Deck 11: Changes in a Parents Ownership Interest, Statement of Cash Flows, & Earnings Per Share

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/86

العب

ملء الشاشة (f)

Deck 11: Changes in a Parents Ownership Interest, Statement of Cash Flows, & Earnings Per Share

1

The acquisition of some or all of the stock held by minority stockholders of a subsidiary should be accounted for by the __________________________________ method.

purchase

2

When a parent sells a portion of its common stock holdings in a subsidiary and when the shares owned were acquired in block acquisitions, the theoretically preferred method of relieving the investment account is the ____________________ __________________________ method.

average cost

3

When a parent sells a portion of its common stock holdings in a subsidiary at a gain, the gain is to be credited to_____________________________________________.

income

4

When a parent sells a portion of its common stock holdings in a subsidiary at a loss, the loss is to be charged to ___________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under the _____________________________________________ concept, an increase or a decrease in a parent's interest in the subsidiary's net assets at book value as a result of the issuance of additional common shares by a subsidiary is credited or debited, respectively, to income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

6

Under the ___________________________________________ concept, an increase or a decrease in a parent's interest in the subsidiary's net assets at book value as a result of the issuance of additional common shares by a subsidiary is credited or debited, respectively, to Additional Paid-in Capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

7

If a subsidiary issues additional common shares to the public at more than the current book value per share of the subsidiary's common stock, the parent's total dollar interest in the subsidiary's _________________________________________ is __________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

8

The purchase method must be used to account for the acquisition of noncontroling interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

9

If 90% of a company's outstanding common shares are obtained in a business combination properly accounted for as a purchase, the acquisition of the remaining shares may be accounted for as a pooling of interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

10

When a subsidiary pays less than book value to acquire the minority interest, the parent's total dollar interest in the subsidiary's net assets at their book value is increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

11

When a subsidiary pays more than book value to acquire the noncontrolling interest, an adjustment must be made to the carrying value of the parent's Investment in Subsidiary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

12

When a parent acquires the noncontrolling interest of a partially owned subsidiary, no change is made to the total carrying value of the investment; only a reclassification of amounts among the components of the major conceptual elements is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

13

When a parent sells a portion of its common stock holdings in a subsidiary, the accounting issue is whether the Investment account should be updated under the equity method to the date of the disposal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

14

When a parent sells a portion of its common stock holdings in a subsidiary at a gain, the gain must be reported in income in the year of the disposal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the parent company concept, the issuance of additional common stock by a subsidiary at more than book value results in a gain to the parent that must be reported in the consolidated income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

16

When a subsidiary issues additional common stock at less than book value, the parent's equity in the subsidiary's net assets at book value increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

17

When a subsidiary issues additional common stock at more or less than book value, the parent's equity in the subsidiary's net assets at book value is unchanged under the economic unit concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

18

Intercompany dividends would not be reported in a consolidated statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

19

In a consolidated statement of cash flows using the indirect format, the parent's amortization of cost in excess of book value is not reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

20

In a consolidated statement of cash flows using the indirect format, an amount is reported for the noncontrolling interest when the subsidiary is partially owned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

21

When a parent and subsidiary have substantial intercompany transactions, the easiest way to prepare the consolidated statement of cash flows is to use the "analyzing the changes in the consolidated balance sheet" approach-not the "combining the separate statements" approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a subsidiary has potentially dilutive securities outstanding, the parent still applies the equity method of accounting in the normal manner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

23

When a subsidiary has potentially dilutive securities outstanding, the parent may have to make adjustments to the denominator used to compute consolidated earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

24

If fully diluted earnings per share are not required to be presented based on the parent's capital structure, then such a presentation will not become necessary even though a subsidiary has potentially dilutive securities other than common stock equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

25

When a subsidiary has potentially dilutive securities outstanding, the basic approach in computing earnings per share on a consolidated basis is to determine how much of the subsidiary's earnings should be used by the parent to compute consolidated earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

26

_____The parent does not make any adjustment to the total carrying value of its Investment in Subsidiary account when the subsidiary acquires the noncontrolling interest:

A) Providing the subsidiary paid more than the book value per share.

B) Providing the subsidiary paid less than the book value per share.

C) Regardless of whether the subsidiary paid more or less than the book value per share.

D) Unless the Securities and Exchange Commission requires an adjustment to be made.

E) Unless there is a permanent impairment in value to the carrying value of the investment.

A) Providing the subsidiary paid more than the book value per share.

B) Providing the subsidiary paid less than the book value per share.

C) Regardless of whether the subsidiary paid more or less than the book value per share.

D) Unless the Securities and Exchange Commission requires an adjustment to be made.

E) Unless there is a permanent impairment in value to the carrying value of the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

27

_____When a parent acquires some or all of the noncontrolling interest in a subsidiary, to record the acquisition of the shares it must use the:

A) Equity method.

B) Cost method.

C) Economic unit concept.

D) Parent company concept.

E) None of the above.

A) Equity method.

B) Cost method.

C) Economic unit concept.

D) Parent company concept.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

28

_____ When a portion of common stock holdings in a subsidiary is sold and the common shares were acquired by the parent in block acquisitions, the method of relieving the investment account that best reflects the economics of the transaction is:

A) Specific identification.

B) First-in, first-out.

C) Last-in, first-out.

D) Average cost.

E) Equity.

A) Specific identification.

B) First-in, first-out.

C) Last-in, first-out.

D) Average cost.

E) Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

29

_____When a parent that has a 75%-owned subsidiary sells 20% of its holdings at more than 20% of the carrying value of the investment, which of the following will occur or result?

A) The parent will record a gain under the parent company concept that will be eliminated in consolidation.

B) The parent will record an increase to Additional Paid-in Capital under the economic unit concept that will be eliminated in consolidation.

C) The parent will record a gain under the parent company concept that will not be eliminated in consolidation.

D) The parent will record an increase to Additional Paid-in Capital under the economic unit concept that will not be eliminated in consolidation.

E) None of the above.

A) The parent will record a gain under the parent company concept that will be eliminated in consolidation.

B) The parent will record an increase to Additional Paid-in Capital under the economic unit concept that will be eliminated in consolidation.

C) The parent will record a gain under the parent company concept that will not be eliminated in consolidation.

D) The parent will record an increase to Additional Paid-in Capital under the economic unit concept that will not be eliminated in consolidation.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

30

_____ When a parent that has a 90%-owned subsidiary sells 10% of its holdings at less than the book value per share amount, which of the following will usually occur or result?

A) The noncontrolling interest will decrease.

B) The carrying value of the investment will remain unchanged.

C) The carrying value of the investment will increase.

D) The parent will report a gain or loss that will not be eliminated in consolidation.

E) None of the above.

A) The noncontrolling interest will decrease.

B) The carrying value of the investment will remain unchanged.

C) The carrying value of the investment will increase.

D) The parent will report a gain or loss that will not be eliminated in consolidation.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

31

_____When a portion of common stock holdings in a subsidiary is sold and the common shares were acquired by the parent in block acquisitions, an acceptable method of relieving the investment account for income tax reporting is:

A) Specific identification.

B) Cost.

C) Equity.

D) Average cost.

E) Last-in, first-out.

A) Specific identification.

B) Cost.

C) Equity.

D) Average cost.

E) Last-in, first-out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

32

_____When a subsidiary issues additional common stock to the public at more than the book value per share:

A) The parent has an increase in its equity in the subsidiary's net assets, which is reported as a gain under the economic unit concept.

B) The parent has an increase in its equity in the subsidiary's net assets, which is reported as Additional Paid-in Capital under the parent company concept.

C) The parent has a decrease in its equity in the subsidiary's net assets, which is reported as a loss under the parent company concept.

D) The parent has a decrease in its equity in the subsidiary's net assets, which is reported as a reduction to Additional Paid-in Capital under the economic unit concept.

E) None of the above.

A) The parent has an increase in its equity in the subsidiary's net assets, which is reported as a gain under the economic unit concept.

B) The parent has an increase in its equity in the subsidiary's net assets, which is reported as Additional Paid-in Capital under the parent company concept.

C) The parent has a decrease in its equity in the subsidiary's net assets, which is reported as a loss under the parent company concept.

D) The parent has a decrease in its equity in the subsidiary's net assets, which is reported as a reduction to Additional Paid-in Capital under the economic unit concept.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

33

_____When a subsidiary issues additional common stock to the public at more or less than the book value per share:

A) A reclassification is made between the individual components of the detailed analysis of the investment account.

B) An adjustment is made to the carrying value of the investment under the parent company concept.

C) An adjustment is made to the carrying value of the investment under the economic unit concept.

D) An adjustment is made to the carrying value of the investment under both the parent company conept and the economic unit concept.

E) The investment account can be written down but not written up.

A) A reclassification is made between the individual components of the detailed analysis of the investment account.

B) An adjustment is made to the carrying value of the investment under the parent company concept.

C) An adjustment is made to the carrying value of the investment under the economic unit concept.

D) An adjustment is made to the carrying value of the investment under both the parent company conept and the economic unit concept.

E) The investment account can be written down but not written up.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

34

_____When a subsidiary issues additional common stock at below book value, which of the following could occur or result?

A) No adjustment is required to the carrying value of the investment.

B) The noncontrolling interest will decrease.

C) Under the parent company concept, a loss would be reported by the parent that will not be eliminated in consolidation.

D) The carrying value of any unamortized goodwill could increase.

E) None of the above.

A) No adjustment is required to the carrying value of the investment.

B) The noncontrolling interest will decrease.

C) Under the parent company concept, a loss would be reported by the parent that will not be eliminated in consolidation.

D) The carrying value of any unamortized goodwill could increase.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

35

_____ Pylo owns 75% of the outstanding common stock of Sylo. Sylo acquired 10% of its outstanding common stock from NCI shareholders for $90,000 when its book value was $600,000. How much dilution did Pylo suffer?

A) $ -0-.

B) $5,000.

C) $22,500.

D) $25,000.

E) $30,000.

A) $ -0-.

B) $5,000.

C) $22,500.

D) $25,000.

E) $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

36

_____ Pylo owns 75% of the outstanding common stock of Sylo. Sylo acquired 10% of its outstanding common stock from NCI shareholders for $90,000 when its book value was $600,000. How much dilution did the remaining NCI shareholders suffer?

A) $ -0-.

B) $5,000.

C) $6,500.

D) $7,500.

E) None of the above.

A) $ -0-.

B) $5,000.

C) $6,500.

D) $7,500.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

37

_____ Paxco owns 80% of the outstanding common stock of Saxco. These holdings were acquired in a single block purchase in 2002. On, 4/1/06 Paxco sold 25% of its holdings in Saxco for $84,000. At 12/31/03, the carrying value of Paxco's investment in Saxco was $320,000. During the first quarter of 2006, Saxco reported net income of $80,000 and declared dividends of $30,000. Paxco uses the equity method. In Paxco's 2006 income statement, it should report a:

A) Gain of $4,000.

B) Gain of $10,000.

C) Loss of $6,000.

D) Loss of $12,000.

E) None of the above.

A) Gain of $4,000.

B) Gain of $10,000.

C) Loss of $6,000.

D) Loss of $12,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

38

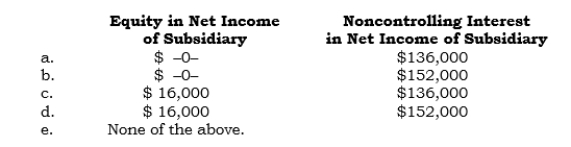

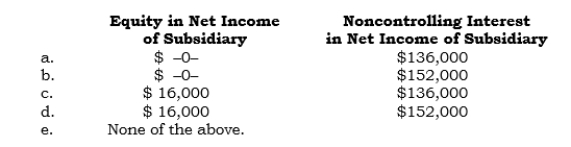

_____ Paxco owns 80% of the outstanding common stock of Saxco. These holdings were acquired in a single block purchase in 2002. On, 4/1/06 Paxco sold 25% of its holdings in Saxco for $84,000. At 12/31/03, the carrying value of Paxco's investment in Saxco was $320,000. During the first quarter of 2006, Saxco reported net income of $80,000 and declared dividends of $30,000. Paxco uses the equity method. Saxco reported net income of $300,000 for the last three quarters of 2006. Which of the following amounts would be reported in the 2006 consolidated income statement?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

39

_____ On 6/1/06, Silo, a 90%-owned subsidiary of Pilo, issued 20,000 shares of its $1 par value common stock to the public for $600,000. Silo had 100,000 shares outstanding and having a total book value of $2,000,000 just prior to this issuance. As a result of this issuance, the amount the parent would report in its 2006 income statement under the parent company concept is:

A) -0-.

B) Loss of $150,000.

C) Loss of $180,000.

D) Gain of $150,000.

E) Gain of $180,000.

A) -0-.

B) Loss of $150,000.

C) Loss of $180,000.

D) Gain of $150,000.

E) Gain of $180,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

40

_____ On 6/1/06, Silo, a 90%-owned subsidiary of Pilo, issued 20,000 shares of its $1 par value common stock to the public for $600,000. Silo had 100,000 shares outstanding and having a total book value of $2,000,000 just prior to this issuance. As a result of this issuance, the amount the parent would report in its 2006 income statement under the economic unit concept is:

A) -0-.

B) Loss of $150,000.

C) Loss of $180,000.

D) Gain of $150,000.

E) Gain of $180,000.

A) -0-.

B) Loss of $150,000.

C) Loss of $180,000.

D) Gain of $150,000.

E) Gain of $180,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

41

_____ Sudee Inc. is a 60%-owned subsidiary of Pudee Inc. For 2006, Sudee reported net income of $200,000, declared dividends of $150,000, and paid dividends of $125,000 ($25,000 remains unpaid at year-end). In the consolidated statement of cash flows for 2006, what amount would be reported for dividends, assuming the parent declared and paid $1,000,000 of dividends?

A) $1,000,000

B) $1,050,000

C) $1,060,000.

D) $1,060,000

E) None of the above.

A) $1,000,000

B) $1,050,000

C) $1,060,000.

D) $1,060,000

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

42

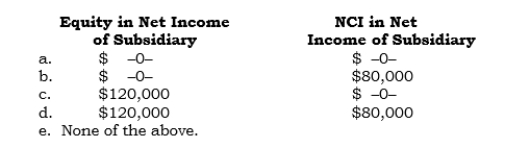

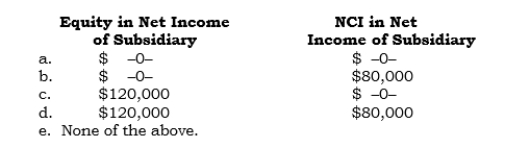

_____ Sudee Inc. is a 60%-owned subsidiary of Pudee Inc. For 2006, Sudee reported net income of $200,000, declared dividends of $150,000, and paid dividends of $125,000 ($25,000 remains unpaid at year-end). In the consolidated statement of cash flows for 2006, what amount would be reported for each of the following accounts using the indirect approach?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

43

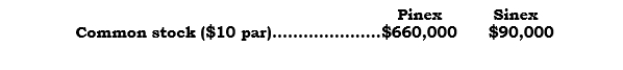

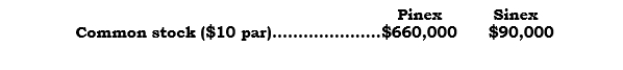

_____ Pinex and its 100%-owned subsidiary, Sinex, have the following common stock accounts at 12/31/06:

On 6/30/06, Pinex issued 6,000 shares of common stock. Neither company had any other common stock activity during 2006. In computing consolidated earnings per share for the year ended 12/31/06, the number of shares used should be

On 6/30/06, Pinex issued 6,000 shares of common stock. Neither company had any other common stock activity during 2006. In computing consolidated earnings per share for the year ended 12/31/06, the number of shares used should be

A) 63,000.

B) 66,000

C) 72,000

D) 75,000.

E) None of the above.

On 6/30/06, Pinex issued 6,000 shares of common stock. Neither company had any other common stock activity during 2006. In computing consolidated earnings per share for the year ended 12/31/06, the number of shares used should be

On 6/30/06, Pinex issued 6,000 shares of common stock. Neither company had any other common stock activity during 2006. In computing consolidated earnings per share for the year ended 12/31/06, the number of shares used should beA) 63,000.

B) 66,000

C) 72,000

D) 75,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

44

______ Pullox owns 100% of Sullox's outstanding common stock. For 2006, Sullox reported net income of $400,000. In addition to its 45,000 shares of common stock owned by Pullox, Sullox has outstanding warrants to purchase 15,000 shares of its common stock. These warrants were outstanding during all of 2006, and 10,000 shares were assumed to be repurchased under the treasury stock method for earnings per share purposes. Pullox reported net income of $1,000,000 from its own separate operations, exclusive of any earnings or dividends of Sullox.

For primary earnings per share on a consolidated basis, the numerator in this calculation is:

A) $1,000,000

B) $1,300,000

C) $1,340,000

D) $1,360,000

E) $1,400,000

For primary earnings per share on a consolidated basis, the numerator in this calculation is:

A) $1,000,000

B) $1,300,000

C) $1,340,000

D) $1,360,000

E) $1,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

45

______ Pullox owns 100% of Sullox's outstanding common stock. For 2006, Sullox reported net income of $400,000. In addition to its 45,000 shares of common stock owned by Pullox, Sullox has outstanding warrants to purchase 15,000 shares of its common stock. These warrants were outstanding during all of 2006, and 10,000 shares were assumed to be repurchased under the treasury stock method for earnings per share purposes. Pullox reported net income of $1,000,000 from its own separate operations, exclusive of any earnings or dividends of Sullox.

What is the consolidated net income?

A) $1,000,000

B) $1,300,000

C) $1,340,000

D) $1,360,000

E) $1,400,000

What is the consolidated net income?

A) $1,000,000

B) $1,300,000

C) $1,340,000

D) $1,360,000

E) $1,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

46

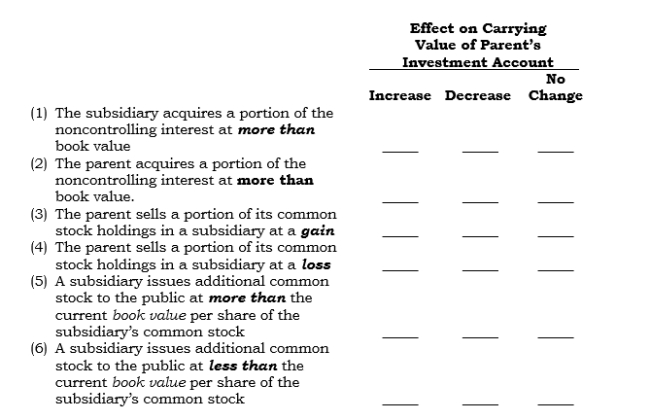

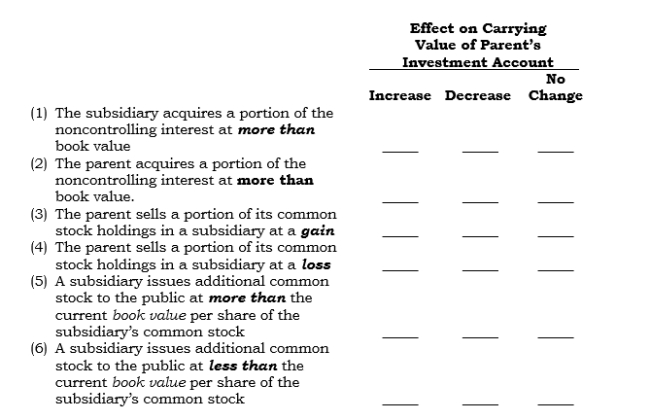

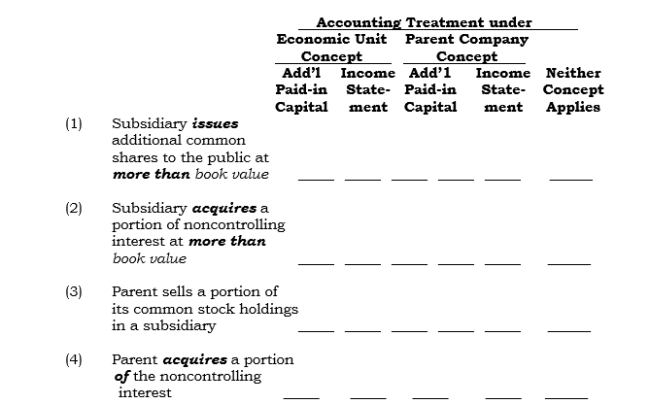

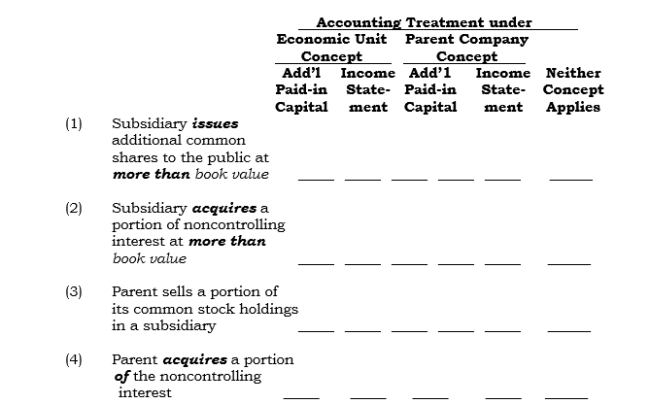

For the following statements, place an X in the appropriate column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

47

For each of the following questions, place an X in the appropriate column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

48

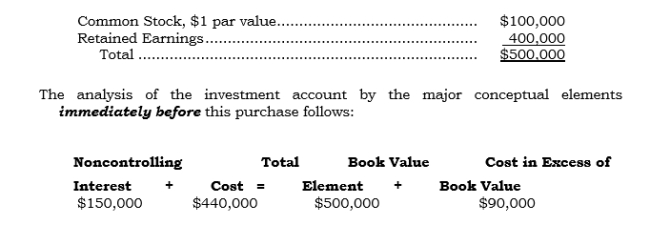

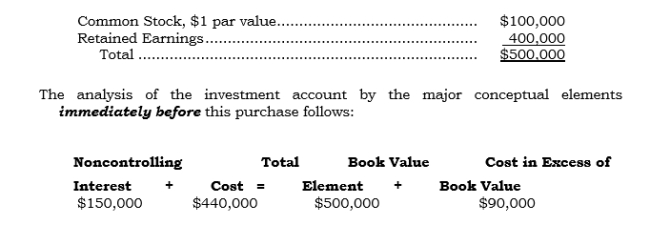

Sumtex, a 70%-owned subsidiary of Pumtex, acquired 16% of its outstanding common shares from noncontrolling shareholders for $110,000. The capital accounts of Sumtex immediately before this purchase follow:

Required:

Required:

Update the analysis of the Investment account as a result of the subsidiary's acquisition of the noncontrolling interest.

Required:

Required:Update the analysis of the Investment account as a result of the subsidiary's acquisition of the noncontrolling interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

49

On 9/1/06, Palex, which reports on a calendar-year basis, sold 20% of its common stock holdings in its 75%-owned subsidiary, Salex, for $108,000. All of the shares owned of Salex were acquired several years ago in a business combination accounted for as a purchase. Palex uses the equity method of accounting. On 9/1/06, the carrying value of the investment account was $350,000 (the properly updated balance at that date). Salex reported net income of $44,000 for the 8 months ended 8/31/06, and $40,000 for the 4 months ended 12/31/06.

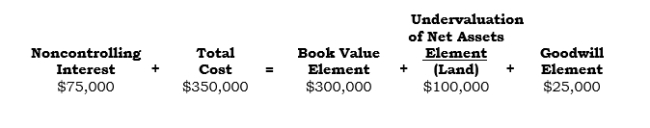

The conceptual analysis of the investment account had the following balances immediately before the sale:

Required:

Required:

(1) Update the conceptual analysis as a result of the disposal.

(2) Compute the gain or loss to be reported on the sale of the shares sold, and indicate whether it is a gain or a loss.

(3) Compute the amount that is reflected in Palex's general ledger account, Equity in Net Income of Subsidiary for 2006

(4) Compute the amount of the noncontrolling interest deduction to be reported in the consolidated income statement for 2006.

The conceptual analysis of the investment account had the following balances immediately before the sale:

Required:

Required:(1) Update the conceptual analysis as a result of the disposal.

(2) Compute the gain or loss to be reported on the sale of the shares sold, and indicate whether it is a gain or a loss.

(3) Compute the amount that is reflected in Palex's general ledger account, Equity in Net Income of Subsidiary for 2006

(4) Compute the amount of the noncontrolling interest deduction to be reported in the consolidated income statement for 2006.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

50

On 6/1/06, Silex, a 90%-owned subsidiary of Pilex, issued 20,000 shares of its $1 par value common stock to the public for $260,000. The balance in the equity accounts of Silex immediately before the issuance follows:

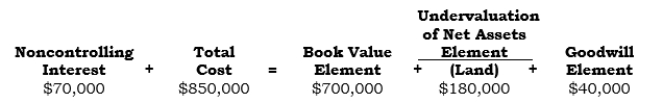

The analysis of the investment account immediately before the issuance follows:

The analysis of the investment account immediately before the issuance follows:

Required:

Required:

(1) Update the analysis as a result of the issuance of the additional shares by Silex.

(2) Prepare the parent's adjusting entry, if any.

The analysis of the investment account immediately before the issuance follows:

The analysis of the investment account immediately before the issuance follows: Required:

Required:(1) Update the analysis as a result of the issuance of the additional shares by Silex.

(2) Prepare the parent's adjusting entry, if any.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

51

In consolidation, a subsidiary's preferred stock-to the extent it is not held by the parent-is treated as part of the ______________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

52

For a 100%-owned subsidiary that has preferred stock that is not owned by the parent company, a portion of the subsidiary's _________________________________ may have to be shown as part of the _______________________________ in consolidation, depending on the features and dividend status of the preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

53

Preferred stock of a subsidiary is shown as preferred stock in the stockholders' equity section of the consolidated balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

54

Preferred stock of a subsidiary is shown as part of the noncontrolling interest in the consolidated balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

55

When a subsidiary's preferred stock has cumulative, participating, or call features, the subsidiary's book retained earnings may require an adjusting entry in the subsidiary's general ledger to reclassify a portion of the retained earnings to the preferred stock accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

56

_____ Concerning a parent that has an investment in its subsidiary's preferred stock, which of the following statements is true?

A) If the parent's cost of the preferred stock holding differs from its share of the book value of the preferred stock holding, the carrying value of the investment in the preferred stock may be adjusted to such book value.

B) The subsidiary's preferred stock held by the parent company is not treated as part of the noncontrolling interest in consolidation.

C) The parent should account for its holdings using the equity method.

D) All of the above.

E) None of the above.

A) If the parent's cost of the preferred stock holding differs from its share of the book value of the preferred stock holding, the carrying value of the investment in the preferred stock may be adjusted to such book value.

B) The subsidiary's preferred stock held by the parent company is not treated as part of the noncontrolling interest in consolidation.

C) The parent should account for its holdings using the equity method.

D) All of the above.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

57

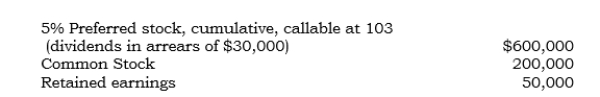

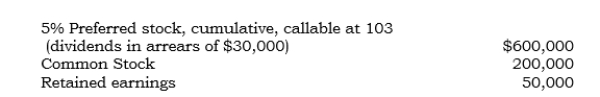

_____ On 1/1/06 Panto acquired 80% of the outstanding common stock of Santo. On that date, Santo had the following equity balances:

The preferred stock has a call premium of $20,000 and cumulative dividends in arrears of $60,000. The amount to be reported for the noncontrolling interest in a consolidated balance sheet on that date is:

The preferred stock has a call premium of $20,000 and cumulative dividends in arrears of $60,000. The amount to be reported for the noncontrolling interest in a consolidated balance sheet on that date is:

A) $100,000.

B) $500,000.

C) $516,000.

D) $564,000.

E) None of the above.

The preferred stock has a call premium of $20,000 and cumulative dividends in arrears of $60,000. The amount to be reported for the noncontrolling interest in a consolidated balance sheet on that date is:

The preferred stock has a call premium of $20,000 and cumulative dividends in arrears of $60,000. The amount to be reported for the noncontrolling interest in a consolidated balance sheet on that date is:A) $100,000.

B) $500,000.

C) $516,000.

D) $564,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

58

_____ On 1/1/06 Panto acquired 80% of the outstanding common stock of Santo. On that date, Santo had the following equity balances:

The preferred stock has a call premium of $20,000 and cumulative dividends in arrears of $60,000. How much would appear in the parent's Equity in Net Income of Subsidiary account at the end of 2006 assuming that Santo reported $100,000 of net income for 2006?

The preferred stock has a call premium of $20,000 and cumulative dividends in arrears of $60,000. How much would appear in the parent's Equity in Net Income of Subsidiary account at the end of 2006 assuming that Santo reported $100,000 of net income for 2006?

A) $ -0-.

B) $64,000.

C) $80,000.

D) $100,000.

E) None of the above.

The preferred stock has a call premium of $20,000 and cumulative dividends in arrears of $60,000. How much would appear in the parent's Equity in Net Income of Subsidiary account at the end of 2006 assuming that Santo reported $100,000 of net income for 2006?

The preferred stock has a call premium of $20,000 and cumulative dividends in arrears of $60,000. How much would appear in the parent's Equity in Net Income of Subsidiary account at the end of 2006 assuming that Santo reported $100,000 of net income for 2006?A) $ -0-.

B) $64,000.

C) $80,000.

D) $100,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

59

Pylox acquired 80% of the outstanding common stock of Sylox on 1/1/06. Information pertaining to Sylox as of that date follows:

Required:

Required:

(1) Determine the amount that would be assigned to the noncontrolling interest (NCI) column in the parent's analysis of the investment account as of 1/1/06.

(2) Determine the amount that would be reported for the NCI in a consolidated balance sheet at 1/1/06.

(3) Assuming Sylox reported net income of $80,000 for 2006 and declared dividends of $60,000 on its 5% preferred stock, determine the amount of earnings that Pylox would record under the equity method.

Required:

Required:(1) Determine the amount that would be assigned to the noncontrolling interest (NCI) column in the parent's analysis of the investment account as of 1/1/06.

(2) Determine the amount that would be reported for the NCI in a consolidated balance sheet at 1/1/06.

(3) Assuming Sylox reported net income of $80,000 for 2006 and declared dividends of $60,000 on its 5% preferred stock, determine the amount of earnings that Pylox would record under the equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

60

When a subsidiary holds a common stock investment of less than 20% in another subsidiary of a common parent, the subsidiary accounts for its investment using the ______________________________ method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

61

In indirect vertical holdings, at least one of the companies is both a(n) __________ _________________ and a(n) ______________________________ .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

62

When indirect vertical or horizontal holdings, or both, exist, consolidated net income can be determined through consolidation or by using the successive application of the ______________________________ method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

63

In reciprocal holdings, the treasury stock method fits under the ________________________________ concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

64

In reciprocal holdings, the traditional allocation method fits under the ______________________________ concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

65

The difference between consolidation and the equity method lies in the _________ __________________ reported in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

66

In reciprocal holdings, the NCI shareholders of the subsidiary are ______________ ______________________ stockholders of the parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

67

The proof of the traditional allocation method is to assume that a(n) ________________________________ occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

68

In reciprocal holdings, simultaneous equations are used in the _________________ ____________________ method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

69

When indirect vertical holdings exist, it is necessary to consolidate to determine the consolidated net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

70

Indirect horizontal holdings exist when one subsidiary of a common parent holds an investment in another subsidiary of the parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

71

In certain types of indirect holdings, it is possible for one of the affiliated companies to be both a parent and a subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

72

In indirect vertical holdings, the sequence of consolidation is to start at the highest parent-subsidiary level and then work downward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

73

When indirect horizontal holdings exist, it is appropriate to apply the equity method of accounting, even when one company has less than a 20% investment in the common stock of another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

74

When indirect horizontal holdings exist, the consolidated net income is determined under the treasury stock method, which is part of the parent company concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

75

When reciprocal holdings exist, consolidated net income can be determined with the application of the equity method, which is consistent with the treasury stock method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

76

The traditional allocation method is essentially a part of the equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

77

Under the traditional allocation method, a portion of the parent's earnings is reported as not accruing to the controlling interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

78

Whether the use of the treasury stock method or the traditional allocation method is correct depends on the validity of the assumption that the subsidiary will eventually be liquidated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

79

_____ In indirect vertical holdings,

A) The treasury stock method is used.

B) The traditional allocation method is used.

C) A third-tier subsidiary may be consolidated even though 50% or less of its earnings accrue to the top-level parent.

D) A third-tier subsidiary cannot be consolidated unless more than 50% of its earnings accrue to the top-level parent.

E) No subsidiary is also a parent.

A) The treasury stock method is used.

B) The traditional allocation method is used.

C) A third-tier subsidiary may be consolidated even though 50% or less of its earnings accrue to the top-level parent.

D) A third-tier subsidiary cannot be consolidated unless more than 50% of its earnings accrue to the top-level parent.

E) No subsidiary is also a parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

80

_____ In indirect horizontal holdings,

A) Horizontal investments of less than 20% cannot be accounted for under the equity method.

B) Consolidated net income cannot be determined through successive application of the equity method.

C) Consolidated net income can be determined under the treasury stock method.

D) Consolidated net income can be determined under the traditional allocation method.

E) A subsidiary has an investment in another subsidiary of a common parent. f. None of the above.

A) Horizontal investments of less than 20% cannot be accounted for under the equity method.

B) Consolidated net income cannot be determined through successive application of the equity method.

C) Consolidated net income can be determined under the treasury stock method.

D) Consolidated net income can be determined under the traditional allocation method.

E) A subsidiary has an investment in another subsidiary of a common parent. f. None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck