Deck 7: Current Liabilities and Long-Term Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/65

العب

ملء الشاشة (f)

Deck 7: Current Liabilities and Long-Term Liabilities

1

Unearned revenue, an operating liability, arises when a company receives cash before any goods are delivered or services are rendered.

True

2

Accrued liabilities are obligations for which there is no external transaction.

True

3

If accrued liabilities are overestimated in the current period, the reported income in a following period will be lower than it should be.

False

4

Contingent liabilities that are 'probable' and can be reasonably estimated are recorded on the balance sheet as a liability and as an expense in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

5

The principal and interest that will be paid on long-term debt within the next operating cycle are reported on the balance sheet as "current portion of long-term debt."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

6

Unlike stock, once sold, bonds can only be traded in private transactions between arms' length parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

7

The coupon rate of a bond typically equals the yield (market) rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

8

The gain (or loss) on the repurchase of a bond carries no economic effects, as the gain (or loss) is exactly offset by the present value of the future cash flow implications of the repurchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

9

The market rate of interest is equal to the risk-free rate plus a credit-rating premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

10

Credit ratings are an opinion of a company's relative default risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

11

The market rate of interest is equal to the risk-free rate plus a risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

12

Higher credit-rated borrowers receive lower interest rates than lower credit-rated borrowers, but the differences are typically not significant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

13

Contingent Liabilities must have the following criteria - select all that apply.

A) The obligation is certain to require payment at some point in the future.

B) The obligation will probably require payment at some point in the future.

C) The obligation is estimable.

D) The obligation will possibly require payment at some point in the future.

E) None of the above

A) The obligation is certain to require payment at some point in the future.

B) The obligation will probably require payment at some point in the future.

C) The obligation is estimable.

D) The obligation will possibly require payment at some point in the future.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which one of the following would be considered a contingent liability?

A) A company estimates that it will probably have to pay $75,000 to the EPA for a chemical spill.

B) A company owes $35,000 on inventories purchased on credit.

C) A company has access to a line of credit with a bank in the amount of $120,000.

D) A company believes that it is reasonably possible it will lose a lawsuit and damages could be $100,000.

E) None of the above

A) A company estimates that it will probably have to pay $75,000 to the EPA for a chemical spill.

B) A company owes $35,000 on inventories purchased on credit.

C) A company has access to a line of credit with a bank in the amount of $120,000.

D) A company believes that it is reasonably possible it will lose a lawsuit and damages could be $100,000.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following would not require the company to record an accrual on the balance sheet?

A) The company owes $43,000 in wages to its employees for the previous two weeks.

B) Interest will be paid when a note payable matures in the following accounting period.

C) Management believes a lawsuit against the company is meritless because they have never had a single complaint about dangerous side effects of their drug in two years.

D) The company knows that they will be fined for pollution as a result of their manufacturing process and can estimate the amount of the obligation.

E) None of the above

A) The company owes $43,000 in wages to its employees for the previous two weeks.

B) Interest will be paid when a note payable matures in the following accounting period.

C) Management believes a lawsuit against the company is meritless because they have never had a single complaint about dangerous side effects of their drug in two years.

D) The company knows that they will be fined for pollution as a result of their manufacturing process and can estimate the amount of the obligation.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

16

EZ Wheels Corporation manufactures kick scooters. The company offers a one-year warranty on all scooters. During 2017, the company recorded net sales of $1,900 million. Historically, about 4% of all sales are returned under warranty and the cost of repairing and or replacing goods under warranty is about 30% of retail value. Assume that at the start of the year EZ Wheels' balance sheet included an accrued warranty liability of $16.3 million and at the end of the year, the accrued warranty liability balance was $12.4 million.

What was EZ Wheels Corporation's warranty expense for 2017?

A) 12.4 million

B) 22.8 million

C) 76.0 million

D) 26.7 million

E) None of the above

What was EZ Wheels Corporation's warranty expense for 2017?

A) 12.4 million

B) 22.8 million

C) 76.0 million

D) 26.7 million

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

17

EZ Wheels Corporation manufactures kick scooters. The company offers a one-year warranty on all scooters. During 2017, the company recorded net sales of $1,900 million. Historically, about 4% of all sales are returned under warranty and the cost of repairing and or replacing goods under warranty is about 30% of retail value. Assume that at the start of the year EZ Wheels' balance sheet included an accrued warranty liability of $16.3 million and at the end of the year, the accrued warranty liability balance was $12.4 million.

How much did EZ Wheels pay during the year to repair and/or replace scooters under warranty?

A) 12.4 million

B) 22.8 million

C) 76.0 million

D) 26.7 million

E) None of the above

How much did EZ Wheels pay during the year to repair and/or replace scooters under warranty?

A) 12.4 million

B) 22.8 million

C) 76.0 million

D) 26.7 million

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

18

Chang, Inc. issued a 120-day note in the amount of $360,000 on 12/16/17 with an annual rate of 5%. What amount of interest has accrued as of 12/31/17?

A) $ 750.00

B) $ 725.81

C) $ 739.73

D) $6,000.00

E) $5,917.81

A) $ 750.00

B) $ 725.81

C) $ 739.73

D) $6,000.00

E) $5,917.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

19

Chang, Inc. issued a 3-month note in the amount of $360,000 on 12/01/17 with an annual rate of 5%. What amount of interest has accrued as of 12/31/17?

A) $4,438

B) $1,500

C) $ 950

D) $4,500

E) $1,479

A) $4,438

B) $1,500

C) $ 950

D) $4,500

E) $1,479

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

20

On January 1, Bloomingdale, Inc. borrows $92,000 from First Estate Bank. The loan is due in one year along with 4% interest. The company is preparing its quarterly report for March 31. Which of the following best describes the necessary accrual for interest expense?

A) $ 920 increase liabilities, increase expenses

B) $3,680 decrease liabilities, decrease cash

C) $3 680 increase expenses, decrease cash

D) $3,680 increase liabilities, decrease expenses

E) $ 920 decrease liabilities, decrease cash

A) $ 920 increase liabilities, increase expenses

B) $3,680 decrease liabilities, decrease cash

C) $3 680 increase expenses, decrease cash

D) $3,680 increase liabilities, decrease expenses

E) $ 920 decrease liabilities, decrease cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

21

Hudson Corp. sells $300,000 of bonds to private investors. The bonds have a 7% coupon rate and interest is paid semiannually. The bonds were sold to yield 10%.

What periodic interest payment does Hudson make to its investors?

A) $18,000

B) $20,000

C) $ 9,000

D) $10,500

E) None of the above

What periodic interest payment does Hudson make to its investors?

A) $18,000

B) $20,000

C) $ 9,000

D) $10,500

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

22

Pinto Corp. sells $300,000 of bonds to private investors. The bonds have a 4% coupon rate and interest is paid semiannually. The bonds were sold to yield 5%.

What periodic interest payment does Pinto make to its investors?

A) $6,000

B) $5,000

C) $2,500

D) $3,000

E) None of the above

What periodic interest payment does Pinto make to its investors?

A) $6,000

B) $5,000

C) $2,500

D) $3,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

23

Reed Corp. sells $500,000 of bonds to private investors. The bonds are due in five years, have a 6% coupon rate, and interest is paid semiannually. The bonds were sold to yield 4%.

What proceeds does Reed receive from the investors?

A) $544,913

B) $474,345

C) $526,948

D) $499,999

E) None of the above

What proceeds does Reed receive from the investors?

A) $544,913

B) $474,345

C) $526,948

D) $499,999

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

24

Reed Corp. sells $700,000 of bonds to private investors. The bonds are due in five years, have a 4% coupon rate and interest is paid semiannually. The bonds were sold to yield 6%.

What proceeds does Reed receive from the investors?

A) $600,000

B) $574,409

C) $640,289

D) $523,227

E) None of the above

What proceeds does Reed receive from the investors?

A) $600,000

B) $574,409

C) $640,289

D) $523,227

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

25

Sykora Corp. sells $450,000 of bonds to private investors. The bonds are due in 5 years, have a 6% coupon rate and interest is paid semiannually. Sykora received $490,222 for the bonds at issuance.

The effective rate on these bonds is:

A) 6%

B) 9%

C) 4%

D) 10%

E) None of the above

The effective rate on these bonds is:

A) 6%

B) 9%

C) 4%

D) 10%

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

26

Heller Company issues $950,000 of 12% bonds that pay interest semiannually and mature in 10 years.

What is the bonds' issue price assuming that the bonds' market interest rate is 10% per year?

A) $ 950,000

B) $1,068,391

C) $ 626,485

D) $1,111,758

E) None of the above

What is the bonds' issue price assuming that the bonds' market interest rate is 10% per year?

A) $ 950,000

B) $1,068,391

C) $ 626,485

D) $1,111,758

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

27

Heller Company issues $950,000 of 10% bonds that pay interest semiannually and mature in 10 years.

What is the bonds' issue price assuming that the bonds' market interest rate is 14% per year?

A) $ 748,714

B) $ 950,000

C) $ 751,788

D) $1,273,515

E) None of the above

What is the bonds' issue price assuming that the bonds' market interest rate is 14% per year?

A) $ 748,714

B) $ 950,000

C) $ 751,788

D) $1,273,515

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

28

InterTech Corporation needed financing to build a new manufacturing plant. On June 30th, 2017, InterTech issued $4,350,000 of 8-year bonds with a 6% coupon rate (payments due on December 31st and June 30th). The effective interest rate was 8%.

What amount in interest expense did InterTech record for the December 31, 2017 payment?

A) $153,725

B) $130,500

C) $156,625

D) $174,000

E) None of the above

What amount in interest expense did InterTech record for the December 31, 2017 payment?

A) $153,725

B) $130,500

C) $156,625

D) $174,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

29

InterTech Corporation needed financing to build a new manufacturing plant. On June 30th, 2017, InterTech issued $4,350,000 of 8-year bonds with a 6% coupon rate (payments due on December 31st and June 30th). The effective interest rate was 8%.

What amount in interest expense did InterTech record for the June 30, 2018 payment?

A) $130,500

B) $154,654

C) $174,000

D) $157,671

E) None of the above

What amount in interest expense did InterTech record for the June 30, 2018 payment?

A) $130,500

B) $154,654

C) $174,000

D) $157,671

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

30

Assume that in January 2017, Vivendi announced a €1.2 billion bond issuance. The bonds have a coupon rate of 6.75% payable semiannually. Assume the bonds have been assigned credit ratings of BBB (stable outlook) by Standard and Poor's, Baa2 (stable outlook) by Moody's, and BBB (stable outlook) by Fitch.

Which of the following is not true?

A) The yield on these bonds would have been lower if Standard and Poor's, Moody's, and Fitch had assigned higher credit ratings.

B) The periodic interest payment will be €40.50 million.

C) The coupon rate on these bonds would have been higher if Standard and Poor's, Moody's, and Fitch had assigned lower credit ratings.

D) The periodic interest expense will depend on the bond's yield.

E) None of the above

Which of the following is not true?

A) The yield on these bonds would have been lower if Standard and Poor's, Moody's, and Fitch had assigned higher credit ratings.

B) The periodic interest payment will be €40.50 million.

C) The coupon rate on these bonds would have been higher if Standard and Poor's, Moody's, and Fitch had assigned lower credit ratings.

D) The periodic interest expense will depend on the bond's yield.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

31

Butler, Inc. paid $75,000 to retire a note with a face value of $83,000. The note was issued with an 8% coupon rate paid semiannually. The note was three years from maturity and had a net book value of $68,200.

What is the net gain or loss on the redemption of the note?

A) $6,800 loss

B) $8,000 gain

C) $8,000 loss

D) $6,800 gain

E) None of the above

What is the net gain or loss on the redemption of the note?

A) $6,800 loss

B) $8,000 gain

C) $8,000 loss

D) $6,800 gain

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

32

Washington Inc. issued $705,000 of 6%, 20-year bonds at 98 on January 1, 2009. Through January 1, 2017, Washington amortized $8,200 of the bond discount. On January 1, 2017, Washington Inc. retired the bonds at 102 (after making the interest payment on that date).

What is the gain or loss that Washington Inc. would report for the retirement of this bond?

A) $20,000 gain

B) $14,100 loss

C) $20,000 loss

D) $14,100 gain

E) None of the above

What is the gain or loss that Washington Inc. would report for the retirement of this bond?

A) $20,000 gain

B) $14,100 loss

C) $20,000 loss

D) $14,100 gain

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

33

Credit analysis concerns which of the following?

A) The price of a company's stock

B) The ability of a company to consistently pay dividends

C) The probability a company will make timely payments

D) An assessment of a company's credit-granting policies

E) None of the above

A) The price of a company's stock

B) The ability of a company to consistently pay dividends

C) The probability a company will make timely payments

D) An assessment of a company's credit-granting policies

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following corporate debt ratings are ordered in terms of decreasing market interest rate?

A) AAA, A, BB, C

B) A, AAA, BB, C

C) BB, C, A, AAA

D) C, BB, A, AAA

E) None of the above

A) AAA, A, BB, C

B) A, AAA, BB, C

C) BB, C, A, AAA

D) C, BB, A, AAA

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following business factors does not play a role in determining a company's credit rating?

A) Industry characteristics

B) Capital structure

C) Management

D) Profitability

E) None of the above

A) Industry characteristics

B) Capital structure

C) Management

D) Profitability

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is the risk premium for a company that has a yield rate of 6.24% when the risk-free rate is 4.88%?

A) 4.88%

B) 1.36%

C) 6.24%

D) 11.12%

E) None of the above

A) 4.88%

B) 1.36%

C) 6.24%

D) 11.12%

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

37

In general, how do credit analysts determine the risk-free rate?

A) The average corporate yield

B) The yield on U.S. Government borrowings

C) The rate defined by the largest U.S. banks

D) The weighted-average corporate yield based on the preceding four quarters

E) None of the above

A) The average corporate yield

B) The yield on U.S. Government borrowings

C) The rate defined by the largest U.S. banks

D) The weighted-average corporate yield based on the preceding four quarters

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following does Moody's not consider in deriving the credit rating of a company?

A) Profitability ratios

B) Loan covenants

C) Solvency ratios

D) Collateral

E) None of the above

A) Profitability ratios

B) Loan covenants

C) Solvency ratios

D) Collateral

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

39

For each item below, identify the amount (if any) that would be reported as a liability on Nike, Inc.'s fiscal year-end balance sheet at May 31, 2017.

a. Nike, Inc. agreed to purchase materials for its new line of running shoes in June 2017.

b. Nike, Inc. signed a 60-day 8% note for $105,000 on May 12, 2017 to finance its seasonal working capital needs. Principal and interest are due on July 11, 2017.

c. Nike, Inc. owes $180,000 at year-end for inventory purchases.

d. Nike, Inc. received a $250,000 deposit from Foot Locker for an order on the new line of running shoes that will be ready for shipment in September 2017.

a. Nike, Inc. agreed to purchase materials for its new line of running shoes in June 2017.

b. Nike, Inc. signed a 60-day 8% note for $105,000 on May 12, 2017 to finance its seasonal working capital needs. Principal and interest are due on July 11, 2017.

c. Nike, Inc. owes $180,000 at year-end for inventory purchases.

d. Nike, Inc. received a $250,000 deposit from Foot Locker for an order on the new line of running shoes that will be ready for shipment in September 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

40

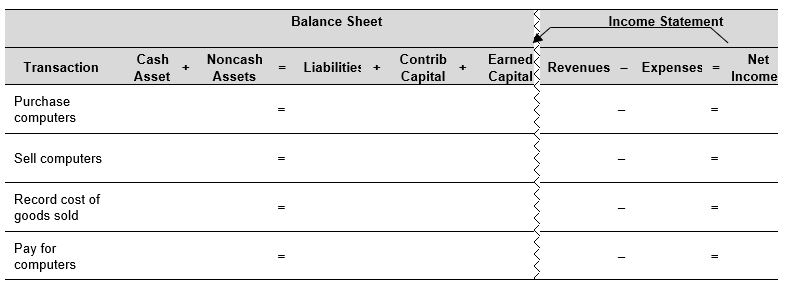

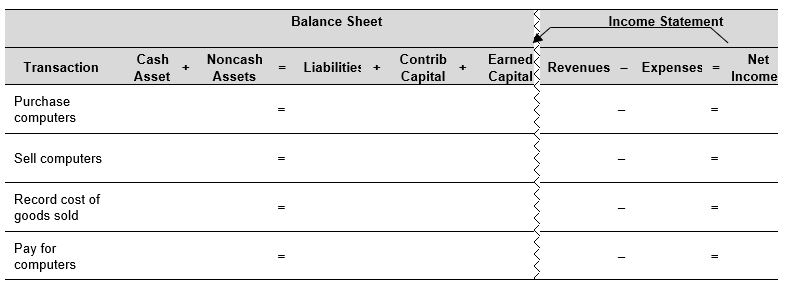

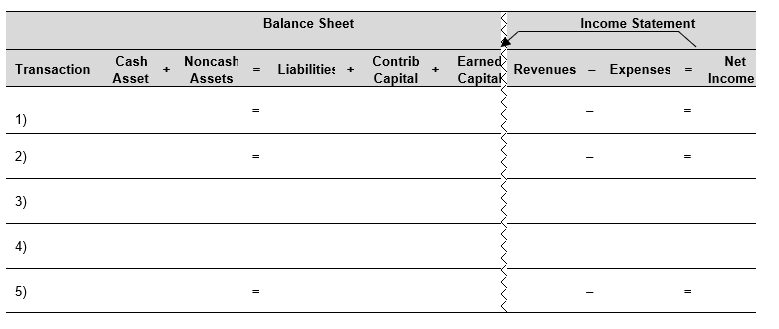

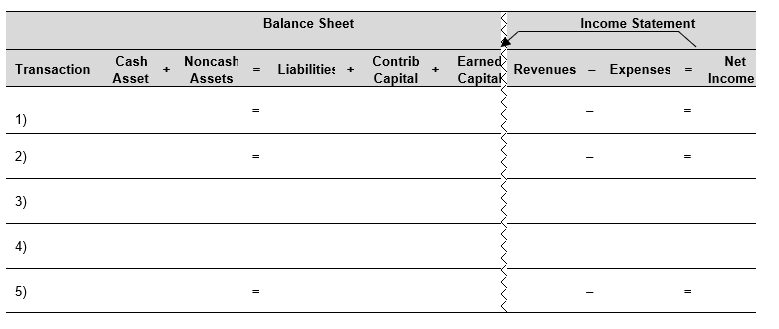

Electronics Incorporated (EI) purchased 120 computers from its supplier on credit at a cost of $500 per computer. The computers were purchased to be held for sale to customers. By the end of the month, EI had sold all 120 computers for $800 each. The store received payment for these computers but waited until the end of the month to settle its account payable with the supplier.

Use the financial statement effects template below to record these transactions.

Use the financial statement effects template below to record these transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

41

EZ Wheels Corporation manufactures kick scooters. The company offers a one-year warranty on all scooters. During 2017, the company recorded net sales of $2,800 million. Historically, about 3% of all sales are returned under warranty and the cost of repairing and or replacing goods under warranty is about 30% of retail value. Assume that at the start of the year EZ Wheels' balance sheet included an accrued warranty liability of $15.4 million and at the end of the year, the accrued warranty liability balance was $11.5 million.

a. How should EZ Wheels account for warranty claims?

b. Calculate EZ Wheels' warranty expense for 2017.

c. How much did EZ Wheels pay during the year to repair and or replace scooters under warranty?

a. How should EZ Wheels account for warranty claims?

b. Calculate EZ Wheels' warranty expense for 2017.

c. How much did EZ Wheels pay during the year to repair and or replace scooters under warranty?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

42

On July 1, 2017, Leahy Corporation took out a short-term loan of $45,000 to be repaid in one year. The annual interest rate is 4% with no interest payments due until the loan is repaid. How much interest should Leahy accrue by year-end December 31, 2017? How should it be recorded in the financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

43

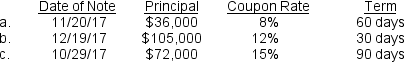

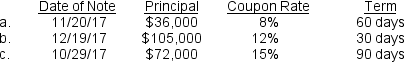

Compute the accrued interest as of December 31, 2017, on each of the following notes payable:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

44

InterTech Corporation needed financing to build a new manufacturing plant. On June 30th, 2017, InterTech issued $3,450,000 of 8-year bonds with a 6% coupon rate (payments due on December 31st and June 30th). The effective interest rate was 8%.

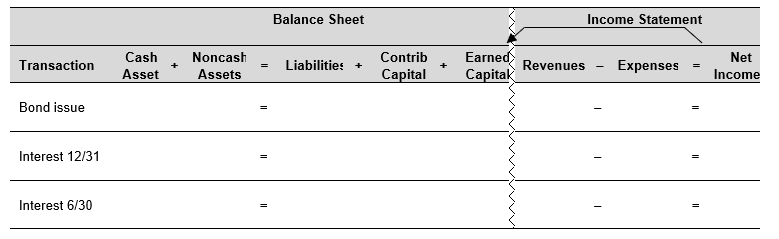

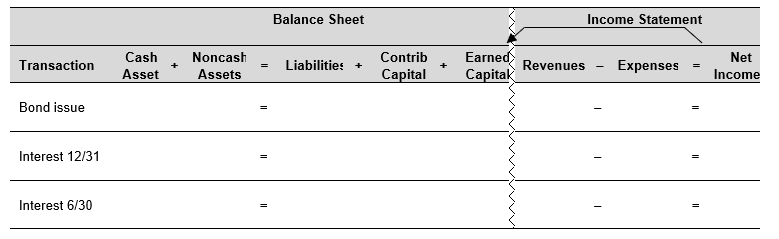

Use the financial statement effects template below to record the bond issue and InterTech's first two interest payments.

Use the financial statement effects template below to record the bond issue and InterTech's first two interest payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

45

On December 31st, 2017, Daniels Sportsplex opened for business. The company borrowed $18,000,000 at 8% and signed a 10 year note that is to be repaid in 19 equal semiannual payments of $975,000 on June 30th and December 31st, with a balloon payment at maturity. Use the financial statement effects template below to record the issuance of the note and the payments of the first four installments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

46

Walter Company issues $750,000 of 12% bonds that pay interest semiannually and mature in 10 years. Compute the bonds' issue price assuming that the bonds' market interest rate is:

a. 10% per year compounded semiannually

b. 14% per year compounded semiannually

a. 10% per year compounded semiannually

b. 14% per year compounded semiannually

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

47

Hamilton Company issues $5,250,000 in 7% bonds due in five years with semiannual interest payments. How much should Hamilton expect to receive if the market return for similar bonds is 8%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

48

Cambridge Corporation issued $1,200,000 of 7% bonds that mature in five years. Compute the bond issue price assuming that the market rate for similar bonds is:

a. 8% per year compounded annually (and interest is paid annually)

b. 10% per year compounded semi-annually (and interest is paid semi-annually)

a. 8% per year compounded annually (and interest is paid annually)

b. 10% per year compounded semi-annually (and interest is paid semi-annually)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

49

Manfred Company retired $500,000 of 5% bonds payable at 96 on June 30, 2017, two years before the bonds matured. The bond book value on June 30, 2017 is $475,000, and bond interest is paid up to the date of retirement.

What is the gain/loss on the retirement of these bonds?

What is the gain/loss on the retirement of these bonds?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

50

Mahoney, Inc. paid $66,000 to retire a note with a face value of $75,000. The note was issued with an 8% coupon rate paid semiannually. If the note was three years from maturity and had a net book value of $59,200, what is the net gain or loss on the redemption of this note?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

51

On June 30th, one year before maturity, Bava Industries retired $495,000 of 8% bonds at a cost of 96. The bond's had a net book value on June 30th of $457,500. Bond interest is presently paid up to the date of retirement.

What is the gain or loss on the retirement of these bonds?

What is the gain or loss on the retirement of these bonds?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

52

Washington Inc. issued $675,000 of 6%, 20-year bonds at 98 on January 1, 2009. Through January 1, 2017, Washington amortized $7,500 of the bond discount. On January 1, 2017, Washington Inc. retired the bonds at 103 (after making the interest payment on that date).

Calculate the net book value of the bond on January 1, 2017 and the gain or loss that Washington Inc. would report for this retirement.

Calculate the net book value of the bond on January 1, 2017 and the gain or loss that Washington Inc. would report for this retirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

53

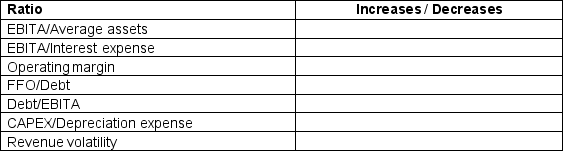

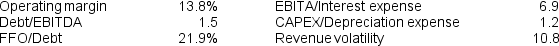

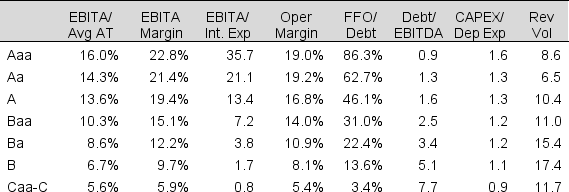

The table below shows financial ratios that Moody's uses to assess risk for corporate debt. For each ratio, indicate whether financial risk increases or decreases when the ratio is higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

54

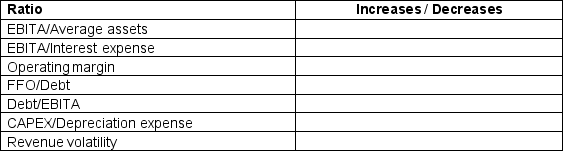

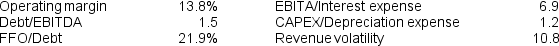

Weiss Corporation's 2017 financial statements yield the following financial ratios.

Using the partial listing of ratios utilized by Moody's Investors Services along with the median averages for the various ratings, estimate the credit rating that Moody's might assign to Weiss Corporation.

Using the partial listing of ratios utilized by Moody's Investors Services along with the median averages for the various ratings, estimate the credit rating that Moody's might assign to Weiss Corporation.

Using the partial listing of ratios utilized by Moody's Investors Services along with the median averages for the various ratings, estimate the credit rating that Moody's might assign to Weiss Corporation.

Using the partial listing of ratios utilized by Moody's Investors Services along with the median averages for the various ratings, estimate the credit rating that Moody's might assign to Weiss Corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

55

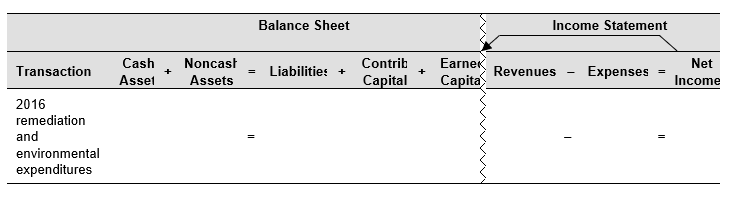

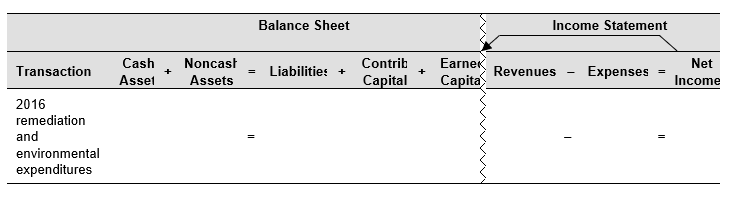

Merck & Co. included the following footnote in its 2016 Form 10-K:

Environmental Matters

The Company believes that there are no compliance issues associated with applicable environmental laws and regulations that would have a material adverse effect on the Company. The Company is also remediating environmental contamination resulting from past industrial activity at certain of its sites. Expenditures for remediation and environmental liabilities were $11 million in 2016, and are estimated at $44 million in the aggregate for the years 2017 through 2021. These amounts do not consider potential recoveries from other parties. The Company has taken an active role in identifying and accruing for these costs and in management's opinion, the liabilities for all environmental matters that are probable and reasonably estimable have been accrued and totaled $83 million and $109 million at December 31, 2016 and 2015, respectively. These liabilities are undiscounted, do not consider potential recoveries from other parties and will be paid out over the periods of remediation for the applicable sites, which are expected to occur primarily over the next 15 years. Although it is not possible to predict with certainty the outcome of these matters, or the ultimate costs of remediation, management does not believe that any reasonably possible expenditures that may be incurred in excess of the liabilities accrued should exceed $64 million in the aggregate. Management also does not believe that these expenditures should result in a material adverse effect on the Company's financial position, results of operations, liquidity, or capital resources for any year.

Required:

a. How does Merck account for environmental liabilities that are probable and reasonably estimable? At December 31, 2016, how much were these liabilities?

b. How does Merck account for environmental liabilities that are reasonably possible? At December 31, 2016, how much were these liabilities?

c. The footnote mentions $83 million and $44 million as estimated future expenditures. Explain what each of these amounts represents and why they differ.

d. Use the financial statement effects template below, to record Merck's 2016 remediation and environmental expenditures, assuming that the liability had already been accrued on Merck's books.

Environmental Matters

The Company believes that there are no compliance issues associated with applicable environmental laws and regulations that would have a material adverse effect on the Company. The Company is also remediating environmental contamination resulting from past industrial activity at certain of its sites. Expenditures for remediation and environmental liabilities were $11 million in 2016, and are estimated at $44 million in the aggregate for the years 2017 through 2021. These amounts do not consider potential recoveries from other parties. The Company has taken an active role in identifying and accruing for these costs and in management's opinion, the liabilities for all environmental matters that are probable and reasonably estimable have been accrued and totaled $83 million and $109 million at December 31, 2016 and 2015, respectively. These liabilities are undiscounted, do not consider potential recoveries from other parties and will be paid out over the periods of remediation for the applicable sites, which are expected to occur primarily over the next 15 years. Although it is not possible to predict with certainty the outcome of these matters, or the ultimate costs of remediation, management does not believe that any reasonably possible expenditures that may be incurred in excess of the liabilities accrued should exceed $64 million in the aggregate. Management also does not believe that these expenditures should result in a material adverse effect on the Company's financial position, results of operations, liquidity, or capital resources for any year.

Required:

a. How does Merck account for environmental liabilities that are probable and reasonably estimable? At December 31, 2016, how much were these liabilities?

b. How does Merck account for environmental liabilities that are reasonably possible? At December 31, 2016, how much were these liabilities?

c. The footnote mentions $83 million and $44 million as estimated future expenditures. Explain what each of these amounts represents and why they differ.

d. Use the financial statement effects template below, to record Merck's 2016 remediation and environmental expenditures, assuming that the liability had already been accrued on Merck's books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

56

Following is a footnote for Abbott Laboratories 2016 annual report (in millions):

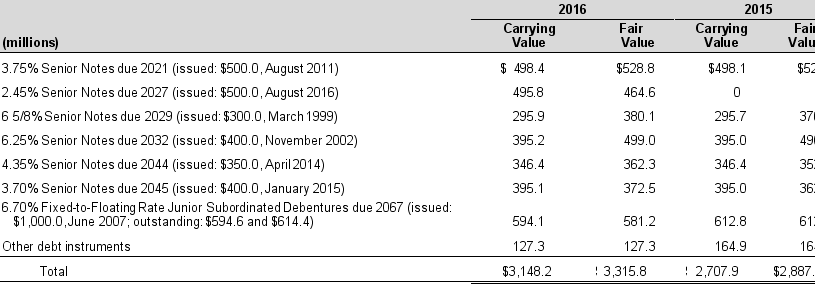

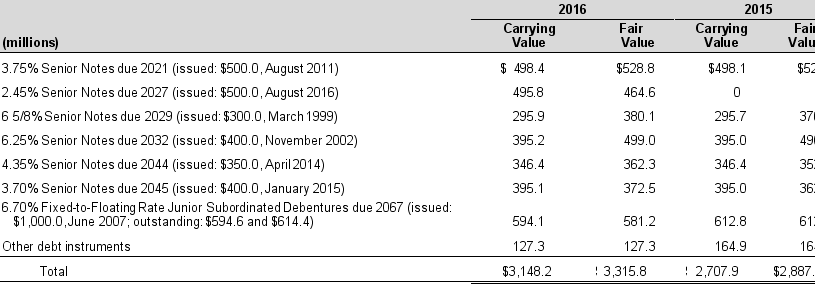

The following is a summary of long-term debt at December 31:

In November 2016, Abbott issued $15.1 billion of medium and long-term debt to primarily fund the cash portion of the acquisition of St. Jude Medical. Abbott issued $2.85 billion of 2.35% Senior Notes due November 22, 2019; $2.85 billion of 2.90% Senior Notes due November 30, 2021; $1.50 billion of 3.40% Senior Notes due November 30, 2023; $3.00 billion of 3.75% Senior Notes due November 30, 2026; $1.65 billion of 4.75% Senior Notes due November 30, 2036; and $3.25 billion of 4.90% Senior Notes due November 30, 2046. In November 2016, Abbott also entered into interest rate swap contracts totaling $3.0 billion related to the new debt, which have the effect of changing Abbott's obligation from a fixed interest rate to a variable interest rate obligation on the related debt instruments.

In November 2016, Abbott issued $15.1 billion of medium and long-term debt to primarily fund the cash portion of the acquisition of St. Jude Medical. Abbott issued $2.85 billion of 2.35% Senior Notes due November 22, 2019; $2.85 billion of 2.90% Senior Notes due November 30, 2021; $1.50 billion of 3.40% Senior Notes due November 30, 2023; $3.00 billion of 3.75% Senior Notes due November 30, 2026; $1.65 billion of 4.75% Senior Notes due November 30, 2036; and $3.25 billion of 4.90% Senior Notes due November 30, 2046. In November 2016, Abbott also entered into interest rate swap contracts totaling $3.0 billion related to the new debt, which have the effect of changing Abbott's obligation from a fixed interest rate to a variable interest rate obligation on the related debt instruments.

Principal payments required on long-term debt outstanding at December 31, 2016 are $3 million in 2017, $2 million in 2018, $3.8 billion in 2019, $1.3 billion in 2020, $2.9 billion in 2021 and $12.9 billion in 2022 and thereafter.

At December 31, 2016, Abbott's long-term debt rating was A+ by Standard & Poor's Corporation and A2 by Moody's Investors Service. In conjunction with the completion of the St. Jude Medical acquisition on January 4, 2017, the ratings were adjusted to BBB by Standard & Poor's Corporation and Baa3 by Moody's Investors Service. Abbott has readily available financial resources, including unused lines of credit of $5.0 billion which expire in 2019 and that support commercial paper borrowing arrangements. Abbott's weighted-average interest rate on short-term borrowings was 0.6% at December 31, 2016 and 0.2% at December 31, 2015 and 2014.

Required:

a. What proportion of long-term debt will Abbott Labs repay in 2017?

b. How much does the company owe under the line of credit at year end? Why does Abbott Labs discuss this in its debt footnote?

c. How did the acquisition of St. Jude Medical impact Abbott Labs' default risk?

The following is a summary of long-term debt at December 31:

In November 2016, Abbott issued $15.1 billion of medium and long-term debt to primarily fund the cash portion of the acquisition of St. Jude Medical. Abbott issued $2.85 billion of 2.35% Senior Notes due November 22, 2019; $2.85 billion of 2.90% Senior Notes due November 30, 2021; $1.50 billion of 3.40% Senior Notes due November 30, 2023; $3.00 billion of 3.75% Senior Notes due November 30, 2026; $1.65 billion of 4.75% Senior Notes due November 30, 2036; and $3.25 billion of 4.90% Senior Notes due November 30, 2046. In November 2016, Abbott also entered into interest rate swap contracts totaling $3.0 billion related to the new debt, which have the effect of changing Abbott's obligation from a fixed interest rate to a variable interest rate obligation on the related debt instruments.

In November 2016, Abbott issued $15.1 billion of medium and long-term debt to primarily fund the cash portion of the acquisition of St. Jude Medical. Abbott issued $2.85 billion of 2.35% Senior Notes due November 22, 2019; $2.85 billion of 2.90% Senior Notes due November 30, 2021; $1.50 billion of 3.40% Senior Notes due November 30, 2023; $3.00 billion of 3.75% Senior Notes due November 30, 2026; $1.65 billion of 4.75% Senior Notes due November 30, 2036; and $3.25 billion of 4.90% Senior Notes due November 30, 2046. In November 2016, Abbott also entered into interest rate swap contracts totaling $3.0 billion related to the new debt, which have the effect of changing Abbott's obligation from a fixed interest rate to a variable interest rate obligation on the related debt instruments.Principal payments required on long-term debt outstanding at December 31, 2016 are $3 million in 2017, $2 million in 2018, $3.8 billion in 2019, $1.3 billion in 2020, $2.9 billion in 2021 and $12.9 billion in 2022 and thereafter.

At December 31, 2016, Abbott's long-term debt rating was A+ by Standard & Poor's Corporation and A2 by Moody's Investors Service. In conjunction with the completion of the St. Jude Medical acquisition on January 4, 2017, the ratings were adjusted to BBB by Standard & Poor's Corporation and Baa3 by Moody's Investors Service. Abbott has readily available financial resources, including unused lines of credit of $5.0 billion which expire in 2019 and that support commercial paper borrowing arrangements. Abbott's weighted-average interest rate on short-term borrowings was 0.6% at December 31, 2016 and 0.2% at December 31, 2015 and 2014.

Required:

a. What proportion of long-term debt will Abbott Labs repay in 2017?

b. How much does the company owe under the line of credit at year end? Why does Abbott Labs discuss this in its debt footnote?

c. How did the acquisition of St. Jude Medical impact Abbott Labs' default risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Progressive Corporation (a property and casualty insurance company) reported the following in its 2016 annual report:

*For purposes of this exercise, assume the entire debt amount is long-term.

*For purposes of this exercise, assume the entire debt amount is long-term.

Required:

a. Explain in layman's terms the liabilities labeled "Unearned premiums" and "Loss reserves."

b. What percentage of Progressive's total liabilities relates to current operating liabilities for 2016? Do you believe that this number is higher than most companies or lower? Why?

c. Which current liability reported by Progressive is the least reliably measured - that is, the most subjective? Explain.

*For purposes of this exercise, assume the entire debt amount is long-term.

*For purposes of this exercise, assume the entire debt amount is long-term.Required:

a. Explain in layman's terms the liabilities labeled "Unearned premiums" and "Loss reserves."

b. What percentage of Progressive's total liabilities relates to current operating liabilities for 2016? Do you believe that this number is higher than most companies or lower? Why?

c. Which current liability reported by Progressive is the least reliably measured - that is, the most subjective? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

58

Progressive Corporation (a property and casualty insurance company) reported the following in its 2016 annual report:

During 2016, we renewed the unsecured, discretionary line of credit (the "Line of Credit") with PNC Bank, National Association (PNC) in the maximum principal amount of $100 million. The prior line of credit, entered into in March 2015, had expired. The Line of Credit is on substantially the same terms and conditions as the prior line of credit. Subject to the terms and conditions of the Line of Credit documents, advances under the Line of Credit (if any) will bear interest at a variable rate equal to the higher of PNC's Prime Rate or the sum of the Federal Funds Open Rate plus 50 basis points. Each advance must be repaid on the 30th day after the advance or, if earlier, on April 30, 2017, the expiration date of the Line of Credit. Prepayments are permitted without penalty. All advances under the Line of Credit are subject to PNC's discretion. We had no borrowings under the Line of Credit or the prior line of credit in 2016 or 2015.

During 2016, we renewed the unsecured, discretionary line of credit (the "Line of Credit") with PNC Bank, National Association (PNC) in the maximum principal amount of $100 million. The prior line of credit, entered into in March 2015, had expired. The Line of Credit is on substantially the same terms and conditions as the prior line of credit. Subject to the terms and conditions of the Line of Credit documents, advances under the Line of Credit (if any) will bear interest at a variable rate equal to the higher of PNC's Prime Rate or the sum of the Federal Funds Open Rate plus 50 basis points. Each advance must be repaid on the 30th day after the advance or, if earlier, on April 30, 2017, the expiration date of the Line of Credit. Prepayments are permitted without penalty. All advances under the Line of Credit are subject to PNC's discretion. We had no borrowings under the Line of Credit or the prior line of credit in 2016 or 2015.

Aggregate principal payments on debt outstanding at December 31, 2016, is as follows:

Continued next page

Continued next page

Required:

a. What amount does Progressive report for long-term debt on its balance sheet?

b. Why is there a difference between the fair value and the carrying value of Progressive's long-term debt?

c. Were the 3.75% notes originally issued at par, at a discount or at a premium? How do you know?

d. What is the amount of the unamortized discount on the 6.25% notes as of December 31, 2016?

e. What cash interest payment did Progressive make for the 6 5/8 notes in 2016? What interest expense did Progressive record for these notes during 2016? Assume for this question that Progressive pays interest annually.

f. If Progressive were to repurchase all of its bonds on January 1, 2017, how would the income statement be affected?

g. How much does the company owe under the line of credit with PNC Bank at year end? Why does Progressive discuss this in its debt footnote?

h. What does the footnote reveal about timing of debt due in 2017 and thereafter?

During 2016, we renewed the unsecured, discretionary line of credit (the "Line of Credit") with PNC Bank, National Association (PNC) in the maximum principal amount of $100 million. The prior line of credit, entered into in March 2015, had expired. The Line of Credit is on substantially the same terms and conditions as the prior line of credit. Subject to the terms and conditions of the Line of Credit documents, advances under the Line of Credit (if any) will bear interest at a variable rate equal to the higher of PNC's Prime Rate or the sum of the Federal Funds Open Rate plus 50 basis points. Each advance must be repaid on the 30th day after the advance or, if earlier, on April 30, 2017, the expiration date of the Line of Credit. Prepayments are permitted without penalty. All advances under the Line of Credit are subject to PNC's discretion. We had no borrowings under the Line of Credit or the prior line of credit in 2016 or 2015.

During 2016, we renewed the unsecured, discretionary line of credit (the "Line of Credit") with PNC Bank, National Association (PNC) in the maximum principal amount of $100 million. The prior line of credit, entered into in March 2015, had expired. The Line of Credit is on substantially the same terms and conditions as the prior line of credit. Subject to the terms and conditions of the Line of Credit documents, advances under the Line of Credit (if any) will bear interest at a variable rate equal to the higher of PNC's Prime Rate or the sum of the Federal Funds Open Rate plus 50 basis points. Each advance must be repaid on the 30th day after the advance or, if earlier, on April 30, 2017, the expiration date of the Line of Credit. Prepayments are permitted without penalty. All advances under the Line of Credit are subject to PNC's discretion. We had no borrowings under the Line of Credit or the prior line of credit in 2016 or 2015.Aggregate principal payments on debt outstanding at December 31, 2016, is as follows:

Continued next page

Continued next pageRequired:

a. What amount does Progressive report for long-term debt on its balance sheet?

b. Why is there a difference between the fair value and the carrying value of Progressive's long-term debt?

c. Were the 3.75% notes originally issued at par, at a discount or at a premium? How do you know?

d. What is the amount of the unamortized discount on the 6.25% notes as of December 31, 2016?

e. What cash interest payment did Progressive make for the 6 5/8 notes in 2016? What interest expense did Progressive record for these notes during 2016? Assume for this question that Progressive pays interest annually.

f. If Progressive were to repurchase all of its bonds on January 1, 2017, how would the income statement be affected?

g. How much does the company owe under the line of credit with PNC Bank at year end? Why does Progressive discuss this in its debt footnote?

h. What does the footnote reveal about timing of debt due in 2017 and thereafter?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

59

Gold Enterprises recently issued $40 million of 12% coupon bonds, payable semiannually, which mature in 10 years. The bonds were sold for $37,796,299 to yield a 13% annual rate.

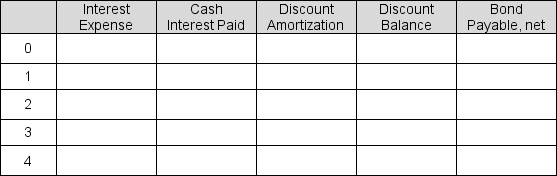

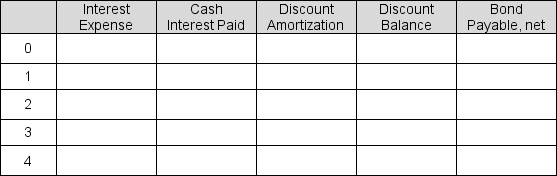

Use the table below to show the amortization of the discount, interest expense, and the carrying amount of the bonds from issuance till the end of Period 4.

Use the table below to show the amortization of the discount, interest expense, and the carrying amount of the bonds from issuance till the end of Period 4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

60

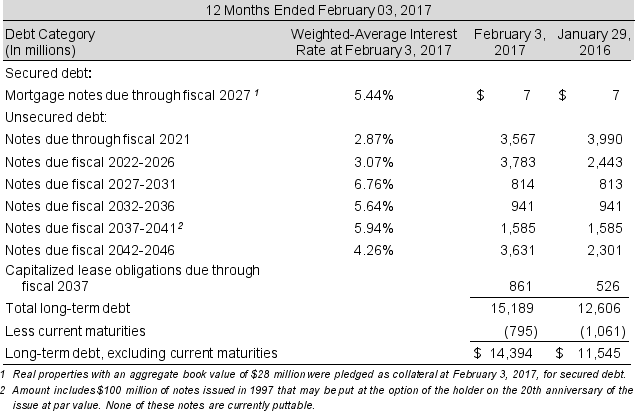

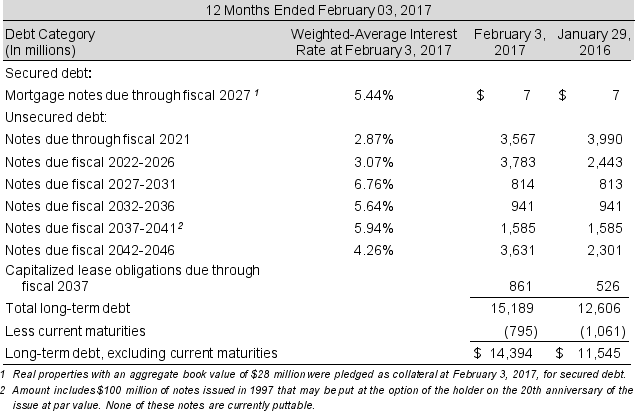

Following is the debt footnote from the Lowe's 2017 form 10-K:

Required:

Required:

a. What is the amount of debt on Lowe's balance sheet as of February 3, 2017?

b. What proportion of Lowe's long-term debt is due before February 2, 2018?

c. How much of Lowe's assets were pledged as collateral as of February 3, 2017?

d. What effect, if any, does Lowe's collateral have on its credit risk and interest costs?

e. Assume that the notes due fiscal 2042-2046 outstanding at the beginning of the year were 4.26% notes issued to yield 4.4%. At the beginning of the year, these notes had an unamortized discount of $132 million. What cash interest payment did Lowe's make for these notes, assuming interest is paid annually? What interest expense did Lowe's record for these notes during the current year?

Required:

Required: a. What is the amount of debt on Lowe's balance sheet as of February 3, 2017?

b. What proportion of Lowe's long-term debt is due before February 2, 2018?

c. How much of Lowe's assets were pledged as collateral as of February 3, 2017?

d. What effect, if any, does Lowe's collateral have on its credit risk and interest costs?

e. Assume that the notes due fiscal 2042-2046 outstanding at the beginning of the year were 4.26% notes issued to yield 4.4%. At the beginning of the year, these notes had an unamortized discount of $132 million. What cash interest payment did Lowe's make for these notes, assuming interest is paid annually? What interest expense did Lowe's record for these notes during the current year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

61

Progressive Corp. (a property and casualty insurance company) reported "Loss and loss adjustment expense reserves" (an operating liability) of $11,368.0 million its 2016 Form 10-K. What is the allowance for loan and lease losses? How could Progressive's managers use the reserve to manage income? Provide a numerical example of the income statement effect of this sort of earnings management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

62

What determines the effective cost of debt?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

63

What is the difference between the reported gain (loss) on debt repurchase and the economic gain (loss) on the repurchase? How should such gains / losses be analyzed? Why are current values not reflected on a company's balance sheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

64

What are some ratios used by Moody's to measure default risk? What are some other relevant (non-ratio) factors used to determine debt ratings?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

65

Define bond default. What are some potential ramifications if a company defaults on its debt?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck