Deck 13: Appendix A: The Language of Accountants: Debits and Credits

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/128

العب

ملء الشاشة (f)

Deck 13: Appendix A: The Language of Accountants: Debits and Credits

1

Regardless of the business activity recorded, the left side of an account is the debit side and the right side is the credit side.

True

2

All accounts have normal balances on the debit side.

False

3

The normal balance in a revenue account is a credit balance.

True

4

Asset accounts are increased with debit entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

5

Expense accounts are increased with credit entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

6

The normal balance for an account is the side in which increases are recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

7

The typical form of a T-account shows debits on the right and credits on the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

8

A compound entry does not necessarily have to maintain total debits equal to total credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

9

The analysis of each transaction must result in equal amounts being recorded as debits and as credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

10

Transactions are first recorded in a journal and then posted to the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

11

Transactions are first recorded in the general ledger and then posted to a journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

12

Each transaction entered in a general journal must have equal dollar amounts of debits and credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

13

A trial balance is a list of the account titles in the general ledger with their respective debit and credit balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

14

One reason for preparing a trial balance is to determine if the debits and credits in the general ledger are equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

15

One reason for preparing a trial balance is to make sure that all of the period's transactions have been recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

16

The purpose of an unadjusted trial balance is to be sure the general ledger is in balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

17

The trial balance prepared before the general ledger accounts are adjusted is called an adjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

18

An unadjusted trial balance shows the general ledger account balances before any adjustments have been made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

19

Each adjusting entry affects a balance sheet account and an income statement account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

20

An adjusted trial balance is a listing of all the year-end balance sheet accounts, since all the income statement accounts have been closed to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

21

Adjusting entries must be journalized and posted before closing entries may be prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

22

An account is closed at year-end when an entry changes its balance to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

23

The post-closing trial balance includes only balance sheet accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

24

The complete accounting cycle begins with the analysis of transactions and ends with the preparation of financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

25

All accounts in the general ledger are closed at a company's fiscal year end in order to facilitate preparation of the financial statements and to ready the accounts for the activities of the next year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

26

The double-entry system of debits and credits means that:

A) Two pieces of information must be recorded for each transaction--the date and the dollar amount.

B) Debits will be recorded twice as often as credits.

C) At least two entries, a debit and a credit, must be made for each transaction.

D) Each debit and credit will be recorded two times, once in the general ledger and once in the trial balance.

E) None of the above

A) Two pieces of information must be recorded for each transaction--the date and the dollar amount.

B) Debits will be recorded twice as often as credits.

C) At least two entries, a debit and a credit, must be made for each transaction.

D) Each debit and credit will be recorded two times, once in the general ledger and once in the trial balance.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

27

The term debit refers to:

A) The left side of an account

B) The right side of an account

C) The side of an account on which increases are recorded

D) Both A and C

E) None of the above

A) The left side of an account

B) The right side of an account

C) The side of an account on which increases are recorded

D) Both A and C

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

28

The term credit refers to:

A) The left side of an account

B) The right side of an account

C) The side of an account on which decreases are recorded

D) Both B and C

E) None of the above

A) The left side of an account

B) The right side of an account

C) The side of an account on which decreases are recorded

D) Both B and C

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

29

The normal balance of an account is:

A) The debit side

B) The credit side

C) The side on which increases are recorded

D) The side on which decreases are recorded

E) None of the above

A) The debit side

B) The credit side

C) The side on which increases are recorded

D) The side on which decreases are recorded

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following accounts normally has a credit balance?

A) Accounts Receivable

B) Dividends

C) Notes Payable

D) Rent Expense

E) None of the above

A) Accounts Receivable

B) Dividends

C) Notes Payable

D) Rent Expense

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following accounts normally has a debit balance?

A) Accounts Payable

B) Common Stock

C) Dividends

D) Service Fees Earned

E) None of the above

A) Accounts Payable

B) Common Stock

C) Dividends

D) Service Fees Earned

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

32

Debits to which accounts result in an increased balance?

A) Assets and common stock

B) Revenues and assets

C) Common stock and expenses

D) Assets and expenses

E) Liabilities and expenses

A) Assets and common stock

B) Revenues and assets

C) Common stock and expenses

D) Assets and expenses

E) Liabilities and expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

33

In a double-entry accounting system:

A) All accounts have normal debit balances

B) A debit entry is recorded on the left side of an account

C) Liabilities, owner's common, and expense accounts all have normal credit balances

D) A credit entry records a decrease in an account

E) None of the above

A) All accounts have normal debit balances

B) A debit entry is recorded on the left side of an account

C) Liabilities, owner's common, and expense accounts all have normal credit balances

D) A credit entry records a decrease in an account

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Cash T-account has a beginning balance of $26,000. During the year, $122,000 was debited and $120,500 was credited to the account.

What is the ending balance of cash?

A) ($2,500)

B) $27,500

C) $18,500

D) Cannot be determined from the information given

What is the ending balance of cash?

A) ($2,500)

B) $27,500

C) $18,500

D) Cannot be determined from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

35

If the beginning Cash account balance was $18,400, the ending balance was $10,200, and total cash received during the period was $44,000, what amount of cash was paid out during the period?

A) $52,200

B) $35,800

C) $ 1,800

D) $42,400

E) None of the above

A) $52,200

B) $35,800

C) $ 1,800

D) $42,400

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following journal entries will record the payment of a $850 accounts payable originally incurred for Office Supplies?

A) Debit Office Supplies; credit Cash

B) Debit Office Supplies; credit Accounts Payable

C) Debit Cash; credit Accounts Payable

D) Debit Accounts Payable; credit Cash

A) Debit Office Supplies; credit Cash

B) Debit Office Supplies; credit Accounts Payable

C) Debit Cash; credit Accounts Payable

D) Debit Accounts Payable; credit Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

37

A company bills customers for services rendered on account. Which of the following is one part of recording this transaction?

A) Debit Service Revenue

B) Credit Cash

C) Debit Accounts Receivable

D) Credit Unearned Revenue

A) Debit Service Revenue

B) Credit Cash

C) Debit Accounts Receivable

D) Credit Unearned Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

38

Maxwell Industries recorded and paid $700 advertising for the current month. Which occurred?

A) Current assets increase

B) Current liabilities decrease

C) Net income decreases

D) Retained earnings increases

A) Current assets increase

B) Current liabilities decrease

C) Net income decreases

D) Retained earnings increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

39

When invoices are sent to customers billing them for services that have been performed, the correct transaction analysis is:

A) Debit Accounts Receivable and credit Service Fees Earned

B) Debit Accounts Payable and credit Service Fees Earned

C) Debit Service Fees Earned and credit Accounts Receivable

D) Debit Cash and credit Service Fees Earned

E) Debit Accounts Receivable and credit Accounts Payable

A) Debit Accounts Receivable and credit Service Fees Earned

B) Debit Accounts Payable and credit Service Fees Earned

C) Debit Service Fees Earned and credit Accounts Receivable

D) Debit Cash and credit Service Fees Earned

E) Debit Accounts Receivable and credit Accounts Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

40

Recording the collection of accounts receivable from customers involves:

A) Debiting Accounts Receivable and crediting Cash

B) Debiting Cash and crediting Service Fees Earned

C) Debiting Cash and crediting Accounts Payable

D) Debiting Cash and crediting Accounts Receivable

E) None of the above

A) Debiting Accounts Receivable and crediting Cash

B) Debiting Cash and crediting Service Fees Earned

C) Debiting Cash and crediting Accounts Payable

D) Debiting Cash and crediting Accounts Receivable

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

41

Recording a stock issuance in exchange for cash involves:

A) Debiting Cash and crediting Notes Payable

B) Debiting Cash and crediting Dividends

C) Debiting Cash and crediting Common Stock

D) Debiting Common Stock and crediting Cash

E) None of the above

A) Debiting Cash and crediting Notes Payable

B) Debiting Cash and crediting Dividends

C) Debiting Cash and crediting Common Stock

D) Debiting Common Stock and crediting Cash

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

42

Recording the borrowing of money for which a note is signed involves:

A) Debiting Cash and crediting Notes Receivable

B) Debiting Cash and crediting Accounts Payable

C) Debiting Cash and crediting Service Fees Earned

D) Debiting Cash and crediting Notes Payable

E) None of the above

A) Debiting Cash and crediting Notes Receivable

B) Debiting Cash and crediting Accounts Payable

C) Debiting Cash and crediting Service Fees Earned

D) Debiting Cash and crediting Notes Payable

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

43

Paying a previously recorded invoice from a supplier (of supplies) involves:

A) Debiting Supplies and crediting Cash

B) Debiting Accounts Payable and crediting Cash

C) Debiting Supplies and crediting Accounts Payable

D) Debiting Cash and crediting Supplies

E) None of the above

A) Debiting Supplies and crediting Cash

B) Debiting Accounts Payable and crediting Cash

C) Debiting Supplies and crediting Accounts Payable

D) Debiting Cash and crediting Supplies

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

44

Recording the payment of dividends to shareholders involves:

A) Debiting Dividends and crediting Cash

B) Debiting Cash and Common Stock

C) Debiting Withdrawal Expense and crediting Cash

D) Debiting Notes Payable and crediting Cash

E) None of the above

A) Debiting Dividends and crediting Cash

B) Debiting Cash and Common Stock

C) Debiting Withdrawal Expense and crediting Cash

D) Debiting Notes Payable and crediting Cash

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following transactions should be recorded using a compound journal entry?

A) Common stock is issued for cash.

B) The company receives payment on account from a customer.

C) The company pays a two-year insurance premium.

D) The company purchases a desk, paying 10% in cash with the balance due in 60 days.

E) None of the above

A) Common stock is issued for cash.

B) The company receives payment on account from a customer.

C) The company pays a two-year insurance premium.

D) The company purchases a desk, paying 10% in cash with the balance due in 60 days.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is a correct statement?

A) Any type of business transaction may be recorded in the general journal.

B) Only compound journal entries are recorded in the general journal.

C) The word journalize means to transfer information from the general journal to the general ledger.

D) The use of a general journal eliminates the need for a general ledger.

E) None of the above

A) Any type of business transaction may be recorded in the general journal.

B) Only compound journal entries are recorded in the general journal.

C) The word journalize means to transfer information from the general journal to the general ledger.

D) The use of a general journal eliminates the need for a general ledger.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

47

A trial balance that balances is useful because it indicates with certainty that:

A) All entries into accounts during the period were made correctly.

B) All accounts have normal balances.

C) Total debits in the general ledger equal total credits.

D) All of the above

E) None of the above

A) All entries into accounts during the period were made correctly.

B) All accounts have normal balances.

C) Total debits in the general ledger equal total credits.

D) All of the above

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

48

A trial balance can be described as:

A) A list of general ledger account titles and balances at a certain date

B) A grouping of the accounts used by an organization to prepare its basic financial statements

C) A record on which are recorded the increases and decreases of a particular financial statement component, such as cash

D) One of the basic financial statements of an organization

E) None of the above

A) A list of general ledger account titles and balances at a certain date

B) A grouping of the accounts used by an organization to prepare its basic financial statements

C) A record on which are recorded the increases and decreases of a particular financial statement component, such as cash

D) One of the basic financial statements of an organization

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

49

A trial balance:

A) Must balance when it is first prepared

B) Will balance only if there are no errors in the general ledger accounts

C) Will balance only if the total debits and total credits in the general ledger are equal

D) Both B) and C)

E) None of the above

A) Must balance when it is first prepared

B) Will balance only if there are no errors in the general ledger accounts

C) Will balance only if the total debits and total credits in the general ledger are equal

D) Both B) and C)

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following errors may escape detection when a trial balance is prepared?

A) Failing to record or enter a particular transaction

B) Entering a transaction more than once

C) Entering one or more amounts in the wrong accounts

D) Making an error that exactly offsets the effect of another error

E) All of the above

A) Failing to record or enter a particular transaction

B) Entering a transaction more than once

C) Entering one or more amounts in the wrong accounts

D) Making an error that exactly offsets the effect of another error

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following shows all the general ledger account balances in one place?

A) Chart of accounts

B) Special journal

C) Trial balance

D) General journal

E) None of the above

A) Chart of accounts

B) Special journal

C) Trial balance

D) General journal

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

52

When Honest Abe received his paycheck, he realized that his employer made an error in computing his wages and overpaid him by $1,300. So he promptly returned the excess amount.

When the employer receives a check from Abe for the amount of the overpayment, which of the following journal entries will be made by the employer?

A) Debit Cash and credit Wages Expense

B) Debit Wages Expense and credit Cash

C) Debit Cash and Credit Wages Payable

D) Debit Wages Payable and credit Wages Expense

When the employer receives a check from Abe for the amount of the overpayment, which of the following journal entries will be made by the employer?

A) Debit Cash and credit Wages Expense

B) Debit Wages Expense and credit Cash

C) Debit Cash and Credit Wages Payable

D) Debit Wages Payable and credit Wages Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

53

Terry Company purchased supplies for $7,000 on credit on January 1. On January 15, they made a cash payment of $2,000 to the supplier, and signed a one -year note for the remaining amount to settle the account.

Terry Company's journal entry on January 15 will include:

A) Debit Notes Payable for $5,000

B) Credit Accounts Payable for $5,000

C) Credit Notes Payable for $5,000

D) Debit Cash for $5,000

Terry Company's journal entry on January 15 will include:

A) Debit Notes Payable for $5,000

B) Credit Accounts Payable for $5,000

C) Credit Notes Payable for $5,000

D) Debit Cash for $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

54

St. Clair Motor Supplies had the following transactions during December:

Paid a note of $17,000 owed since March plus $425 for interest.

Sold $36,525 of merchandise to customers on account. Cost of goods sold was $21,250.

Paid accounts payable of $2,050.

As a result of these transactions, at year-end, liabilities and stockholders' equity would show a total:

A) Decrease by $4,575

B) Decrease by $4,200

C) Decrease by $4,800

D) Increase by $13,425

Paid a note of $17,000 owed since March plus $425 for interest.

Sold $36,525 of merchandise to customers on account. Cost of goods sold was $21,250.

Paid accounts payable of $2,050.

As a result of these transactions, at year-end, liabilities and stockholders' equity would show a total:

A) Decrease by $4,575

B) Decrease by $4,200

C) Decrease by $4,800

D) Increase by $13,425

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

55

During January, Wells Corporation purchased $100,000 of inventory; they paid one-fourth in cash and signed a note for the remaining balance.

This transaction will be recorded as:

A) Inventory 100,000

Cash 75,000

Notes Payable 25,000

B) Inventory 100,000

Cash 25,000

Accounts Payable 75,000

C) Inventory 100,000

Accounts Payable 75,000

Cash 25,000

D) Inventory 100,000

Cash 25,000

Notes Payable 75,000

This transaction will be recorded as:

A) Inventory 100,000

Cash 75,000

Notes Payable 25,000

B) Inventory 100,000

Cash 25,000

Accounts Payable 75,000

C) Inventory 100,000

Accounts Payable 75,000

Cash 25,000

D) Inventory 100,000

Cash 25,000

Notes Payable 75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

56

Horizon Company, an internet service provider, has 1,000,000 customers. The customers make electronic payments of $70 each for that month's service on the last day of each month. Horizon Company does not send any bills to their customers.

The company's journal entry on the day they receive the payment will include:

A) A credit to Internet Service Revenue for $70,000,000

B) A debit to Accounts Receivable for $70,000,000

C) A credit to Accounts Receivable for $70,000,000

D) A debit to Internet Service Expense for $70,000,000

The company's journal entry on the day they receive the payment will include:

A) A credit to Internet Service Revenue for $70,000,000

B) A debit to Accounts Receivable for $70,000,000

C) A credit to Accounts Receivable for $70,000,000

D) A debit to Internet Service Expense for $70,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

57

A customer received and then paid a $9,000 utility bill from Maryland Power Company. The journal entry by Maryland Power Company to record receipt of the payment would include:

A) A credit to Accounts Payable

B) A credit to Accounts Receivable

C) A credit to Utilities Revenue

D) A debit to Accounts Receivable

A) A credit to Accounts Payable

B) A credit to Accounts Receivable

C) A credit to Utilities Revenue

D) A debit to Accounts Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

58

Jackson Company purchased a new car for $30,000 by paying $12,000 cash, and trading in an old car with a recorded net cost and market value of $10,000. They also signed a Note for $8,000.

The required journal entry will not:

A) Debit New Car for $30,000

B) Debit Notes Payable for $8,000

C) Credit Old Car for $10,000

D) Credit Notes Payable for $8,000

The required journal entry will not:

A) Debit New Car for $30,000

B) Debit Notes Payable for $8,000

C) Credit Old Car for $10,000

D) Credit Notes Payable for $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

59

Kobe Company provided consulting service to a client on January 1, and billed them for $15,000. On February 1, the client made cash payment of $8,000 and signed a note for $7,000 to settle the account.

What is Kobe Company's journal entry on February 1?

A) Cash 8,000

Accounts Receivable 7,000

Notes Receivable 15,000

B) Accounts Payable 15,000

Notes Payable 7,000

Cash 8,000

C) Cash 8,000

Notes Receivable 7,000

Consulting Revenue 15,000

D) Cash 8,000

Notes Receivable 7,000

Accounts Receivable 15,000

What is Kobe Company's journal entry on February 1?

A) Cash 8,000

Accounts Receivable 7,000

Notes Receivable 15,000

B) Accounts Payable 15,000

Notes Payable 7,000

Cash 8,000

C) Cash 8,000

Notes Receivable 7,000

Consulting Revenue 15,000

D) Cash 8,000

Notes Receivable 7,000

Accounts Receivable 15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following errors, each considered individually, would cause the trial balance totals to be unequal?

A) A transaction was not posted

B) A payment of $56 for insurance was posted as a debit of $56 to Prepaid Insurance and a credit of $56 to Cash

C) A payment of $211 to a creditor was posted as a debit of $2,111 to Accounts Payable and a credit of $211 to Cash

D) Cash received from customers on account was posted as a debit of $100 to Cash and a credit of $100 to Accounts Payable

A) A transaction was not posted

B) A payment of $56 for insurance was posted as a debit of $56 to Prepaid Insurance and a credit of $56 to Cash

C) A payment of $211 to a creditor was posted as a debit of $2,111 to Accounts Payable and a credit of $211 to Cash

D) Cash received from customers on account was posted as a debit of $100 to Cash and a credit of $100 to Accounts Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

61

The purchase of a delivery truck for $9,500 (on credit) was posted as debit to Delivery Trucks for $9,500, and a debit to Notes Payable for $9,500.

What effect would this error have on the trial balance?

A) The total of the Debit column of the trial balance will exceed the total of the Credit column by $9,500.

B) The total of the Credit column of the trial balance will exceed the total of the Debit column by $9,500.

C) The total of the Credit column of the trial balance will exceed the total of the Debit column by $19,000.

D) The total of the Debit column of the trial balance will exceed the total of the Credit column by $19,000.

What effect would this error have on the trial balance?

A) The total of the Debit column of the trial balance will exceed the total of the Credit column by $9,500.

B) The total of the Credit column of the trial balance will exceed the total of the Debit column by $9,500.

C) The total of the Credit column of the trial balance will exceed the total of the Debit column by $19,000.

D) The total of the Debit column of the trial balance will exceed the total of the Credit column by $19,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

62

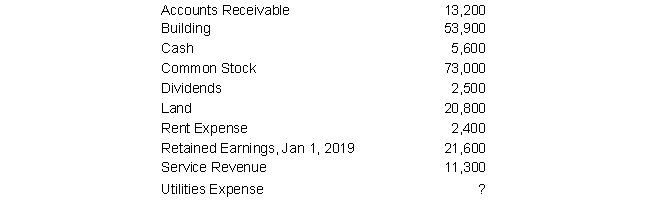

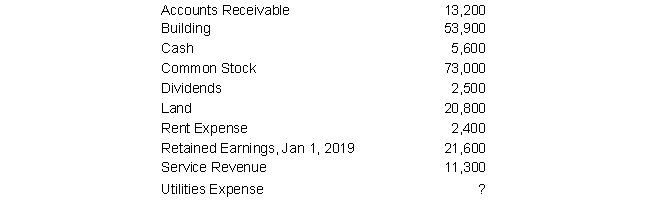

The unadjusted Trial Balance for Tyler Company shows the following accounts (in alphabetical order) on December 31, 2019. Each account shown has a normal balance.

Assuming the Trial Balance in balance, determine Tyler Company's Utilities Expense for 2019:

Assuming the Trial Balance in balance, determine Tyler Company's Utilities Expense for 2019:

A) $3,900

B) $2,900

C) $9,500

D) $7,500

Assuming the Trial Balance in balance, determine Tyler Company's Utilities Expense for 2019:

Assuming the Trial Balance in balance, determine Tyler Company's Utilities Expense for 2019:A) $3,900

B) $2,900

C) $9,500

D) $7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

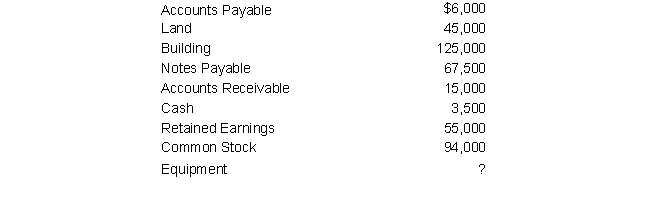

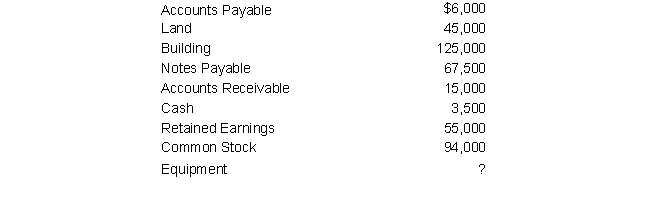

63

As of December 31, 2019, the Balance Sheet of Sparkling Products, Inc. contains the following items (in random order):

Determine the amount of Equipment.

Determine the amount of Equipment.

A) $ 21,000

B) $ 34,000

C) $ 21,750

D) $172,500

Determine the amount of Equipment.

Determine the amount of Equipment.A) $ 21,000

B) $ 34,000

C) $ 21,750

D) $172,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

64

M. Mabrey received $2,500 from a tenant on December 1 for five months' rent of an office. This rent was for December, January, February, March, and April.

If Mabrey debited Cash and credited Unearned Rental Income for $2,500 on December 1, what necessary adjustment would be made on December 31?

A) Unearned Rental Income 2,000

Rental income 2,000

B) Rental Income 500

Unearned Rental Income 500

C) Unearned Rental income 500

Rental Income 500

D) Rental Income 2,000

Unearned Rental Income 2,000

E) None of the above

If Mabrey debited Cash and credited Unearned Rental Income for $2,500 on December 1, what necessary adjustment would be made on December 31?

A) Unearned Rental Income 2,000

Rental income 2,000

B) Rental Income 500

Unearned Rental Income 500

C) Unearned Rental income 500

Rental Income 500

D) Rental Income 2,000

Unearned Rental Income 2,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

65

P. Disco received $2,400 from a tenant on December 1 for three months' rent of an office. This rent was for December, January, and February.

If Disco debited Cash and credited Unearned Rental Income for $2,400 on December 1, what necessary adjustment would be made on December 31?

A) Unearned Rental Income 800

Rental Income 800

B) Rental Income 800

Unearned Rental Income 800

C) Unearned Rental income 1,600

Rental Income 1,600

D) Rental Income 1,600

Unearned Rental Income 1,600

E) None of the above

If Disco debited Cash and credited Unearned Rental Income for $2,400 on December 1, what necessary adjustment would be made on December 31?

A) Unearned Rental Income 800

Rental Income 800

B) Rental Income 800

Unearned Rental Income 800

C) Unearned Rental income 1,600

Rental Income 1,600

D) Rental Income 1,600

Unearned Rental Income 1,600

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

66

Early in the accounting period, a customer paid $1,500 for services in advance of receiving them; Cash was debited and Unearned Service Fees was credited for $1,500. At the end of the accounting period, two-thirds of the services paid for had yet to be performed.

The proper adjusting entry is:

A) Unearned Service Fees 1,000

Service Fees Earned 1,000

B) Service Fees Earned 500

Unearned Service Fees 500

C) Unearned Service Fees 500

Service Fees Earned 500

D) Service Fees Earned 1,000

Unearned Service Fees 1,000

E) None of the above

The proper adjusting entry is:

A) Unearned Service Fees 1,000

Service Fees Earned 1,000

B) Service Fees Earned 500

Unearned Service Fees 500

C) Unearned Service Fees 500

Service Fees Earned 500

D) Service Fees Earned 1,000

Unearned Service Fees 1,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

67

On September 1, Best Company began a contract to provide services to Dildwood Company for six months, with the total $10,800 payment to be made at the end of the six-month period. Equal services are provided each month. The firm uses the account Fees Receivable to reflect amounts due but not yet billed.

What proper adjusting entry would Best Company make on December 31, the end of the accounting period (no previous adjustment has been made)?

A) Cash 7,200

Service Fees Earned 7,200

B) Fees Receivable 10,800

Service Fees Earned 7,200

Unearned Service Fees 3,600

C) Fees Receivable 7,200

Service Fees Earned 7,200

D) Unearned Service Fees 7,200

Service Fees Earned 7,200

E) None of the above

What proper adjusting entry would Best Company make on December 31, the end of the accounting period (no previous adjustment has been made)?

A) Cash 7,200

Service Fees Earned 7,200

B) Fees Receivable 10,800

Service Fees Earned 7,200

Unearned Service Fees 3,600

C) Fees Receivable 7,200

Service Fees Earned 7,200

D) Unearned Service Fees 7,200

Service Fees Earned 7,200

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

68

On December 31, the end of the accounting period, $5,300 in service fees had been earned but not billed or received. The firm uses the account Fees Receivable to reflect amounts due but not yet billed.

The proper adjusting entry would be:

A) Cash 5,300

Service Fees Earned 5,300

B) Fees Receivable 5,300

Service Fees Earned 5,300

C) Fees Receivable 5,300

Unearned Service Fees 5,300

D) Unearned Service Fees 5,300

Service Fees Earned 5,300

E) None of the above

The proper adjusting entry would be:

A) Cash 5,300

Service Fees Earned 5,300

B) Fees Receivable 5,300

Service Fees Earned 5,300

C) Fees Receivable 5,300

Unearned Service Fees 5,300

D) Unearned Service Fees 5,300

Service Fees Earned 5,300

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

69

Smith Company paid $26,400 for a four-year insurance policy on September 1 and recorded the $26,400 as a debit to Prepaid Insurance and a credit to Cash.

What adjusting entry should Smith make on December 31, the end of the accounting period (no previous adjustment has been made)?

A) Prepaid Insurance 2,200

Insurance Expense 2,200

B) Insurance Expense 2,200

Prepaid Insurance 2,200

C) Prepaid Insurance 24,200

Insurance Expense 24,200

D) Insurance Expense 6,600

Prepaid Insurance 6,600

E) None of the above

What adjusting entry should Smith make on December 31, the end of the accounting period (no previous adjustment has been made)?

A) Prepaid Insurance 2,200

Insurance Expense 2,200

B) Insurance Expense 2,200

Prepaid Insurance 2,200

C) Prepaid Insurance 24,200

Insurance Expense 24,200

D) Insurance Expense 6,600

Prepaid Insurance 6,600

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

70

Williams Company paid $24,000 for a two-year insurance policy on October 1 and recorded the $24,000 as a debit to Prepaid Insurance and a credit to Cash.

What adjusting entry should Williams make on December 31, the end of the accounting period (no previous adjustment has been made)?

A) Prepaid Insurance 3,000

Insurance Expense 3,000

B) Insurance Expense 12,000

Prepaid Insurance 12,000

C) Prepaid Insurance 21,000

Insurance Expense 21,000

D) Insurance Expense 3,000

Prepaid Insurance 3,000

E) None of the above

What adjusting entry should Williams make on December 31, the end of the accounting period (no previous adjustment has been made)?

A) Prepaid Insurance 3,000

Insurance Expense 3,000

B) Insurance Expense 12,000

Prepaid Insurance 12,000

C) Prepaid Insurance 21,000

Insurance Expense 21,000

D) Insurance Expense 3,000

Prepaid Insurance 3,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

71

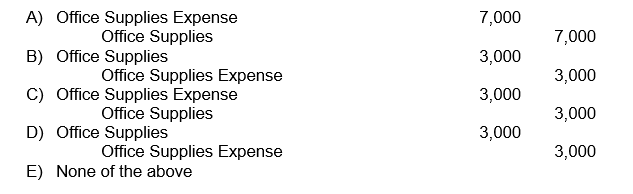

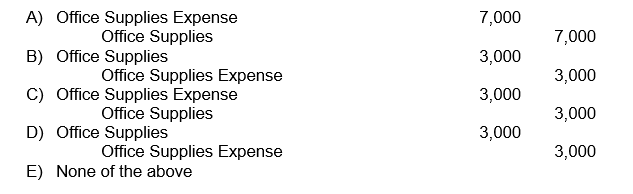

Office Supplies had a beginning balance of $8,000. During the month, purchases of office supplies totaling $2,000 were debited to the Office Supplies account.

If $3,000 worth of office supplies is still on hand at month-end, what is the proper adjusting entry?

If $3,000 worth of office supplies is still on hand at month-end, what is the proper adjusting entry?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

72

Printing Supplies had a beginning balance of $4,000. During the month, purchases of printing supplies totaling $3,000 were debited to the Printing Supplies account.

If $2,000 worth of printing supplies is still on hand at month-end, what is the proper adjusting entry?

A) Printing Supplies Expense 2,000

Printing Supplies 2,000

B) Printing Supplies 5,000

Printing Supplies Expense 5,000

C) Printing Supplies Expense 5,000

Printing Supplies 5,000

D) Printing Supplies 2,000

Printing Supplies Expense 2,000

E) None of the above

If $2,000 worth of printing supplies is still on hand at month-end, what is the proper adjusting entry?

A) Printing Supplies Expense 2,000

Printing Supplies 2,000

B) Printing Supplies 5,000

Printing Supplies Expense 5,000

C) Printing Supplies Expense 5,000

Printing Supplies 5,000

D) Printing Supplies 2,000

Printing Supplies Expense 2,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

73

During their first year, Smith and Associates bought $16,000 worth of supplies for their CPA firm. When purchased, the supplies were debited to Supplies and credited to Accounts Payable.

What adjusting entry would Smith and Associates make if $4,000 worth of supplies were on hand at year-end?

A) Supplies Expense 12,000

Supplies 12,000

B) Supplies 4,000

Supplies Expense 4,000

C) Supplies Expense 4,000

Supplies 4,000

D) Supplies 12,000

Supplies Expense 12,000

E) None of the above

What adjusting entry would Smith and Associates make if $4,000 worth of supplies were on hand at year-end?

A) Supplies Expense 12,000

Supplies 12,000

B) Supplies 4,000

Supplies Expense 4,000

C) Supplies Expense 4,000

Supplies 4,000

D) Supplies 12,000

Supplies Expense 12,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Supplies account balance at the end of the period is $22,000. Supplies totaling $18,800 have been purchased during the period and debited to Supplies. A physical count shows $5,000 worth of supplies on hand at the end of the period.

The proper adjusting entry is:

A) Supplies 5,000

Supplies Expense 5,000

B) Supplies Expense 4,700

Supplies 4,700

C) Supplies Expense 17,000

Supplies 17,000

D) Supplies Expense 18,800

Supplies 18,800

E) None of the above

The proper adjusting entry is:

A) Supplies 5,000

Supplies Expense 5,000

B) Supplies Expense 4,700

Supplies 4,700

C) Supplies Expense 17,000

Supplies 17,000

D) Supplies Expense 18,800

Supplies 18,800

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

75

West Company signed a one-year lease on April 1 and paid the $11,400 total year's rent in advance. West recorded the transaction as a debit to Prepaid Rent and a credit to Cash.

What adjusting entry should West make on December 31 (no previous adjustment has been made)?

A) Prepaid Rent 2,850

Rent Expense 2,850

B) Prepaid Rent 8,550

Rent Expense 8,550

C) Rent Expense 8,550

Prepaid Rent 8,550

D) Rent Expense 2,850

Prepaid Rent 2,850

E) None of the above

What adjusting entry should West make on December 31 (no previous adjustment has been made)?

A) Prepaid Rent 2,850

Rent Expense 2,850

B) Prepaid Rent 8,550

Rent Expense 8,550

C) Rent Expense 8,550

Prepaid Rent 8,550

D) Rent Expense 2,850

Prepaid Rent 2,850

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

76

Forrester Company signed a two-year lease on July 1 and paid the $17,400 total rent in advance. Forrester recorded the transaction as a debit to Prepaid Rent and a credit to Cash.

What adjusting entry should Forrester make on December 31 (no previous adjustment has been made)?

A) Prepaid Rent 13,050

Rent Expense 13,050

B) Prepaid Rent 4,350

Rent Expense 4,350

C) Rent Expense 8,700

Prepaid Rent 8,700

D) Rent Expense 4,350

Prepaid Rent 4,350

E) None of the above

What adjusting entry should Forrester make on December 31 (no previous adjustment has been made)?

A) Prepaid Rent 13,050

Rent Expense 13,050

B) Prepaid Rent 4,350

Rent Expense 4,350

C) Rent Expense 8,700

Prepaid Rent 8,700

D) Rent Expense 4,350

Prepaid Rent 4,350

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

77

Likert Company calculates that interest of $900 has accrued at December 31 on outstanding notes payable. How should Likert record this on December 31?

A) Prepaid Interest 900

Interest Expense 900

B) Interest Expense 900

Interest Payable 900

C) Interest Expense 900

Cash 900

D) Interest Payable 900

Interest Expense 900

E) None of the above

A) Prepaid Interest 900

Interest Expense 900

B) Interest Expense 900

Interest Payable 900

C) Interest Expense 900

Cash 900

D) Interest Payable 900

Interest Expense 900

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

78

Assume December 31 is a Wednesday. Wages are paid every Friday, and the weekly payroll (for five days) amounts to $3,000.

To record the correct amount of expense for December, the firm makes the following entry on December 31:

A) Wages Payable 3,000

Wages Expense 3,000

B) Wages Payable 1,800

Wages Expense 1,800

C) Wages Expense 1,680

Wages Payable 1,680

D) Wages Expense 1,800

Wages Payable 1,800

E) None of the above

To record the correct amount of expense for December, the firm makes the following entry on December 31:

A) Wages Payable 3,000

Wages Expense 3,000

B) Wages Payable 1,800

Wages Expense 1,800

C) Wages Expense 1,680

Wages Payable 1,680

D) Wages Expense 1,800

Wages Payable 1,800

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

79

Benson Company calculates it has earned (but not yet collected or recorded) interest of $525 at December 31 on outstanding notes receivable.

How should Benson record this on December 31?

A) Interest Receivable 525

Interest Payable 525

B) Interest Receivable 525

Interest Income 525

C) Interest Payable 525

Interest Income 525

D) Interest Income 525

Interest Receivable 525

E) None of the above

How should Benson record this on December 31?

A) Interest Receivable 525

Interest Payable 525

B) Interest Receivable 525

Interest Income 525

C) Interest Payable 525

Interest Income 525

D) Interest Income 525

Interest Receivable 525

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck

80

Assume December 31 is a Monday. Wages are paid every Friday, and the weekly payroll (for five days) amounts to $6,000.

To record the correct amount of expense for December, the firm makes the following entry on December 31:

A) Wages Expense 1,200

Wages Payable 1,200

B) Wages Payable 1,200

Wages Expense 1,200

C) Wages Expense 6.000

Wages Payable 6,000

D) Wages Expense 4,800

Wages Payable 4,800

E) None of the above

To record the correct amount of expense for December, the firm makes the following entry on December 31:

A) Wages Expense 1,200

Wages Payable 1,200

B) Wages Payable 1,200

Wages Expense 1,200

C) Wages Expense 6.000

Wages Payable 6,000

D) Wages Expense 4,800

Wages Payable 4,800

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 128 في هذه المجموعة.

فتح الحزمة

k this deck