Deck 12: Analysis and Interpretation of Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/55

العب

ملء الشاشة (f)

Deck 12: Analysis and Interpretation of Financial Statements

1

Asset turnover measures a company's profitability.

False

2

Ratios provide one way to compare companies in the same industry regardless of their size.

True

3

All things equal, the higher a company's inventory turnover rate, the better.

True

4

Return on assets can be disaggregated into profit margin and return on common stockholders' equity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

5

Solvency ratios measure a company's ability to meet its debt obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

6

A common size balance sheet expresses the balance sheet items as a percentage of total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

7

Gains and losses related to the disposal of a segment of a business, and any related income tax effects, are reported in the discontinued operations section of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which one of the following ratios does not involve assets?

A) Account receivable turnover

B) Current ratio

C) Profit margin

D) Inventory turnover

A) Account receivable turnover

B) Current ratio

C) Profit margin

D) Inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

9

Liquidity analysis of a company includes the following useful measures: (select all that apply)

A) Current ratio

B) Quick ratio

C) Times-interest-earned ratio

D) Debt-to-equity ratio

E) Working capital

A) Current ratio

B) Quick ratio

C) Times-interest-earned ratio

D) Debt-to-equity ratio

E) Working capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

10

Return on assets is computed as:

A) Net income / Average stockholders' equity

B)Net income / Average total assets

C) Net Sales / Average total assets

D) Net income / Net sales

A) Net income / Average stockholders' equity

B)Net income / Average total assets

C) Net Sales / Average total assets

D) Net income / Net sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

11

Big K Grocer's balance sheet shows average stockholders' equity of $5,000 million, net operating profit after tax of $57 million, net income of $190 million, and common shares issued of $958 million. The company has no preferred shares issued.

Big K Grocer's return on common stockholders' equity for the year is:

A) 1.10%

B) 3.80%

C) 72.90%

D) 7.30%

E) There is not enough information to calculate the ratio.

Big K Grocer's return on common stockholders' equity for the year is:

A) 1.10%

B) 3.80%

C) 72.90%

D) 7.30%

E) There is not enough information to calculate the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

12

Big K Grocer's financial statements show average shareholders' equity of $5,103 million, net income of $700 million, and average total assets of $23,175 million.

How much is Big K Grocer's return on assets for the year?

A) 21.42%

B) 3.02%

C) 21.24%

D) 4.77%

E) There is not enough information to calculate the ratio.

How much is Big K Grocer's return on assets for the year?

A) 21.42%

B) 3.02%

C) 21.24%

D) 4.77%

E) There is not enough information to calculate the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

13

Big K Grocer's financial statements show net income of $700 million, sales of $76,733 million, and average total assets of $23,175 million.

How much is Big K Grocer's profit margin for the year?

A) 4.71%

B) 0.91%

C) 30.20%

D) 6.42%

E) There is not enough information to calculate the ratio.

How much is Big K Grocer's profit margin for the year?

A) 4.71%

B) 0.91%

C) 30.20%

D) 6.42%

E) There is not enough information to calculate the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

14

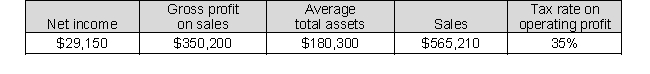

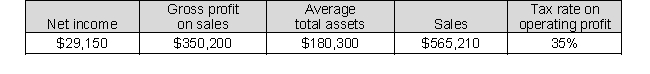

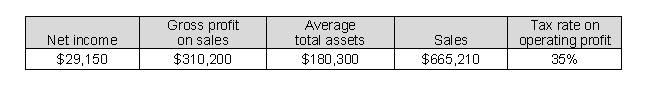

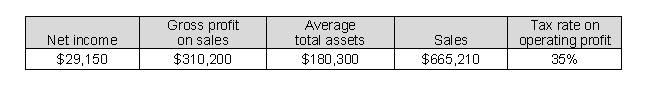

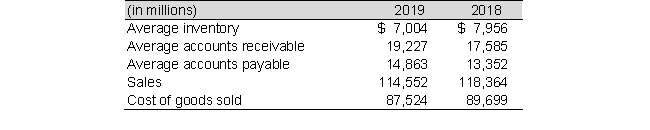

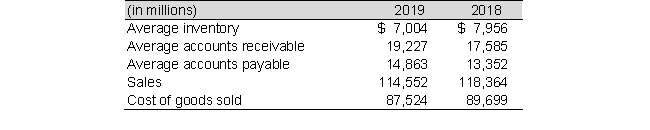

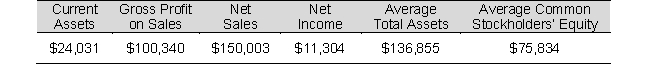

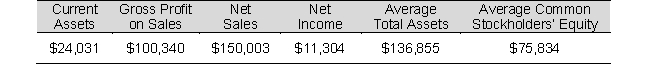

Use the following selected balance sheet and income statement information for Gardening Supply Co. (in millions) to compute the gross profit percentage to the nearest hundredth of a percent.

A) 5.16%

B) 17.30%

C) 16.17%

D) 61.96%

A) 5.16%

B) 17.30%

C) 16.17%

D) 61.96%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

15

Use the following selected balance sheet and income statement information for Gardening Supply Co. (in millions) to compute the return on assets to the nearest hundredth.

A) 17.30%

B) 5.16%

C) 5.52%

D) 21.71%

A) 17.30%

B) 5.16%

C) 5.52%

D) 21.71%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

16

Use the following selected balance sheet and income statement information for Gardening Supply Co. (in millions) to compute asset turnover (AT) to the nearest hundredth of a percent.

A) 0.32

B) 3.69

C) 17.30

D) 5.52

A) 0.32

B) 3.69

C) 17.30

D) 5.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

17

Smith Enterprises reported sales revenue totaling $280,000, $335,000, and $354,000 in the years, 2018, 2019, and 2020, respectively.

Performing trend analysis, with 2018 serving as the base year, what is the percentage for 2020?

A) 123.58%

B) 19.08%

C) 126.43%

D) 28.21%

Performing trend analysis, with 2018 serving as the base year, what is the percentage for 2020?

A) 123.58%

B) 19.08%

C) 126.43%

D) 28.21%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

18

At December 31, Williams Company has total assets of $500,000, total liabilities of $300,000, and total owner's equity of $200,000.

At December 31, Williams Company's debt-to-equity ratio is:

A) 0.25

B) 5.00

C) 0.80

D) 1.50

E) None of the above

At December 31, Williams Company's debt-to-equity ratio is:

A) 0.25

B) 5.00

C) 0.80

D) 1.50

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

19

At December 31, Mendez Company has total assets of $900,000, total liabilities of $200,000, and total owner's equity of $700,000.

At December 31, Mendez Company's debt-to-equity ratio is:

A) 0.29

B) 1.20

C) 5.00

D) 0.17

E) None of the above

At December 31, Mendez Company's debt-to-equity ratio is:

A) 0.29

B) 1.20

C) 5.00

D) 0.17

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

20

The operating-cash-flow-to-current-liabilities ratio is computed by dividing a firm's a net cash flow from operating activities by:

A) Current liabilities at the end of the period

B) Current liabilities at the beginning of the period

C) Total liabilities at the middle of the period

D) Average current liabilities for the period

E) None of the above

A) Current liabilities at the end of the period

B) Current liabilities at the beginning of the period

C) Total liabilities at the middle of the period

D) Average current liabilities for the period

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

21

Cherokee Company is preparing trend percentages for its service fees earned for the period 2010 through 2020. The base year is 2016.

The 2019 trend percentage is computed as:

A) 2019 service fees earned divided by 2018 service fees earned

B) 2019 service fees earned divided by 2016 service fees earned

C) 2016 service fees earned divided by 2019 service fees earned

D) 2018 service fees earned divided by 2019 service fees earned

E) None of the above

The 2019 trend percentage is computed as:

A) 2019 service fees earned divided by 2018 service fees earned

B) 2019 service fees earned divided by 2016 service fees earned

C) 2016 service fees earned divided by 2019 service fees earned

D) 2018 service fees earned divided by 2019 service fees earned

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

22

Stern Company's net income was $75,000 for 2018, $81,250 for 2019, and $69,800 for 2020. Assume trend percentages for net income over the three-year period are computed, with 2018 serving as the base year.

The trend percentage for 2020's net income is:

A) 100.0

B) 108.7

C) 93.1

D) 73.6

E) None of the above

The trend percentage for 2020's net income is:

A) 100.0

B) 108.7

C) 93.1

D) 73.6

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

23

Rodriguez Company reported net income of $1,300 million for the current year. The weighted average number of common shares outstanding was 554 million shares. Rodriguez paid $30 million in dividends on preferred stock.

How much is basic earnings per share amount for the current year?

A) $2.23

B) $2.18

C) $2.29

D) $2.34

How much is basic earnings per share amount for the current year?

A) $2.23

B) $2.18

C) $2.29

D) $2.34

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

24

Benson Company sells a segment of its operations at a loss. Benson has not previously experienced such an event and does not expect to again.

The loss from the disposal of the segment should be reported in the income statement as:

A) An extraordinary item

B) A separate amount in a discontinued operations section

C) A separate amount in net income from continuing operations

D) As part of cost of goods sold

E) None of the above

The loss from the disposal of the segment should be reported in the income statement as:

A) An extraordinary item

B) A separate amount in a discontinued operations section

C) A separate amount in net income from continuing operations

D) As part of cost of goods sold

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

25

Information about a segment of the business that a company sells, abandons, or otherwise disposes of is reported in the:

A) Retained earnings statement

B) Discontinued operations section of the income statement

C) Balance sheet

D) Continuing operations section of the income statement

A) Retained earnings statement

B) Discontinued operations section of the income statement

C) Balance sheet

D) Continuing operations section of the income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

26

World Airlines has no preferred stock outstanding. The company had 50,000 shares of common stock outstanding on January 1 and issued 20,000 additional shares on April 1.

If World's net income was $359,000, the company should report earnings per share of (to the nearest cent)

A) $4.27

B) $4.60

C) $5.52

D) $5.98

E) None of the above

If World's net income was $359,000, the company should report earnings per share of (to the nearest cent)

A) $4.27

B) $4.60

C) $5.52

D) $5.98

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

27

Bowden, Inc. has no preferred stock outstanding. The company had 40,000 shares of common stock outstanding on January 1 and issued 12,000 additional shares on May 1.

If Bowden's net income was $100,000, the company should report earnings per share of (to the nearest cent)

A) $2.00

B) $2.22

C) $2.08

D) $2.62

E) None of the above

If Bowden's net income was $100,000, the company should report earnings per share of (to the nearest cent)

A) $2.00

B) $2.22

C) $2.08

D) $2.62

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

28

Westminster, Inc. has net income of $185,000. At January 1, the company had outstanding 54,000 shares of $25 par value common stock and 10,000 shares of 6%, $50 par value cumulative preferred stock. On September 1, an additional 18,000 shares of common stock were issued.

What is the earnings per share (to the nearest cent)?

A) $2.22

B) $2.58

C) $2.25

D) $2.05

E) None of the above

What is the earnings per share (to the nearest cent)?

A) $2.22

B) $2.58

C) $2.25

D) $2.05

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

29

Pooly Inc. has net income of $136,000 for the current year. At January 1, the company had outstanding 37,000 shares of $10 par value common stock and 5,000 shares of 8%, $50 par value cumulative preferred stock. On October 1, an additional 12,000 shares of common stock were issued.

What is the earnings per share (to the nearest cent)?

A) $2.37

B) $2.90

C) $3.40

D) $2.70

E) None of the above

What is the earnings per share (to the nearest cent)?

A) $2.37

B) $2.90

C) $3.40

D) $2.70

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

30

At December 31, Belinda, Inc. had 500,000 shares of common stock issued and outstanding, 250,000 of which had been issued and outstanding throughout the year and 250,000 of which were issued on July 1. Net income for the year ended December 31, was $795,000.

What is Belinda's 2013 earnings per common share (to the nearest cent)?

A) $1.06

B) $1.27

C) $1.59

D) $2.12

E) None of the above

What is Belinda's 2013 earnings per common share (to the nearest cent)?

A) $1.06

B) $1.27

C) $1.59

D) $2.12

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

31

At December 31, McKensie's price-earnings ratio was 13.4. McKensie's net income was $330,000, its earnings per share was $3.50, and its annual dividend per share was $2.00.

What was the per share market price of McKensie's stock at December 31?

A) $46.90

B) $16.40

C) $32.80

D) $57.40

E) None of the above

What was the per share market price of McKensie's stock at December 31?

A) $46.90

B) $16.40

C) $32.80

D) $57.40

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

32

On the income statement of a merchandising company, interest income and interest expense are reported:

A) By offsetting interest income and interest expense and showing the excess as an operating revenue or expense

B) As separate items of other income and expense below the net operating income or loss

C) As part of cost of goods sold

D) By showing interest income as additional sales revenue and interest expense as an operating expense

E) Some other way

A) By offsetting interest income and interest expense and showing the excess as an operating revenue or expense

B) As separate items of other income and expense below the net operating income or loss

C) As part of cost of goods sold

D) By showing interest income as additional sales revenue and interest expense as an operating expense

E) Some other way

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

33

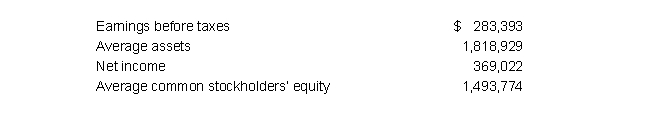

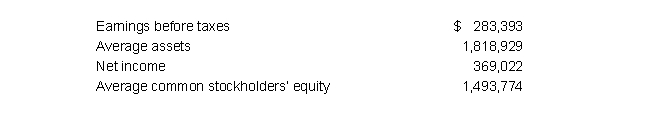

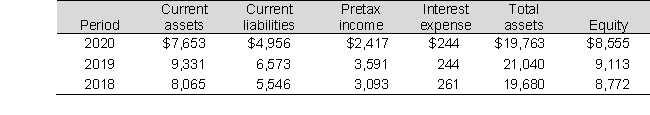

Selected balance sheet and income statement information for Forrester Company follows in millions:

a. Calculate the company's return on common stockholders' equity.

b. Explain what information this provides to management.

a. Calculate the company's return on common stockholders' equity.

b. Explain what information this provides to management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

34

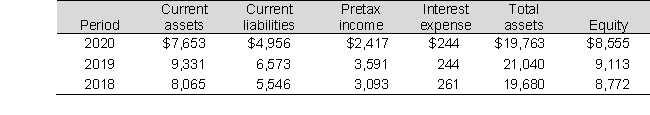

Selected balance sheet and income statement information from the Electric Company for fiscal years 2018 through 2020 follows (Amounts in millions):

a. Compute the times-interest-earned ratio for each year and discuss any trends.

b. What concerns about Electric's ability to meet its interest obligations might creditors have? Explain.

a. Compute the times-interest-earned ratio for each year and discuss any trends.

b. What concerns about Electric's ability to meet its interest obligations might creditors have? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

35

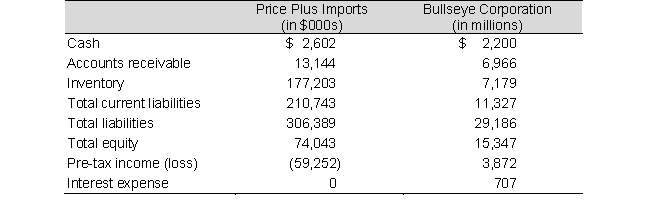

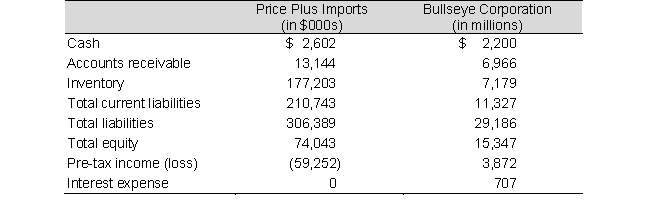

Selected recent balance sheet and income statement information for the clothing companies: Price Plus Imports and Bullseye Corporation follows:

a. Calculate the current ratio and quick ratio for both companies.

b. Which company is more liquid?

c. Calculate the times-interest-earned and debt-to-equity ratios for both companies.

d. Which company is more solvent? Explain.

a. Calculate the current ratio and quick ratio for both companies.

b. Which company is more liquid?

c. Calculate the times-interest-earned and debt-to-equity ratios for both companies.

d. Which company is more solvent? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

36

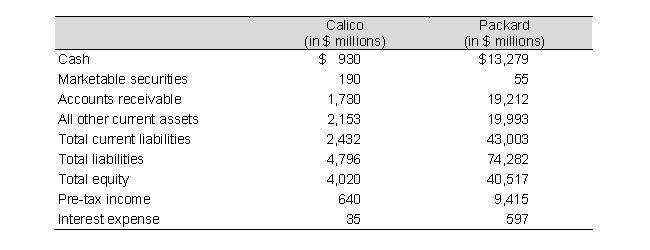

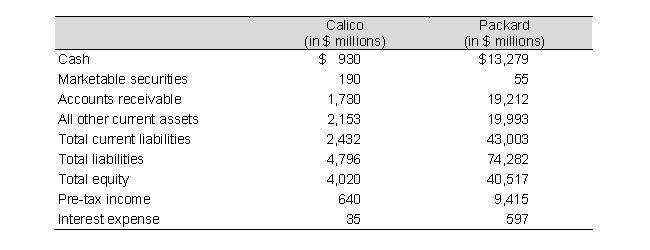

Selected balance sheet and income statement information for two manufacturing companies: Calico, Inc. and Packard Corporation follows:

a. Calculate the current ratio and quick ratio for both companies.

b. Which company is more liquid?

c. Calculate the times-interest-earned ratio and debt-to-equity ratio for both companies.

d. Which company is more solvent?

a. Calculate the current ratio and quick ratio for both companies.

b. Which company is more liquid?

c. Calculate the times-interest-earned ratio and debt-to-equity ratio for both companies.

d. Which company is more solvent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

37

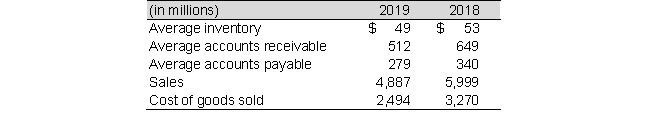

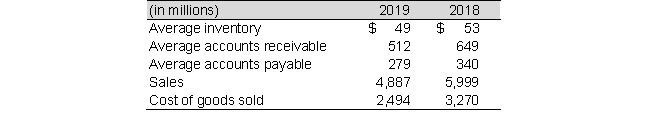

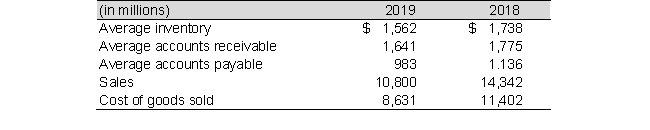

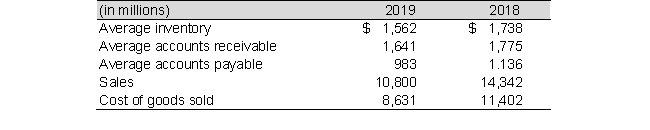

Selected recent balance sheet and income statement information for Eva Systems, Inc. follows:

a. Calculate accounts receivable turnover for both years. Has accounts receivable turnover improved during the year or worsened?

b. Calculate inventory turnover for 2019 and 2018. Has inventory turnover improved during the year or worsened?

a. Calculate accounts receivable turnover for both years. Has accounts receivable turnover improved during the year or worsened?

b. Calculate inventory turnover for 2019 and 2018. Has inventory turnover improved during the year or worsened?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

38

Selected recent balance sheet and income statement information for Smith & Johnson Corporation follows:

a. Calculate accounts receivable turnover for both years. Has it improved during the year or worsened?

b. Calculate inventory turnover for both years. Has it improved during the year or worsened?

a. Calculate accounts receivable turnover for both years. Has it improved during the year or worsened?

b. Calculate inventory turnover for both years. Has it improved during the year or worsened?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

39

Selected recent balance sheet and income statement information for Somerset, Inc. follows:

a. Calculate accounts receivable turnover for both years. Has it improved during the year or worsened?

b. Calculate inventory turnover for both years. Has it improved during the year or worsened?

a. Calculate accounts receivable turnover for both years. Has it improved during the year or worsened?

b. Calculate inventory turnover for both years. Has it improved during the year or worsened?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

40

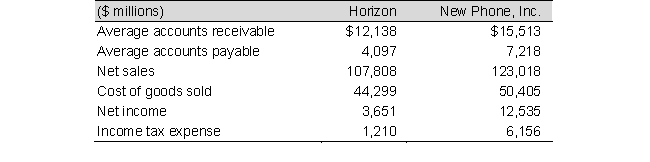

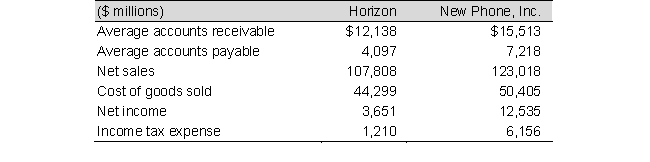

Selected recent balance sheet and income statement information for the communication giants, Horizon Communications, Inc., and New Phone Inc., follow:

a. Compute accounts receivable turnover for Horizon Communications, Inc. and New Phone, Inc. .

b. Interpret and comment on the differences between the receivables turnover rates between each company assuming the industry average is 9.0 times.

a. Compute accounts receivable turnover for Horizon Communications, Inc. and New Phone, Inc. .

b. Interpret and comment on the differences between the receivables turnover rates between each company assuming the industry average is 9.0 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

41

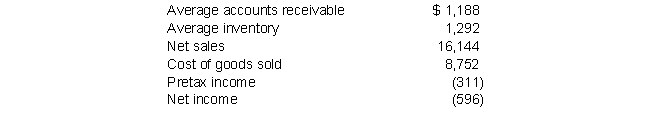

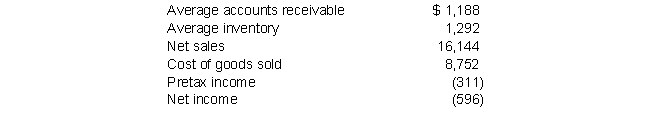

Selected recent balance sheet and income statement information for Business Products, Inc. follows (in $ millions):

Compute accounts receivable turnover and inventory turnover.

Compute accounts receivable turnover and inventory turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

42

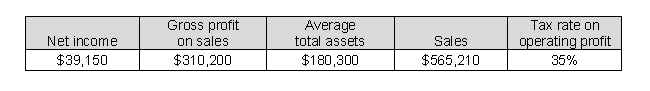

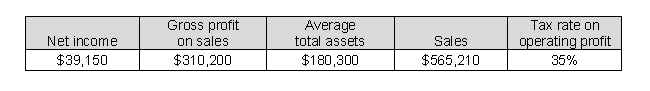

The following is selected balance sheet and income statement information for Menendez Company.

Compute the following ratios:

a. Gross profit percentage

b. Profit margin

c. Asset turnover

d. Return on assets

e. Return on common stockholders' equity (Menendez Company has no preferred stock)

Compute the following ratios:

a. Gross profit percentage

b. Profit margin

c. Asset turnover

d. Return on assets

e. Return on common stockholders' equity (Menendez Company has no preferred stock)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

43

During the current year, Darnsworth Company had 50,000 shares of $10 par value common stock and 7,000 shares of 8%, $30 par value convertible preferred stock outstanding. Darnsworth Company's net income was $450,000.

Compute earnings per share for the year.

Compute earnings per share for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

44

Listed below are six items or sections that may be found in a multiple-step income statement.

-Gross profit

A) 1

B) 2

C) 3

D) 4

E) 5

-Gross profit

A) 1

B) 2

C) 3

D) 4

E) 5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

45

Listed below are six items or sections that may be found in a multiple-step income statement.

-Discontinued operations

A) 5

B) 6

C) 7

D) 8

E) 9

-Discontinued operations

A) 5

B) 6

C) 7

D) 8

E) 9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

46

During the current year, Swade Corporation had 75,000 shares of $5 par value common stock and 10,000 shares of 6%, $25 par value preferred stock outstanding. Swade Corporation's net income is $399,000.

Compute the earnings per share for the year.

Compute the earnings per share for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

47

During the current year, Tapir Corporation had 160,000 shares of $5 par value common stock and 30,000 shares of 5%, $20 par value preferred stock outstanding. Tapir Corporation's net income is $480,000.

Compute the primary earnings per share for the year.

Compute the primary earnings per share for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

48

The following information relates to Corte, Inc. for the current year:

a. Compute Corte's earnings per share.

b. Compute Corte's price-earnings ratio at December 31.

a. Compute Corte's earnings per share.

b. Compute Corte's price-earnings ratio at December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

49

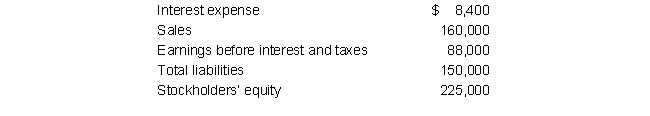

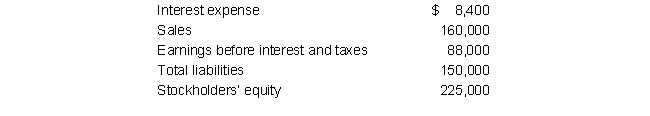

Twin Roads Company has the following values taken from its annual report (in thousands):

a. Calculate Twin Roads Company's times-interest-earned ratio.

b. Calculate Twin Roads Company's debt-to-equity ratio.

a. Calculate Twin Roads Company's times-interest-earned ratio.

b. Calculate Twin Roads Company's debt-to-equity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

50

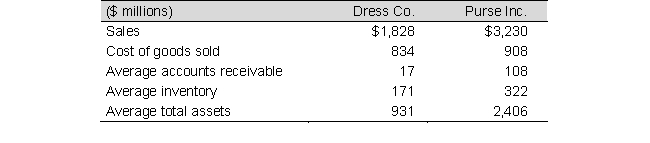

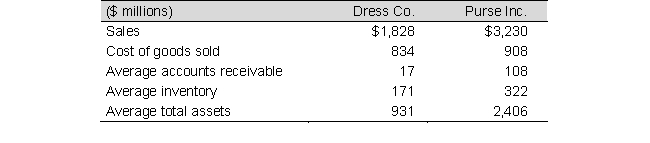

Selected recent balance sheet and income statement information from Dress Co. and Purse Inc. follows:

a. Compute the following turnover rates for each company:

1. Accounts receivable turnover

2. Inventory turnover

3. Asset turnover

b. Interpret and comment on any differences you observe between the turnover rates for these two companies.

a. Compute the following turnover rates for each company:

1. Accounts receivable turnover

2. Inventory turnover

3. Asset turnover

b. Interpret and comment on any differences you observe between the turnover rates for these two companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

51

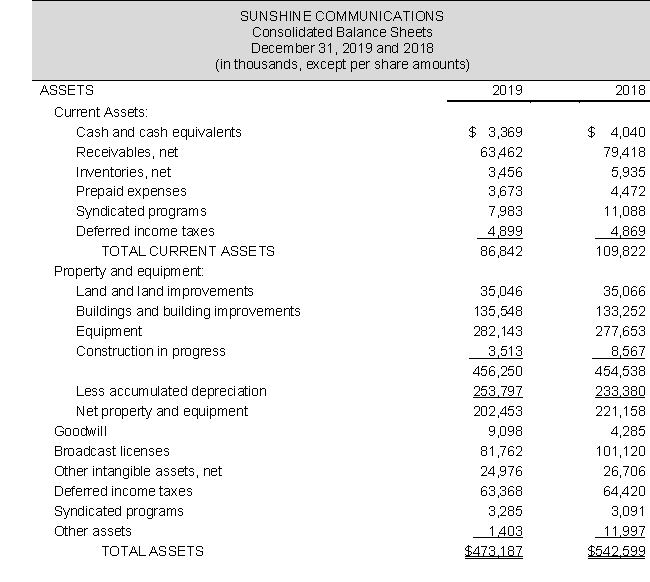

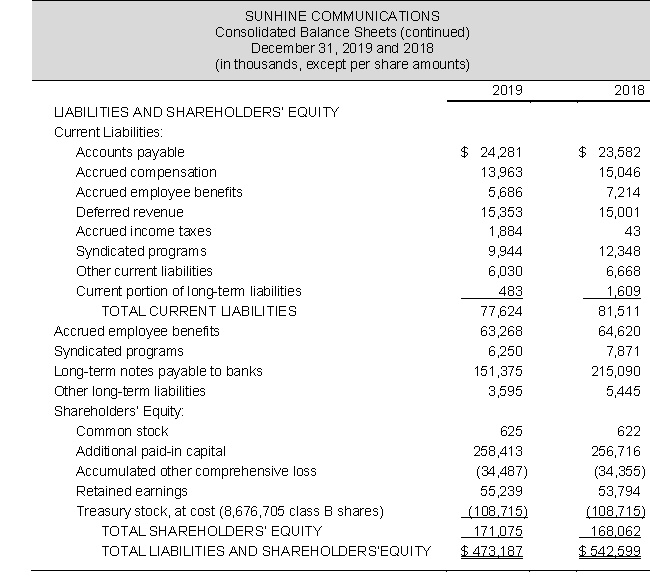

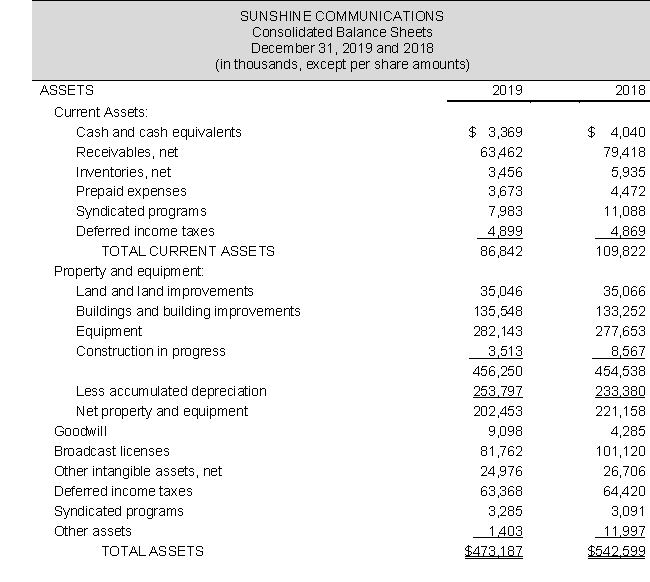

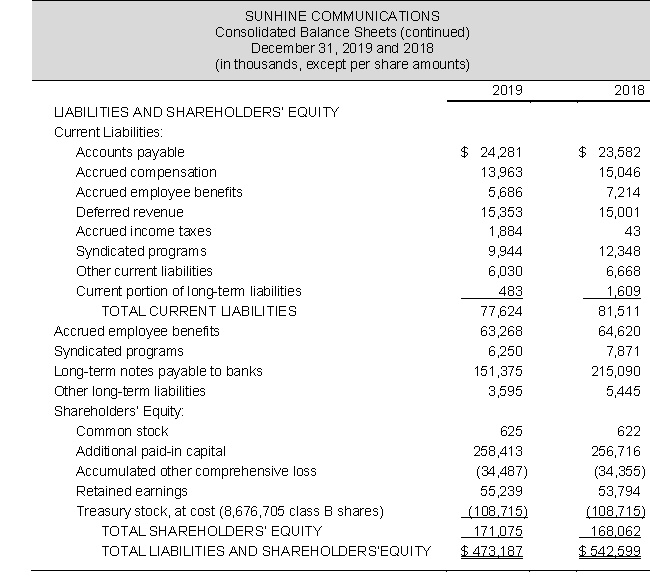

The balance sheets and income statements for Sunshine Communications follow:

a. Compute the company's current ratio for both years. Comment on any observed trend.

b. Compute the debt-to-equity ratios for both years. Comment on any observed trend.

a. Compute the company's current ratio for both years. Comment on any observed trend.

b. Compute the debt-to-equity ratios for both years. Comment on any observed trend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

52

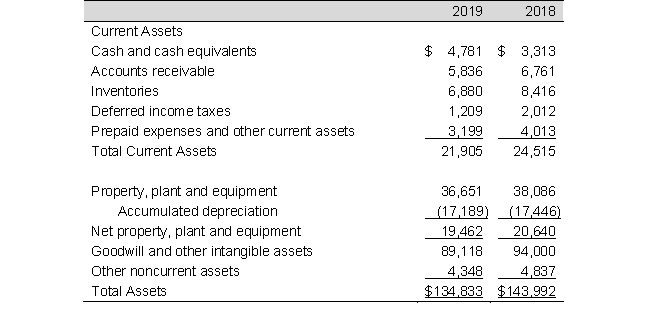

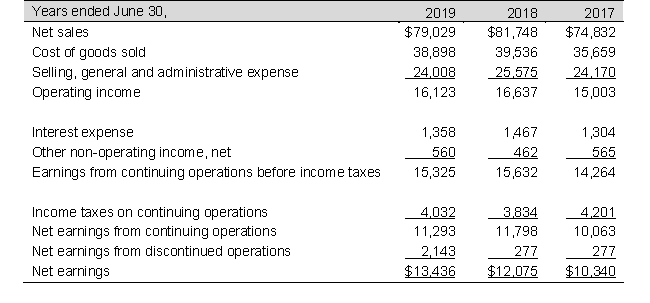

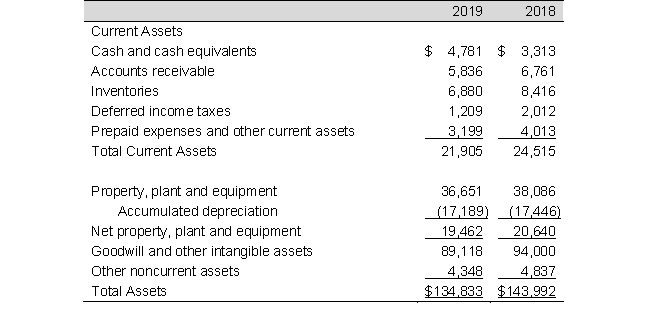

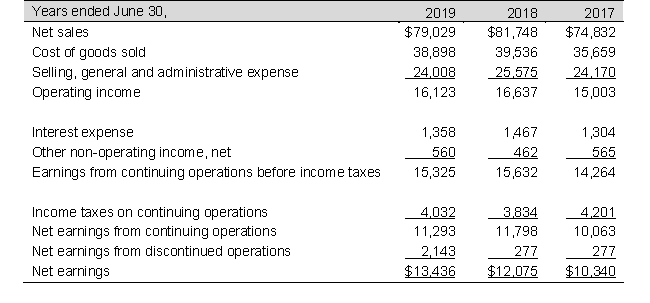

The partial balance sheets and income statements for Fun Merchandise, Inc., for fiscal years ending June 30, 2019 and 2018 follow (in millions):

Required

Required

a. Calculate accounts receivable turnover for 2019 and 2018. Accounts receivable in 2017 totaled $6,629 million. Has accounts receivable turnover improved during the year or worsened?

b. Calculate inventory turnover for 2019 and 2018. Inventories in 2017 were $6,819 million. Has inventory turnover improved during the year or worsened?

c. Calculate asset turnover for 2019 and 2018 considering that 2017 total assets are $138,014 million.

Required

Requireda. Calculate accounts receivable turnover for 2019 and 2018. Accounts receivable in 2017 totaled $6,629 million. Has accounts receivable turnover improved during the year or worsened?

b. Calculate inventory turnover for 2019 and 2018. Inventories in 2017 were $6,819 million. Has inventory turnover improved during the year or worsened?

c. Calculate asset turnover for 2019 and 2018 considering that 2017 total assets are $138,014 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

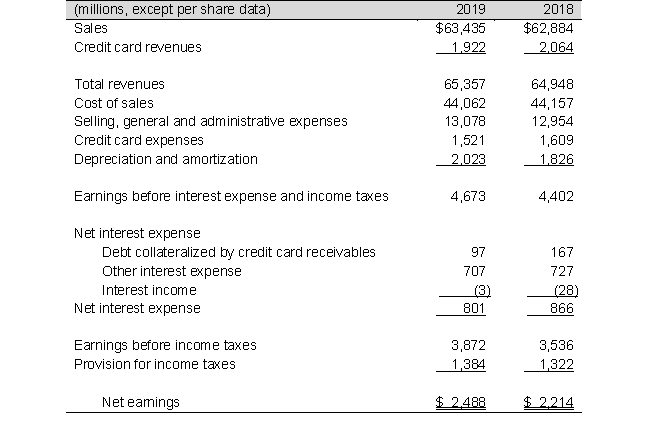

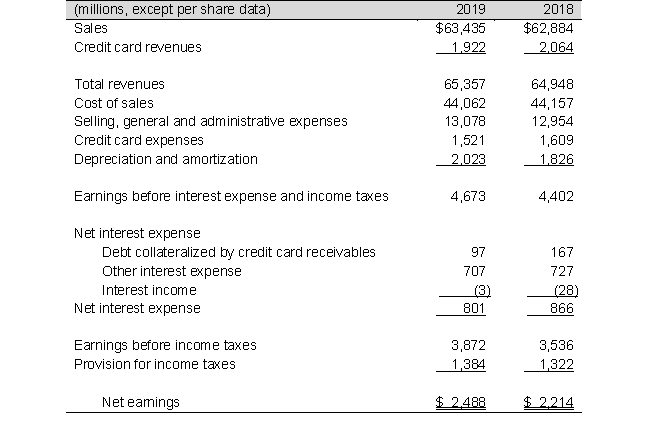

53

The income statements for Sommerset Corporation for 2019 and 2018 follow:

a. Prepare a common-size income statement for 2019 and 2018. Round to one decimal place.

b. Comment on the most significant changes.

a. Prepare a common-size income statement for 2019 and 2018. Round to one decimal place.

b. Comment on the most significant changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

54

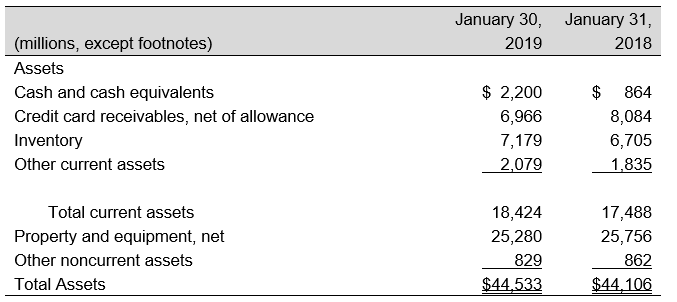

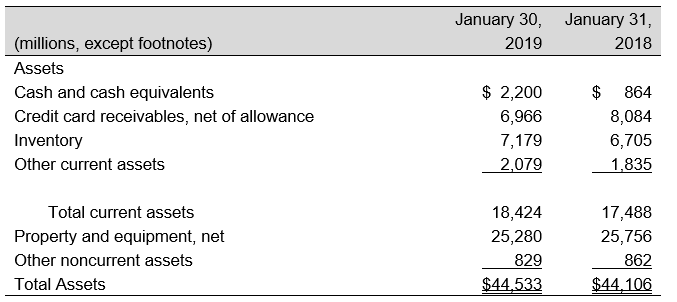

The balance sheets for Beldon Corporation for the years ending January 30, 2019 and January 31, 2018 follow:

a. Prepare common-size statements for the asset section of Beldon's balance sheet for 2019 and 2018. Round to one decimal place.

b. Comment on the most significant changes.

a. Prepare common-size statements for the asset section of Beldon's balance sheet for 2019 and 2018. Round to one decimal place.

b. Comment on the most significant changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

55

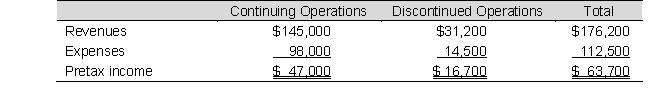

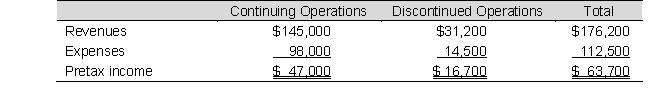

Consider the following results for Winsberg Webcom:

Prepare the income statement for this company assuming a 35% income tax rate. Omit the statement heading.

Prepare the income statement for this company assuming a 35% income tax rate. Omit the statement heading.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck