Deck 6: Debt Valuation and Interest Rates

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/90

العب

ملء الشاشة (f)

Deck 6: Debt Valuation and Interest Rates

1

A short-term debt obligation with an initial maturity less than 1 year is best described as a:

A) bill.

B) note.

C) bond.

A) bill.

B) note.

C) bond.

bill.

2

A debt obligation with a maturity between 1 and 7 years is best described as a:

A) Bill.

B) note.

C) bond.

A) Bill.

B) note.

C) bond.

note.

3

A long-term debt instrument in which the borrower promises repayment, usually with interest, with an initial maturity longer than 7 years is best described as a:

A) bill.

B) note.

C) bond.

A) bill.

B) note.

C) bond.

bond.

4

The lender in a bond transaction is referred to as the:

A) issuer.

B) bondholder.

C) bond underwriter.

A) issuer.

B) bondholder.

C) bond underwriter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

5

The legal document that specifies the payment requirements, all other salient matters relating to a bond is best described as:

A) issuer.

B) collateral.

C) bond indenture.

D) term to maturity.

A) issuer.

B) collateral.

C) bond indenture.

D) term to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following would not be contained in an indenture agreement?

A) Par value

B) Collateral

C) Interest rate

D) Credit rating

E) Term to maturity

A) Par value

B) Collateral

C) Interest rate

D) Credit rating

E) Term to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

7

A bond is quoted at 102.816. This would mean that a $1,000 par value bond would be selling at what price?

A) $100.00

B) $102.82

C) $1,000.00

D) $1,028.16

A) $100.00

B) $102.82

C) $1,000.00

D) $1,028.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

8

A debt instrument that is not secured is best described as a:

A) debenture

B) mortgage bond

C) collateral trust bond

D) equipment trust bond

A) debenture

B) mortgage bond

C) collateral trust bond

D) equipment trust bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

9

A debt instrument secured by a general claim on the issuer's unencumbered assets is a:

A) debenture

B) mortgage bond

C) collateral trust bond

D) equipment trust bond

A) debenture

B) mortgage bond

C) collateral trust bond

D) equipment trust bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

10

Your client likes to invest in debt with a rating of BBB (Standard & Poor's and Fitch Ratings) or Baa (Moody's) and higher. This class of investment would best be described as:

A) in default

B) high-yield debt

C) investment grade debt

A) in default

B) high-yield debt

C) investment grade debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which additional bond feature provides protection against rising interest rates and results in the bonds generally trading near their par value?

A) Putable bond

B) Callable bond

C) Extendible bond

D) Convertible bond

E) Floating rate bond

A) Putable bond

B) Callable bond

C) Extendible bond

D) Convertible bond

E) Floating rate bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following additional bond features does not primarily benefit the bond issuer?

A) Callable bond

B) Sinking fund provision

C) Purchase fund provision

A) Callable bond

B) Sinking fund provision

C) Purchase fund provision

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following additional bond features does not primarily benefit the bondholder?

A) Putable bond

B) Callable bond

C) Extendible bond

D) Convertible bond

E) Purchase fund provision

A) Putable bond

B) Callable bond

C) Extendible bond

D) Convertible bond

E) Purchase fund provision

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

14

The bond quote of a 5-year, 8 percent, semi-annual coupon bond when the market rate is 8 percent is closest to:

A) 91.89

B) 100.00

C) 104.61

D) 108.53

A) 91.89

B) 100.00

C) 104.61

D) 108.53

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

15

The bond quote of a 15-year, 7 percent, semi-annual coupon bond when the market rate is 7 percent is closest to:

A) 91.89

B) 100.00

C) 104.61

D) 108.53

A) 91.89

B) 100.00

C) 104.61

D) 108.53

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

16

The sensitivity of bond prices to changes in interest rates is:

A) credit risk.

B) default risk.

C) inflation risk.

D) interest rate risk.

A) credit risk.

B) default risk.

C) inflation risk.

D) interest rate risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

17

The bond quote of a 15-year, 7 percent, semi-annual coupon bond when the market rate is 11 percent is closest to:

A) 70.93

B) 95.62

C) 100.00

D) 136.78

A) 70.93

B) 95.62

C) 100.00

D) 136.78

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

18

The bond quote of a 5-year, 8 percent, semi-annual coupon bond when the market rate is 10 percent is closest to:

A) 92.28

B) 95.62

C) 100.00

D) 108.81

A) 92.28

B) 95.62

C) 100.00

D) 108.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is not true regarding yield to maturity?

A) Yield to maturity is also called market rate of interest.

B) When yield to maturity is equal to the coupon rate, the bond will trade at par value.

C) A callable bond always trades based on its yield to call instead of its yield to maturity.

D) Yield to maturity is the discount rate used to value the cash flows of a debt obligation.

E) The yield to maturity calculation assumes that coupon payments are reinvested in similar-yielding investments.

A) Yield to maturity is also called market rate of interest.

B) When yield to maturity is equal to the coupon rate, the bond will trade at par value.

C) A callable bond always trades based on its yield to call instead of its yield to maturity.

D) Yield to maturity is the discount rate used to value the cash flows of a debt obligation.

E) The yield to maturity calculation assumes that coupon payments are reinvested in similar-yielding investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

20

The bond quote of a 5-year, 8 percent, semi-annual coupon bond when the market rate is 6 percent is closest to:

A) 91.89

B) 100.00

C) 104.61

D) 108.53

A) 91.89

B) 100.00

C) 104.61

D) 108.53

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

21

The bond quote of a 15-year, 7 percent, semi-annual coupon bond when the market rate is 5 percent is closest to:

A) 81.61

B) 100.00

C) 104.61

D) 120.93

A) 81.61

B) 100.00

C) 104.61

D) 120.93

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

22

Consider bonds A, B, C, and D, each with a par value of $1,000. Which of the following bond's price is most sensitive to market rate changes?

A) Bond A: 4 year, 7 percent coupon rate, yield 4.2 percent

B) Bond B: 5 year, 6.5 percent coupon rate, yield 4.3 percent

C) Bond C: 8 year, 6.5 percent coupon rate, yield 4.2 percent

D) Bond D: 15 year, 5 percent coupon rate, yield 4.2 percent

A) Bond A: 4 year, 7 percent coupon rate, yield 4.2 percent

B) Bond B: 5 year, 6.5 percent coupon rate, yield 4.3 percent

C) Bond C: 8 year, 6.5 percent coupon rate, yield 4.2 percent

D) Bond D: 15 year, 5 percent coupon rate, yield 4.2 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

23

The value of a 12-year zero-coupon bond with a face value of $1,000 and a market yield of 4.5 percent is closest to:

A) $225.00

B) $450.00

C) $586.25

D) $589.66

E) $1,000.00

A) $225.00

B) $450.00

C) $586.25

D) $589.66

E) $1,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

24

The value of a 20-year zero coupon bond with a face value of $1,000 and a market yield of 6 percent is closest to:

A) $300.00

B) $306.56

C) $311.80

D) $600.00

E) $1,000.00

A) $300.00

B) $306.56

C) $311.80

D) $600.00

E) $1,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which factors lead to higher interest rate risk?

A) Shorter term bonds with lower coupon rates and lower market yields

B) Longer term bonds with higher coupon rates and lower market yields

C) Longer term bonds with lower coupon rates and lower market yields

D) Longer term bonds with lower coupon rates and higher market yields

A) Shorter term bonds with lower coupon rates and lower market yields

B) Longer term bonds with higher coupon rates and lower market yields

C) Longer term bonds with lower coupon rates and lower market yields

D) Longer term bonds with lower coupon rates and higher market yields

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Issuer Corporation issued a 20-year bond with a 6 percent coupon. The bond had a yield to maturity of 8 percent one year after issuance. the value of Issuer's bond one year after issuance, in bond quote terms, is closest to:

A) 76.34

B) 80.21

C) 80.63

D) 100.00

A) 76.34

B) 80.21

C) 80.63

D) 100.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following choices would not be the actual price paid for a debt obligation that considers the amount of accrued interest on the security?

A) Cash price

B) Dirty price

C) Clean price

A) Cash price

B) Dirty price

C) Clean price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is incorrect?

A) Yield to call is always greater than yield to maturity.

B) Yield to maturity assumes the bond is held to maturity.

C) The discount rate used to evaluate bonds is yield to maturity.

D) Yield to maturity assumes that all interest payments can be reinvested in similar yielding investments.

A) Yield to call is always greater than yield to maturity.

B) Yield to maturity assumes the bond is held to maturity.

C) The discount rate used to evaluate bonds is yield to maturity.

D) Yield to maturity assumes that all interest payments can be reinvested in similar yielding investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

29

Annual coupon interest divided by current market price is the formula for:

A) yield to call.

B) current yield.

C) yield to maturity.

D) internal rate of return.

A) yield to call.

B) current yield.

C) yield to maturity.

D) internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

30

The yield to maturity on a 30-year, 6 percent bond that pays semi-annual coupons and is selling for $1,025 is closest to:

A) 2.91%

B) 3.00%

C) 5.82%

D) 6.00%

A) 2.91%

B) 3.00%

C) 5.82%

D) 6.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

31

The yield to maturity on a 20-year, 3 percent bond that pays semi-annual coupons and is selling for $990 is closest to:

A) 1.50%

B) 1.53%

C) 3.00%

D) 3.07%

A) 1.50%

B) 1.53%

C) 3.00%

D) 3.07%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

32

The yield to maturity on a 30-year zero-coupon bond that is presently quoted at 42 is closest to:

A) 0.00%

B) 2.91%

C) 3.00%

D) 5.87%

A) 0.00%

B) 2.91%

C) 3.00%

D) 5.87%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

33

The yield to maturity on a 10-year zero-coupon bond that is presently quoted at 96 is closest to:

A) 0.41%

B) 3.00%

C) 4.00%

D) 4.10%

A) 0.41%

B) 3.00%

C) 4.00%

D) 4.10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

34

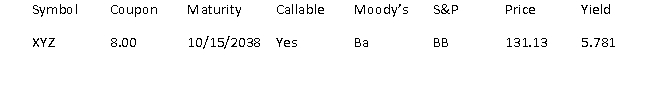

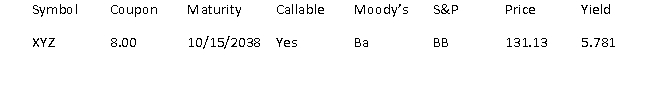

Given the following bond quote information, which of the following statements is incorrect?

A) If you own $50,000 face value of these bonds, the value of your bonds is $65,565.

B) The bond is rated Ba and BB by two agencies, which means this is an investment grade bond.

C) The bond is callable, which means that if certain conditions are met, XYZ can buy the bond from the investor.

D) The bond has a coupon of 8% but because the market yield of 5.781% is less than the coupon rate, the bond trades at a premium from its face value.

A) If you own $50,000 face value of these bonds, the value of your bonds is $65,565.

B) The bond is rated Ba and BB by two agencies, which means this is an investment grade bond.

C) The bond is callable, which means that if certain conditions are met, XYZ can buy the bond from the investor.

D) The bond has a coupon of 8% but because the market yield of 5.781% is less than the coupon rate, the bond trades at a premium from its face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

35

XYZ bond is trading for 103. The bond's call price is 105. Trades of XYZ bond will most likely be based on which of the following:

A) XYZ bond's yield to call

B) XYZ bond's coupon rate

C) XYZ bond's current yield

D) XYZ bond's yield to maturity

A) XYZ bond's yield to call

B) XYZ bond's coupon rate

C) XYZ bond's current yield

D) XYZ bond's yield to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

36

If ABC bond has a coupon rate of 5% and a yield to maturity of 4.5%, which of the following would be true?

A) ABC will trade at par value

B) ABC will trade at a discount

C) ABC will trade at a premium

A) ABC will trade at par value

B) ABC will trade at a discount

C) ABC will trade at a premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

37

XYZ bond is trading for 105. The bond's call price is 102. Trades of XYZ bond will most likely be based on which of the following?

A) XYZ bond's yield to call

B) XYZ bond's coupon rate

C) XYZ bond's current yield

D) XYZ bond's yield to maturity

A) XYZ bond's yield to call

B) XYZ bond's coupon rate

C) XYZ bond's current yield

D) XYZ bond's yield to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements is incorrect?

A) Generally, we evaluate yield to call based on the bond's first available call.

B) Generally, a callable bond trades at a value that reflects the higher of yield to call and yield to maturity.

C) If the call price of a bond is above its current market price, it is unlikely that the bond would be called back, so the bond will sell based on its yield to maturity rather than its yield to call.

D) If the call price of a bond is below its current market price, it is likely that the bond would be called back, so the bond will sell based on its yield to call rather than its yield to maturity.

A) Generally, we evaluate yield to call based on the bond's first available call.

B) Generally, a callable bond trades at a value that reflects the higher of yield to call and yield to maturity.

C) If the call price of a bond is above its current market price, it is unlikely that the bond would be called back, so the bond will sell based on its yield to maturity rather than its yield to call.

D) If the call price of a bond is below its current market price, it is likely that the bond would be called back, so the bond will sell based on its yield to call rather than its yield to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following would not be an example of a Treasury security?

A) TIPS

B) T-bill

C) Treasury note

D) EE/E Savings bond

E) State of New York municipal bond

A) TIPS

B) T-bill

C) Treasury note

D) EE/E Savings bond

E) State of New York municipal bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following protects investors against the effects of inflation?

A) TIPS

B) T-bill

C) Treasury note

D) EE/E Savings bond

E) State of New York municipal bond

A) TIPS

B) T-bill

C) Treasury note

D) EE/E Savings bond

E) State of New York municipal bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is not true regarding a T-bill?

A) It carries a maturity of one year or less

B) It is an obligation of the U.S. federal government

C) It has compounded interest, which is paid monthly

D) The discount rate on the T-bill is determined in the U.S. Treasury's auction

A) It carries a maturity of one year or less

B) It is an obligation of the U.S. federal government

C) It has compounded interest, which is paid monthly

D) The discount rate on the T-bill is determined in the U.S. Treasury's auction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

42

To annualize the yield on a T-bill one would use the:

A) Current yield

B) Yield to call

C) Yield to maturity

D) Bond equivalent yield

A) Current yield

B) Yield to call

C) Yield to maturity

D) Bond equivalent yield

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

43

The value of a 90-day T-bill with a face value of $100,000 that has a quoted yield of 3.75 percent is closest to:

A) $99,083.81

B) $100,000.00

C) $100,924.66

D) $103,750.00

A) $99,083.81

B) $100,000.00

C) $100,924.66

D) $103,750.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

44

The value of a 95-day T-bill with a face value of $100,000 that has a quoted yield of 4.00 percent is closest to:

A) $98,969.63

B) $100,000.00

C) $101,041.10

D) $104,000.00

A) $98,969.63

B) $100,000.00

C) $101,041.10

D) $104,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is a security of the U.S. government?

A) Municipal bond

B) Corporate bond

C) Commercial paper

D) Cash management bills

A) Municipal bond

B) Corporate bond

C) Commercial paper

D) Cash management bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following would not protect investors from inflation?

A) TIPS

B) I Savings bond

C) EE/E Savings bond

A) TIPS

B) I Savings bond

C) EE/E Savings bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

47

The rate charged for lending today's dollars in return for getting dollars back in the future, without taking into account the purchasing power of those future dollars is best described as a:

A) basis point.

B) risk-free rate.

C) default free rate.

D) nominal interest rate.

A) basis point.

B) risk-free rate.

C) default free rate.

D) nominal interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

48

Approximate the risk-free rate of interest on a bond with a real rate of 1.5% and expected inflation of 1.0%.

A) 0.50%

B) 1.00%

C) 1.50%

D) 2.50%

A) 0.50%

B) 1.00%

C) 1.50%

D) 2.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

49

The approximate nominal risk-free rate of interest on a bond with a real rate of 0.75% and expected inflation of 0.50% is closest to:

A) 0.50%

B) 0.75%

C) 1.25%

D) 1.50%

A) 0.50%

B) 0.75%

C) 1.25%

D) 1.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

50

The nominal risk-free rate of interest on a bond with a real rate of 1.25% and expected inflation of 1.5%, using the approximation and the precise formulas, respectively, are closest to:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

51

Equity is a promise by the borrower to repay the amount borrowed, plus interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

52

The borrower in a bond transaction is referred to as the bondholder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

53

The interest payment on a note or bond is called its coupon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

54

A zero coupon bond is a debt obligation that commits the issuer to pay a fixed amount of interest periodically and then repay the principal amount at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the yield to maturity is equal to a bond's coupon, the bond will trade at par.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

56

Bonds can be valued by breaking them into two separate components: an annuity consisting of the identical and regular interest payments, plus a lump-sum principal payment at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

57

Your broker quotes 98.250 for a $1,000 par value bond. This would mean the bond is currently selling for $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

58

A type of debt instrument secured by equipment is a collateral trust bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

59

If the indenture agreement restricts Company A from paying executive salary increases above cost of living adjustments, this would be an example of a positive covenant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

60

A borrower agreeing to not pay dividends if the interest coverage ratio is below 2.0 is an example of a positive covenant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

61

A borrower agreeing to have an annual audit of its financial statements is an example of a positive covenant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

62

When market interest rates are above the coupon rate on a bond, the bond would trade at a premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

63

When market interest rates are below the coupon rate on a bond, the bond would trade at a premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

64

If interest rates increase, the market prices of bonds increase. If interest rates decrease, the market prices of bonds decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

65

The greater the sensitivity of a bond to interest rate changes, the greater the duration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

66

Market prices of zero coupon bonds are less sensitive to interest rate changes than coupon bonds because they make no coupon payments at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

67

Yield to maturity is an internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

68

Current yield is the return on a callable bond assuming that the bond is called away before maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

69

A bond with a coupon rate of 6% and a yield to maturity of 4.5% will trade at a premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

70

A bond with a coupon rate of 3.5% and a yield to maturity of 5% will trade at a premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

71

Bonds issued by the State of Texas are an example of sovereign debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

72

Absolute auction is the process the U.S. Treasury uses to determine the discount rate when new Treasury bills are issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

73

In the U.S., yields on T-bills are usually quoted based on the bank discount yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

74

The only distinction between U.S. Treasury notes and U.S. Treasury bonds is the maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

75

Describe the difference between a zero coupon bond and a straight coupon bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

76

What is the difference between a bond and a mortgage?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

77

Estimate the yield to call on a 15-year 6 percent semi-annual pay bond that is callable in 5 years at a call price of $1,050, if the bond pays semi-annual coupons and is selling for $1,030.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

78

Estimate the yield to call on a 15-year 6 percent semi-annual pay bond that is callable in 5 years at a call price of $1,025, if the bond pays semi-annual coupons and is selling for $1,020.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

79

Estimate the bond equivalent yield

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

80

Estimate the bond discount yield

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck