Deck 22: Partnerships: Liquidations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/35

العب

ملء الشاشة (f)

Deck 22: Partnerships: Liquidations

1

The Revised Uniform Partnership Act specifies that the order of payment to creditors and partners during the liquidation process is as follows:

a. __________________________________________.

b. __________________________________________.

c. __________________________________________.

a. __________________________________________.

b. __________________________________________.

c. __________________________________________.

a. partnership creditors other than partners

b. partners' loans-if subordinated

c. partners' capital

b. partners' loans-if subordinated

c. partners' capital

2

A historical statement prepared in a partnership liquidation is the ______________ _________________________________.

statement of realization and liquidation

3

A schedule used in connection with the liquidation of a partnership that is prepared each time cash becomes available for distribution to partners is the ____________________________________.

schedule of safe payments

4

A procedure that was discarded by the Revised Uniform Partnership Act in which partnership assets are deemed a separate pool of assets, as are each partner's personal assets, is the ___________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

5

In the liquidation of a partnership, the subtraction of a partner's capital deficit balance against the balance of any loan outstanding to the partnership is referred to as the _________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a partner absorbs the deficit balance in another partner's capital account during liquidation, then the absorbing partner has ______________________________ the insolvent partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

7

The manner of distributing cash to partners in the liquidation process has the end result of ___________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under the Revised Uniform Partnership Act, gains and losses during liquidation are allocated among the partners differently from preliquidation profits and losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

9

If partners agree to allocate liquidation gains and losses differently from the manner set forth in the Revised Uniform Partnership Act, they may do so.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

10

If a partnership agreement provides that capital balances are to be maintained in accordance with the profit and loss ratio, then a partner cannot ever be put in the position of having to absorb more than his or her share of the liquidation losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

11

When a partnership has a loan outstanding to a partner, the marshalling of assets principle requires that the receivable be written off against the partner's capital account in liquidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

12

In partnership liquidations, a loan by a partner to a partnership is substantively treated as a part of the capital of that partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

13

The statement of realization and liquidation is a historical schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under the rule of setoff, a partner who has to absorb the deficit balance of another partner has legal recourse against the partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the marshalling of assets principle (no longer used) partnership creditors have first priority, partners' loans have second priority, and partners' capital has third priority as to the right to partnership assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

16

In a liquidation in which the two worst-case assumptions are being applied, a partner who has a deficit balance as a result of applying these assumptions is required to make a capital contribution if he or she cannot make good the deficit through the right of setoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

17

No need exists to apply the two worst-case assumptions if a cash distribution plan is prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

18

_____ The Revised Uniform Partnership Act contains

A) The rule of setoff.

B) The use of a cash distribution plan.

C) The marshalling of assets principle.

D) The special profit and loss sharing method.

E) None of the above.

A) The rule of setoff.

B) The use of a cash distribution plan.

C) The marshalling of assets principle.

D) The special profit and loss sharing method.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

19

_____ Under the Revised Uniform Partnership Act, gains and losses incurred on the realization of assets are to be allocated among the partners

A) Using the ratio of the partners' capital balances.

B) In their normal profit and loss sharing ratio.

C) Using the marshalling of assets principle.

D) Equally.

E) None of the above.

A) Using the ratio of the partners' capital balances.

B) In their normal profit and loss sharing ratio.

C) Using the marshalling of assets principle.

D) Equally.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

20

_____ Under the rule of setoff,

A) A partnership's loan to a partner is credited to that partner's capital account when that partner has a capital deficit.

B) A partner's loan to a partnership is credited to that partner's capital account when that partner has a capital deficit.

C) Personal funds of a partner must be set aside to make up a partner's capital deficit.

D) Partnership assets must be set aside to pay off personal creditors of an insolvent partner.

E) None of the above.

A) A partnership's loan to a partner is credited to that partner's capital account when that partner has a capital deficit.

B) A partner's loan to a partnership is credited to that partner's capital account when that partner has a capital deficit.

C) Personal funds of a partner must be set aside to make up a partner's capital deficit.

D) Partnership assets must be set aside to pay off personal creditors of an insolvent partner.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

21

_____ Under the Revised Uniform Partnership Act,

A) The claims of partnership creditors of an insolvent partnership have no greater or lesser legal status than the claims of a partner's personal creditors against a partner's personal assets.

B) A partner's personal creditors have second priority against partnership assets, first priority going to partnership creditors.

C) Partnership creditors have first priority against a partner's personal assets.

D) A partner's personal creditors have first priority against partnership assets.

E) None of the above.

A) The claims of partnership creditors of an insolvent partnership have no greater or lesser legal status than the claims of a partner's personal creditors against a partner's personal assets.

B) A partner's personal creditors have second priority against partnership assets, first priority going to partnership creditors.

C) Partnership creditors have first priority against a partner's personal assets.

D) A partner's personal creditors have first priority against partnership assets.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

22

_____ Under the marshalling of assets principle (which no longer applies),

A) A partner's personal creditors have first priority against partnership assets.

B) A partner's personal creditors have second priority against partnership assets, first priority going to partnership creditors.

C) Partnership creditors have first priority against a partner's personal assets.

D) Partnership creditors have second priority against a partner's personal assets, first priority going to personal creditors.

E) None of the above.

A) A partner's personal creditors have first priority against partnership assets.

B) A partner's personal creditors have second priority against partnership assets, first priority going to partnership creditors.

C) Partnership creditors have first priority against a partner's personal assets.

D) Partnership creditors have second priority against a partner's personal assets, first priority going to personal creditors.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

23

_____ In preparing a cash distribution plan at the start of a partnership liquidation,

A) The capital and loan balances of the partners are not combined.

B) The capital and loan balances of the partners are combined.

C) The two worst-case assumptions are used.

D) The marshalling of assets principle is applied.

E) None of the above.

A) The capital and loan balances of the partners are not combined.

B) The capital and loan balances of the partners are combined.

C) The two worst-case assumptions are used.

D) The marshalling of assets principle is applied.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

24

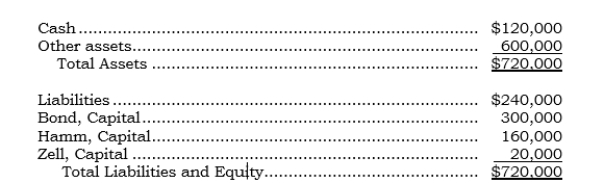

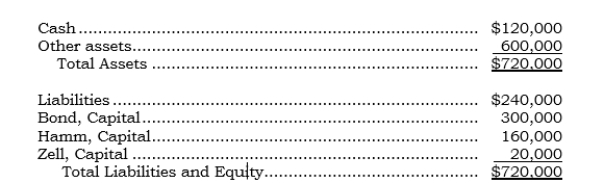

_____ The following condensed balance sheet is prepared for the partnership of Bond, Hamm, and Zell, who share profits and losses in the ratio of 5:3:2, respectively:

The partners decide to liquidate the partnership. The other assets are sold for $460,000. How should the available cash be distributed?

The partners decide to liquidate the partnership. The other assets are sold for $460,000. How should the available cash be distributed?

A) Bond, $300,000; Hamm, $160,000; Zell, $20,000.

B) Bond, $230,000; Hamm, $118,000; Zell, $ -0-.

C) Bond, $226,000; Hamm, $114,000; Zell, $ -0-.

D) Bond, $225,000; Hamm, $115,000; Zell, $ -0-.

E) None of the above.

The partners decide to liquidate the partnership. The other assets are sold for $460,000. How should the available cash be distributed?

The partners decide to liquidate the partnership. The other assets are sold for $460,000. How should the available cash be distributed?A) Bond, $300,000; Hamm, $160,000; Zell, $20,000.

B) Bond, $230,000; Hamm, $118,000; Zell, $ -0-.

C) Bond, $226,000; Hamm, $114,000; Zell, $ -0-.

D) Bond, $225,000; Hamm, $115,000; Zell, $ -0-.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

25

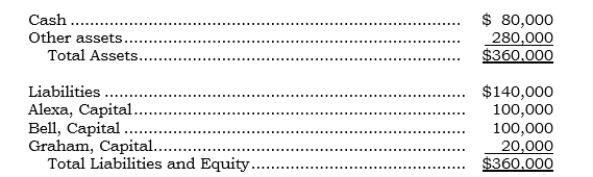

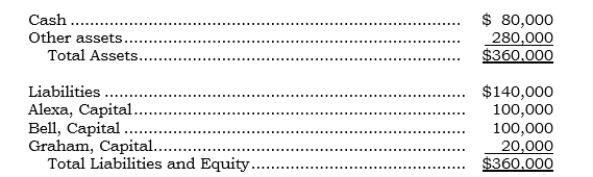

_____ The following condensed balance sheet is presented for the partnership of Alexa, Bell, and Graham, who share profits and losses in the ratio of 6:2:2, respectively:

The partners agree to liquidate the partnership after selling the other assets. The other assets are sold for $160,000. How should the available cash be distributed?

The partners agree to liquidate the partnership after selling the other assets. The other assets are sold for $160,000. How should the available cash be distributed?

A) Alexa, $100,000; Bell, $100,000; Graham, $20,000.

B) Alexa, $25,000; Bell, $75,000; Graham, $ -0-.

C) Alexa, $28,000; Bell, $76,000; Graham, $ -0-.

D) Alexa, $26,000; Bell, $74,000; Graham, $ -0-.

E) None of the above.

The partners agree to liquidate the partnership after selling the other assets. The other assets are sold for $160,000. How should the available cash be distributed?

The partners agree to liquidate the partnership after selling the other assets. The other assets are sold for $160,000. How should the available cash be distributed?A) Alexa, $100,000; Bell, $100,000; Graham, $20,000.

B) Alexa, $25,000; Bell, $75,000; Graham, $ -0-.

C) Alexa, $28,000; Bell, $76,000; Graham, $ -0-.

D) Alexa, $26,000; Bell, $74,000; Graham, $ -0-.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

26

_____ The following condensed balance sheet is presented for the partnership of Anders, Barnes, and Crowley, who share profits and losses in the ratio 5:3:2, respectively:

The partners decide to liquidate the partnership. The other assets are sold for $500,000. How should the available cash be distributed?

The partners decide to liquidate the partnership. The other assets are sold for $500,000. How should the available cash be distributed?

A) Anders, $280,000; Barnes, $28,000; Crowley, $252,000.

B) Anders, $210,000; Barnes, $ -0-; Crowley, $224,000.

C) Anders, $200,000; Barnes, $ -0-; Crowley, $220,000.

D) Anders, $203,000; Barnes, $ -0-; Crowley, $217,000.

E) Anders, $210,000; Barnes, $ -0-; Crowley, $210,000.

The partners decide to liquidate the partnership. The other assets are sold for $500,000. How should the available cash be distributed?

The partners decide to liquidate the partnership. The other assets are sold for $500,000. How should the available cash be distributed?A) Anders, $280,000; Barnes, $28,000; Crowley, $252,000.

B) Anders, $210,000; Barnes, $ -0-; Crowley, $224,000.

C) Anders, $200,000; Barnes, $ -0-; Crowley, $220,000.

D) Anders, $203,000; Barnes, $ -0-; Crowley, $217,000.

E) Anders, $210,000; Barnes, $ -0-; Crowley, $210,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

27

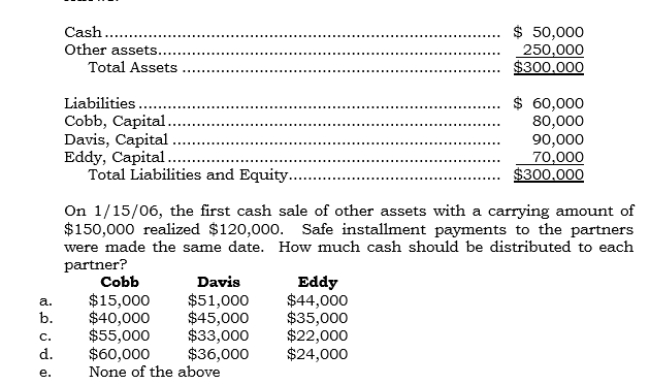

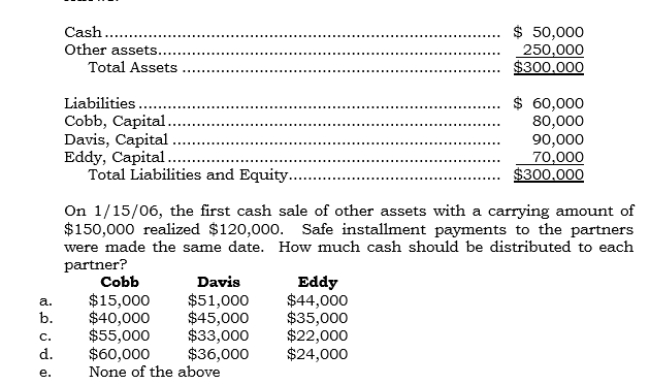

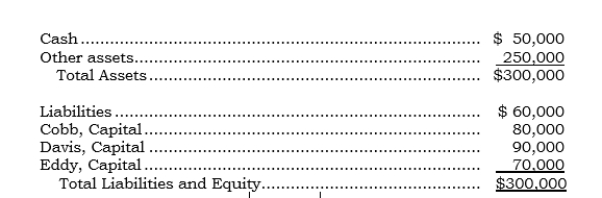

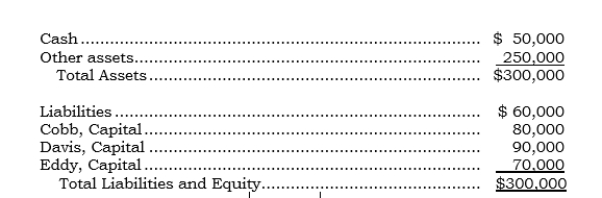

_____ On 1/1/06, the partners of Cobb, Davis, and Eddy, who share profits and losses in the ratio of 5:3:2, respectively, decided to liquidate their partnership. On this date, the partnership condensed balance sheet was as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

28

_____ The following condensed balance sheet is presented for the partnership of Alpha, Baker, and Charley, who share profits and losses in the ratio 4:4:2, respectively:

Assume that the partners decided to liquidate the partnership. The first sale of noncash assets having a book value of $90,000 realized $50,000, and all cash available after settlement with creditors was distributed. How should the available cash have been distributed?

Assume that the partners decided to liquidate the partnership. The first sale of noncash assets having a book value of $90,000 realized $50,000, and all cash available after settlement with creditors was distributed. How should the available cash have been distributed?

A) Alpha, $8,000; Baker, $8,000; Charley, $4,000.

B) Alpha, $6,667; Baker, $6,667; Charley, $6,666.

C) Alpha, $ -0-; Baker, $13,333; Charley, $6,667.

D) Alpha, $ -0-; Baker, $3,000; Charley, $17,000.

E) Alpha, $ -0-; Baker, $18,500; Charley, $1,500.

Assume that the partners decided to liquidate the partnership. The first sale of noncash assets having a book value of $90,000 realized $50,000, and all cash available after settlement with creditors was distributed. How should the available cash have been distributed?

Assume that the partners decided to liquidate the partnership. The first sale of noncash assets having a book value of $90,000 realized $50,000, and all cash available after settlement with creditors was distributed. How should the available cash have been distributed?A) Alpha, $8,000; Baker, $8,000; Charley, $4,000.

B) Alpha, $6,667; Baker, $6,667; Charley, $6,666.

C) Alpha, $ -0-; Baker, $13,333; Charley, $6,667.

D) Alpha, $ -0-; Baker, $3,000; Charley, $17,000.

E) Alpha, $ -0-; Baker, $18,500; Charley, $1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

29

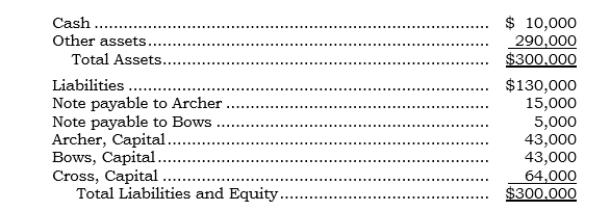

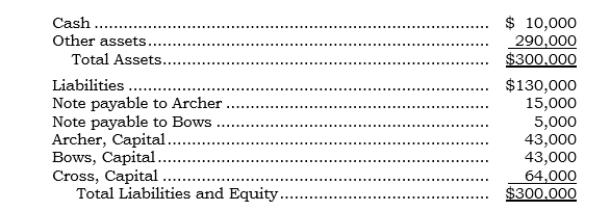

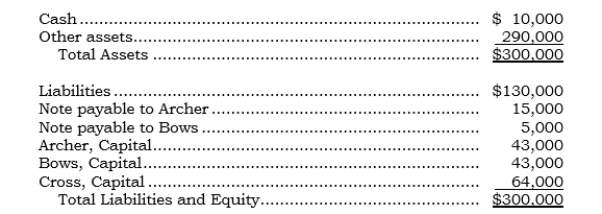

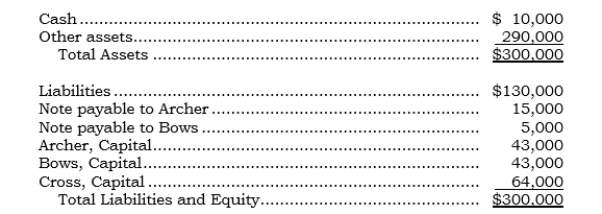

_____ The following condensed balance sheet is presented for the partnership of Archer, Bows, and Cross, who share profits and losses in the ratio 6:3:1, respectively:

Bows paid $30,000 to creditors out of her own personal funds-this has not been reflected in the above balance sheet. Archer is personally solvent but temporarily not liquid.

Bows paid $30,000 to creditors out of her own personal funds-this has not been reflected in the above balance sheet. Archer is personally solvent but temporarily not liquid.

The partners decided to liquidate the partnership. The first sale of noncash assets having a book value of $140,000 realized $120,000. How should the available cash be distributed?

A) Archer, $ -0-; Bows, $ -0-; Cross, $ -0-.

B) Archer, $10,000; Bows, $10,000; Cross, $10,000.

C) Archer, $ -0-; Bows, $ -0-; Cross, $30,000.

D) Archer, $21,000; Bows, $8,000; Cross, $1,000.

E) Archer, $18,333; Bows, $8,333; Cross, $3,334.

Bows paid $30,000 to creditors out of her own personal funds-this has not been reflected in the above balance sheet. Archer is personally solvent but temporarily not liquid.

Bows paid $30,000 to creditors out of her own personal funds-this has not been reflected in the above balance sheet. Archer is personally solvent but temporarily not liquid.The partners decided to liquidate the partnership. The first sale of noncash assets having a book value of $140,000 realized $120,000. How should the available cash be distributed?

A) Archer, $ -0-; Bows, $ -0-; Cross, $ -0-.

B) Archer, $10,000; Bows, $10,000; Cross, $10,000.

C) Archer, $ -0-; Bows, $ -0-; Cross, $30,000.

D) Archer, $21,000; Bows, $8,000; Cross, $1,000.

E) Archer, $18,333; Bows, $8,333; Cross, $3,334.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

30

The following condensed balance sheet is prepared for the partnership of Bond, Hamm, and Zell, who share profits and losses in the ratio 5:3:2, respectively:

The partners decide to liquidate the partnership. The other assets are sold for $460,000.

The partners decide to liquidate the partnership. The other assets are sold for $460,000.

Required:

How should the available cash be distributed?

Bond _______________ Hamm _______________ Zell _______________

The partners decide to liquidate the partnership. The other assets are sold for $460,000.

The partners decide to liquidate the partnership. The other assets are sold for $460,000.Required:

How should the available cash be distributed?

Bond _______________ Hamm _______________ Zell _______________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

31

The following condensed balance sheet is presented for the partnership of Alexa, Bell, and Graham, who share profits and losses in the ratio 6:2:2, respectively:

The partners agreed to liquidate the partnership after selling the other assets. The other assets were sold for $160,000.

The partners agreed to liquidate the partnership after selling the other assets. The other assets were sold for $160,000.

Required:

How should the available cash be distributed?

Alexa _______________ Bell _______________ Graham _______________

The partners agreed to liquidate the partnership after selling the other assets. The other assets were sold for $160,000.

The partners agreed to liquidate the partnership after selling the other assets. The other assets were sold for $160,000.Required:

How should the available cash be distributed?

Alexa _______________ Bell _______________ Graham _______________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

32

The following condensed balance sheet is presented for the partnership of Anders, Barnes, and Crowley, who share profits and losses in the ratio 5:3:2, respectively:

Assume that the partners decided to liquidate the partnership and that the other assets were sold for $500,000.

Assume that the partners decided to liquidate the partnership and that the other assets were sold for $500,000.

Required:

How should the available cash be distributed?

Anders _______________ Barnes _______________ Crowley _______________

Assume that the partners decided to liquidate the partnership and that the other assets were sold for $500,000.

Assume that the partners decided to liquidate the partnership and that the other assets were sold for $500,000.Required:

How should the available cash be distributed?

Anders _______________ Barnes _______________ Crowley _______________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

33

On 1/1/06, the partners of Cobb, Davis, and Eddy, who share profits and losses in the ratio 5:3:2, respectively, decided to liquidate their partnership. On this date, the partnership condensed balance sheet was as follows:

On 1/15/06, the first cash sale of other assets with a book value of $150,000 realized $120,000. Safe installment payments to the partners were made the same date.

On 1/15/06, the first cash sale of other assets with a book value of $150,000 realized $120,000. Safe installment payments to the partners were made the same date.

Required:

How should the available cash be distributed?

On 1/15/06, the first cash sale of other assets with a book value of $150,000 realized $120,000. Safe installment payments to the partners were made the same date.

On 1/15/06, the first cash sale of other assets with a book value of $150,000 realized $120,000. Safe installment payments to the partners were made the same date.Required:

How should the available cash be distributed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

34

The following condensed balance sheet is presented for the partnership of Alpha, Baker, and Charley, who share profits and losses in the ratio 4:4:2, respectively:

The partners decide to liquidate the partnership. The first sale of noncash assets having a book value of $90,000 realized $50,000. All cash available after settlement with creditors was distributed.

The partners decide to liquidate the partnership. The first sale of noncash assets having a book value of $90,000 realized $50,000. All cash available after settlement with creditors was distributed.

Required:

How should the available cash have been distributed?

The partners decide to liquidate the partnership. The first sale of noncash assets having a book value of $90,000 realized $50,000. All cash available after settlement with creditors was distributed.

The partners decide to liquidate the partnership. The first sale of noncash assets having a book value of $90,000 realized $50,000. All cash available after settlement with creditors was distributed.Required:

How should the available cash have been distributed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck

35

The following condensed balance sheet is presented for the partnership of Archer, Bows, and Cross, who share profits and losses in the ratio 6:3:1, respectively:

Bows paid $30,000 to creditors out of her own personal funds-this has not been reflected in the above balance sheet. Archer is personally solvent but temporarily not liquid. The partners decide to liquidate the partnership. The first sale of noncash assets having a book value of $140,000 realizes $120,000.

Bows paid $30,000 to creditors out of her own personal funds-this has not been reflected in the above balance sheet. Archer is personally solvent but temporarily not liquid. The partners decide to liquidate the partnership. The first sale of noncash assets having a book value of $140,000 realizes $120,000.

Required:

How should the available cash be distributed?

Bows paid $30,000 to creditors out of her own personal funds-this has not been reflected in the above balance sheet. Archer is personally solvent but temporarily not liquid. The partners decide to liquidate the partnership. The first sale of noncash assets having a book value of $140,000 realizes $120,000.

Bows paid $30,000 to creditors out of her own personal funds-this has not been reflected in the above balance sheet. Archer is personally solvent but temporarily not liquid. The partners decide to liquidate the partnership. The first sale of noncash assets having a book value of $140,000 realizes $120,000.Required:

How should the available cash be distributed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 35 في هذه المجموعة.

فتح الحزمة

k this deck