Deck 4: Introduction to Business Combinations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

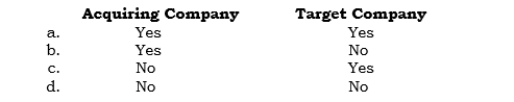

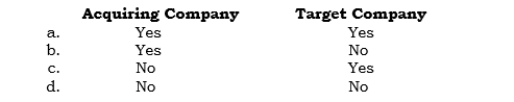

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/105

العب

ملء الشاشة (f)

Deck 4: Introduction to Business Combinations

1

The process of trying to acquire the business of a target company is commonly called a(n) ________________________________________.

takeover attempt

2

An offer made by an acquiring company directly to the stockholders of the target company is known as a(n) ________________________________________.

tender offer

3

A type of business combination no longer allowed in which common stock had to be the primary consideration given is a(n) _____________________________________.

pooling of interests

4

The only type of business combination currently allowed is called a(n) ________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

5

The two types of property that may be acquired in a business combination are ____________________________________ and _____________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

6

The two resulting organizational forms of an acquired business are __________________________________ and _____________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

7

The term used to refer to a business that was acquired by obtaining its common stock is ________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

8

A type of business combination in which one of the combining companies ceases its legal existence is called a(n) _____________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

9

A type of business combination in which both combining companies cease their legal existence is called a(n) ________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

10

A company that has no revenue-producing operations of its own but only investments in subsidiaries is called a(n) _____________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

11

In purchase accounting, the primary consideration given must be cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

12

In purchase accounting, the primary consideration given must be common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

13

In purchase accounting, the primary consideration given may be either cash or common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

14

In pooling of interests accounting, the consideration given must be common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

15

In purchase accounting, the type of consideration given is irrelevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

16

In purchase accounting, the target company's common stock must be acquired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

17

In purchase accounting, a new basis of accounting is established for the target company's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

18

In pooling of interests accounting, a new basis of accounting is established for the target company's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

19

In purchase accounting, a new basis of accounting is established for the assets of the two combining companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

20

In pooling of interests accounting, a new basis of accounting is established for the assets of the two combining companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

21

In purchase accounting, goodwill is reported, if present.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

22

In pooling of interests accounting, goodwill is reported, if present.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

23

In purchase accounting, a common-stock-for-common-stock exchange must occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

24

In pooling of interests accounting, a common-stock-for-common-stock exchange must occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

25

Whether to use purchase accounting or pooling of interests accounting is left to the judgment of management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

26

FAS 141 does not concern itself with how the target company (or its stockholders) account for the disposal of their interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

27

Purchase accounting must be used unless certain conditions exist, in which case the pooling of interests method is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

28

In purchase accounting, a parent-subsidiary relationship is always created.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

29

In the acquisition of 100% of the target company's assets, purchase accounting is optional.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

30

In purchase accounting, the target company never makes any entries on its books as a result of the combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

31

When assets are acquired, the target company never makes any entries on its books as a result of the combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

32

When common stock is acquired, the target company never makes any entries on its books as a result of the combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

33

In purchase accounting, an account called Investment in Subsidiary is always used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

34

In purchase accounting, an account called Investment in Subsidiary is never used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

35

To avoid reporting goodwill, the acquiring company should acquire the target company's common stock instead of its assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

36

To avoid reporting goodwill, the acquiring company should acquire the target company's assets instead of its common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

37

To avoid changing the basis of accounting for the target company's assets, the acquiring company should acquire assets instead of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

38

To avoid changing the basis of accounting for the target company's assets, the acquiring company should acquire common stock instead of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

39

To avoid having to deal with the target company's labor union after the combination, the acquiring company should acquire common stock instead of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

40

To avoid potential unrecorded liabilities, the acquiring company should acquire assets instead of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

41

Goodwill must be capitalized and amortized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

42

Goodwill must be (1) capitalized and (2) amortized only if its value has been impaired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

43

Goodwill must be capitalized--never to be amortized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

44

Goodwill must be capitalized--never to be amortized or written down.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

45

Goodwill can be amortized or not amortized, depending on management's judgment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

46

Goodwill can never be charged directly to stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

47

Goodwill is always reported in purchase accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

48

Goodwill is never reported in a pooling of interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

49

In purchase accounting, a statutory merger is possible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

50

In purchase accounting, a statutory consolidation is possible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

51

In a statutory merger, the legal existence of the target company is terminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

52

In a statutory consolidation, the legal existence of the target company is terminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

53

In a statutory merger, a new corporation is created-no corporation's legal existence is terminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

54

In a statutory consolidation, a new corporation is created-no corporation's legal existence is terminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

55

In a statutory merger, a new corporation is created-the legal existence of each combining company is terminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

56

In a statutory consolidation, a new corporation is created-the legal existence of each combining company is terminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

57

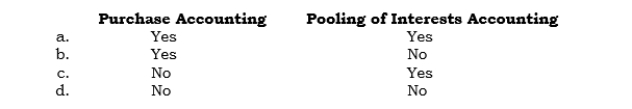

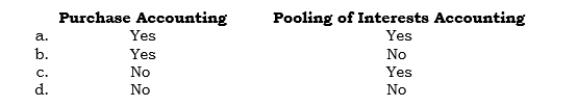

_____ A change in basis of accounting for assets and liabilities occurs in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

58

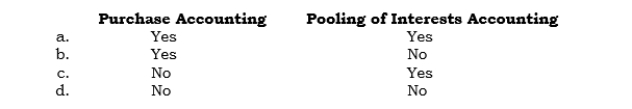

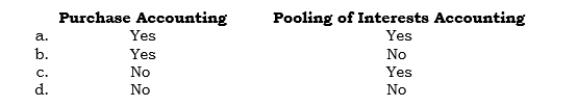

_____ Goodwill, if present, can be reported as a result of using

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

59

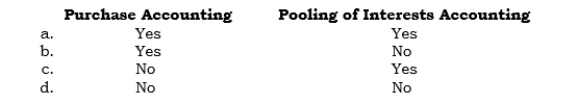

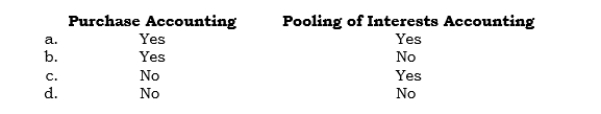

_____ Cash must be given as consideration in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

60

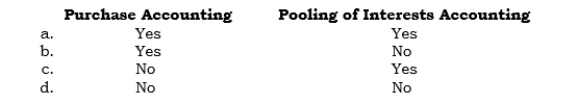

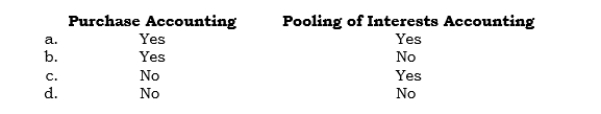

_____ Common stock must be given as consideration in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

61

_____ The target company's outstanding common stock must be acquired in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

62

_____ Under purchase accounting, which of the following items must occur:

A) Common stock must be acquired.

B) A parent-subsidiary relationship must be established.

C) Cash must be the consideration given.

D) Common stock must be issued as consideration.

E) None of the above items must occur.

A) Common stock must be acquired.

B) A parent-subsidiary relationship must be established.

C) Cash must be the consideration given.

D) Common stock must be issued as consideration.

E) None of the above items must occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

63

_____ In purchase accounting, a new basis of accounting is established for the

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

64

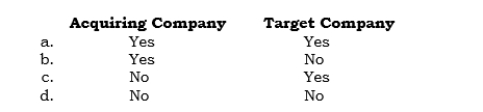

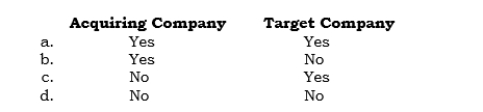

_____ FAS 141 applies to accounting for the transaction by the

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

65

_____ In purchase accounting, whether to continue with the old basis of accounting or use the new basis of accounting depends on whether

A) Common stock was acquired.

B) Assets were acquired.

C) The target company's assets are undervalued (in total).

D) Whether a statutory merger occurs.

E) None of the above.

A) Common stock was acquired.

B) Assets were acquired.

C) The target company's assets are undervalued (in total).

D) Whether a statutory merger occurs.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

66

_____ Under purchase accounting,

A) The business combination is automatically a taxable event.

B) Goodwill cannot exist.

C) Assets of the acquiring company (as compared with the target company) are revalued to their current values.

D) A fusion of equity interests is deemed to occur.

E) None of the above.

A) The business combination is automatically a taxable event.

B) Goodwill cannot exist.

C) Assets of the acquiring company (as compared with the target company) are revalued to their current values.

D) A fusion of equity interests is deemed to occur.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

67

_____ In all cases in which all of the target company's outstanding common stock is acquired,

A) A taxable event has occurred.

B) A statutory merger will result.

C) A parent-subsidiary relationship is formed.

D) A pooling of interests results.

E) None of the above.

A) A taxable event has occurred.

B) A statutory merger will result.

C) A parent-subsidiary relationship is formed.

D) A pooling of interests results.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

68

_____ In all cases in which the target company's assets are acquired,

A) A taxable event has occurred.

B) A statutory consolidation will result.

C) A parent-subsidiary relationship is formed.

D) A pooling of interests results.

E) None of the above.

A) A taxable event has occurred.

B) A statutory consolidation will result.

C) A parent-subsidiary relationship is formed.

D) A pooling of interests results.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

69

_____ In a business combination in which the assets of the target company are acquired, which of the following cannot occur, arise, or result?

A) A parent-subsidiary relationship.

B) A home office-branch/division relationship.

C) The recognition of goodwill.

D) A new basis of accounting.

E) None of the above.

A) A parent-subsidiary relationship.

B) A home office-branch/division relationship.

C) The recognition of goodwill.

D) A new basis of accounting.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

70

_____ In a business combination in which the assets of the target company are acquired, which of the following cannot occur, arise, or result?

A) The recognition of a bargain purchase element .

B) A statutory consolidation.

C) Goodwill.

D) A new basis of accounting.

E) None of the above.

A) The recognition of a bargain purchase element .

B) A statutory consolidation.

C) Goodwill.

D) A new basis of accounting.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

71

_____ In a business combination in which the target company's common stock becomes owned by the other company, which of the following always occurs?

A) A pooling of interests.

B) The recognition of goodwill.

C) A parent-subsidiary relationship is formed.

D) A home office-branch/division relationship is formed.

E) None of the above.

A) A pooling of interests.

B) The recognition of goodwill.

C) A parent-subsidiary relationship is formed.

D) A home office-branch/division relationship is formed.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

72

_____ In a business combination in which the target company's common stock becomes owned by the other company, which of the following always occurs, arises, or results?

A) A statutory merger.

B) A statutory consolidation.

C) The formation of a holding company.

D) Goodwill.

E) None of the above.

A) A statutory merger.

B) A statutory consolidation.

C) The formation of a holding company.

D) Goodwill.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

73

_____ Under purchase accounting, which of the following items is true?

A) Goodwill always exist.

B) Goodwill is charged to earnings at the acquisition date.

C) Goodwill is charged to stockholders' equity at the acquisition date.

D) Goodwill is capitalized-never to be amortized.

E) None of the above.

A) Goodwill always exist.

B) Goodwill is charged to earnings at the acquisition date.

C) Goodwill is charged to stockholders' equity at the acquisition date.

D) Goodwill is capitalized-never to be amortized.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

74

_____ Goodwill must be accounted for in which of the following manners?

A) Charge to stockholders' equity at the business combination date.

B) Capitalize as an asset never to be amortized or written down.

C) Capitalize as an asset always to be amortized.

D) Capitalize as an asset to be amortized only if its value becomes impaired.

E) Capitalize as an asset to be written down only if its value becomes impaired.

A) Charge to stockholders' equity at the business combination date.

B) Capitalize as an asset never to be amortized or written down.

C) Capitalize as an asset always to be amortized.

D) Capitalize as an asset to be amortized only if its value becomes impaired.

E) Capitalize as an asset to be written down only if its value becomes impaired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

75

_____ Goodwill, when properly recognized, must be

A) Amortized only when appropriate.

B) Amortized over no more than 40 years in all cases.

C) Amortized or written down periodically, at management's discretion.

D) Amortized only if management has established a policy of amortizing goodwill.

E) None of the above.

A) Amortized only when appropriate.

B) Amortized over no more than 40 years in all cases.

C) Amortized or written down periodically, at management's discretion.

D) Amortized only if management has established a policy of amortizing goodwill.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

76

_____ A new corporation is created, and no corporation's legal existence is terminated in a

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

77

_____ A new corporation is created, and the legal existence of each combining company is terminated in a

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

78

_____ When a statutory merger has been effected,

A) A new company is formed to carry on the businesses of two previously existing companies.

B) One of the combining companies ceases its legal existence.

C) A parent-subsidiary relationship is formed.

D) A pooling of interests has occurred.

E) None of the above.

A) A new company is formed to carry on the businesses of two previously existing companies.

B) One of the combining companies ceases its legal existence.

C) A parent-subsidiary relationship is formed.

D) A pooling of interests has occurred.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

79

_____A reason for acquiring assets versus acquiring common stock is that

A) Acquiring assets is much simpler.

B) Acquiring assets does not require approval by the target company's

Board of directiors.

C) The acquiring company can avoid inheriting contingent liabilities of the target company.

D) By acquiring assets, a statutory consolidation can later be effected.

E) None of the above.

A) Acquiring assets is much simpler.

B) Acquiring assets does not require approval by the target company's

Board of directiors.

C) The acquiring company can avoid inheriting contingent liabilities of the target company.

D) By acquiring assets, a statutory consolidation can later be effected.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

80

Pye Company acquired 100% of the outstanding common stock of Slyce Company Pye gave $400,000 cash as consideration. Slyce's net assets have a book value of $300,000 and a current value of $375,000.

Required:

Record the entries that would be made on each company's books as a result of this transaction.

Required:

Record the entries that would be made on each company's books as a result of this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck