Deck 21: Mergers and Acquisitions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/77

العب

ملء الشاشة (f)

Deck 21: Mergers and Acquisitions

1

The combination of two companies into a new legal entity is best described as:

A) a merger.

B) an asset purchase.

C) a hostile takeover.

D) a friendly acquisition.

A) a merger.

B) an asset purchase.

C) a hostile takeover.

D) a friendly acquisition.

a merger.

2

Which of the following statements about takeovers is false?

A) Mergers require approval of both company's shareholders.

B) Acquisitions can be friendly acquisitions or hostile takeovers.

C) Diversification is a good motive for mergers and acquisitions.

D) An acquisition creates a larger company, not a new company like a merger creates.

A) Mergers require approval of both company's shareholders.

B) Acquisitions can be friendly acquisitions or hostile takeovers.

C) Diversification is a good motive for mergers and acquisitions.

D) An acquisition creates a larger company, not a new company like a merger creates.

Diversification is a good motive for mergers and acquisitions.

3

Which of the following is not a type of merger?

A) Vertical

B) Short-form

C) Horizontal

D) Conglomerate

E) Asset purchase

A) Vertical

B) Short-form

C) Horizontal

D) Conglomerate

E) Asset purchase

Asset purchase

4

Which of the following is not correct regarding acquisitions?

A) The acquiring company completely absorbs the target company.

B) The acquired company retains its identity and the acquiring company ceases to exist.

C) Shareholders of the acquiring company do not have to give approval for cash acquisitions.

D) The approval of the target company's shareholders is required because they have to agree to sell their shares.

E) Most acquisitions are cash transactions, where the shareholders in the target company receive cash for their shares.

A) The acquiring company completely absorbs the target company.

B) The acquired company retains its identity and the acquiring company ceases to exist.

C) Shareholders of the acquiring company do not have to give approval for cash acquisitions.

D) The approval of the target company's shareholders is required because they have to agree to sell their shares.

E) Most acquisitions are cash transactions, where the shareholders in the target company receive cash for their shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following does not require approval of both sets of shareholders in a merger or acquisition?

A) A merger

B) A cash acquisition

C) A shares acquisition

A) A merger

B) A cash acquisition

C) A shares acquisition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following requires approval by both sets of shareholders in a merger or acquisition?

A) A merger

B) An asset purchase

C) A cash acquisition

D) A short-form merger

A) A merger

B) An asset purchase

C) A cash acquisition

D) A short-form merger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following was not an acquisition?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

8

Generic Company owns 70% of ABC Company, the acquisition of the remaining 30% of ABC Company is best described as:

A) fairness opinion.

B) short-form merger.

C) minority freeze-out.

D) going private transaction.

A) fairness opinion.

B) short-form merger.

C) minority freeze-out.

D) going private transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

9

What percentage of ownership is required for a short-form merger?

A) 50.0% or more

B) 75.0% or more

C) 89.5% or more

D) 100%

A) 50.0% or more

B) 75.0% or more

C) 89.5% or more

D) 100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

10

Dell, Inc. is reportedly looking at the option of becoming a not-publicly traded company. This would best be described as:

A) a tender offer.

B) a creeping takeover.

C) a minority freeze-out.

D) selling the crown jewels.

E) a going private transaction.

A) a tender offer.

B) a creeping takeover.

C) a minority freeze-out.

D) selling the crown jewels.

E) a going private transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

11

If XYZ Company makes a tender offer for 95% of ABC Company and 75% of the shares are tendered. What percentage of shares tendered do each shareholder that accepted the tender offer get to tender?

A) 75.00%

B) 78.95%

C) 95.00%

D) 100.00%

A) 75.00%

B) 78.95%

C) 95.00%

D) 100.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

12

If XYZ Company makes a tender offer for 75% of ABC Company and 95% of the shares are tendered. What percentage of shares tendered do each shareholder that accepted the tender offer get to tender?

A) 75.00%

B) 78.95%

C) 95.00%

D) 100.00%

A) 75.00%

B) 78.95%

C) 95.00%

D) 100.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

13

When a company acquires a target over a long period of time this is best described as:

A) a tender offer.

B) a vertical merger.

C) a creeping takeover.

D) a short-form merger.

A) a tender offer.

B) a vertical merger.

C) a creeping takeover.

D) a short-form merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is the proper order for the timeline of a friendly acquisition?

A) Approach target, information memorandum, confidentiality agreement, sign letter of intent, main due diligence, final sale agreement, ratified.

B) Approach target, sign letter of intent, confidentiality agreement, information memorandum, main due diligence, final sale agreement, ratified.

C) Approach target, confidentiality agreement, information memorandum, main due diligence, sign letter of intent, ratified, final sale agreement.

D) Approach target, information memorandum, confidentiality agreement, main due diligence, sign letter of intent, ratified, final sale agreement.

A) Approach target, information memorandum, confidentiality agreement, sign letter of intent, main due diligence, final sale agreement, ratified.

B) Approach target, sign letter of intent, confidentiality agreement, information memorandum, main due diligence, final sale agreement, ratified.

C) Approach target, confidentiality agreement, information memorandum, main due diligence, sign letter of intent, ratified, final sale agreement.

D) Approach target, information memorandum, confidentiality agreement, main due diligence, sign letter of intent, ratified, final sale agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

15

Before accessing the data room, serious potential buyers would need to sign:

A) a letter of intent.

B) a purchase agreement.

C) an offering memorandum.

D) a confidentiality agreement.

A) a letter of intent.

B) a purchase agreement.

C) an offering memorandum.

D) a confidentiality agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is not a defensive response to a hostile takeover?

A) A poison pill

B) Creating a data room

C) Seeking a white knight

D) Selling the crown jewels

E) A shareholders rights plan

A) A poison pill

B) Creating a data room

C) Seeking a white knight

D) Selling the crown jewels

E) A shareholders rights plan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

17

Tyler's Chicken made a tender offer for 70 percent of Julia's Turkey Company. Julia's Turkey Company has 10,000 shares outstanding. You are a shareholder of Julia's Turkey Company. If shareholders of Julia's Turkey tender 8,000 shares, and you tender 500 shares, how many of your shares will be accepted by Tyler's Chicken?

A) 350 shares

B) 438 shares

C) 500 shares

D) 560 shares

A) 350 shares

B) 438 shares

C) 500 shares

D) 560 shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

18

South Sporting Goods made a tender offer for 80 percent of North Sporting Goods. North Sporting Goods has 50,000 shares outstanding. You are a shareholder of North Sporting Goods. If shareholders of North Sporting Goods tender 35,000 shares, and you tender 1,000 shares, how many of your shares will be accepted by Tyler's Chicken?

A) 350 shares

B) 500 shares

C) 800 shares

D) 1,000 shares

A) 350 shares

B) 500 shares

C) 800 shares

D) 1,000 shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

19

The underlying motive of mergers and acquisitions is best described as:

A) to add value.

B) to grow the company.

C) to eliminate the competition.

D) to increase managerial prestige.

A) to add value.

B) to grow the company.

C) to eliminate the competition.

D) to increase managerial prestige.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

20

The merger of two winemakers would best be described as:

A) a vertical merger.

B) a hostile takeover.

C) a horizontal merger.

D) a conglomerate merger.

E) an international merger.

A) a vertical merger.

B) a hostile takeover.

C) a horizontal merger.

D) a conglomerate merger.

E) an international merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following measures the potential effects of a merger on competition?

A) Buffett index

B) Monopoly index

C) Herfindahl-Hirschman Index

D) Antitrust measurement index

A) Buffett index

B) Monopoly index

C) Herfindahl-Hirschman Index

D) Antitrust measurement index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

22

A wooden post company acquiring a timber company would best be described as:

A) a horizontal merger.

B) a conglomerate merger.

C) an international merger.

D) a vertical merger going forward.

E) a vertical merger going backward.

A) a horizontal merger.

B) a conglomerate merger.

C) an international merger.

D) a vertical merger going forward.

E) a vertical merger going backward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

23

A natural gas company located in Mexico merges with a natural gas company located in Brazil. This merger would best be described as:

A) a vertical merger

B) a horizontal merger.

C) a conglomerate merger.

D) an international merger.

E) both a horizontal merger and an international merger.

A) a vertical merger

B) a horizontal merger.

C) a conglomerate merger.

D) an international merger.

E) both a horizontal merger and an international merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

24

A movie production company buys a line of movie theatres. From the perspective of the movie production company, this would best be described as:

A) a horizontal merger.

B) a conglomerate merger.

C) an international merger.

D) a vertical merger going forward.

E) a vertical merger going backward.

A) a horizontal merger.

B) a conglomerate merger.

C) an international merger.

D) a vertical merger going forward.

E) a vertical merger going backward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

25

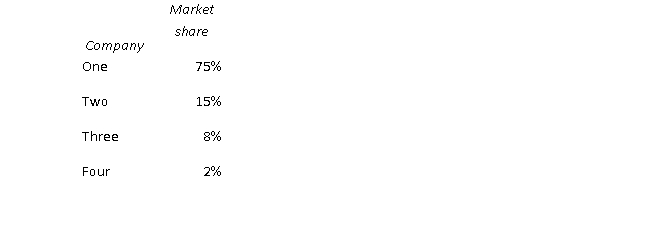

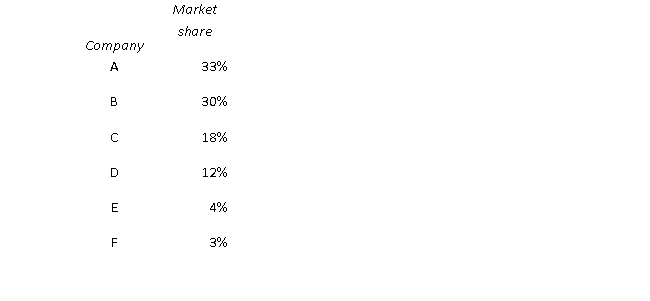

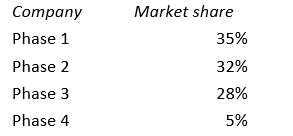

The duck call industry includes four different companies with the following market share:

The Herfindahl-Hirschman Index for the duck call industry is closest to:

The Herfindahl-Hirschman Index for the duck call industry is closest to:

A) 5,625

B) 5,918

C) 8,100

D) 10,000

The Herfindahl-Hirschman Index for the duck call industry is closest to:

The Herfindahl-Hirschman Index for the duck call industry is closest to:A) 5,625

B) 5,918

C) 8,100

D) 10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

26

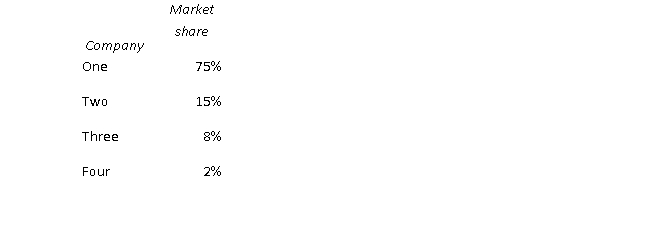

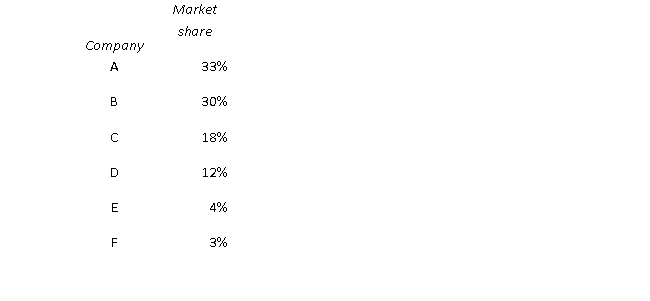

The duck call industry includes four different companies with the following market share:

If companies B and C are going to merge, what will the increase in the Herfindahl-Hirschman Index be nearest:

If companies B and C are going to merge, what will the increase in the Herfindahl-Hirschman Index be nearest:

A) 23

B) 240

C) 484

D) 2,250

If companies B and C are going to merge, what will the increase in the Herfindahl-Hirschman Index be nearest:

If companies B and C are going to merge, what will the increase in the Herfindahl-Hirschman Index be nearest:A) 23

B) 240

C) 484

D) 2,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

27

If the pizza industry has an HHI of 1,700. The industry can best be classified as:

A) a monopoly.

B) an un-concentrated market.

C) a highly concentrated market.

D) a moderately concentrated market.

A) a monopoly.

B) an un-concentrated market.

C) a highly concentrated market.

D) a moderately concentrated market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

28

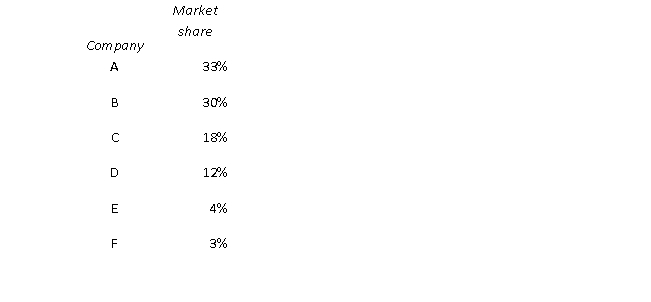

The cellular phone industry includes six different companies with the following market share:

The Herfindahl-Hirschman Index for the cellular phone industry is nearest to:

The Herfindahl-Hirschman Index for the cellular phone industry is nearest to:

A) 1,980

B) 2,482

C) 3,126

D) 10,000

The Herfindahl-Hirschman Index for the cellular phone industry is nearest to:

The Herfindahl-Hirschman Index for the cellular phone industry is nearest to:A) 1,980

B) 2,482

C) 3,126

D) 10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

29

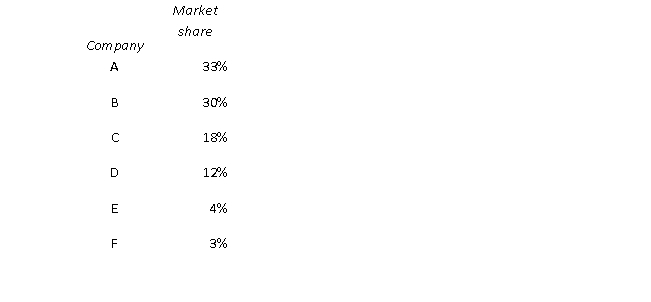

The cellular phone industry includes six different companies with the following market share:

If companies A and B are going to merge, what the increase in the Herfindahl-Hirschman Index will be nearest:

If companies A and B are going to merge, what the increase in the Herfindahl-Hirschman Index will be nearest:

A) 990

B) 1,980

C) 2,482

D) 10,000

If companies A and B are going to merge, what the increase in the Herfindahl-Hirschman Index will be nearest:

If companies A and B are going to merge, what the increase in the Herfindahl-Hirschman Index will be nearest:A) 990

B) 1,980

C) 2,482

D) 10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the U.S. winemaking industry has an HHI of 1,250. The industry can best be classified as:

A) a monopoly.

B) an un-concentrated market.

C) a highly concentrated market.

D) a moderately concentrated market.

A) a monopoly.

B) an un-concentrated market.

C) a highly concentrated market.

D) a moderately concentrated market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

31

Generic Company has a premerger value of $200 million and Company A has a premerger value of $30 million. After merging the new company is worth $250 million. What is the synergy value of the merger?

A) $20 million

B) $30 million

C) $50 million

D) $200 million

E) $250 million

A) $20 million

B) $30 million

C) $50 million

D) $200 million

E) $250 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is not a reason for achieving economies of scale in a merger?

A) Reducing capacity

B) Spreading fixed costs

C) Geographic synergies

D) Spreading variable costs

A) Reducing capacity

B) Spreading fixed costs

C) Geographic synergies

D) Spreading variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following mergers is most likely to experience economies of scope?

A) Merger between a beer brewery and a winery

B) Merger between a salon chain and a clothing chain

C) Merger between an airline and an internet company

D) Merger between a package delivery service and a coffee chain

A) Merger between a beer brewery and a winery

B) Merger between a salon chain and a clothing chain

C) Merger between an airline and an internet company

D) Merger between a package delivery service and a coffee chain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is not a motive for mergers?

A) Tax benefits

B) Operating synergies

C) Efficiency increases

D) Strategic Alignments

E) Increased need of external financing

A) Tax benefits

B) Operating synergies

C) Efficiency increases

D) Strategic Alignments

E) Increased need of external financing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

35

Financing synergies arise for all of the following reasons except:

A) Decreased debt capacity

B) Reduced cash flow variability

C) Reduction in average issuing costs

D) Improved access to capital markets

A) Decreased debt capacity

B) Reduced cash flow variability

C) Reduction in average issuing costs

D) Improved access to capital markets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

36

Two managerial motivations for mergers and acquisitions which may not be a good thing are:

A) strategic realignment and tax benefits.

B) Efficiency increases and financing synergies.

C) complementary strengths and geographic synergies.

D) increased company size and reduced company risk through diversification.

A) strategic realignment and tax benefits.

B) Efficiency increases and financing synergies.

C) complementary strengths and geographic synergies.

D) increased company size and reduced company risk through diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following statements is incorrect?

A) When using cash, the acquirer bears all the risk.

B) It always pays for the shareholders of the target company to be taken over.

C) Managers have less interest in the financing of the deal than in getting the deal done.

D) When using share swaps in acquisitions, the risk is borne by the shareholders in both companies.

E) The stock price of acquiring companies usually goes up on announcement of a merger indicating it is getting a good value for the company being acquired.

A) When using cash, the acquirer bears all the risk.

B) It always pays for the shareholders of the target company to be taken over.

C) Managers have less interest in the financing of the deal than in getting the deal done.

D) When using share swaps in acquisitions, the risk is borne by the shareholders in both companies.

E) The stock price of acquiring companies usually goes up on announcement of a merger indicating it is getting a good value for the company being acquired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is not a component of fair market value?

A) Closely related parties

B) Open and unrestricted market

C) Knowledgeable, informed, and prudent parties

D) Neither party under any compulsion to transact

A) Closely related parties

B) Open and unrestricted market

C) Knowledgeable, informed, and prudent parties

D) Neither party under any compulsion to transact

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following would be an example of a management buyout?

A) Disney purchasing Pixar

B) Sears purchasing K-Mart

C) Exxon merging with Mobil

D) Bank of America purchasing Merrill Lynch

E) Michael Dell and others proposing to purchase Dell, Inc.

A) Disney purchasing Pixar

B) Sears purchasing K-Mart

C) Exxon merging with Mobil

D) Bank of America purchasing Merrill Lynch

E) Michael Dell and others proposing to purchase Dell, Inc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is not a drawback to using liquidation valuation to value a merger or acquisition?

A) Not forward looking

B) Values based on existing assets

C) Can involve several imprecise estimates

D) Uses free cash flows because these are what are left over after all obligations are paid

A) Not forward looking

B) Values based on existing assets

C) Can involve several imprecise estimates

D) Uses free cash flows because these are what are left over after all obligations are paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is incorrect regarding accounting for acquisitions?

A) Goodwill resulting from an acquisition may not be amortized.

B) Companies use the purchase method for accounting for acquisitions.

C) Additional paid in capital is the excess of what the acquirer paid for the target that could not be accounted for in fair market value.

D) The acquirer assumes all the assets and liabilities of the target and all operating results from the date of acquisition going forward.

A) Goodwill resulting from an acquisition may not be amortized.

B) Companies use the purchase method for accounting for acquisitions.

C) Additional paid in capital is the excess of what the acquirer paid for the target that could not be accounted for in fair market value.

D) The acquirer assumes all the assets and liabilities of the target and all operating results from the date of acquisition going forward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

42

The following illustration is best described as a merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

43

Acquisitions and mergers can be pure cash transactions, or pure share transactions, but cannot be cash and share transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

44

In a merger, both sets of shareholders have to agree to exchange their existing shares for shares in the new company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

45

A fairness opinion is a document signed by a potential buyer guaranteeing it will keep confidential any information it sees in the data room about a target company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

46

If a company or other investor buys an interest in a publicly traded company that is more than 1 percent of that publicly traded company's stock, the purchaser of the interest must file a Schedule 13D with the SEC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

47

Because of the no-shop clause the bidder of a tender offer must pay all security holders that tender shares the highest price paid in the tender offer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

48

A data room is more likely to be used in a friendly acquisition than with a hostile takeover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

49

When an acquisition is made for cash, it is taxable in the hands of the target company shareholders, while a share swap is usually non-taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

50

Cash acquisitions have tax-advantages for shareholders of the target company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

51

An offering memorandum is usually prepared in hostile takeovers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

52

Increased company size can sometimes be a good motive for mergers and acquisitions, and can also sometimes be a bad motive for mergers and acquisitions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

53

Diversification is a good motive for mergers and acquisitions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

54

The merger of two video game companies would best be described as a conglomerate merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

55

There is a potential merger in the U.S. snack cake industry. The current HHI is 1,700 and the new HHI would be 2,700. The U.S. Department of Justice would classify this as an un-concentrated market, which would increase the likelihood of this merger being approved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

56

A software company buying a sports franchise would best be described as a vertical merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

57

ABC Company has a premerger value of $20 million and Company XYZ has a premerger value of $2.5 million. After merging the new company is worth $25.5 million. The synergy value of the merger is 25.5 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

58

Fair market value is the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

59

When valuing a merger or acquisition using the discounted cash flow approach, free cash flows should be used when running the calculation as opposed to traditional cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

60

Goodwill resulting from an acquisition is how much a company has overpaid to acquire another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

61

What are some possible motivations for an asset purchase instead of a merger or acquisition?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

62

List some of the defenses to a hostile takeover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

63

The Best Tacos made a tender offer for 75 percent of The Second Best Tacos. The Second Best Tacos has 100,000 shares outstanding. You are a shareholder of The Second Best Tacos. If shareholders of The Second Best Tacos tender 90,000 shares, and you tender 5,000 shares, how many of your shares will be accepted by Tyler's Chicken?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

64

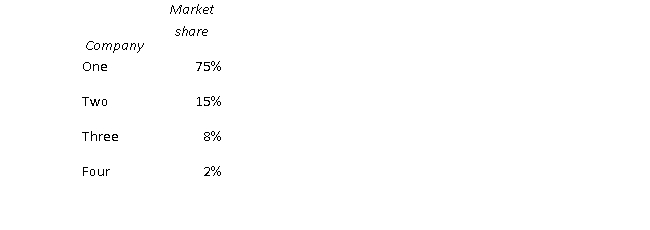

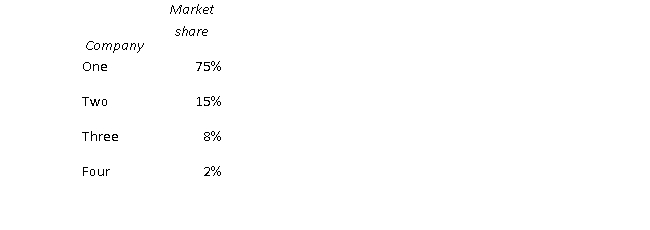

The timeshare vacation industry includes four different companies with the following market share:

a) What is the Herfindahl-Hirschman Index for the timeshare vacation industry?

a) What is the Herfindahl-Hirschman Index for the timeshare vacation industry?

b) If companies Phase 2 and Phase 3 are going to merge, what will the increase in the Herfindahl-Hirschman Index be?

c) Would this be a merger that would reduce competition? Support your answer.

a) What is the Herfindahl-Hirschman Index for the timeshare vacation industry?

a) What is the Herfindahl-Hirschman Index for the timeshare vacation industry?b) If companies Phase 2 and Phase 3 are going to merge, what will the increase in the Herfindahl-Hirschman Index be?

c) Would this be a merger that would reduce competition? Support your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

65

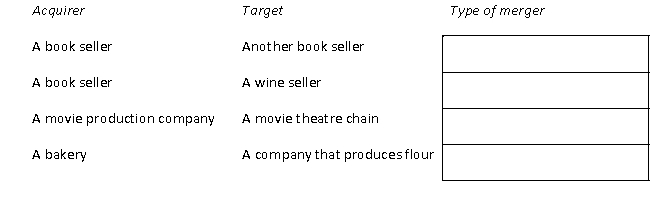

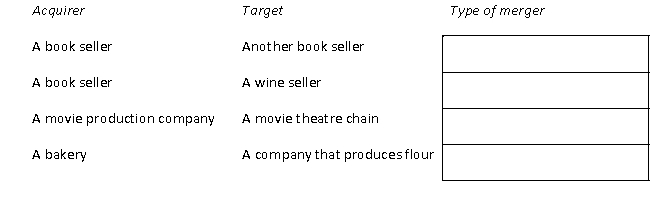

For each of the following, classify the merger as horizontal, vertical, or conglomerate:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

66

List possible valuation methods used to value a merger or acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

67

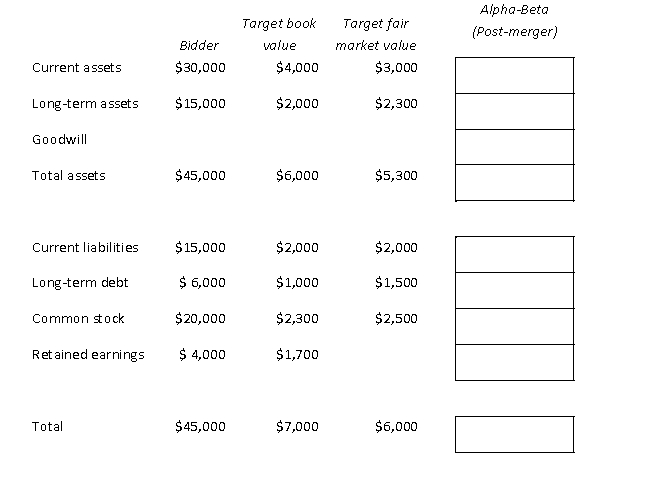

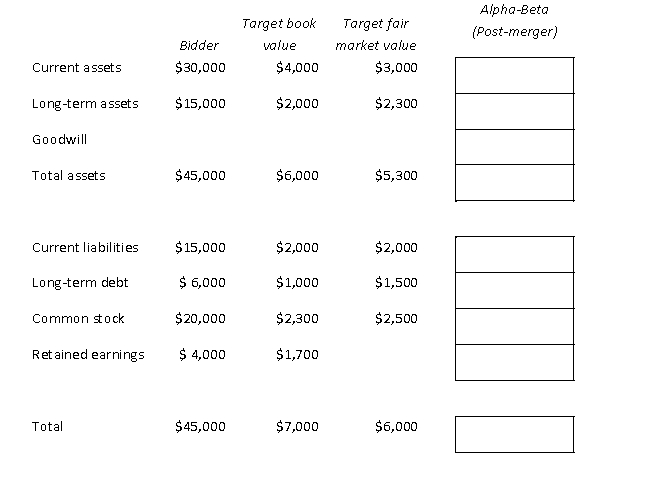

Alpha Company is merging with Beta Company. Complete the following balance sheet for the post-merger Alpha-Beta Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

68

The combination of two companies that results in the formation of a new corporation is best described as:

A) a merger.

B) an acquisition.

C) a conglomerate.

A) a merger.

B) an acquisition.

C) a conglomerate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

69

The merger of a jewelry company with a mining company is best described as a:

A) conglomerate.

B) vertical merger.

C) horizontal merger.

A) conglomerate.

B) vertical merger.

C) horizontal merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

70

The motive to merge that is based on the idea that combining manufacturing so produce a larger scale of production that results in lower costs per unit produced is best described as:

A) diversification.

B) economies of scale.

C) efficiencies of scope.

A) diversification.

B) economies of scale.

C) efficiencies of scope.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

71

The requirement that the bidder in a tender offer pay all security holders that tender shares the highest price paid in a tender offer is best described as the:

A) best price rule.

B) acquisition rule.

C) underwriting rule.

D) tender offer rule.

A) best price rule.

B) acquisition rule.

C) underwriting rule.

D) tender offer rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

72

An acquisition of a company for the purposes of changing the company's status from a publicly-traded company to a private company is best described as a:

A) diversifying.

B) going private.

C) public offering.

D) going backward.

A) diversifying.

B) going private.

C) public offering.

D) going backward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

73

If the FTC requires that a company sell off some of its operations so that the merger or acquisition is approved, this is referred to as:

A) fix it first.

B) fix it and forget it.

C) fix by reduction.

A) fix it first.

B) fix it and forget it.

C) fix by reduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

74

The higher the level of the Herfindahl-Hirschman index, the more concentrated the industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

75

If a company has a trailing price-earnings ratio of 12 and current earnings of $5 million, the value of its equity if earnings are expected to grow at a rate of 4 percent per year is closest to:

A) $0.4 million.

B) $2.4 million

C) $60 million.

D) $62.4 million.

A) $0.4 million.

B) $2.4 million

C) $60 million.

D) $62.4 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

76

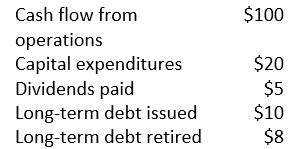

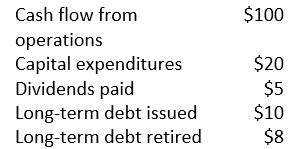

Consider a company with the following financial information, in millions:

Its free cash flow to equity is closest to:

A) $75 million.

B) $80 million.

C) $82 million

D) $90 million.

Its free cash flow to equity is closest to:

A) $75 million.

B) $80 million.

C) $82 million

D) $90 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

77

Goodwill is best described as the:

A) value of intangible assets of the target company.

B) premium of the purchase price over the value of the stock prior to the announcement of the acquisition bid.

C) difference between the purchase price for the target company and the fair market value of the assets of the target.

A) value of intangible assets of the target company.

B) premium of the purchase price over the value of the stock prior to the announcement of the acquisition bid.

C) difference between the purchase price for the target company and the fair market value of the assets of the target.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck