Deck 2: Managerial Accounting Concepts and Cost Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/74

العب

ملء الشاشة (f)

Deck 2: Managerial Accounting Concepts and Cost Flows

1

Period costs are assumed to provide benefit to the company in the period in which the product is sold.

False

2

A variable cost is one that varies both in total (with respect to the amount of items produced) and per unit.

False

3

Manufacturing firms and merchandising firms generally include all the same expenses as product costs.

False

4

Because customers can so quickly compare prices, a business cannot simply raise their prices, but must be able to control costs in order to realize a reasonable profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

5

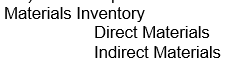

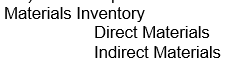

Because the cost of Indirect Materials is included in Manufacturing Overhead, these materials are not included in Materials Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

6

Finished Goods inventory includes all items that have been completed but have not yet been sold to customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

7

Service firms typically do not have a Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

8

Cost of Goods Manufactured is the cost of items transferred from Work in Process Inventory to Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

9

Companies are required to disclose a Schedule of Cost of Goods Manufactured as part of their financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

10

Cost of goods manufactured = Ending Work in Process + Beginning Work in Process - Total Manufacturing Costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

11

Indirect Materials costs flow directly from Materials Inventory to Work in Process Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

12

The journal entry to record indirect labor includes a debt to Manufacturing Overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

13

When a product is completed, the costs associated with production are debited to the Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following would not be considered product costs?

A) Wages paid to assembly line workers

B) Cleaning supplies for an administration building

C) Electricity bill for a manufacturing facility

D) Salary of a factory supervisor

E) Parts used in the production of an automobile

A) Wages paid to assembly line workers

B) Cleaning supplies for an administration building

C) Electricity bill for a manufacturing facility

D) Salary of a factory supervisor

E) Parts used in the production of an automobile

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

15

If production increases within a given range, fixed costs per unit will:

A) Decrease

B) Increase

C) Stay constant

D) Vary depending on the source of the fixed costs

E) None of the above

A) Decrease

B) Increase

C) Stay constant

D) Vary depending on the source of the fixed costs

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following would be considered a direct cost for a unit of production?

A) Depreciation on production facilities

B) Salary paid to factory general supervisor

C) Wages paid to assembly line workers

D) Indirect materials used in the production process

E) None of the above

A) Depreciation on production facilities

B) Salary paid to factory general supervisor

C) Wages paid to assembly line workers

D) Indirect materials used in the production process

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

17

Service firms generally include which of the following as product or job costs:

A) Supervisor salaries

B) Direct labor wages

C) Utilities

D) Service firms do not track job costs

A) Supervisor salaries

B) Direct labor wages

C) Utilities

D) Service firms do not track job costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following are not included in the Work in Process Inventory?

A) Direct Materials that have been put into production

B) Direct Labor incurred in production

C) Manufacturing Overhead allocated to units of production

D) All of the above are included in Work in Process Inventory

A) Direct Materials that have been put into production

B) Direct Labor incurred in production

C) Manufacturing Overhead allocated to units of production

D) All of the above are included in Work in Process Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

19

What is the correct order of the flow of product costs through the inventory system?

A) Materials Inventory, Work in Process, Cost of Goods Sold, Finished Goods

B) Materials Inventory, Work in Process, Finished Goods, Cost of Goods Sold

C) Work in Process, Finished Goods, Materials Inventory, Cost of Goods Sold

D) Cost of Goods Sold, Work in Process, Materials Inventory, Finished Goods

A) Materials Inventory, Work in Process, Cost of Goods Sold, Finished Goods

B) Materials Inventory, Work in Process, Finished Goods, Cost of Goods Sold

C) Work in Process, Finished Goods, Materials Inventory, Cost of Goods Sold

D) Cost of Goods Sold, Work in Process, Materials Inventory, Finished Goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is not an example of Manufacturing Overhead?

A) Factory supervisor salary

B) Production facility rent expense

C) Cleaning supplies for factory floor

D) Electricity bill for administration building

E) Manufacturing equipment depreciation

A) Factory supervisor salary

B) Production facility rent expense

C) Cleaning supplies for factory floor

D) Electricity bill for administration building

E) Manufacturing equipment depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

21

Total Manufacturing Costs for the period include:

A) Total Direct Labor

B) Total Materials Purchased

C) Total Cost of Goods Sold

D) Administrative and Selling Expenses

E) All of the above

A) Total Direct Labor

B) Total Materials Purchased

C) Total Cost of Goods Sold

D) Administrative and Selling Expenses

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

22

Cost of Goods Sold can be calculated in the following manner:

A) Beginning Work in Process + Cost of Goods Manufactured - Ending Work in Process

B) Beginning Finished Goods + Cost of Goods Manufactured - Ending Finished Goods

C) Ending Materials Inventory + Ending Work in Process + Ending Finished Goods

D) Ending Finished Goods - Beginning Finished Goods - Manufacturing Overhead

A) Beginning Work in Process + Cost of Goods Manufactured - Ending Work in Process

B) Beginning Finished Goods + Cost of Goods Manufactured - Ending Finished Goods

C) Ending Materials Inventory + Ending Work in Process + Ending Finished Goods

D) Ending Finished Goods - Beginning Finished Goods - Manufacturing Overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Schedule of Cost of Goods Manufactured includes all of the following except:

A) Total Manufacturing Costs for the period

B) Beginning Work in Process Inventory

C) Cost of Goods Manufactured

D) Manufacturing Overhead for the period

E) All of these are included in the Schedule of Cost of Goods Manufactured

A) Total Manufacturing Costs for the period

B) Beginning Work in Process Inventory

C) Cost of Goods Manufactured

D) Manufacturing Overhead for the period

E) All of these are included in the Schedule of Cost of Goods Manufactured

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

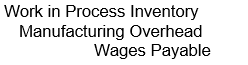

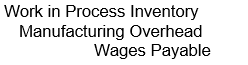

24

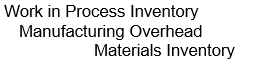

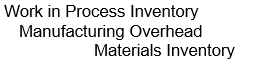

Which of the following entries correctly reflects the entry for the requisition of materials (direct and indirect) for use in production?

A)

B) Materials Inventory

Accounts Payable

C)

D)

A)

B) Materials Inventory

Accounts Payable

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

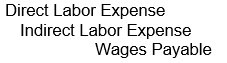

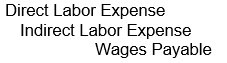

25

Which of the following entries correctly reflects the entry for recording the wages of all factory workers?

A) Wage Expense

Work in Process Inventory

B) Work in Process Inventory

Wages Expense

Cash

C)

D)

A) Wage Expense

Work in Process Inventory

B) Work in Process Inventory

Wages Expense

Cash

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following entries would a manufacturing firm record at the completion of a product for sale?

A) Finished Goods Inventory

Work in Process Inventory

B) Cost of Goods Sold

Work in Process Inventory

C) Work in Process Inventory

Cost of Goods Sold

D) Work in Process Inventory

Finished Goods Inventory

A) Finished Goods Inventory

Work in Process Inventory

B) Cost of Goods Sold

Work in Process Inventory

C) Work in Process Inventory

Cost of Goods Sold

D) Work in Process Inventory

Finished Goods Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following entries correctly reflects the accumulation of Manufacturing Overhead?

A) Manufacturing Overhead

Cash

B) Indirect Labor

Manufacturing Overhead

C) Manufacturing Overhead

Accumulated Depreciation-Factory Equipment

D) Manufacturing Overhead

Materials Inventory

E) A, C, and D

A) Manufacturing Overhead

Cash

B) Indirect Labor

Manufacturing Overhead

C) Manufacturing Overhead

Accumulated Depreciation-Factory Equipment

D) Manufacturing Overhead

Materials Inventory

E) A, C, and D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

28

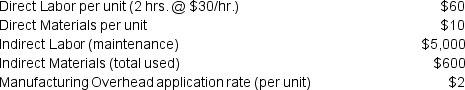

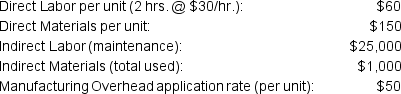

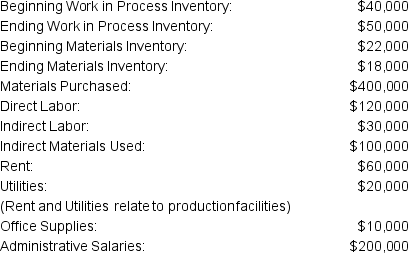

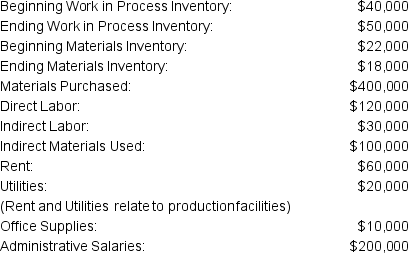

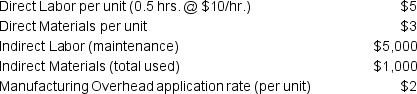

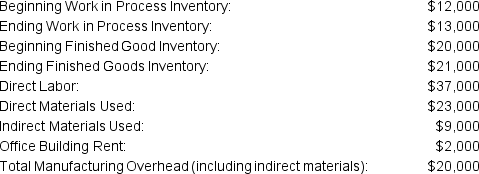

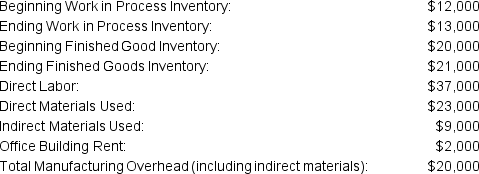

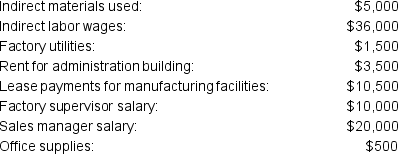

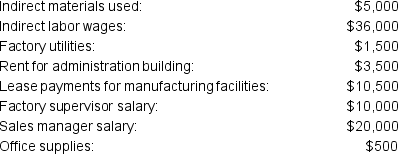

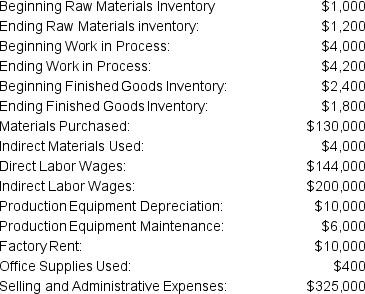

Quincy Manufacturing, Inc. makes kitchen appliance replacement parts. In May, Quincy produced 2000 units. Costs incurred were as follows:

Given this data, the total Prime Cost for the units produced in the month of May was:

Given this data, the total Prime Cost for the units produced in the month of May was:

A) $29,600

B) $120,000

C) $149,600

D) $140,000

E) None of the above

Given this data, the total Prime Cost for the units produced in the month of May was:

Given this data, the total Prime Cost for the units produced in the month of May was:A) $29,600

B) $120,000

C) $149,600

D) $140,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

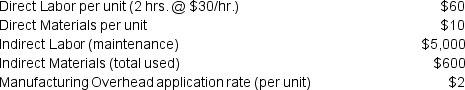

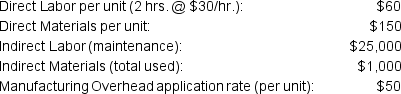

29

Quincy Manufacturing, Inc. makes kitchen appliance replacement parts. In May, Quincy produced 2000 units. Costs incurred were as follows:

Given this data, the per-unit Conversion Cost for the month of May was:

Given this data, the per-unit Conversion Cost for the month of May was:

A) $12

B) $30

C) $70

D) $72

E) $62

Given this data, the per-unit Conversion Cost for the month of May was:

Given this data, the per-unit Conversion Cost for the month of May was:A) $12

B) $30

C) $70

D) $72

E) $62

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

30

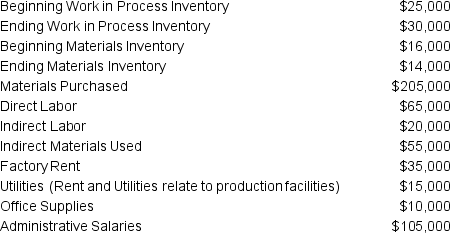

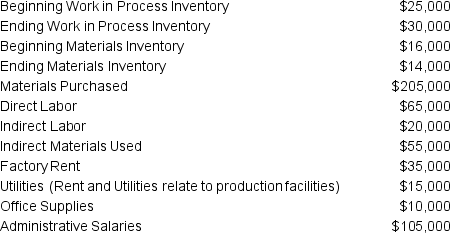

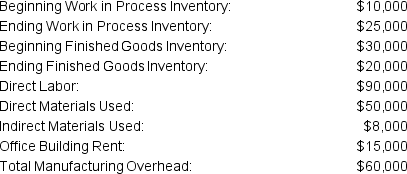

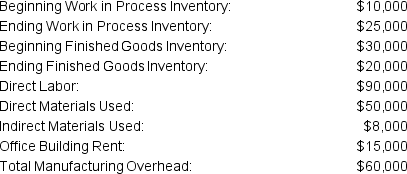

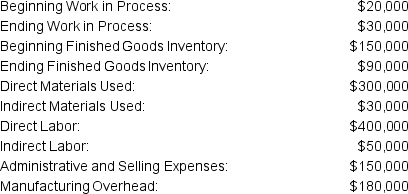

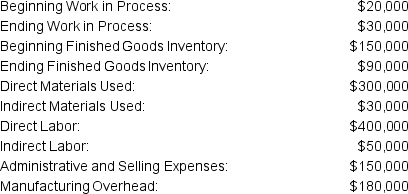

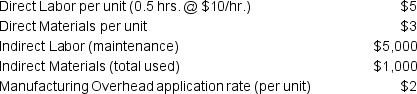

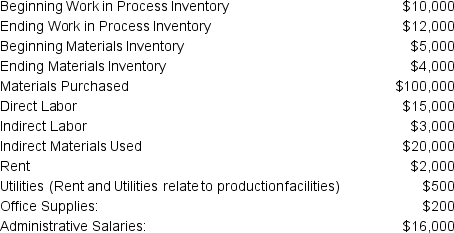

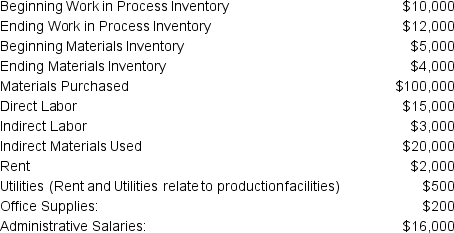

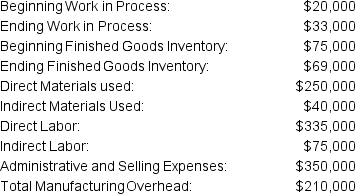

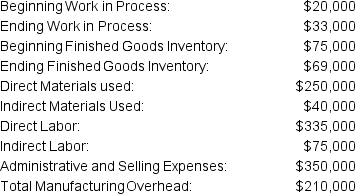

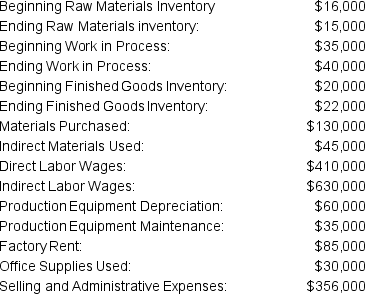

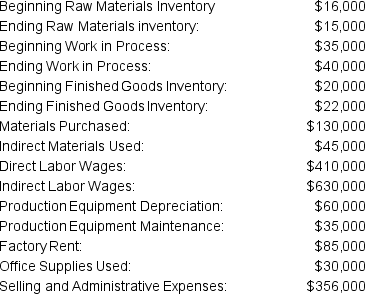

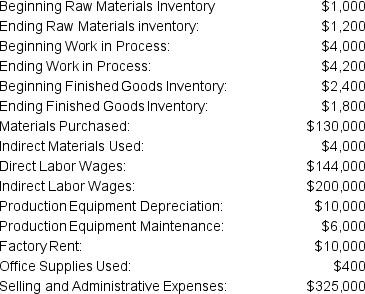

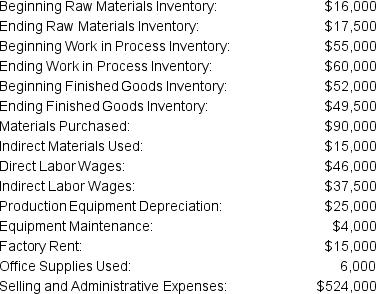

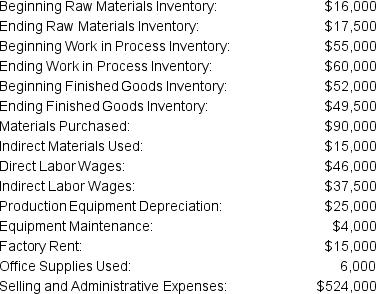

Countertops Unlimited, a manufacturer of kitchen and bath countertops, had the following information for production last period:

Assuming that all manufacturing overhead was applied to Work in Process inventory, Total Manufacturing Costs for the period was:

Assuming that all manufacturing overhead was applied to Work in Process inventory, Total Manufacturing Costs for the period was:

A) $217,000

B) $125,000

C) $342,000

D) $367,000

E) None of the above

Assuming that all manufacturing overhead was applied to Work in Process inventory, Total Manufacturing Costs for the period was:

Assuming that all manufacturing overhead was applied to Work in Process inventory, Total Manufacturing Costs for the period was:A) $217,000

B) $125,000

C) $342,000

D) $367,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

31

Countertops Unlimited, a manufacturer of kitchen and bath countertops, had the following information for production last period:

Assuming that all manufacturing overhead was applied to Work in Process inventory, Cost of Goods Manufactured for the period was:

Assuming that all manufacturing overhead was applied to Work in Process inventory, Cost of Goods Manufactured for the period was:

A) $217,000

B) $125,000

C) $345,000

D) $367,000

E) $337,000

Assuming that all manufacturing overhead was applied to Work in Process inventory, Cost of Goods Manufactured for the period was:

Assuming that all manufacturing overhead was applied to Work in Process inventory, Cost of Goods Manufactured for the period was:A) $217,000

B) $125,000

C) $345,000

D) $367,000

E) $337,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

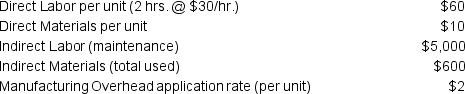

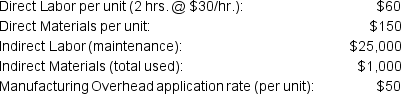

32

Harris Manufacturing, Inc. makes refrigerator replacement parts. In May, Harris produced 2,000 units. Costs incurred were as follows:

Given this data, calculate the total Prime Costs for the units produced in the month of May.

Given this data, calculate the total Prime Costs for the units produced in the month of May.

Given this data, calculate the total Prime Costs for the units produced in the month of May.

Given this data, calculate the total Prime Costs for the units produced in the month of May.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

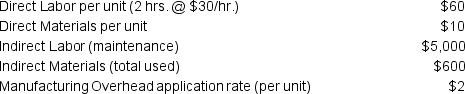

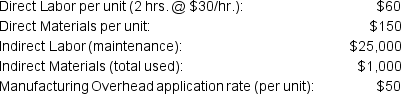

33

Harris Manufacturing, Inc. makes refrigerator replacement parts. In May, Harris produced 2,000 units. Costs incurred were as follows:

Given this data, what was the Conversion Cost per unit?

Given this data, what was the Conversion Cost per unit?

Given this data, what was the Conversion Cost per unit?

Given this data, what was the Conversion Cost per unit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

34

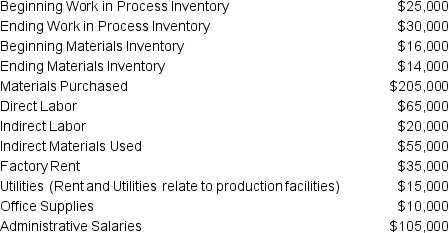

Fantastic Floors Co., a manufacturer of tile and hardwood flooring, had the following information for production last period:

Assuming that all manufacturing overhead is applied to Work in Process inventory, what were Total Manufacturing Costs for the period?

Assuming that all manufacturing overhead is applied to Work in Process inventory, what were Total Manufacturing Costs for the period?

Assuming that all manufacturing overhead is applied to Work in Process inventory, what were Total Manufacturing Costs for the period?

Assuming that all manufacturing overhead is applied to Work in Process inventory, what were Total Manufacturing Costs for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

35

High Adventure, Inc. produces gear for climbing, hiking, and camping. Last month, High Adventure reported the following:

What was the Cost of Goods Manufactured for the period?

What was the Cost of Goods Manufactured for the period?

What was the Cost of Goods Manufactured for the period?

What was the Cost of Goods Manufactured for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

36

Ogden Electronics (OE) produced 60,000 widgets last month. OE started the month with $100,000 worth of inventory in Finished Goods. The company incurred $140,000 of various utility and rent charges on their factory, paid $400,000 for raw materials to use in production, and paid employees $100,000 in wages.

During the month, inventory costing $600,000 was completed and transferred to Finished Goods Inventory. At the end of the month, OE had $40,000 of Inventory in Finished Goods, $20,000 in Materials Inventory, and $30,000 still in Work in Process.

What was OE's Cost of Goods Sold for the month?

During the month, inventory costing $600,000 was completed and transferred to Finished Goods Inventory. At the end of the month, OE had $40,000 of Inventory in Finished Goods, $20,000 in Materials Inventory, and $30,000 still in Work in Process.

What was OE's Cost of Goods Sold for the month?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

37

Settees Inc. manufactures furniture. They reported the following data for the year:

What was the Cost of Goods Sold for Settees?

What was the Cost of Goods Sold for Settees?

What was the Cost of Goods Sold for Settees?

What was the Cost of Goods Sold for Settees?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

38

Beginning Materials Inventory was $600. Ending Materials Inventory was $465. Materials used in production was $15,900, which included $1,200 of Indirect Materials. All purchases of inventory are on Account.

In the entry to record the purchase of Materials Inventory, how much was the credit to Accounts Payable?

In the entry to record the purchase of Materials Inventory, how much was the credit to Accounts Payable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

39

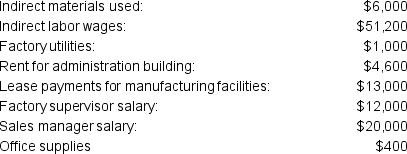

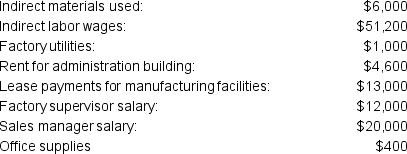

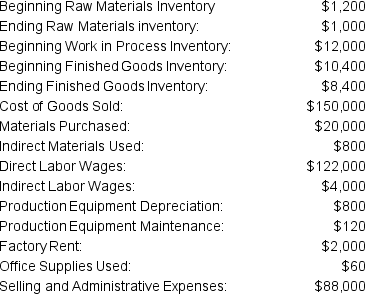

The following data is available for a manufacturing company:

What is the total amount debited to manufacturing overhead for the period?

What is the total amount debited to manufacturing overhead for the period?

What is the total amount debited to manufacturing overhead for the period?

What is the total amount debited to manufacturing overhead for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

40

Work in Process Inventory was $11,500 at the beginning of the period, and $9,500 at the end of the period. Total Manufacturing costs for the period were $37,000. Cost of Goods Sold for the period was $47,500.

If the beginning balance of Finished Goods Inventory was $32,500, what is the ending balance in Finished Goods Inventory?

If the beginning balance of Finished Goods Inventory was $32,500, what is the ending balance in Finished Goods Inventory?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

41

A service firm recorded the beginning and ending balances of Work in Process Inventory as $40,000 and $42,680 respectively. Direct Labor was $64,000, and Overhead allocated was $40,000.

What amount should be recognized as Cost of Services?

What amount should be recognized as Cost of Services?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

42

Bell Productions makes holiday decorations. In June, Bell produced 3,000 units. Costs incurred were as follows:

Given this data, what was the Conversion Cost per unit?

Given this data, what was the Conversion Cost per unit?

Given this data, what was the Conversion Cost per unit?

Given this data, what was the Conversion Cost per unit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

43

Tender Tissues, a manufacturer of consumer paper products, had the following information for production last period:

Assuming that all manufacturing overhead is applied to Work in Process inventory, what were Total Manufacturing Costs for the period?

Assuming that all manufacturing overhead is applied to Work in Process inventory, what were Total Manufacturing Costs for the period?

Assuming that all manufacturing overhead is applied to Work in Process inventory, what were Total Manufacturing Costs for the period?

Assuming that all manufacturing overhead is applied to Work in Process inventory, what were Total Manufacturing Costs for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

44

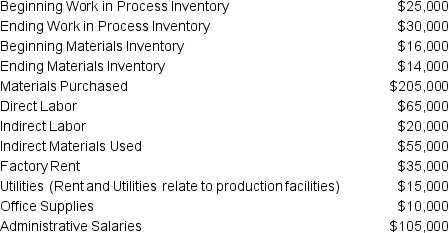

Perfect Popcorn manufactures bulk snack foods. Last month, PP reported the following:

Assume that all manufacturing overhead is applied to Work in Process Inventory.

Assume that all manufacturing overhead is applied to Work in Process Inventory.

What was the Cost of Goods Manufactured for the period?

Assume that all manufacturing overhead is applied to Work in Process Inventory.

Assume that all manufacturing overhead is applied to Work in Process Inventory.What was the Cost of Goods Manufactured for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

45

Rebel Sound Inc. produced 30,000 audio devices last month. Rebel started the month with $10,000 worth of inventory in Finished Goods. The company incurred $15,000 of various utility and rent charges on their factory, paid $50,000 for raw materials to use in production, and paid employees $60,000 in wages. During the month, inventory costing $120,000 was completed and transferred to the Finished Goods Inventory. At the end of the month, Rebel had $5,000 of Inventory in Finished Goods, $6,000 in Materials Inventory, and $24,000 still in Work in Process.

What was Rebel's Cost of Goods Sold for the month?

What was Rebel's Cost of Goods Sold for the month?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

46

Harmonics Mfg. manufactures electronic musical instruments. They reported the following data for the year:

Assume that all manufacturing overhead is applied to Work in Process Inventory.

Assume that all manufacturing overhead is applied to Work in Process Inventory.

What was the Cost of Goods Sold for Harmonics?

Assume that all manufacturing overhead is applied to Work in Process Inventory.

Assume that all manufacturing overhead is applied to Work in Process Inventory.What was the Cost of Goods Sold for Harmonics?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

47

Beginning Materials Inventory was $3,000. Ending Materials Inventory was $3,300. Materials used in production was $25,000, which included $2,000 of Indirect Materials. All purchases of inventory are on Account.

In the entry to record the purchase of Inventory, how much was the credit to Accounts Payable?

In the entry to record the purchase of Inventory, how much was the credit to Accounts Payable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

48

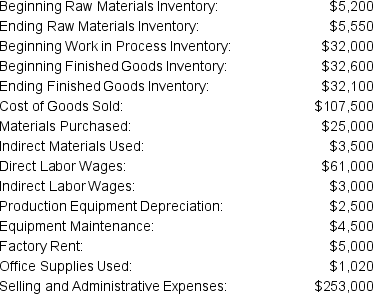

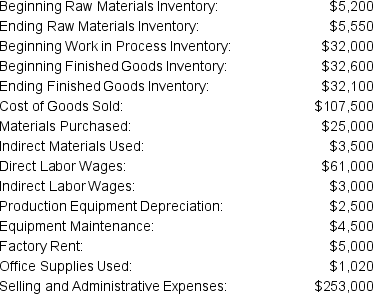

The following data is available for a manufacturing company:

What is the total amount debited to manufacturing overhead for the period?

What is the total amount debited to manufacturing overhead for the period?

What is the total amount debited to manufacturing overhead for the period?

What is the total amount debited to manufacturing overhead for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

49

Work in Process Inventory was $4,000 at the beginning of the period, and $5,000 at the end of the period. Total Manufacturing costs for the period were $27,500. Cost of Goods Sold for the period was $35,000.

If the beginning balance of Finished Goods Inventory was $10,000, what is the ending balance in Finished Goods Inventory?

If the beginning balance of Finished Goods Inventory was $10,000, what is the ending balance in Finished Goods Inventory?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

50

A service firm recorded the beginning and ending balances of Work in Process Inventory as $5,000 and $3,900 respectively. Direct Labor was $15,000, and Overhead allocated was $4,500.

What amount should be recognized as Cost of Services?

What amount should be recognized as Cost of Services?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

51

What are mixed costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

52

What are period costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

53

How does overall variable cost change with respect to production levels?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

54

How does a fixed cost per unit change with respect to production levels?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

55

What are the three components of product costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

56

What type of inventory accounts are usually found on the financial statements of service firms?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

57

What are Prime Costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

58

How are manufacturing overhead costs applied to products?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

59

What are Total Manufacturing Costs for a period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

60

How is Cost of Goods Manufactured for a period calculated?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

61

How is Cost of Goods Sold for a period calculated?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

62

Where does the Cost of Goods Sold for a period appear on a company's financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

63

What is the entry to record the use of materials (direct and indirect) in production?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is the entry to record the incurrence of factory payroll?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is the entry to record factory equipment depreciation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is the entry to record the sale of goods on account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

67

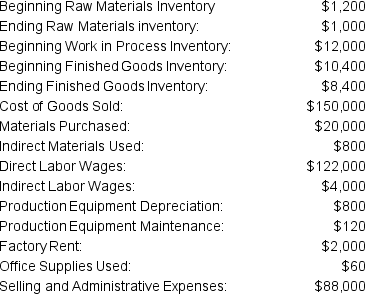

Prescott Manufacturing reported the following information at year-end:

What was Prescott's Cost of Goods Manufactured for the period?

What was Prescott's Cost of Goods Manufactured for the period?

What was Prescott's Cost of Goods Manufactured for the period?

What was Prescott's Cost of Goods Manufactured for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

68

Quincy Manufacturing uses just-in-time inventory techniques to reduce their carrying costs. Despite having a low level of working capital, they experience significant sales and production levels. Quincy reported the following information at year-end:

What was Quincy's Cost of Goods Sold for the period?

What was Quincy's Cost of Goods Sold for the period?

What was Quincy's Cost of Goods Sold for the period?

What was Quincy's Cost of Goods Sold for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

69

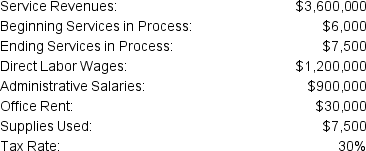

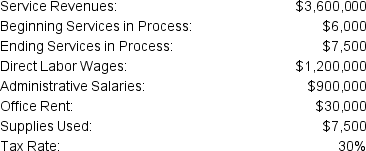

Mabel's Tees (MT) is a sole proprietorship owned and operated by Mabel Taylor. MT's takes plain t-shirts and prints or sews logos and designs on them for customers. Taylor is required to file financial statements with her bank each month in order to keep the company's credit line open. MT reported the following results for March:

The bank is especially concerned about the Working Capital ratio, so they want to be sure that MT is reporting its assets fairly.

The bank is especially concerned about the Working Capital ratio, so they want to be sure that MT is reporting its assets fairly.

What was MT's Ending Work in Process Inventory for the period?

The bank is especially concerned about the Working Capital ratio, so they want to be sure that MT is reporting its assets fairly.

The bank is especially concerned about the Working Capital ratio, so they want to be sure that MT is reporting its assets fairly.What was MT's Ending Work in Process Inventory for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

70

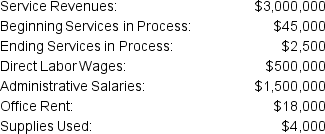

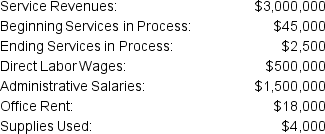

Christensen and Associates, LLP is a public accounting firm that provides audit and tax preparation services to local business. Christensen is preparing period-end financial statements, and has accumulated the following financial information for the year:

What was Christensen's Net Income for the period?

What was Christensen's Net Income for the period?

What was Christensen's Net Income for the period?

What was Christensen's Net Income for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

71

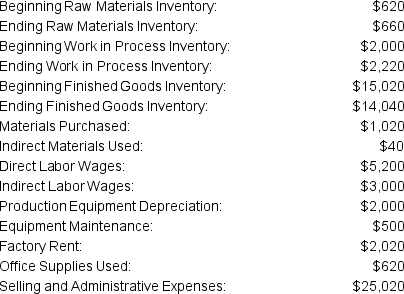

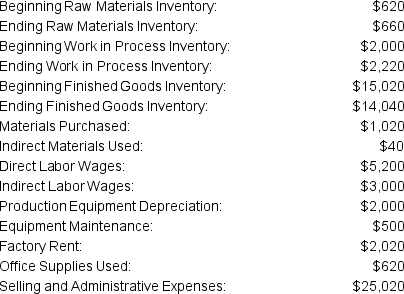

Jackson Printing Inc. reported the following information at year-end:

What was Jackson's Cost of Goods Manufactured for the period?

What was Jackson's Cost of Goods Manufactured for the period?

What was Jackson's Cost of Goods Manufactured for the period?

What was Jackson's Cost of Goods Manufactured for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

72

Production Department 2 (of Manufacturing Company Inc.) is required to track and report departmental expenses and costs. PD2 reported the following information at year-end:

What was PD2's Cost of Goods Sold for the period?

What was PD2's Cost of Goods Sold for the period?

What was PD2's Cost of Goods Sold for the period?

What was PD2's Cost of Goods Sold for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

73

TypeRight is a keyboard manufacturing company, specializing in ergonomic designs that reduce typing fatigue and decrease the risk of injuries related to office work. TypeRight reported the following information for last month:

What was TypeRight's Ending Work in Process Inventory for the period?

What was TypeRight's Ending Work in Process Inventory for the period?

What was TypeRight's Ending Work in Process Inventory for the period?

What was TypeRight's Ending Work in Process Inventory for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

74

Regent & Associates is a local law firm. After successfully resolving most of their pending cases, Regent is preparing period-end financial statements, and has accumulated the following financial information for the year:

What was Murdock's Operating Income for the period?

What was Murdock's Operating Income for the period?

What was Murdock's Operating Income for the period?

What was Murdock's Operating Income for the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck