Deck 4: Analyzing and Interpreting Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 4: Analyzing and Interpreting Financial Statements

1

Highly leveraged firms have higher RNOA than firms with lower leverage.

False

2

Repurchasing shares near year-end will increase a firm's return on equity (ROE).

True

3

All else equal, when investors consider a firm's return on equity (ROE) they consider less risky a firm that earns proportionately more of that return from operating activities as opposed to nonoperating activities.

True

4

To determine tax on net operating profit, we begin with total tax expense and deduct taxes related to net nonoperating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

Increasing a company's net operating asset turnover (NOAT) increases both RNOA and ROE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

If Company A has a higher net operating profit margin (NOPM) than Company B, then Company A's RNOA will be higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

Net operating asset turnover (NOAT) measures a company's profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

ROE can be disaggregated into operating and nonoperating returns. Nonoperating return will be positive as long as Spread is positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

A current ratio greater than 1.0 is generally desirable for a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

The only difference between return on assets (ROA) and return on net operating assets (RNOA) is that the denominator in RNOA is typically smaller than the denominator in ROA because the former is net of operating liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

The DuPont analysis disaggregates return on equity into profitability, productivity, and leverage components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

ROE is computed as:

A) Net income attributable to controlling interest / Average equity attributable to controlling interest

B) Net income attributable to controlling interest / Net sales

C) [RNOA + (FLEV × Spread)] x NCI ratio

D) A and B

E) A and C

A) Net income attributable to controlling interest / Average equity attributable to controlling interest

B) Net income attributable to controlling interest / Net sales

C) [RNOA + (FLEV × Spread)] x NCI ratio

D) A and B

E) A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

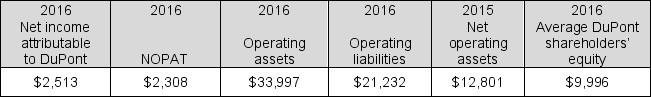

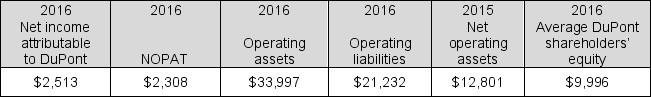

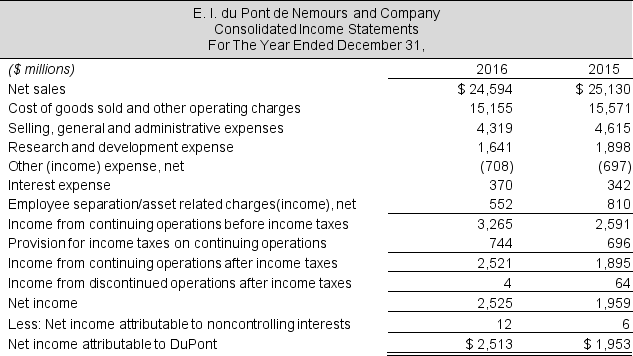

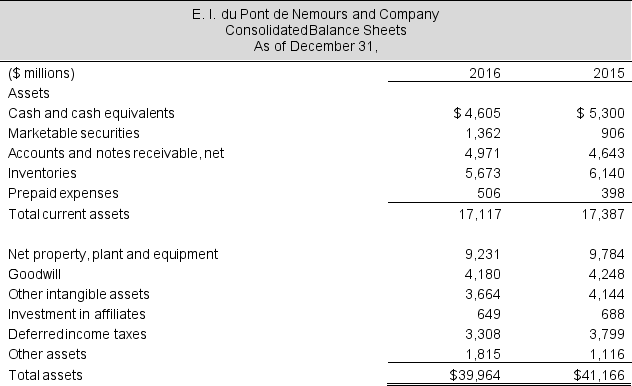

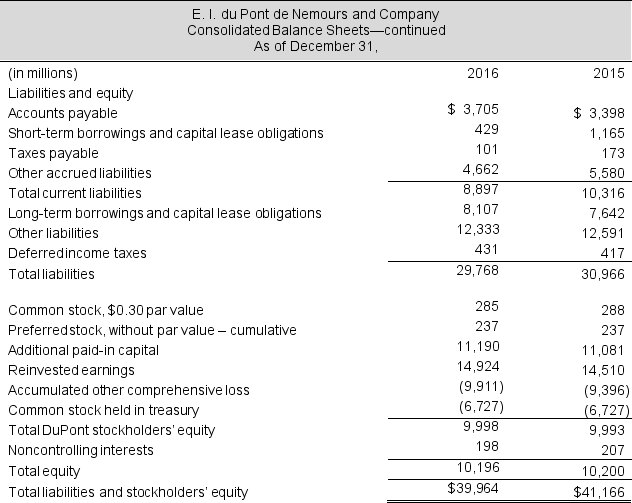

The 2016 balance sheet of E.I. du Pont de Nemours and Company shows average DuPont shareholders' equity attributable to controlling interest of $9,996 million, net operating profit after tax of $2,308 million, net income attributable to DuPont of $2,513 million, and common shares issued of 950.044 million.

Assume the company has no preferred shares issued. DuPont's return on equity (ROE) for the year is:

A) 30.7%

B) 37.6%

C) 25.1%

D) 36.4%

E) There is not enough information to calculate the ratio.

Assume the company has no preferred shares issued. DuPont's return on equity (ROE) for the year is:

A) 30.7%

B) 37.6%

C) 25.1%

D) 36.4%

E) There is not enough information to calculate the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

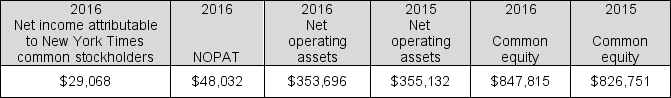

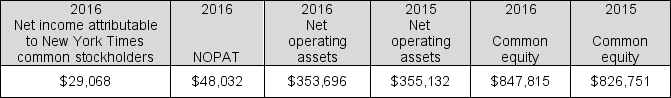

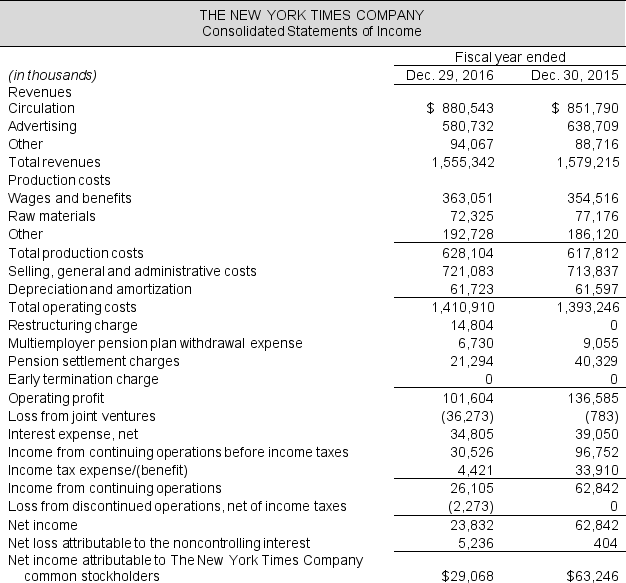

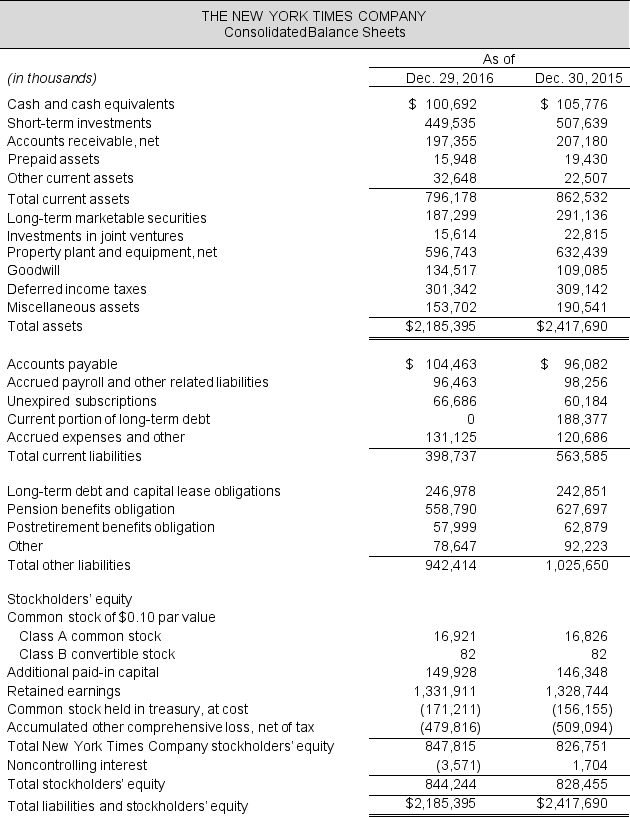

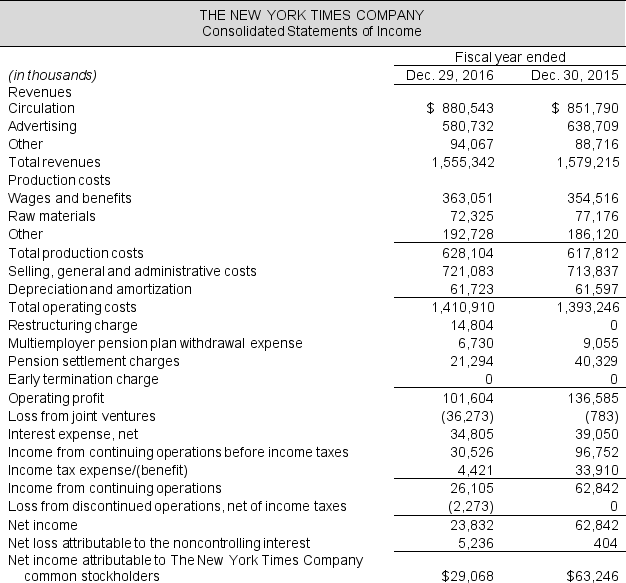

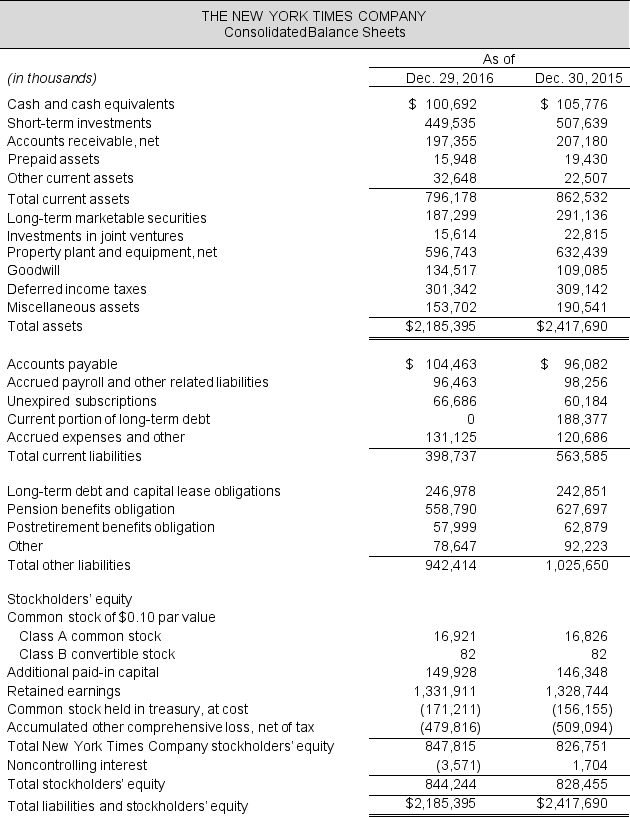

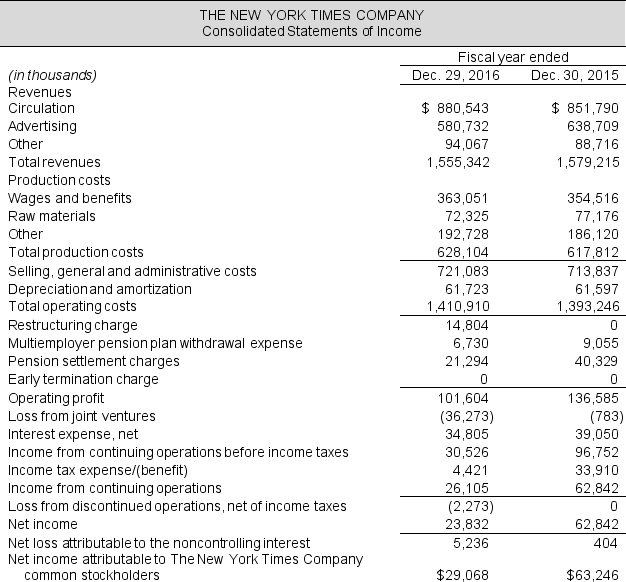

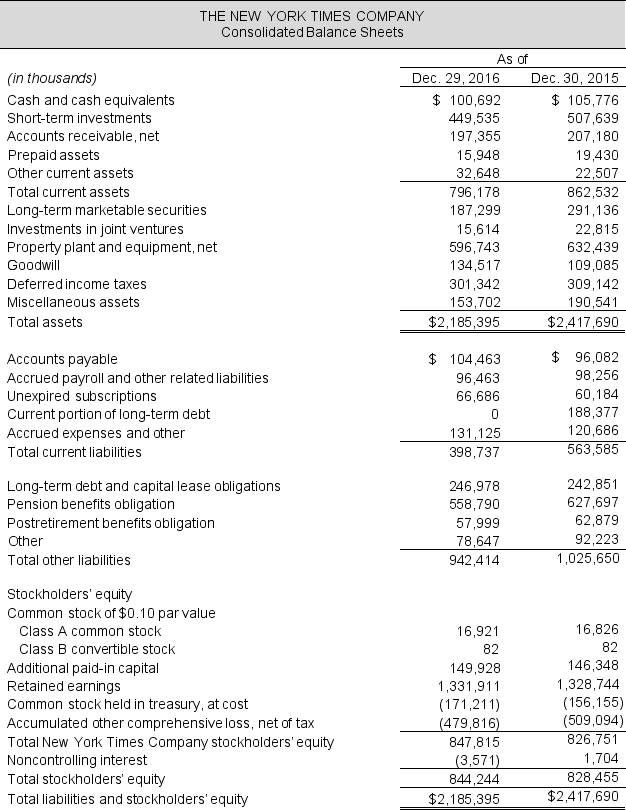

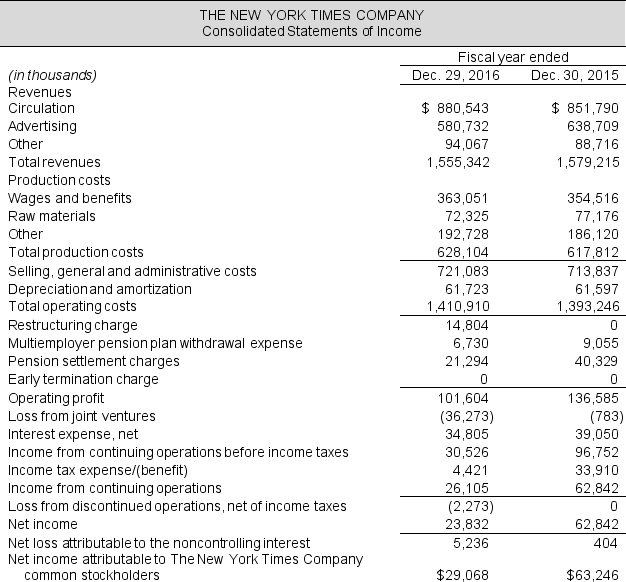

The 2016 financial statements of The New York Times Company reveal average shareholders' equity attributable to controlling interest of $837,283 thousand, net operating profit after tax of $48,032 thousand, net income attributable to The New York Times Company of $29,068 thousand, and average net operating assets of $354,414 thousand.

The company's return on equity (ROE) for the year is:

A) 3.5%

B) 13.8%

C) 6.9%

D) 14.3%

E) There is not enough information to calculate the ratio.

The company's return on equity (ROE) for the year is:

A) 3.5%

B) 13.8%

C) 6.9%

D) 14.3%

E) There is not enough information to calculate the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

The 2017 balance sheet of Staples, Inc. shows total assets of $8,271 million, operating assets of $6,566 million, operating liabilities of $3,527 million, and shareholders' equity of $3,688 million.

Staples' 2017 net operating assets are:

A) $11,798 million

B) $ 6,566 million

C) $ 4,744 million

D) $ 3,039 million

E) None of the above

Staples' 2017 net operating assets are:

A) $11,798 million

B) $ 6,566 million

C) $ 4,744 million

D) $ 3,039 million

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

The 2016 balance sheet of Whole Foods Market reports operating assets of $5,489 million, operating liabilities of $2,066 million, and total liabilities of $3,117 million.

Whole Food's average net operating assets are:

A) $3,423 million

B) $2,372 million

C) $3,562 million

D) $2,510 million

E) There is not enough information to calculate the amount.

Whole Food's average net operating assets are:

A) $3,423 million

B) $2,372 million

C) $3,562 million

D) $2,510 million

E) There is not enough information to calculate the amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

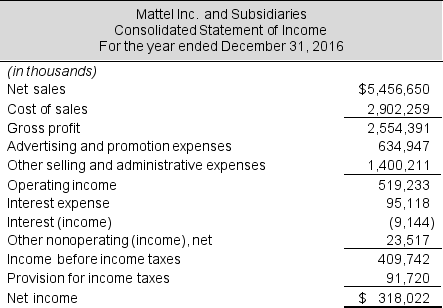

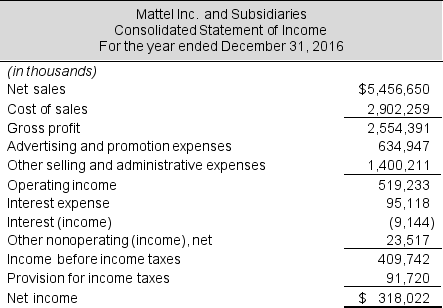

Mattel Inc.'s 2016 financial statements show operating profit before interest and tax of $519,233 thousand, net income of $318,022 thousand, provision for income taxes of $91,720 thousand and net nonoperating expense before tax of $109,491 thousand.

Assume Mattel's statutory tax rate for 2016 is 37%. Mattel's 2016 tax shield is:

A) $ 68,979 thousand

B) $ 40,512 thousand

C) $ 277,510 thousand

D) $ 186,460 thousand

E) None of the above

Assume Mattel's statutory tax rate for 2016 is 37%. Mattel's 2016 tax shield is:

A) $ 68,979 thousand

B) $ 40,512 thousand

C) $ 277,510 thousand

D) $ 186,460 thousand

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

Mattel Inc.'s 2016 financial statements show operating profit before interest and tax of $519,233 thousand, net income of $318,022 thousand, provision for income taxes of $91,720 thousand and net nonoperating expense before tax of $109,491 thousand. Assume Mattel's statutory tax rate for 2016 is 37%.

Mattel's 2016 effective tax rate is:

A) 22.4%

B) 37.0%

C) 19.4%

D) 17.7%

E) None of the above

Mattel's 2016 effective tax rate is:

A) 22.4%

B) 37.0%

C) 19.4%

D) 17.7%

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

Net operating profit after tax (NOPAT) includes operating revenues less expenses such as:

A) Cost of goods sold (COGS)

B) Taxes on operating income

C) Selling, general and administrative expenses (SG&A)

D) After-tax earnings from investments and interest expenses

E) All of the above

F) A, B and C only

A) Cost of goods sold (COGS)

B) Taxes on operating income

C) Selling, general and administrative expenses (SG&A)

D) After-tax earnings from investments and interest expenses

E) All of the above

F) A, B and C only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

The 2016 financial statements of The New York Times Company reveal average shareholders' equity attributable to controlling interest of $837,283 thousand, net operating profit after tax of $48,032 thousand, net income attributable to The New York Times Company of $29,068 thousand, and average net operating assets of $354,414 thousand.

The company's return on net operating assets (RNOA) for the year is:

A) 3.5%

B) 6.9%

C) 13.6%

D) 18.7%

E) There is not enough information to calculate the ratio.

The company's return on net operating assets (RNOA) for the year is:

A) 3.5%

B) 6.9%

C) 13.6%

D) 18.7%

E) There is not enough information to calculate the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

The fiscal 2016 financial statements of Nike Inc. shows net operating profit margin (NOPM) of 11.4%, net operating asset turnover (NOAT) of 3.83, return on equity of 30.1%, and adjusted return on assets of 17.1%.

What is the company's nonoperating return?

A) (13.6)%

B) 18.7%

C) (14.5)%

D) 35.4%

E) There is not enough information to calculate the ratio.

What is the company's nonoperating return?

A) (13.6)%

B) 18.7%

C) (14.5)%

D) 35.4%

E) There is not enough information to calculate the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

The 2016 balance sheet of The New York Times Company shows net operating profit margin (NOPM) of 3.1%, net operating asset turnover (NOAT) of 4.39, return on equity of 3.5%, and adjusted return on assets of 2.2%.

What is the company's nonoperating return?

A) (24.0)%

B) 7.9%

C) (1.1)%

D) (10.1)%

E) None of the above

What is the company's nonoperating return?

A) (24.0)%

B) 7.9%

C) (1.1)%

D) (10.1)%

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

The fiscal year-end 2016 financial statements for Walt Disney Co. report revenues of $55,632 million, net operating profit after tax of $9,954 million, net operating assets of $58,603 million. The fiscal year-end 2015 balance sheet reports net operating assets of $59,079 million.

Walt Disney's 2016 net operating profit margin is:

A) 16.9%

B) 12.5%

C) 17.9%

D) 11.7%

E) There is not enough information to calculate the ratio.

Walt Disney's 2016 net operating profit margin is:

A) 16.9%

B) 12.5%

C) 17.9%

D) 11.7%

E) There is not enough information to calculate the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

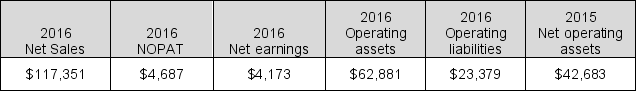

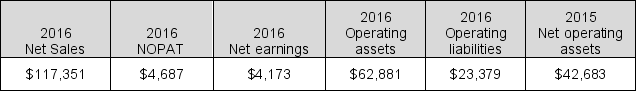

The fiscal 2016 financial statements for Walgreens Boots Alliance, Inc., report net sales of $117,351 million, net operating profit after tax of $4,687 million, net operating assets of $39,502 million. The 2015 balance sheet reports net operating assets of $42,683 million.

Walgreen's 2016 net operating asset turnover is:

A) 11.5%

B) 2.86

C) 13.3%

D) 2.97

E) There is not enough information to calculate the ratio.

Walgreen's 2016 net operating asset turnover is:

A) 11.5%

B) 2.86

C) 13.3%

D) 2.97

E) There is not enough information to calculate the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

Kroger's 2016 financial statements show net operating profit after tax of $2,286 million, net income of $1,975 million, sales of $115,337 million, and average net operating assets of $18,616 million.

Kroger's net operating asset turnover for the year is:

A) 12.3%

B) 8.11

C) 6.20

D) 10.9%

E) There is not enough information to calculate the ratio.

Kroger's net operating asset turnover for the year is:

A) 12.3%

B) 8.11

C) 6.20

D) 10.9%

E) There is not enough information to calculate the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

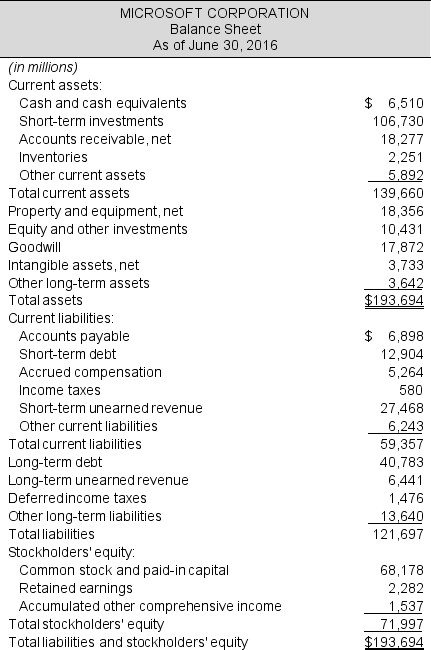

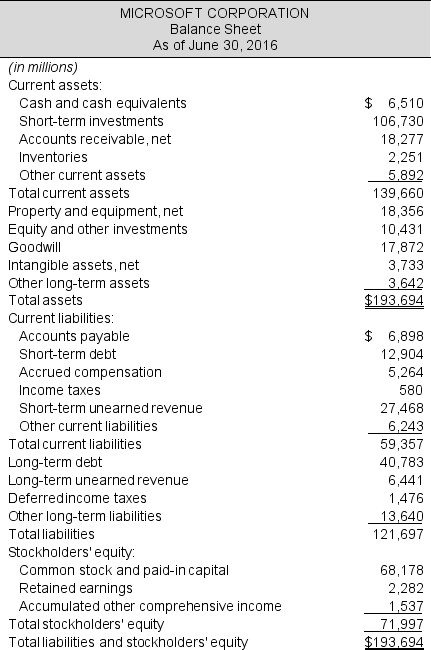

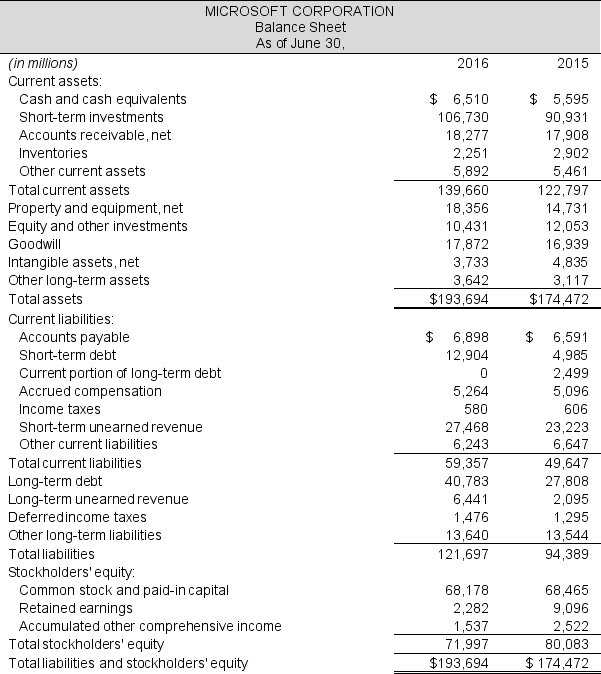

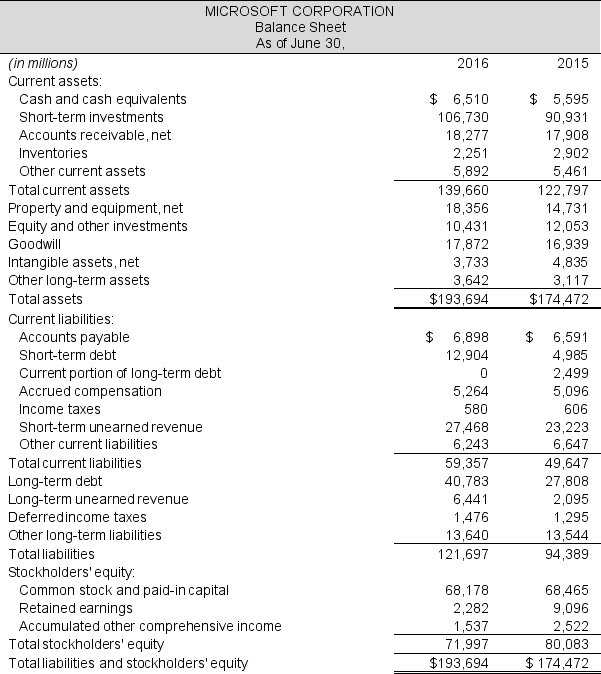

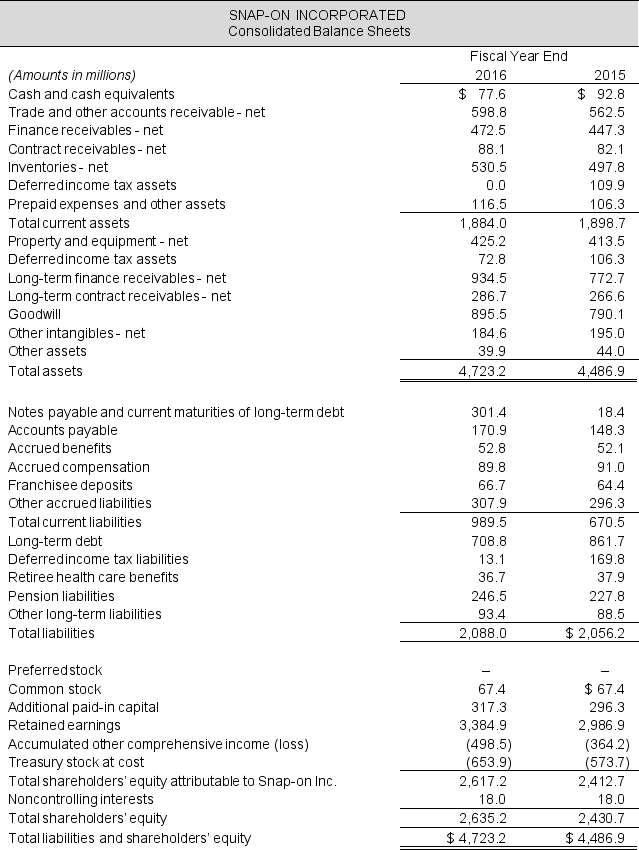

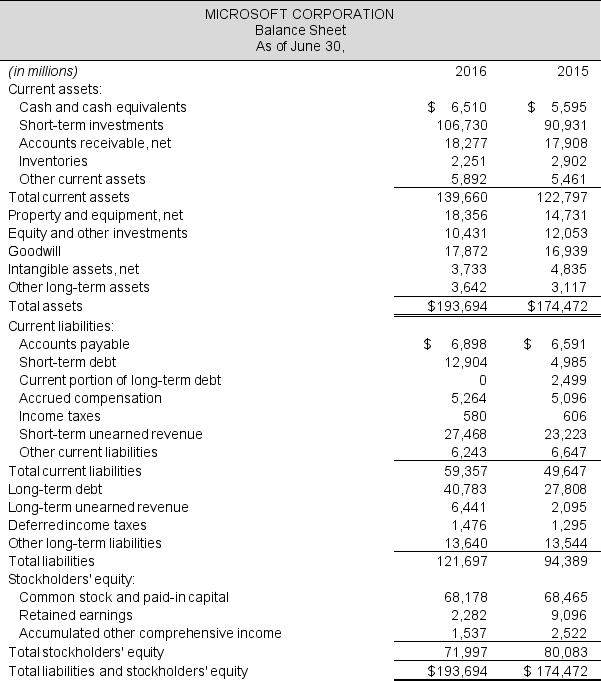

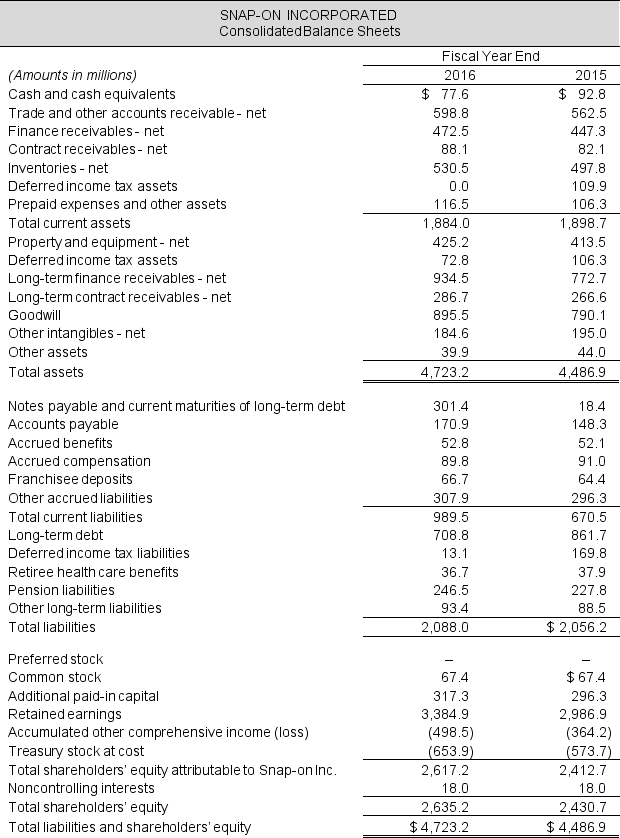

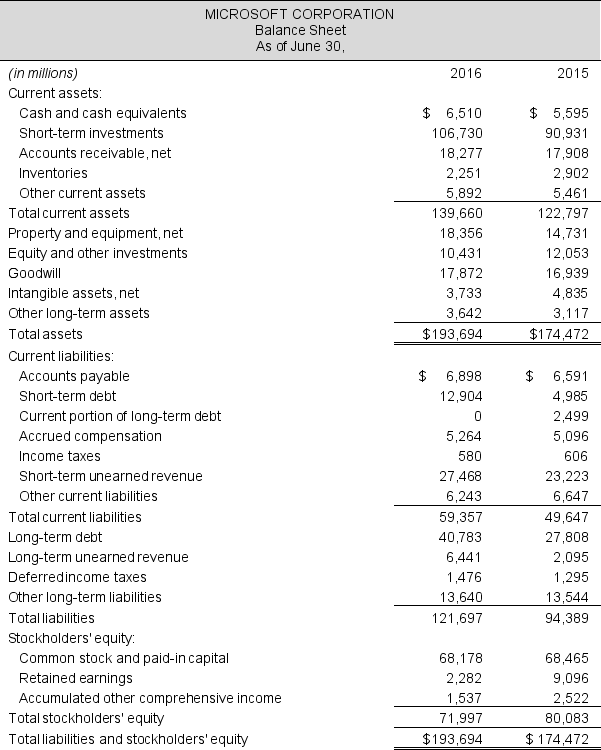

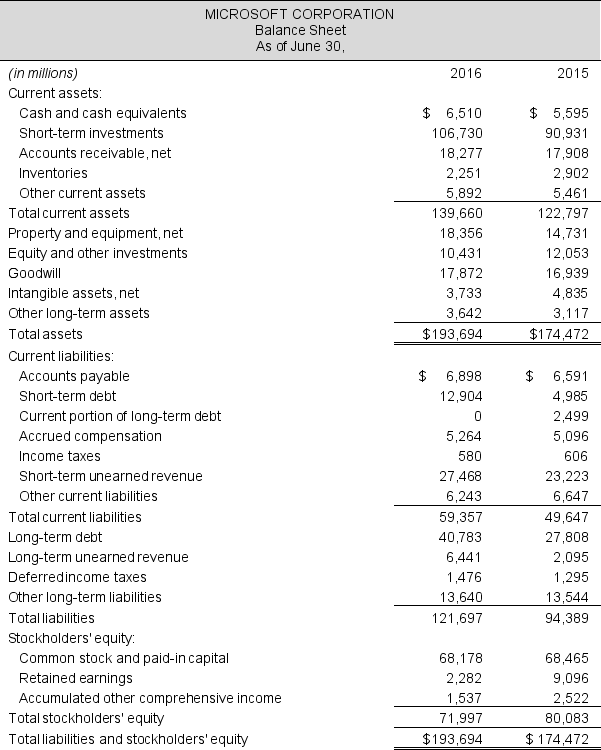

The 2016 balance sheet of Microsoft Corp. reports total assets of $193,694 million, operating liabilities of $68,010 million, and total shareholders' equity of $71,997 million.

Microsoft 2016 nonoperating liabilities are:

A) $140,007 million

B) $ 53,687 million

C) $ 68,010 million

D) $121,697 million

E) There is not enough information to calculate the amount.

Microsoft 2016 nonoperating liabilities are:

A) $140,007 million

B) $ 53,687 million

C) $ 68,010 million

D) $121,697 million

E) There is not enough information to calculate the amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

The fiscal 2016 financial statements of Nike Inc. shows average net operating assets (NOA) of $8,450 million, average net nonoperating obligations (NNO) of $(4,033) million, average total liabilities of $9,014 million, and average equity of $12,483 million.

The company's 2016 financial leverage (FLEV) is:

A) (0.477)

B) (0.559)

C) (0.323)

D) (0.447)

E) There is not enough information to determine the ratio.

The company's 2016 financial leverage (FLEV) is:

A) (0.477)

B) (0.559)

C) (0.323)

D) (0.447)

E) There is not enough information to determine the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

The fiscal 2017 financial statements of Reed Enterprises shows average net operating assets (NOA) of $4,795 million, average net nonoperating obligations (NNO) of $605 million, average total liabilities of $6,330 million, and year-end equity of $5,240 million.

The company's 2017 financial leverage (FLEV) is:

A) 0.144

B) 0.126

C) 0.115

D) 0.091

E) There is not enough information to determine the ratio.

The company's 2017 financial leverage (FLEV) is:

A) 0.144

B) 0.126

C) 0.115

D) 0.091

E) There is not enough information to determine the ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

Liquidity refers to:

A) A company's operating cycle

B) A company's ability to general sales from use of its assets

C) A company's ability to meet its debt obligations

D) A company's amount of financial leverage

E) A company's cash availability

A) A company's operating cycle

B) A company's ability to general sales from use of its assets

C) A company's ability to meet its debt obligations

D) A company's amount of financial leverage

E) A company's cash availability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

The current ratio is used to assess:

A) Solvency

B) Bankruptcy position

C) Liquidity

D) Financial leverage

E) None of the above

A) Solvency

B) Bankruptcy position

C) Liquidity

D) Financial leverage

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is a measure of liquidity?

A) Liabilities-to-Equity Ratio = Total Liabilities / Stockholder's Equity

B) Times Interest Earned = Earnings before interest and taxes / Interest Expense

C) Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

D) Return on net operating assets (RNOA)

E) All of the above

A) Liabilities-to-Equity Ratio = Total Liabilities / Stockholder's Equity

B) Times Interest Earned = Earnings before interest and taxes / Interest Expense

C) Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

D) Return on net operating assets (RNOA)

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

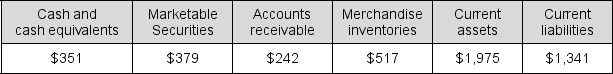

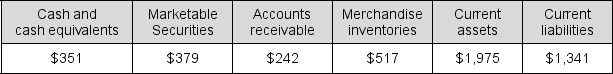

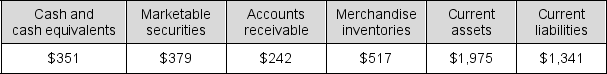

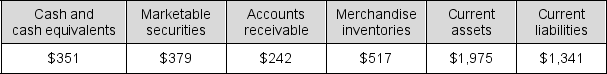

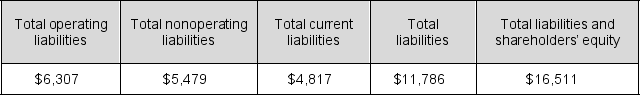

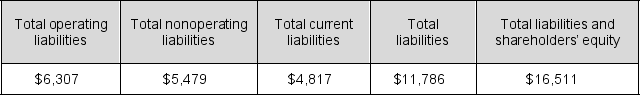

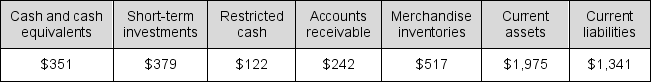

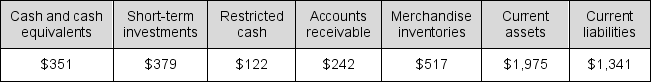

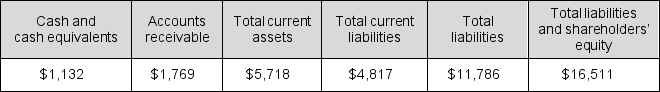

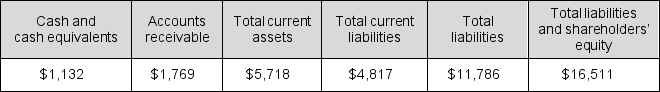

The fiscal 2016 balance sheet for Whole Foods Market reports the following data (in millions). What is the company's current ratio?

A) 0.69

B) 1.38

C) 0.72

D) 1.47

E) None of the above

A) 0.69

B) 1.38

C) 0.72

D) 1.47

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

The fiscal 2016 balance sheet for Whole Foods Market reports the following data (in millions). What is the company's quick ratio?

A) 0.69

B) 1.38

C) 0.72

D) 1.47

E) None of the above

A) 0.69

B) 1.38

C) 0.72

D) 1.47

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

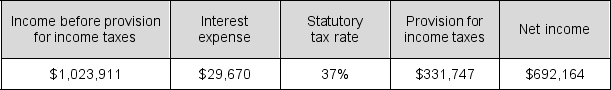

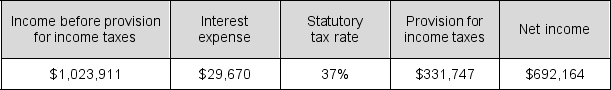

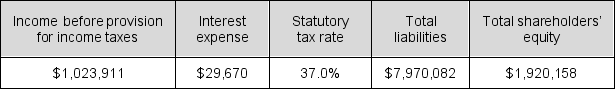

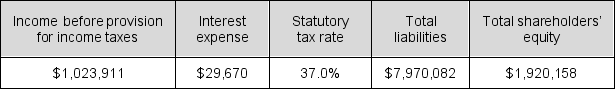

Selected income statement data follow for Harley Davidson, Inc., for the year ended December 31, 2016 (in thousands). What is the company's times interest earned ratio?

A) 34.5

B) 24.3

C) 17.8

D) 35.5

E) None of the above

A) 34.5

B) 24.3

C) 17.8

D) 35.5

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

Selected balance sheet data follow for Goodyear Tire & Rubber Company for the year ended December 31, 2016 (in millions). What is the company's liabilities-to-equity ratio?

A) 2.49

B) 1.40

C) 3.23

D) 0.71

E) None of the above

A) 2.49

B) 1.40

C) 3.23

D) 0.71

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

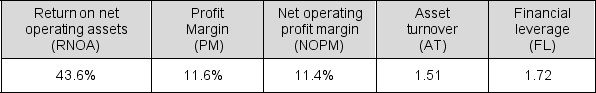

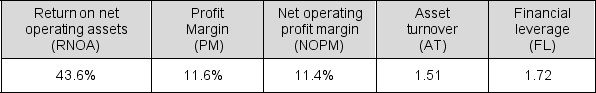

Selected ratios follow for Nike, Inc. for the year ended December 31, 2016 (in millions). What is the company's return on equity (ROE) for the year?

A) 13.1%

B) 32.2%

C) 17.5%

D) 30.1%

E) None of the above

A) 13.1%

B) 32.2%

C) 17.5%

D) 30.1%

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

Selected balance sheet and income statement data follow for E.I. DuPont de Nemours and Company (in millions). Use the data to calculate the following:

a. Return on equity (ROE)

b. Return on net operating assets (RNOA)

c. The company's nonoperating return

a. Return on equity (ROE)

b. Return on net operating assets (RNOA)

c. The company's nonoperating return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

Selected balance sheet and income statement data follow for The New York Times Company for fiscal 2016 (in thousands). Use the data to calculate the following:

a. Return on equity (ROE)

b. Return on net operating assets (RNOA)

c. The company's nonoperating return

a. Return on equity (ROE)

b. Return on net operating assets (RNOA)

c. The company's nonoperating return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

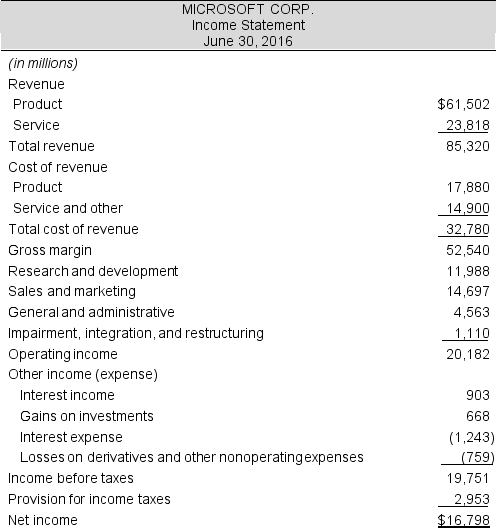

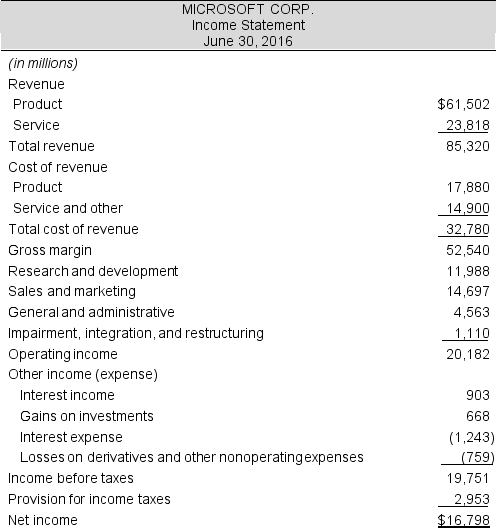

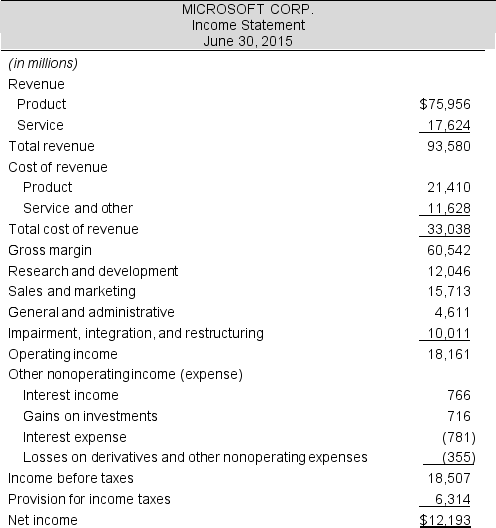

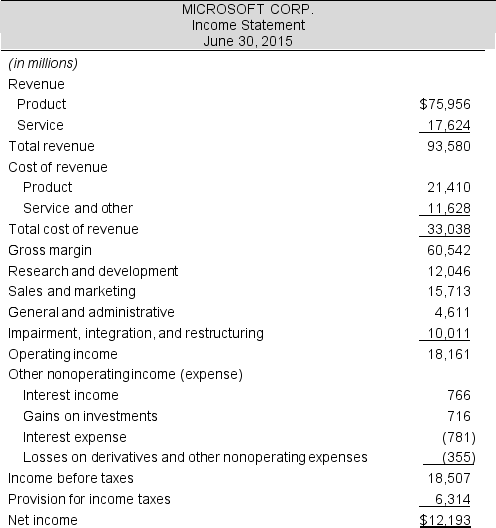

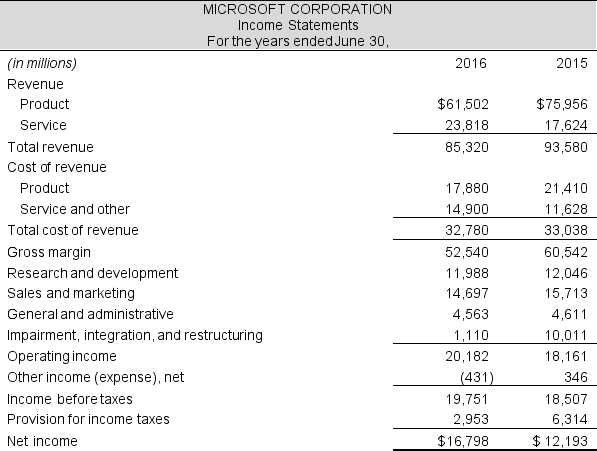

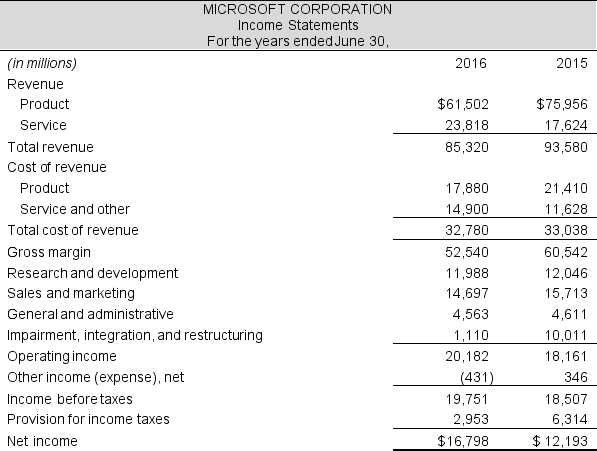

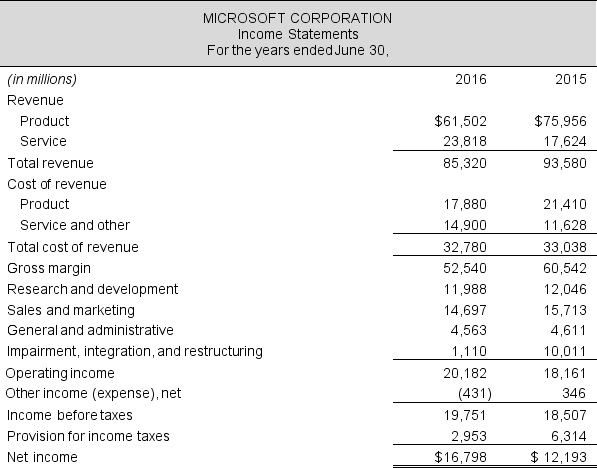

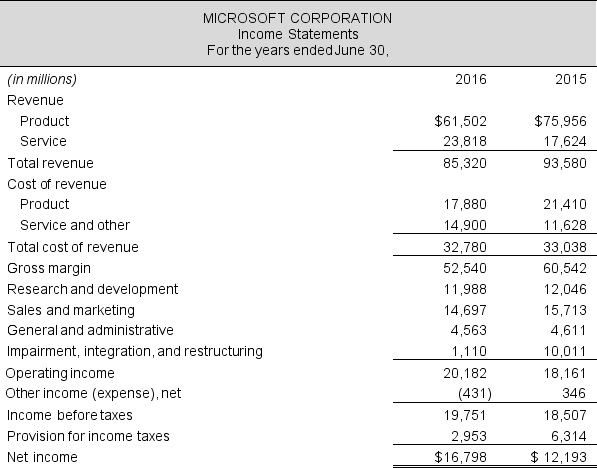

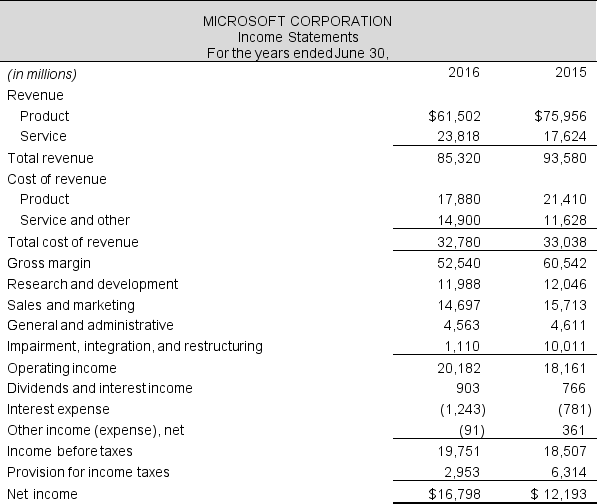

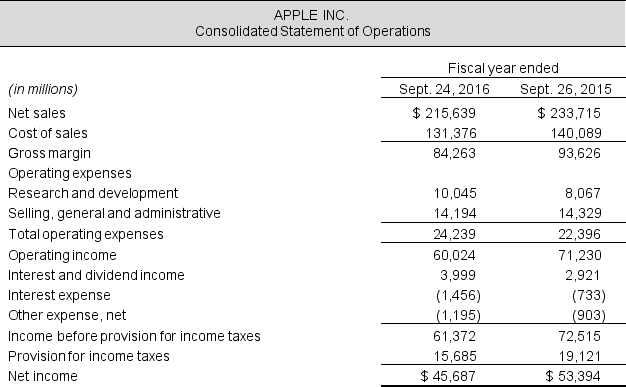

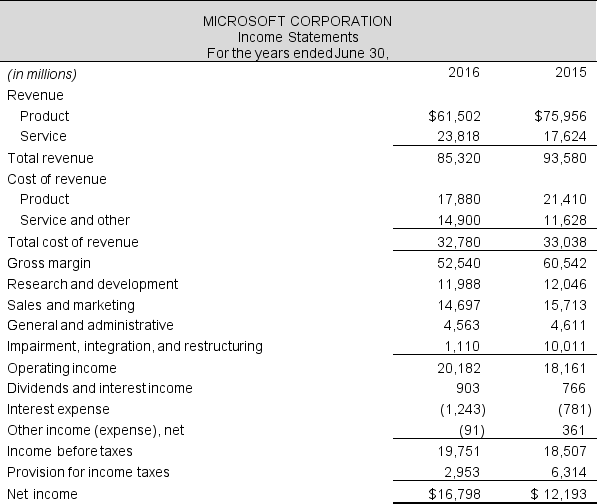

Use the income statement for Microsoft Corporation to compute the following:

a. Tax shield

b. The tax on operating profit

c. NOPAT

The company's combined federal and state statutory tax rate is 37.0%.

a. Tax shield

b. The tax on operating profit

c. NOPAT

The company's combined federal and state statutory tax rate is 37.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the income statement for Microsoft Corporation to compute the following:

a. Tax shield

b. The tax on operating profit

c. NOPAT

The company's combined federal and state statutory tax rate is 37.0%.

a. Tax shield

b. The tax on operating profit

c. NOPAT

The company's combined federal and state statutory tax rate is 37.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

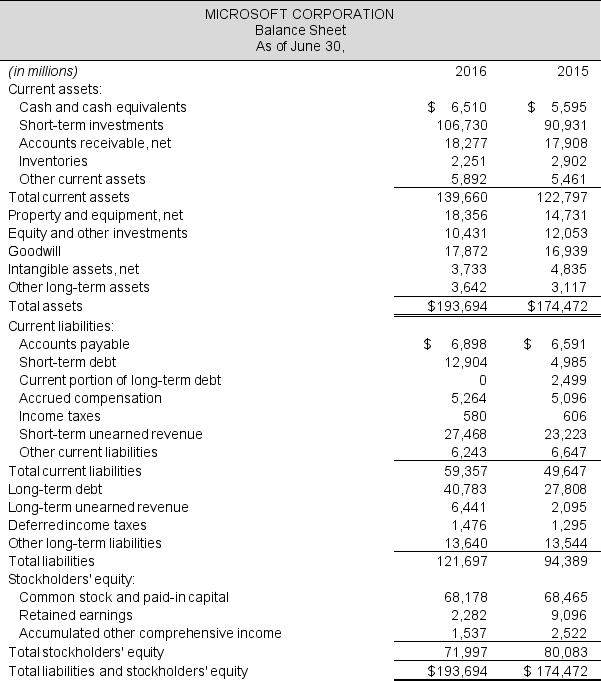

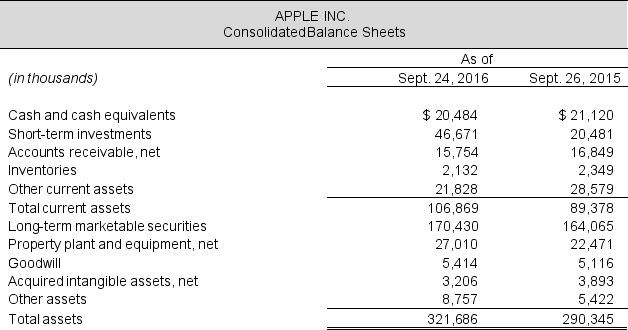

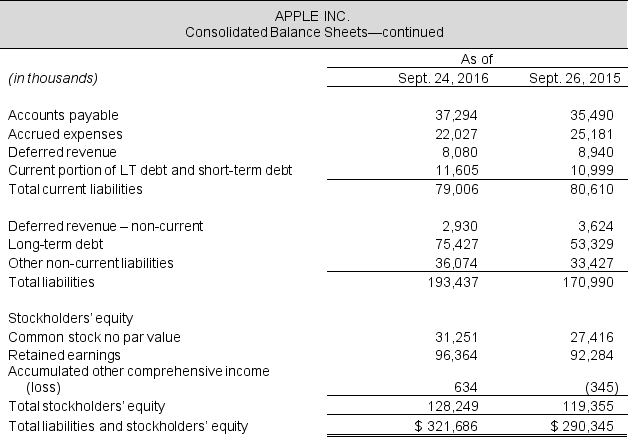

Use Microsoft's balance sheets for the fiscal year 2016 to compute the following (assume equity and other investments is operating):

a. Operating assets

b. Operating liabilities

c. Net operating assets (NOA)

a. Operating assets

b. Operating liabilities

c. Net operating assets (NOA)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the following income statement for Mattel Inc. ($ thousands) to compute the following:

a. Tax shield

b. Taxes on operating profit

c. Tax rate on operating profit

The company's statutory tax rate is 37%.

a. Tax shield

b. Taxes on operating profit

c. Tax rate on operating profit

The company's statutory tax rate is 37%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

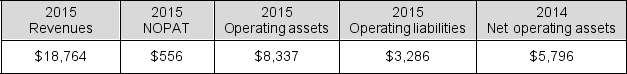

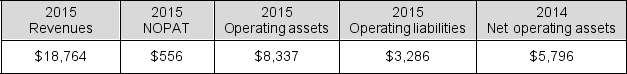

Selected balance sheet and income statement data follow for Staples, Inc. (in millions). Use the data to calculate a) return on net operating assets (RNOA), b) net operating profit margin (NOPM), and c) net operating asset turnover (NOAT) for fiscal 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

Selected balance sheet and income statement data follow for Walgreens Boots Alliance, Inc. for the year ended August 31, 2016 (in millions). Use the data to calculate a) return on net operating assets (RNOA), b) net operating profit margin (NOPM), and c) net operating asset turnover (NOAT). Confirm that RNOA = NOPM × NOAT.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

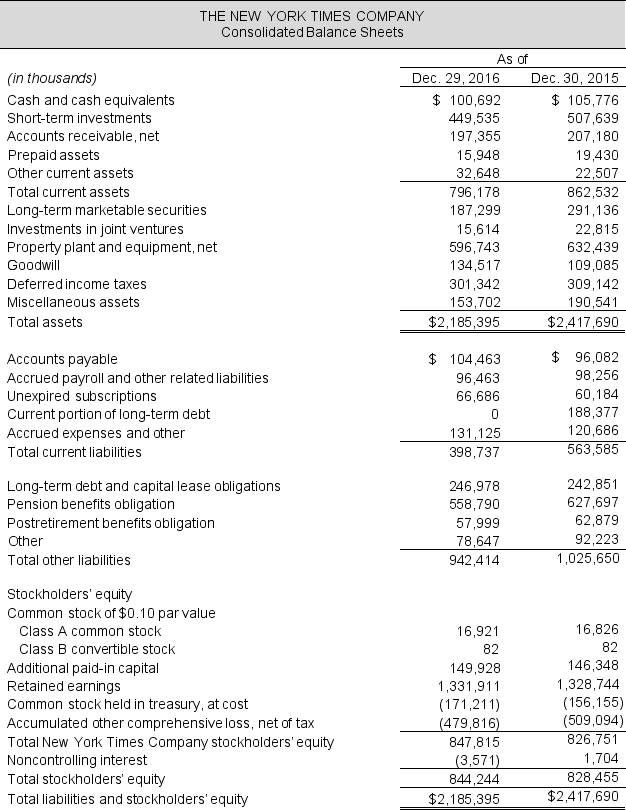

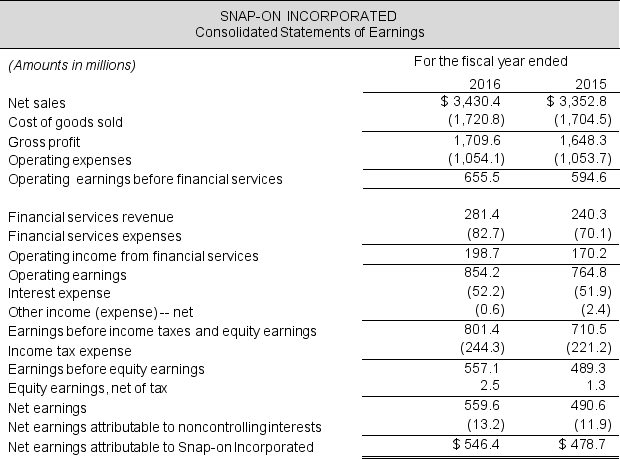

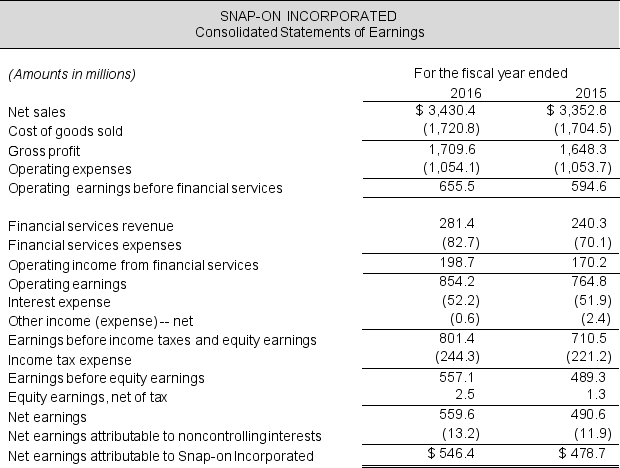

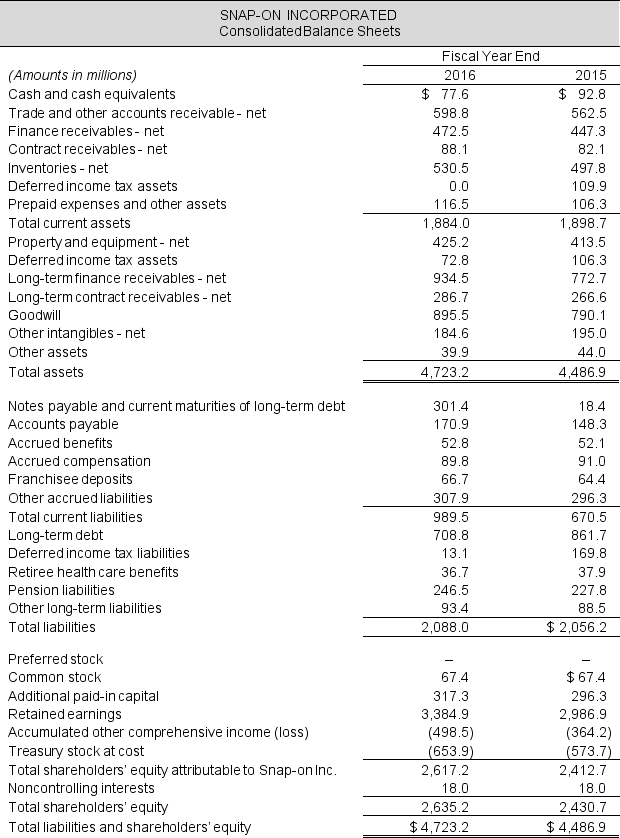

Selected income statement and balance sheet data follow for Snap-On Incorporated for fiscal 2016 and 2015. Use these data to calculate a) FLEV, b) spread, and c) return on equity (ROE) for fiscal 2016 only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

Selected balance sheet income statement data follow for Whole Foods Market, Inc. for the year ended September 25, 2016 (in millions). Use the data to calculate the company's current ratio and quick ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

Selected balance sheet and income statement data follow for Harley Davidson, Inc. for the year ended December 31, 2016 (in thousands). Use the data to calculate a) times interest earned, and b) liabilities-to-equity ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

Selected balance sheet and income statement data follow for Goodyear Tire & Rubber Company for the year ended December 31, 2016 (in millions). Use the data to calculate the company's current ratio and liabilities-to-equity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the following selected balance sheet and income statement data for Mattel Inc. (in $ thousands) to compute a) return on equity, b) profit margin (PM), c) asset turnover (AT), and d) financial leverage (FL) for fiscal 2016. Show that ROE = PM × AT × FL.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

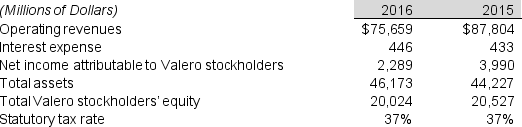

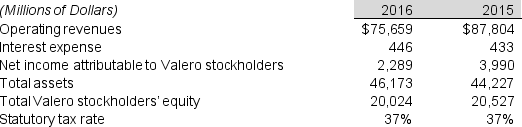

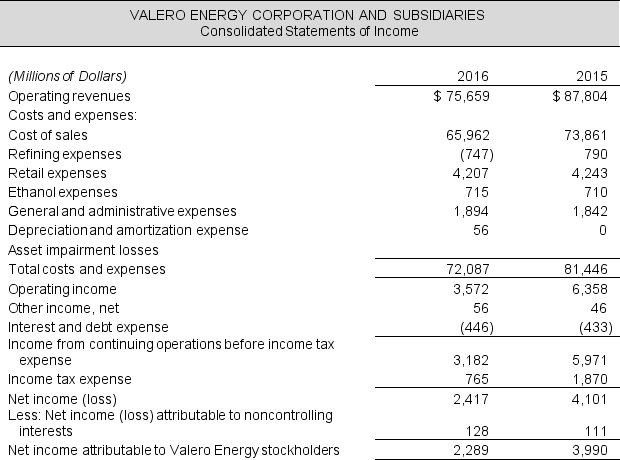

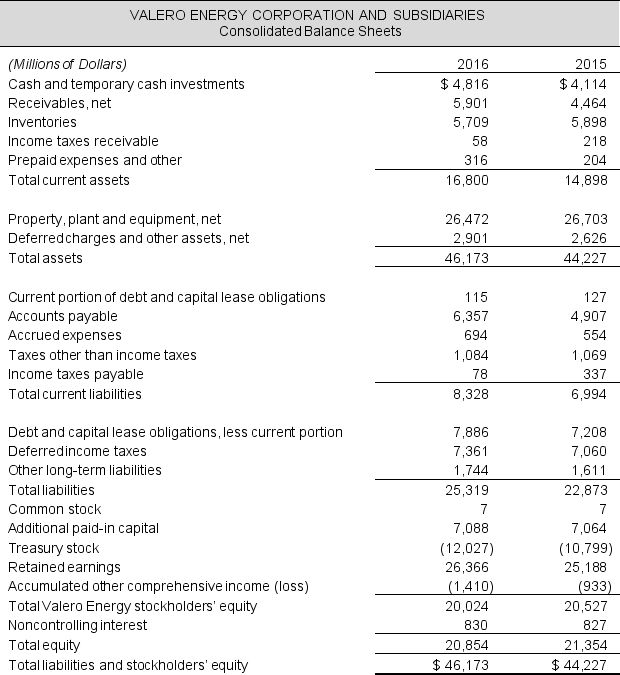

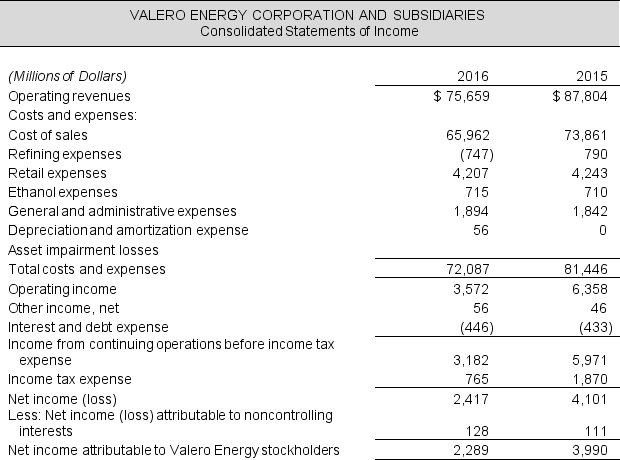

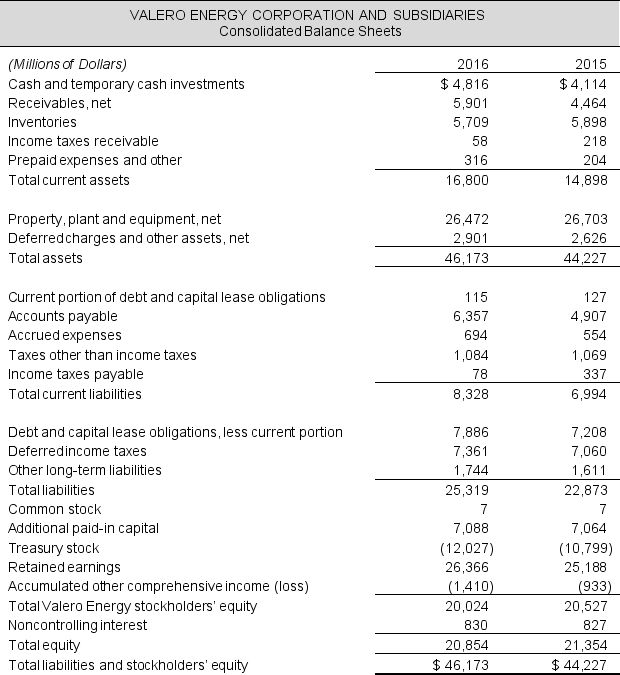

Use the following selected balance sheet and income statement data for Valero Energy Corporation (in $ millions) to compute a) return on equity, b) profit margin (PM), c) asset turnover (AT), and d) financial leverage (FL) for fiscal 2016. Show that ROE = PM × AT × FL.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

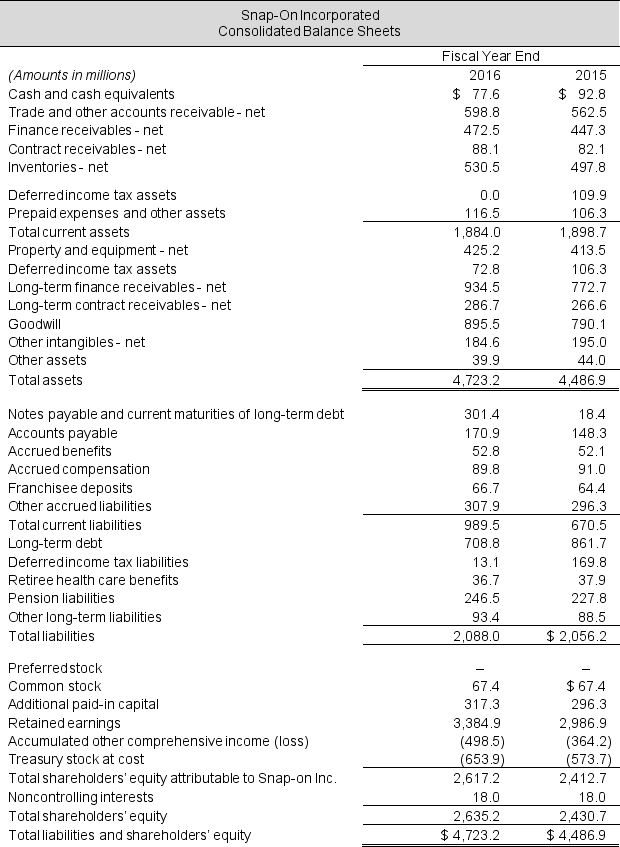

Income statements and balance sheets follow for The New York Times Company. Refer to these financial statements to answer the requirements.

Required:

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Net operating assets are $397,299 thousand in 2014.

d. Compute return on common shareholders equity (ROE) for 2016 and 2015. Stockholders' equity attributable to New York Times Company in 2014 is $726,328 thousand.

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison?

Required:

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Net operating assets are $397,299 thousand in 2014.

d. Compute return on common shareholders equity (ROE) for 2016 and 2015. Stockholders' equity attributable to New York Times Company in 2014 is $726,328 thousand.

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

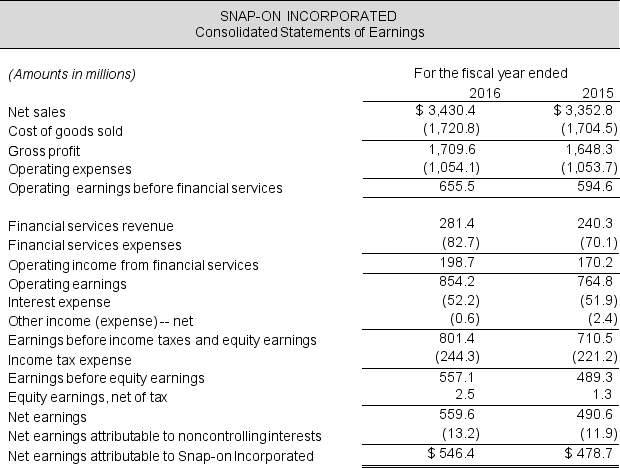

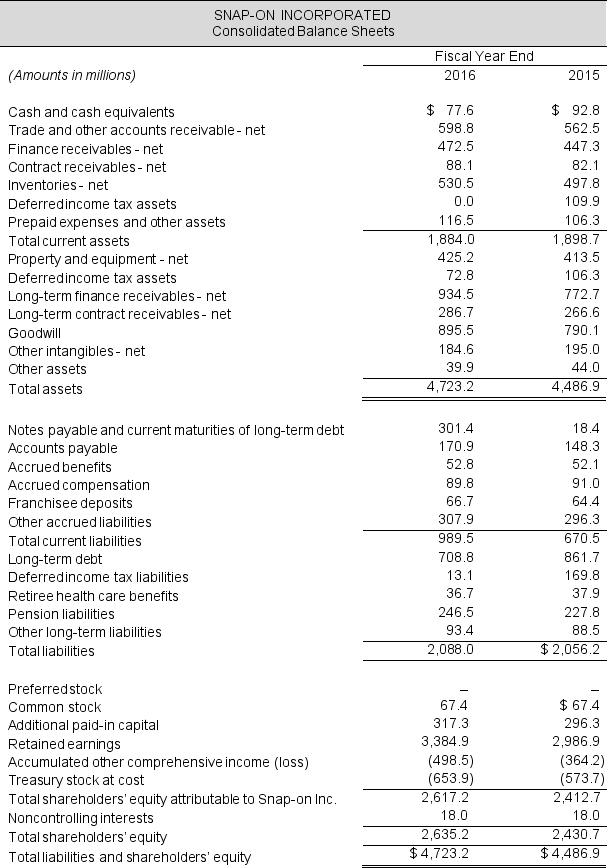

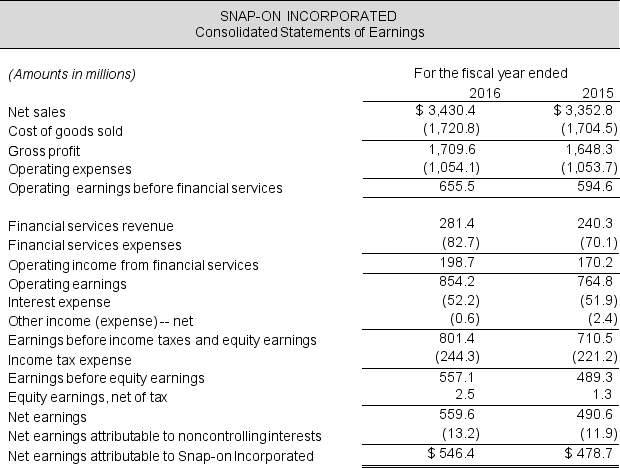

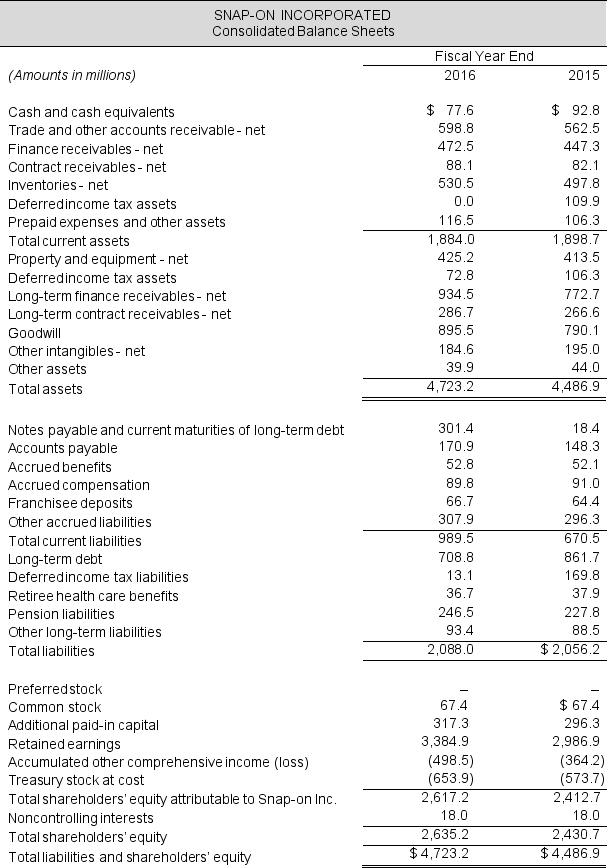

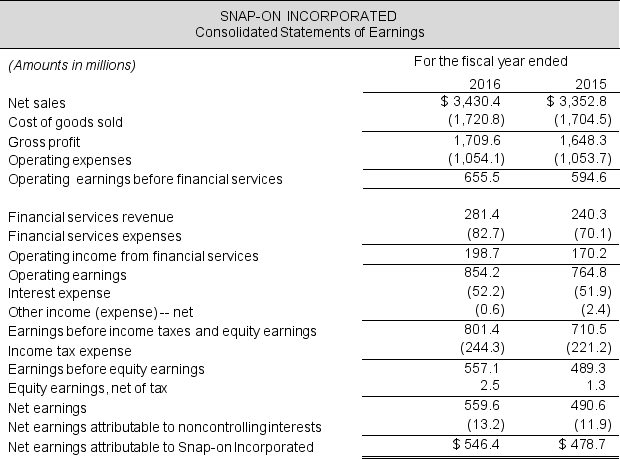

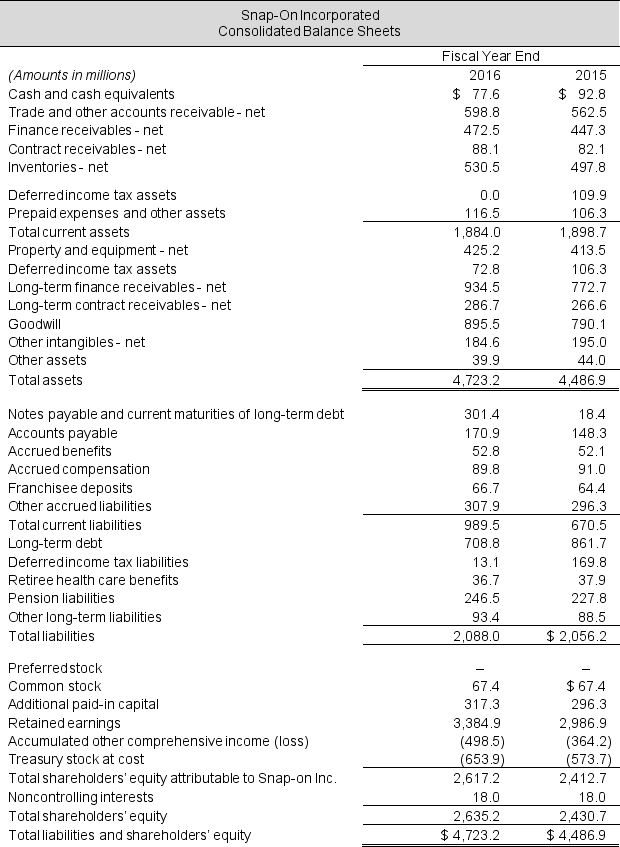

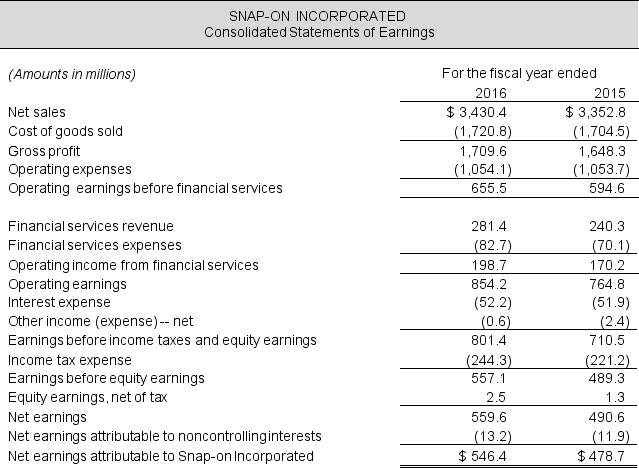

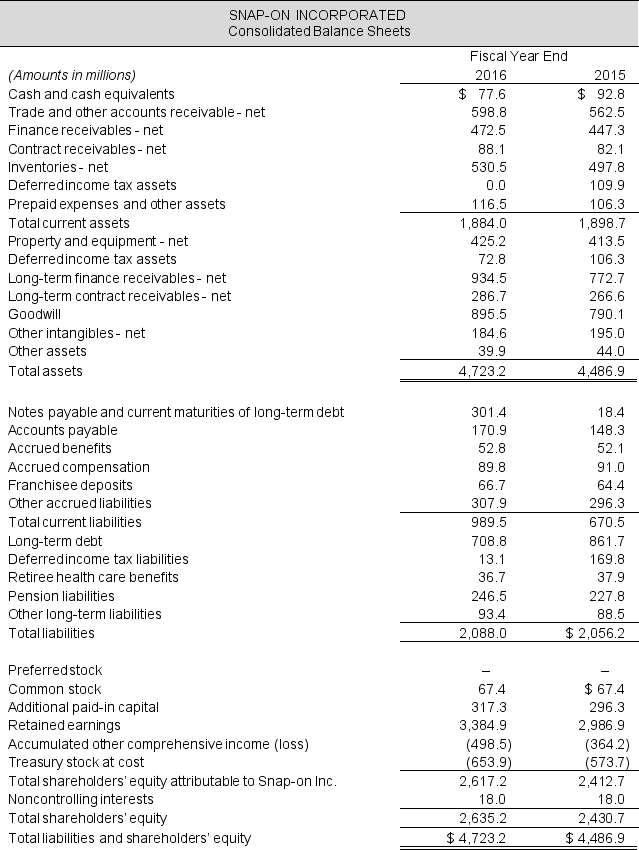

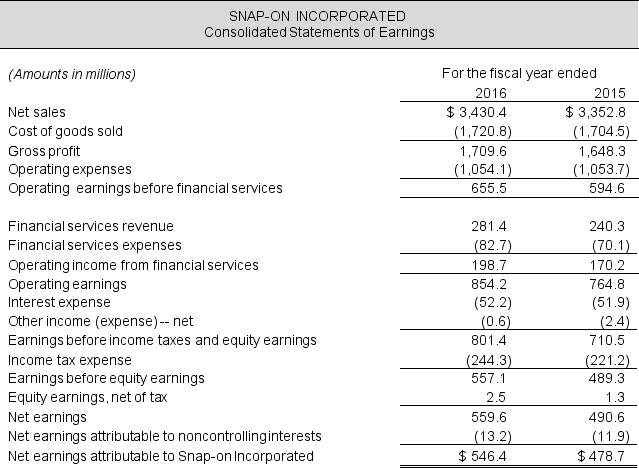

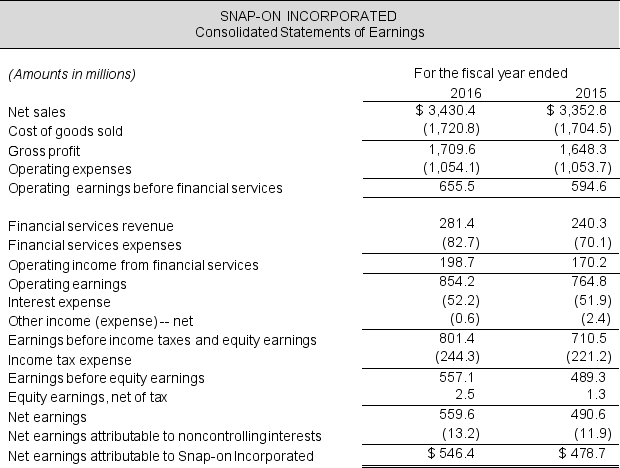

Income statements and balance sheets follow for Snap-On Incorporated. Refer to these financial statements to answer the requirements.

Required:

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for fiscal 2016 and 2015.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Net operating assets are $3,011.7 million in 2014.

d. Compute return on equity (ROE) for 2016 and 2015. (Stockholders' equity attributable to Snap-On in 2014 is $2,207.8 million.)

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison?

Required:

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for fiscal 2016 and 2015.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Net operating assets are $3,011.7 million in 2014.

d. Compute return on equity (ROE) for 2016 and 2015. (Stockholders' equity attributable to Snap-On in 2014 is $2,207.8 million.)

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

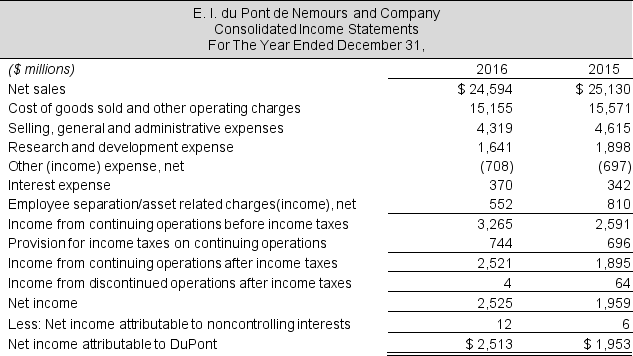

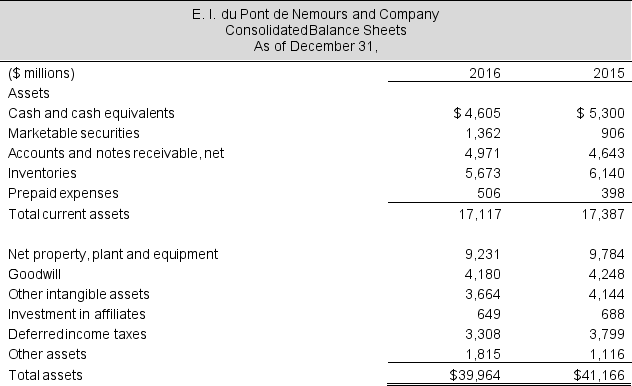

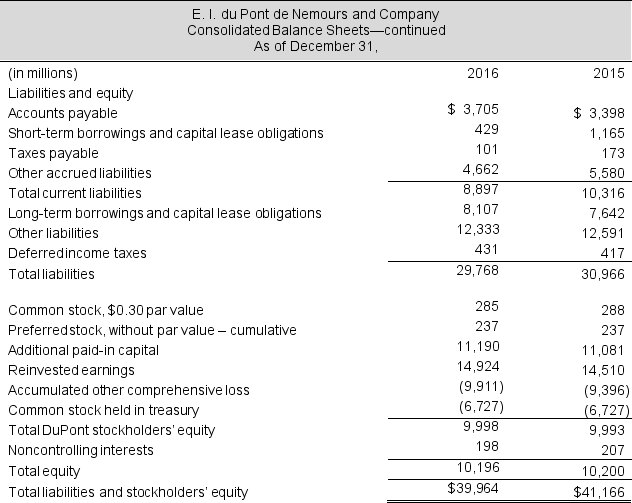

Income statements and balance sheets follow for E.I. DuPont de Nemours and Company. Refer to these financial statements to answer the requirements.

Required

Required

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rate is 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Net operating assets are $13,239 million in 2014.

d. Compute return on equity (ROE) for 2016 and 2015. DuPont Stockholders' equity in 2014 is $13,320 million.

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison?

Required

Required a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rate is 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Net operating assets are $13,239 million in 2014.

d. Compute return on equity (ROE) for 2016 and 2015. DuPont Stockholders' equity in 2014 is $13,320 million.

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

Income statements and balance sheets follow for Microsoft Corporation. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015. Assume Equity and other investments are operating assets.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Net operating assets are $26,720 million in 2014.

d. Compute return on equity (ROE) for 2016 and 2015. (Stockholders' equity in 2014 is $89,784 million.)

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison

Required:

Required: a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015. Assume Equity and other investments are operating assets.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Net operating assets are $26,720 million in 2014.

d. Compute return on equity (ROE) for 2016 and 2015. (Stockholders' equity in 2014 is $89,784 million.)

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

Income statements and balance sheets follow for The New York Times Company. Refer to these financial statements to answer the requirements.

Required:

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Comment on the year-over-year change. Net operating assets are $397,299 thousand in 2014.

d. Disaggregate RNOA into profitability and asset turnover components (NOPM and NOAT, respectively). What explains the year-over-year change in RNOA?

Required:

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Comment on the year-over-year change. Net operating assets are $397,299 thousand in 2014.

d. Disaggregate RNOA into profitability and asset turnover components (NOPM and NOAT, respectively). What explains the year-over-year change in RNOA?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

Income statements and balance sheets follow for Snap-On Incorporated. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rate is 37% for both fiscal years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Comment on the year-over-year change. Net operating assets are $3,011.7 million in 2014.

d. Disaggregate RNOA into profitability and asset turnover components (NOPM and NOAT, respectively). Remember to include both net sales and financial services revenue in total revenue. What explains the year-over-year change in RNOA?

Required:

Required: a. Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rate is 37% for both fiscal years.

b. Compute net operating assets (NOA) for 2016 and 2015.

c. Compute return on net operating assets (RNOA) for 2016 and 2015. Comment on the year-over-year change. Net operating assets are $3,011.7 million in 2014.

d. Disaggregate RNOA into profitability and asset turnover components (NOPM and NOAT, respectively). Remember to include both net sales and financial services revenue in total revenue. What explains the year-over-year change in RNOA?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

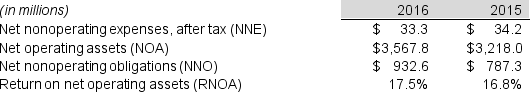

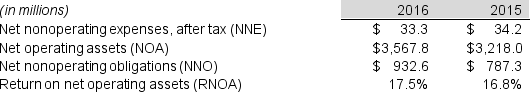

Income statements and balance sheets follow for Snap-On Incorporated. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute net nonoperating expenses (NNE) for 2016 and 2015. Assume that combined federal and state statutory tax rate is 37% for both fiscal years.

b. Compute net nonoperating obligations (NNO) for 2016 and 2015.

c. Compute Spread for 2016 and 2015. Return on net operating assets is 17.5% and 16.8% in 2016 and 2015, respectively. In 2014, net nonoperating obligations were $786.4 million.

d. Compute FLEV for 2016 and 2015. In 2014, net nonoperating obligations were $786.4 million and total shareholders' equity was $2,225.3 million.

e. Calculate return on equity (ROE) for both years. Show that ROE = RNOA + (FLEV × Spread) x NCI ratio. Interpret the year-over-year change in ROE. (Hint: consider the changes in both FLEV and Spread.) In 2014, shareholders' equity attributable to Snap-On was $2,207.8 and total shareholders' equity was $2,225.3.

Required:

Required: a. Compute net nonoperating expenses (NNE) for 2016 and 2015. Assume that combined federal and state statutory tax rate is 37% for both fiscal years.

b. Compute net nonoperating obligations (NNO) for 2016 and 2015.

c. Compute Spread for 2016 and 2015. Return on net operating assets is 17.5% and 16.8% in 2016 and 2015, respectively. In 2014, net nonoperating obligations were $786.4 million.

d. Compute FLEV for 2016 and 2015. In 2014, net nonoperating obligations were $786.4 million and total shareholders' equity was $2,225.3 million.

e. Calculate return on equity (ROE) for both years. Show that ROE = RNOA + (FLEV × Spread) x NCI ratio. Interpret the year-over-year change in ROE. (Hint: consider the changes in both FLEV and Spread.) In 2014, shareholders' equity attributable to Snap-On was $2,207.8 and total shareholders' equity was $2,225.3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

Income statements and balance sheets follow for Microsoft Corporation. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute net nonoperating expenses (NNE) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net nonoperating obligations (NNO) for 2016 and 2015.

c. Compute Spread for 2016 and 2015. Return on net operating assets (RNOA) is 109.1% and 52.6% in 2016 and 2015, respectively. NNO were $(63,064) million in 2014.

d. Compute FLEV for 2016 and 2015. In 2014, net nonoperating obligations (assets) were $(63,064) million and shareholders' equity was $89,784 million.

e. Calculate return on equity (ROE) for both years. Show that ROE = RNOA + (FLEV × Spread). Interpret the year-over-year change in ROE.

Required:

Required: a. Compute net nonoperating expenses (NNE) for 2016 and 2015. Assume that combined federal and state statutory tax rates are 37% for both years.

b. Compute net nonoperating obligations (NNO) for 2016 and 2015.

c. Compute Spread for 2016 and 2015. Return on net operating assets (RNOA) is 109.1% and 52.6% in 2016 and 2015, respectively. NNO were $(63,064) million in 2014.

d. Compute FLEV for 2016 and 2015. In 2014, net nonoperating obligations (assets) were $(63,064) million and shareholders' equity was $89,784 million.

e. Calculate return on equity (ROE) for both years. Show that ROE = RNOA + (FLEV × Spread). Interpret the year-over-year change in ROE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

Income statements and balance sheets follow for Snap-On Incorporated. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute the company's current ratio and quick ratio for fiscal 2016 and 2015. Comment on any observed trend.

b. Compute the company's times interest earned and liabilities-to-equity ratio for 2016 and 2015. Comment on any observed trend.

c. Summarize your findings in a conclusion about the company's liquidity and solvency. Do you have any concerns about the company's ability to meet its debt obligations?

Required:

Required: a. Compute the company's current ratio and quick ratio for fiscal 2016 and 2015. Comment on any observed trend.

b. Compute the company's times interest earned and liabilities-to-equity ratio for 2016 and 2015. Comment on any observed trend.

c. Summarize your findings in a conclusion about the company's liquidity and solvency. Do you have any concerns about the company's ability to meet its debt obligations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

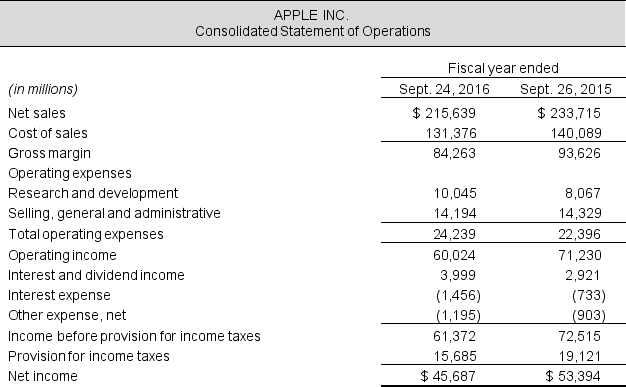

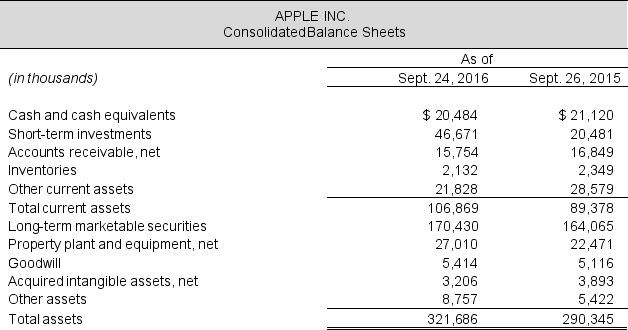

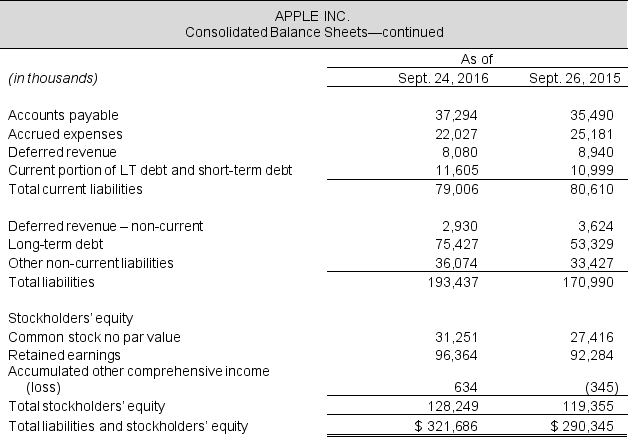

Income statements and balance sheets follow for Microsoft Corporation and Apple Inc. Refer to these financial statements to answer the requirements.

Required:

Required:

a. Compute the current ratio and quick ratio for both firms for fiscal 2016. Compare the ratios and determine which company is more liquid.

b. Compute the times interest earned and liabilities-to-equity ratios for both firms for fiscal 2016. Which company is more solvent?

c. Do you have any concerns about either company's ability to meet its debt obligations? Explain.

Required:

Required: a. Compute the current ratio and quick ratio for both firms for fiscal 2016. Compare the ratios and determine which company is more liquid.

b. Compute the times interest earned and liabilities-to-equity ratios for both firms for fiscal 2016. Which company is more solvent?

c. Do you have any concerns about either company's ability to meet its debt obligations? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

Use the following balance sheets and income statements for Valero Energy Corporation to answer the requirements.

Required:

Required:

a. Compute Valero's return on equity (ROE) for 2016 and 2015. Valero Energy stockholders' equity in 2014 was $20,677 million.

b. Compute the profit margin (PM), asset turnover (AT), and financial leverage (FL) components of the basic DuPont model. Show that ROE = PM × AT × FL for 2016. Total assets were $45,550 million in 2014. Which component(s) explain the year over year change in Valero's ROE?

c. Compute adjusted return on assets (ROA) for 2016 and 2015. Assume a tax rate of 37% for both years.

Required:

Required: a. Compute Valero's return on equity (ROE) for 2016 and 2015. Valero Energy stockholders' equity in 2014 was $20,677 million.

b. Compute the profit margin (PM), asset turnover (AT), and financial leverage (FL) components of the basic DuPont model. Show that ROE = PM × AT × FL for 2016. Total assets were $45,550 million in 2014. Which component(s) explain the year over year change in Valero's ROE?

c. Compute adjusted return on assets (ROA) for 2016 and 2015. Assume a tax rate of 37% for both years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

Explain the trade-off between net operating profit margin and net operating asset turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

Explain how return on net operating assets (RNOA) and financial leverage (FLEV) affect Return on Equity (ROE). Is greater FLEV always better?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is liquidity? Identify and discuss two ways to measure a company's liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is solvency? Identify and discuss two ways a company's solvency is measured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is the difference between the traditional ROA measure (part of the traditional DuPont analysis) and the return on net operating assets (RNOA)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck