Deck 9: Operational Budgeting and Profit Planning

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/81

العب

ملء الشاشة (f)

Deck 9: Operational Budgeting and Profit Planning

1

An operating budget is a prediction of expected revenues and expenses and other operating and financing transactions for a future period.

True

2

The traditional justifications of budgeting include improved communications, improved planning, and improved sales.

False

3

The incremental approach to budgeting establishes a base amount for all budget items and requires explanation or justification for any budgeted amount above that level.

False

4

The input/output approach to budgeting budgets physical inputs and costs as a function of planned activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

5

All type of Operations budgeting emphasizes activities performed, rather than traditional expense categories?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

6

A more traditional budget would emphasize expense categories such as salaries, office supplies, and maintenance, while an activity-based budget would emphasize activities performed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

7

A budget that summarizes all receipts and disbursements expected to occur during the budget period is called a receipts and disbursements budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

8

The most appropriate and commonly followed sequences of preparing budget schedules is to prepare the sales budget, followed by the production budget, followed by the purchases budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

9

In a manufacturing setting, the purchases budget is based on the sales budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

10

The manufacturing cost budget is based on the cost of total materials purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

11

A top-down approach to budgeting involves little participation in the budget process by lower level managers and employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

12

Life-cycle budgeting is based on a moving time frame that extends over a fixed period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following factors is not an advantage of preparing operating budgets?

A) Improved communications

B) Improved basis of performance evaluation

C) Increased employee loyalty

D) Improved planning

A) Improved communications

B) Improved basis of performance evaluation

C) Increased employee loyalty

D) Improved planning

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is not part of risk management?

A) Identify possible risks and their implications

B) Eliminate all risks that have been identified

C) Select a response to each risk

D) Predict the probability and impact of each risk

A) Identify possible risks and their implications

B) Eliminate all risks that have been identified

C) Select a response to each risk

D) Predict the probability and impact of each risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

15

The ability to move from an informal "reaction" style of management to a formal "proactive" style is one of the primary direct results of:

A) Formal budgeting

B) Specialty training

C) Ethics

D) Hiring outside consultants

A) Formal budgeting

B) Specialty training

C) Ethics

D) Hiring outside consultants

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

16

Budgets improve ____________________ and ____________________.

A) Communication; profits

B) Information; revenues

C) Revenues; profits

D) Communication; coordination

A) Communication; profits

B) Information; revenues

C) Revenues; profits

D) Communication; coordination

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

17

When management directs attention only to those activities not proceeding according to plan, they are engaging in:

A) Activity-based management

B) Organization-based management

C) Management by exception

D) Just-in-time management

A) Activity-based management

B) Organization-based management

C) Management by exception

D) Just-in-time management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following statements concerning an incremental budget is true?

A) An incremental budget has revenues and expenditures assigned to specific categories and items of responsibility.

B) An incremental budget begins with the premise that every dollar of budgeted expenditure must be justified.

C) An incremental budget is often used where the relationships between inputs and outputs are weak or nonexistent.

D) An incremental budget has revenues and expenditures allocated to general areas.

A) An incremental budget has revenues and expenditures assigned to specific categories and items of responsibility.

B) An incremental budget begins with the premise that every dollar of budgeted expenditure must be justified.

C) An incremental budget is often used where the relationships between inputs and outputs are weak or nonexistent.

D) An incremental budget has revenues and expenditures allocated to general areas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following statements concerning the minimum level approach to budgeting is true?

A) The minimum level approach to budgeting establishes a base amount for all budget items and requires explanation or justification for any budgeted amount above that level.

B) The minimum level approach to budgeting budgets physical inputs and costs as functions of planned activity.

C) The minimum level approach to budgeting budgets costs for a coming period as a dollar or percentage change from the amount budgeted or spent in some previous period.

D) The minimum level approach to budgeting has been more widely used in government than in business organizations.

A) The minimum level approach to budgeting establishes a base amount for all budget items and requires explanation or justification for any budgeted amount above that level.

B) The minimum level approach to budgeting budgets physical inputs and costs as functions of planned activity.

C) The minimum level approach to budgeting budgets costs for a coming period as a dollar or percentage change from the amount budgeted or spent in some previous period.

D) The minimum level approach to budgeting has been more widely used in government than in business organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is not a common approach to developing a budget?

A) The incremental approach

B) The input/output approach

C) The qualitative approach

D) The minimum level approach

A) The incremental approach

B) The input/output approach

C) The qualitative approach

D) The minimum level approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which budgeting approach is often used when the relationships between inputs and outputs are weak or nonexistent?

A) Incremental approach

B) Input/output approach

C) Activity-based approach

D) Minimum level approach

A) Incremental approach

B) Input/output approach

C) Activity-based approach

D) Minimum level approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which budgeting approach is used most often for service, manufacturing, and distribution activities where there exists a clearly defined relationship between effort and accomplishment?

A) The continuous budgeting approach

B) The input/output approach

C) The activity based approach

D) Participation budgeting

A) The continuous budgeting approach

B) The input/output approach

C) The activity based approach

D) Participation budgeting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which budgeting approach is widely used in government and non-profit organizations?

A) The continuous budgeting approach

B) The input/output approach

C) The incremental approach

D) Participation budgeting

A) The continuous budgeting approach

B) The input/output approach

C) The incremental approach

D) Participation budgeting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements concerning zero-based budgeting is true?

A) Zero-based budgeting specifies that every line item must be rounded to the nearest thousand dollar increment.

B) Zero-based budgeting specifies that every expenditure must be justified.

C) Zero-based budgeting is a variation of the incremental approach.

D) Zero-based budgeting is mainly used to assess research and development departments and similar departments where the relationship between inputs and outputs is weakest.

A) Zero-based budgeting specifies that every line item must be rounded to the nearest thousand dollar increment.

B) Zero-based budgeting specifies that every expenditure must be justified.

C) Zero-based budgeting is a variation of the incremental approach.

D) Zero-based budgeting is mainly used to assess research and development departments and similar departments where the relationship between inputs and outputs is weakest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which budgeting approach predicts a cost objective's budget by anticipating the consumption of cost drivers?

A) The continuous budgeting approach

B) The input/output approach

C) The activity-based approach

D) Participation budgeting

A) The continuous budgeting approach

B) The input/output approach

C) The activity-based approach

D) Participation budgeting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

26

____________________ budgets emphasize the expected cost of planned activities that will be consumed for a process, department, service, product, or other budget objective.

A) Master

B) Activity-based

C) Cash

D) Capital

A) Master

B) Activity-based

C) Cash

D) Capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements about budgeted financial statements is not true?

A) Budgeted financial statements need to adhere to the same format as the audited financial statements.

B) Development of budgeted financial statements is facilitated by spreadsheet programs.

C) Budgeted financial statements reflect the results of operations assuming all budgeted predictions are correct.

D) Budgeted financial statements are hypothetical.

A) Budgeted financial statements need to adhere to the same format as the audited financial statements.

B) Development of budgeted financial statements is facilitated by spreadsheet programs.

C) Budgeted financial statements reflect the results of operations assuming all budgeted predictions are correct.

D) Budgeted financial statements are hypothetical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following costs would be reported in the general and administrative expense budget?

A) Factory overhead

B) Sales commissions

C) Direct manufacturing labor

D) Expenses incurred in an accounting department

A) Factory overhead

B) Sales commissions

C) Direct manufacturing labor

D) Expenses incurred in an accounting department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

29

All of the following are true of the sales budget except:

A) It contains a forecast of unit sales volume

B) It contains a forecast of sales dollars

C) It may contain a forecast of sales collections

D) It may contain a forecast of Kaizen activities

A) It contains a forecast of unit sales volume

B) It contains a forecast of sales dollars

C) It may contain a forecast of sales collections

D) It may contain a forecast of Kaizen activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements concerning the cash budget is true?

A) The cash budget summarizes all economic activities during the budget period.

B) The cash budget summarizes all cash receipts and disbursements during the budget period.

C) The cash budget summarizes all sales and expenses during the budget period.

D) The cash budget summarizes all revenues and expenses during the budget period.

A) The cash budget summarizes all economic activities during the budget period.

B) The cash budget summarizes all cash receipts and disbursements during the budget period.

C) The cash budget summarizes all sales and expenses during the budget period.

D) The cash budget summarizes all revenues and expenses during the budget period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is (are) the primary source(s) of information for the cash budget?

A) The prior year's financial statements

B) The capital budget

C) The sales forecast

D) The purchases and operating expense budgets

A) The prior year's financial statements

B) The capital budget

C) The sales forecast

D) The purchases and operating expense budgets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

32

Jewelry Company has a sales budget for next month of $200,000. Cost of goods sold is expected to be 25 percent of sales. All goods are paid for in the month following purchase. The beginning inventory of merchandise is $20,000, and an ending inventory of $24,000 is desired. Beginning accounts payable is $206,500.

The cost of goods sold for next month is expected to be:

A) $ 80,000

B) $ 50,000

C) $160,000

D) $ 75,000

The cost of goods sold for next month is expected to be:

A) $ 80,000

B) $ 50,000

C) $160,000

D) $ 75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

33

Thomas Company has a sales budget for next month of $1,000,000. Cost of goods sold is expected to be 25 percent of sales. All goods are paid for in the month following purchase. The beginning inventory of merchandise is $50,000, and an ending inventory of $64,000 is desired. Beginning accounts payable is $160,000.

For Thomas Company, the ending accounts payable should be:

A) $341,000

B) $414,000

C) $356,000

D) $264,000

For Thomas Company, the ending accounts payable should be:

A) $341,000

B) $414,000

C) $356,000

D) $264,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Year 1 selling expense budget for Kamal Corporation is as follows:

Delivery and commission expenses vary proportionally with budgeted sales in dollars. Advertising and office expenses are fixed. Miscellaneous expenses include $5,000 of fixed costs. The rest varies with budgeted sales in dollars. The Year 2 budgeted sales is $5,000,000.

What will be the value for commission expenses in the Year 2 selling expense budget?

A) $102,000

B) $ 24,000

C) $120,000

D) $122,000

Delivery and commission expenses vary proportionally with budgeted sales in dollars. Advertising and office expenses are fixed. Miscellaneous expenses include $5,000 of fixed costs. The rest varies with budgeted sales in dollars. The Year 2 budgeted sales is $5,000,000.

What will be the value for commission expenses in the Year 2 selling expense budget?

A) $102,000

B) $ 24,000

C) $120,000

D) $122,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

35

The Year 1 selling expense budget for Apple Corporation is as follows:

Delivery and commission expenses vary proportionally with budgeted sales in dollars. Advertising and office expenses are fixed. Miscellaneous expenses include $2,000 of fixed costs. The rest varies with budgeted sales in dollars. The budgeted sales for Year 2 are $330,000.

What will be the value of miscellaneous expenses in the Year 2 selling expense budget?

A) $6,200

B) $4,200

C) $3,960

D) $3,600

Delivery and commission expenses vary proportionally with budgeted sales in dollars. Advertising and office expenses are fixed. Miscellaneous expenses include $2,000 of fixed costs. The rest varies with budgeted sales in dollars. The budgeted sales for Year 2 are $330,000.

What will be the value of miscellaneous expenses in the Year 2 selling expense budget?

A) $6,200

B) $4,200

C) $3,960

D) $3,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

36

The Michael Miller Corporation has a sales budget for next month of $200,000. Cost of goods sold is expected to be $125,000. All goods are paid for in the month following their purchase. The beginning inventory of merchandise is $8,000, and an ending inventory of $6,000 is desired. Beginning accounts payable is $26,000.

How much merchandise inventory will The Michael Miller Corporation need to purchase next month?

A) $123,000

B) $190,000

C) $246,000

D) $400,000

How much merchandise inventory will The Michael Miller Corporation need to purchase next month?

A) $123,000

B) $190,000

C) $246,000

D) $400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

37

Joy Manufacturing Company needs to know its anticipated cash inflows for the next quarter by month. Cash sales are 25 percent of total sales each month. Historically, sales on account have been collected as follows: 50 percent in the month of the sale, 30 percent in the month after the sale, and the remaining 20 percent two months after the sale.

Gross sales for the quarter are projected as follows:

Accounts receivable on December 31 were $30,000.

Joy's expected cash collections for March would be:

A) $37,000

B) $32,000

C) $47,200

D) $30,250

Gross sales for the quarter are projected as follows:

Accounts receivable on December 31 were $30,000.

Joy's expected cash collections for March would be:

A) $37,000

B) $32,000

C) $47,200

D) $30,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

38

Florida Curtain Works is in the process of preparing its budget for next year. Cost of goods sold has been estimated at 60 percent of sales. Fabric purchases and payments are to be made during the month preceding the month of sale. Wages are estimated at 20 percent of sales and are paid during the month of sale. Other operating costs amounting to 25 percent of sales are to be paid in the month following the month of sales. Sales revenue is forecasted as follows:

What is the amount of fabric purchases during the month of March?

A) $240,000

B) $144,000

C) $288,000

D) $150,000

What is the amount of fabric purchases during the month of March?

A) $240,000

B) $144,000

C) $288,000

D) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following budgets tends to tie into all of the other budgets?

A) The operating budget

B) The cash budget

C) The sales budget

D) The purchasing budget

A) The operating budget

B) The cash budget

C) The sales budget

D) The purchasing budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following pairs of terms do not match?

A) Continuous budgeting, perpetual budgeting

B) Life-cycle budgeting, input/output approach

C) Participation budget, bottom-up approach

D) Budgetary slack, "padding the budget"

A) Continuous budgeting, perpetual budgeting

B) Life-cycle budgeting, input/output approach

C) Participation budget, bottom-up approach

D) Budgetary slack, "padding the budget"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

41

In a manufacturing setting, the purchase budget is based on:

A) The sales budget

B) The production budget

C) The manufacturing labor budget

D) The cash disbursements

A) The sales budget

B) The production budget

C) The manufacturing labor budget

D) The cash disbursements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following budgets for a manufacturing firm indicates the raw materials that must be acquired to meet production needs and ending inventory requirements?

A) The sales budget

B) The production budget

C) The purchases budget

D) The manufacturing disbursements budget

A) The sales budget

B) The production budget

C) The purchases budget

D) The manufacturing disbursements budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements concerning the cash disbursements amount in the cash budget is true in a manufacturing setting, but not true a merchandise setting?

A) The cash disbursements amount is no longer based off of the purchasing budget.

B) The cash disbursements amount includes planned disbursements for ending inventory.

C) The cash disbursements amount includes planned disbursements for conversion costs.

D) The cash disbursements does not need to equal changes in finished goods inventory.

A) The cash disbursements amount is no longer based off of the purchasing budget.

B) The cash disbursements amount includes planned disbursements for ending inventory.

C) The cash disbursements amount includes planned disbursements for conversion costs.

D) The cash disbursements does not need to equal changes in finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following budgets is directly affected by changes in planned conversion costs?

A) The sales budget

B) The cash receipts budget

C) The general and administrative budget

D) The manufacturing cost budget

A) The sales budget

B) The cash receipts budget

C) The general and administrative budget

D) The manufacturing cost budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

45

Tod Table Company manufactures tables. The estimated number of table sales for each of the last three months of Year 1 is as follows:

Finished goods inventory at the end of November was 2,000 units. Desired ending finished goods inventory is equal to 25 percent of the next month's sales. Tod Table expects to sell the tables for $100 each. January sales for Year 2 are projected at 16,000 tables.

How many tables should Tod produce in December?

A) 15,000

B) 14,000

C) 9,500

D) 7,500

Finished goods inventory at the end of November was 2,000 units. Desired ending finished goods inventory is equal to 25 percent of the next month's sales. Tod Table expects to sell the tables for $100 each. January sales for Year 2 are projected at 16,000 tables.

How many tables should Tod produce in December?

A) 15,000

B) 14,000

C) 9,500

D) 7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

46

Joslyn Company manufactures metal brackets. The estimated number of metal bracket sales for the first three months of the current year is:

Finished goods inventory at the end of last December was 300 units. Desired ending finished goods inventory is equal to 20 percent of the next month's sales. Joslyn Company expects to sell the brackets for $20 each.

How many brackets should Joslyn produce in January?

A) 1,960

B) 1,230

C) 1,400

D) 1,300

Finished goods inventory at the end of last December was 300 units. Desired ending finished goods inventory is equal to 20 percent of the next month's sales. Joslyn Company expects to sell the brackets for $20 each.

How many brackets should Joslyn produce in January?

A) 1,960

B) 1,230

C) 1,400

D) 1,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

47

Holt Company manufactures boxes. To manufacture a box, it takes 22 units of wood and 1 units of plastic. Scheduled production of boxes for the next two months is 1,000 and 1,500 boxes, respectively. Beginning inventory is 8,000 units of wood and 60 units of plastic. The ending inventory of wood is planned to decrease 2,000 units each for the next two months, and the plastic inventory is expected to increase 10 units each of the next two months.

How many units of wood does Holt expect to use in production during the second month?

A) 33,000 units

B) 96,000 units

C) 48,000 units

D) 36,000 units

How many units of wood does Holt expect to use in production during the second month?

A) 33,000 units

B) 96,000 units

C) 48,000 units

D) 36,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

48

Holt Company manufactures boxes. To manufacture a box, it takes 22 units of wood and 1 units of plastic. Scheduled production of boxes for the next two months is 1,000 and 1,500 boxes, respectively. Beginning inventory is 8,000 units of wood and 60 units of plastic. The ending inventory of wood is planned to decrease 2,000 units each for the next two months, and the plastic inventory is expected to increase 10 units each of the next two months.

Based on this information, the number of units of wood that Holt needs to purchase during the first month is:

A) 28,000 units

B) 30,000 units

C) 8,000 units

D) 20,000 units

Based on this information, the number of units of wood that Holt needs to purchase during the first month is:

A) 28,000 units

B) 30,000 units

C) 8,000 units

D) 20,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

49

Little Red Company manufactures wooden wagons. To manufacture a wagon, it takes 10 units of wood and 1 unit of steel. Scheduled production of wagons for the next two months is 500 and 600 units, respectively. Beginning inventory is 4,000 units of wood and 30 units of steel. The ending inventory of wood is planned to decrease 500 units each of the next two months, and the steel inventory is expected to increase 7 units each of the next two months.

How many units of steel are expected in the raw materials inventory at the end of the second month?

A) 60 units

B) 44 units

C) 45 units

D) 90 units

How many units of steel are expected in the raw materials inventory at the end of the second month?

A) 60 units

B) 44 units

C) 45 units

D) 90 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

50

The Mighty Manufacturing Company expects to incur the following per unit costs for 1,000 units of production:

What is the total cost reported in the manufacturing cost budget?

A) $188,000

B) $147,000

C) $ 94,000

D) $ 80,000

What is the total cost reported in the manufacturing cost budget?

A) $188,000

B) $147,000

C) $ 94,000

D) $ 80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

51

The forecasted sales pertain to Glad Corporation:

Finished Goods Inventory (August 31): 14,000

Glad Corporation has a selling price of $5 on all units and expects to maintain ending inventories equal to 25 percent of the next month's sales.

How many units does Glad expect to produce in September?

A) 28,000

B) 36,000

C) 34,000

D) 68,000

Finished Goods Inventory (August 31): 14,000

Glad Corporation has a selling price of $5 on all units and expects to maintain ending inventories equal to 25 percent of the next month's sales.

How many units does Glad expect to produce in September?

A) 28,000

B) 36,000

C) 34,000

D) 68,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

52

Budgetary slack refers to:

A) Intentionally requesting more funds in the budget than needed

B) The time lag between budget preparation and actual operations.

C) Overspending the budget allowance

D) The time lag between budget discussions and actual preparation of budgets

A) Intentionally requesting more funds in the budget than needed

B) The time lag between budget preparation and actual operations.

C) Overspending the budget allowance

D) The time lag between budget discussions and actual preparation of budgets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following aspects related to budgeting and human behavior is not correct?

A) Budgets often produce strong reactions in people.

B) The preparation period for a participative budget is generally longer than that for an imposed budget.

C) A disadvantage of the use of budgets is that they always decrease employee motivation.

D) Personnel who do not participate in budget preparation are likely to lack a commitment in achieving their part of the budget.

A) Budgets often produce strong reactions in people.

B) The preparation period for a participative budget is generally longer than that for an imposed budget.

C) A disadvantage of the use of budgets is that they always decrease employee motivation.

D) Personnel who do not participate in budget preparation are likely to lack a commitment in achieving their part of the budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

54

For budgets to be successful, managers should do all of the following except:

A) Encourage wide participation by all management levels

B) Use budget performance reports to identify both good and poor performance

C) Emphasize the importance of budgeting as a planning device to the employees

D) Emphasize the importance of meeting the budget in order to receive performance raises

A) Encourage wide participation by all management levels

B) Use budget performance reports to identify both good and poor performance

C) Emphasize the importance of budgeting as a planning device to the employees

D) Emphasize the importance of meeting the budget in order to receive performance raises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is a suggested technique for managing the budgeting process in a manner that increases employee motivation?

A) Measure the budget against performance only when assessing poor performers

B) Never alter the budget

C) Top management should disassociate itself from the budget

D) Emphasize the budget as a planning device

A) Measure the budget against performance only when assessing poor performers

B) Never alter the budget

C) Top management should disassociate itself from the budget

D) Emphasize the budget as a planning device

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

56

Budgeted sales of the East End Burger Joint for the first quarter of the year are as follows:

The cost of sales averages 40 percent of sales revenue and management desires ending inventories equal to 25 percent of the following month's sales.

Assuming the January 1 inventory is $6,250, the January purchases budget is:

A) $ 8,000

B) $21,000

C) $15,500

D) $11,250

The cost of sales averages 40 percent of sales revenue and management desires ending inventories equal to 25 percent of the following month's sales.

Assuming the January 1 inventory is $6,250, the January purchases budget is:

A) $ 8,000

B) $21,000

C) $15,500

D) $11,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

57

Black Horse Transportation's sales budget for the first quarter follows:

All sales are on account (credit) with 50% collected in the month of sale, 30% collected in the following month after sale, and 20% collected in the second month after sale. There are no uncollectable accounts.

The March cash receipts are:

A) $260,000

B) $102,500

C) $250,500

D) $172,500

All sales are on account (credit) with 50% collected in the month of sale, 30% collected in the following month after sale, and 20% collected in the second month after sale. There are no uncollectable accounts.

The March cash receipts are:

A) $260,000

B) $102,500

C) $250,500

D) $172,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

58

Black Horse Transportation's sales budget for the first quarter follows:

All sales are on account (credit) with 50% collected in the month of sale, 30% collected in the following month after sale, and 20% collected in the second month after sale. There are no uncollectable accounts.

The Accounts Receivable balance that would appear on the Balance Sheet for March is:

A) $142,500

B) $205,000

C) $150,500

D) $105,000

All sales are on account (credit) with 50% collected in the month of sale, 30% collected in the following month after sale, and 20% collected in the second month after sale. There are no uncollectable accounts.

The Accounts Receivable balance that would appear on the Balance Sheet for March is:

A) $142,500

B) $205,000

C) $150,500

D) $105,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

59

The following forecasted sales pertain to Glad Corporation:

Collection pattern: 75 percent in month of sale; 25 percent in month following sale

Accounts Receivable (August 31): $14,000

Finished Goods Inventory (August 31): 15,000

Glad Corporation has a selling price of $10 per unit and expects to maintain ending inventories equal to 30 percent of the next month's sales.

Calculate the budgeted beginning balance in units for finished goods inventory on November 1?

Collection pattern: 75 percent in month of sale; 25 percent in month following sale

Accounts Receivable (August 31): $14,000

Finished Goods Inventory (August 31): 15,000

Glad Corporation has a selling price of $10 per unit and expects to maintain ending inventories equal to 30 percent of the next month's sales.

Calculate the budgeted beginning balance in units for finished goods inventory on November 1?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

60

Harry Company has the following sales forecast for the next quarter: April, 2,500 units; May, 3,000 units; June, 3,300 units. Sales totaled 2,100 units in March. The March ending finished goods inventory was 750 units. End-of-month finished goods inventory levels are planned to be equal to 30 percent of the next month's planned sales.

Calculate the number of units of inventory Harry needs to purchase for April?

Calculate the number of units of inventory Harry needs to purchase for April?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

61

Jack Frost Company has the following sales forecast for the next quarter: January, 13,000 units; February, 12,000 units; March, 14,000 units. Sales totaled 8,000 units in December. The December ending finished goods inventory was 2,000 units. End-of-month finished goods inventory levels are planned to be equal to 20 percent of the next month's planned sales. Calculate the number of units of inventory Jack Frost Company needs to purchase for January?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

62

The forecasted sales pertain to Yong, Inc.:

Collection pattern: 70 percent in month of sale; 30 percent in month following the sale

Accounts Receivable (December 31): $70,000

Finished Goods Inventory (December 31): 80,000

The company has a selling price of $10 per unit and expects to maintain ending inventories equal to 20 percent of the next month's sales.

Calculate the amount of cash that Yong expects to collect in February?

Collection pattern: 70 percent in month of sale; 30 percent in month following the sale

Accounts Receivable (December 31): $70,000

Finished Goods Inventory (December 31): 80,000

The company has a selling price of $10 per unit and expects to maintain ending inventories equal to 20 percent of the next month's sales.

Calculate the amount of cash that Yong expects to collect in February?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

63

Rover Productions needs to know its anticipated cash inflows for the next quarter by month. Cash sales are 10 percent of total sales each month. Historically, credit sales on account have been collected as follows: 50 percent in the month of sale, 35 percent in the month after the sale, and the remaining 15 percent two months after the sale. Sales for the quarter are projected as follows: April, $60,000; May, $50,000; and June, $70,000. Accounts receivable on March 31 were $30,000.

Calculate the amount of Rover's expected cash collections for June.

Calculate the amount of Rover's expected cash collections for June.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

64

Austin Company has the following sales forecasts for the selected three-month period in the current year:

Collection pattern: 65% of sales are collected in the month of the sale,

35% is collected in the following month.

Accounts Receivable balance (April 1): $10,000

Cash balance (April 1): $5,000

Minimum cash balance is $5,000. Cash can be borrowed in $100 increments from the local bank (assume no interest charges).

Calculate the expected amount Austin Company will need to borrow from the bank balance at the end of April in order to maintain its minimum cash balance. Assume that cash is received only from customers and that $9,000 is paid out during April.

Collection pattern: 65% of sales are collected in the month of the sale,

35% is collected in the following month.

Accounts Receivable balance (April 1): $10,000

Cash balance (April 1): $5,000

Minimum cash balance is $5,000. Cash can be borrowed in $100 increments from the local bank (assume no interest charges).

Calculate the expected amount Austin Company will need to borrow from the bank balance at the end of April in order to maintain its minimum cash balance. Assume that cash is received only from customers and that $9,000 is paid out during April.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

65

Blue Company has the following sales forecasts for the first three months of the current year:

Collection pattern: 75% of sales are collected in the month of the sale,

25% is collected in the following month.

Accounts Receivable balance (January 1): $4,000

Cash balance (January 1): $3,000

Minimum cash balance is $5,000. Cash can be borrowed in $500 increments from the local bank (assume no interest charges).

Calculate the expected amount Blue Company will need to borrow from the bank at the end of January in order to maintain its minimum cash balance. Assume that cash is received only from customers and that $14,000 is paid out during January.

Collection pattern: 75% of sales are collected in the month of the sale,

25% is collected in the following month.

Accounts Receivable balance (January 1): $4,000

Cash balance (January 1): $3,000

Minimum cash balance is $5,000. Cash can be borrowed in $500 increments from the local bank (assume no interest charges).

Calculate the expected amount Blue Company will need to borrow from the bank at the end of January in order to maintain its minimum cash balance. Assume that cash is received only from customers and that $14,000 is paid out during January.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

66

Under Garment Wear (UGW) Company is in the process of preparing its budget for next year. Cost of goods sold has been estimated at 65 percent of sales. Fabric purchases and payments are to be made during the month preceding the month of sale. Wages (produc2tion-related) are estimated at 20 percent of sales and are paid during the month of sale. Other operating costs amounting to 25 percent of sales are to be paid in the month following the month of sales. Additionally, a monthly lease payment of $5,000 is paid to Net World for computer services. Sales revenue is forecasted as follows:

Calculate the amount of budgeted cash disbursements for the month of May?

Calculate the amount of budgeted cash disbursements for the month of May?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

67

Kitchen Cabinets Company is in the process of preparing its budget for next year. Cost of goods sold has been estimated at 70 percent of sales. Materials purchases and payments are to be made during the month preceding the month of sale. Wages are estimated at 22 percent of sales and are paid during the month of sale. Other operating costs amounting to 24 percent of sales are to be paid in the month following the month of sales. Additionally, a monthly lease payment of $5,000 is paid to Net World for computer services. Sales revenue is forecasted as follows:

Calculate the amount of budgeted cash disbursements for the month of June?

Calculate the amount of budgeted cash disbursements for the month of June?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

68

Sysco Merchandising Firm is developing its budgets for Year 2. The Year 1 income statement is as follows:

Selling prices will increase by 10 percent, and sales volume in units will decrease by 6 percent. The cost of goods sold as a percent of sales will decrease to 62 percent. Other than depreciation, all operating costs are variable.

Prepare a budgeted functional income statement for Year 2.

Selling prices will increase by 10 percent, and sales volume in units will decrease by 6 percent. The cost of goods sold as a percent of sales will decrease to 62 percent. Other than depreciation, all operating costs are variable.

Prepare a budgeted functional income statement for Year 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

69

Koshy Company is planning a cash budget for the next three months. Estimated sales revenue is:

All sales are on credit; 60 percent is collected during the month of sale, and 40 percent is collected during the next month. Cost of goods sold is 80 percent of sales. Payments for merchandise sold are made in the month following the month of sale. Operating expenses total $26,000 per month and are paid during the month incurred. The cash balance on February 1 is estimated to be $35,000.

Prepare monthly cash budgets for February, March, and April.

All sales are on credit; 60 percent is collected during the month of sale, and 40 percent is collected during the next month. Cost of goods sold is 80 percent of sales. Payments for merchandise sold are made in the month following the month of sale. Operating expenses total $26,000 per month and are paid during the month incurred. The cash balance on February 1 is estimated to be $35,000.

Prepare monthly cash budgets for February, March, and April.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

70

Carpenter Corp manufactures a product with the following standard costs:

Carpenter plans to produce 10,000 units in March 2017.

Prepare a manufacturing cost budget for March 2017.

Carpenter plans to produce 10,000 units in March 2017.

Prepare a manufacturing cost budget for March 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

71

The following data is obtained from the general records in the shipping department at United Federal Delivery Company for August:

●Inspecting packages prior to placement on truck takes 1 minute per package.

●Processing paperwork for each shipment (each truck loaded) takes 30 minutes.

●Loading packages takes 1 minute of labor per package plus an additional 3 labor hours per truck

●Miscellaneous tasks take 2 hours per truck.

●Temporary employees to perform all of the above tasks can be hired for any amount of hours at a rate of $20 per hour during the summer (no benefits).

●One supervisor is needed for every 1,000 hours of temporary employee labor (rounded up).

●Supervisors are paid a flat rate of $4,100 per month.

●Supervisors divide their time evenly among inspecting, processing, and loading activities, and miscellaneous tasks.

●$1,000 per month general department overhead is allocated to miscellaneous tasks and $2,000 per month to loading, inspecting and processing activities.

August will have 12 working days. United Federal expects to load 6 trucks per day during August. There are on average 100 packages per truck.

Required:

Prepare a budget using the activity-based approach for the costs of inspecting, processing, loading, and miscellaneous activities within the shipping department for August.

●Inspecting packages prior to placement on truck takes 1 minute per package.

●Processing paperwork for each shipment (each truck loaded) takes 30 minutes.

●Loading packages takes 1 minute of labor per package plus an additional 3 labor hours per truck

●Miscellaneous tasks take 2 hours per truck.

●Temporary employees to perform all of the above tasks can be hired for any amount of hours at a rate of $20 per hour during the summer (no benefits).

●One supervisor is needed for every 1,000 hours of temporary employee labor (rounded up).

●Supervisors are paid a flat rate of $4,100 per month.

●Supervisors divide their time evenly among inspecting, processing, and loading activities, and miscellaneous tasks.

●$1,000 per month general department overhead is allocated to miscellaneous tasks and $2,000 per month to loading, inspecting and processing activities.

August will have 12 working days. United Federal expects to load 6 trucks per day during August. There are on average 100 packages per truck.

Required:

Prepare a budget using the activity-based approach for the costs of inspecting, processing, loading, and miscellaneous activities within the shipping department for August.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

72

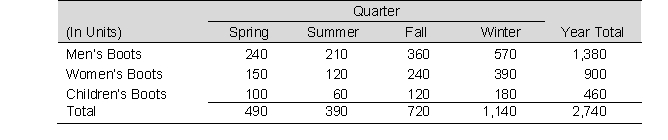

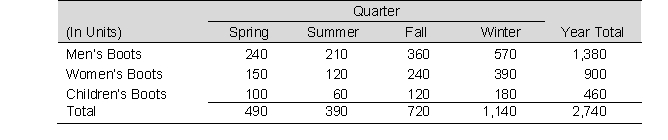

Aspen Ski Shop specializes in selling ski boots and maintains sales that are extremely seasonal. For the year 2017, Aspen is trying to decide whether to establish a sales budget based on average sales or on sales estimated by quarter. The unit sales for 2017 are expected to be 20 percent lower than 2016 sales. Unit sales by quarter for 2016 are as follows:

Men's ski boots sell for $175, women's sell for $170, and children's sell for $115.

Men's ski boots sell for $175, women's sell for $170, and children's sell for $115.

Required: Assuming a 20 percent decrease in sales, prepare a sales budget for each quarter of 2017 using:

a. Average quarterly sales

b. Actual quarterly sales

c. Identify the advantage of using each method.

Men's ski boots sell for $175, women's sell for $170, and children's sell for $115.

Men's ski boots sell for $175, women's sell for $170, and children's sell for $115.Required: Assuming a 20 percent decrease in sales, prepare a sales budget for each quarter of 2017 using:

a. Average quarterly sales

b. Actual quarterly sales

c. Identify the advantage of using each method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

73

TJ Class Company sells three products with the following seasonal sales pattern:

Products:

The annual sales budget shows forecasts for the different products and their expected selling price per unit as follows:

Required: Prepare a sales budget in units and dollars by quarters for the company for the coming year.

Products:

The annual sales budget shows forecasts for the different products and their expected selling price per unit as follows:

Required: Prepare a sales budget in units and dollars by quarters for the company for the coming year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

74

Sales for July, August, and September are expected to be $100,000, $90,000, and $110,000, respectively, for Koslov Company. All sales are on account (terms 2/15, net 30 days) and are collected 60 percent in the month of the sale and 40 percent in the following month. One-half of all sales discounts are taken on the average. Raw materials are purchased one month before being needed, and all purchases and expenses are paid for as incurred.

Activities for the quarter are expected to be:

Required: Using the given information, prepare a cash budget for August.

Activities for the quarter are expected to be:

Required: Using the given information, prepare a cash budget for August.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

75

Justin Company is in the process of preparing its budget for next year. Cost of goods sold has been estimated at 60 percent of sales. Merchandise purchases are to be made during the month preceding the month of the sales. Button pays 60 percent in the month of purchase and 40 percent in the month following. Wages are estimated at 20 percent of sales and are paid during the month of sale. Other operating costs amounting to 10 percent of sales are to be paid in the month following the sale.

Required: Prepare a schedule of cash disbursements for January, February, and March.

Required: Prepare a schedule of cash disbursements for January, February, and March.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

76

Guitar Supplies Company has the following sales budget for the first three months of the current year:

Historically, the following trend has been established regarding cash collection of sales:

●65 percent in month of sale

●25 percent in month following sale

● 8 percent in second month following sale

● 2 percent uncollectible

The company allows a 2 percent cash discount for payments made by customers during the month of the sale. November and December sales were $50,000 and $100,000, respectively.

Required: Prepare a schedule of budgeted cash collections from sales for January, February, and March.

Historically, the following trend has been established regarding cash collection of sales:

●65 percent in month of sale

●25 percent in month following sale

● 8 percent in second month following sale

● 2 percent uncollectible

The company allows a 2 percent cash discount for payments made by customers during the month of the sale. November and December sales were $50,000 and $100,000, respectively.

Required: Prepare a schedule of budgeted cash collections from sales for January, February, and March.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

77

Budgeted sales of gloves for First Fleet for the first six months of the year 2018 are as follows:

The beginning inventory for 2018 is 105,000 units. The budgeted inventory at the end of a month is 30 percent of units to be sold the following month. Purchase price per unit is $3 per unit.

Required: Prepare a purchases budget in units and dollars for each month, January through May.

The beginning inventory for 2018 is 105,000 units. The budgeted inventory at the end of a month is 30 percent of units to be sold the following month. Purchase price per unit is $3 per unit.

Required: Prepare a purchases budget in units and dollars for each month, January through May.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

78

The forecasted sales pertain to Peterson, Inc.:

Collection pattern: 60 percent in month of sale; 40 percent in month following the sale

Accounts Receivable (Beginning Quarter 1) : $70,000

Number of Units in Finished Goods Inventory (Beginning Quarter 1): 4,000

All company sales are for $20 per unit. The company plans to maintain ending inventories equal to 20 percent of the next quarter's sales.

How many units does Peterson expect to produce in Quarters 1 through 4?

Collection pattern: 60 percent in month of sale; 40 percent in month following the sale

Accounts Receivable (Beginning Quarter 1) : $70,000

Number of Units in Finished Goods Inventory (Beginning Quarter 1): 4,000

All company sales are for $20 per unit. The company plans to maintain ending inventories equal to 20 percent of the next quarter's sales.

How many units does Peterson expect to produce in Quarters 1 through 4?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

79

Holt Frames manufactures picture frames. Sales for April are expected to be 12,500 units of various sizes. Historically, the average frame requires 4 feet of framing, 1 square foot of glass, and 2 square feet of backing. Beginning inventory includes 5,000 feet of framing, 1,000 square feet of glass, and 2,000 square feet of backing. Current prices are $0.10 per foot of framing, $3.00 per square foot of glass, and $2.00 per square foot of backing. Ending inventory should be 150 percent of beginning inventory. Purchases are paid for in the month acquired.

Required:

a. Determine the quantity of framing, glass, and backing that Holt Frames is to purchase during April.

b. Determine the total amount of cash needed for April purchases.

Required:

a. Determine the quantity of framing, glass, and backing that Holt Frames is to purchase during April.

b. Determine the total amount of cash needed for April purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

80

Troy Corporation has the following budgeted sales for the selected four-month period:

There were 14,000 units of finished goods in inventory at the beginning of October. Plans are to have an inventory of finished product equal to 25 percent of the unit sales for the next month.

Five pounds of a single raw material are required for each unit produced. Each pound of material costs $10. Plans are to have inventory levels for materials equal to 30 percent of the amount of materials needed to satisfy next month's production and 84,000 units of raw material on hand at the end of December. Materials inventory on October 1 was 60,000 pounds.

Required:

a. Prepare a production budget in units for October, November, and December.

b. Prepare a purchase budget in pounds and dollars for October, November, and December.

There were 14,000 units of finished goods in inventory at the beginning of October. Plans are to have an inventory of finished product equal to 25 percent of the unit sales for the next month.

Five pounds of a single raw material are required for each unit produced. Each pound of material costs $10. Plans are to have inventory levels for materials equal to 30 percent of the amount of materials needed to satisfy next month's production and 84,000 units of raw material on hand at the end of December. Materials inventory on October 1 was 60,000 pounds.

Required:

a. Prepare a production budget in units for October, November, and December.

b. Prepare a purchase budget in pounds and dollars for October, November, and December.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck