Deck 5: Business Expenses

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/16

العب

ملء الشاشة (f)

Deck 5: Business Expenses

1

The information in FAS 109 and the FIN 48 interpretation of FAS 109, have been incorporated into the Accounting Standards Codification Section 740-10-55.

True

2

By 2014, all corporations with at least $5 million in assets will be required to file Form 1120, Schedule UTP with their tax returns.

False

3

Crib Corporation, a cash-basis corporation, has $50,000 of expenses it could pay this year or it could postpone payment until next year. What is the present value effect of postponing the payment, using a 6 percent discount rate, if its current marginal tax rate is 34 percent but its marginal tax rate is expected to be 39 percent next year? How would your answer change if the next year's tax rate is expected to be 25 percent?

$50,000 x (.39 - .34) x .943 = $2,358 reduction in present value of tax liability

$50,000 x (.34 - .25) x .943 = $4,244 increase in the present value of the tax liability

$50,000 x (.34 - .25) x .943 = $4,244 increase in the present value of the tax liability

4

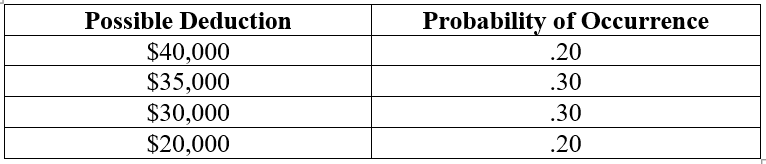

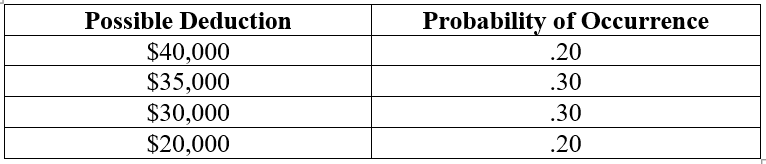

Jensen Corporation plans to take a deduction on its tax return that it believes it is more likely than not that it will be sustained. It is not sure, however, of the exact amount that will be realized. It has established the following amounts and probabilities:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

5

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-Transportation expenses on a business trip within the United States if business days exceed personal days.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-Transportation expenses on a business trip within the United States if business days exceed personal days.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

6

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-Meals and lodging expenses for a foreign business trip if personal days exceed business days.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-Meals and lodging expenses for a foreign business trip if personal days exceed business days.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

7

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-Cost of a hunting lodge available for employees use on a nondiscriminatory basis.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-Cost of a hunting lodge available for employees use on a nondiscriminatory basis.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

8

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-Rent paid for one-year by contract on November 1 by an accrual-basis taxpayer.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-Rent paid for one-year by contract on November 1 by an accrual-basis taxpayer.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

9

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-Fines by the health department for unsanitary conditions.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-Fines by the health department for unsanitary conditions.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

10

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-$200 interest on a loan that was used to purchase California State revenue bonds.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-$200 interest on a loan that was used to purchase California State revenue bonds.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

11

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-Business investigation expenses incurred by a restaurant owner who investigates but abandons plans to open a hobby mart.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-Business investigation expenses incurred by a restaurant owner who investigates but abandons plans to open a hobby mart.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

12

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-$2,000 of start-up expenses paid to open a suburban branch of an existing shoe store.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-$2,000 of start-up expenses paid to open a suburban branch of an existing shoe store.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

13

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-Weekend meals and lodging when business meetings are held on Friday and Monday and these costs are less than the round-trip flight home.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-Weekend meals and lodging when business meetings are held on Friday and Monday and these costs are less than the round-trip flight home.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

14

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-Expenses for a vacation home rented for 275 days and used 20 days by the owner.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-Expenses for a vacation home rented for 275 days and used 20 days by the owner.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

15

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

-Mortgage interest and taxes on the home in which a sole proprietor has a home office. Gross profit from the business is only $1,500.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

-Mortgage interest and taxes on the home in which a sole proprietor has a home office. Gross profit from the business is only $1,500.

A)fully deductible(F)

B)partially deductible(P)

C)nondeductible(N)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck

16

Fabricio, Inc. is an accrual basis corporation. Fabricio ages its receivables to calculate the addition to its reserve for bad debts. The following were reported during the current year:

The amount deductible for bad debt expense on Fabricio's tax return for the current year is:

A) $18,000

B) $25,000

C) $40,000

D) $43,000

The amount deductible for bad debt expense on Fabricio's tax return for the current year is:

A) $18,000

B) $25,000

C) $40,000

D) $43,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 16 في هذه المجموعة.

فتح الحزمة

k this deck