later for $39.90 per share. During the year that you held the stock, you were paid a dividend of $2.03 per share. Calculate the dividend yield, capital gains yield and total yield for your investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

14

You purchased 25 corporate bonds for $985.00 each and held them for one year, at which point you sold the bonds for $965.30 each. During the year, you received interest payments of $79.80 per bond. Calculate the current yield, capital gains yield and total yield on the bonds for the year during which you owned them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

15

Your purchased a stock on June 1 for $112.00 per share and promptly sold it on September 1 for $115.36 per share. Calculated the holding period return and the annualized return on the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

16

You purchased a stock for $50.00 share at the end of 2014. At the end of the years 2015-2018, the stock was worth $54.75, $59.13, $56.41 and $60.06 respectively. You sold the stock at the end of 2019 for $62.00 per share. Calculate your arithmetic and geometric mean returns for the stock during the period in which you owned it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

17

In years 1-5, Stock A had returns of 5.6%, 7.9%, 4.2%, 1.8% and 4.5% respectively. During that same period of time the stock market had returns of 6.2%, 7.3%, 5.8%, 4.5% and 6.1% respectively. Use these data and Excel's COVARIANCE.P and VAR.P functions to calculate Stock A's beta over this five-year period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

18

Stock A's returns have a standard deviation of 7.0%, while Stock B's returns have a standard deviation of 9.0%. The correlation coefficient between stocks A and B is 0.45. Use these data to calculate the standard deviation of a portfolio that contains 40% Stock A and 60% Stock B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck