Deck 6: Reporting and Analyzing Revenues and Receivables

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/52

العب

ملء الشاشة (f)

Deck 6: Reporting and Analyzing Revenues and Receivables

1

According to GAAP revenue recognition criteria, in order for revenue to be recognized on the income statement, an amount must be either realized, realizable, or earned.

False

2

A computer retailer has a 30-day return policy. The company can report revenue on the full amount as soon as the merchandise is sold if returns are immaterial.

True

3

Revenues from discontinued operations of a company are reported separately from revenues from continuing operations in the income statement.

True

4

The net accounts receivable reported in the current asset section of a company's balance sheet represents all receivables expected to be collected within the next year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

5

Restructuring costs have two components: employee severance costs and extraordinary costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

6

Channel stuffing arises when a company records a nonrecurring loss in a period of already depressed income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

7

The balance in Allowance for Uncollectible Accounts represents the amount a company thinks it will not collect from a customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

8

Underestimating the allowance for uncollectible accounts can shift income from future periods into the present period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

9

Income statement effects of uncollectibles occur at the point of estimation, not when an account is written-off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

10

The completed contract method recognizes revenue when the product is completed and transferred to the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

11

One motive of earnings management is a desire to mislead some financial statement users about a company's financial performance in order to gain economic advantage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

12

If a company sells two or more products or services under the same sales agreement for one lump-sum price, the sales price must be reduced by the cost of the goods or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

13

GAAP requires that companies recognize revenue subsequent to customer purchases by using the percentage-of-completion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

14

IFRS requires companies to use the completed contract method for long-term contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the below cases is not an example of potentially misleading reporting?

A) Channel stuffing

B) Overly optimistic estimates

C) Recognizing revenue after goods are delivered

D) Mischaracterizing transactions as arm's length

A) Channel stuffing

B) Overly optimistic estimates

C) Recognizing revenue after goods are delivered

D) Mischaracterizing transactions as arm's length

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is not considered an issue relating to proper revenue recognition?

A) Asset write-downs

B) Channel stuffing

C) Income smoothing

D) Lack of arm's length transactions

A) Asset write-downs

B) Channel stuffing

C) Income smoothing

D) Lack of arm's length transactions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is an indicator of a revenue recognition issue?

A) Optimistic estimates in accrual accounting

B) Receipt of payment prior to delivery

C) Receipt of payment after completion of service or delivery of goods

D) Sale to end-customer with no right of return

A) Optimistic estimates in accrual accounting

B) Receipt of payment prior to delivery

C) Receipt of payment after completion of service or delivery of goods

D) Sale to end-customer with no right of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following does not relate to improper revenue recognition?

A) Recording revenue in advance of the execution of sales agreement

B) Recognized revenue prior to collecting payment

C) Mischaracterizing transactions as arm's-length

D) Taking a big bath

A) Recording revenue in advance of the execution of sales agreement

B) Recognized revenue prior to collecting payment

C) Mischaracterizing transactions as arm's-length

D) Taking a big bath

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

19

What method(s) is(are) required by IFRS when accounting for long-term contracts?

A) Percentage-of-completion or cost recovery methods

B) Only cost-recovery

C) Only percentage-of-completion

D) Percentage-of-completion or completed contract methods

A) Percentage-of-completion or cost recovery methods

B) Only cost-recovery

C) Only percentage-of-completion

D) Percentage-of-completion or completed contract methods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following items can be considered as a persistent income statement item for analysis purposes?

A) Effects of a strike

B) Gains and losses on the disposal of a business segment

C) Bad debt expense

D) Write-down or write-offs of receivables

A) Effects of a strike

B) Gains and losses on the disposal of a business segment

C) Bad debt expense

D) Write-down or write-offs of receivables

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

21

Excess Construction Corp. has a $16 million contract to construct a building. The company estimates $10.4 million in costs to construct the building and an expected gross profit of $5.6 million. During the current year, the company incurred $3,120,000 of costs on the contract.

Under the percentage-of-completion method, how much will Excess Construction Corp. report as revenue in the current year?

A) $3,120,000

B) $5,600,000

C) $4,800,000

D) $10,400,000

Under the percentage-of-completion method, how much will Excess Construction Corp. report as revenue in the current year?

A) $3,120,000

B) $5,600,000

C) $4,800,000

D) $10,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is not true regarding a discontinued operation?

A) The discontinued business unit has its own identifiable operations and cash flows.

B) The operations and cash flows of the unit must be removed from the company's continuing operations.

C) The company must have no significant continuing involvement in the discontinued unit's operations after its disposal.

D) The company must have reported its intention to sell the related business unit in the previous year's annual report notes.

A) The discontinued business unit has its own identifiable operations and cash flows.

B) The operations and cash flows of the unit must be removed from the company's continuing operations.

C) The company must have no significant continuing involvement in the discontinued unit's operations after its disposal.

D) The company must have reported its intention to sell the related business unit in the previous year's annual report notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

23

Caroline's Collectibles estimates its uncollectible accounts by aging its accounts receivable and applying percentages to various aged categories of accounts. Caroline's Collectible computes a total of $6,720 in estimated losses as of December 31, 2016. Its Accounts Receivable account has a balance of $ 225,600 and its Allowance for Uncollectible Accounts has an unused balance of $960 before adjustment at December 31, 2016.

How much is bad debt expense that Caroline's Collectibles will report in 2016?

A) $ 960

B) $7,680

C) $6,720

D) $5,760

How much is bad debt expense that Caroline's Collectibles will report in 2016?

A) $ 960

B) $7,680

C) $6,720

D) $5,760

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

24

On which financial statement and at what amount are accounts receivable reported?

A) Balance sheet at the amount owed by customers

B) Income statement at the net uncollectible amount

C) Income statement at the amount written off

D) Balance sheet at the net realizable value

A) Balance sheet at the amount owed by customers

B) Income statement at the net uncollectible amount

C) Income statement at the amount written off

D) Balance sheet at the net realizable value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

25

Nickolas's Pizza intentionally overestimates the amount of its write-downs of assets in order to record a nonrecurring loss in a period of already depressed income.

What is this behavior called?

A) Restructuring costs

B) Big Bath

C) Arm's length sales

D) Income smoothing

What is this behavior called?

A) Restructuring costs

B) Big Bath

C) Arm's length sales

D) Income smoothing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

26

At what amount will accounts receivable be reported on the balance sheet if the gross receivable balance is $94,000 and the allowance for uncollectible accounts is estimated at 8% of gross receivables?

A) $99,760

B) $86,480

C) $90,240

D) $56,400

A) $99,760

B) $86,480

C) $90,240

D) $56,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following does not occur when a company receives additional information that requires it to increase its expectations of uncollectible accounts receivable?

A) Accounts receivable (net) is reduced

B) Bad debt expense is increased

C) Net income is reduced

D) The allowance account is decreased

A) Accounts receivable (net) is reduced

B) Bad debt expense is increased

C) Net income is reduced

D) The allowance account is decreased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following formula computes the average collection period?

A) Average daily sales / Account receivable

B) Account receivable / Average daily sales

C) Sales / Average accounts receivable

D) Average accounts receivable / Average daily sales

A) Average daily sales / Account receivable

B) Account receivable / Average daily sales

C) Sales / Average accounts receivable

D) Average accounts receivable / Average daily sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

29

If the collection period lengthens compared to historic figures and industry averages, what might the reason be?

A) Deterioration of collectability of receivables

B) A change in sales mix to longer paying customers

C) A decrease in the amount of sales generated

D) A and B

E) All of the above

A) Deterioration of collectability of receivables

B) A change in sales mix to longer paying customers

C) A decrease in the amount of sales generated

D) A and B

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

30

Identify and explain when each of the following companies should recognize revenue for the sales of their products:

A. Sears is a retail store that sells products with a 30-day period of right of return.

B. United Airlines sells airplane tickets for the current and upcoming year.

C. Apple sells computers and extended warranties for those computers.

A. Sears is a retail store that sells products with a 30-day period of right of return.

B. United Airlines sells airplane tickets for the current and upcoming year.

C. Apple sells computers and extended warranties for those computers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

31

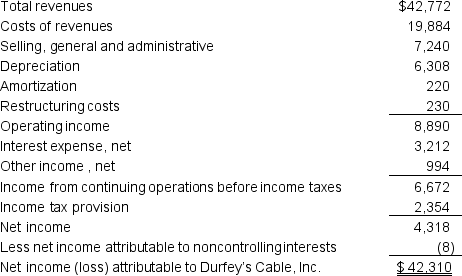

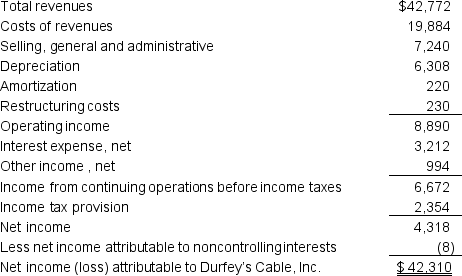

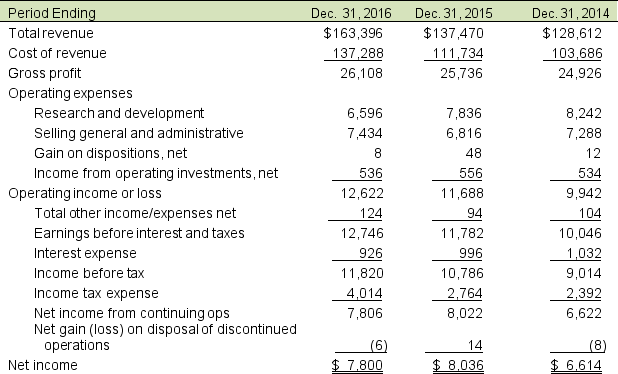

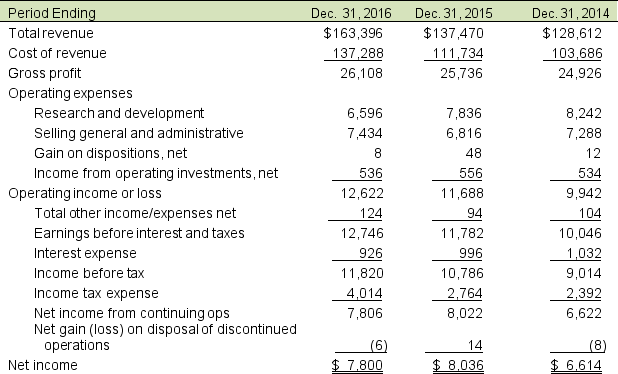

Following is the income statement reported by Durfey's Cable, Inc. from its 2016 annual report (amounts in millions).

Identify the items in its income statement that might be considered nonrecurring items.

Identify the items in its income statement that might be considered nonrecurring items.

Identify the items in its income statement that might be considered nonrecurring items.

Identify the items in its income statement that might be considered nonrecurring items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

32

Identify and explain potential revenue recognition issues relating to the following operations:

A. Motor Bikes, Inc. is a store that sells second-hand motorcycles on consignment from sellers. It remits to the sellers the sale price less the commission.

B. 1-800-MyFlowers is an internet flower store. It receives fees in advance to provide flowers all year long.

A. Motor Bikes, Inc. is a store that sells second-hand motorcycles on consignment from sellers. It remits to the sellers the sale price less the commission.

B. 1-800-MyFlowers is an internet flower store. It receives fees in advance to provide flowers all year long.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

33

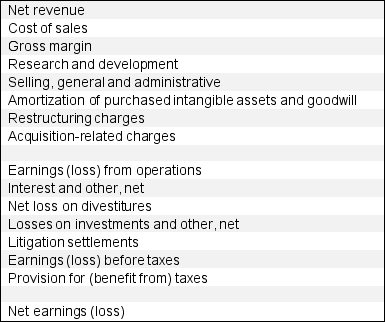

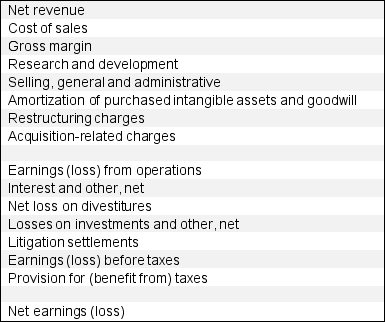

Following are the income statement accounts for a recent Tom's Computers income statement.

Identify the items in Tom's Computers' statement that might be considered nonrecurring items.

Identify the items in Tom's Computers' statement that might be considered nonrecurring items.

Identify the items in Tom's Computers' statement that might be considered nonrecurring items.

Identify the items in Tom's Computers' statement that might be considered nonrecurring items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

34

A $3,600,000 contract is executed to build a luxury boat. Total estimated costs to complete the project are $2,340,000 million. The construction company incurred the following costs during the project: $936,000 in 2014; $234,000 in 2015; and $1,170,000 in 2016. Compute revenues, expenses, and income for each year 2014 through 2016 using the percentage-of-completion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

35

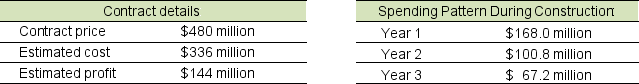

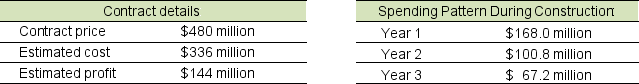

Mathew's Marble contracts to lay marble in a new museum over a three-year period. The company's accountants record the following details relating to the project:

Compute the amount of revenue, expense and income for each year using the percentage-of-completion method.

Compute the amount of revenue, expense and income for each year using the percentage-of-completion method.

Compute the amount of revenue, expense and income for each year using the percentage-of-completion method.

Compute the amount of revenue, expense and income for each year using the percentage-of-completion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

36

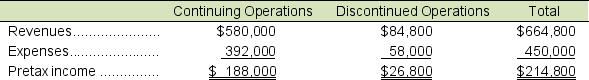

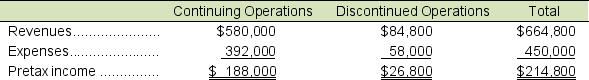

Consider the following results for Waldow's Webcam:

Prepare the income statement for this company assuming a 35% income tax rate. Omit the statement heading.

Prepare the income statement for this company assuming a 35% income tax rate. Omit the statement heading.

Prepare the income statement for this company assuming a 35% income tax rate. Omit the statement heading.

Prepare the income statement for this company assuming a 35% income tax rate. Omit the statement heading.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

37

Mathew's Marble, a national supplier of marble products, has enjoyed several years of strong earnings during the recent housing boom. However, economists believe construction spending will be down significantly over the next couple of years. In an effort to maintain its current level of profitability, Mathew's Marble has decided to decrease its allowance for uncollectible accounts estimate from 3.5% to 2%. What effect will this action have on current and future period profits?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

38

Twelve years ago, Kenyon Construction began operating out of a new building that cost $84 million to construct. At that time, Kenyon's management estimated the building had a useful life of 30 years. Today (or twelve years later), management revised its estimate of the useful life of the building to 36 years, which will reduce annual depreciation expense to $2,100,000.

A. How would the change in the estimated useful life of the building impact Kenyon's income statement?

B. What possible incentives might management have to overestimate or underestimate the useful life of a long-term asset?

A. How would the change in the estimated useful life of the building impact Kenyon's income statement?

B. What possible incentives might management have to overestimate or underestimate the useful life of a long-term asset?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

39

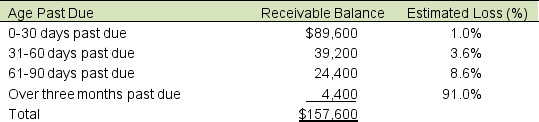

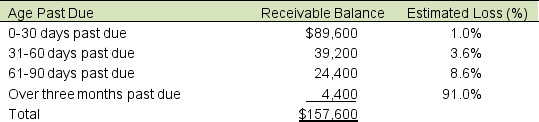

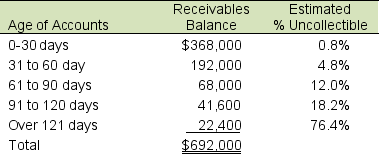

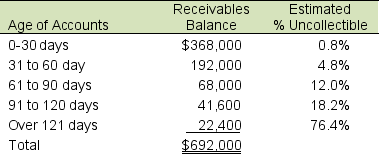

C-Market reports the following analysis of potential losses in its accounts receivable:

The balance of Allowance for Uncollectible Accounts is $560 on December 31, 2016 prior to adjustments.

The balance of Allowance for Uncollectible Accounts is $560 on December 31, 2016 prior to adjustments.

A. Compute bad debt expense that will be recorded for 2016.

B. What is the amount of accounts receivable to be reported on C-Market's December 31, 2016 balance sheet?

The balance of Allowance for Uncollectible Accounts is $560 on December 31, 2016 prior to adjustments.

The balance of Allowance for Uncollectible Accounts is $560 on December 31, 2016 prior to adjustments.A. Compute bad debt expense that will be recorded for 2016.

B. What is the amount of accounts receivable to be reported on C-Market's December 31, 2016 balance sheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

40

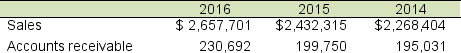

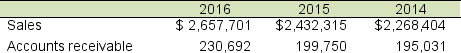

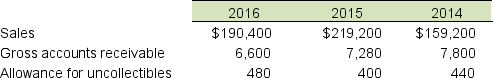

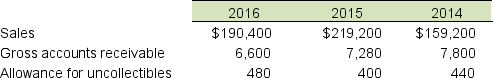

American Chocolate Co. reports the following in its 2016 10K report:

Calculate the accounts receivable turnover and average collection period for 2016 and 2015. Comment on the findings.

Calculate the accounts receivable turnover and average collection period for 2016 and 2015. Comment on the findings.

Calculate the accounts receivable turnover and average collection period for 2016 and 2015. Comment on the findings.

Calculate the accounts receivable turnover and average collection period for 2016 and 2015. Comment on the findings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

41

GP3, Inc. estimated uncollectible accounts receivable at December 31, 2016 at $13,488, based on estimates on various ages of receivables and before learning of the bankruptcy of one of its customers. The customer owed $5,360, and the legal department has estimated costs to collect the balance owed by this customer at $8,000. The gross receivables balance on December 31, 2016 after write-offs is $337,200, and the allowance of uncollectible accounts balance was $14,480 at December 31, 2015. At December 12, 2016, the company wrote off $6,800 other accounts deemed uncollectible.

A. How would the legal department advise GP3, Inc. to handle the collection of the $5,360?

B. Draw a t-account for Allowance for Uncollectible Accounts and post all 2016 amounts to it, assuming that both the $6,800 and $5,360 have been written off.

C. What is the effect of the $6,800 write off on gross and net accounts receivable?

A. How would the legal department advise GP3, Inc. to handle the collection of the $5,360?

B. Draw a t-account for Allowance for Uncollectible Accounts and post all 2016 amounts to it, assuming that both the $6,800 and $5,360 have been written off.

C. What is the effect of the $6,800 write off on gross and net accounts receivable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

42

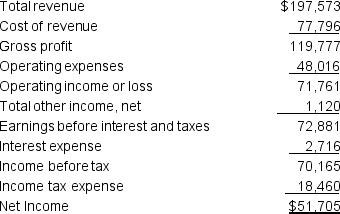

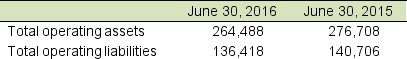

The Above & Beyond Books Company engages in the manufacture and sale of books worldwide. Its income statement for the year ending June 30, 2016 and selected amounts from its June 30, 2016 balance sheet follow:

Assume the marginal tax rate is 35%.

Assume the marginal tax rate is 35%.

Determine the following for Above & Beyond Books for its year ending June 30, 2016:

Determine the following for Above & Beyond Books for its year ending June 30, 2016:

A. NOPAT

B. RNOA

C. NOPM

D. Interpret the meaning of these three amounts as it applies to Above & Beyond Books.

Assume the marginal tax rate is 35%.

Assume the marginal tax rate is 35%. Determine the following for Above & Beyond Books for its year ending June 30, 2016:

Determine the following for Above & Beyond Books for its year ending June 30, 2016:A. NOPAT

B. RNOA

C. NOPM

D. Interpret the meaning of these three amounts as it applies to Above & Beyond Books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

43

Gray Tabby, Inc. provided the following aging of its receivables at December 31.

During the year, $25,024 of receivables were written off. The balance at the beginning of the year in the allowance account was $23,760.

During the year, $25,024 of receivables were written off. The balance at the beginning of the year in the allowance account was $23,760.

A. How much will Gray Tabby report as uncollectible accounts expense for the year?

B. How much is the net realizable value of Gray Tabby's receivables at year end?

During the year, $25,024 of receivables were written off. The balance at the beginning of the year in the allowance account was $23,760.

During the year, $25,024 of receivables were written off. The balance at the beginning of the year in the allowance account was $23,760.A. How much will Gray Tabby report as uncollectible accounts expense for the year?

B. How much is the net realizable value of Gray Tabby's receivables at year end?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

44

Omni Corporation describes its revenue recognition policies in Note 1 to the financial information presented in its 2016 annual report.

Our services and products are generally sold based upon purchase orders or contracts with our customers that include fixed or determinable prices but do not include right of return provisions or other significant post-delivery obligations. Our products are produced in a standard manufacturing operation, even if produced to our customer's specifications. We recognize revenue from product sales when title passes to the customer, the customer assumes risks and rewards of ownership, collectability is reasonably assured, and delivery occurs as directed by our customer. Service revenue, including training and consulting services, is recognized when the services are rendered and collectability is reasonably assured. Rates for services are typically priced on a per day, per meter, per man-hour, or similar basis.

Software sales. Sales of perpetual software licenses, net of any deferred maintenance and support fees, are recognized as revenue upon shipment. Sales of time-based licenses are recognized as revenue over the license period. Maintenance and support fees are recognized as revenue ratably over the contract period, usually a one-year duration.

Percentage of completion. Revenue from certain long-term, integrated project management contracts to provide well construction, and completion services is reported on the percentage-of-completion method of accounting. Progress is generally based upon physical progress related to contractually defined units of work. Physical percent complete is determined as a combination of input and output measures as deemed appropriate by the circumstances. All known or anticipated losses on contracts are provided for when they become evident. Cost adjustments that are in the process of being negotiated with customers for extra work or changes in the scope of work are included in revenue when collection is deemed probable.

A. Identify the main sources of revenues for Omni

B. What are the revenue recognition policies?

Our services and products are generally sold based upon purchase orders or contracts with our customers that include fixed or determinable prices but do not include right of return provisions or other significant post-delivery obligations. Our products are produced in a standard manufacturing operation, even if produced to our customer's specifications. We recognize revenue from product sales when title passes to the customer, the customer assumes risks and rewards of ownership, collectability is reasonably assured, and delivery occurs as directed by our customer. Service revenue, including training and consulting services, is recognized when the services are rendered and collectability is reasonably assured. Rates for services are typically priced on a per day, per meter, per man-hour, or similar basis.

Software sales. Sales of perpetual software licenses, net of any deferred maintenance and support fees, are recognized as revenue upon shipment. Sales of time-based licenses are recognized as revenue over the license period. Maintenance and support fees are recognized as revenue ratably over the contract period, usually a one-year duration.

Percentage of completion. Revenue from certain long-term, integrated project management contracts to provide well construction, and completion services is reported on the percentage-of-completion method of accounting. Progress is generally based upon physical progress related to contractually defined units of work. Physical percent complete is determined as a combination of input and output measures as deemed appropriate by the circumstances. All known or anticipated losses on contracts are provided for when they become evident. Cost adjustments that are in the process of being negotiated with customers for extra work or changes in the scope of work are included in revenue when collection is deemed probable.

A. Identify the main sources of revenues for Omni

B. What are the revenue recognition policies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

45

At December 31, 2016, retailer Susan Bicycles had a balance of $330,400 in its Accounts Receivable account and an unused balance of $1,120 in its Allowance for Uncollectible Accounts account. The company analyzed and aged its accounts receivable based on the following estimated uncollectible amounts:

1.2% of current balances of $174,000

4.4% of balances 31-60 days of $88,400

10.8% of balances of 61-90 days of $35,600

42.0% of balances over 91 days of $32,400

The company bases its provision for credit losses on the aging analysis.

A. What amount of bad debt expense will Susan Bicycles report in its 2016 income statement?

B. How would Accounts Receivable and the Allowance for Uncollectible Accounts appear in its December 31, 2016, balance sheet?

C. Why might Susan Bicycles opt to extend terms of credit on sales?

1.2% of current balances of $174,000

4.4% of balances 31-60 days of $88,400

10.8% of balances of 61-90 days of $35,600

42.0% of balances over 91 days of $32,400

The company bases its provision for credit losses on the aging analysis.

A. What amount of bad debt expense will Susan Bicycles report in its 2016 income statement?

B. How would Accounts Receivable and the Allowance for Uncollectible Accounts appear in its December 31, 2016, balance sheet?

C. Why might Susan Bicycles opt to extend terms of credit on sales?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

46

Andy's accounts receivable financial data (in millions) for three years are listed below:

A. Calculate the net realizable value of receivables that will be reported on Andy's balance sheet for each year.

A. Calculate the net realizable value of receivables that will be reported on Andy's balance sheet for each year.

B. Determine the accounts receivable turnover for 2016 and 2015.

C. Compare the accounts receivable turnovers for 2016 and 2015 and comment on the differences.

A. Calculate the net realizable value of receivables that will be reported on Andy's balance sheet for each year.

A. Calculate the net realizable value of receivables that will be reported on Andy's balance sheet for each year.B. Determine the accounts receivable turnover for 2016 and 2015.

C. Compare the accounts receivable turnovers for 2016 and 2015 and comment on the differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

47

Aircraft Carrier Company reports the following in its 2016 10-K filing (amounts in millions):

Identify nonrecurring items on Aircraft Carrier's income statement.

Identify nonrecurring items on Aircraft Carrier's income statement.

Identify nonrecurring items on Aircraft Carrier's income statement.

Identify nonrecurring items on Aircraft Carrier's income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

48

Patrick Constructors entered into a $2,400,000 million contract to build a restaurant. Total estimated costs to complete the project are $1,800,000 million. The construction company incurred the following costs during the project: $720,000 in 2014; $270,000 in 2015; and $810,000 in 2016. Compute revenues, expenses, and income for each year 2014 through 2016 using the percentage-of-completion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

49

Peter Gilgen & Co., (PG & Co.) reports the following footnote relating to its discontinued operations from its 2016 10-K annual report.

Management's Discussion & Analysis

Recent Developments: In May 2016, we completed the divestiture of our snacks business to The K Cereal Company. In accordance with the applicable accounting guidance for the disposal of long-lived assets, the results of our snacks business are presented as discontinued operations and, as such, have been excluded from continuing operations and from segment results for all periods presented. As a result of this change, the pet care business is now included in the Fabric Care and Home Care segment.

A. What are discontinued operations?

B. Describe the accounting treatment in the income statement according to GAAP for discontinued operations.

C. How should the results of the operations of the discontinued segment be interpreted when evaluating the financial performance for PG & Co. for 2015 and 2016?

Management's Discussion & Analysis

Recent Developments: In May 2016, we completed the divestiture of our snacks business to The K Cereal Company. In accordance with the applicable accounting guidance for the disposal of long-lived assets, the results of our snacks business are presented as discontinued operations and, as such, have been excluded from continuing operations and from segment results for all periods presented. As a result of this change, the pet care business is now included in the Fabric Care and Home Care segment.

A. What are discontinued operations?

B. Describe the accounting treatment in the income statement according to GAAP for discontinued operations.

C. How should the results of the operations of the discontinued segment be interpreted when evaluating the financial performance for PG & Co. for 2015 and 2016?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

50

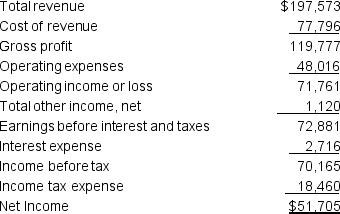

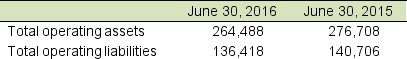

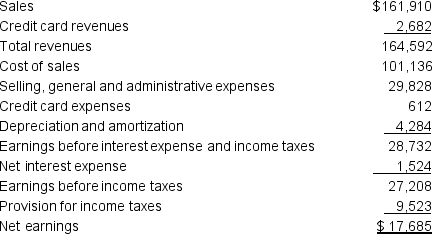

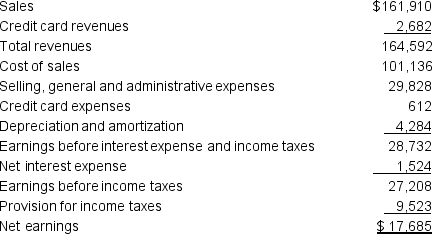

Bullseye, Inc. is a large retailer. Its income statement for the year ending January 30, 2016 (in millions) follows:

Selected amounts from Bullseye's 2016 and 2015 balance sheets follow (amounts in millions):

Selected amounts from Bullseye's 2016 and 2015 balance sheets follow (amounts in millions):

Assume a marginal tax rate of 35%.

Assume a marginal tax rate of 35%.

Determine the following for Bullseye for its year ending January 30, 2016:

A. NOPAT

B. RNOA

C. NOPM (Use total revenues for this calculation)

D. Interpret the meaning of these three amounts as it applies to Bullseye.

Selected amounts from Bullseye's 2016 and 2015 balance sheets follow (amounts in millions):

Selected amounts from Bullseye's 2016 and 2015 balance sheets follow (amounts in millions): Assume a marginal tax rate of 35%.

Assume a marginal tax rate of 35%.Determine the following for Bullseye for its year ending January 30, 2016:

A. NOPAT

B. RNOA

C. NOPM (Use total revenues for this calculation)

D. Interpret the meaning of these three amounts as it applies to Bullseye.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

51

Define accounts receivable turnover and the average collection period. What insights do these ratios offer an analysis of a company's accounts receivable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

52

Discuss when each of the following types of businesses should likely recognize revenue:

A. A large software company, such as Microsoft, when significant production, modification, or customization does not exist.

B. A clothing retailer such as Abercrombie & Fitch.

A. A large software company, such as Microsoft, when significant production, modification, or customization does not exist.

B. A clothing retailer such as Abercrombie & Fitch.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck