Deck 19: Working Capital Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/92

العب

ملء الشاشة (f)

Deck 19: Working Capital Management

1

A company's cash on hand and the rate that cash is used in operations due to negative operating cash flows is best described as:

A) liquidity.

B) cash burn.

C) productivity.

D) financial leverage.

E) operational efficiency.

A) liquidity.

B) cash burn.

C) productivity.

D) financial leverage.

E) operational efficiency.

cash burn.

2

How long a company can operate before it has to raise funds, either by issuing stock or borrowing is best described as:

A) liquidity.

B) burn rate.

C) cash burn.

D) financial leverage.

E) operational efficiency.

A) liquidity.

B) burn rate.

C) cash burn.

D) financial leverage.

E) operational efficiency.

burn rate.

3

The sum of a company's current assets is best described as:

A) liquidity.

B) cash burn.

C) total assets.

D) working capital.

E) net working capital.

A) liquidity.

B) cash burn.

C) total assets.

D) working capital.

E) net working capital.

working capital.

4

Current assets minus current liabilities is best described as:

A) liquidity.

B) cash burn.

C) total assets.

D) working capital.

E) net working capital.

A) liquidity.

B) cash burn.

C) total assets.

D) working capital.

E) net working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is the correct formula to determine cash?

A) Beginning cash balance + collections from customers - payments to suppliers = ending cash balance

B) Beginning cash balance - collections from customers + payments to suppliers = ending cash balance

C) Beginning cash balance + collections from customers + payments to suppliers = ending cash balance

D) Beginning cash balance - collections from customers - payments to suppliers = ending cash balance

A) Beginning cash balance + collections from customers - payments to suppliers = ending cash balance

B) Beginning cash balance - collections from customers + payments to suppliers = ending cash balance

C) Beginning cash balance + collections from customers + payments to suppliers = ending cash balance

D) Beginning cash balance - collections from customers - payments to suppliers = ending cash balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

6

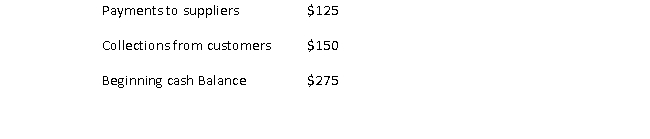

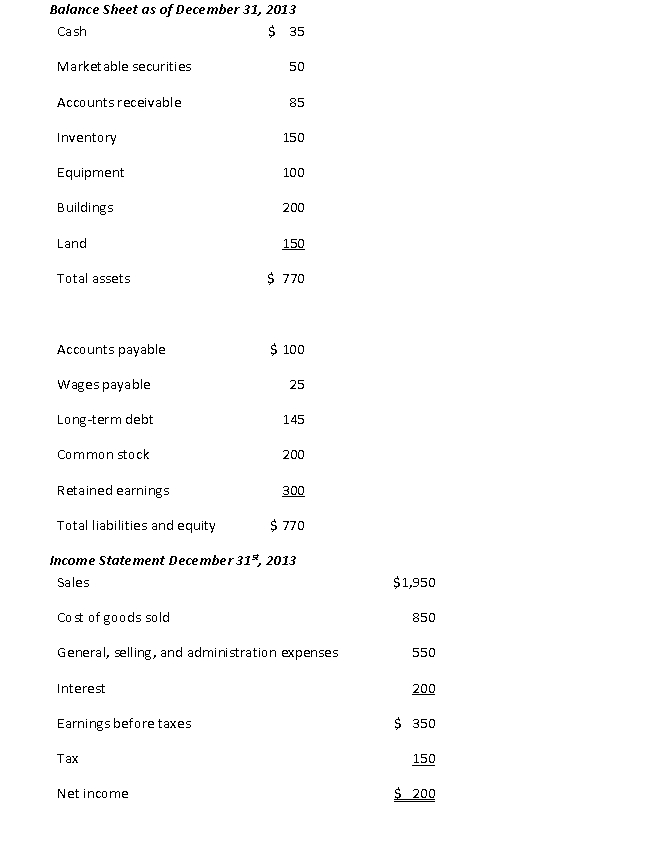

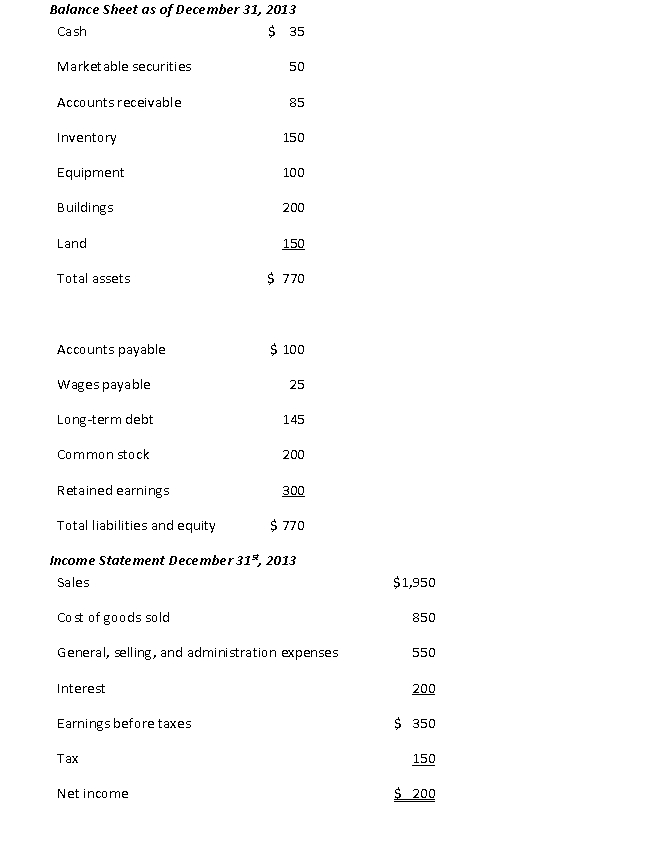

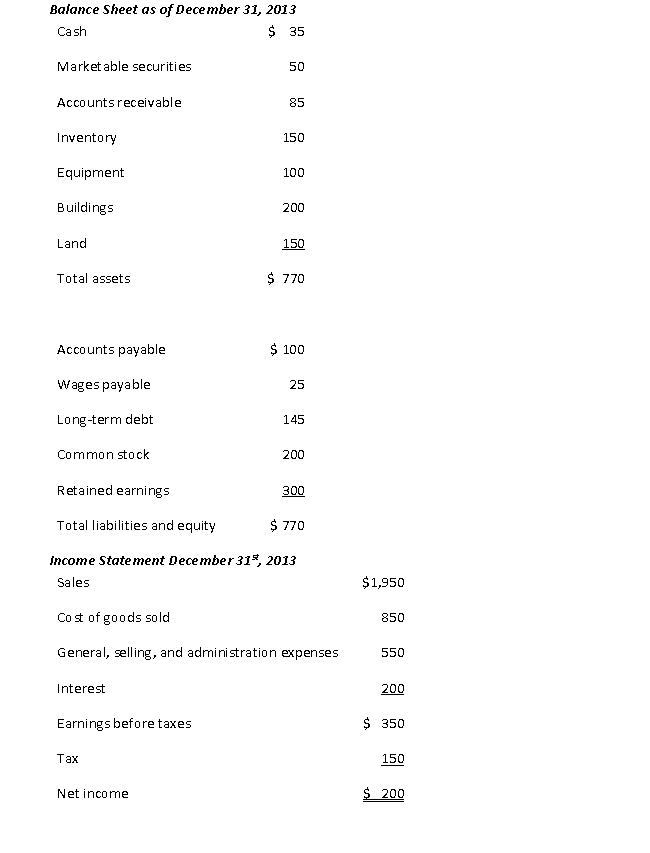

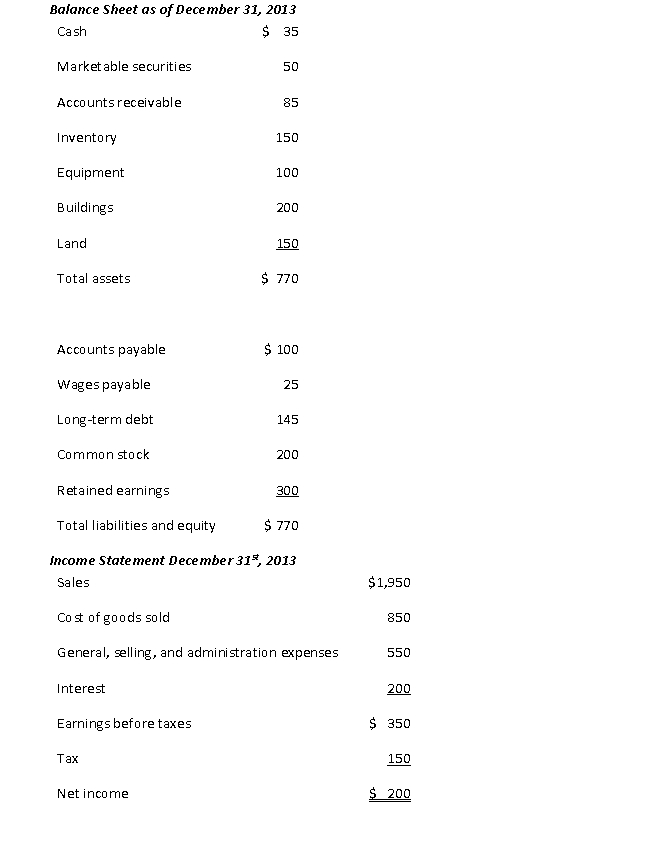

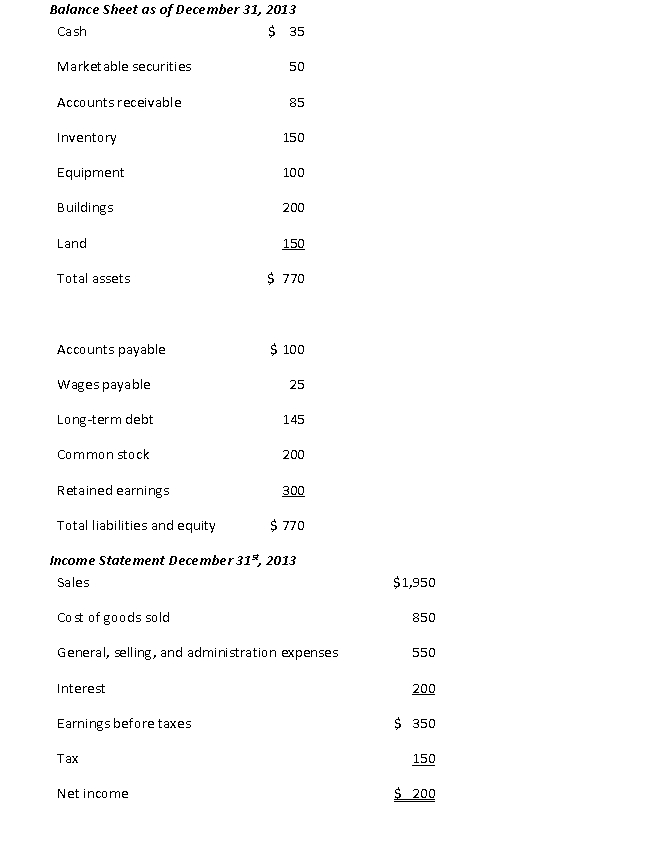

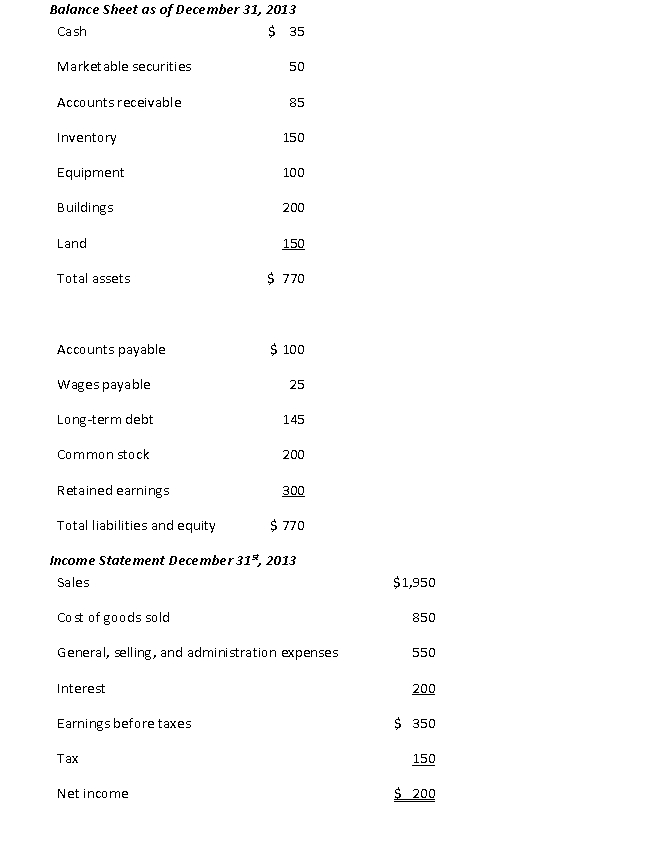

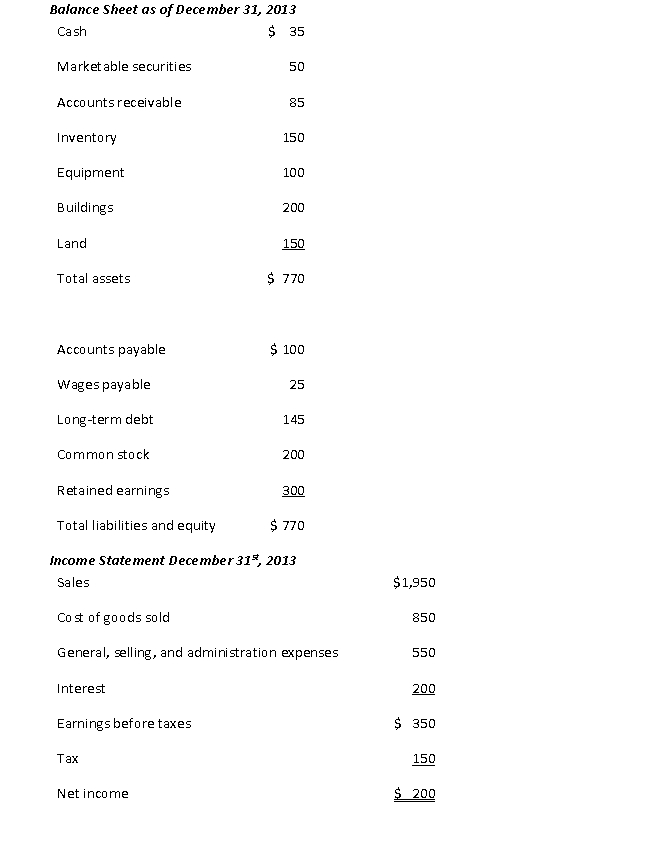

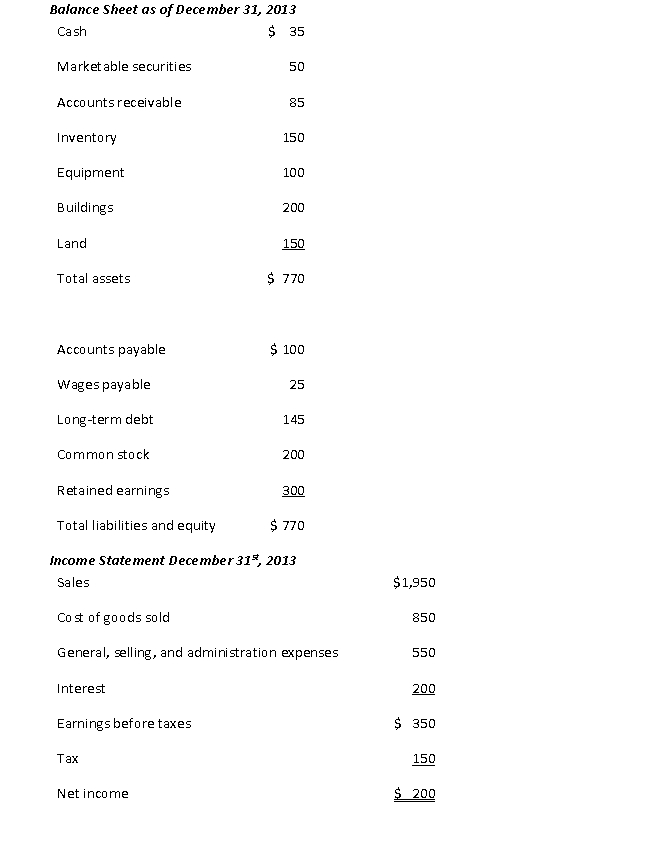

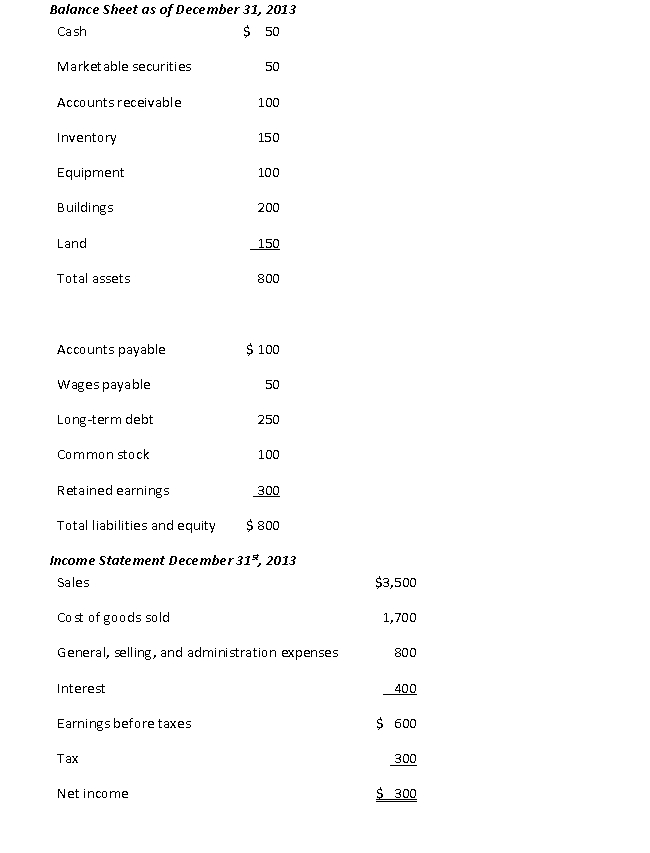

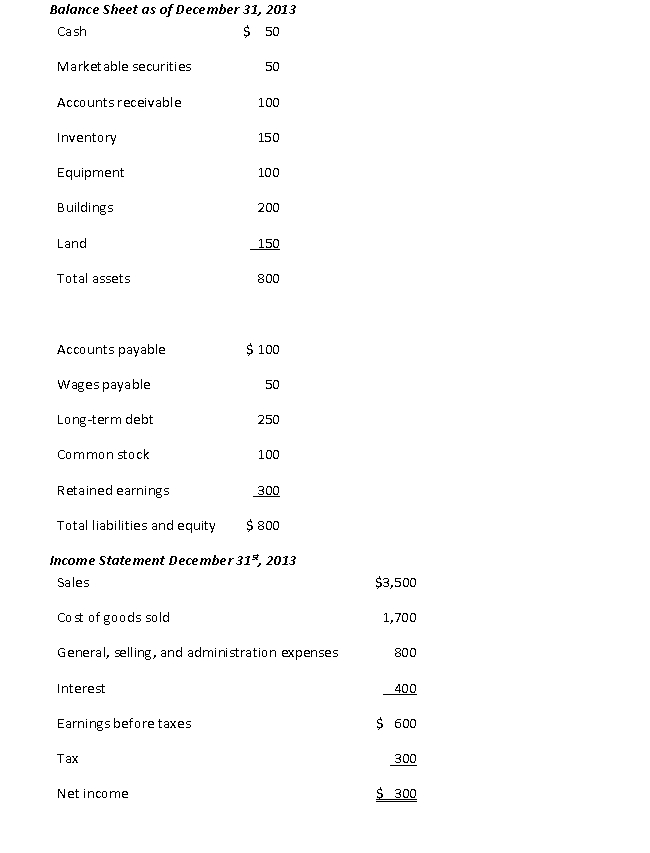

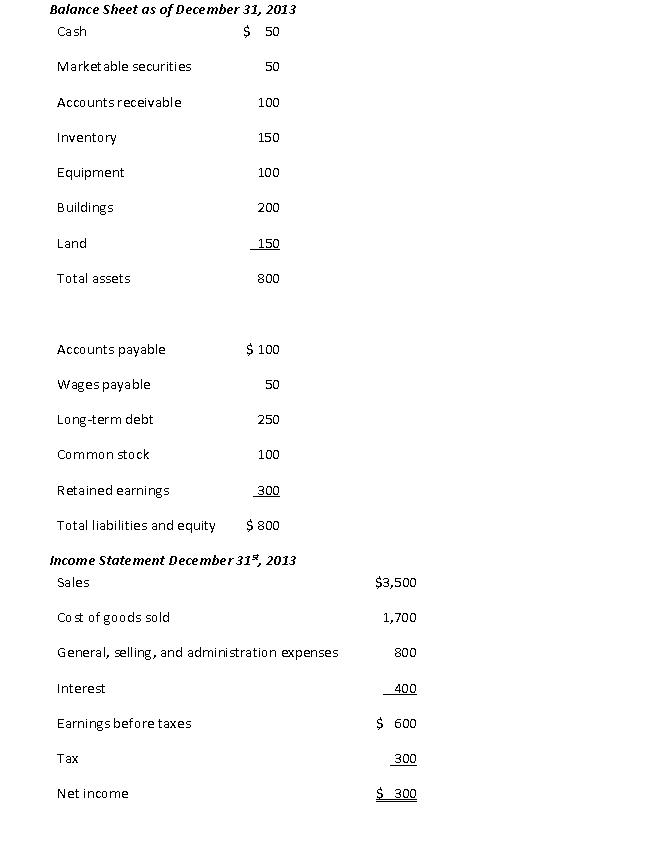

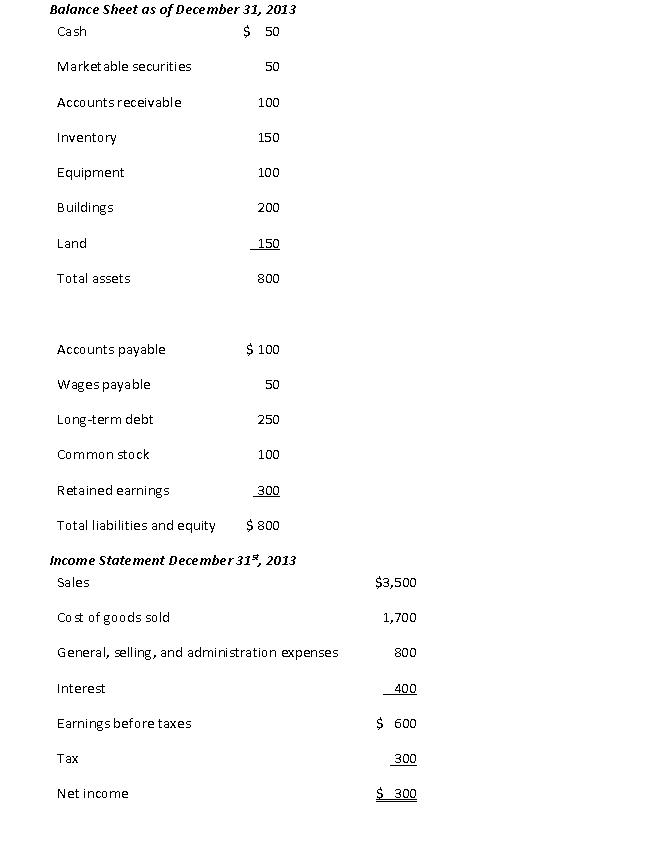

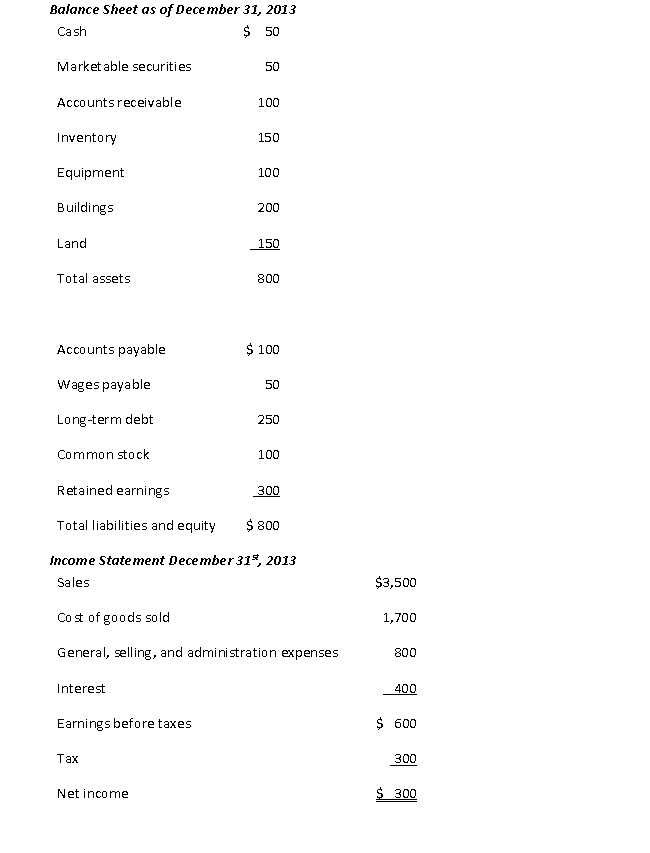

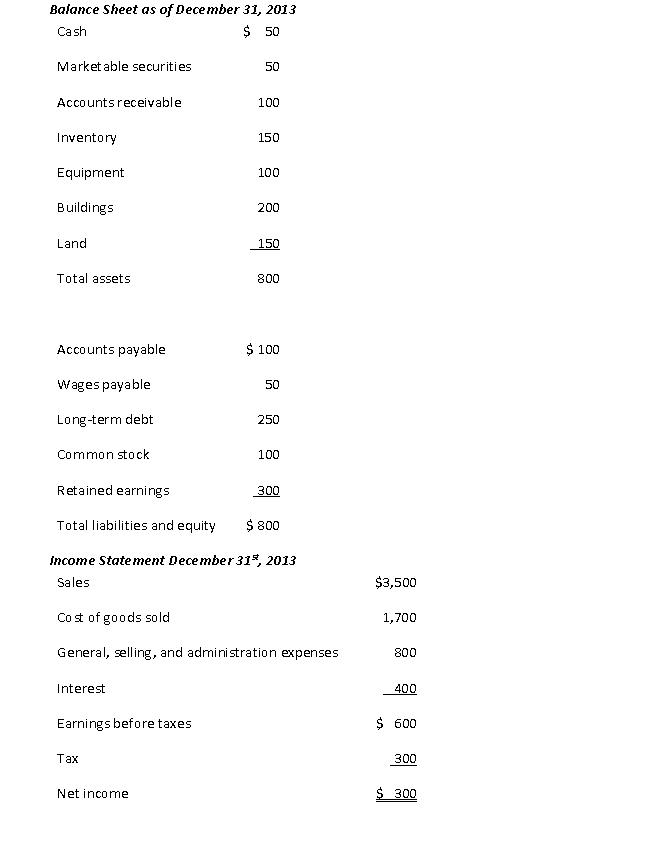

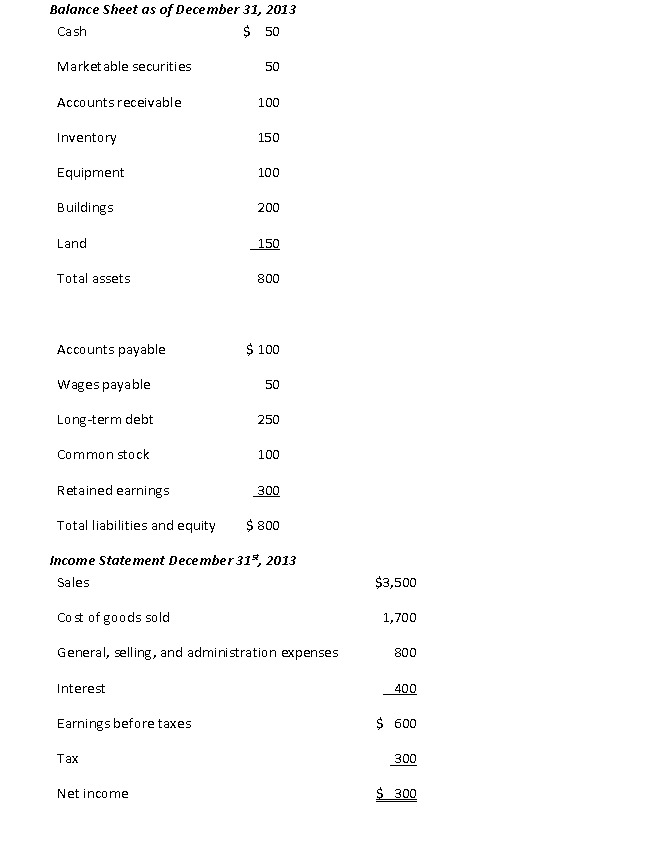

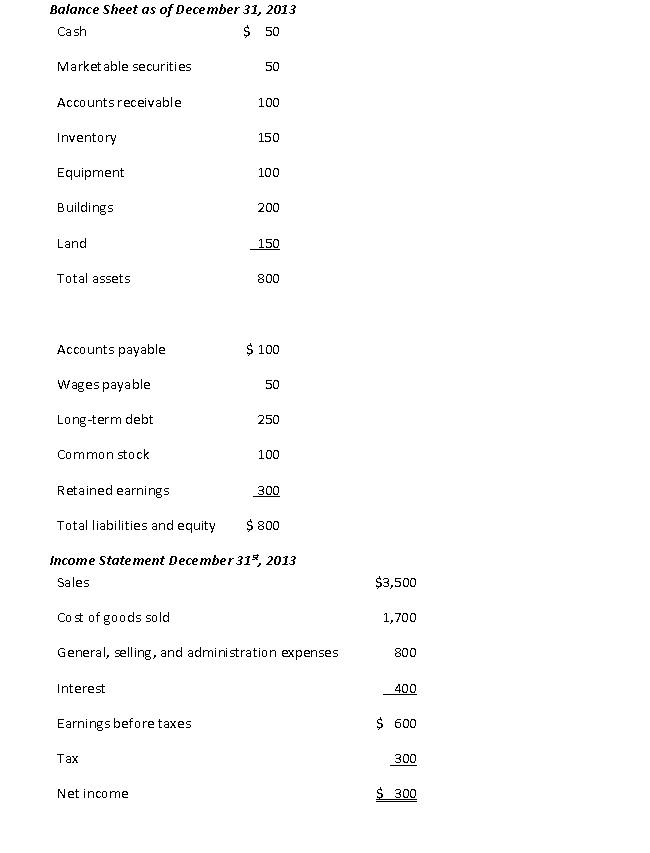

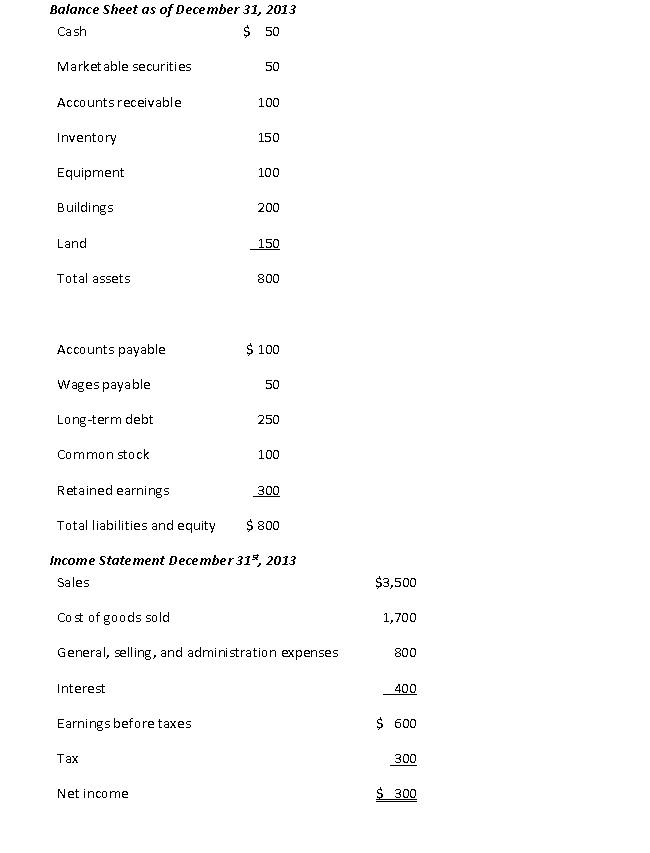

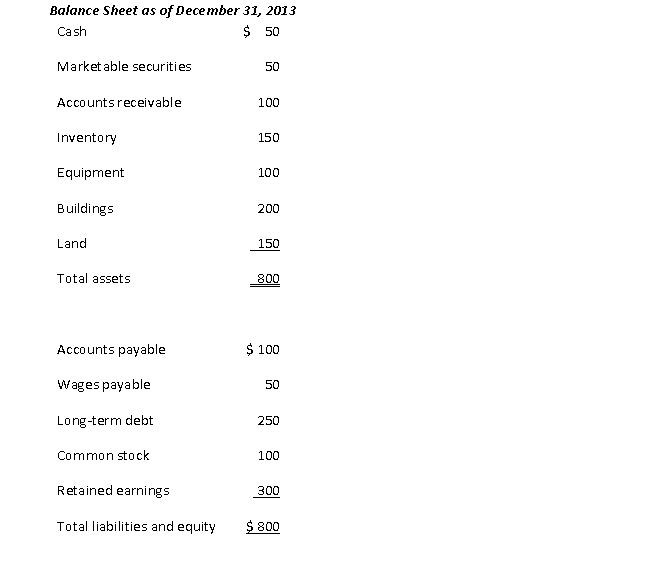

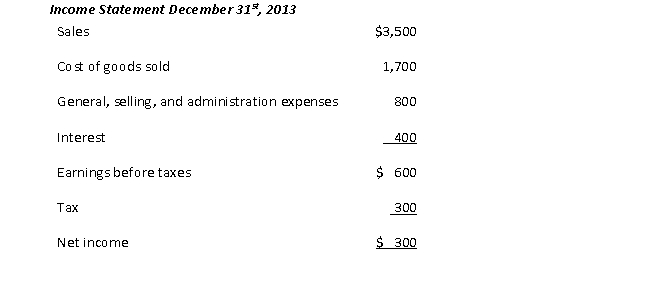

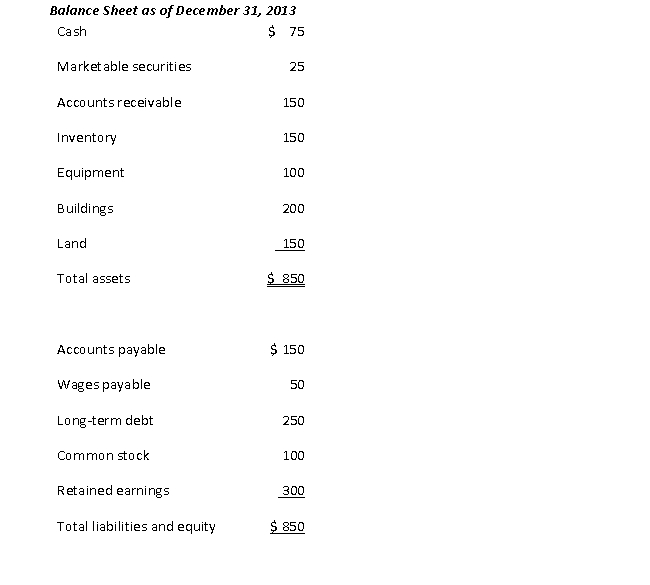

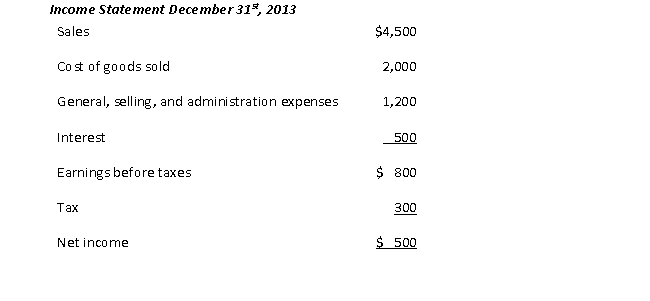

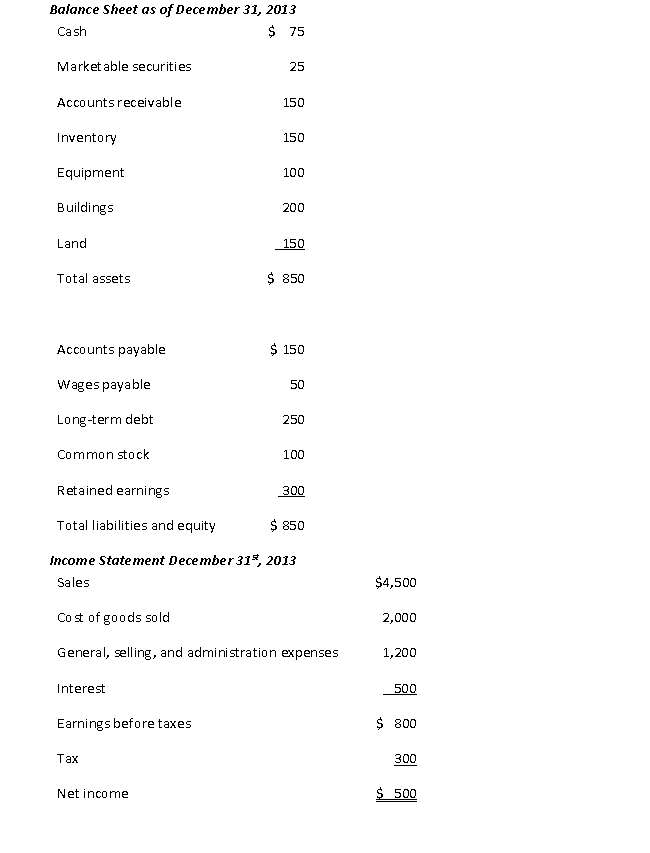

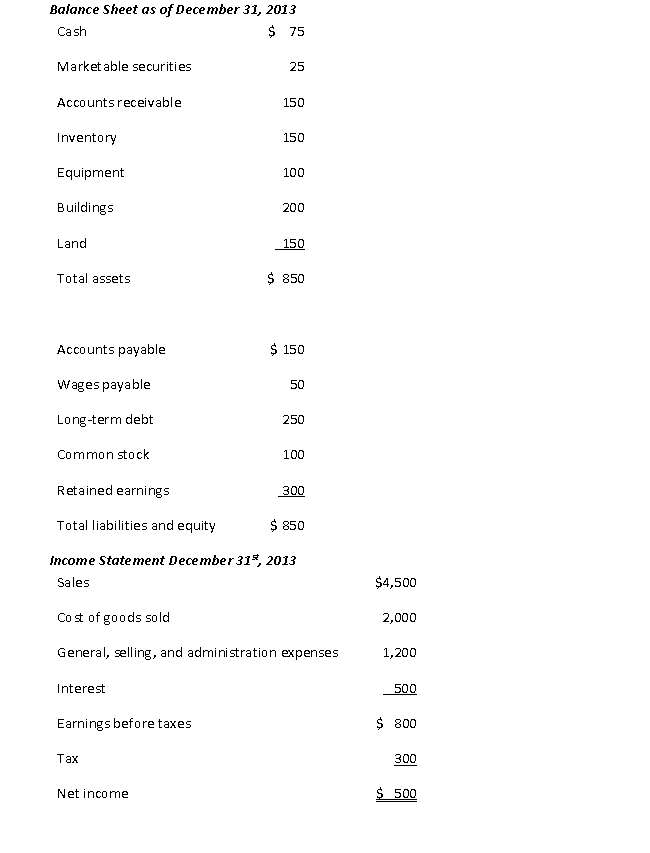

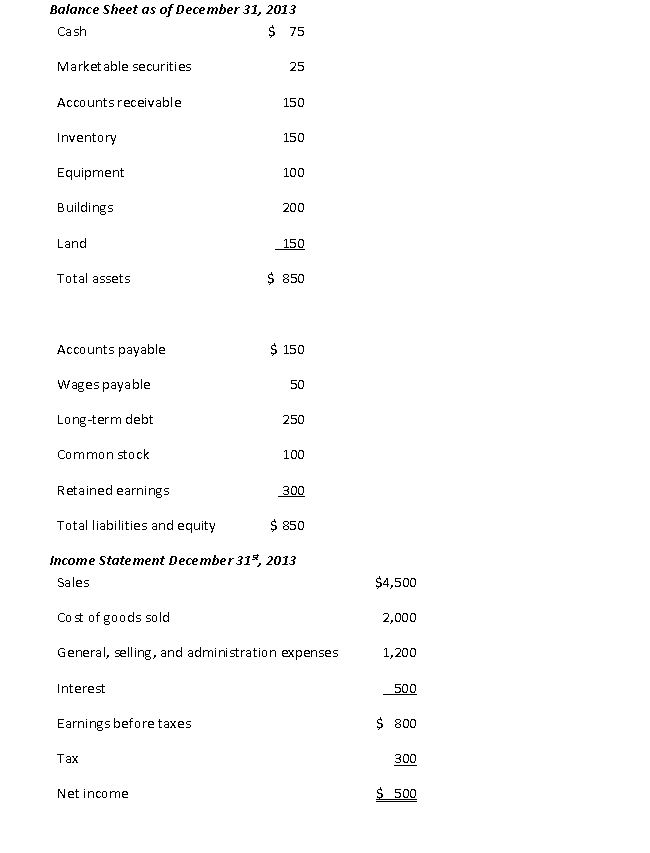

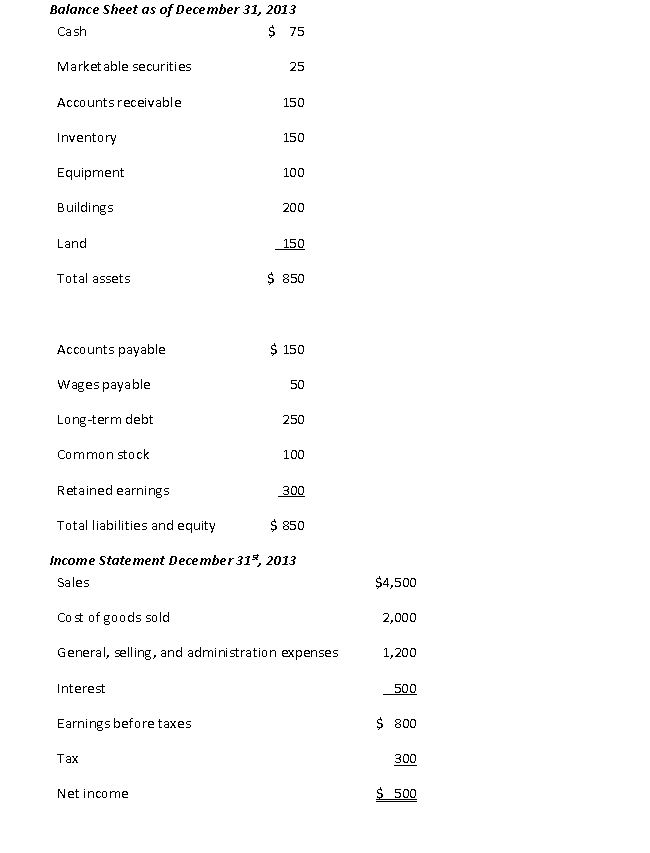

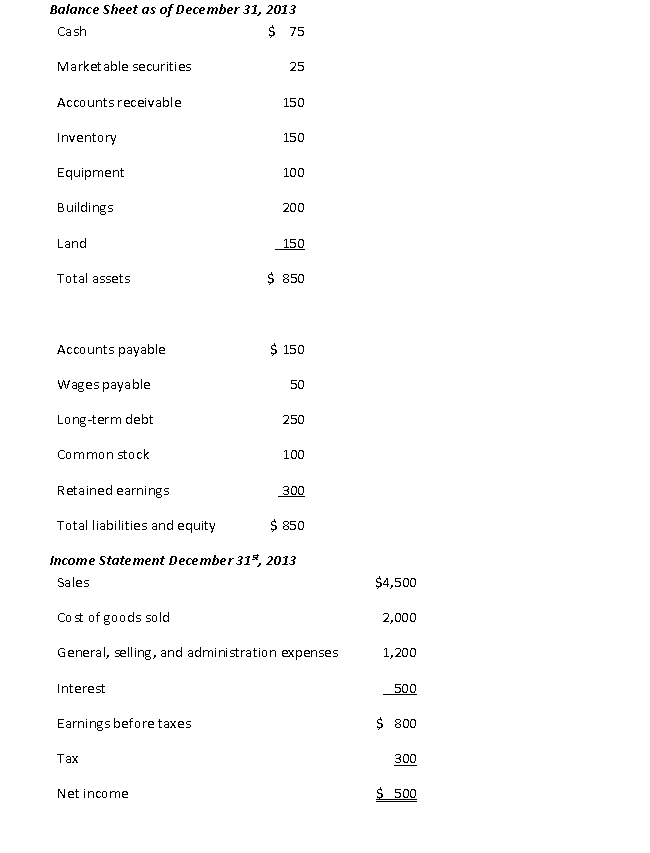

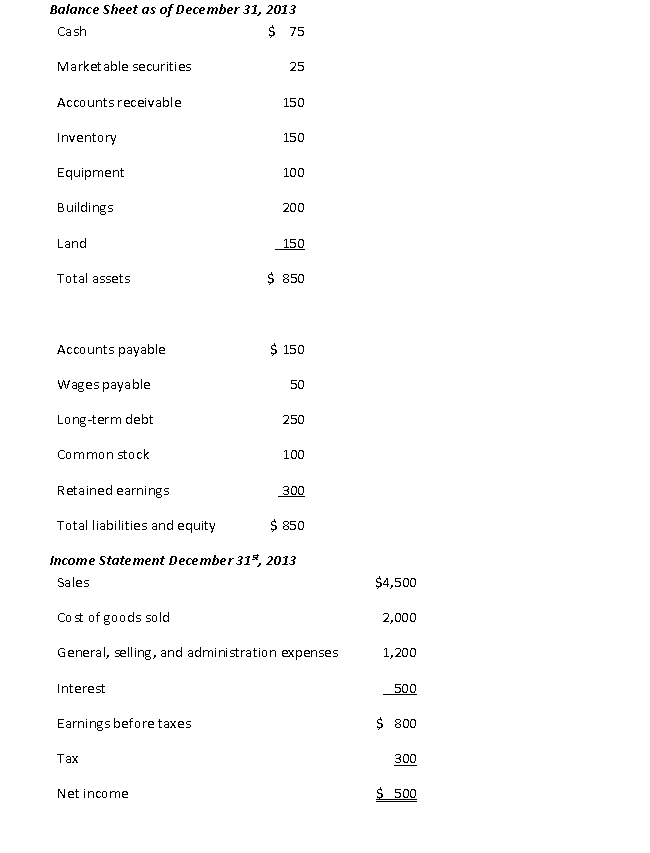

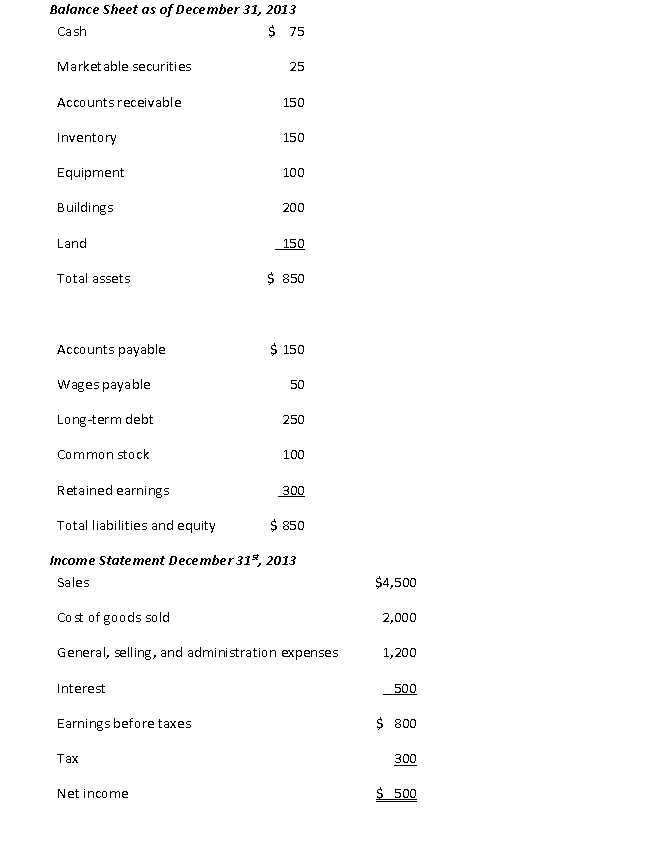

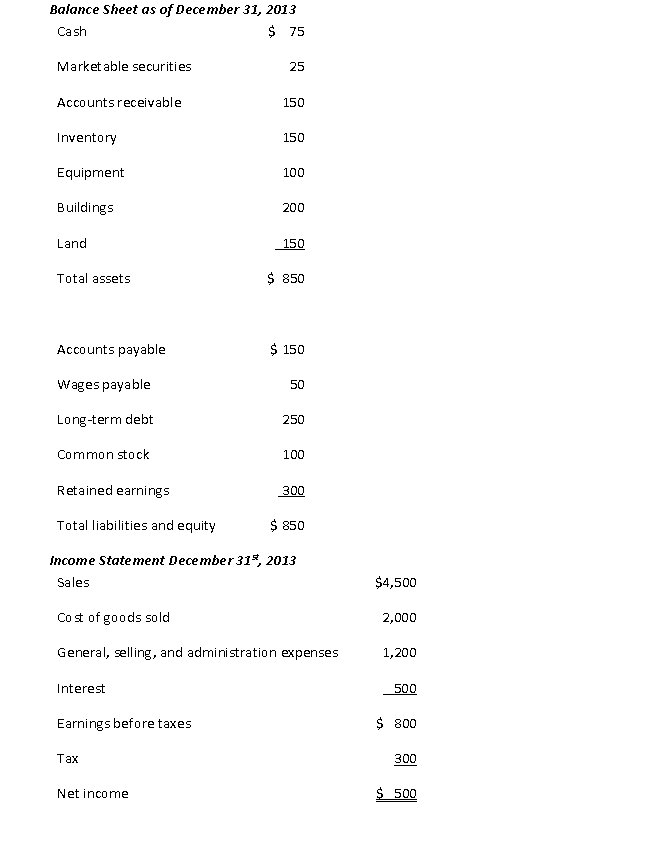

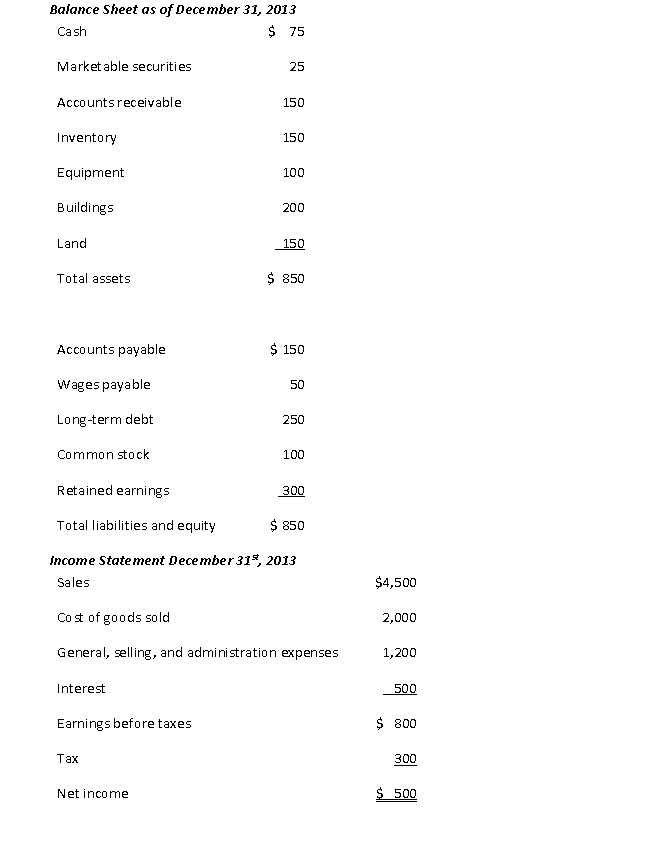

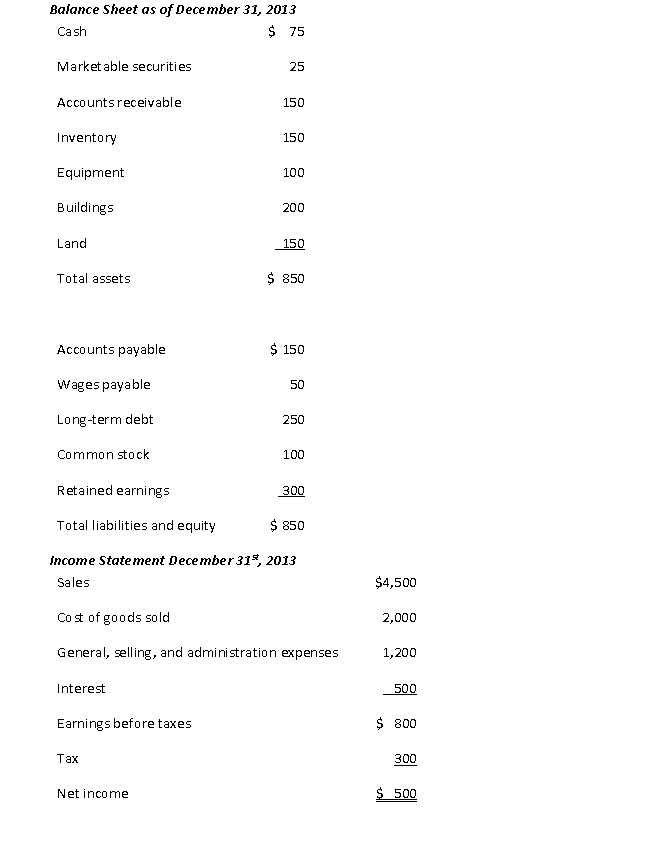

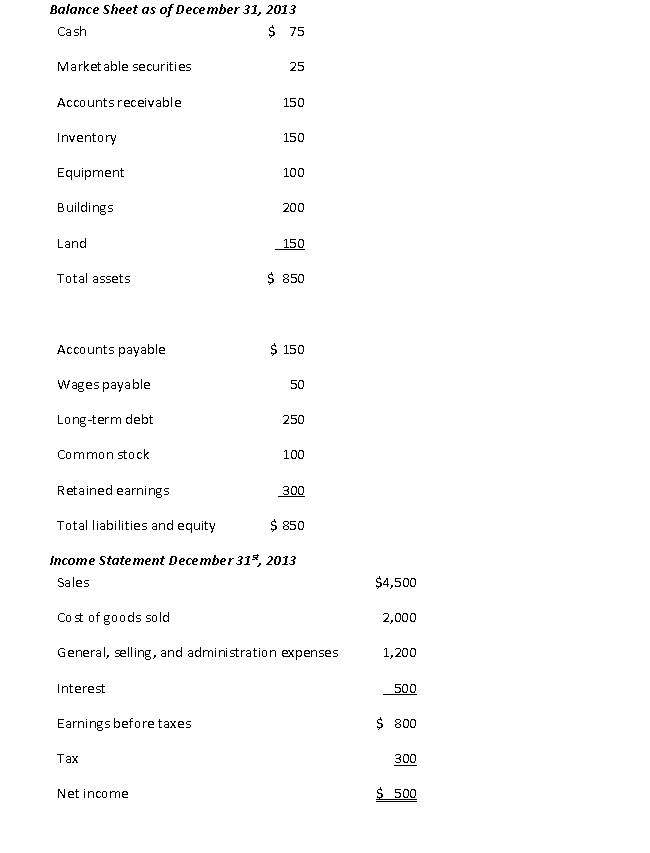

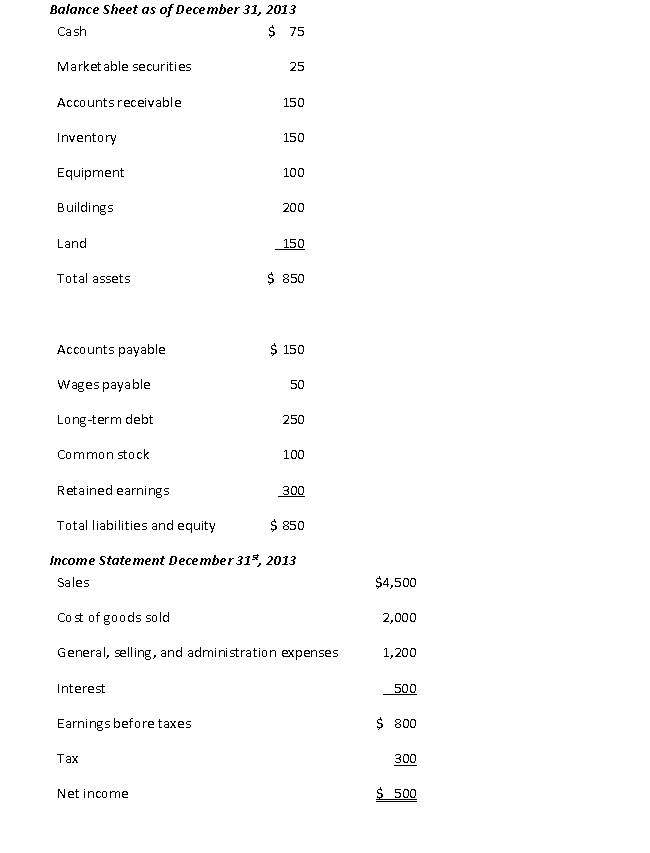

The ending cash balance for a company with the following financial information:

is closest to:

is closest to:

A) $0

B) $250

C) $300

D) $325

E) $550

is closest to:

is closest to:A) $0

B) $250

C) $300

D) $325

E) $550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

7

The terms under which a company grants credit to its customers is best described as:

A) credit policy.

B) liquidity policy.

C) payment policy.

D) inventory policy.

A) credit policy.

B) liquidity policy.

C) payment policy.

D) inventory policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

8

How quickly a company pays off the credit it receives from other companies is best described as:

A) credit policy.

B) liquidity policy.

C) payment policy.

D) inventory policy.

A) credit policy.

B) liquidity policy.

C) payment policy.

D) inventory policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

9

Determining whether to use EOQ, MRP or JIT is part of what type of policy?

A) Credit policy

B) Liquidity policy

C) Payment policy

D) Inventory policy

A) Credit policy

B) Liquidity policy

C) Payment policy

D) Inventory policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is the correct current ratio calculation?

A) Current assets / Current liabilities

B) Current assets - Current liabilities

C) Current liabilities - Current assets

D) Current liabilities / Current assets

A) Current assets / Current liabilities

B) Current assets - Current liabilities

C) Current liabilities - Current assets

D) Current liabilities / Current assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is the correct quick ratio calculation?

A) Current assets / Current liabilities

B) (Cash + Accounts receivable) / Current liabilities

C) (Cash + Marketable securities) / Current liabilities

D) (Cash + Marketable securities + Accounts receivable) / Current liabilities

A) Current assets / Current liabilities

B) (Cash + Accounts receivable) / Current liabilities

C) (Cash + Marketable securities) / Current liabilities

D) (Cash + Marketable securities + Accounts receivable) / Current liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is the correct accounts receivable turnover calculation?

A) Revenues / Accounts receivable

B) Accounts receivable /Revenues

C) Accounts receivable / Current liabilities

D) Accounts receivable / Average daily sales

E) (Cash + Marketable securities + Accounts receivable) / Current liabilities

A) Revenues / Accounts receivable

B) Accounts receivable /Revenues

C) Accounts receivable / Current liabilities

D) Accounts receivable / Average daily sales

E) (Cash + Marketable securities + Accounts receivable) / Current liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is the correct days sales outstanding calculation?

A) Revenues / Accounts receivable

B) Accounts receivable/ Revenues

C) Average daily sales/ Accounts receivable

D) Accounts receivable/Average daily sales

A) Revenues / Accounts receivable

B) Accounts receivable/ Revenues

C) Average daily sales/ Accounts receivable

D) Accounts receivable/Average daily sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is the correct inventory turnover calculation?

A) Inventory / Cost of goods sold

B) Cost of goods sold /Inventory

C) Inventory / Average days cost of goods sold

D) Average days cost of goods sold / Inventory

A) Inventory / Cost of goods sold

B) Cost of goods sold /Inventory

C) Inventory / Average days cost of goods sold

D) Average days cost of goods sold / Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is the correct days sales in inventory calculation?

A) 365 / Inventory turnover

B) Inventory turnover / 365

C) Inventory / Cost of goods sold

D) Cost of goods sold /Inventory

A) 365 / Inventory turnover

B) Inventory turnover / 365

C) Inventory / Cost of goods sold

D) Cost of goods sold /Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is the correct accounts payable turnover calculation?

A) Inventory Turnover / 365

B) Inventory / Accounts Payable

C) Purchases / Accounts Payable

D) Accounts Payable /Purchases

E) Accounts Payable / Average Days' Purchases

A) Inventory Turnover / 365

B) Inventory / Accounts Payable

C) Purchases / Accounts Payable

D) Accounts Payable /Purchases

E) Accounts Payable / Average Days' Purchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

17

The average time it takes a company to acquire inventory, sell it, and collect the sale proceeds is best described as:

A) liquidity.

B) cash burn.

C) operating cycle.

D) cash conversion cycle.

E) days sales outstanding.

A) liquidity.

B) cash burn.

C) operating cycle.

D) cash conversion cycle.

E) days sales outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

18

The measure of the average time between when a company pays cash for its inventory purchases and when it receives cash for its sales is best described as the:

A) liquidity.

B) cash burn.

C) operating cycle.

D) cash conversion cycle.

E) days sales outstanding.

A) liquidity.

B) cash burn.

C) operating cycle.

D) cash conversion cycle.

E) days sales outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

19

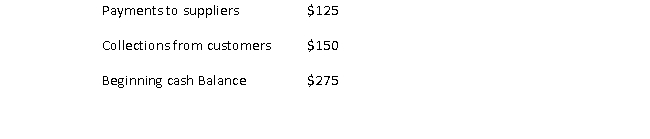

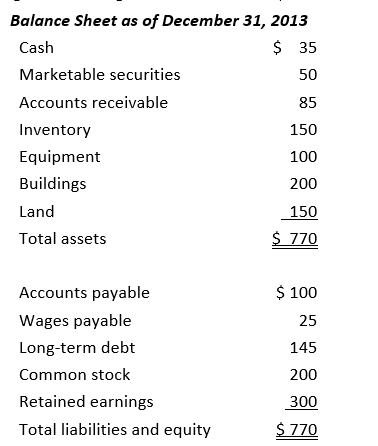

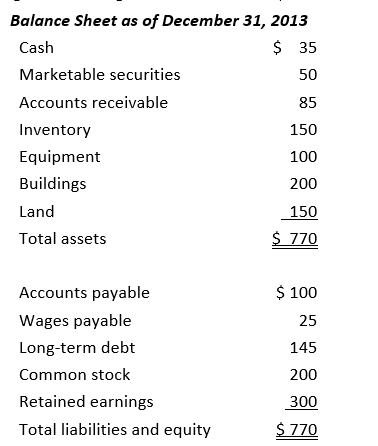

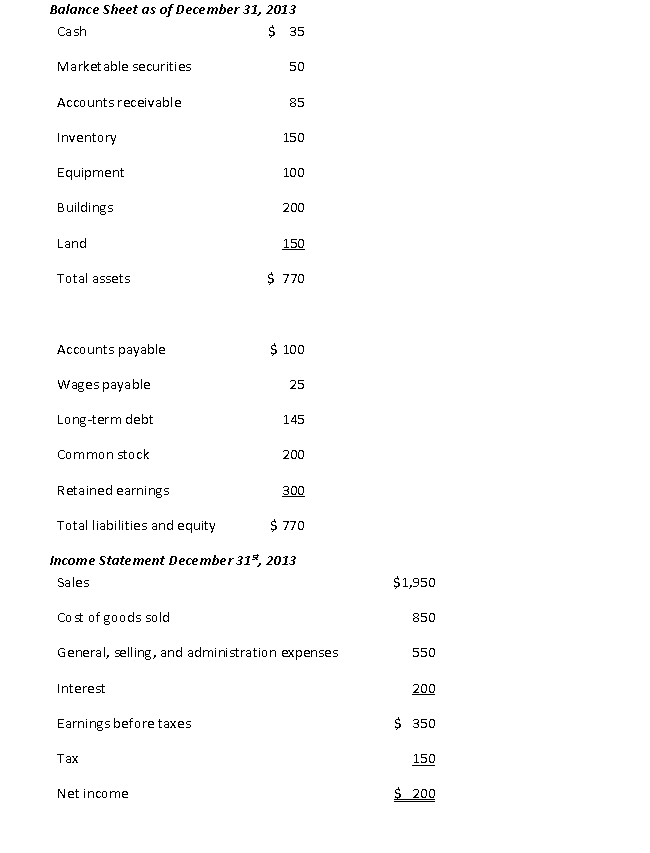

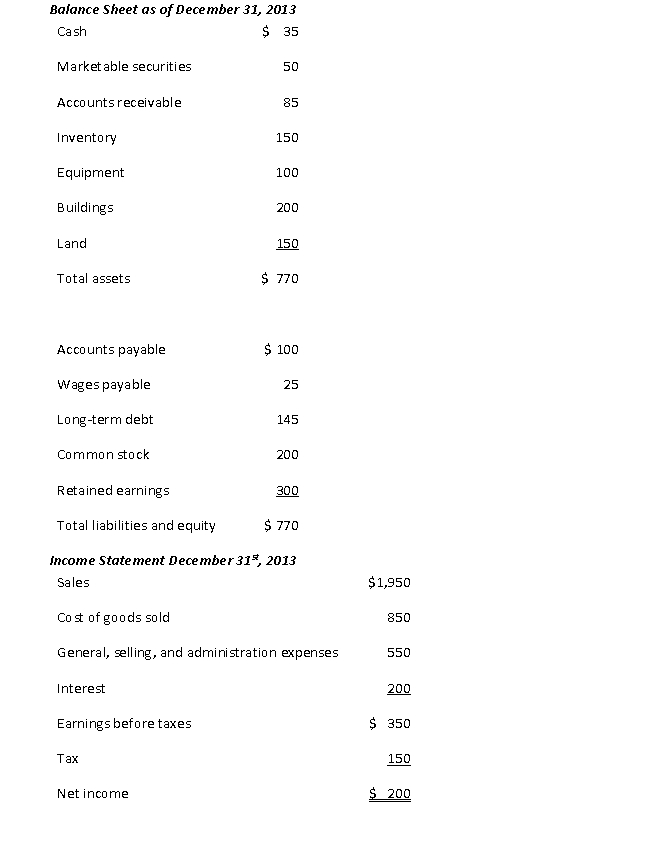

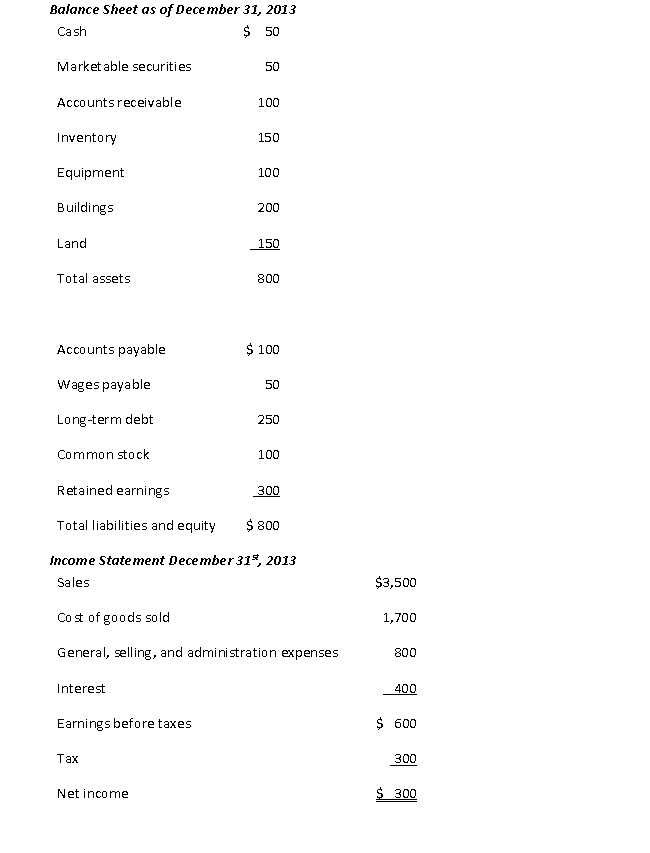

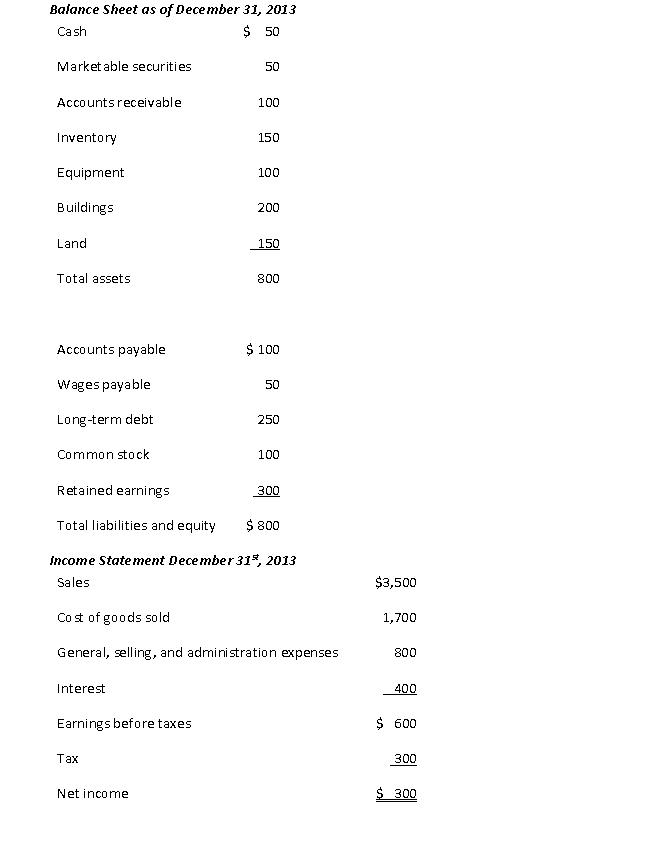

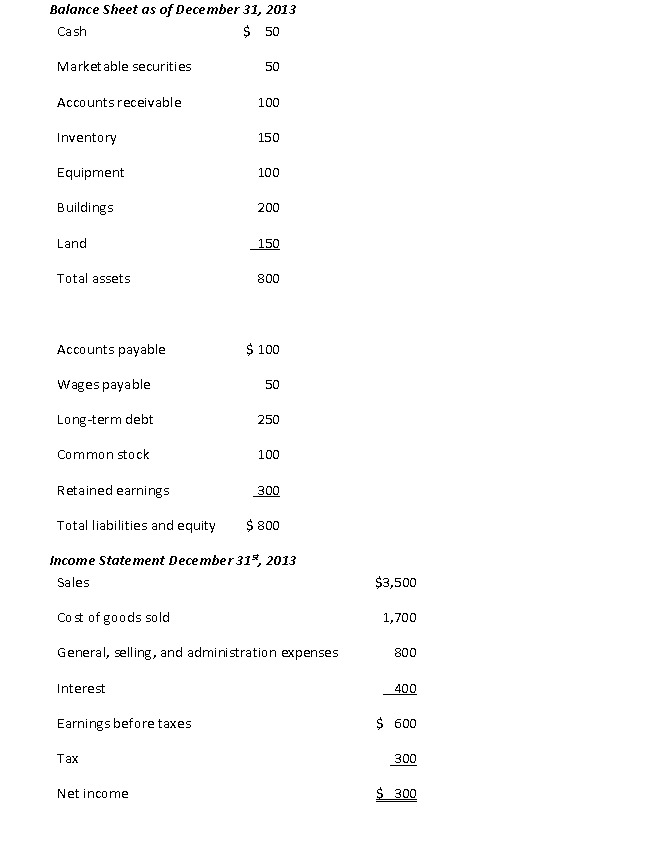

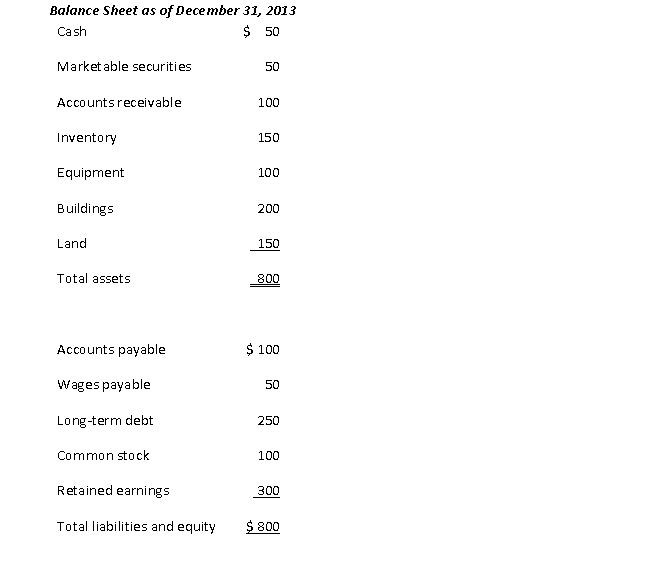

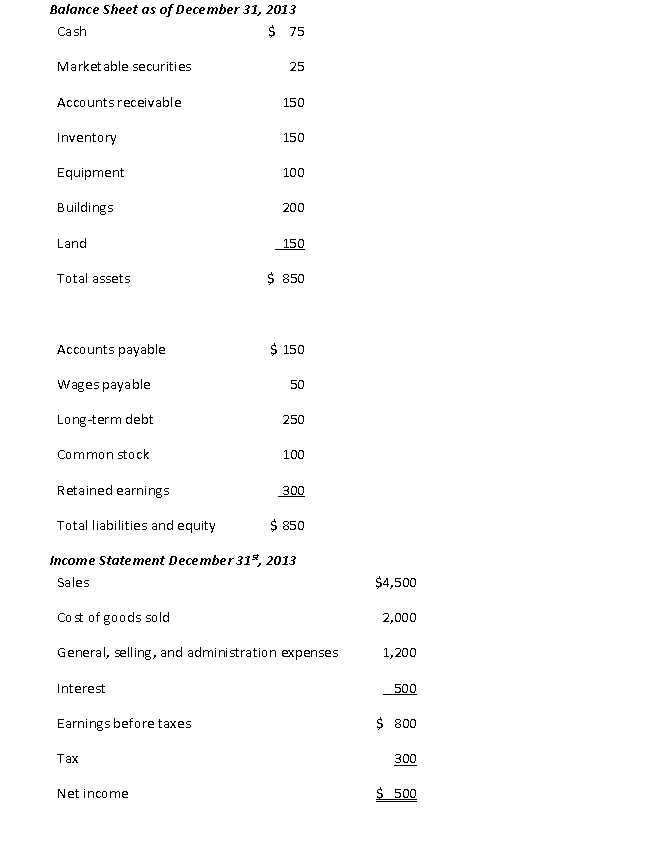

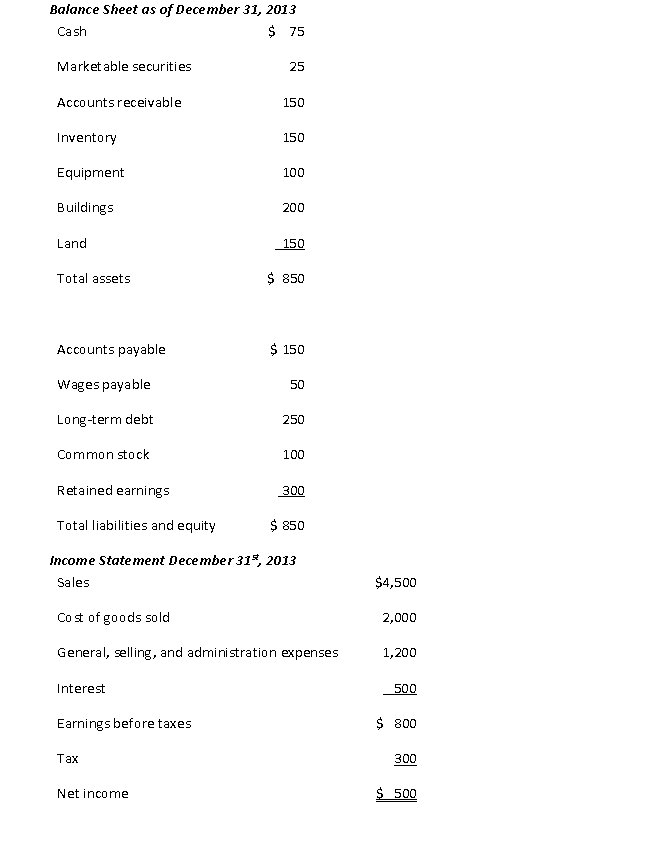

Using the following financial statements,

the quick ratio is closest to:

the quick ratio is closest to:

A) 0.28

B) 0.68

C) 1.36

D) 2.56

the quick ratio is closest to:

the quick ratio is closest to:A) 0.28

B) 0.68

C) 1.36

D) 2.56

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

20

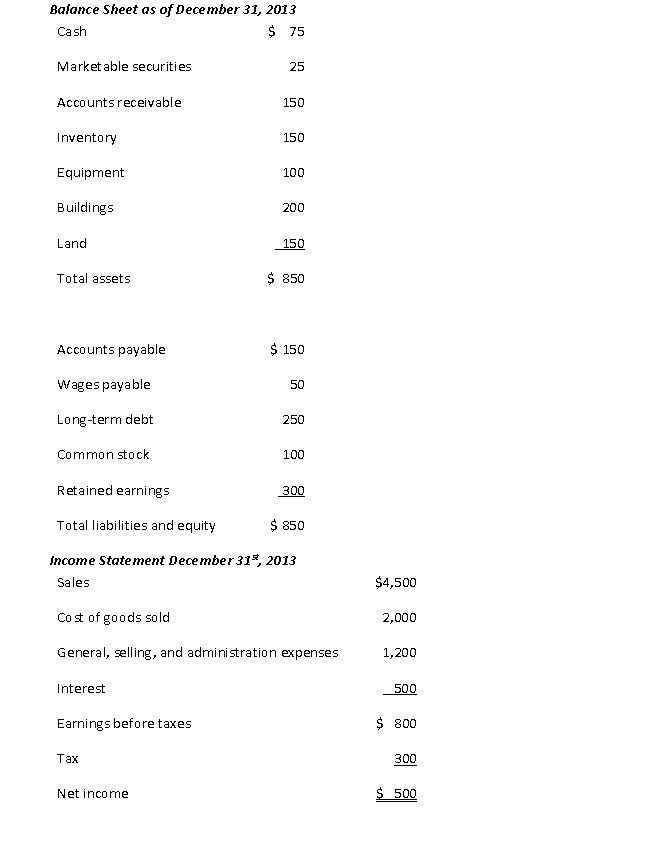

Using the following financial statements

the current ratio is closest to:

the current ratio is closest to:

A) 0.29

B) 2.56

C) 3.20

the current ratio is closest to:

the current ratio is closest to:A) 0.29

B) 2.56

C) 3.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

21

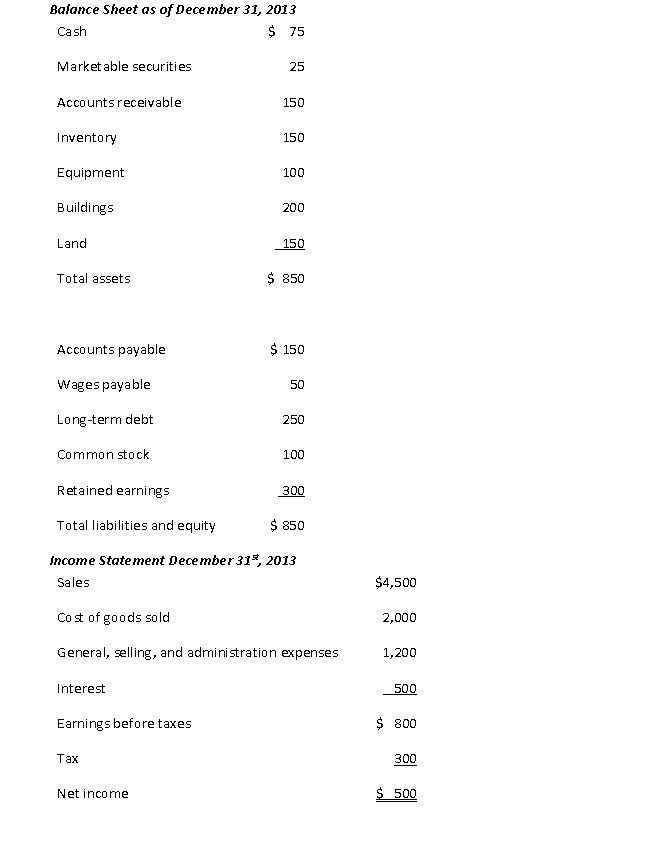

Using the following financial statements:

the accounts receivable turnover ratio is closest to:

the accounts receivable turnover ratio is closest to:

A) 14.4

B) 22.9

C) 28.9

D) 34.1

the accounts receivable turnover ratio is closest to:

the accounts receivable turnover ratio is closest to:A) 14.4

B) 22.9

C) 28.9

D) 34.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

22

Using the following financial statements

the days sales outstanding is closest to:

the days sales outstanding is closest to:

A) 15.9

B) 36.5

C) 59.9

D) 137.4

the days sales outstanding is closest to:

the days sales outstanding is closest to:A) 15.9

B) 36.5

C) 59.9

D) 137.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

23

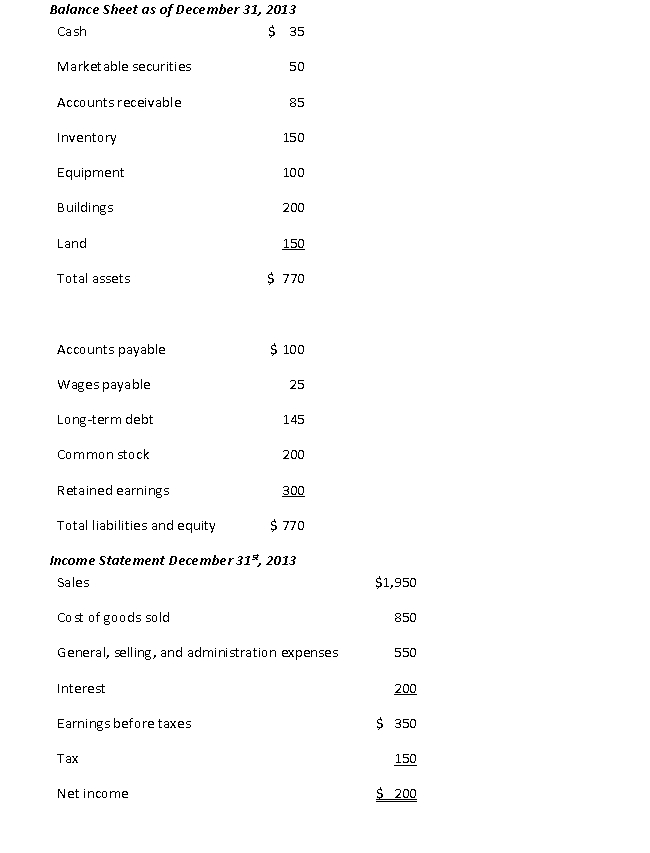

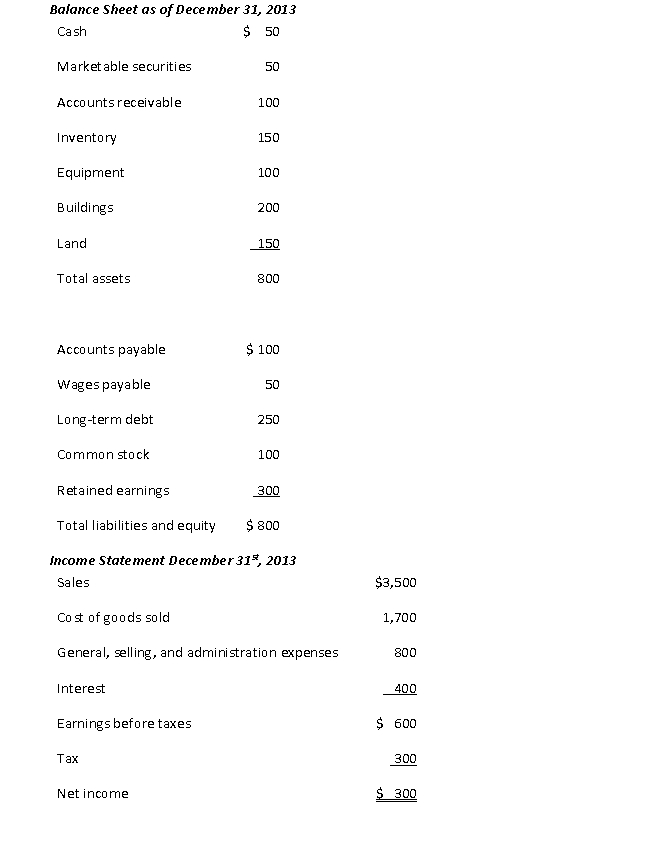

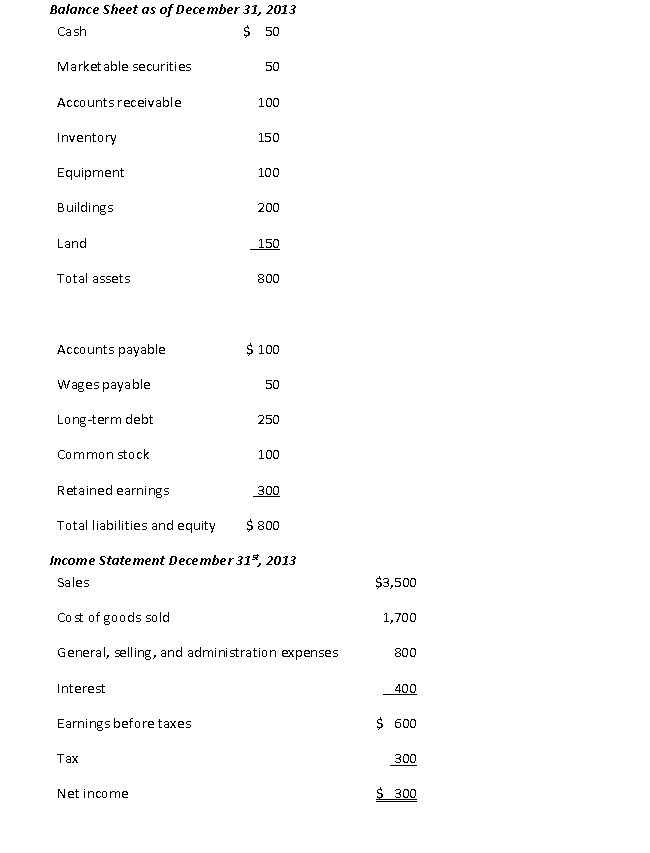

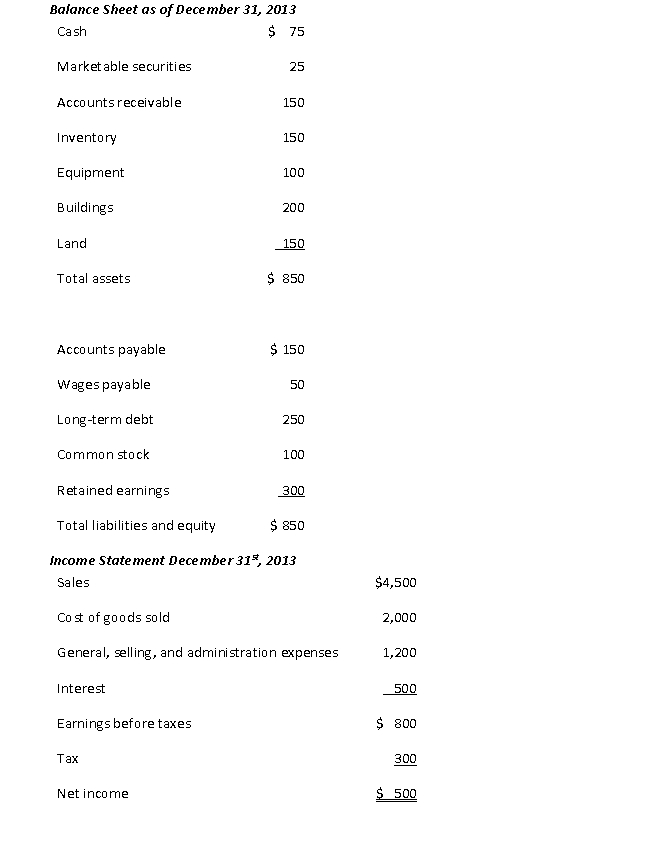

Using the following financial statement information,

the inventory turnover ratio is closest to:

the inventory turnover ratio is closest to:

A) 0.14

B) 0.18

C) 5.67

D) 7.33

the inventory turnover ratio is closest to:

the inventory turnover ratio is closest to:A) 0.14

B) 0.18

C) 5.67

D) 7.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

24

Using the following financial statements

the days sales in inventory is closest to:

the days sales in inventory is closest to:

A) 28.1

B) 64.4

C) 71.1

D) 137.4

the days sales in inventory is closest to:

the days sales in inventory is closest to:A) 28.1

B) 64.4

C) 71.1

D) 137.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

25

Using the following financial statements,

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:

A) 6.8

B) 8.5

C) 10.0

D) 19.5

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:A) 6.8

B) 8.5

C) 10.0

D) 19.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

26

Using the following financial statements,

the days payables outstanding is closest to:

the days payables outstanding is closest to:

A) 18.9

B) 36.7

C) 42.9

D) 53.8

the days payables outstanding is closest to:

the days payables outstanding is closest to:A) 18.9

B) 36.7

C) 42.9

D) 53.8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

27

Using the following financial statements

the operating cycle is closest to:

the operating cycle is closest to:

A) 80.3

B) 88.0

C) 173.9

D) 208.5

the operating cycle is closest to:

the operating cycle is closest to:A) 80.3

B) 88.0

C) 173.9

D) 208.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

28

Using the following financial statement information,

the cash conversion cycle (CCC), assuming all sales on credit and that beginning inventory is equal to ending inventory, is closest to:

the cash conversion cycle (CCC), assuming all sales on credit and that beginning inventory is equal to ending inventory, is closest to:

A) 34.2

B) 37.4

C) 137.2

D) 189.6

the cash conversion cycle (CCC), assuming all sales on credit and that beginning inventory is equal to ending inventory, is closest to:

the cash conversion cycle (CCC), assuming all sales on credit and that beginning inventory is equal to ending inventory, is closest to:A) 34.2

B) 37.4

C) 137.2

D) 189.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

29

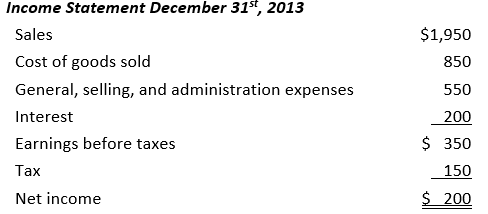

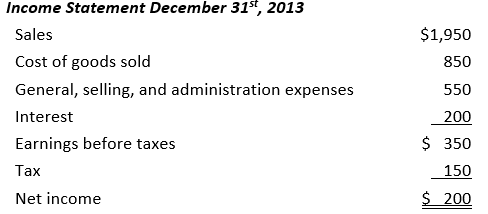

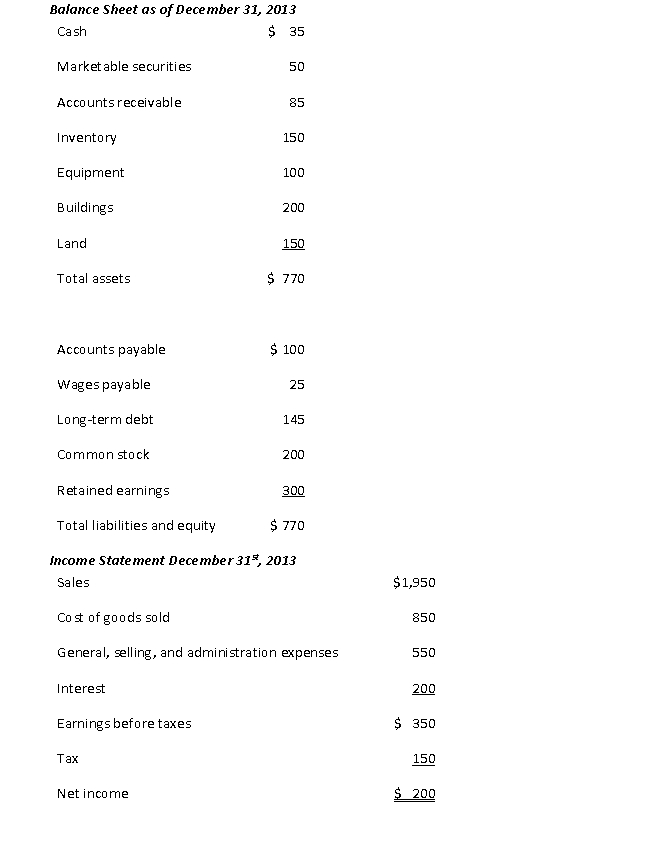

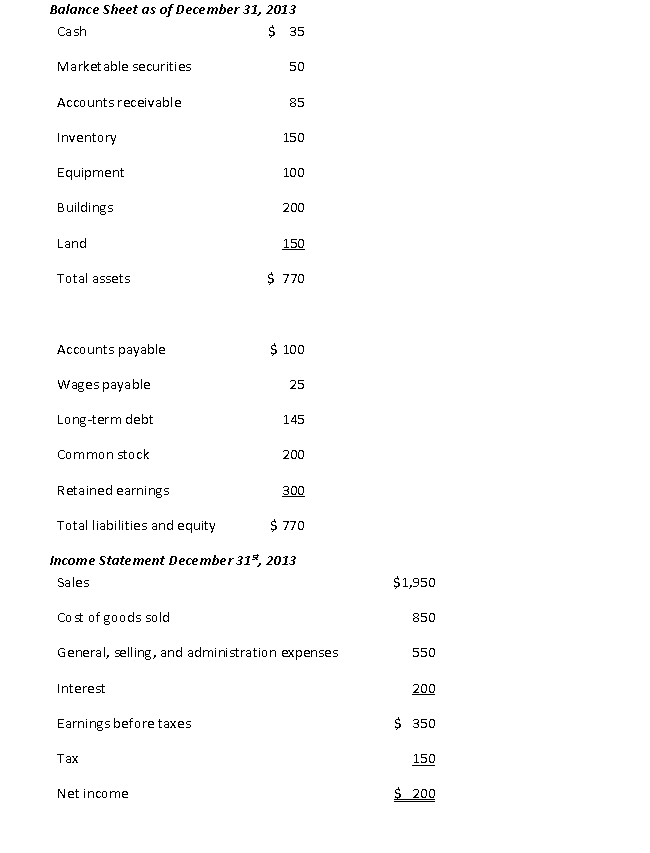

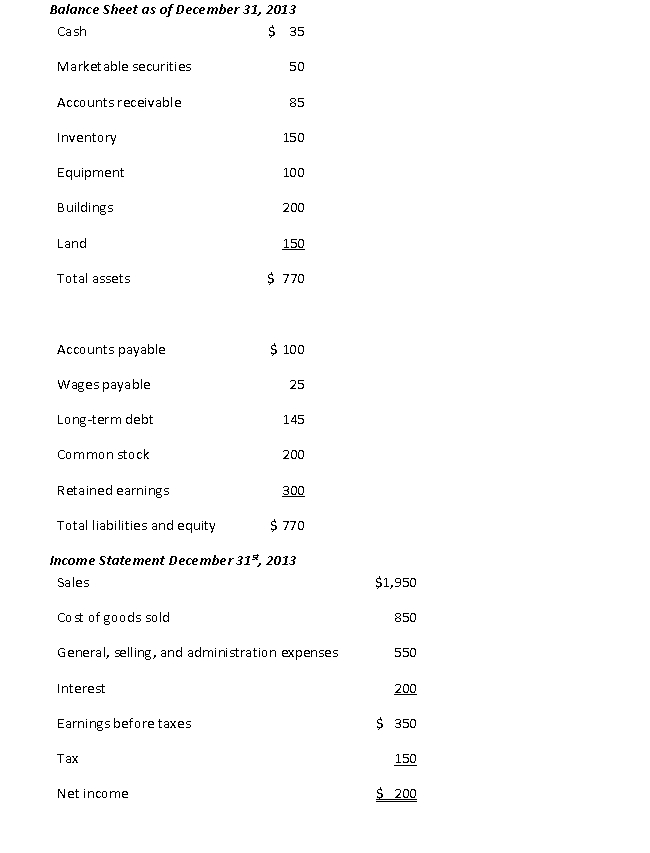

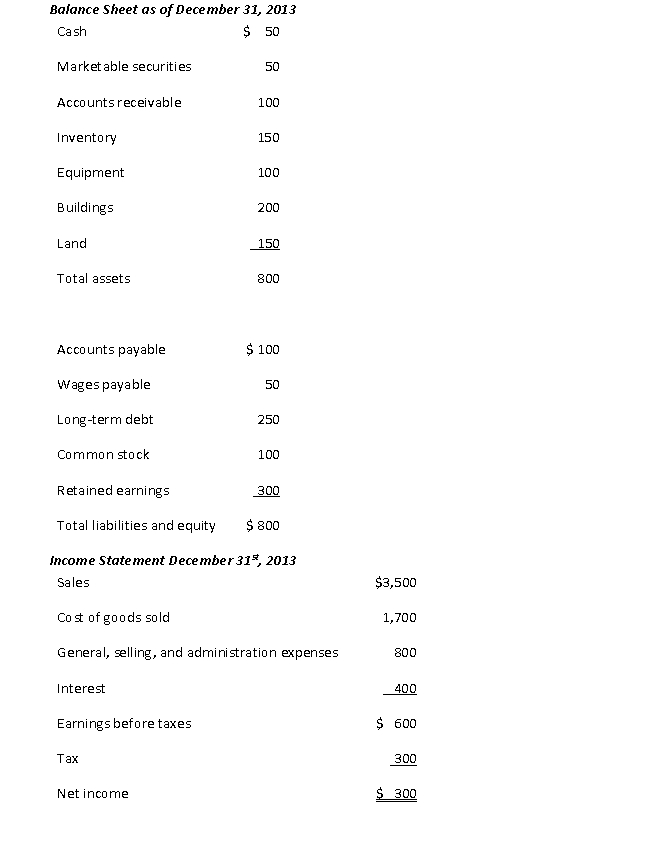

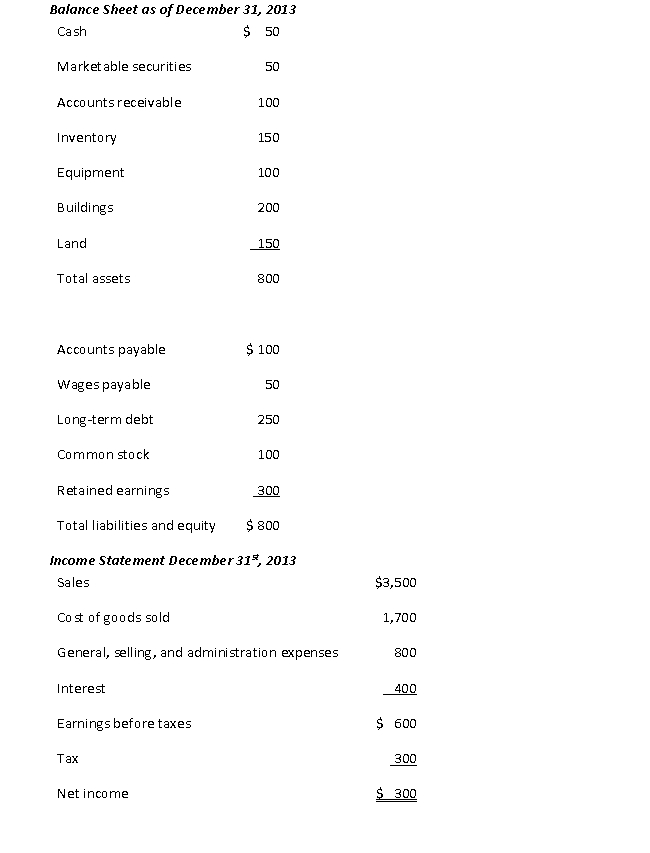

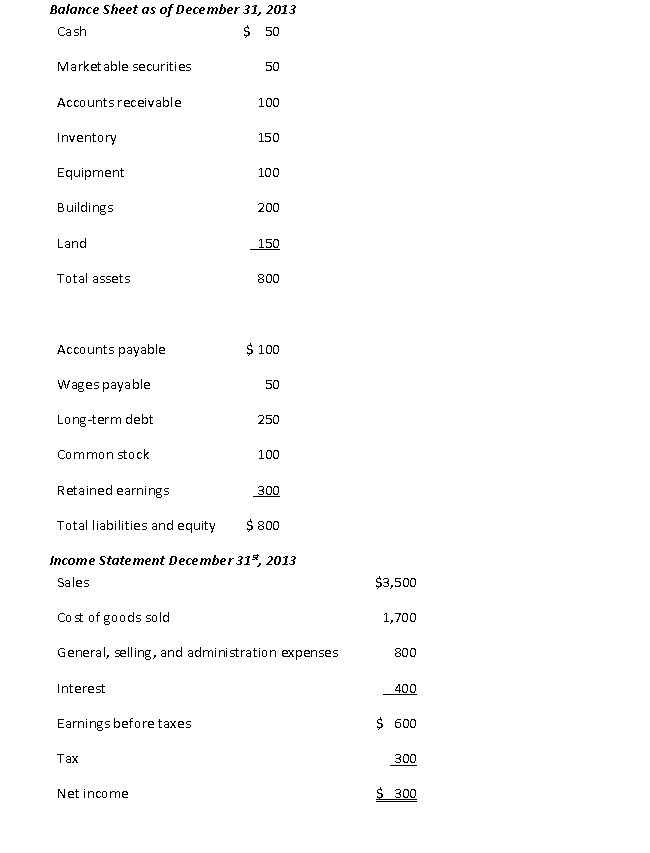

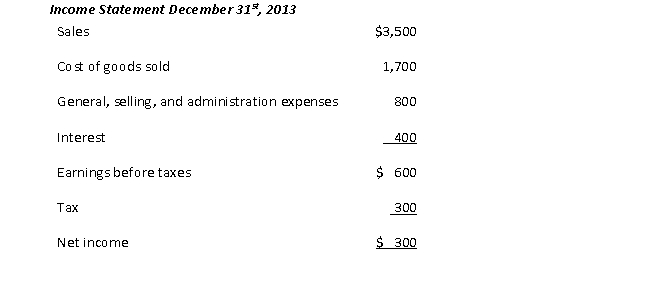

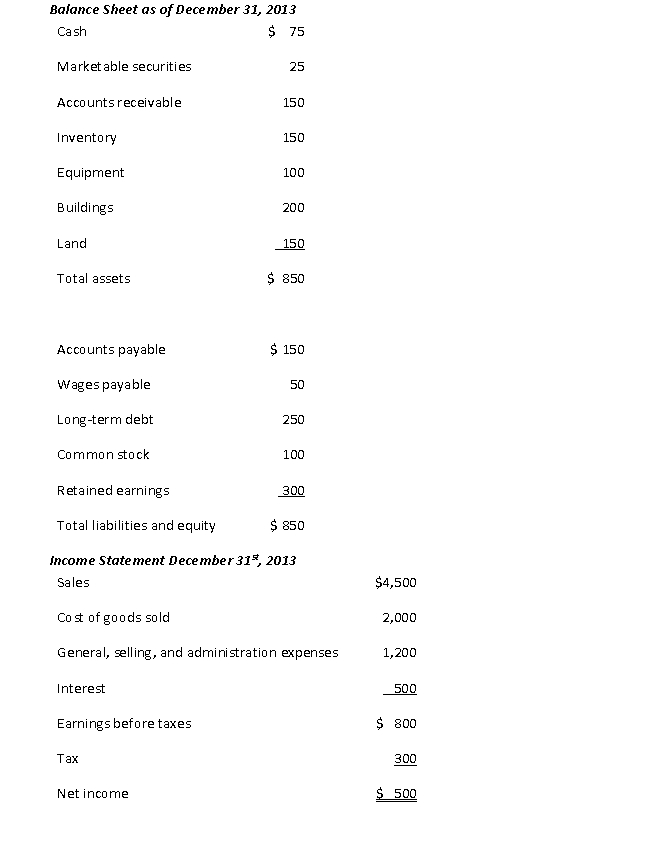

Using the following financial statement information,

the quick ratio is closest to:

the quick ratio is closest to:

A) 0.33

B) 0.67

C) 1.33

D) 2.33

the quick ratio is closest to:

the quick ratio is closest to:A) 0.33

B) 0.67

C) 1.33

D) 2.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

30

Using the following financial statement information,

the current ratio is closest to:

the current ratio is closest to:

A) 0.19

B) 2.33

C) 3.50

the current ratio is closest to:

the current ratio is closest to:A) 0.19

B) 2.33

C) 3.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

31

Using the following financial statement information,

the accounts receivable turnover ratio, assuming all sales are for credit, is closest to:

the accounts receivable turnover ratio, assuming all sales are for credit, is closest to:

A) 20.0

B) 35.0

C) 40.0

the accounts receivable turnover ratio, assuming all sales are for credit, is closest to:

the accounts receivable turnover ratio, assuming all sales are for credit, is closest to:A) 20.0

B) 35.0

C) 40.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

32

Using the following financial statement information,

the days sales outstanding, assuming all sales on credit, is closest to:

the days sales outstanding, assuming all sales on credit, is closest to:

A) 10.4

B) 21.5

C) 36.5

D) 75.1

the days sales outstanding, assuming all sales on credit, is closest to:

the days sales outstanding, assuming all sales on credit, is closest to:A) 10.4

B) 21.5

C) 36.5

D) 75.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

33

Using the following financial statement information,

the inventory turnover ratio is closest to:

the inventory turnover ratio is closest to:

A) 0.08

B) 0.09

C) 11.33

D) 12.00

the inventory turnover ratio is closest to:

the inventory turnover ratio is closest to:A) 0.08

B) 0.09

C) 11.33

D) 12.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

34

Using the following financial statement information,

the days sales in inventory is closest to:

the days sales in inventory is closest to:

A) 15.6

B) 32.2

C) 68.4

D) 75.2

the days sales in inventory is closest to:

the days sales in inventory is closest to:A) 15.6

B) 32.2

C) 68.4

D) 75.2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

35

Using the following financial statement information,

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:

A) 11.3

B) 17.0

C) 18.0

D) 35.0

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:A) 11.3

B) 17.0

C) 18.0

D) 35.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

36

Using the following financial statement information,

the days payables outstanding is closest to:

the days payables outstanding is closest to:

A) 10.5

B) 21.5

C) 21.6

D) 32.3

the days payables outstanding is closest to:

the days payables outstanding is closest to:A) 10.5

B) 21.5

C) 21.6

D) 32.3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

37

Using the following financial statement information,

the operating cycle, assuming all sales on credit, is closest to:

the operating cycle, assuming all sales on credit, is closest to:

A) 42.6

B) 52.1

C) 96.6

D) 143.6

the operating cycle, assuming all sales on credit, is closest to:

the operating cycle, assuming all sales on credit, is closest to:A) 42.6

B) 52.1

C) 96.6

D) 143.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

38

Using the following financial statement information,

the cash conversion cycle (CCC), assuming all sales are on credit and that beginning inventory is equal to ending inventory, is closest to:

the cash conversion cycle (CCC), assuming all sales are on credit and that beginning inventory is equal to ending inventory, is closest to:

A) 19.9

B) 21.1

C) 75.0

D) 133.4

the cash conversion cycle (CCC), assuming all sales are on credit and that beginning inventory is equal to ending inventory, is closest to:

the cash conversion cycle (CCC), assuming all sales are on credit and that beginning inventory is equal to ending inventory, is closest to:A) 19.9

B) 21.1

C) 75.0

D) 133.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

39

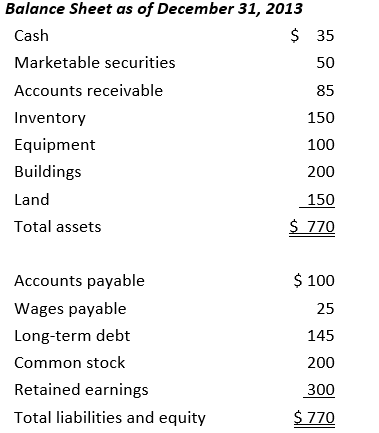

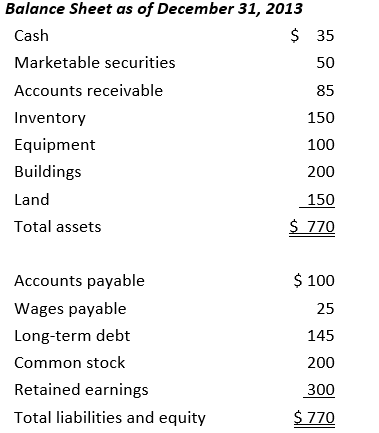

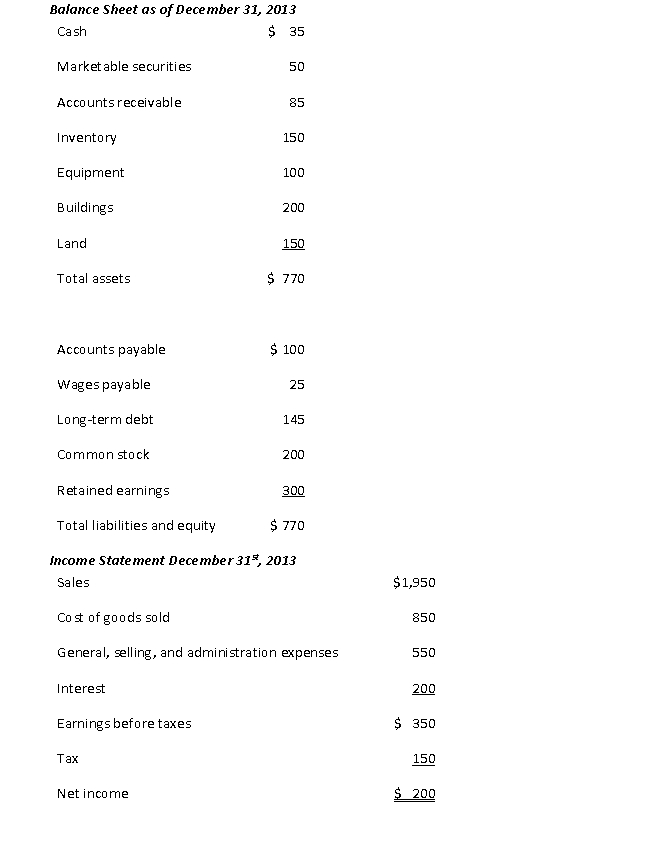

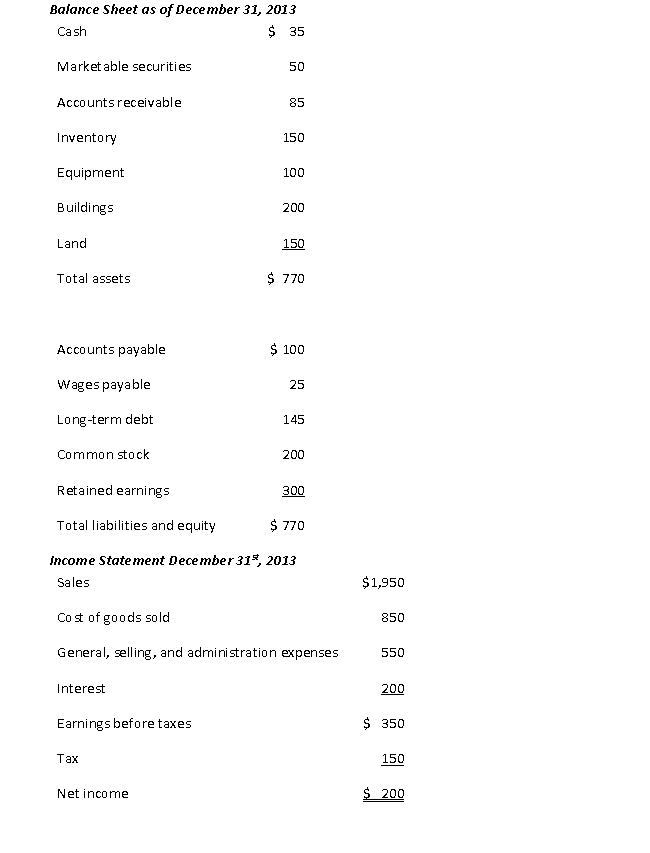

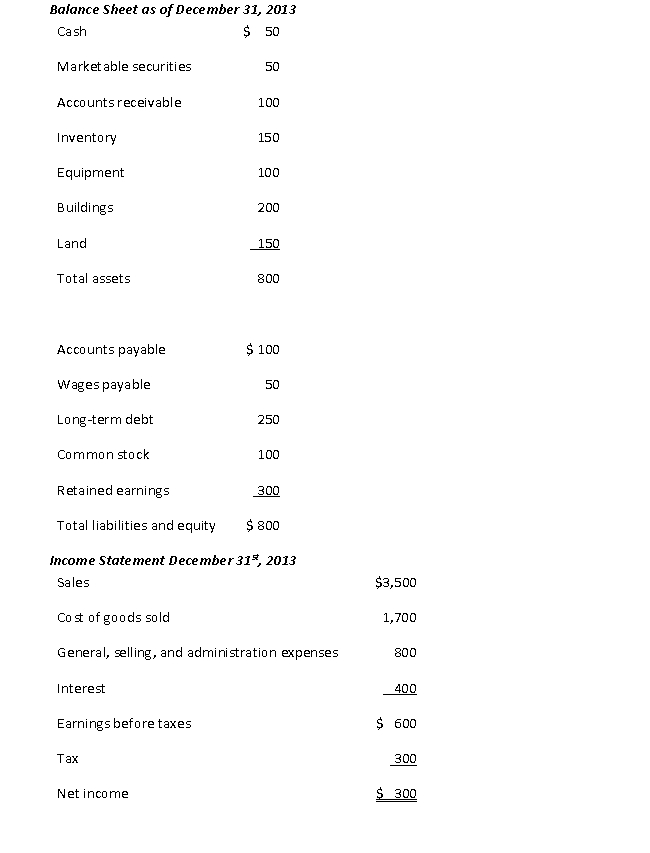

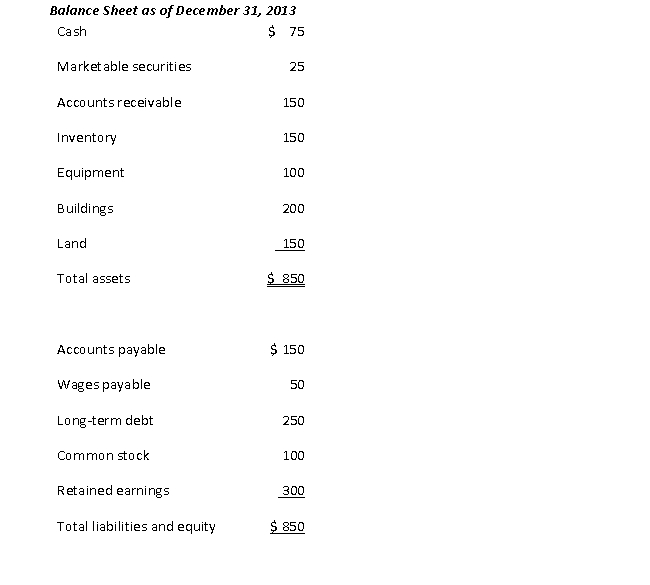

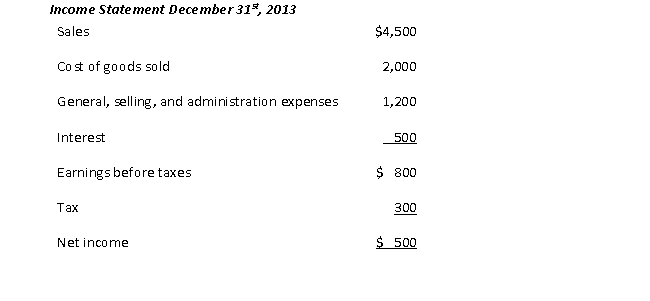

Using the following financial statement information,

the quick ratio is closest to:

the quick ratio is closest to:

A) 0.38

B) 0.50

C) 1.25

D) 2.00

the quick ratio is closest to:

the quick ratio is closest to:A) 0.38

B) 0.50

C) 1.25

D) 2.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

40

Using the following financial statement information,

the current ratio is closest to:

the current ratio is closest to:

A) 0.16

B) 2.00

C) 2.67

the current ratio is closest to:

the current ratio is closest to:A) 0.16

B) 2.00

C) 2.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

41

Using the following financial statement information,

the accounts receivable turnover ratio is closest to:

the accounts receivable turnover ratio is closest to:

A) 18.0

B) 30.0

C) 36.0

the accounts receivable turnover ratio is closest to:

the accounts receivable turnover ratio is closest to:A) 18.0

B) 30.0

C) 36.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

42

Using the following financial statement information,

The days sales outstanding, assuming all sales are on credit, is closest to:

The days sales outstanding, assuming all sales are on credit, is closest to:

A) 12.2

B) 27.4

C) 32.4

D) 73.0

The days sales outstanding, assuming all sales are on credit, is closest to:

The days sales outstanding, assuming all sales are on credit, is closest to:A) 12.2

B) 27.4

C) 32.4

D) 73.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

43

Using the following financial statement information,

the inventory turnover ratio is closest to:

the inventory turnover ratio is closest to:

A) 0.06

B) 0.08

C) 13.33

D) 16.67

the inventory turnover ratio is closest to:

the inventory turnover ratio is closest to:A) 0.06

B) 0.08

C) 13.33

D) 16.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

44

Using the following financial statement information,

the days sales in inventory is closest to:

the days sales in inventory is closest to:

A) 12.7

B) 27.4

C) 64.4

D) 73.0

the days sales in inventory is closest to:

the days sales in inventory is closest to:A) 12.7

B) 27.4

C) 64.4

D) 73.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

45

Using the following financial statement information,

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:

A) 10.0

B) 13.3

C) 16.7

D) 30.0

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:

the accounts payable turnover, assuming that beginning inventory is equal to ending inventory, is closest to:A) 10.0

B) 13.3

C) 16.7

D) 30.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

46

Using the following financial statement information,

the days payables outstanding is closest to:

the days payables outstanding is closest to:

A) 12.3

B) 22.0

C) 27.4

D) 36.6

the days payables outstanding is closest to:

the days payables outstanding is closest to:A) 12.3

B) 22.0

C) 27.4

D) 36.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

47

Using the following financial statement information,

the operating cycle is closest to:

the operating cycle is closest to:

A) 39.6

B) 44.6

C) 100.4

D) 137.4

the operating cycle is closest to:

the operating cycle is closest to:A) 39.6

B) 44.6

C) 100.4

D) 137.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

48

Using the following financial statement information,

the cash conversion cycle (CCC), assuming all sales on credit and assuming that beginning inventory is equal to ending inventory, is closest to:

the cash conversion cycle (CCC), assuming all sales on credit and assuming that beginning inventory is equal to ending inventory, is closest to:

A) 8.0

B) 12.2

C) 78.4

D) 125.2

the cash conversion cycle (CCC), assuming all sales on credit and assuming that beginning inventory is equal to ending inventory, is closest to:

the cash conversion cycle (CCC), assuming all sales on credit and assuming that beginning inventory is equal to ending inventory, is closest to:A) 8.0

B) 12.2

C) 78.4

D) 125.2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

49

The reason for holding cash required for a company's normal operations is best described as:

A) finance motive.

B) speculative motive.

C) transactions motive.

D) precautionary motive.

A) finance motive.

B) speculative motive.

C) transactions motive.

D) precautionary motive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

50

The reason that companies keep cash on hand to take care of unanticipated required outlays, such as unexpected repairs on equipment is best described as:

A) finance motive

B) speculative motive

C) transactions motive

D) precautionary motive

A) finance motive

B) speculative motive

C) transactions motive

D) precautionary motive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

51

The reason that companies will accumulate cash in anticipation of any major outlays, such as lump-sum loan repayments or dividend payments is best described as:

A) finance motive.

B) speculative motive.

C) transactions motive.

D) precautionary motive.

A) finance motive.

B) speculative motive.

C) transactions motive.

D) precautionary motive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

52

The fact that companies may keep extra cash available to take advantage of unexpected "bargains", such as the opportunity to purchase raw materials very cheaply is best described as:

A) finance motive.

B) speculative motive.

C) transactions motive.

D) precautionary motive.

A) finance motive.

B) speculative motive.

C) transactions motive.

D) precautionary motive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is not one of the four C's of credit?

A) Cost

B) Capacity

C) Character

D) Conditions

A) Cost

B) Capacity

C) Character

D) Conditions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

54

A company is considering the purchase of one of its inputs from supplier A. The credit terms are 1.5/10 net 30. What is the effective annual cost of forgoing the discount and paying on day 30?

A) 20.19%

B) 31.76%

C) 73.61%

A) 20.19%

B) 31.76%

C) 73.61%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

55

A company is considering the purchase of one of its inputs from supplier A. The credit terms are 2/10 net 30. What is the effective annual cost of forgoing the discount and paying on day 30?

A) 27.86%

B) 44.59%

C) 109.05%

A) 27.86%

B) 44.59%

C) 109.05%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following inventory management approaches attempts to find the optimal inventory level that minimizes the total of shortage and carrying costs?

A) The ABC Approach

B) Just-in-time (JIT) inventory system

C) Material Requirement Planning (MRP)

D) Economic Order Quantity (EOQ) Model

A) The ABC Approach

B) Just-in-time (JIT) inventory system

C) Material Requirement Planning (MRP)

D) Economic Order Quantity (EOQ) Model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following inventory management systems works in conjunction with production schedules to determine the exact level of raw materials and work-in-process that must be on hand to meet finished goods demand?

A) The ABC Approach

B) Just-in-time (JIT) inventory system

C) Material Requirement Planning (MRP)

D) Economic Order Quantity (EOQ) Model

A) The ABC Approach

B) Just-in-time (JIT) inventory system

C) Material Requirement Planning (MRP)

D) Economic Order Quantity (EOQ) Model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following inventory management systems fine-tunes the receipt of raw materials so that they arrive exactly when they are required in the production process?

A) The ABC Approach

B) Just-in-time (JIT) inventory system

C) Material Requirement Planning (MRP)

D) Economic Order Quantity (EOQ) Model

A) The ABC Approach

B) Just-in-time (JIT) inventory system

C) Material Requirement Planning (MRP)

D) Economic Order Quantity (EOQ) Model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following inventory management approaches attempts to divide inventory into several categories based on the value of the inventory items, their overall level of importance to the company's operations, and their profitability?

A) The ABC Approach

B) Just-in-time (JIT) inventory system

C) Material Requirement Planning (MRP)

D) Economic Order Quantity (EOQ) Mode

A) The ABC Approach

B) Just-in-time (JIT) inventory system

C) Material Requirement Planning (MRP)

D) Economic Order Quantity (EOQ) Mode

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

60

A company orders 240,000 windows per year. Every time a company orders windows from its suppliers, the supplier charges $1,000 in shipping and handling. The cost of keeping windows on hand, in terms of storage and maintenance costs, is $.25 per window. What quantity of windows should the company order?

A) 20,000

B) 30,984

C) 43,818

D) 60,000

A) 20,000

B) 30,984

C) 43,818

D) 60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

61

The important method of financing that occurs when a company finances its purchases through credit terms offered by their suppliers is best described as:

A) bank loan.

B) trade credit.

C) commercial paper.

D) factor arrangement.

E) bankers' acceptance.

A) bank loan.

B) trade credit.

C) commercial paper.

D) factor arrangement.

E) bankers' acceptance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements is correct?

A) Operating loans are long-term financing arrangements.

B) Operating loans are typically secured by accounts receivable and inventory.

C) Operating loans are only available to large institutions with excellent credit ratings.

D) Banks generally offer an operating line for 100% of accounts receivable less than 90 days and 100% of the company's inventory value.

A) Operating loans are long-term financing arrangements.

B) Operating loans are typically secured by accounts receivable and inventory.

C) Operating loans are only available to large institutions with excellent credit ratings.

D) Banks generally offer an operating line for 100% of accounts receivable less than 90 days and 100% of the company's inventory value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

63

First Bank offers XYZ Company a 1-year variable rate loan at a rate of prime plus ½%. Prime rate is 3%. Payments must be made monthly and there are no other fees. What is the effective annual cost of this loan?

A) .29%

B) 3.00%

C) 3.50%

D) 3.56%

A) .29%

B) 3.00%

C) 3.50%

D) 3.56%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which kind of short-term financing is likely to be used by a small firm with average credit?

A) Bank loan

B) Commercial paper

C) Bankers' acceptance

D) Money market instrument

A) Bank loan

B) Commercial paper

C) Bankers' acceptance

D) Money market instrument

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

65

A short-term financing instrument, which is issued at a discount in large denominations, with a maturity date of 30, 60, or 90 days, in which a bank guarantees the payments is best described as:

A) bank loan.

B) commercial paper.

C) bankers' acceptance.

D) money market instrument.

A) bank loan.

B) commercial paper.

C) bankers' acceptance.

D) money market instrument.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

66

A large ski manufacturer issues $50 million face value 60-day commercial paper for net proceeds of $49.75 million. The ski manufacturer must maintain a $50 million credit line, on which it must pay a standby fee of .1 percent. The effective annual cost to the ski manufacturer of this financing arrangement is nearest to:

A) .50%

B) .60%

C) 3.04%

D) 3.73%

A) .50%

B) .60%

C) 3.04%

D) 3.73%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

67

A large ski manufacturer issues $50 million face value 60-day commercial paper for net proceeds of $49.75 million. The ski manufacturer must maintain a $50 million credit line, on which it must pay a standby fee of .1 percent. The quoted yield of this commercial paper is closest to:

A) .50%

B) .60%

C) 3.04%

D) 3.73%

A) .50%

B) .60%

C) 3.04%

D) 3.73%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

68

A conduit for packaging portfolios of receivables and selling them to investors in the money market is best described as:

A) Bank loan

B) Trade paper

C) Commercial paper

D) Bankers' acceptance

E) Special purpose vehicle (SPV)

A) Bank loan

B) Trade paper

C) Commercial paper

D) Bankers' acceptance

E) Special purpose vehicle (SPV)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements is incorrect?

A) Special purpose vehicles are usually formed as sole proprietorships.

B) The credit risk of the seller of the receivables or loans is not directly involved in the securitization.

C) To improve the credit quality of SPVs, credit enhancements such as requiring collateral, insurance, or other agreements are often added.

D) Companies that offer financing for purchases sell the loans directly to the capital market through SPVs so that neither the loans nor the financing appear on their balance sheets.

A) Special purpose vehicles are usually formed as sole proprietorships.

B) The credit risk of the seller of the receivables or loans is not directly involved in the securitization.

C) To improve the credit quality of SPVs, credit enhancements such as requiring collateral, insurance, or other agreements are often added.

D) Companies that offer financing for purchases sell the loans directly to the capital market through SPVs so that neither the loans nor the financing appear on their balance sheets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

70

The tests a credit rating agency performs to gauge the effect of changing economic conditions to see how it affects the ability of the SPV to pay off its securities is best described as:

A) stress tests.

B) ratio analysis.

C) prepayments.

D) credit enhancement.

A) stress tests.

B) ratio analysis.

C) prepayments.

D) credit enhancement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

71

Working capital refers to a company's cash on hand and the rate that cash is used in operations due to negative operating cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

72

Companies use the finance motive to keep cash on hand for unanticipated required outlays of cash such as unexpected repairs on equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company can use a lock-box system to reduce the float time of customer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

74

Credit analysis is the process designed to assess the risk of nonpayment by potential customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

75

A company should borrow funds at a rate of 10% to take advantage of credit terms offered to them of 1/10 net 30 if the company normally does not pay until the 30th day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

76

Trade credit is usually one of a company's most important sources of short-term financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

77

Factor arrangements are usually one of the most cost effective forms of financing for companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

78

A company is considering the purchase of one of its inputs from supplier

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

79

A company is considering the purchase of one of its inputs from supplier

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

80

A company orders 120,000 windows per year. Every time a company orders windows from its suppliers, the supplier charges $1,000 in shipping and handling. The cost of keeping windows on hand, in terms of storage and maintenance costs, is $.25 per window. What quantity of windows should the company order?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck