Deck 8: Tax-Deferred Exchanges

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/27

العب

ملء الشاشة (f)

Deck 8: Tax-Deferred Exchanges

1

What is the difference between a gain deferral and a gain exclusion?

If a gain is deferred, the taxation of the gain is postponed to a future date. If the gain is excluded, it escapes taxation entirely.

2

Molly and Dolly form MD Corporation. Molly transfers a building with a fair market value of $800,000 and a basis of $400,000 that is encumbered by a $100,000 mortgage that the corporation assumes in exchange for 50 percent of MD's stock (fair market value = $700,000). Dolly contributes equipment valued at $900,000 with a basis of $500,000 that is encumbered by a $200,000 liability that the corporation assumes in exchange for the other 50 percent of MD's stock. What are Molly and Dolly's realized and recognized gains and their bases in the stock received.

-Refer to the information in the preceding problem. How would your answers change if Molly and Dolly formed a general partnership in which they were equal partners instead of a corporation?

-Refer to the information in the preceding problem. How would your answers change if Molly and Dolly formed a general partnership in which they were equal partners instead of a corporation?

Molly and Dolly's realized and recognized gains do not change; nor does the partnership's bases in the building and equipment. Molly and Dolly's bases in their partnership interests change, however: Molly: $400,000 - $100,000 liability assumed + $150,000 (50% of $300,000 total liabilities assumed by partnership) = $450,000; Dolly: $500,000 - $200,000 + $150,000 = $450,000.

3

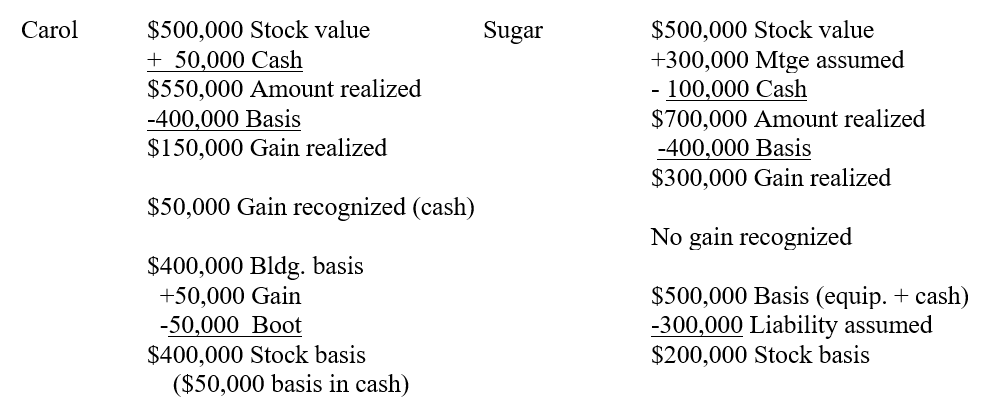

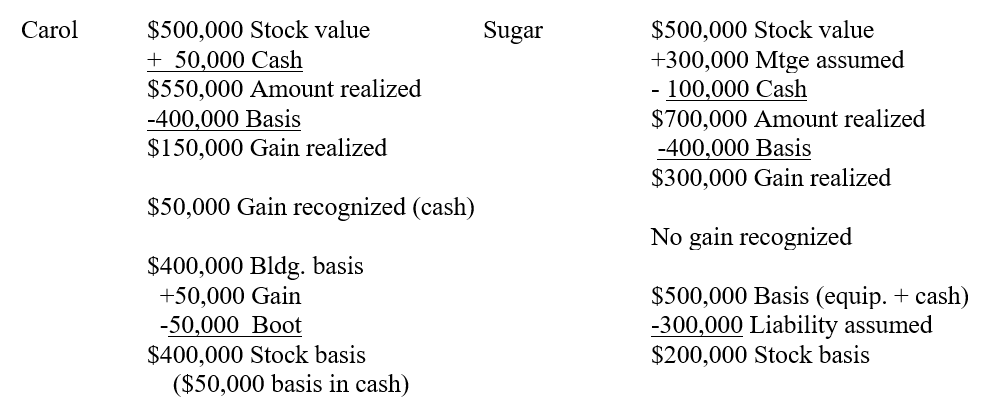

Carol and Sugar form a corporation. Carol transfers property valued at $550,000 (basis of $400,000) to the corporation in exchange for 50 percent of the corporate stock valued at $500,000. Sugar transfers property valued at $700,000 (basis of $400,000) and a $300,000 mortgage that the corporation assumes for the other 50 percent of the stock. In addition Sugar transfers $100,000 cash to the corporation and the corporation then transfers $50,000 cash to Carol along with the corporate stock. What are Carol and Sugar's realized and recognized gains or losses and their bases in the stock received. What is the corporation's basis in the assets received?

Total value of stock = $550,000 + $700,000 - $300,000 + $100,000 - $50,000 = $1,000,000

Corporation's basis in building = $400,000 carryover basis + $50,000 gain recognized = $450,000; equipment basis = $400,000 carryover basis; $50,000 is basis in cash retained

Corporation's basis in building = $400,000 carryover basis + $50,000 gain recognized = $450,000; equipment basis = $400,000 carryover basis; $50,000 is basis in cash retained

4

Carol and Sugar form a corporation. Carol transfers property valued at $550,000 (basis of $400,000) to the corporation in exchange for 50 percent of the corporate stock valued at $500,000. Sugar transfers property valued at $700,000 (basis of $400,000) and a $300,000 mortgage that the corporation assumes for the other 50 percent of the stock. In addition Sugar transfers $100,000 cash to the corporation and the corporation then transfers $50,000 cash to Carol along with the corporate stock. What are Carol and Sugar's realized and recognized gains or losses and their bases in the stock received.

-Refer to the information in the preceding problem. How would your answers change if Carol and Sugar formed a general partnership in which they were equal partners instead of a corporation?

-Refer to the information in the preceding problem. How would your answers change if Carol and Sugar formed a general partnership in which they were equal partners instead of a corporation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

5

Identify the following provisions as deferral (D) or exclusion (E) provisions.

-Wash sale

A)deferral(D)

B)exclusion(E)

-Wash sale

A)deferral(D)

B)exclusion(E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

6

Identify the following provisions as deferral (D) or exclusion (E) provisions.

-Sale of personal residence

A)deferral(D)

B)exclusion(E)

-Sale of personal residence

A)deferral(D)

B)exclusion(E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

7

Identify the following provisions as deferral (D) or exclusion (E) provisions.

-Involuntary conversion

A)deferral(D)

B)exclusion(E)

-Involuntary conversion

A)deferral(D)

B)exclusion(E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

8

Identify the following provisions as deferral (D) or exclusion (E) provisions.

-Transfers to a partnership by a partner

A)deferral(D)

B)exclusion(E)

-Transfers to a partnership by a partner

A)deferral(D)

B)exclusion(E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

9

Identify the following provisions as deferral (D) or exclusion (E) provisions.

-Sale of qualifying small business stock

A)deferral(D)

B)exclusion(E)

-Sale of qualifying small business stock

A)deferral(D)

B)exclusion(E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

10

Identify the following provisions as deferral (D) or exclusion (E) provisions.

-Loss on personal auto sale

A)deferral(D)

B)exclusion(E)

-Loss on personal auto sale

A)deferral(D)

B)exclusion(E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

11

Identify the following provisions as deferral (D) or exclusion (E) provisions.

-Like-kind exchange

A)deferral(D)

B)exclusion(E)

-Like-kind exchange

A)deferral(D)

B)exclusion(E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

12

Identify the following provisions as deferral (D) or exclusion (E) provisions.

-Corporate reorganization

A)deferral(D)

B)exclusion(E)

-Corporate reorganization

A)deferral(D)

B)exclusion(E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

13

How much does a taxpayer in the 35 percent tax bracket save by deferring a $1,000,000 gain for 3 years using a 6 percent discount rate for evaluation?

A) $350,000

B) $294,000

C) $160,000

D) $56,000

E) None of the above

A) $350,000

B) $294,000

C) $160,000

D) $56,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

14

Willow Corporation exchanged land valued at $250,000 (adjusted basis = $175,000) for a building owned by Tree Corporation valued at $350,000 (adjusted basis = $200,000) and $50,000 cash. In addition, Willow assumed the $150,000 mortgage on Tree's building. What are Willow and Tree's realized gains or losses on the properties exchanged, respectively?

A) $75,000, 0

B) $75,000, $150,000

C) $225,000, $150,000

D) $225,000, $200,000

E) None of the above

A) $75,000, 0

B) $75,000, $150,000

C) $225,000, $150,000

D) $225,000, $200,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

15

Willow Corporation exchanged land valued at $250,000 (adjusted basis = $175,000) for a building owned by Tree Corporation valued at $350,000 (adjusted basis = $200,000) and $50,000 cash. In addition, Willow assumed the $150,000 mortgage on Tree's building.

-Refer to the information in the preceding question. What are Willow's and Tree's recognized gain or loss, respectively?

A) 0, 0

B) $50,000, $100,000

C) $50,000, $150,000

D) $75,000, $150,000

E) None of the above

-Refer to the information in the preceding question. What are Willow's and Tree's recognized gain or loss, respectively?

A) 0, 0

B) $50,000, $100,000

C) $50,000, $150,000

D) $75,000, $150,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

16

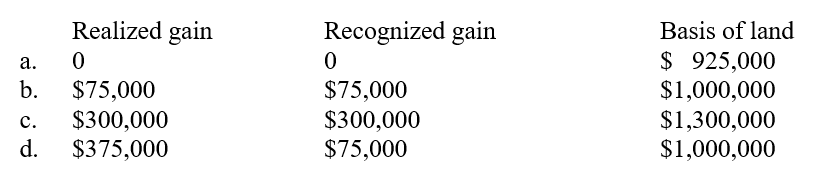

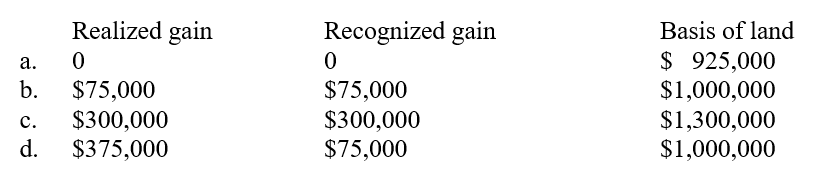

Zandu Corporation exchanged a building (fair market value = $1,000,000, adjusted basis = $700,000) and two semi-tractor-trailers (fair market value = $300,000; adjusted basis = $225,000), all five years old, for land to build a new facility valued at $1,300,000. What is Zandu's realized and recognized gain and its basis in the land?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

17

James corporation exchanges a building (fair market value = $800,000, adjusted basis = $600,000) that has a $100,000 mortgage for another building owned by Pete Corporation (fair market value = $1,100,000, adjusted basis = $600,000) that is encumbered by a $400,000 mortgage.

-Refer to the information in the preceding question. What are James's and Pete's recognized gains on the exchange, respectively?

A) 0, 0

B) 0, $300,000

C) $100,000, 0

D) $100,000, $400,000

E) None of the above

-Refer to the information in the preceding question. What are James's and Pete's recognized gains on the exchange, respectively?

A) 0, 0

B) 0, $300,000

C) $100,000, 0

D) $100,000, $400,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

18

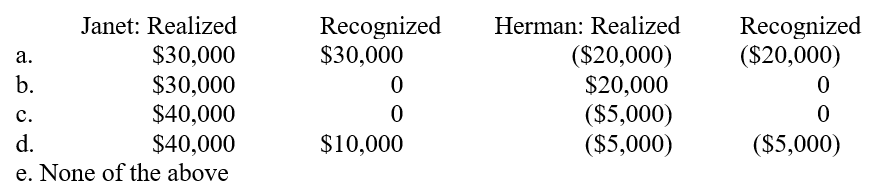

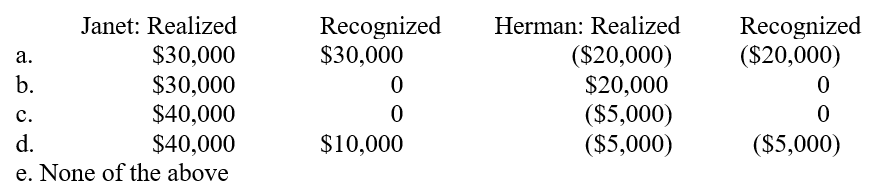

As part of a divorce decree, Janet must give her ex-spouse Herman her half-interest in stock with a total value of $120,000 (total basis = $70,000) in exchange for his half-interest in their home with a total value of $150,000 and a basis of $130,000. What are Janet and Herman's realized and recognized gains or losses on this exchange?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

19

Sam's land was condemned for a sewage treatment plant. He received $600,000 for the land that had a basis of $650,000. What is his realized and recognized gain or loss, respectively, on this involuntary conversion?

A) ($50,000), ($50,000)

B) ($50,000), 0

C) $50,000, $50,000

D) 0, 0

E) None of the above

A) ($50,000), ($50,000)

B) ($50,000), 0

C) $50,000, $50,000

D) 0, 0

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

20

A transfers machines valued at $170,000 (basis = $150,000) along with $30,000 cash to AB Corporation and B transfers real property valued at $320,000 (basis = $310,000) to the corporation. A receives 40 percent of the outstanding stock and B receives 60 percent. B also receives $20,000 from the corporation.

-Refer to the information in problem 25. What is A's basis for his AB stock?

A) $180,000

B) $170,000

C) $160,000

D) $150,000

E) None of the above

-Refer to the information in problem 25. What is A's basis for his AB stock?

A) $180,000

B) $170,000

C) $160,000

D) $150,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

21

A transfers machines valued at $170,000 (basis = $150,000) along with $30,000 cash to AB Corporation and B transfers real property valued at $320,000 (basis = $310,000) to the corporation. A receives 40 percent of the outstanding stock and B receives 60 percent. B also receives $20,000 from the corporation.

-Refer to the information in problem 25. What is B's basis for his AB stock?

A) $340,000

B) $320,000

C) $310,000

D) $300,000

E) None of the above

-Refer to the information in problem 25. What is B's basis for his AB stock?

A) $340,000

B) $320,000

C) $310,000

D) $300,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

22

A transfers machines valued at $170,000 (basis = $150,000) along with $30,000 cash to AB Corporation and B transfers real property valued at $320,000 (basis = $310,000) to the corporation. A receives 40 percent of the outstanding stock and B receives 60 percent. B also receives $20,000 from the corporation.

-Refer to the information in problem 25. What is AB Corporation's basis for the machines?

A) $150,000

B) $160,000

C) $170,000

D) $180,000

E) None of the above

-Refer to the information in problem 25. What is AB Corporation's basis for the machines?

A) $150,000

B) $160,000

C) $170,000

D) $180,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

23

A transfers machines valued at $170,000 (basis = $150,000) along with $30,000 cash to AB Corporation and B transfers real property valued at $320,000 (basis = $310,000) to the corporation. A receives 40 percent of the outstanding stock and B receives 60 percent. B also receives $20,000 from the corporation.

-Refer to the information in problem 25. What is AB Corporation's basis for the real property?

A) $300,000

B) $310,000

C) $320,000

D) $330,000

E) None of the above

-Refer to the information in problem 25. What is AB Corporation's basis for the real property?

A) $300,000

B) $310,000

C) $320,000

D) $330,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

24

Cal contributes property valued at $50,000 (adjusted basis = $30,000) to a partnership in exchange for a partnership interest valued at $40,000 and $10,000 cash. What is Cal's recognized gain or loss on these transfers?

A) 0

B) $4,000

C) $10,000

D) $20,000

A) 0

B) $4,000

C) $10,000

D) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

25

Elizabeth exchanges her retail storage assets for retail displays. In this like-kind exchange, Elizabeth receives $2,000 in cash. The storage assets have a fair market value of $12,000 and Elizabeth's basis in the assets is $3,000. The displays have a fair market value of $10,000 and a basis of $8,000.

-Refer to the information in problem 36. What is Elizabeth's recognized gain on the exchange?

A) zero

B) $2,000

C) $6,000

D) $9,000

-Refer to the information in problem 36. What is Elizabeth's recognized gain on the exchange?

A) zero

B) $2,000

C) $6,000

D) $9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

26

Elizabeth exchanges her retail storage assets for retail displays. In this like-kind exchange, Elizabeth receives $2,000 in cash. The storage assets have a fair market value of $12,000 and Elizabeth's basis in the assets is $3,000. The displays have a fair market value of $10,000 and a basis of $8,000.

-Refer to the information in problem 36. What is Elizabeth's basis in the displays received in the exchange?

A) $9,000

B) $6,000

C) $3,000

D) zero

-Refer to the information in problem 36. What is Elizabeth's basis in the displays received in the exchange?

A) $9,000

B) $6,000

C) $3,000

D) zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

27

Juan owned a small rental property, which was condemned by the county to expand a local park. His adjusted basis in the property was $40,000 and he received a payment of $75,000 from the county. A year later he purchased a similar piece of real estate for $70,000.

-Refer to the information in problem 39. What is Juan's basis in the replacement property?

A) $40,000

B) $45,000

C) $50,000

D) $70,000

E) $75,000

-Refer to the information in problem 39. What is Juan's basis in the replacement property?

A) $40,000

B) $45,000

C) $50,000

D) $70,000

E) $75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck