Deck 15: Translating Foreign Currency Statements: The Current Rate Method

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

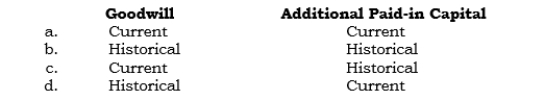

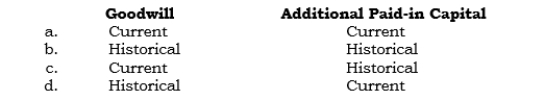

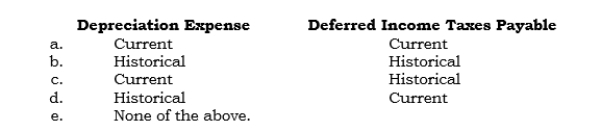

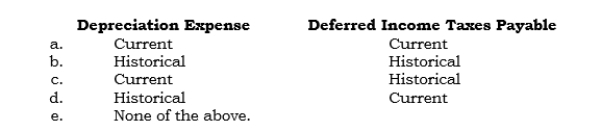

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/99

العب

ملء الشاشة (f)

Deck 15: Translating Foreign Currency Statements: The Current Rate Method

1

To express a foreign subsidiary's financial statements in U.S. dollars, one ____________________________ and then ____________________________.

restates (to U.S. GAAP), translates (into U.S. dollars)

2

The three translation approaches that can be used are (a) the __________________ __________________ approach, (b) the ____________________________ approach, and (c) the __________________________.

foreign currency unit of measure, U.S. dollar unit of measure,

current value approach using purchasing power parity theory

current value approach using purchasing power parity theory

3

The translation method that fits under the foreign currency unit of measure approach is the _____________________________ method.

current rate

4

Under the foreign currency unit of measure approach, the focus is on the ________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

5

A foreign subsidiary that has assets exceeding its liabilities is said to be in a(n) ________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

6

A foreign subsidiary that has liabilities exceeding its assets is said to be in a(n) ________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

7

Under FAS 52, the effect of an exchange rate change when using the current rate method is called a(n) ____________________________________, and it is reported in ____________________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under FAS 52, the effect of an exchange rate change arising from using the current rate method is called a(n) _______________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

9

Under FAS 52, the AOCI-Cumulative Translation Adjustment account balance is reported in earnings when the foreign unit is ______________________________ or ____________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

10

When a foreign subsidiary has its foreign currency as its functional currency, the parent would hedge the _______________________________________ to prevent reporting an adverse impact on stockholders' equity as a result of an adverse exchange rate change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

11

A basic procedure after translation is to conform to U.S. GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

12

A basic procedure before translation is to conform to U.S. GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

13

A basic procedure before translation is to adjust foreign fixed assets for foreign inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under the foreign currency unit of measure approach, the monetary-nonmonetary distinction is crucial.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the foreign currency unit of measure approach, the focus is on the net asset position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

16

Under the foreign currency unit of measure approach, the focus is on the composition of the individual assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under the foreign currency unit of measure approach, the relationships in the foreign currency statements are maintained in translation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

18

Under the foreign currency unit of measure approach, a decrease in the direct exchange rate results in an adverse reporting result when the parent has a positive balance in its Investment in Subsidiary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under the foreign currency unit of measure approach, an increase in the direct exchange rate always results in an adverse reporting result when the parent has a positive balance in its Investment in Subsidiary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the foreign currency unit of measure approach, monetary accounts are always translated at the current exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

21

Under the foreign currency unit of measure approach, the current rate method is used to translate all assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

22

Under the foreign currency unit of measure approach, the current rate method is used to translate all assets, liabilities, and equity accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

23

Under the foreign currency unit of measure approach, the temporal method is used to translate all assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

24

Under the current rate method, all current assets and current liabilities are translated at the current exchange rate, and all noncurrent assets and noncurrent liabilities are translated at historical exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

25

When the current rate method is used, a lower-of-cost-or-market test of the subsidiary's assets in U.S. dollars is not necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

26

When the current rate method is used, the effect of an exchange rate change is reported in Other Comprehensive Income-not in earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

27

When the current rate method is used, the effect of an exchange rate change is reported currently in earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

28

When the current rate method is used, the effect of an exchange rate change is reported as a deferred gain or loss in the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

29

When the current rate method is used, the effect of an exchange rate change must be reported formally in a "Statement of Comprehensive Income."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

30

Under FAS 52, the AOCI-Cumulative Translation Adjustment account is closed out directly to retained earnings when the foreign unit is sold or liquidated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

31

Under FAS 52, the AOCI-Cumulative Translation Adjustment account is closed out and reported in earnings when the foreign unit is sold or liquidated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

32

When the current rate method is used, any exchange rate change adjustment to a parent's long-term intercompany receivable from (or payable to) its foreign subsidiary is reported currently in earnings-regardless of whether the amount is expected to be paid in the foreseeable future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

33

When the current rate method is used, any exchange rate change adjustment to a parent's long-term intercompany receivable from (or payable to) its foreign subsidiary is reported as an adjustment to the OCI-Translation Adjustment account (bypassing the current income statement)-regardless of whether the amount is expected to be paid in the foreseeable future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

34

When the current rate method is used, any exchange rate change adjustment to a parent's long-term intercompany receivable from (or payable to) its foreign subsidiary is reported currently in earnings-only if the amount is not expected to be paid in the foreseeable future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

35

When the current rate method is used, any exchange rate change adjustment to a parent's long-term intercompany receivable from (or payable to) its foreign subsidiary is reported as an adjustment to the OCI-Translation Adjustment account (bypassing earnings)-only if the amount is not expected to be paid in the foreseeable future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

36

When the current rate method is used, any exchange rate change adjustment to a parent's Dividend Receivable from its foreign subsidiary is reported currently in earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

37

When the current rate method is used, any exchange rate change adjustment to a parent's Dividend Receivable from its foreign subsidiary is reported as an adjustment to the OCI-Translation Adjustment account (bypassing earnings).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

38

When the current rate method is used, the calculation of any unrealized intercompany profit on intercompany inventory transfers is made using the current exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

39

When the current rate method is used and a net investment in a foreign subsidiary is hedged, there may not be an offsetting effect to the translation adjustment resulting from the translation process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

40

When the current rate method is used, FX gains and losses on hedges of net investments must be reported in Other Comprehensive Income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

41

_____ Before a foreign subsidiary's financial position and results of operations can be reported to the stockholders of the U.S. parent company, it is necessary to

A) Restate for foreign inflation and then translate.

B) Translate and then restate for foreign inflation.

C) Translate and then restate to U.S. GAAP.

D) Restate for foreign inflation, restate to U.S. GAAP, and then translate.

E) None of the above.

A) Restate for foreign inflation and then translate.

B) Translate and then restate for foreign inflation.

C) Translate and then restate to U.S. GAAP.

D) Restate for foreign inflation, restate to U.S. GAAP, and then translate.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

42

_____ Before a foreign subsidiary's financial position and results of operations can be reported to the stockholders of the U.S. parent company, it is necessary to

A) Restate to U.S. GAAP and then translate.

B) Translate and then restate for foreign inflation.

C) Translate and then restate to U.S. GAAP.

D) Restate for foreign inflation, restate to U.S. GAAP, and then translate.

E) None of the above.

A) Restate to U.S. GAAP and then translate.

B) Translate and then restate for foreign inflation.

C) Translate and then restate to U.S. GAAP.

D) Restate for foreign inflation, restate to U.S. GAAP, and then translate.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

43

_____ Which of the following accounts is a monetary item?

A) Cost of Sales.

B) Inventory.

C) Investment in Common Stock of IBM Corporation.

D) Additional Paid-in Capital.

E) None of the above.

A) Cost of Sales.

B) Inventory.

C) Investment in Common Stock of IBM Corporation.

D) Additional Paid-in Capital.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

44

_____ Which of the following accounts is a monetary item?

A) Sales.

B) Intercompany Bonds Payable.

C) Investment in Common Stock of IBM Corporation.

D) Deferred Income Tax Expense.

E) None of the above.

A) Sales.

B) Intercompany Bonds Payable.

C) Investment in Common Stock of IBM Corporation.

D) Deferred Income Tax Expense.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

45

_____ Which of the following accounts is a monetary item?

A) Depreciation Expense.

B) Inventory.

C) Investment in Common Stock (of a subsidiary).

D) Intercompany Payable-Long-term portion

E) None of the above.

A) Depreciation Expense.

B) Inventory.

C) Investment in Common Stock (of a subsidiary).

D) Intercompany Payable-Long-term portion

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

46

_____ Which of the following accounts is not a monetary item?

A) Deferred Income Taxes Payable.

B) Intercompany Payables.

C) Long-term Intercompany Payables.

D) Investment in Bonds.

E) None of the above.

A) Deferred Income Taxes Payable.

B) Intercompany Payables.

C) Long-term Intercompany Payables.

D) Investment in Bonds.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

47

_____ Which of the following accounts is a monetary item?

A) Deferred Income Taxes Expense.

B) Additional Paid-in Capital.

C) Sales.

D) Deferred Charges.

E) None of the above.

A) Deferred Income Taxes Expense.

B) Additional Paid-in Capital.

C) Sales.

D) Deferred Charges.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

48

_____ Which of the following statements is false for the foreign currency unit of measure approach?

A) No distinction is made between monetary and nonmonetary accounts.

B) The focus is on the parent's net investment.

C) The relationships of items in the foreign currency financial statements are maintained in expressing the accounts in U.S. dollars.

D) The translated amounts in U.S. dollars for nonmonetary assets represent the current values of the assets.

E) None of the above.

A) No distinction is made between monetary and nonmonetary accounts.

B) The focus is on the parent's net investment.

C) The relationships of items in the foreign currency financial statements are maintained in expressing the accounts in U.S. dollars.

D) The translated amounts in U.S. dollars for nonmonetary assets represent the current values of the assets.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

49

_____ When using a foreign currency unit of measure approach, the focus is on the

A) Net asset (net investment) position.

B) Net monetary position.

C) Net monetary asset position.

D) Net monetary liability position.

E) None of the above.

A) Net asset (net investment) position.

B) Net monetary position.

C) Net monetary asset position.

D) Net monetary liability position.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

50

_____ Which of the following statements holds true for the foreign currency unit of measure approach?

A) The "disappearing plant" phenomenon does not result.

B) It is not necessary to restate the foreign financial statements to U.S. GAAP before translation into U.S. dollars.

C) It makes sense to use it when the inflation rate in the foreign country is high.

D) It produces unusual reporting results when nonmonetary assets are financed by foreign borrowings.

E) None of the above.

A) The "disappearing plant" phenomenon does not result.

B) It is not necessary to restate the foreign financial statements to U.S. GAAP before translation into U.S. dollars.

C) It makes sense to use it when the inflation rate in the foreign country is high.

D) It produces unusual reporting results when nonmonetary assets are financed by foreign borrowings.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

51

_____ A translation method that fits under the foreign currency unit of measure approach is

A) The monetary-nonmonetary method.

B) The current-noncurrent method.

C) The current rate method.

D) The temporal method.

E) None of the above.

A) The monetary-nonmonetary method.

B) The current-noncurrent method.

C) The current rate method.

D) The temporal method.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

52

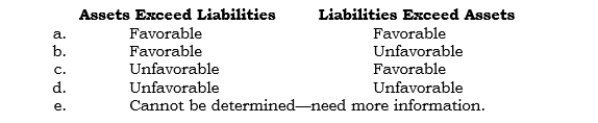

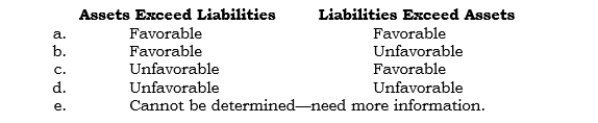

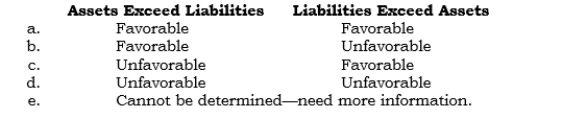

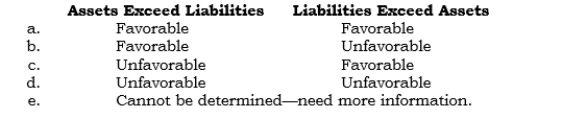

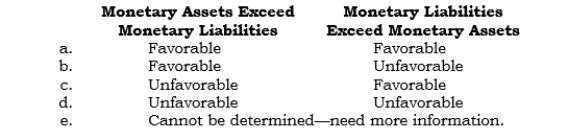

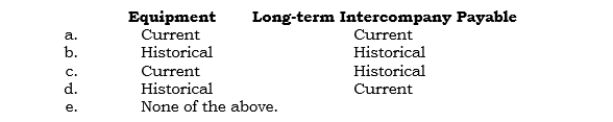

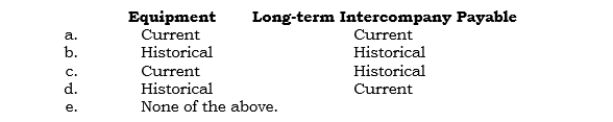

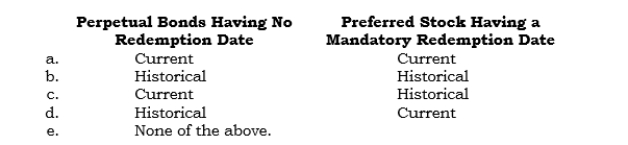

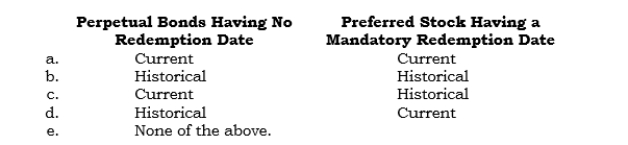

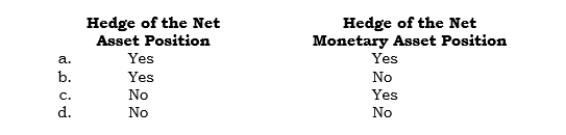

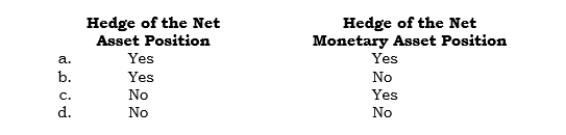

_____ Under the current rate method of translation, what is the effect of a decrease in the direct exchange rate under each of the following situations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

53

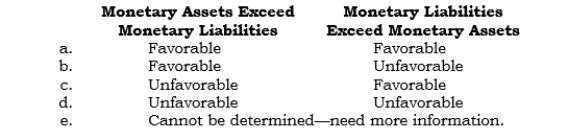

_____ Under the current rate method of translation, what is the effect of an increase in the direct exchange rate under each of the following situations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

54

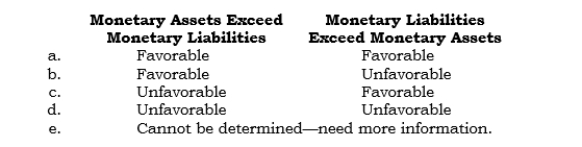

_____ Under the current rate method, what is the effect of a decrease in the direct exchange rate under each of the following situations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

55

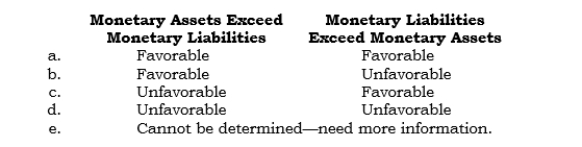

_____ Under the current rate method, what is the effect of an increase in the direct exchange rate under each of the following situations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

56

_____ Under FAS 52, the term current rate is defined

A) As the exchange rate at the balance sheet reporting date.

B) As the average exchange rate during the current year.

C) As the exchange rate in effect when a current year transaction occurred.

D) Differently for the balance sheet than for the income statement.

E) None of the above.

A) As the exchange rate at the balance sheet reporting date.

B) As the average exchange rate during the current year.

C) As the exchange rate in effect when a current year transaction occurred.

D) Differently for the balance sheet than for the income statement.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

57

_____ Under FAS 52, which translation procedures are followed under the current rate method of translation?

A) All balance sheet accounts are translated at the current exchange rate.

B) All income statement accounts are translated at the current exchange rate.

C) A combination of current and historical exchange rates is used in both financial statements.

D) Both a and b.

E) None of the above.

A) All balance sheet accounts are translated at the current exchange rate.

B) All income statement accounts are translated at the current exchange rate.

C) A combination of current and historical exchange rates is used in both financial statements.

D) Both a and b.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

58

_____ Under FAS 52, which translation procedures are followed under the current rate method of translation?

A) All assets and liabilities are translated at the current exchange rate.

B) All income statement accounts are translated at the current exchange rate.

C) A combination of current and historical exchange rates is used in both financial statements.

D) Both a and b.

E) None of the above.

A) All assets and liabilities are translated at the current exchange rate.

B) All income statement accounts are translated at the current exchange rate.

C) A combination of current and historical exchange rates is used in both financial statements.

D) Both a and b.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

59

_____ Under FAS 52, what occurs in translation under the current rate method of translation?

A) All income statement accounts are expressed in dollars by using exchange rates in effect when the items were recognized in the income statement.

B) The effects of exchange rate changes are reported currently in earnings.

C) All assets and liabilities are translated using exchange rates that produce the U.S. dollar equivalent at the time the transactions giving rise to the balance occurred.

D) The temporal method must be used.

E) None of the above.

A) All income statement accounts are expressed in dollars by using exchange rates in effect when the items were recognized in the income statement.

B) The effects of exchange rate changes are reported currently in earnings.

C) All assets and liabilities are translated using exchange rates that produce the U.S. dollar equivalent at the time the transactions giving rise to the balance occurred.

D) The temporal method must be used.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

60

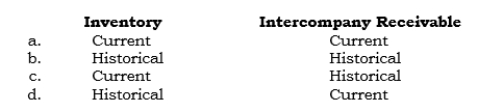

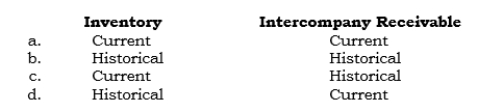

_____ Which exchange rates are used to express the following accounts in dollars under the current rate method of translation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

61

_____ Which exchange rates are used to express the following accounts in dollars when the current rate method is used? (Assume that valuation in the local currency is at market value, which conforms to the rules of FAS 115, "Accounting for Certain Investments in Debt and Equity Securities.")

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

62

_____ Which exchange rates are used to express the following accounts in dollars under the current rate method of translation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

63

_____ Which exchange rates are used to express the following accounts in dollars under the current rate method of translation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

64

_____ Which exchange rates are used to express the following accounts in dollars under the current rate method of translation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

65

_____ Which exchange rates are used to express the following accounts (resulting from financing inflows) in dollars under the current rate method of translation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

66

_____ Under FAS 52, how is the effect of an exchange rate change for the current year reported when the current rate method of translation is used?

A) Currently in the earnings.

B) Currently in earnings as an extraordinary item if material.

C) As a direct charge or credit to Other Comprehensive Income.

D) Deferred in the asset or liability section of the balance sheet.

E) None of the above.

A) Currently in the earnings.

B) Currently in earnings as an extraordinary item if material.

C) As a direct charge or credit to Other Comprehensive Income.

D) Deferred in the asset or liability section of the balance sheet.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

67

_____ Which of the following is not an allowable reason for eliminating the balance in the AOCI-Cumulative Translation Adjustment account?

A) Sale of the investment (the common stock).

B) Liquidation of the subsidiary (through sale of its assets).

C) Stability has existed for the exchange rate for three years or more.

D) The foreign government has permanently seized the subsidiary's assets.

E) None of the above.

A) Sale of the investment (the common stock).

B) Liquidation of the subsidiary (through sale of its assets).

C) Stability has existed for the exchange rate for three years or more.

D) The foreign government has permanently seized the subsidiary's assets.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

68

_____ During 2006, the Japanese yen strengthened. Under the current rate method, a favorable reporting result occurred as a result of this 2006 exchange rate change. What was the subsidiary's average financial position during 2006?

A) A net monetary asset position.

B) A net monetary liability position.

C) A net investment (net asset) position.

D) A net liability position.

A) A net monetary asset position.

B) A net monetary liability position.

C) A net investment (net asset) position.

D) A net liability position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

69

_____ During 2006, the Swiss franc weakened. Under the current rate method, an unfavorable reporting result occurred as a result of this 2006 exchange rate change. What was the subsidiary's average financial position during 2006?

A) A net monetary asset position.

B) A net monetary liability position.

C) A net investment (net asset) position.

D) A net liability position.

A) A net monetary asset position.

B) A net monetary liability position.

C) A net investment (net asset) position.

D) A net liability position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

70

_____ During 2006, the Mexican peso weakened. A favorable reporting result occurred as a result of this 2006 exchange rate change. What was the subsidiary's average financial position during 2006?

A) A net monetary asset position.

B) A net monetary liability position.

C) A net investment (net asset) position.

D) A net liability position.

A) A net monetary asset position.

B) A net monetary liability position.

C) A net investment (net asset) position.

D) A net liability position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

71

_____ Patonics has a long-term intercompany receivable on its books resulting from a loan made to a foreign subsidiary several years ago. No due date is specified inasmuch as settlement is not planned in the foreseeable future. The receivable is denominated in U.S. dollars. During 2006, the U.S. dollar strengthened. Patonics uses the foreign currency unit of measure approach. At 12/31/06, Patonics should

A) Adjust the intercompany receivable downward and debit OCI-Translation Adjustment.

B) Adjust the intercompany receivable downward and debit FX Transaction Loss.

C) Adjust the intercompany receivable downward and debit Investment in Subsidiary.

D) Make no adjustment to the Intercompany Receivable account.

E) None of the above.

A) Adjust the intercompany receivable downward and debit OCI-Translation Adjustment.

B) Adjust the intercompany receivable downward and debit FX Transaction Loss.

C) Adjust the intercompany receivable downward and debit Investment in Subsidiary.

D) Make no adjustment to the Intercompany Receivable account.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

72

_____ Parrco has a long-term intercompany receivable on its books resulting from a loan made to a foreign subsidiary several years ago. No due date is specified inasmuch as settlement is not planned in the foreseeable future. The receivable is denominated in Swiss francs. During 2006, the U.S. dollar strengthened. Parrco uses the foreign currency unit of measure approach. At 12/31/06, Parrco should

A) Adjust the intercompany receivable downward and debit OCI-Translation Adjustment.

B) Adjust the intercompany receivable downward and debit FX Transaction Loss.

C) Adjust the intercompany receivable downward and debit Investment in Subsidiary.

D) Make no adjustment to the Intercompany Receivable account.

E) None of the above.

A) Adjust the intercompany receivable downward and debit OCI-Translation Adjustment.

B) Adjust the intercompany receivable downward and debit FX Transaction Loss.

C) Adjust the intercompany receivable downward and debit Investment in Subsidiary.

D) Make no adjustment to the Intercompany Receivable account.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

73

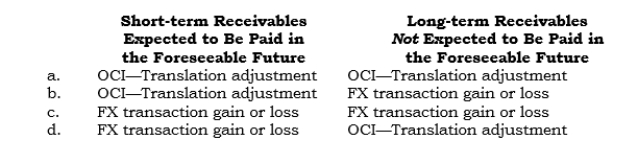

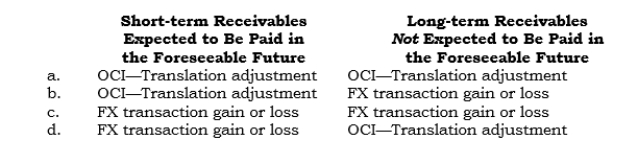

_____ Penex has an intercompany receivable denominated in foreign currency from its foreign subsidiary. Penex uses the foreign currency unit of measure approach. In which account should Penex make adjustments to reflect the current exchange rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

74

_____ At 12/31/06, Pivax had a $60,000 dividend receivable from its foreign subsidiary. The dividend of 100,000 LCU is denominated in LCU and was declared on 12/28/06, when the direct exchange rate was $.60. The dividend was remitted to Pivax on 1/8/07, when the direct exchange rate was $.62. The direct exchange rate at 12/31/06 was $.59. Pivax uses the foreign currency unit of measure approach. At 12/31/06, Pivax should

A) Adjust the Dividend Receivable account downward and debit OCI-Translation Adjustment for $1,000.

B) Adjust the Dividend Receivable account downward and debit Foreign Currency Transaction Loss for $1,000.

C) Make no adjustment to the Dividend Receivable account.

D) Adjust the Dividend Receivable account upward by $2,000.

E) None of the above.

A) Adjust the Dividend Receivable account downward and debit OCI-Translation Adjustment for $1,000.

B) Adjust the Dividend Receivable account downward and debit Foreign Currency Transaction Loss for $1,000.

C) Make no adjustment to the Dividend Receivable account.

D) Adjust the Dividend Receivable account upward by $2,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

75

_____ Pavax has intercompany sales to its foreign subsidiary and uses the foreign currency unit of measure approach. Pavax should calculate the amount of any unrealized intercompany profit using the

A) Current exchange rate.

B) Average exchange rate.

C) Historical exchange rate.

D) Nominal exchange rate.

E) None of the above.

A) Current exchange rate.

B) Average exchange rate.

C) Historical exchange rate.

D) Nominal exchange rate.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

76

_____ A foreign subsidiary has the foreign currency as its functional currency. The parent enters into an FX forward to hedge its net investment. What will occur or be the accounting treatment?

A) There will always be an offsetting effect.

B) There may or may not be an offsetting effect.

C) Any gain or loss on the forward exchange contract must be recognized currently in earnings.

D) Any gain or loss on the forward exchange contract will be deferred on the parent's books and treated as an adjustment to the Investment in Subsidiary account.

E) None of the above.

A) There will always be an offsetting effect.

B) There may or may not be an offsetting effect.

C) Any gain or loss on the forward exchange contract must be recognized currently in earnings.

D) Any gain or loss on the forward exchange contract will be deferred on the parent's books and treated as an adjustment to the Investment in Subsidiary account.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

77

_____ A parent owns a foreign subsidiary that has as its functional currency the local currency. To avoid reporting a possible negative effect in the U.S. dollar financial statements from an adverse change in the exchange rate, the parent should hedge which of the following items?

A) The net investment (net asset) position.

B) The net monetary asset position.

C) The net monetary liability position.

D) The net monetary position whether it be positive or negative.

A) The net investment (net asset) position.

B) The net monetary asset position.

C) The net monetary liability position.

D) The net monetary position whether it be positive or negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

78

_____ A parent owns a foreign subsidiary that has as its functional currency the local currency. During 2006, the foreign subsidiary had (a) a net asset position of 500,000 LCUs and (b) a net monetary asset position of 400,000 LCUs. Which of the following gains or losses on hedging transactions can be charged or credited to the parent's OCI-Translation Adjustment account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

79

_____ Under FAS 52, how is the effect of an exchange rate change reported when the current rate method of translation is used?

A) Report as a deferred gain or loss in the balance sheet.

B) Report currently in earnings.

C) Report in Other Comprehensive Income.

D) Report in the "Owner Changes in Net Assets" section of the statement of comprehensive income.

E) Report as an extraordinary item.

A) Report as a deferred gain or loss in the balance sheet.

B) Report currently in earnings.

C) Report in Other Comprehensive Income.

D) Report in the "Owner Changes in Net Assets" section of the statement of comprehensive income.

E) Report as an extraordinary item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

80

_____ Pakex's French subsidiary, Sakex, sold inventory on credit to a British customer on 12/22/06. The sale was denominated in pounds, and the customer paid in full in March 2007. From the sales date to 12/31/06, the pound strengthened relative to the franc (which is Sakex's functional currency). Sakex's gain should be reported as

A) An offset to the uncollected receivable.

B) A separate component of stockholders' equity (bypassing earnings).

C) A deferred credit reported immediately below liabilities.

D) An adjustment to the recorded sales amount.

E) An FX gain in the current income statement.

A) An offset to the uncollected receivable.

B) A separate component of stockholders' equity (bypassing earnings).

C) A deferred credit reported immediately below liabilities.

D) An adjustment to the recorded sales amount.

E) An FX gain in the current income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck