Deck 19: Bankruptcy Reorganizations and Liquidations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/51

العب

ملء الشاشة (f)

Deck 19: Bankruptcy Reorganizations and Liquidations

1

A special class of creditors created by the federal bankruptcy statutes is _____________________________________.

creditors with priority

2

The term used to describe the party that is the subject of a bankruptcy proceeding is ________________________________________.

debtor

3

Chapter 7 of the federal bankruptcy statutes deals with _______________________, and Chapter 11 deals with ________________________________________.

liquidations, reorganizations

4

Creditors filing an involuntary bankruptcy petition must be owed at least ___________________________________ in total.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

5

The only basis for an involuntary bankruptcy filing by creditors is _____________________________________.________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

6

The major categories of debt that are given special priority under the bankruptcy statutes are

a. ________________________________________.

b. ________________________________________.

c. ________________________________________.

d. ________________________________________.

e. ________________________________________.

f. ________________________________________.

a. ________________________________________.

b. ________________________________________.

c. ________________________________________.

d. ________________________________________.

e. ________________________________________.

f. ________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

7

In a Chapter 11 filing, the appointment of a trustee is _______________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

8

A class of creditors has accepted a plan of reorganization if such plan has been accepted by creditors that hold at least ________________________________________ in amount and _____________________________________ in number of the allowed claims of such class of creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

9

A trustee is authorized to void both ___________________________________________ and ________________________________________ transfers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

10

In a liquidation filing, if the court desires information that relates the activity of the trustee with the book balances existing when the trustee was appointed, then a statement of ________________________________________ may be prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

11

The subject of a bankruptcy proceeding is now referred to as a bankrupt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

12

The federal bankruptcy statutes apply only to corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

13

An eligible corporation may be forced into bankruptcy proceedings against its will by its creditors under Chapter 7 or 11 of the bankruptcy statutes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

14

Chapter 11 of the bankruptcy statutes pertains only to voluntary liquidations and reorganizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

15

In involuntary petitions, the debtor must owe at least $5,000, regardless of how many creditors are needed to sign the petition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

16

The primary grounds for filing an involuntary petition is that the debtor is generally not paying its debts as they become due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under the bankruptcy statutes, "creditors with priority" include fully secured creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

18

Wages owed to individuals up to $5,000 are classified as "creditors with priority" under the bankruptcy statutes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

19

As to the priority of "creditors with priority," taxes have second priority after administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

20

In bankruptcy reorganizations under Chapter 11, the court usually appoints a trustee to manage the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

21

An advantage of a troubled debt restructuring compared with a bankruptcy reorganization is that it almost always results in a greater forgiveness of debt (reduction of the debtor's liabilities).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

22

In Chapter 11 bankruptcy reorganizations, FAS 15 usually will not apply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

23

In Chapter 11 bankruptcy reorganizations, the total future payments are compared with the carrying amount of the debt to determine the amount of forgiveness of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

24

In Chapter 11 bankruptcy reorganizations, present-value procedures are required in determining the amount of forgiveness of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

25

In Chapter 11 bankruptcy reorganizations, the amount of debt forgiven may be reported in the income statement or as a credit directly to stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

26

In Chapter 7 liquidations, management will usually carry out the sale of the assets and pay off creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

27

The "statement of affairs" is an integral part of a plan of reorganization under Chapter 11.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

28

Under Chapter 7, the "statement of affairs" is not a required statement to be submitted by trustees in liquidation cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

29

_____ The federal bankruptcy statutes are not applicable to

A) Corporations.

B) Partnerships.

C) Individuals.

D) Banking institutions.

E) None of the above.

A) Corporations.

B) Partnerships.

C) Individuals.

D) Banking institutions.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

30

_____ The federal bankruptcy statutes are not applicable to

A) Sole proprietorships.

B) Railroads.

C) Individuals.

D) Insurance companies.

E) None of the above.

A) Sole proprietorships.

B) Railroads.

C) Individuals.

D) Insurance companies.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

31

_____ The federal bankruptcy statutes are not applicable to

A) Municipalities.

B) Subchapter S corporations.

C) Publicly owned utilities.

D) Limited partnerships.

E) None of the above.

A) Municipalities.

B) Subchapter S corporations.

C) Publicly owned utilities.

D) Limited partnerships.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

32

_____ Which of the following situations is required for an involuntary bankruptcy petition to be filed?

A) There must be three or more creditors.

B) There must be 12 or more creditors.

C) The majority of creditors must sign the petition.

D) Creditors must be owed at least $2,000.

E) None of the above.

A) There must be three or more creditors.

B) There must be 12 or more creditors.

C) The majority of creditors must sign the petition.

D) Creditors must be owed at least $2,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

33

_____ Which of the following situations is required for an involuntary bankruptcy petition to be filed?

A) The majority of the creditors as to the amount of the unsecured liabilities must sign the petition.

B) The majority of the creditors as to the number of unsecured creditors must sign the petition.

C) Creditors must be owed at least $5,000.

D) A custodian cannot have been appointed or have taken possession of the debtor's property within 120 days before the date of the filing of the petition.

E) None of the above.

A) The majority of the creditors as to the amount of the unsecured liabilities must sign the petition.

B) The majority of the creditors as to the number of unsecured creditors must sign the petition.

C) Creditors must be owed at least $5,000.

D) A custodian cannot have been appointed or have taken possession of the debtor's property within 120 days before the date of the filing of the petition.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

34

_____ Which of the following is not a "creditor with priority," as that term is used in the bankruptcy statutes?

A) Taxes.

B) Wages, subject to certain limitations.

C) Bankruptcy administration costs.

D) Amounts owed to public utilities.

E) None of the above.

A) Taxes.

B) Wages, subject to certain limitations.

C) Bankruptcy administration costs.

D) Amounts owed to public utilities.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

35

_____ In a bankruptcy reorganization under Chapter 11,

A) FAS 15 will usually apply.

B) Present-value procedures are required in determining the amount of debt forgiven.

C) The amount of debt forgiven must be treated as a gain and credited to income (and classified as an extraordinary item if material) in the new (emerging) entity's income statement.

D) The carrying amount of the debt is compared with the total future payments.

E) None of the above.

A) FAS 15 will usually apply.

B) Present-value procedures are required in determining the amount of debt forgiven.

C) The amount of debt forgiven must be treated as a gain and credited to income (and classified as an extraordinary item if material) in the new (emerging) entity's income statement.

D) The carrying amount of the debt is compared with the total future payments.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

36

_____ In a Chapter 11 bankruptcy reorganization, the discharge of indebtedness is to be reported as

A) An adjustment to retained earnings in the predecessor's final statement of retained earnings.

B) An extraordinary item in the predecessor entity's final statement of operations.

C) An extraordinary item in the first statement of operation of the new reporting entity.

D) An adjustment to retained earnings in the new entity's initial statement of retained earnings.

E) None of the above.

A) An adjustment to retained earnings in the predecessor's final statement of retained earnings.

B) An extraordinary item in the predecessor entity's final statement of operations.

C) An extraordinary item in the first statement of operation of the new reporting entity.

D) An adjustment to retained earnings in the new entity's initial statement of retained earnings.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

37

_____ In a Chapter 11 bankruptcy reorganization, bankruptcy-related losses and expenses incurred prior to the confirmation are to be reported as

A) Deferred charges in the balance sheet.

B) An extraordinary item in the income statement.

C) A separate category in the income statement other than as an extraordinary item.

D) An adjustment to retained earnings.

E) None of the above.

A) Deferred charges in the balance sheet.

B) An extraordinary item in the income statement.

C) A separate category in the income statement other than as an extraordinary item.

D) An adjustment to retained earnings.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

38

_____ A company that has emerged from a Chapter 11 bankruptcy reorganization will do all of the following except

A) Report no beginning retained earnings or deficit.

B) Never present financial statements of the old entity for periods prior to the confirmation date for comparison purposes.

C) Report bankruptcy-related costs in a special "reorganization items" category in the statement of operations.

D) Report the excess of reorganization value over amounts allocated to assets effectively as an asset in the balance sheet.

E) None of the above.

A) Report no beginning retained earnings or deficit.

B) Never present financial statements of the old entity for periods prior to the confirmation date for comparison purposes.

C) Report bankruptcy-related costs in a special "reorganization items" category in the statement of operations.

D) Report the excess of reorganization value over amounts allocated to assets effectively as an asset in the balance sheet.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

39

_____ A company that has emerged from Chapter 11 bankruptcy reorganization would use which of the following items in its balance sheet?

A) Prepetition liabilities subject to compromise.

B) Prepetition liabilities not subject to compromise.

C) Postpetition liabilities.

D) Postpetition liabilities subject to compromise.

E) None of the above.

A) Prepetition liabilities subject to compromise.

B) Prepetition liabilities not subject to compromise.

C) Postpetition liabilities.

D) Postpetition liabilities subject to compromise.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

40

_____ A company that has not yet emerged from Chapter 11 bankruptcy reorganization would not use which of the following items in its balance sheet?

A) Prepetition liabilities subject to compromise.

B) Prepetition liabilities not subject to compromise.

C) Postpetition liabilities.

D) Postpetition liabilities subject to compromise.

E) None of the above.

A) Prepetition liabilities subject to compromise.

B) Prepetition liabilities not subject to compromise.

C) Postpetition liabilities.

D) Postpetition liabilities subject to compromise.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

41

_____ When is a "statement of affairs" used?

A) Only in liquidations.

B) Only in reorganizations.

C) In both liquidations and reorganizations.

D) In preparing a statement of realization and liquidation.

E) None of the above.

A) Only in liquidations.

B) Only in reorganizations.

C) In both liquidations and reorganizations.

D) In preparing a statement of realization and liquidation.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

42

_____ In a "statement of affairs,"

A) Assets pledged with partially secured creditors are shown on the asset side of the statement and as a deduction on the liability side of the statement.

B) Assets pledged with fully secured creditors are shown only on the liability side of the statement.

C) Liabilities owed to fully secured creditors are shown only on the asset side of the statement.

D) Liabilities owed to partially secured creditors are shown on the asset side of the balance sheet and as a deduction on the liability side of the statement.

E) None of the above.

A) Assets pledged with partially secured creditors are shown on the asset side of the statement and as a deduction on the liability side of the statement.

B) Assets pledged with fully secured creditors are shown only on the liability side of the statement.

C) Liabilities owed to fully secured creditors are shown only on the asset side of the statement.

D) Liabilities owed to partially secured creditors are shown on the asset side of the balance sheet and as a deduction on the liability side of the statement.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

43

_____ In a "statement of affairs,"

A) Liabilities with priority are shown on the liability side of the statement and as a deduction on the asset side of the statement.

B) Assets pledged with fully secured creditors are shown on the liability side of the statement and as a deduction on the asset side of the statement.

C) Liabilities owed to fully secured creditors are shown on the asset side of the statement and as a deduction on the liability side of the statement.

D) Liabilities owed to partially secured creditors are shown on the asset side of the balance sheet and not as a deduction on the liability side of the statement.

E) None of the above.

A) Liabilities with priority are shown on the liability side of the statement and as a deduction on the asset side of the statement.

B) Assets pledged with fully secured creditors are shown on the liability side of the statement and as a deduction on the asset side of the statement.

C) Liabilities owed to fully secured creditors are shown on the asset side of the statement and as a deduction on the liability side of the statement.

D) Liabilities owed to partially secured creditors are shown on the asset side of the balance sheet and not as a deduction on the liability side of the statement.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

44

_____ Banco, Inc., is in Chapter 11 bankruptcy reorganization proceedings. Information concerning Banco's 10% outstanding bonds as of 6/1/06, as obtained from the plan of reorganization, follows:

(a) Face value-$1,000,000.

(b) Accrued interest-$150,000.

(c) Unamortized bond discount-$10,000.

(d) Total future payments (principal and interest)-$1,080,000.

(e) Present value of future principal and interest payments using an appropriate current interest rate-$700,000.

How much should Banco report as a gain on discharge of indebtedness?

A) $60,000

B) $70,000

C) $300,000

D) $440,000

E) None of the above.

(a) Face value-$1,000,000.

(b) Accrued interest-$150,000.

(c) Unamortized bond discount-$10,000.

(d) Total future payments (principal and interest)-$1,080,000.

(e) Present value of future principal and interest payments using an appropriate current interest rate-$700,000.

How much should Banco report as a gain on discharge of indebtedness?

A) $60,000

B) $70,000

C) $300,000

D) $440,000

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

45

_____ Ruptsy, Inc., is in Chapter 11 bankruptcy reorganization proceedings. Information concerning Ruptsy's 8% outstanding bonds as of 5/2/05, as obtained from the plan of reorganization, follows:

(a) Face value-$2,000,000.

(b) Accrued interest-$200,000.

(c) Unamortized bond premium-$30,000.

(d) Total future payments (principal and interest)-$2,120,000.

(e) Present value of future principal and interest payments using an appropriate current interest rate-$1,800,000.

How much should Banco report as a gain on discharge of indebtedness?

A) $80,000

B) $110,000

C) $280,000

D) $320,000

E) $430,000

(a) Face value-$2,000,000.

(b) Accrued interest-$200,000.

(c) Unamortized bond premium-$30,000.

(d) Total future payments (principal and interest)-$2,120,000.

(e) Present value of future principal and interest payments using an appropriate current interest rate-$1,800,000.

How much should Banco report as a gain on discharge of indebtedness?

A) $80,000

B) $110,000

C) $280,000

D) $320,000

E) $430,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

46

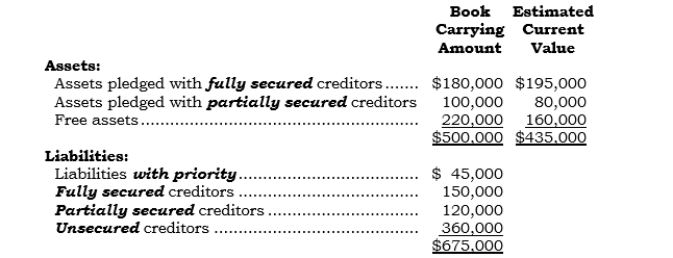

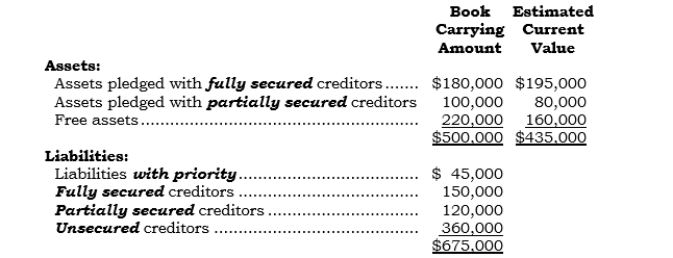

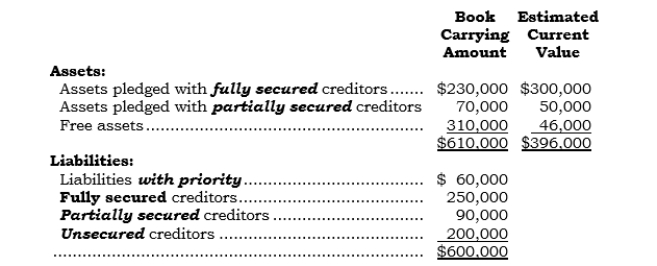

_____ Debtco, Inc., filed a voluntary bankruptcy petition for liquidation on 6/25/06, and the statement of affairs reflects the following amounts:

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash should the partially secured creditors receive?

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash should the partially secured creditors receive?

A) $80,000

B) $94,000

C) $100,000

D) $120,000

E) None of the above.

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash should the partially secured creditors receive?

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash should the partially secured creditors receive?A) $80,000

B) $94,000

C) $100,000

D) $120,000

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

47

_____ Debtco, Inc., filed a voluntary bankruptcy petition for liquidation on 6/25/06, and the statement of affairs reflects the following amounts:

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. ssume the same information as in the preceding question. What total amount of cash will be available to pay the unsecured (nonpriority) creditors?

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. ssume the same information as in the preceding question. What total amount of cash will be available to pay the unsecured (nonpriority) creditors?

A) $99,000

B) $115,000

C) $144,000

D) $160,000

E) None of the above.

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. ssume the same information as in the preceding question. What total amount of cash will be available to pay the unsecured (nonpriority) creditors?

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. ssume the same information as in the preceding question. What total amount of cash will be available to pay the unsecured (nonpriority) creditors?A) $99,000

B) $115,000

C) $144,000

D) $160,000

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

48

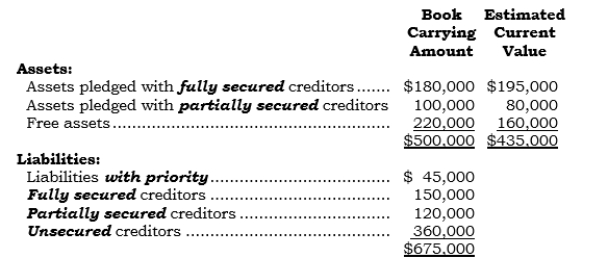

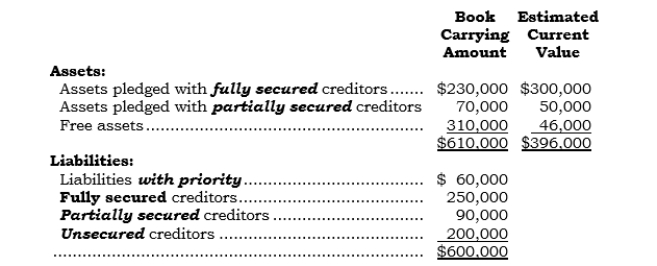

_____ Todd, Inc., filed a voluntary bankruptcy petition for liquidation on 11/11/06, and the statement of affairs reflects the following amounts:

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash should the partially secured creditors receive?

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash should the partially secured creditors receive?

A) $50,000

B) $56,000

C) $70,000

D) $90,000

E) None of the above.

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash should the partially secured creditors receive?

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash should the partially secured creditors receive?A) $50,000

B) $56,000

C) $70,000

D) $90,000

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

49

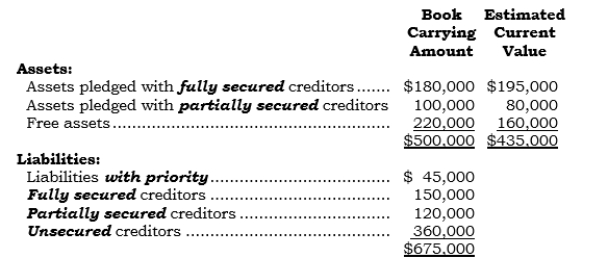

_____ Todd, Inc., filed a voluntary bankruptcy petition for liquidation on 11/11/06, and the statement of affairs reflects the following amounts:

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash will be available to pay the unsecured (nonpriority) creditors?

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash will be available to pay the unsecured (nonpriority) creditors?

A) $30,000

B) $46,000

C) $56,000

D) $96,000

E) None of the above.

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash will be available to pay the unsecured (nonpriority) creditors?

Assume that the assets are converted into cash at the estimated current values and the business is liquidated. What total amount of cash will be available to pay the unsecured (nonpriority) creditors?A) $30,000

B) $46,000

C) $56,000

D) $96,000

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

50

_____ Vannco, Inc., is being liquidated under Chapter 7 of the bankruptcy statutes. Unsecured creditors will be paid at the rate of $.30 on the dollar. Lendorf is owed a $70,000 noninterest-bearing note receivable from Vannco collateralized by equipment having a book value of $60,000 and a liquidation value of $20,000. How much will Lendorf realize on this note?

A) $15,000

B) $21,000

C) $35,000

D) $36,000

E) None of the above.

A) $15,000

B) $21,000

C) $35,000

D) $36,000

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

51

Survivo Company's plan of reorganization under Chapter 11 of the bankruptcy statutes calls for a cash payment of $2,000,000 and the issuance of $3,000,000 of 12% notes payable to its unsecured creditors on a pro rata basis. These unsecured creditors are composed of vendors (owed $1,000,000) and a bank (owed $5,500,000 principal and $300,000 interest). (The 12% interest rate on the notes is considered reasonable under the circumstances.) The notes are to be paid in full in four years.

Required:

Prepare the journal entry related to this settlement.

Required:

Prepare the journal entry related to this settlement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck