Deck 11: Segment Reporting, Transfer Pricing, and Balanced Scorecard

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/76

العب

ملء الشاشة (f)

Deck 11: Segment Reporting, Transfer Pricing, and Balanced Scorecard

1

Segment reports are a feature of responsibility accounting systems and generally are not applicable to other reporting criteria.

R

R

False

2

In a segment report, the profit number immediately after subtracting segment direct fixed costs is called the segment contribution margin.

False

3

In the short run, the best profitability number for deciding the impact of discontinuing a segment is segment margin.

True

4

In the long run, the best profitability number for deciding the impact of discontinuing a segment is segment income after subtracting allocated common segment costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

5

Transfer pricing is a system used only in assigning a price to a product or service transferred between two profit centers within a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

6

Ideally, the price established for a transfer of goods or services between two decentralized organizational units within a company would be one that would always motivate the managers of both units to act in a way that is in the best interest of the company as a whole.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

7

The return on investment can be obtained by multiplying return on equity times asset turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

8

Residual income is more similar to Economic Value Added than it is to return on investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

9

The balanced scorecard approach for evaluating managerial performance is designed to overcome the limits of single measure performance systems, such as ROI or EVA, by evaluating performance on several key dimensions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

10

One of the greatest disadvantages of the balanced scorecard is that it is difficult to harmonize it with the corporate strategy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

11

A segment report can be prepared:

A) Only for reporting units of an organization

B) Only for divisions of an organization

C) For any part of the business for which management believes the information would be useful

D) Only for strategic business segments of an organization

A) Only for reporting units of an organization

B) Only for divisions of an organization

C) For any part of the business for which management believes the information would be useful

D) Only for strategic business segments of an organization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

12

Segment reports are most often produced to coincide with:

A) Internal value chains

B) Managerial lines of responsibility

C) Capital budget centers

D) None of the above

A) Internal value chains

B) Managerial lines of responsibility

C) Capital budget centers

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a segment report for territories, the contribution margin less direct segment fixed costs is typically called the:

A) Segment margin

B) Product margin

C) Territory margin

D) Fixed costs

A) Segment margin

B) Product margin

C) Territory margin

D) Fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements about segment reporting is not true?

A) Segment reports are income statements that show operating results for portions of the business.

B) Product segment reports are designed to show the performance of product lines of a business.

C) Product segment reports are not really segment reports.

D) Statements A and B are correct.

A) Segment reports are income statements that show operating results for portions of the business.

B) Product segment reports are designed to show the performance of product lines of a business.

C) Product segment reports are not really segment reports.

D) Statements A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the sources listed below would a manager be least likely to consider in deciding whether or not to discontinue a given segment?

A) Direct segment costs

B) An evaluation of the importance of the segment to overall operations

C) The common costs allocated to the segment

D) Segment reports

A) Direct segment costs

B) An evaluation of the importance of the segment to overall operations

C) The common costs allocated to the segment

D) Segment reports

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

16

First Fleet Company is a two-division firm and has the following information available for this year:

What is Division A's contribution margin?

A) $ 420,000

B) $ 450,000

C) $ 480,000

D) $(120,000)

What is Division A's contribution margin?

A) $ 420,000

B) $ 450,000

C) $ 480,000

D) $(120,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

17

First Fleet Company is a two-division firm and has the following information available for this year:

What is Division B's division segment margin?

A) $280,000

B) $180,000

C) $220,000

D) $520,000

What is Division B's division segment margin?

A) $280,000

B) $180,000

C) $220,000

D) $520,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

18

Costs that would not be incurred if the segment were discontinued are called:

A) Avoidable common costs

B) Indirect segment costs

C) Variable segment costs

D) Both A and C

A) Avoidable common costs

B) Indirect segment costs

C) Variable segment costs

D) Both A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

19

Product X contribution margin minus Direct product fixed expenses, is termed:

A) Manufacturing margin

B) Operating income

C) Product margin

D) Gross margin

A) Manufacturing margin

B) Operating income

C) Product margin

D) Gross margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

20

Assume the following information for a product line:

What is the product line's segment income?

A) $775,000

B) $900,000

C) $815,000

D) $915,000

What is the product line's segment income?

A) $775,000

B) $900,000

C) $815,000

D) $915,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

21

Assume the following information for a product line:

What is the product line's contribution margin?

A) $ 825,000

B) $ 940,000

C) $ 890,000

D) $ 450,000

What is the product line's contribution margin?

A) $ 825,000

B) $ 940,000

C) $ 890,000

D) $ 450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

22

An advantage of absorption cost transfer pricing arises from the fact that:

A) This method is not as easy to implement as other methods.

B) This method encourages the selling division to operate efficiently.

C) This method allows the selling division to make a contribution toward covering long run fixed costs.

D) This method keeps the purchasing division content.

A) This method is not as easy to implement as other methods.

B) This method encourages the selling division to operate efficiently.

C) This method allows the selling division to make a contribution toward covering long run fixed costs.

D) This method keeps the purchasing division content.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Timberland Lumber Company had the following historical accounting data, per 100 board feet, concerning one of its products in the Sawmill Division:

The historical data is based on an average volume per period of 20,000 board feet. The shelving is normally transferred internally from the Sawmill Division to the Finishing Division. Timberland may also sell the shelving externally for $90 per 100 board feet. The divisions are taxed at identical rates.

Which of the following transfer pricing methods would lead to the highest Finishing Division income if 10,000 board feet are produced and transferred in entirety this period from Sawmill to Finishing?

A) Market price

B) All variable costs plus 50 percent markup

C) Full absorption costing plus 10 percent markup

D) None of these methods generates a higher division income than another.

The historical data is based on an average volume per period of 20,000 board feet. The shelving is normally transferred internally from the Sawmill Division to the Finishing Division. Timberland may also sell the shelving externally for $90 per 100 board feet. The divisions are taxed at identical rates.

Which of the following transfer pricing methods would lead to the highest Finishing Division income if 10,000 board feet are produced and transferred in entirety this period from Sawmill to Finishing?

A) Market price

B) All variable costs plus 50 percent markup

C) Full absorption costing plus 10 percent markup

D) None of these methods generates a higher division income than another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

24

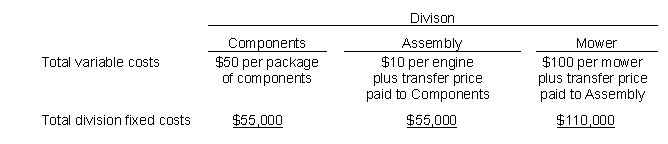

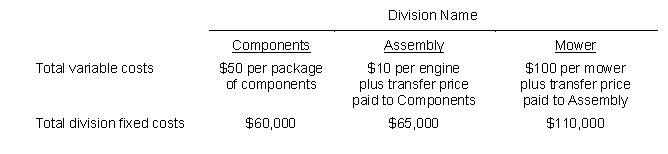

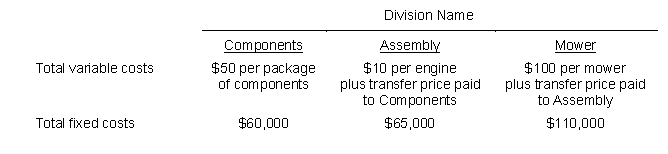

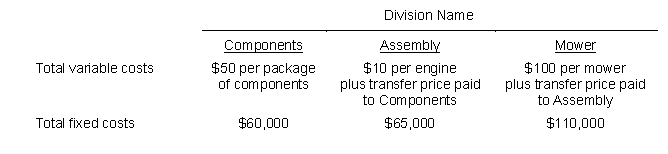

Illinois Mower Manufacturing Company has three divisions. Engine components are transferred from Components to Assembly. Assembled engines are transferred from Assembly to the Mower Division. Costs for each division are given below. Mowers are sold on a competitive outside market for $125. There are no outside markets for engine components or assembled engines.

This period, Components sends Assembly 5,000 packages of engine components.

This period, Components sends Assembly 5,000 packages of engine components.

Using a market based transfer price, determine the amount Assembly would pay Components:

A) Cannot be determined from the information provided

B) Is based on the Component's division's variable cost

C) Is based on the Component's division's full absorption cost

D) Is the $125 market price of the mowers

This period, Components sends Assembly 5,000 packages of engine components.

This period, Components sends Assembly 5,000 packages of engine components.Using a market based transfer price, determine the amount Assembly would pay Components:

A) Cannot be determined from the information provided

B) Is based on the Component's division's variable cost

C) Is based on the Component's division's full absorption cost

D) Is the $125 market price of the mowers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

25

All of the following reasons are legitimate potential disadvantages of using a market-based transfer price except:

A) Use of market price leads division managers to act in a manner that is inconsistent with corporate goals

B) Market price of intermediate goods and services can be difficult to determine

C) Substantially high selling expenses can lead companies to set an artificially high transfer price

D) Market price can be misleading if it is controlled by one or two highly influential companies

A) Use of market price leads division managers to act in a manner that is inconsistent with corporate goals

B) Market price of intermediate goods and services can be difficult to determine

C) Substantially high selling expenses can lead companies to set an artificially high transfer price

D) Market price can be misleading if it is controlled by one or two highly influential companies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

26

What is a transfer price?

A) The amount charged for a product or service that one division provides another

B) The amount charged for goods and services offered to the government

C) An amount charged to cover the costs associated with import/export taxes

D) The amount charged the final consumer to cover all costs incurred along the value chain

A) The amount charged for a product or service that one division provides another

B) The amount charged for goods and services offered to the government

C) An amount charged to cover the costs associated with import/export taxes

D) The amount charged the final consumer to cover all costs incurred along the value chain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following situations gives rise to the need for a transfer price?

A) Two divisions of the same company sell to the same wholesaler

B) Two divisions of the same company sell competing products to the same customer

C) Two divisions of the same company sell to one another

D) Both B and C

A) Two divisions of the same company sell to the same wholesaler

B) Two divisions of the same company sell competing products to the same customer

C) Two divisions of the same company sell to one another

D) Both B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

28

The optimal transfer price from the corporation's viewpoint is:

A) The seller's variable cost plus the seller's opportunity cost

B) The amount that equals segment margin

C) The seller's variable cost plus the buyer's opportunity cost

D) The highest it can possibly obtain

A) The seller's variable cost plus the seller's opportunity cost

B) The amount that equals segment margin

C) The seller's variable cost plus the buyer's opportunity cost

D) The highest it can possibly obtain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

29

When an outside market exists for an intermediate product that is perfectly competitive, the ideal method of transfer pricing is generally:

A) The one that creates the highest margin to the selling unit

B) The price at which the product sells in the external market

C) One that is higher than what the outside market is quoting

D) Based on management accounting numbers

A) The one that creates the highest margin to the selling unit

B) The price at which the product sells in the external market

C) One that is higher than what the outside market is quoting

D) Based on management accounting numbers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following transfer pricing methods is least likely to favor the seller?

A) Allowing the buyer and seller to negotiate the price

B) Variable costs plus 5 percent

C) Absorption cost plus 5 percent

D) Market prices

A) Allowing the buyer and seller to negotiate the price

B) Variable costs plus 5 percent

C) Absorption cost plus 5 percent

D) Market prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

31

Naperville Company has two divisions: the Mixing Division and Bottling Division. The Mixing Division sells beverage mix to the Bottling Division. Standard costs for the Mixing Division are as follows:

The Mixing Division uses the following predetermined overhead rate:

What is the transfer price for the beverage mix per gallon based on standard absorption cost plus a markup of 30 percent?

A) $ 5.35

B) $ 6.24

C) $ 8.70

D) $ 4.75

The Mixing Division uses the following predetermined overhead rate:

What is the transfer price for the beverage mix per gallon based on standard absorption cost plus a markup of 30 percent?

A) $ 5.35

B) $ 6.24

C) $ 8.70

D) $ 4.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

32

Tinley Division has the capacity to make 1,500 units of an intermediate good that is sold both internally and on the open market for a price of $28 each. To make the product, Tinley incurs $6 of variable cost per unit and $12 of fixed costs per unit.

What is the minimum price Tinley would accept for an internal transfer of 1,000 units of the product if the division is operating at 50% capacity?

A) $ 6.00 per unit

B) $12.00 per unit

C) $28.00 per unit

D) $18.00 per unit

What is the minimum price Tinley would accept for an internal transfer of 1,000 units of the product if the division is operating at 50% capacity?

A) $ 6.00 per unit

B) $12.00 per unit

C) $28.00 per unit

D) $18.00 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

33

Joliet Division has the capacity to make 1,500 units of an intermediate good that is sold both internally and on the open market for a price of $32 each. To make the product, Joliet incurs $7 of variable cost per unit and $12 of fixed costs per unit.

What is the minimum price Joliet would accept for an internal transfer of 1,000 units of the product if the division is operating at 100% capacity?

A) $ 7.00 each

B) $19.00 each

C) $32.00 each

D) $30.00 each

What is the minimum price Joliet would accept for an internal transfer of 1,000 units of the product if the division is operating at 100% capacity?

A) $ 7.00 each

B) $19.00 each

C) $32.00 each

D) $30.00 each

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is not relevant when evaluating managers using return on investment?

A) Allocating corporate costs to divisions

B) Measuring division assets

C) Measuring division revenues

D) Measuring division costs

A) Allocating corporate costs to divisions

B) Measuring division assets

C) Measuring division revenues

D) Measuring division costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is residual income?

A) Excess income earned after budgeted income has been achieved

B) The excess of investment center income over the minimum return set by management

C) A percentage of income received by an organization for its participation in a joint venture

D) Income beyond the breakeven point determined by the product's lifecycle

A) Excess income earned after budgeted income has been achieved

B) The excess of investment center income over the minimum return set by management

C) A percentage of income received by an organization for its participation in a joint venture

D) Income beyond the breakeven point determined by the product's lifecycle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following would normally not be included in an investment center's asset base?

A) Accounts receivable

B) Equipment

C) Land for a future plant site

D) Inventory

A) Accounts receivable

B) Equipment

C) Land for a future plant site

D) Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

37

If the international division of Latin American Products had an investment turnover of 1.4 and a return on sales of 0.12, the return on investment would be:

A) 13.2%

B) 26.4%

C) 32.4%

D) 16.8%

A) 13.2%

B) 26.4%

C) 32.4%

D) 16.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is not used in the formulation of economic value added (EVA)?

A) A minimum rate of return set by top management

B) After tax income

C) The weighted average cost of capital

D) Total net assets

A) A minimum rate of return set by top management

B) After tax income

C) The weighted average cost of capital

D) Total net assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

39

Falcon Company had sales of $2,400,000, net income of $400,000, and an asset base of $600,000. Its investment turnover is:

A) 0.25

B) 3.30

C) 2.50

D) 4.00

A) 0.25

B) 3.30

C) 2.50

D) 4.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

40

The following information pertains to the Twix Division, which operates as an investment center:

What were Twix Division's net assets?

A) $16,000,000

B) $32,333,333

C) $25,000,000

D) $24,000,000

What were Twix Division's net assets?

A) $16,000,000

B) $32,333,333

C) $25,000,000

D) $24,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

41

Holland Company had sales of $18,000,000, investment turnover of 60%, and an ROI of 13%. Holland's net assets equal:

A) $ 20,000,000

B) $ 30,000,000

C) $ 10,000,000

D) $ 88,888,888

A) $ 20,000,000

B) $ 30,000,000

C) $ 10,000,000

D) $ 88,888,888

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

42

Under which of the following circumstances is a return on investment performance measure more likely to be misleading in comparing the performance of several divisions?

A) Inventories are valued on a FIFO costing basis.

B) Long-term assets are stated at current prices rather than at book value.

C) Long-term assets are stated at book value.

D) A division manager is over investing in assets that provide little contribution toward earnings.

A) Inventories are valued on a FIFO costing basis.

B) Long-term assets are stated at current prices rather than at book value.

C) Long-term assets are stated at book value.

D) A division manager is over investing in assets that provide little contribution toward earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

43

If both the investment turnover and the return on sales ratio increased by 13 percent, the ROI would increase by: (Hint: Assume that each component of the ROI computation is 1.00 prior to the increase.)

A) 0.00 percent

B) 27.69 percent

C) 26.38 percent

D) 26.00 percent

A) 0.00 percent

B) 27.69 percent

C) 26.38 percent

D) 26.00 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

44

Information for Tube division is as follows:

What is Tube's residual income?

A) $13,000

B) $ 8,000

C) $16,000

D) $12,000

What is Tube's residual income?

A) $13,000

B) $ 8,000

C) $16,000

D) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is a legitimate disadvantage of residual income?

A) It does not explicitly capture cost of capital in the computation of the measure.

B) It does not encourage managers to accept all projects above the minimum return.

C) It is not an effective basis for comparing divisions of substantially different sizes

D) It does not provide any new information beyond ROI.

A) It does not explicitly capture cost of capital in the computation of the measure.

B) It does not encourage managers to accept all projects above the minimum return.

C) It is not an effective basis for comparing divisions of substantially different sizes

D) It does not provide any new information beyond ROI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

46

The return on investment is computed as:

A) Investment center income divided by sales

B) Investment center income divided by Investment center asset base

C) Sales divided by Investment center asset base

D) Investment turnover divided by the Investment center income margin

A) Investment center income divided by sales

B) Investment center income divided by Investment center asset base

C) Sales divided by Investment center asset base

D) Investment turnover divided by the Investment center income margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

47

A balanced scorecard is:

A) An evaluation process that focuses on productivity

B) A performance measurement system that is strictly directed toward sales growth

C) A performance measure that evaluates multiple categories related to organizational goals

D) A series of checks and balances designed to be mutually cooperative with the financial statements

A) An evaluation process that focuses on productivity

B) A performance measurement system that is strictly directed toward sales growth

C) A performance measure that evaluates multiple categories related to organizational goals

D) A series of checks and balances designed to be mutually cooperative with the financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which if the following statements about financial performance measures on a balanced scorecard is not true?

A) No single financial measure captures all performance aspects of an organization.

B) Financial measures have reporting time lags that could hinder timely decision making.

C) Financial measures may not accurately capture the information needed for current decision making.

D) Financial performance measures typically include customer satisfaction and internal processes.

A) No single financial measure captures all performance aspects of an organization.

B) Financial measures have reporting time lags that could hinder timely decision making.

C) Financial measures may not accurately capture the information needed for current decision making.

D) Financial performance measures typically include customer satisfaction and internal processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

49

A balanced scorecard typically includes:

A) Financial measures

B) Customer satisfaction measures

C) Internal processes measures

D) All of the above

A) Financial measures

B) Customer satisfaction measures

C) Internal processes measures

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

50

Beverage Depot has two divisions (Soda and Juice) and has the following information available for the current year:

Beverage Depot's Juice segment income is:

A) $1,200,000

B) $1,100,000

C) $ 980,000

D) $1,380,000

Beverage Depot's Juice segment income is:

A) $1,200,000

B) $1,100,000

C) $ 980,000

D) $1,380,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

51

Beverage Depot's Juice Division, has two product lines (Orange and Apple) and has the following information available for the current year:

The Product Margin for Orange is:

A) $335,000

B) $310,000

C) $260,000

D) $185,000

The Product Margin for Orange is:

A) $335,000

B) $310,000

C) $260,000

D) $185,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

52

Beverage Depot's Juice Division, has two product lines (Orange and Apple) and has the following information available for the current year:

The Product Income for Apple is:

A) $335,000

B) $502,500

C) $640,000

D) $577,500

The Product Income for Apple is:

A) $335,000

B) $502,500

C) $640,000

D) $577,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Jackson Division of Florida Motors had an operating income of $335,000 and net assets of $1,340,000. Florida Motors has a target rate of return of 12 percent. The Jackson Division has an opportunity to increase operating income by $50,000 if a $200,000 investment in assets is made.

What will Jackson's ROI and Residual Income be if the project is undertaken?

A) ROI 12 percent, Residual Income $ 50,000

B) ROI 27 percent, Residual Income $ 198,000

C) ROI 26 percent, Residual Income $ 200,000

D) ROI 25 percent, Residual Income $ 200,200

What will Jackson's ROI and Residual Income be if the project is undertaken?

A) ROI 12 percent, Residual Income $ 50,000

B) ROI 27 percent, Residual Income $ 198,000

C) ROI 26 percent, Residual Income $ 200,000

D) ROI 25 percent, Residual Income $ 200,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

54

Tristar Company has the following information pertaining to its Brick Division for this year:

Corporate expenses allocated to the brick division are $24,000.

Calculate the brick division's contribution margin.

Corporate expenses allocated to the brick division are $24,000.

Calculate the brick division's contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

55

Brick City Company has the following information pertaining to its Stone Division for this year:

Common expenses for the year are $24,000.

Calculate the Stone Division's contribution margin.

Common expenses for the year are $24,000.

Calculate the Stone Division's contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

56

Brick City Company has the following information pertaining to its Brick division for this year:

Corporate expenses allocated to the brick division are $24,000.

Calculate the brick division's division margin.

Corporate expenses allocated to the brick division are $24,000.

Calculate the brick division's division margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

57

Magnus Division earns a contribution margin of $200,000 and has a division margin of $75,000. If Magnus Division is closed, the firm can eliminate all of the direct division expenses and $110,000 of common expenses.

How will closing the division affect the firm's operating income?

How will closing the division affect the firm's operating income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

58

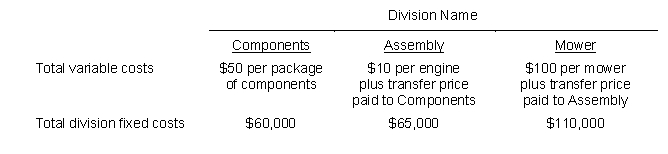

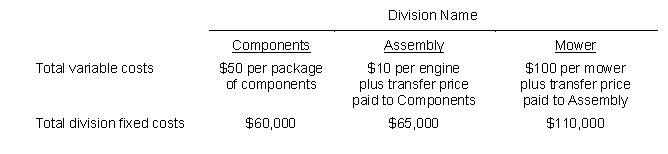

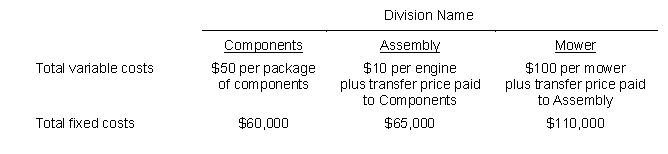

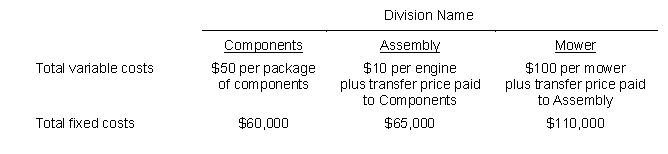

Landscape Manufacturing Company has three divisions. Engine components are transferred from Components to Assembly. Assembled engines are transferred from Assembly to the Mower Division. Costs for each division are given below. Mowers are sold on in a competitive outside market for $250.

All transfers are made at 100% of absorption cost. This period, Components sends Assembly 10,000 packages of engine components.

All transfers are made at 100% of absorption cost. This period, Components sends Assembly 10,000 packages of engine components.

Determine the transfer price Assembly pays Components for engine components.

All transfers are made at 100% of absorption cost. This period, Components sends Assembly 10,000 packages of engine components.

All transfers are made at 100% of absorption cost. This period, Components sends Assembly 10,000 packages of engine components.Determine the transfer price Assembly pays Components for engine components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

59

Landscape Manufacturing Company has three divisions. Engine components are transferred from Components to Assembly. Assembled engines are transferred from Assembly to the Mower Division. Costs for each division are given below. Mowers are sold on in a competitive outside market for $250.

All transfers are made at 100% of absorption cost. During this period, Components sends Assembly 10,000 packages of engine components. Assembly then sends the Mower division 10,000 assembled engines.

All transfers are made at 100% of absorption cost. During this period, Components sends Assembly 10,000 packages of engine components. Assembly then sends the Mower division 10,000 assembled engines.

Determine the transfer price the Mower Division pays Assembly for engines.

All transfers are made at 100% of absorption cost. During this period, Components sends Assembly 10,000 packages of engine components. Assembly then sends the Mower division 10,000 assembled engines.

All transfers are made at 100% of absorption cost. During this period, Components sends Assembly 10,000 packages of engine components. Assembly then sends the Mower division 10,000 assembled engines.Determine the transfer price the Mower Division pays Assembly for engines.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

60

Landscape Manufacturing Company has three divisions. Engine components are transferred from Components to Assembly. Assembled engines are transferred from Assembly to the Mower Division. Costs for each division are given below. Mowers are sold on in a competitive outside market for $250.

All transfers are made at 130% of variable cost. This period, Components sends Assembly 10,000 packages of engine components.

All transfers are made at 130% of variable cost. This period, Components sends Assembly 10,000 packages of engine components.

What is the transfer price Assembly pays Components for engine components?

All transfers are made at 130% of variable cost. This period, Components sends Assembly 10,000 packages of engine components.

All transfers are made at 130% of variable cost. This period, Components sends Assembly 10,000 packages of engine components.What is the transfer price Assembly pays Components for engine components?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

61

Landscape Manufacturing Company has three divisions. Engine components are transferred from Components to Assembly. Assembled engines are transferred from Assembly to the Mower Division. Costs for each division are given below. Mowers are sold on in a competitive outside market for $250.

All transfers are made at 130% of variable cost. During this period, Components sends Assembly 10,000 packages of engine components. Assembly then sends the Mower division 10,000 assembled engines.

All transfers are made at 130% of variable cost. During this period, Components sends Assembly 10,000 packages of engine components. Assembly then sends the Mower division 10,000 assembled engines.

What is the transfer price the Mower Division pays Assembly for engines? (Note: Transfers from one division to another are treated as a variable cost of the buying division.)

All transfers are made at 130% of variable cost. During this period, Components sends Assembly 10,000 packages of engine components. Assembly then sends the Mower division 10,000 assembled engines.

All transfers are made at 130% of variable cost. During this period, Components sends Assembly 10,000 packages of engine components. Assembly then sends the Mower division 10,000 assembled engines.What is the transfer price the Mower Division pays Assembly for engines? (Note: Transfers from one division to another are treated as a variable cost of the buying division.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

62

The following information pertains to the Hillside Division, which operates as an investment center:

Calculate Hillside Division's net income.

Calculate Hillside Division's net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

63

If a company has sales of $1,000,000, net income of $170,000, and an asset base of $1,000,000, what is its return on investment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

64

Wisconsin Company's Division X had the following historical accounting data per unit based on 5,000 units per period:

Fixed manufacturing costs were $10,000. Wisconsin transfers internally from Division X to Division Y. Wisconsin may also sell the transferred units externally for $43 per unit.

If Division X transfers 5,000 units this period at absorption cost plus 10% markup, what would be the unit transfer price?

Fixed manufacturing costs were $10,000. Wisconsin transfers internally from Division X to Division Y. Wisconsin may also sell the transferred units externally for $43 per unit.

If Division X transfers 5,000 units this period at absorption cost plus 10% markup, what would be the unit transfer price?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

65

The following information pertains to the Oklahoma Sooners Division, which operates as an investment center:

Calculate the Oklahoma Sooners Division's net assets.

Calculate the Oklahoma Sooners Division's net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

66

Diamond Division had the following information:

Calculate Diamond Division's economic value added.

Calculate Diamond Division's economic value added.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

67

Madeline Company has two divisions: North and South. For 2017, North had revenues of $200,000 and South had $600,000. In the North Division, fixed expenses were $30,000 and variable expenses were $40,000. In the South Division, fixed expenses were $140,000 and variable expenses were $75,000. Common expenses were $45,000.

Prepare income statements for each division and the company in a format appropriate for segment reporting.

Prepare income statements for each division and the company in a format appropriate for segment reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

68

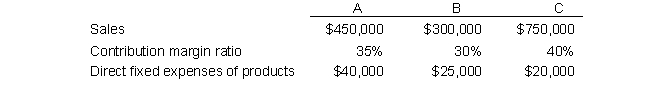

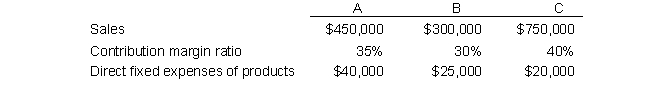

Sprout Company produces three products: A, B, and C. The income statement for 2017 is as follows:

The sales, contribution margin ratios, and direct fixed expenses for the three types of products are as follows:

Prepare income statements segmented by products and include a column for the entire firm in the statement.

Prepare income statements segmented by products and include a column for the entire firm in the statement.

The sales, contribution margin ratios, and direct fixed expenses for the three types of products are as follows:

Prepare income statements segmented by products and include a column for the entire firm in the statement.

Prepare income statements segmented by products and include a column for the entire firm in the statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

69

Glen Manufacturing Company has two divisions: A and B. Division A prepares the steel for processing. Division B processes the steel into the final product. No inventories exist in either division at the beginning or end of the year. During the year, Division A prepared 25,000 lbs. of steel at a cost of $500,000. All the steel was transferred to Division B where additional operating costs of $10 per lb. were incurred. The final product was sold for $1,600,000.

Required:

a. Determine the gross profit for each division and for the company as a whole if the transfer price is $18 per lb.

b. Determine the gross profit for each division and for the company as a whole if the transfer price is $22 per lb.

Required:

a. Determine the gross profit for each division and for the company as a whole if the transfer price is $18 per lb.

b. Determine the gross profit for each division and for the company as a whole if the transfer price is $22 per lb.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

70

The Chip Division of Computer Co. has just revised its actual cost data for the year just ended. Chip Division transfers circuit boards to the Assembly Division, and incurs no selling expense for such transfers. Assembly Division can buy the same goods in the open market for $71 each. Chip's new cost data are:

Current production is 400,000 units, and Chip has a capacity of 600,000 units.

Required:

a. What is the lowest price Chip should charge for the internal transfer of its goods?

b. What is the highest price Assembly should pay Chip for the units?

c. Give the primary reason why Chip should reduce its price for internal transfers below the market price.

Current production is 400,000 units, and Chip has a capacity of 600,000 units.

Required:

a. What is the lowest price Chip should charge for the internal transfer of its goods?

b. What is the highest price Assembly should pay Chip for the units?

c. Give the primary reason why Chip should reduce its price for internal transfers below the market price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Leg Division of Creative Chair Company sells all of its output to the Chair Division of the company. The only product of the Leg Division is chair legs that the Chair Division uses in making chairs. The retail price of the legs is $12 per leg. Each chair completed by the Chair Division requires 4 legs. Production quantity and cost data for the period are as follows:

Required:

Determine the transfer price for a chair leg using:

a. Market price

b. Variable product costs plus 40 percent

c. Absorption costs plus 14 percent

d. Variable costs

e. Total costs plus 9 percent

Required:

Determine the transfer price for a chair leg using:

a. Market price

b. Variable product costs plus 40 percent

c. Absorption costs plus 14 percent

d. Variable costs

e. Total costs plus 9 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

72

Tesla Enterprises is a decentralized corporation that evaluates its divisions based on their reported return on investment. One of Tesla's divisions, the Pipe division, manufactures pipe fittings that are used by the Equipment division as well as other users outside the organization. Pipe has the capacity to make only 3,000 of these fittings at a variable cost of $14 per fitting. Fixed costs of the Pipe division are $90,000 per period and include costs that are common to other products the Pipe division makes. Fixed costs allocated to the fittings sold to the Equipment division are $24,000 per period. The Equipment division uses the fittings and incurs $100 per unit of additional variable costs to make the equipment that sells on the open market for $150. Equipment expects to sell 1,000 pieces of equipment this period. Fixed costs of this division related to depreciation on past expenditures are estimated at $15,000. Fittings like those transferred from Pipe to Equipment sell on the open market for $30 each. Top management of the organization allows divisions to negotiate transfer prices and has a policy of not inferring with the negotiation process.

Required:

a. What is the absolute minimum price Pipe would accept from Equipment for the fittings if Pipe has excess capacity? State any assumptions necessary to answer the question.

b. What is the maximum price Equipment would pay the Pipe division for the fittings?

c. What is the minimum price Pipe would accept if Pipe is operating at capacity to fill orders for these fittings on the open market?

Required:

a. What is the absolute minimum price Pipe would accept from Equipment for the fittings if Pipe has excess capacity? State any assumptions necessary to answer the question.

b. What is the maximum price Equipment would pay the Pipe division for the fittings?

c. What is the minimum price Pipe would accept if Pipe is operating at capacity to fill orders for these fittings on the open market?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

73

Walid Corp is a decentralized company that rewards division managers based on ROI. The City Division produces a component that is used by the County Division. City's unit cost of manufacturing 2,500 components (capacity) is:

City can sell 2,000 units on the open market for $30 by incurring selling costs of $2 per unit.

An outside supplier has offered County 2,500 units of this same component for $27. Orders of less than 2,500 units would cost the County Division $30 each. County needs the 2,500 components to make finished goods, which provide a total contribution of $250,000, without subtracting the cost of the component. The County Division's manager has approached the City Division manager with an offer to purchase the entire 2,500 units from the City Division for a total cost of $130,000 ($26 per unit). If this internal transaction is completed, the City Division would not incur the $2 unit selling costs.

Required: Analyze the effect of this offer considering the following:

a. Is the City Division better off by accepting the offer to sell 2,500 units internally for $26 each?

b. How much is the corporation as a whole better or worse off if the transaction is completed internally as opposed to each division dealing externally? Justify your answer.

c. What is the highest price the County Division would consider paying the City Division for the component?

d. How does the analysis change if City can sell 2,500 units on the open market for $30 with the $2 selling cost?

City can sell 2,000 units on the open market for $30 by incurring selling costs of $2 per unit.

An outside supplier has offered County 2,500 units of this same component for $27. Orders of less than 2,500 units would cost the County Division $30 each. County needs the 2,500 components to make finished goods, which provide a total contribution of $250,000, without subtracting the cost of the component. The County Division's manager has approached the City Division manager with an offer to purchase the entire 2,500 units from the City Division for a total cost of $130,000 ($26 per unit). If this internal transaction is completed, the City Division would not incur the $2 unit selling costs.

Required: Analyze the effect of this offer considering the following:

a. Is the City Division better off by accepting the offer to sell 2,500 units internally for $26 each?

b. How much is the corporation as a whole better or worse off if the transaction is completed internally as opposed to each division dealing externally? Justify your answer.

c. What is the highest price the County Division would consider paying the City Division for the component?

d. How does the analysis change if City can sell 2,500 units on the open market for $30 with the $2 selling cost?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

74

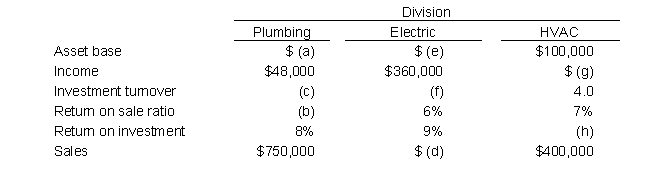

Provide the missing data for the following divisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

75

Bolingbrook Company has the following data for this year:

Bolingbrook Company has a target ROI of 20 percent.

Required: Calculate the following amounts for each division:

a. Return on sales ratio

b. Operating investment turnover

c. ROI

d. Residual income

Bolingbrook Company has a target ROI of 20 percent.

Required: Calculate the following amounts for each division:

a. Return on sales ratio

b. Operating investment turnover

c. ROI

d. Residual income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

76

Discuss the advantage and disadvantage of using residual income as opposed to ROI as an investment center performance measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck